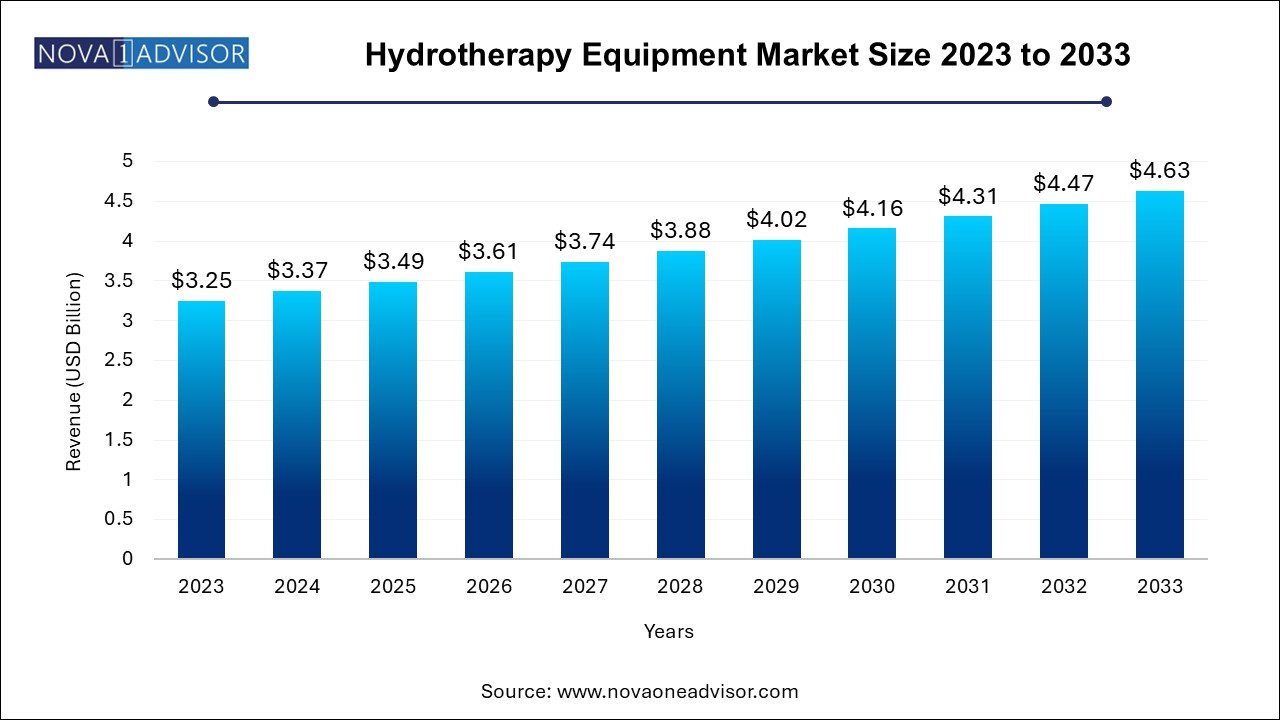

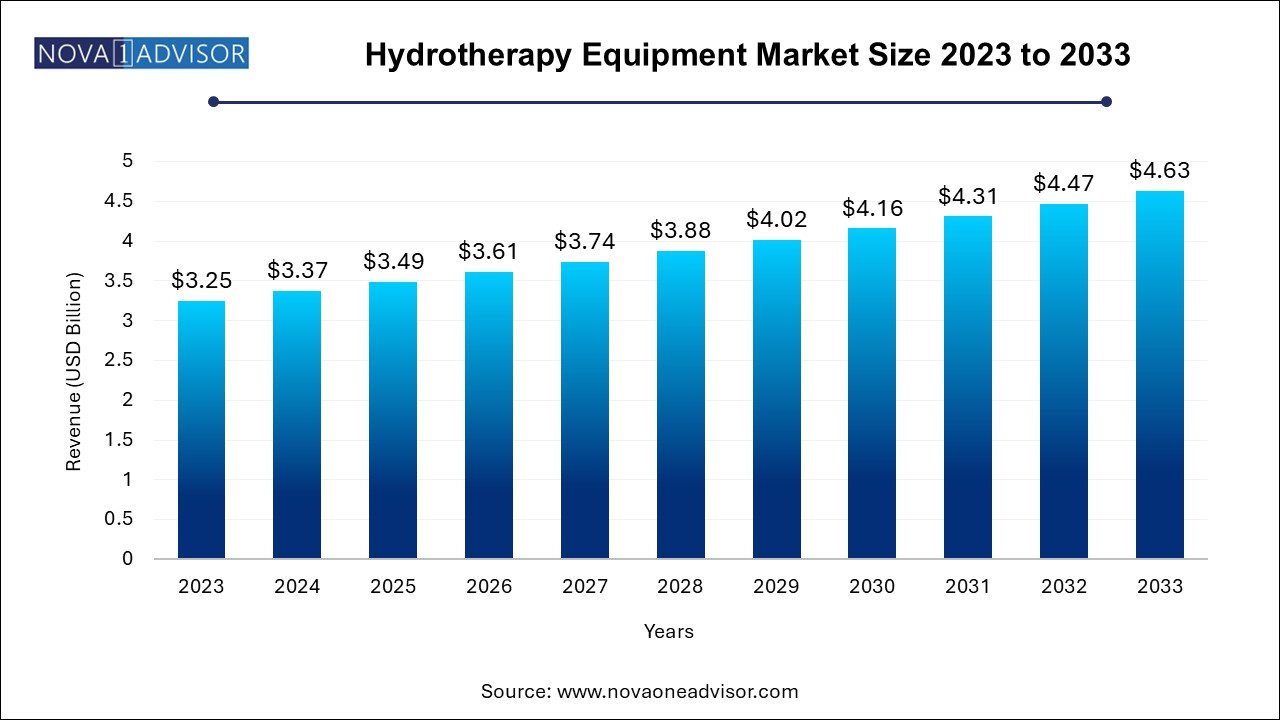

Hydrotherapy Equipment Market Size and Growth

The global hydrotherapy equipment market size was exhibited at USD 3.25 billion in 2023 and is projected to hit around USD 4.63 billion by 2033, growing at a CAGR of 3.6% during the forecast period 2024 to 2033.

Hydrotherapy Equipment Market Key Takeaways:

- The hydrotherapy pools segment led the overall market in 2023 accounting for over 38% of the global share.

- On the other hand, the hydrotherapy tub/bath segment is expected to witness the fastest growth rate from 2024 to 2033.

- The pain management segment dominated the market in 2023 and accounted for 33.9% of the total share.

- However, the cardiology segment is expected to witness the fastest CAGR from 2024 to 2033

- The spas & wellness centers segment accounted for the largest share of over 51% in 2023.

- On the other hand, hospitals & rehabilitation centers segment is anticipated to witness the fastest CAGR over the forecast period.

- North America led the market in 2023 and held a share of 39% in the same year.

- On the other hand, Asia Pacific is estimated to witness the maximum CAGR over the forecast period.

Market Overview

The Global Hydrotherapy Equipment Market is poised for steady growth as healthcare providers, rehabilitation centers, and wellness facilities increasingly adopt water-based therapeutic interventions. Hydrotherapy, also known as aquatic therapy, leverages the physical properties of water such as temperature, pressure, and buoyancy to aid in physical rehabilitation, pain relief, cardiovascular improvement, and mental well-being.

Hydrotherapy equipment includes specialized pools, tubs, underwater treadmills, and tanks that facilitate treatment by improving circulation, reducing inflammation, increasing mobility, and relaxing muscles. Historically associated with spas and wellness retreats, hydrotherapy is now an established clinical tool in hospitals, physiotherapy clinics, and rehabilitation centers. Technological advancements, such as computer-controlled water jets, temperature regulation systems, and integrated underwater cameras, have significantly enhanced the efficacy of modern hydrotherapy units.

