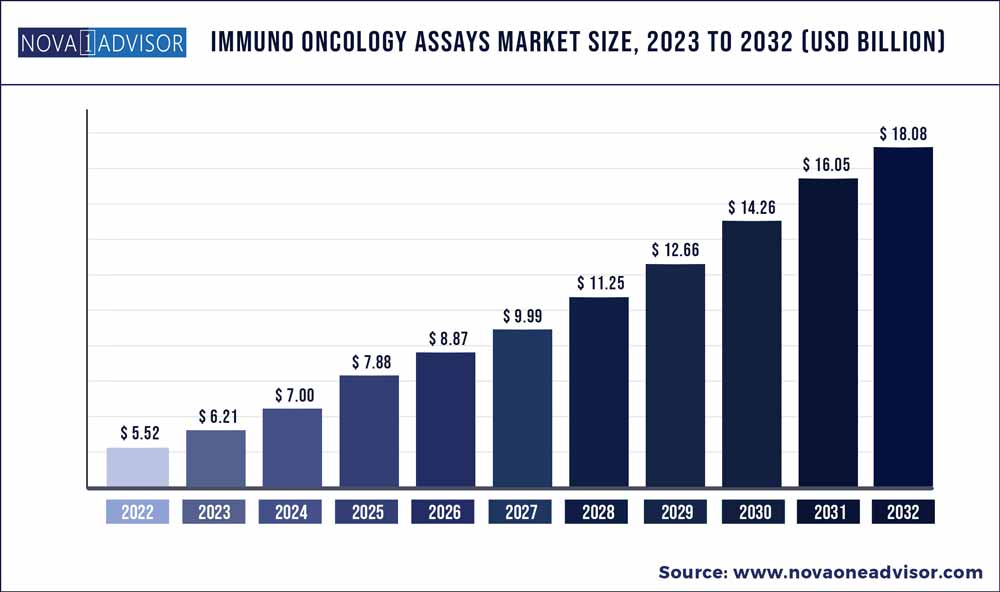

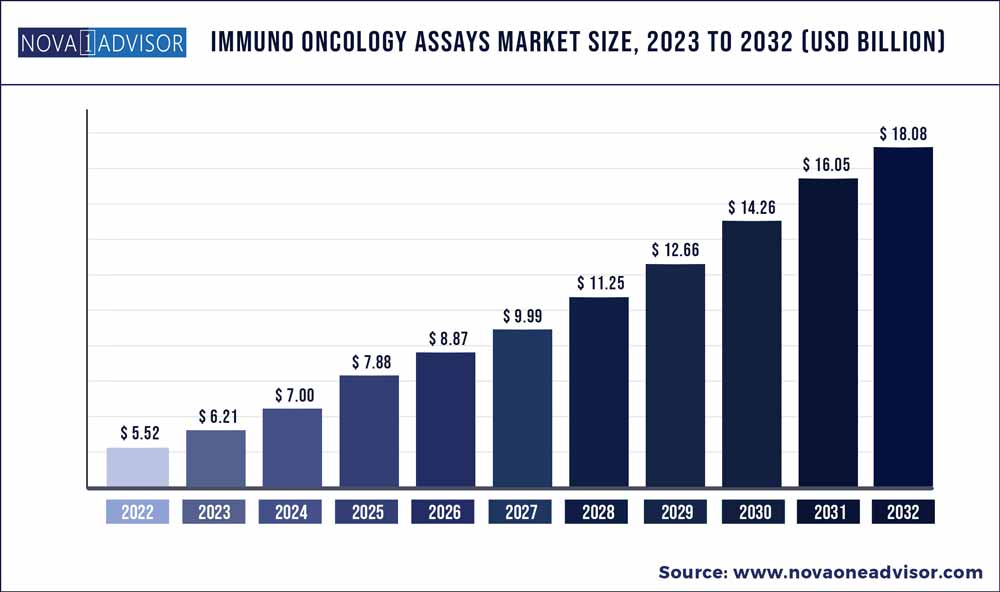

The global Immuno Oncology Assays market size was estimated at USD 5.52 billion in 2022 and is expected to surpass around USD 18.08 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 12.6% during the forecast period 2023 to 2032.

