Home Diagnostics Market Size and Trends

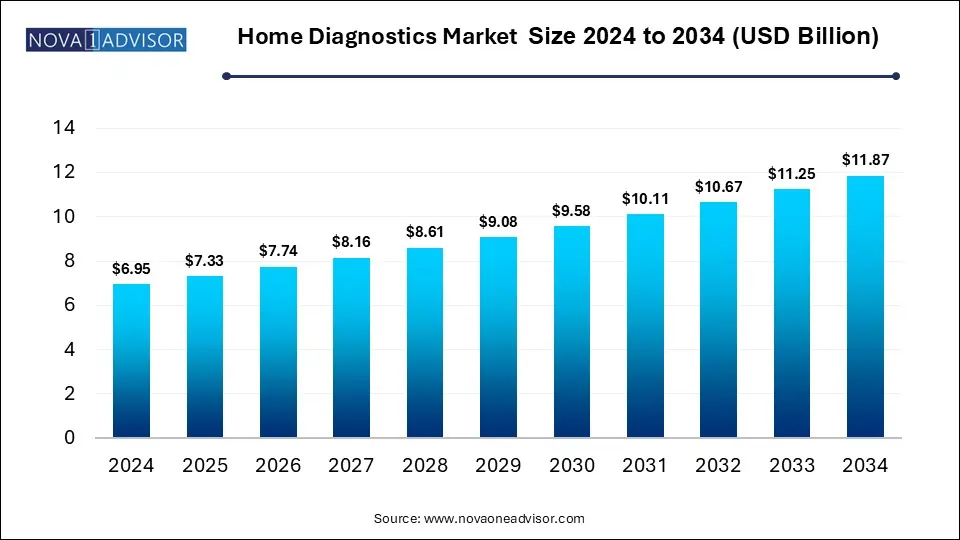

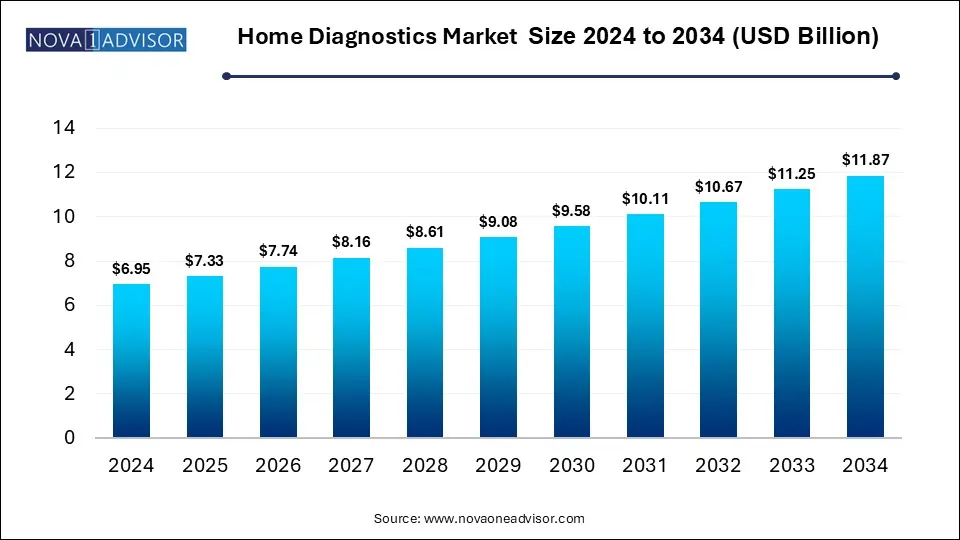

The global home diagnostics market size is calculated at USD 6.95 billion in 2024, grows to USD 7.33 billion in 2025, and is projected to reach around USD 11.87 billion by 2034, expanding at a CAGR of 5.5% from 2025 to 2034. The home diagnostics market growth is driven by the rising disease burden, increased demand for point-of-care testing services and supportive regulatory environment.

Home Diagnostics Market Key Takeaways

- North America dominated the global home diagnostics market with the largest revenue share in 2024.

- Asia Pacific is expected to grow at the fastest rate over the forecast period.

- By test type, the glucose monitoring devices segment dominated the market with the largest share in 2024.

- By test type, the infection testing kits segment is expected to show the fastest growth over the forecast period.

- By form, the cassettes segment accounted for the highest market share in 2024.

- By distribution channel, the retail pharmacies segment held the largest market share in 2024.

- By distribution channel, the online pharmacies segment is expected to register fastest growth during the forecast period.

What Factors Are Driving the Home Diagnostics Market Growth?