As populations age and chronic disease rates rise globally, so does the demand for alternative and complementary therapies. For example, patients recovering from orthopedic surgeries, strokes, and sports injuries benefit immensely from underwater exercises due to the reduced impact on joints. Furthermore, the growing wellness economy, particularly in urban areas, has led to increased investments in hydrotherapy pools and spas targeting stress relief and holistic health.

The market is being further supported by supportive government initiatives, medical reimbursements (in certain regions), and consumer awareness regarding the therapeutic benefits of hydrotherapy. With an increasing number of applications across cardiology, dermatology, and pain management, hydrotherapy is transforming from a niche wellness luxury into a vital part of mainstream medical and rehabilitative care.

Major Trends in the Market

-

Rise in Demand for Non-Invasive Therapies: Hydrotherapy offers a natural, non-invasive treatment alternative for pain and mobility disorders, appealing to patients avoiding pharmacological interventions.

-

Adoption in Sports Medicine and Injury Recovery: Athletic centers and sports rehab clinics are investing in underwater treadmills and high-performance therapy pools to support quicker and safer recovery.

-

Integration of IoT and Smart Features: Hydrotherapy equipment is being developed with digital monitoring tools, temperature sensors, and remote accessibility for personalized care plans.

-

Wellness and Luxury Spa Expansion: Spas are incorporating hydrotherapy tubs and baths with massage jets and aromatherapy systems as part of luxury wellness packages.

