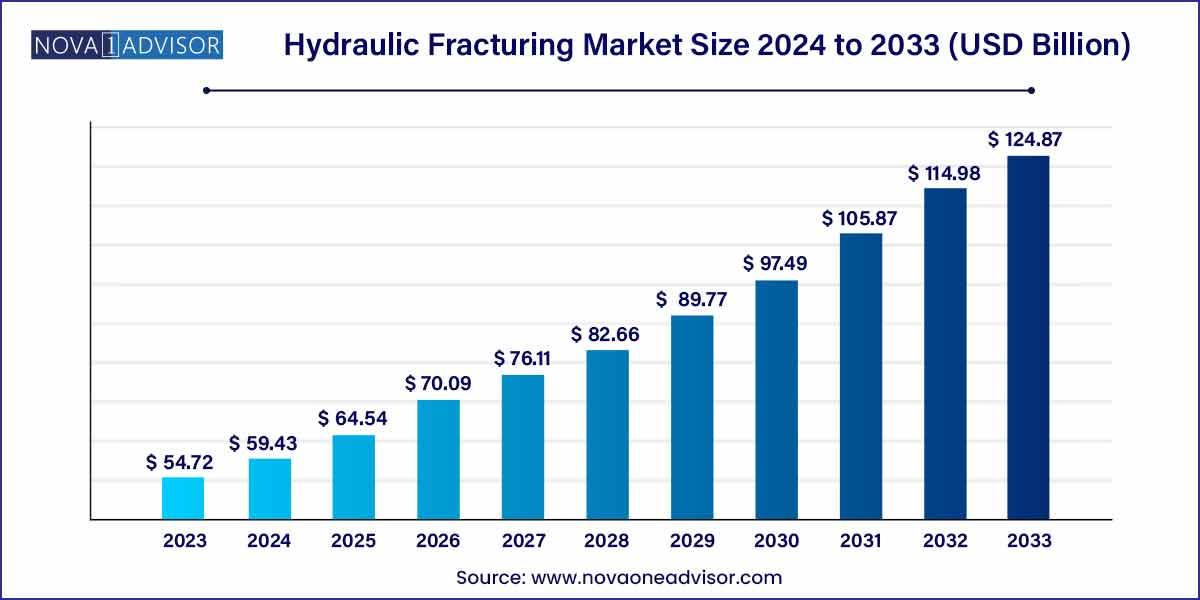

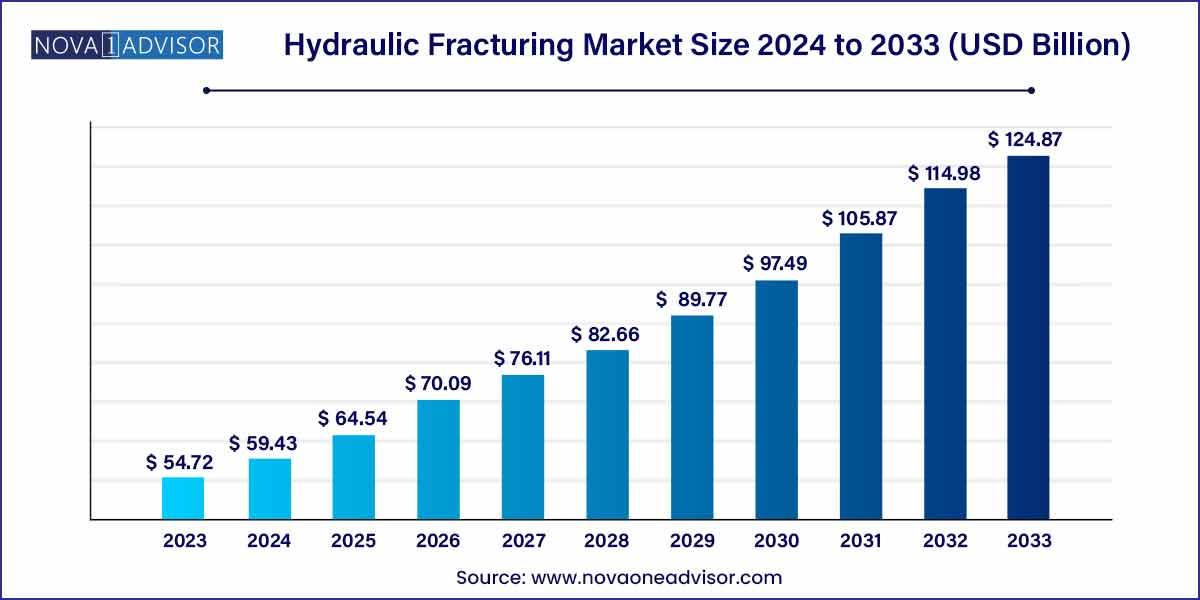

The global hydraulic fracturing market size was exhibited at USD 54.72 billion in 2023 and is projected to hit around USD 124.87 billion by 2033, growing at a CAGR of 8.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific was the leading hydraulic fracturing market, garnering a market share of more than 61% in 2023.

- North America is estimated to grow at a considerable pace during the forecast period.

- Technological advancements have played a crucial role in driving the hydraulic fracturing (fracking) market.

- The horizontal well segment held the dominant share of the hydraulic fracturing market in 2023.

Hydraulic Fracturing Market by Overview

The hydraulic fracturing market remains a cornerstone of the global oil and gas industry, significantly enhancing the production of hydrocarbons from unconventional reserves. Hydraulic fracturing, often referred to as "fracking," involves injecting high-pressure fluid into subterranean rocks to create fractures, thereby facilitating the flow of oil and natural gas to the surface. This technique has unlocked vast reserves of shale gas, tight oil, and tight gas, which were previously uneconomical to exploit.

In 2024, the hydraulic fracturing market is experiencing a resurgence, driven by the growing global energy demand, geopolitical dynamics affecting oil supply, and the rising importance of energy security. Technological advancements, particularly in horizontal drilling and multi-stage fracturing, have greatly enhanced recovery rates while reducing operational costs. Moreover, as countries seek to balance energy transition goals with immediate energy needs, hydraulic fracturing continues to play a critical role, especially in regions like North America, where shale production has transformed energy independence narratives.

However, the industry faces challenges, including environmental concerns, water usage issues, and regulatory scrutiny. To address these, companies are investing in greener fracking technologies, including waterless fracking and the use of recycled fluids. Overall, hydraulic fracturing remains pivotal in shaping the near-term and mid-term global energy landscape.

Hydraulic Fracturing Market Growth

Hydraulic fracturing is known as a technology in which the fluids are drove into the well at a high level of injection in order to breakdown the reservoirs of oil. This fluid comprise of chemicals, water, and sand. In addition, in the production of oil and gas, it is in general used to increase the production of oil & gas reservoirs in order to keep the well sticky in nature and also fracturing fluids are utilized in this technique for creating a fracture of better width. This technique of hydraulic fracturing is father known as fracking and it is utilized to generate gas and oil from the well. Also, this technique of fracking is provided by variouscompanies of oils & natural gas, and it is also utilized in various applications such as tight oil, crude oil, shale oil and many others.

A significant increase in the offshore and onshore oil and gas explorationactivities is one of the major factors driving the market growth. Hydraulic fracturing is extensively used for the redevelopment of well base expansion, oil fields, and exploring new offshore projects for the extraction of crude oil and natural gas. In addition, the growing demand for energy across both emerging and developed nations is providing a growth impetus to the market. Hydraulic fracturing is widely used for the exploration of optimization of oil production and highly impermeable shale reservoirs. In line with this, the increasing adoption of prefundplug technology for horizontal and vertical wells is also contributing to the market growth. In addition, the growth of waterless and foam-based technologies of fracking is working as another growth factor. In addition, foam provides low liquid and high viscosity content that helps in decreasing water reducing and utilizing the impact on the environment. Furthermore, other key factors, comprise of the growth of lucrative fine sand of mesh frac, also with the application of sustainable development favorable policies, are anticipated to drive the market toward growth.

The outbreak of the COVID-19 epidemic in 2020 forced the government to shut down the market in an attempt to restrict the spread of the covid19 virus. Likewise, the lockdown rules and travelling restrictions were assessed across the globe. The propagation of the COVID-19 worldwide has braked down the growth of multitudinous diligence. Furthermore, epidemic has resulted in a substantial decline in affiliated conditioning and transportation, which has further impacted the customer demand for oil and gas. According to the report of International Energy Agency (IEA), the events of geopolitical has increased the low-priced oil supply to the global market of hydraulic fracturing, and during the same time, the demand also declined owing to the outburst of the epidemic, leading to a collapse in oil prices in March 2020. Moreover, these events altogether negatively impacted the global demand regardingoil and natural gas, along with the demand for hydraulic fracturing products & servicesand have integrated significant oil prices volatility.

Hydraulic Fracturing Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 54.72 Billion |

| Market Size by 2033 |

USD 124.87 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Well Type, Application, and Regions |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Kitchen United, Rebel Foods, DoorDash Kitchen, Zuul Kitchen, Keatz, Kitopi, Ghost Kitchen Orlando, Dahmakan, Starbucks (Star Kitchen), Cloud Kitchen. |

Hydraulic Fracturing Market Dynamics:

Driver

Technological advancements

Technological advancements have played a crucial role in driving the Hydraulic Fracturing (fracking) market. Advancement in horizontal drilling techniques allows for greater access to hydrocarbon reservoirs. Technological innovations enable real-time monitoring of well performance and reservoir conditions. Data analytics help operators make informed decisions, optimize production, and troubleshoot issues promptly, improving overall efficiency and reducing downtime. Technologies like Enhanced Oil Recovery (EOR) methods, such as CO2 injection and chemical flooding, can be integrated with hydraulic fracturing to maximize hydrocarbon recovery.

Restraint

Environmental concerns

Governments and regulatory bodies are increasingly scrutinizing the environmental impact of hydraulic fracturing. Stricter regulations, permit requirements, and environmental assessments can increase the operational costs and timelines for fracking projects. Fracking generates a significant amount of wastewater, often containing hazardous substances and heavy metals. Proper disposal and treatment of this wastewater pose challenges, and improper handling can lead to soil and water pollution.

