The global hospital stretchers market size was estimated at USD 2,320.00 million in 2023, is expected to surpass around USD 4,115.74 million by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 5.9% during the forecast period of 2024 to 2033.

.jpg)

Key Takeaways:

- The bariatric segment accounted for the highest revenue share of 37.6%.

- The emergency/trauma segment held the largest revenue share of 32.9% of the global market in 2023.

- The motorized segment held the largest revenue share of more than 66.0% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

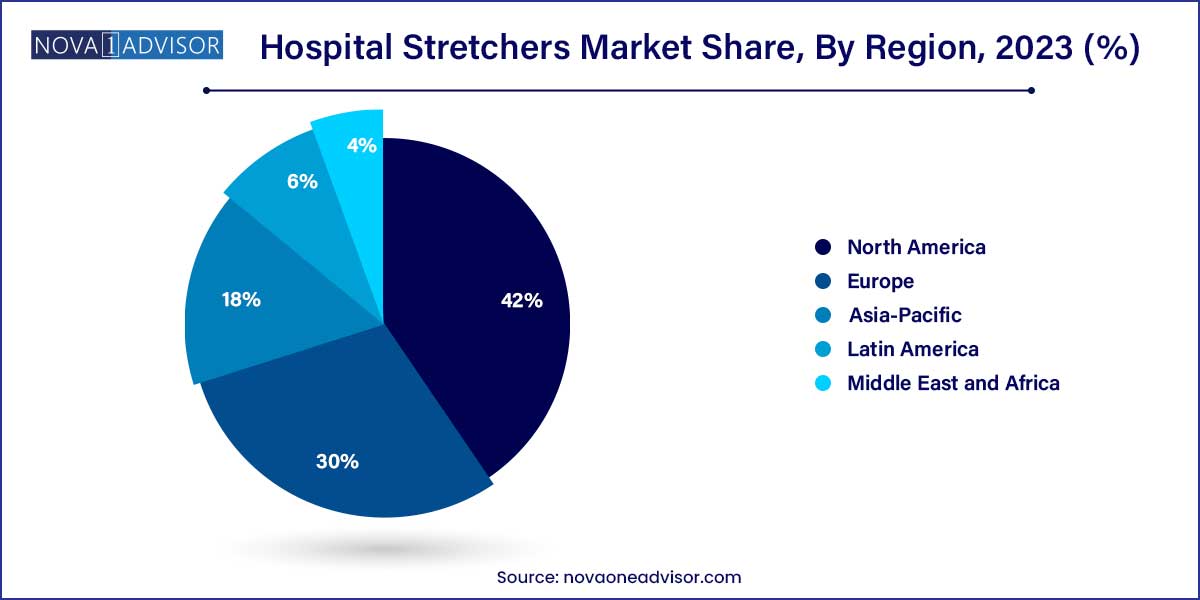

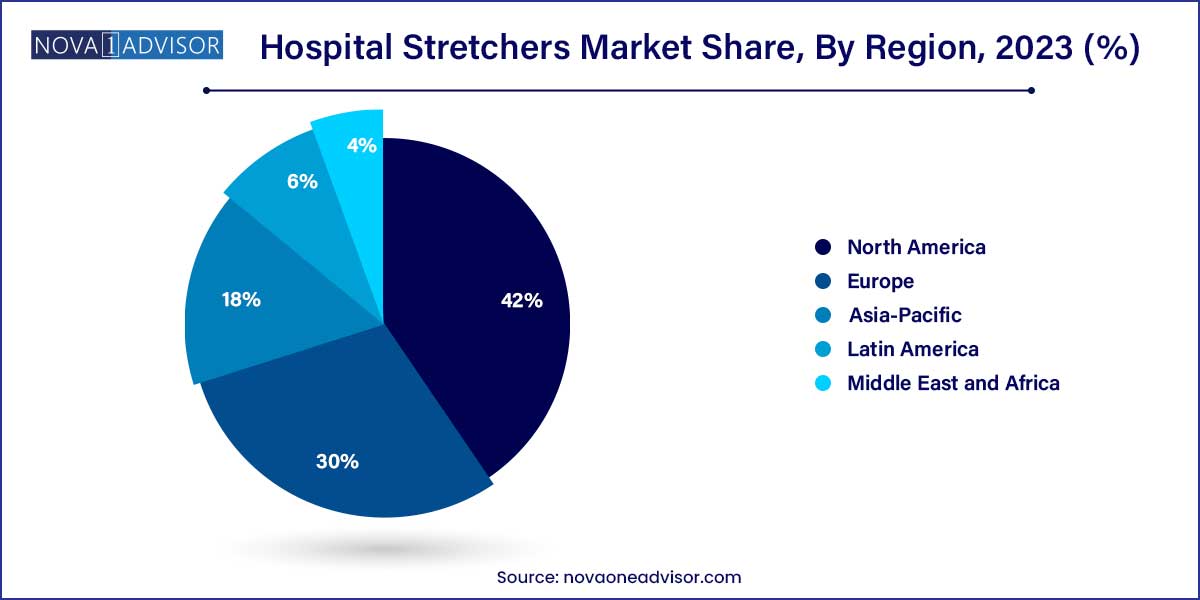

- North America held the largest revenue share of 42.0% of the global market in 2023.

Market Overview

The Hospital Stretchers Market serves as a critical element in patient handling, offering mobility, comfort, and safe transportation within healthcare facilities. Stretchers are widely used for patient movement across different hospital areas, including emergency departments, operation theatres, diagnostic centers, and inpatient wards. They come in various configurations such as fixed-height, adjustable, radiographic, bariatric, and motorized stretchers, addressing diverse patient needs and clinical requirements.

The growing number of hospital admissions, rising incidence of accidents and trauma cases, increasing geriatric population, and expanding healthcare infrastructure are key factors driving demand for hospital stretchers globally. In addition, technological innovations leading to lighter, more ergonomic, and more functional stretcher designs are enhancing operational efficiency and patient care standards.

Leading manufacturers such as Stryker Corporation, Hill-Rom Holdings, and Getinge AB are investing significantly in the development of next-generation stretchers featuring powered mobility, built-in radiographic capabilities, smart monitoring sensors, and advanced braking systems. The market is expected to continue evolving in line with advancements in emergency medicine, trauma care, and surgical interventions.

Major Trends in the Market

-

Growing Adoption of Motorized Stretchers: Improving caregiver ergonomics and patient safety.

-

Integration of Smart Features and IoT Sensors: Real-time monitoring of vital signs during patient transport.

-

Increasing Demand for Lightweight and Foldable Stretchers: Enhancing portability and storage efficiency.

-

Rising Popularity of Radiographic Stretchers: Streamlining patient imaging and reducing transfer-associated risks.

-

Customization of Bariatric Stretchers: Addressing the needs of obese patients.

-

Emphasis on Infection Control: Development of stretchers with antimicrobial surfaces.

-

Surge in Ambulatory Care and Outpatient Procedures: Boosting demand for transport and procedure stretchers.

Hospital Stretchers Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2,320.00 Million |

| Market Size by 2033 |

USD 4,115.74 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, Technology Type, Application, And Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Hill-Rom Holdings; Stryker; Mac Medical; TransMotion Medical Inc.; Fu Shun Hsing Technology; Narang Medical Ltd.; ROYAX; Advanced Instrumentations |

Key Market Driver

Rising Incidence of Road Accidents, Trauma Cases, and Emergency Admissions

A significant driver for the hospital stretchers market is the rising burden of trauma and emergency cases globally. According to the World Health Organization (WHO), road traffic injuries are among the leading causes of death worldwide, particularly among individuals aged 5–29 years. Rapid and safe patient transport is critical in trauma management, and stretchers play a central role in these settings. In March 2024, the U.S. Department of Transportation reported a 10% increase in emergency room admissions related to road accidents over the past two years, reinforcing stretcher demand.

Key Market Restraint

High Cost and Maintenance Requirements of Advanced Stretchers

While motorized and high-end stretchers improve operational efficiency and patient outcomes, their high procurement costs and ongoing maintenance requirements can strain healthcare budgets, especially in emerging economies. Additionally, repairing mechanical and electrical components can be costly and time-consuming, potentially limiting adoption among cost-sensitive healthcare providers. The need for regular maintenance, especially for battery-operated and smart stretchers, can further burden operational costs.