-

Pediatric and Geriatric Therapy: Tailored hydrotherapy solutions are being introduced for children with developmental delays and elderly patients with arthritis or mobility challenges.

-

Eco-Friendly Designs: Manufacturers are focusing on water-saving technologies and energy-efficient heating systems to reduce environmental impact.

-

Portable Hydrotherapy Units: Innovations in compact, mobile hydrotherapy systems are enabling their use in home care and small clinic environments.

Report Scope of Hydrotherapy Equipment Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.37 Billion |

| Market Size by 2033 |

USD 4.63 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

EWAC; HydroWorx; Prime Pacific Health Innovations; BTL; Hydro Physio; Technomex; Stas Doyer; Transcom; Sidmar Manufacturing, Inc.; SwimEx; Kohler Co.; Narang Medical Ltd.; Jacuzzi, Inc.; Accord Medical Products |

Market Driver: Growing Geriatric Population and Rise in Musculoskeletal Disorders

A key driver fueling the hydrotherapy equipment market is the global rise in the elderly population coupled with a surge in age-related musculoskeletal disorders such as arthritis, osteoporosis, and lower back pain. As aging impacts mobility and joint health, hydrotherapy has emerged as a preferred rehabilitative therapy due to its low-impact nature and therapeutic benefits. For instance, the buoyancy of water alleviates stress on weight-bearing joints, while the resistance enhances muscle strength without the risk of injury.

According to the United Nations, the global population aged 65 and above is expected to double from 703 million in 2019 to over 1.5 billion by 2050. This demographic shift is translating into greater demand for long-term care services, particularly those that offer comfort and promote functional independence. Hydrotherapy sessions have been widely adopted in geriatric rehabilitation centers in the U.S., Germany, and Japan, highlighting the increasing clinical relevance of aquatic therapy for age-related degenerative conditions.

Market Restraint: High Initial Investment and Maintenance Costs

One of the major restraints hindering the widespread adoption of hydrotherapy equipment is the high upfront cost associated with installing and maintaining specialized hydrotherapy systems. From infrastructure requirements like plumbing and heating systems to space and staffing, setting up a hydrotherapy unit can be financially intensive. For example, a fully-equipped hydrotherapy pool with underwater treadmills and temperature control systems can cost upwards of $100,000, making it unaffordable for small clinics or wellness startups.

Furthermore, the ongoing costs related to water consumption, electricity, regular sanitation, and technical maintenance further burden healthcare and wellness providers, particularly in developing countries. The lack of insurance coverage for hydrotherapy in certain regions also deters patients from opting for it regularly. Unless supported by subsidies or institutional funding, the financial barrier can be a significant hurdle to broader market penetration.

Market Opportunity: Expansion into Home-Based and Tele-Rehabilitation Models

A major opportunity lies in the development and distribution of compact, home-friendly hydrotherapy equipment that supports remote rehabilitation. The COVID-19 pandemic catalyzed the growth of home-based care and tele-rehabilitation services, prompting both patients and healthcare providers to seek therapeutic solutions that do not require in-person visits. Hydrotherapy bathtubs with therapeutic jets, small-scale underwater treadmills, and mobile hydrotherapy units are increasingly being marketed for in-home use.

Companies are also exploring virtual supervision models, where therapists can remotely monitor hydrotherapy sessions using integrated cameras and sensors. Such hybrid care delivery models are particularly relevant for patients recovering from surgery or managing chronic pain conditions. The convergence of hydrotherapy with digital health not only improves patient adherence and comfort but also opens up new revenue streams for manufacturers and care providers.

Hydrotherapy Equipment Market By Type Insights

Hydrotherapy pools account for the largest share of the market owing to their widespread use in hospitals, sports centers, and rehabilitation clinics. These pools provide a versatile environment for group sessions, post-operative rehabilitation, and chronic condition management. Their therapeutic value is enhanced with temperature control, resistance jets, and submerged lighting. In regions like Europe and North America, multi-specialty hospitals often feature hydrotherapy pools integrated with physiotherapy departments, making them a standard component in rehabilitative infrastructure.

Underwater treadmills, however, are the fastest-growing segment, particularly in sports rehabilitation and orthopedic therapy. These devices enable gait training and cardiovascular workouts without the gravitational strain of land-based exercises. Athletes recovering from ACL injuries or joint replacements often begin their rehab using underwater treadmills to minimize impact and control pain. Technological innovations have made these systems more compact and affordable, increasing their appeal among outpatient physiotherapy centers and sports teams.

Hydrotherapy Equipment Market By Application Insights

Pain management dominates the application landscape due to the versatility of hydrotherapy in alleviating chronic and acute pain conditions. Patients suffering from lower back pain, fibromyalgia, or arthritis benefit from hydrostatic pressure and warm water immersion, which promote circulation and muscle relaxation. Hydrotherapy is frequently prescribed post-surgically to accelerate healing and manage post-operative pain, making it a cornerstone of multimodal pain therapy protocols.