Opportunity

emergence of water management solutions

Increasing environmental regulations and public concern about water usage and contamination have put pressure on the hydraulic fracturing industry to adopt more sustainable and responsible practices. Water management solutions can help companies comply with regulations and demonstrate their commitment to environmental stewardship. Effective water management solutions can lead to cost reductions by optimizing water usage, recycling wastewater, and minimizing the need for freshwater inputs. Concerns about water scarcity and pollution have led to increased scrutiny of fracking operations by communities and stakeholders.

Segmental Analysis

By Well Type

Horizontal wells dominated the hydraulic fracturing market, commanding the largest share in 2024. Horizontal drilling combined with multi-stage hydraulic fracturing has revolutionized the ability to access vast hydrocarbon reserves in unconventional formations. By extending laterally through reservoir rock, horizontal wells maximize exposure to productive zones, significantly increasing extraction rates compared to traditional vertical wells. The Permian Basin, Eagle Ford, and Bakken Shale are prime examples where horizontal drilling has unlocked enormous resource potential. Operators prefer horizontal wells due to their superior economics, improved well productivity, and reduced surface footprint per barrel of oil equivalent (BOE) produced.

Vertical wells are experiencing slower but steady growth, particularly in regions where unconventional resources are less developed or where geological conditions favor vertical completions. In mature conventional basins, vertical fracking still plays a vital role in revitalizing old fields and extracting residual hydrocarbons. Furthermore, in emerging shale plays across Latin America, Africa, and Asia-Pacific, initial exploration efforts often involve vertical wells due to lower drilling costs and quicker results. Although horizontal drilling remains dominant, niche opportunities persist for vertical fracking, particularly where infrastructure and capital constraints exist.

By Application

Shale gas extraction dominated the application segment in the hydraulic fracturing market. Shale gas has transformed the global energy equation, providing a cleaner-burning alternative to coal and a strategic bridge fuel towards decarbonization. The U.S. leads global shale gas production, with fields like the Marcellus and Haynesville Shales showcasing the success of hydraulic fracturing in unlocking vast gas resources. Shale gas production supports electricity generation, industrial activities, and liquefied natural gas (LNG) exports, reinforcing its importance in energy portfolios. Favorable economics, technological refinements, and abundant reserves underpin the dominance of shale gas within hydraulic fracturing applications.

Tight oil is the fastest-growing application segment, driven by surging demand for crude oil and light hydrocarbons. Tight oil reservoirs, typically found in shale or sandstone formations with low permeability, require intensive fracturing techniques to achieve commercial production. The Permian Basin's Wolfcamp and Bone Spring formations are key tight oil-producing zones that have benefited enormously from fracking innovations. Tight oil production is critical in offsetting declines from conventional fields and maintaining global oil supply balance. Rising oil prices, technological advances in drilling efficiencies, and investment returns have rejuvenated tight oil development, particularly in North America.

Regional Analysis

North America dominated the hydraulic fracturing market, accounting for the largest share by a wide margin. The United States pioneered the shale revolution, and hydraulic fracturing remains deeply entrenched in the country's energy strategy. Fields such as the Permian Basin, Bakken Formation, and Marcellus Shale continue to drive activity. Canada's Montney and Duvernay formations also contribute significantly to North America's fracking landscape. The region benefits from established infrastructure, technological leadership, favorable mineral rights regimes, and deep capital markets. Furthermore, political and regulatory environments, while variable at the state/provincial level, generally support continued hydraulic fracturing activities.

Asia-Pacific is the fastest-growing region, fueled by efforts to develop indigenous energy resources and reduce import dependencies. China has the world's largest technically recoverable shale gas reserves and has made significant strides in developing its Sichuan and Tarim Basin resources using hydraulic fracturing. Australia is expanding tight gas and shale gas exploration, while India is opening its unconventional resources to private and foreign investment. Given rising energy demand, supportive policy frameworks, and technological transfers from North America, Asia-Pacific offers immense growth opportunities for hydraulic fracturing service providers and equipment manufacturers.

Key Market Developments

-

April 2025: Halliburton Company unveiled its next-generation electric fracturing fleet, "ZEUS," designed to reduce emissions and operating costs across North American shale plays.

-

March 2025: Schlumberger (SLB) partnered with Sinopec in China to enhance shale gas recovery using advanced fracking technologies customized for local geology.

-

February 2025: Liberty Energy completed a merger with a leading sand supplier to streamline proppant logistics and ensure operational resilience in the Permian Basin.

-

January 2025: Baker Hughes launched a new "EcoStim" suite of environmentally friendly fracturing fluids aimed at reducing freshwater usage by up to 70%.

-

December 2024: Calfrac Well Services expanded its operations into Argentina’s Vaca Muerta shale, securing long-term service contracts with YPF and Tecpetrol.

Some of the prominent players in the hydraulic fracturing market include:

- BJ Services

- Calfroc Well Services

- Basic Energy Services

- RockPile Energy Services

- ProPetro Holding Corporation

- Weatherford

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hydraulic fracturing market.

By Well Type

By Application

- Shale gas

- Tight oil

- Tight gas

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)