Human DNA Vaccines Market Size and Research

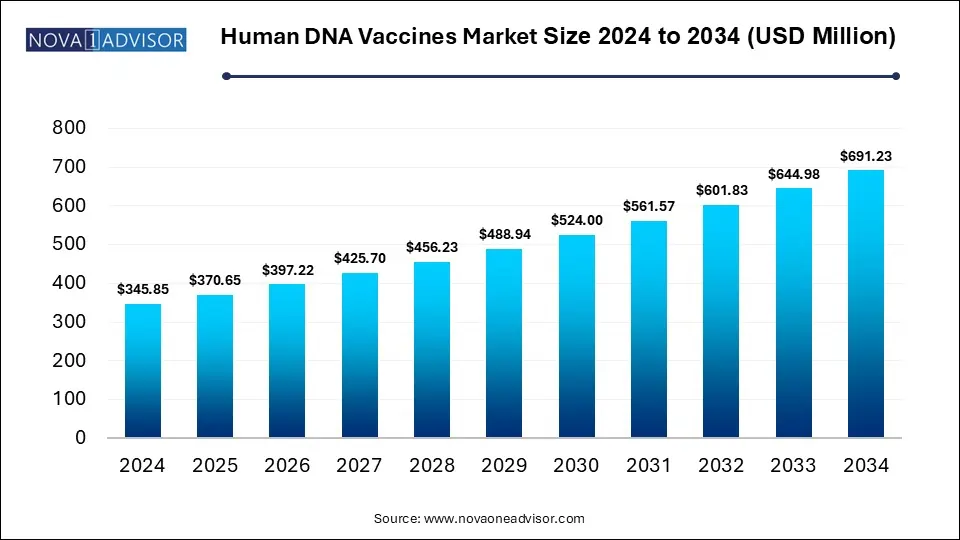

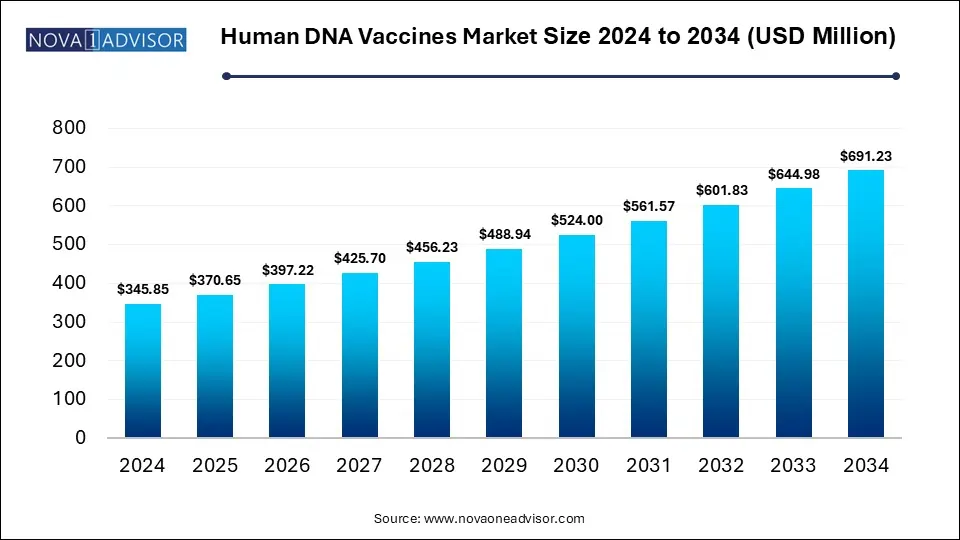

The global human DNA vaccines market size is calculated at USD 345.85 million in 2024, grow to USD 370.65 million in 2025, and is projected to reach around USD 691.23 million by 2034, growing at a CAGR of 7.17% from 2025 to 2034. The market is growing due to rising demand for rapid, scalable vaccine platforms and increasing investment in genetic and infectious disease research. Technological advancements in gene delivery methods also drive market potential.

Key Takeaways

- North America dominated the human DNA vaccines market in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the recombinant protein vaccine market segment held the major market revenue share in 2024.

- By type, the gene-based vaccine segment is expected to grow at the fastest CAGR in the market during the studied years.

- By application, the human papillomavirus segment held the largest market share.

- By application, the influenza segment is expected to grow at the fastest CAGR in the market during the studied years.

- By end-user, the hospital & specialty clinics segment led the market in 2024.

- By end-user, the Ambulatory Surgical Centers segment is expected to grow at the fastest CAGR in the market during the studied years.

How Innovation is Impacting the Human DNA Vaccines Market

Potential analysis of human DNA vaccines refers to the assessment of market growth opportunities, demand drivers, technological advancements, and prospects of DNA-based immunization in preventing human diseases. Innovation is significantly shaping the human DNA vaccines market by enabling faster development, improved efficacy, and targeted delivery systems. Advancements such as electroporation, nanocarriers, and synthetic DNA platforms are enhancing immune responses and reducing side effects. These innovations also support rapid scalability during outbreaks, making DNA vaccines a preferred choice in pandemic preparedness. As a result, they are attracting substantial investment and regulatory interest, boosting the market's future growth potential.

What are the Key Trends in the Human DNA Vaccines Market in 2025?

- In March 2025, researchers at the Icahn School of Medicine at Mount Sinai, led by Dr. Nina Bhardwaj, introduced PGV001—a personalized multi-peptide neoantigen cancer vaccine. Designed to train the immune system to recognize and destroy cancer cells, the vaccine showed promising results in a small group of patients during early testing. This advancement highlights a significant step forward in personalized cancer immunotherapy.

- In March 2025, Oncovita, a biotech firm focused on vaccine development, formed a strategic partnership with the Institut Pasteur and Unither Pharmaceuticals, a specialist in sterile unit-dose manufacturing. The collaboration aims to produce a new combined prophylactic vaccine for children to help prevent various infectious diseases.

How Can AI Affect the Human DNA Vaccines Market?

AI can significantly enhance the potential analysis of human DNA vaccines by accelerating data processing, predicting immune responses, and identifying effective antigen targets. It enables rapid simulation of vaccine efficacy, supports personalized vaccine design, and improves clinical trial efficiency through advanced analytics. By uncovering patterns and insights from large datasets, AI helps forecast market trends, optimize development strategies, and reduce time-to-market. This leads to more informed decisions and a clearer understanding of future market opportunities.

Report Scope of Human DNA Vaccines Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 370.65 Million |

| Market Size by 2034 |

USD 691.23 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 7.17% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Type, By Application, By End User, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Pfizer, Sanofi, Johnson & Johnson, Merck, GSK, Biontech, Moderna |

Market Dynamics

Driver

Increasing Demand for Rapid and Scalable Vaccine Solutions

The rising need for flexible and quickly deployable vaccines drives the growth of the human DNA vaccine market. DNA vaccines can be rapidly designed and produced, making them suitable for responding to outbreaks and pandemics. Their ability to trigger strong immune responses without using live pathogens adds to their appeal. As global health priorities shift towards preparedness and quick action, this demand fuels investment and interest, boosting the market’s long-term potential and strategic value.

Restraint

Limited Clinical Success and Regulatory Approval for Human Use

The absence of widespread clinical breakthroughs and regulatory green lights hinders the growth of the human DNA vaccines market. This lack of proven success raises doubts about their real-world performance and acceptance. As a result, pharmaceutical companies may be reluctant to invest heavily, and healthcare systems may prefer more established vaccine types. This slows innovation, delays product launches, and limits the overall expansion of the CAN vaccine landscape.

Opportunity

Advancements in Delivery Technologies

Improved delivery technologies are paving the broader success of human DNA vaccines by overcoming previous limitations in cellular absorption and immune activation. Innovations such as microneedle arrays and lipid-based carriers enhance precision, reduce discomfort, and increase vaccine stability. These advancements not only boost the effectiveness of DNA vaccines but also make them more accessible and practical for mass immunization, especially in low-resource settings, creating strong opportunities for future market growth.

Segmental Insights

How will the Recombinant Protein Vaccine Segment Dominate the Human DNA Vaccines Market in 2024?

The recombinant protein vaccine segment dominated revenue shares in 2024 within the human DNA vaccine market potential due to its consistent clinical performance and established use in immunization programs. Its ability to produce targeted antigens with fewer side effects attracted wider adoption. Additionally, familiarity among healthcare providers and regulatory agencies, along with efficient manufacturing infrastructure, gave this market a competitive edge, positioning it as a preferred choice over emerging vaccine technologies like DNA-based platforms.