Key Takeaways:

- In 2022, consumables segment accounted for the largest share of the immuno-oncology assays market, by product & service

- In 2022, PCR segment accounted for the largest share in the market, by technology

- In 2022, research applications segment accounted for the largest share in the market, by application

- North America is the largest regional market for immuno-oncology assays

Immuno Oncology Assays Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 6.21 Billion |

| Market Size by 2032 |

USD 28.33 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 12.6% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Product & service, Technology, Indication, Application, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), Agilent Technologies, Inc. (US), Illumina, Inc. (US), NanoString Technologies, Inc. (US), Sartorius AG (Germany), HTG Molecular Diagnostics, Inc. (US), QIAGEN N.V. (Netherlands), Merck Millipore (US), PerkinElmer, Inc. (US), Abbott Laboratories, Inc. (US), Guardant Health, Inc. (US), bioMérieux SA (France), Myriad Genetics, Inc. (US), MESO SCALE DIAGNOSTICS, LLC. (US), Seegene Inc. (South Korea), Bio-Rad Laboratories, Inc. (US), Charles River Laboratories, Inc. (US), Olink (Sweden), ASURAGEN, INC. (US), Invivoscribe, Inc. (US), Creative Biolabs (US), ReachBio LLC (US), and NMI Technologietransfer GmbH (Germany). |

Immuno Oncology Assays Market Dynamics

Drivers: Rising incidence of cancer and growing adoption of targeted therapies

Cancer is a complex disease that develops through the multi-stage carcinogenesis process involving multiple molecular pathway events. Thus, various hurdles are associated with cancer diagnosis, prognosis, and therapy. In this regard, due to the complex nature of cancer, a single marker is not helpful. Moreover, in terms of its molecular profile, each cancer is different from other cancer types. Hence, the use of immuno-oncology assays has been particularly significant in understanding cancer signatures and developing customized therapies.

Globally, the prevalence of cancer has increased significantly over the last few years. Cancer, which has become the leading cause of death globally, accounted for 9.6 million deaths in 2018. According to GLOBOCAN, the number of cancer cases will rise to approximately 30 million by 2040 from 18 million in 2018. More than 60% of new cancer cases occur in Africa, Asia, and Central and South America; 70% of global cancer deaths also occur in these regions. Thus, the growth in the incidence and prevalence of cancer has resulted in a need to conduct extensive research for diagnosis and treatment; immuno-oncology assays form an important part of this research.

Opportunities: Emerging markets offer lucrative opportunities

Emerging economies such as China, India, South Korea, Brazil, and Mexico offer significant growth opportunities to major market players. This can be attributed to their low regulatory barriers, improvements in healthcare infrastructure, growing patient population, and rising healthcare expenditure. The regulatory policies in the Asia Pacific are more adaptive and business-friendly than those in developed countries. This, along with the increasing competition in mature markets, has drawn key players in the immuno-oncology assays market to focus on emerging countries.

Restraints: Requirement of high capital investments and low cost-benefit ratio

Significant capital investments are required for the discovery, development, and validation of biomarkers. Additionally, due to the high drug attrition in clinical trials (with almost 30% of drugs failing in Phase III), diagnostic manufacturers are exposed to significant financial challenges. To gain approval for in vitro diagnostics (IVD) from regulators, manufacturers need successful Phase III clinical trials, which depend on well-validated biomarker tests. Huge investments are required to run clinical trials and address stringent regulatory requirements, which not only affect the ability of small companies to develop biomarkers but also severely affect innovation. Hence, along with the high amount of capital investments, the low cost-benefit ratio is hindering the growth of the immuno-oncology assays market for biomarker detection.

“In 2022, consumables segment accounted for the largest share of the immuno-oncology assays market, by product & service”

Based on product & service, the immuno-oncology assays market is segmented into consumables, instruments, and software & services. The consumables segment accounted for the largest share of the immuno-oncology assays market in 2022. The requirement of consumables in large numbers as compared to instruments is the main factor driving the growth of this segment.

In 2022, PCR segment accounted for the largest share in the market, by technology

The immuno-oncology assays market is segmented into PCR, immunoassay, NGS, flow cytometry, and ISH based on technology. In 2022, the PCR segment accounted for the largest share. The growing use of PCR in immuno-oncology biomarker identification and discovery research is driving the growth of this segment.

In 2022, research applications segment accounted for the largest share in the market, by application

The immuno-oncology assays market is segmented into research applications and clinical diagnostics based on application. In 2022, the research applications segment accounted for the largest share of the immuno-oncology assays market. The rising prominence of biomarker-based drug development is driving the growth of this segment.

North America is the largest regional market for immuno-oncology assays

The global immuno-oncology assays market is segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2022, North America accounted for the largest share of the global immuno-oncology assays market. The North American immuno-oncology assays market's growth can be attributed to the increasing demand for personalized medicine, rising adoption of advanced omics technologies for biomarker discovery, and growing government support for the discovery and development of biomarkers.

Some of the prominent players in the Immuno Oncology Assays Market include:

- Thermo Fisher Scientific, Inc. (US)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Agilent Technologies, Inc. (US)

- Illumina, Inc. (US)

- Merck Millipore (US)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Immuno Oncology Assays market.

By Product & Service

- Consumables

- Instruments

- Software & Services

By Technology

- PCR

- Immunoassay

- NGS

- ISH

- Flow Cytometry

By Indication

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Bladder Cancer

- Melanoma

- Other Cancers

By Application

- Research Applications

- Clinical Diagnostics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)