Key Market Opportunity

Technological Innovation in Smart and Motorized Stretchers

The emergence of smart and motorized stretchers represents a major opportunity for market growth. Stretchers embedded with IoT sensors, telemetry systems, self-propelled motors, and patient monitoring devices offer enhanced safety, improved workflow efficiency, and real-time data capture during patient transfer. In February 2024, a leading hospital in Germany launched a pilot program deploying smart stretchers integrated with telemedicine capabilities, showcasing the potential of high-tech mobility solutions in modern healthcare.

Product Type Insights

Adjustable Height Stretchers dominated the product type segment in 2024. Adjustable stretchers offer flexibility to healthcare providers, allowing them to optimize the stretcher height for patient safety and procedural efficiency. These stretchers are widely used across emergency rooms, operating rooms, and diagnostic units, ensuring smooth patient transfers and minimizing caregiver back injuries.

Bariatric Stretchers are the fastest-growing product segment. With global obesity rates rising, hospitals are increasingly investing in heavy-duty stretchers capable of handling higher patient weights. Bariatric stretchers offer reinforced frames, wider beds, and advanced safety features such as integrated scales and heavy-duty wheels. In March 2024, the World Obesity Federation highlighted the urgent need for healthcare facilities to upgrade patient handling equipment, including bariatric stretchers.

Application Insights

Non-Motorized Stretchers dominated the technology type segment. Despite the advancement of motorized alternatives, non-motorized stretchers remain widely used, particularly in cost-sensitive environments, due to their lower upfront and maintenance costs. They are favored for their simplicity, reliability, and ease of use in various healthcare settings.

Motorized Stretchers are growing rapidly, driven by the need for reduced physical strain on caregivers and improved maneuverability in critical care and emergency departments. New motorized stretchers feature electric lift functions, self-driving mechanisms, and braking assist technologies. In January 2024, Hill-Rom introduced a new line of motorized stretchers aimed at improving hospital workflow efficiency and patient safety.

Technology Type Insights

Non-Motorized Stretchers dominated the technology type segment. Despite the advancement of motorized alternatives, non-motorized stretchers remain widely used, particularly in cost-sensitive environments, due to their lower upfront and maintenance costs. They are favored for their simplicity, reliability, and ease of use in various healthcare settings.

Motorized Stretchers are growing rapidly, driven by the need for reduced physical strain on caregivers and improved maneuverability in critical care and emergency departments. New motorized stretchers feature electric lift functions, self-driving mechanisms, and braking assist technologies. In January 2024, Hill-Rom introduced a new line of motorized stretchers aimed at improving hospital workflow efficiency and patient safety.

Regional Insights

North America dominated the global hospital stretchers market in 2024. Factors contributing to this dominance include a strong focus on patient safety, widespread adoption of advanced hospital equipment, high healthcare expenditure, and a well-established emergency care infrastructure. The U.S. in particular has stringent hospital safety and operational guidelines that emphasize the use of specialized stretchers. In March 2024, the American College of Emergency Physicians endorsed new standards recommending updated emergency department stretchers for trauma care.

Asia-Pacific is the fastest-growing region. Rapid urbanization, healthcare infrastructure improvements, growing medical tourism, and rising incidence of accidents and chronic diseases are boosting market growth in countries like China, India, and Japan. Governments are heavily investing in emergency medical services (EMS) and trauma care centers, further driving stretcher demand. In April 2024, India's Health Ministry launched an initiative to modernize ambulance services across 20 states, with significant allocations for advanced stretchers and patient transport systems.

Some of the prominent players in the hospital stretchers market include:

- Hill-Rom Holdings

- Stryker

- Mac Medical

- TransMotion Medical Inc.

- Fu Shun Hsing Technology

- Narang Medical Limited

- ROYAX

- Advanced Instrumentations

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hospital stretchers market.

Product Type

- Fixed Height

- Bariatric

- Adjustable Height

- Radiographic

Technology Type

Application

- Daycare/Inpatient

- Surgery

- Emergency/Trauma

- Ambulatory/Transport

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

.jpg)