Cardiology is an emerging application area with immense potential. Hydrotherapy exercises are being incorporated into cardiac rehabilitation programs to improve cardiovascular endurance, reduce stress, and enhance circulation. In countries like Japan and Germany, supervised aquatic cardiac therapy is gaining acceptance for patients recovering from heart attacks and surgeries. With growing clinical evidence supporting its efficacy, the use of hydrotherapy in cardiology is expected to expand rapidly in the coming years.

Hydrotherapy Equipment Market By End Use Insights

Hospitals and rehabilitation centers have traditionally dominated the hydrotherapy equipment market. These facilities offer structured and clinically supervised hydrotherapy sessions tailored to a wide range of conditions, from post-operative recovery to neurological rehabilitation. Inpatient and outpatient departments often integrate hydrotherapy into multidisciplinary treatment plans. Government and private investments in public healthcare infrastructure are further supporting the adoption of large-scale hydrotherapy equipment in these settings.

Spa and wellness centers, on the other hand, are witnessing the fastest growth. The rising global wellness trend and consumer preference for holistic therapies have led to a surge in demand for hydrotherapy services. Luxury spas now offer high-end hydrotherapy tubs with massage jets, essential oils, and chromotherapy options. Urban centers in Southeast Asia, the UAE, and parts of Europe are particularly driving this segment, where hydrotherapy is seen not only as therapeutic but also as a luxury experience.

Hydrotherapy Equipment Market By Regional Insights

North America leads the hydrotherapy equipment market due to its advanced healthcare infrastructure, high health awareness, and strong presence of key market players. In the U.S. and Canada, hydrotherapy is widely used in hospitals, rehabilitation centers, and long-term care facilities. Reimbursement provisions for physiotherapy and occupational therapy under Medicare and private insurance plans also support adoption. Moreover, wellness trends have pushed spas and boutique fitness centers to invest in hydrotherapy offerings, including cold plunge pools and heated tubs.

The presence of major companies such as HydroWorx, Jacuzzi Inc., and SwimEx in the region further enhances innovation and product availability. Collaborations between sports teams and rehabilitation specialists in the U.S. have also contributed to the popularity of underwater treadmills and recovery pools in athletic therapy.

Asia Pacific is witnessing the fastest growth, fueled by rapid urbanization, rising disposable income, and increasing investments in wellness tourism and healthcare. Countries like China, India, and South Korea are seeing a proliferation of wellness resorts, Ayurvedic centers, and physiotherapy clinics that incorporate hydrotherapy equipment. In India, several Ayurveda-based retreats are merging traditional hydrotherapy with modern treatments, appealing to both domestic and international clientele.

The growing geriatric population in countries like Japan is another critical factor. In response, Japanese rehabilitation centers are installing advanced hydrotherapy units for elderly care and orthopedic recovery. Government initiatives promoting active aging and preventive healthcare are also boosting demand. The region's large population base, rising middle class, and evolving healthcare infrastructure position it as a significant growth frontier for hydrotherapy equipment providers.

Some of the prominent players in the global hydrotherapy equipment market include:

- EWAC

- HydroWorx

- Prime Pacific Health Innovations

- BTL

- Hydro Physio

- Technomex

- Stas Doyer

- Transcom

- Sidmar Manufacturing, Inc.

- SwimEx

- Kohler Co.

- Narang Medical Ltd.

- Jacuzzi, Inc.

- Accord Medical Products

Recent Developments

-

February 2025: HydroWorx unveiled its new HydroWorx 360 series underwater treadmill featuring variable resistance jets and integrated patient monitoring for cardiac rehab applications.

-

December 2024: Jacuzzi Brands LLC launched a new line of hydrotherapy bathtubs with eco-friendly heating systems and AI-powered jet flow customization for luxury wellness centers.

-

October 2024: SwimEx partnered with the NFL Alumni Health Program to supply hydrotherapy pools for injury rehabilitation across training camps in the U.S.

-

July 2024: Prime Pacific Health Innovations introduced a modular hydrotherapy pool model aimed at compact clinics and sports facilities in Asia Pacific.

-

May 2024: Aquaform expanded its European footprint by opening a new manufacturing unit in Poland to meet growing demand in Eastern Europe and Russia.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global hydrotherapy equipment market

Type

- Chambers/Tanks

- Hydrotherapy Pools

- Hydrotherapy Tub/Bath

- Underwater Treadmill

- Others

Application

- Cardiology

- Dermatology

- Pain Management

- Others

End-use

- Hospitals & Rehabilitation Centers

- Spa & Wellness Centers

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa