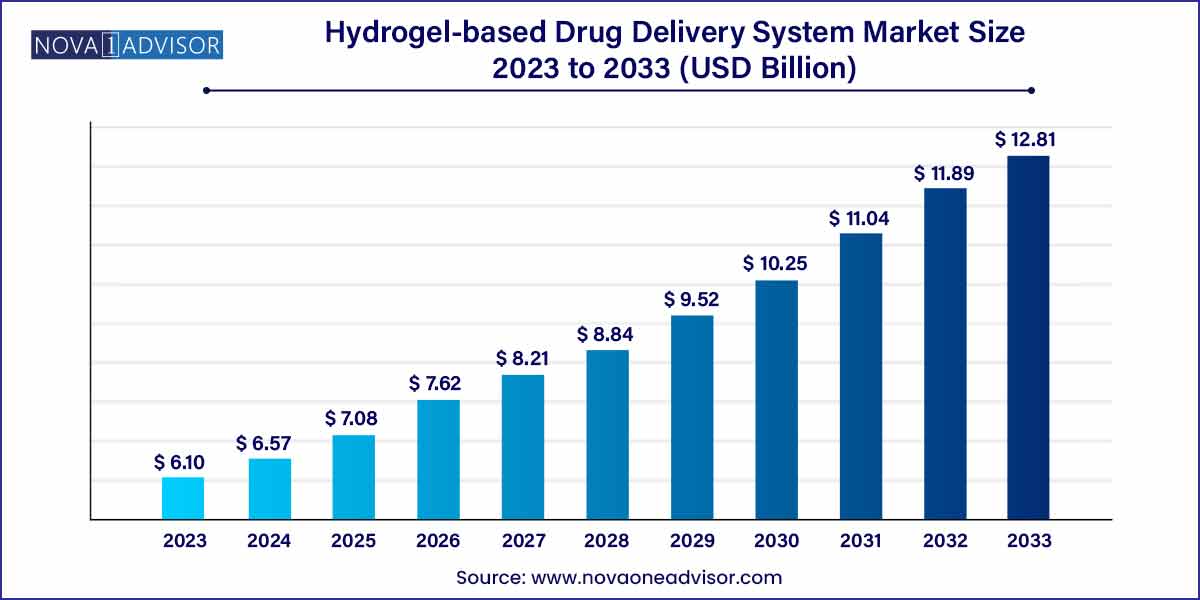

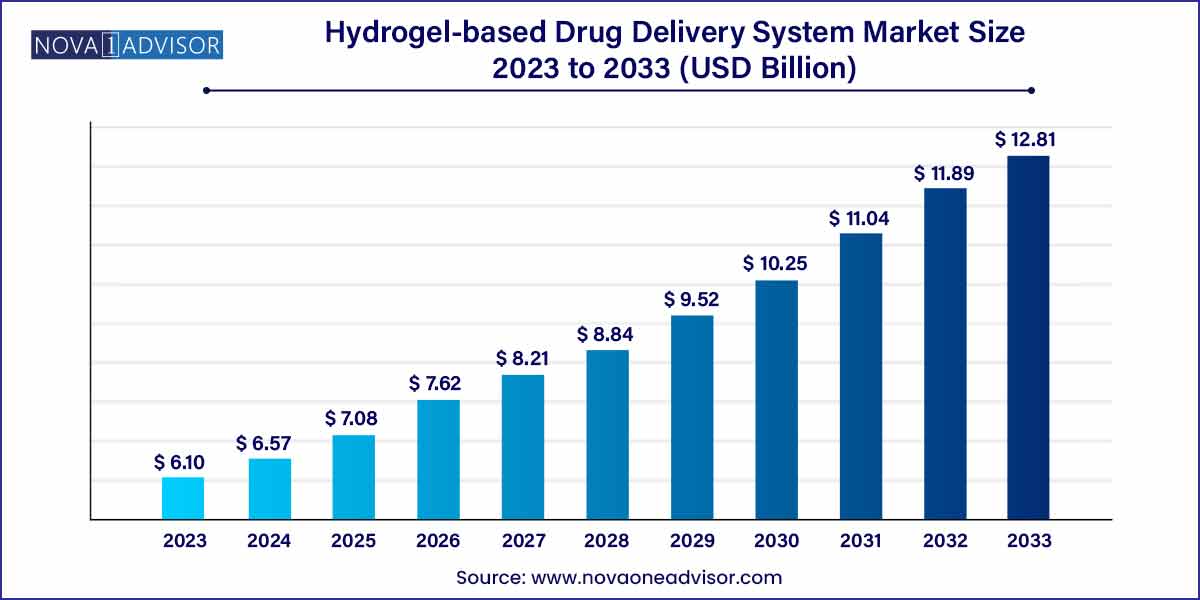

The global hydrogel-based drug delivery system size was exhibited at USD 6.10 billion in 2023 and is projected to hit around USD 12.81 billion by 2033, growing at a CAGR of 7.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- The natural segment dominated the market for hydrogel-based drug delivery systems and accounted for the largest revenue share of 32.3% in 2023.