The gene-based vaccines segment is anticipated to grow at the fastest CAGR because of its innovative approach to stimulating a long-lasting immune response by using genetic material to instruct cells to produce antigens. This method allows for quicker vaccine updates in response to evolving diseases. Increased research funding, technological progress, and successful early trials for rapid development and market expansion drive the market growth.

Why Did the Human Papillomavirus Segment Dominate the Human DNA Vaccines Market in 2024?

The human papillomavirus segment led the human DNA vaccines market due to the urgent need for effective prevention against HPV-related cancer and genital infections. Its dominance is supported by widespread vaccination initiatives, particularly in women's health programs, and growing acceptance of DNA-based approaches. Continued innovation in therapeutic HPV vaccines and strong support from global health organizations have further amplified this market impact, securing its leading position in market shares and future potential.

The influenza segment is projected to witness the fastest CAGR in the human DNA vaccines market as frequent strain variations demand swift and flexible vaccine development. DNA vaccine technology allows for faster updates and production, meeting the urgent need for timely protection. Gearing global concerns over flu-related health risks, along with advancements in gene-based immunization, has accelerated research efforts for the rapid expansion of the market.

How Does the Hospital & Specialty Clinics Segment Dominate the Market?

Hospitals and specialty clinics dominated the human DNA vaccine market due to their critical role in offering advanced treatment options, managing immunization programs, and supporting early-stage clinical testing. Their ability to handle complex vaccine protocols and provide personalized care makes them central to adopting novel DNA-based therapies. Moreover, increasing patient trust in institutional healthcare settings and the presence of skilled medical staff contribute to the segment’s strong position in driving market growth and vaccine accessibility.

Ambulatory surgical centers are projected to experience the fastest growth in the human DNA vaccine market due to their expanding role in delivering outpatient services and preventive care. These centers offer a streamlined, patient-friendly environment with lower operational costs and quicker service, making them attractive for vaccine administration. As healthcare systems shift toward decentralized models and demand for accessible immunization rises, these facilities are increasingly positioned as key contributors to the widespread adoption of DNA vaccines.

Regional Insights

How is North America Contributing to the Expansion of Human DNA Vaccines Market?

North America dominated the potential analysis of the human DNA vaccine market due to its strong biotechnology infrastructure, high healthcare spending, and early adoption of advanced medical technologies. The region benefits from active government support, robust R&D investments, and the presence of leading pharmaceutical companies. Additionally, favorable regulatory frameworks and a strong clinical trial network have accelerated the development and evaluation of DNA vaccines, positioning North America as a key leader in this market’s growth.

How is Asia-Pacific approaching the Human DNA Vaccines Market in 2025?

The Asia-Pacific region is projected to witness the fastest CAGR in the human DNA vaccine market in 2025 due to rapid technological adoption, increasing prevalence of infectious diseases, and supportive regulatory reforms. Countries like China, India, and South Korea are strengthening their biotech capabilities and encouraging domestic vaccine innovation. Growing public-private partnerships, improved access to healthcare, and rising demand for cost-effective immunization options further boost the region’s potential for accelerated market expansion.

Some of The Prominent Players in The Human DNA Vaccines Market Include:

- Pfizer

- Sanofi

- Johnson & Johnson

- Merck

- GSK

- Biontech

- Moderna

Recent Development in the Human DNA Vaccines Market

- In May 2025, the FDA approved the Novavax COVID-19 vaccine for use in individuals aged 12 and older, particularly targeting those with underlying health conditions that heighten their risk of severe illness. This authorization also includes older adults, aiming to protect vulnerable groups more effectively against COVID-19.

- In March 2025, researchers at Cedars-Sinai developed DYNA, an AI-powered tool designed to accurately connect gene mutations with specific diseases. This innovation is expected to advance personalized medicine and support the development of more precise and effective targeted therapies.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Human DNA vaccines market.

By Type

- Recombinant protein vaccine

- Gene-based vaccine

By Application

- HIV

- Human Papillomavirus

- Influenza

- Others

By End User

- Hospital & Specialty Clinics

- Ambulatory Surgical Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)