Home diagnostics refers to the use of medical devices for conducting diagnostic tests at a patient’s home instead of a clinic or laboratory. These test allow individuals to get diagnosed or monitor their health for different conditions from the comfort of their homes. Rapid advancements and innovation are leading to development of more reliable, precise and sensitive home diagnostic kits that user-friendly and integrated with digital technologies. Factors such as expanding applications of these devices, compact designs, cost-effectiveness, increased consumer health awareness, rising trend of home healthcare and accelerated regulatory approvals are driving the market growth.

What are the Key Trends in the Home Diagnostics Market in 2025?

- In June 2025, Tracky, an innovative healthtech start-up and a part of DrStore Healthcare Services India Pvt Ltd., officially introduced its flagship product, Tracky CGM which is India’s first Bluetooth-enabled Continuous Glucose Monitor (CGM).

- In April 2025, Resmed introduced its U.S. Food and Drug Administration (FDA) approved NightOwl home sleep apnea test (HSAT) in the U.S. The simplified and accurate disposable home sleep apnea test device used for diagnosing obstructive sleep apnea (OSA) can store up to ten nights of sleep data for a single patient.

What is The Future of AI in Home Diagnostics Market?

Increased global demand for early and accurate disease diagnosis is driving the adoption of AI technologies by manufacturers in home diagnostic technologies. AI algorithms can be applied for analyzing medical images generated by MRIs and X-rays for detecting abnormalities. Wearable devices integrated with AI technologies is enabling remote monitoring of patient vitals and providing insights to patients and healthcare professionals in real-time, further allowing timely interventions. Vast amounts of patient data such as medical history and genetic factors analysed by AI algorithms is facilitating the creation of personalized treatment approaches.

Report Scope of Home Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 7.33 Billion |

| Market Size by 2034 |

USD 11.87 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Test Type, Form, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott Laboratories, BTNX, Inc., Becton Dickinson & Company, ACON Laboratories, Inc., ARKRAY Inc., Roche Holding AG, Assure Tech, SA Scientific, Zeotis Inc., Bionime Corporation, Quidel Corporation. |

Market Dynamics

Drivers

Increased Emphasis on Personalized and Preventive Healthcare

With the globally rising burden of chronic disease such as diabetes and cancer as well as infectious diseases is driving the demand for continuous monitoring and early detection of these conditions. Home diagnostic tests are offering a convenient and accessible solution to individuals. Home diagnostics are enabling personalized monitoring of patients, further facilitating development of tailored treatment plans. Moreover, increased health awareness and focus of individuals on preventive healthcare is leading to adoption of these self-testing options for preventive screenings and proactive health management.

Restraints

High Costs of Testing Kits

Significant investments in the research and development activities by medical device manufacturers is facilitating the development of advanced home diagnostic tools incorporated with features such as biomarkers and AI technologies, potentially leading higher costs of end products for consumers. Furthermore, stringent regulatory approval processes can lead to increased compliance costs and delayed market entry of innovative technologies, further restraining the market growth.

Opportunities

Technological Advancements Facilitating Remote Patient Monitoring

Home diagnostic technologies allowing continuous monitoring of patient health conditions are expanding remote patient monitoring capabilities, especially in underprivileged areas. Integration of AI and telemedicine is enhancing the efficacy and workflow of home diagnostics. Advancements in biosensors and lab-on-a-chip technology are facilitating the development of small wearable devices such as smartwatches and rings for continuous monitoring of patient vital signs and rapid diagnosis of various conditions. Internet of Medical Things (IoMT) and 5G technology are revolutionizing remote patient monitoring by enabling seamless collection and real-time transmission of data from patient’s home.

Segmental Insights

Why Did the Glucose Monitoring Devices Segment Dominate in 2024?

By test type, the glucose monitoring devices segment accounted for the largest market share in 2024. Globally rising prevalence of both Type 1 and Type 2 diabetes, due to factors such as aging demographics, obesity, sedentary lifestyles and unhealthy diets is creating a huge demand for glucose monitoring devices for effective management of diabetes. Increase adoption of continuous glucose monitoring devices by patients is enabling real-time insights of blood glucose levels. Advancements in sensor technologies is leading to development of convenient and minimally invasive glucose measurement techniques. Furthermore, growing emphasis on proactive disease management, reduced visits to clinics, improved patient life quality, government support and favourable reimbursement policies are fuelling the market growth.

By test type, the infection testing kits segment is expected to register the fastest growth during the forecast period. The market growth of this segment can be attributed to the increasing cases of infectious diseases, focus on preventive healthcare, availability of easy-to-use infection testing kits and continuous advancements in diagnostic technologies. Diagnostic testing in sensitive conditions such as STIs (Sexually Transmitted Infections) is driving the adoption of home testing offering a discrete and private alternative for patients. Additionally, various governments are launching awareness campaigns as well as establishing and supporting the development of distribution networks for providing free or subsidized at-home diagnostic testing kits to the public, especially in underserved communities.

What Made Cassettes the Dominant Segment in 2024?

By form, the cassettes segment dominated the market with the highest share in 2024. Cassettes are plastic devices utilized for rapid diagnostic tests for detection of various diseases. They are designed to be user-friendly, disposable and require minimum training for applying which makes them suitable for home testing. Moreover, affordability of these devices, rising chronic disease burden, expanding global population, increasing disposable incomes and growing awareness of early disease detection are the factors driving the market dominance of this segment. Advancements in diagnostic technologies is enabling the development of highly sensitive and specific cassette tests. Rising adoption of telemedicine platforms is facilitating the use of remote patient monitoring tools and home diagnostic tests.

How Retail Pharmacies Segment Dominated the Market in 2024?

By distribution channel, the retail pharmacies segment generated the largest revenue in the market in 2024. Retail pharmacies are present everywhere and easily accessible to consumers for purchasing without any appointments and offer convenience of picking the test kit off the shelf. Pharmacists are one of the most trusted healthcare professionals who can provide proper guidance on choosing and using the appropriate home diagnostic test for consumers. Pharmacies are implementing strategic product placement practices for making these home diagnostic kits visible and readily available to visiting consumers. Moreover, retail pharmacies are expanding their services by offering point-of-care testing services within the pharmacy.

By distribution channel, the online pharmacies segment is expected to register fastest growth during the forecast period. Booming e-commerce sector and increased penetration of digital technologies as well as evolving consumer behaviours are driving the market growth of this segment. Online pharmacies offer 24/7 access to services which allows consumers to browse and purchase home diagnostic kits at any time and any place, beyond geographical limitations and without the need for visiting the store physically. A wide range of kits for various conditions are available through online applications and websites offering doorstep delivery.

Discreet packaging for sensitive tests like HIV, STI or drug abuse is provided by online pharmacies to maintain patient privacy. Additionally, competitive pricing strategies, integration with telehealth platforms, increased smartphone use, rising number of health conscious individuals and supportive government initiatives are fuelling the market expansion of this segment.

Regional Insights

What Drives North America’s Dominance in the Home Diagnostics Market?

North America held the largest revenue share in the global home diagnostics market in 2024. The region’s well-established healthcare infrastructure with significant investments is enabling adoption and access to advanced diagnostic technologies as well as development of innovative products. High prevalence of chronic diseases, especially in the aging population is driving the for convenient and accurate home diagnostic kits. Increased consumer awareness, focus on proactive health management, supportive regulatory environment authorizing over-the-counter (OTC) home diagnostic tests, robust distribution networks and favourable reimbursement policies are driving the region’s market dominance. Government support through funding for developing point-of-care testing kits and promoting research activities as well as initiatives for integrating at-home testing with telemedicine are fuelling the market expansion.

What Opportunities Lie in the Asia Pacific Home Diagnostics Market?

Asia Pacific is anticipated to witness fastest growth in the global home diagnostics market over the forecast period. Large patient pool with rising burden of lifestyle-related chronic diseases due to factors such as rapid urbanization and industrialization activities, evolving dietary habits, sedentary lifestyles and aging demographics are creating the demand for long-term monitoring and ideal home diagnostic solutions. Increasing number of diabetes patients and infectious disease cases in countries like China and India is contributing to adoption of these devices. Furthermore, rising disposable incomes, innovative product launches, advancing healthcare infrastructure, integration digital technologies, emergence of telehealth platforms and government support are factors creating lucrative opportunities for the region’s market growth.

Some of The Prominent Players in The Home Diagnostics Market Include:

Recent Developments in the Home Diagnostics Market

- In April 2025, SEKISUI Diagnostics introduced the Metrix COVID/Flu Test which is the second assay on the Metrix Molecular Platform. The test can be used at the point-of-care and in home settings.

- In March 2025, Visby Medical received the U.S. Food and Drug Administration’s (FDA’s) approval for its Visby Medical Women’s Sexual Health Test, a first-of-its-kind home diagnostic test for chlamydia, gonorrhea and trichomoniasis available without a prescription.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Home Diagnostics Market.

By Test Type

- Glucose Monitoring Devices

- Pregnancy Test

- Ovulation Predictor Test Kits

- HIV Test Kits

- Cholesterol Detection Kits

- Infection Testing Kits

- Drug of Abuse Test Kits

- Others

By Form

- Cassettes

- Midstream

- Instruments

- Strips

- Test

- Digital Monitoring

- Dip Cards

By Distribution Channel

- Retail Pharmacies

- Drug Stores

- Hypermarket & Supermarkets

- Online Pharmacies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)