- The ocular segment dominated the market for hydrogel-based drug delivery systems and accounted for the largest revenue share of 40.0% in 2023.

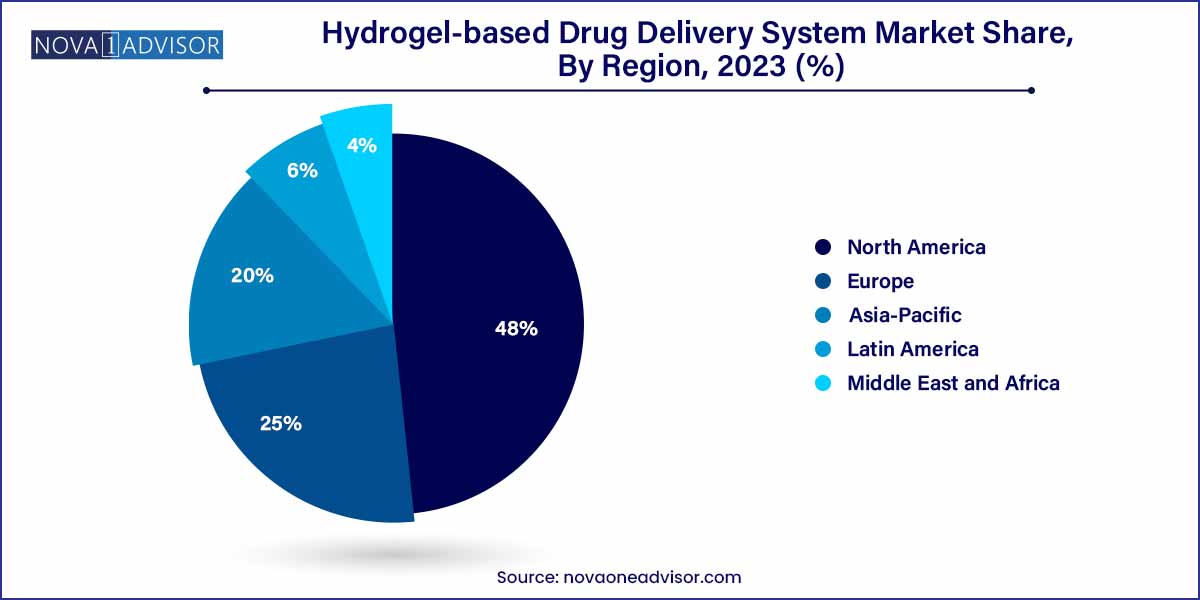

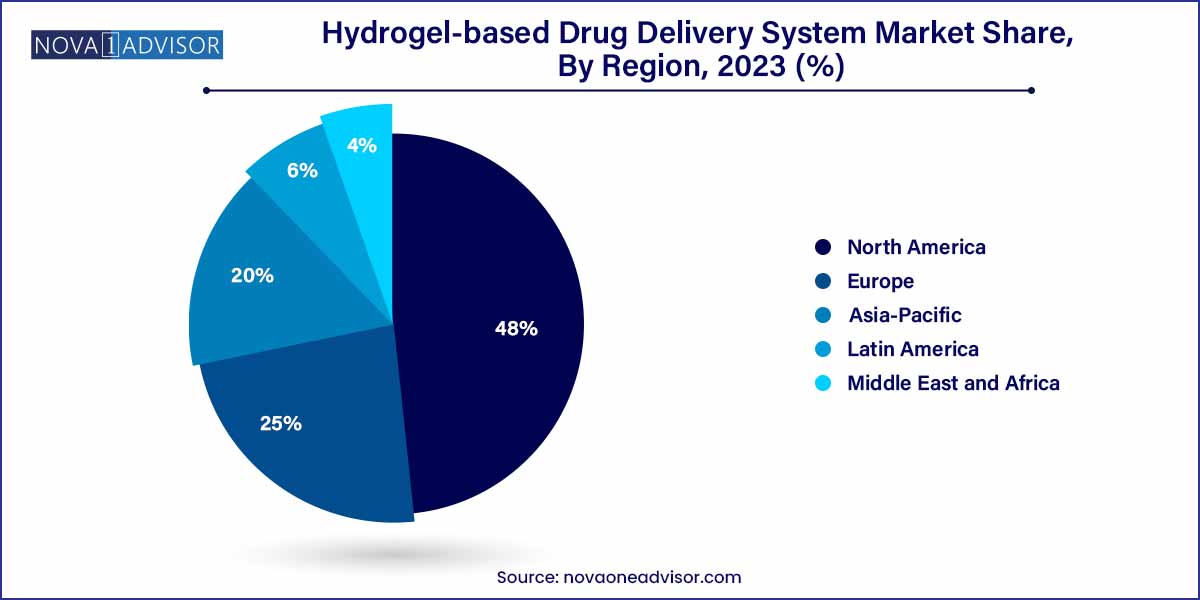

- North America dominated the hydrogel-based drug delivery systems market and accounted for the largest revenue share of 48.0% in 2023.

Market Overview

The hydrogel-based drug delivery system market represents a rapidly expanding frontier in pharmaceutical and biomedical innovation. Hydrogels are three-dimensional, hydrophilic polymer networks capable of absorbing substantial amounts of biological fluids while maintaining structural integrity. Their unique properties including biocompatibility, tunable mechanical strength, controlled drug release profiles, and ease of functionalization make them ideal for a variety of drug delivery applications.

Initially recognized for their applications in wound care and contact lenses, hydrogels have transitioned into the spotlight of advanced drug delivery systems (DDS). They provide advantages such as localized drug delivery, reduced systemic toxicity, and improved patient compliance by enabling sustained and targeted therapeutic effects. Hydrogels are being explored for the delivery of a broad range of therapeutics including chemotherapeutics, proteins, peptides, and vaccines.

The market's expansion is fueled by rising incidences of chronic diseases like cancer, diabetes, and autoimmune disorders, where sophisticated and sustained drug delivery can significantly improve treatment outcomes. Additionally, the burgeoning field of regenerative medicine and the growing need for personalized therapy have intensified the demand for hydrogel-based DDS. Continuous research in smart hydrogels responsive to stimuli such as pH, temperature, or enzymes further broadens the application horizon.

Major Trends in the Market

-

Development of Smart and Stimuli-responsive Hydrogels: Introduction of hydrogels that release drugs in response to environmental triggers like pH, temperature, and enzymes.

-

Increasing Research in Biodegradable Hydrogels: Focus on minimizing long-term residues and improving post-treatment safety profiles.

-

Combination Therapies and Co-delivery Systems: Hydrogels enabling simultaneous delivery of multiple drugs or biologics.

-

Expansion into Regenerative Medicine and Tissue Engineering: Hydrogels serving dual roles as scaffolds and drug depots.

-

Rising Interest in Injectable Hydrogel Systems: Preference for minimally invasive drug delivery techniques.

-

Customization through 3D Printing of Hydrogel Structures: Advanced manufacturing techniques enabling personalized drug delivery matrices.

-

Collaborations Between Academia and Industry: Accelerating the translation of research findings into commercial applications.

Hydrogel-based Drug Delivery System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 6.10 Billion |

| Market Size by 2033 |

USD 12.81 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Polymer Origin, Delivery Route, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

GALDERMA; Blairex Laboratories, Inc.; Johnson & Johnson; Bausch and Lomb; Medtronic; Ocular Therapeutix, Inc.; Ferring B.V.; Endo International plc; Akorn, Incorporated; Tolmar Pharmaceuticals, Inc. |

Driver: Increasing Incidence of Chronic Diseases

One of the primary drivers of the hydrogel-based drug delivery system market is the rising global burden of chronic diseases. Conditions such as cancer, cardiovascular diseases, diabetes, and autoimmune disorders demand therapies that offer sustained and targeted drug release to maximize efficacy while minimizing side effects. Hydrogels provide localized delivery, reducing systemic drug exposure and associated toxicities. For instance, in oncology, hydrogel implants delivering chemotherapeutic agents directly into tumor sites help achieve higher local drug concentrations while sparing healthy tissues. As the global aging population grows and lifestyles shift towards more sedentary patterns, the demand for innovative, patient-friendly drug delivery systems like hydrogels is poised for substantial growth.

Restraint: Challenges in Regulatory Approval and Commercialization

Despite their promising applications, hydrogel-based drug delivery systems face significant challenges in regulatory approval and commercialization. The complexity of hydrogel formulations, variability in drug release kinetics, and difficulties in achieving consistent reproducibility during large-scale manufacturing create hurdles. Regulatory bodies require extensive preclinical and clinical data to ensure the safety, efficacy, and quality of novel DDS, extending time-to-market and increasing development costs. Additionally, integrating hydrogels into existing therapeutic regimes requires healthcare providers to adapt to new administration methods, posing an additional barrier to rapid market adoption.

Opportunity: Advances in Personalized Medicine and Regenerative Therapies

The convergence of hydrogel technology with personalized medicine and regenerative therapies presents an immense opportunity for market expansion. Personalized hydrogel systems can be tailored to release drugs based on an individual’s specific biological markers, ensuring optimal therapeutic outcomes. In regenerative medicine, hydrogels act as scaffolds delivering growth factors, stem cells, and cytokines to facilitate tissue regeneration. Innovations such as 3D bioprinted hydrogel structures capable of releasing therapeutic agents in a spatially and temporally controlled manner are revolutionizing treatment strategies. As healthcare shifts towards more individualized and regenerative approaches, hydrogel-based systems will become increasingly central.

Polymer Origin Insights

Synthetic hydrogels dominated the polymer origin segment. Synthetic hydrogels, such as polyethylene glycol (PEG), polyacrylamide, and polyvinyl alcohol-based hydrogels, offer superior tunability, mechanical stability, and reproducibility compared to natural hydrogels. Their predictable degradation profiles and capacity for functionalization make them highly attractive for controlled drug delivery applications. Pharmaceutical companies often prefer synthetic hydrogels for commercial products due to the ability to customize physical and chemical properties to match therapeutic needs precisely.

Hybrid hydrogels are the fastest-growing polymer origin segment. Combining the benefits of both natural and synthetic polymers, hybrid hydrogels are emerging as a dynamic area of research and application. These systems integrate the biocompatibility and bioactivity of natural polymers like alginate or collagen with the mechanical strength and consistency of synthetic components. Hybrid hydrogels find increasing use in applications demanding both biological functionality and mechanical performance, such as cartilage repair and localized cancer therapy.

Delivery Route Insights

Topical delivery dominated the delivery route segment. Topical hydrogel systems have long been established in wound healing, burn treatment, and dermatological drug delivery. Their ability to provide a moist environment, coupled with the sustained release of therapeutic agents, has made them indispensable in wound management. Hydrogels used for topical drug delivery are often loaded with antibiotics, growth factors, or anti-inflammatory agents, offering controlled, site-specific therapeutic actions with minimal systemic absorption.

Subcutaneous delivery is the fastest-growing delivery route segment. The move towards minimally invasive drug delivery options has driven the rapid growth of subcutaneous hydrogel injections. These injectable hydrogels are utilized for the slow and sustained release of therapeutic agents in chronic conditions such as diabetes, cancer, and autoimmune diseases. Products like "OncoGel," an injectable hydrogel loaded with paclitaxel for local cancer treatment, highlight the potential of subcutaneous delivery methods to revolutionize conventional therapy paradigms.

Regional Insights

North America dominated the hydrogel-based drug delivery system market. North America, particularly the United States, holds a commanding position in the market due to robust healthcare infrastructure, a high prevalence of chronic diseases, and substantial investments in biomedical research. Leading companies such as Ashland Global, DSM Biomedical, and Medtronic, along with numerous academic institutions, are driving innovation in hydrogel technologies. Additionally, the proactive regulatory support for novel drug delivery systems and increasing public-private collaborations accelerate the commercialization of hydrogel-based therapies in the region.

Asia-Pacific is the fastest-growing region. Asia-Pacific is witnessing exponential growth driven by rising healthcare investments, expanding biopharmaceutical industries, and increasing patient awareness. Countries such as China, Japan, South Korea, and India are making strategic moves towards adopting advanced therapeutic technologies. Government initiatives to modernize healthcare systems and increasing participation in clinical trials further bolster regional growth. Additionally, the large patient base suffering from chronic diseases offers a fertile ground for hydrogel-based therapies.

Some of the prominent players in the hydrogel-based drug delivery system include:

- GALDERMA

- Blairex Laboratories, Inc.

- Johnson & Johnson

- Bausch and Lomb

- Medtronic

- Ocular Therapeutix, Inc.

- Ferring B.V.

- Endo International plc

- Akorn, Incorporated

- Tolmar Pharmaceuticals, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hydrogel-based drug delivery system.

Polymer Origin

Delivery Route

- Subcutaneous

- Ocular

- Oral Cavity

- Topical

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)