In Vitro Fertilization Market Size and Trends

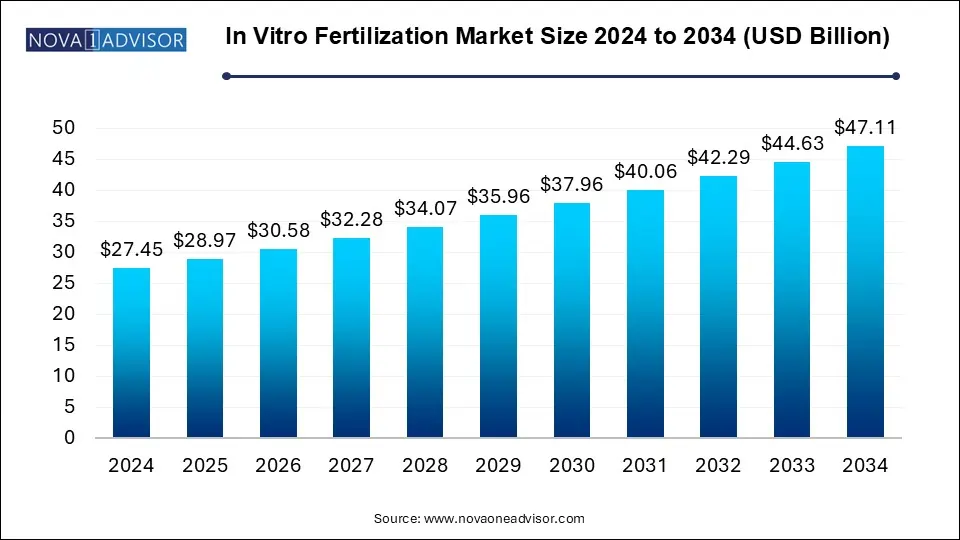

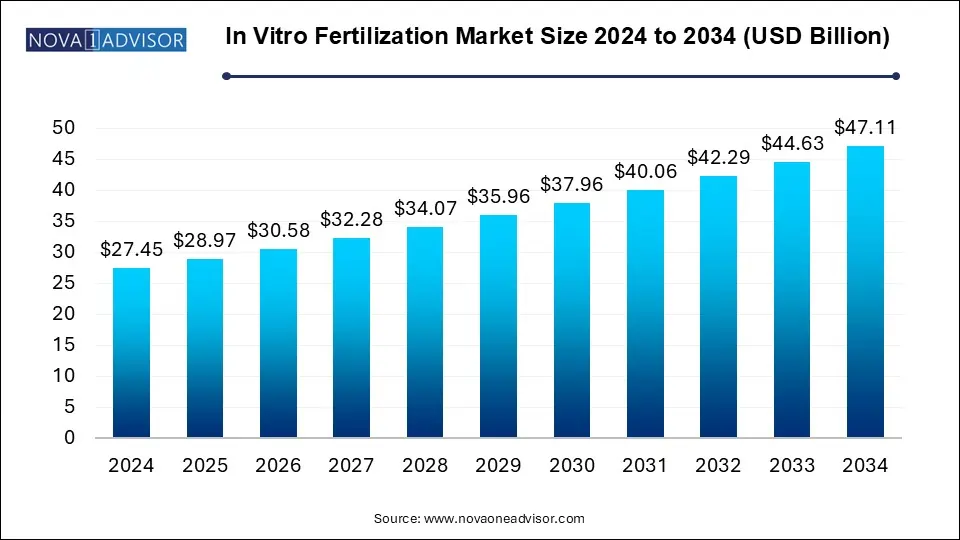

The In vitro fertilization market size was exhibited at USD 27.45 billion in 2024 and is projected to hit around USD 47.11 billion by 2034, growing at a CAGR of 5.55% during the forecast period 2025 to 2034.

In Vitro Fertilization Market Key Takeaways:

- The culture media segment dominated the market with the largest revenue share of 40.9 % in 2024.

- Disposable devices segment is expected to grow at the fastest CAGR during forecast years.

- Frozen non-donor segment dominated the market with largest revenue share in 2024

- Fertility clinics segment dominated the market with largest revenue share of 80.0% in 2024

- Hospitals and other settings segments is expected to grow at a significant CAGR over the forecast period.

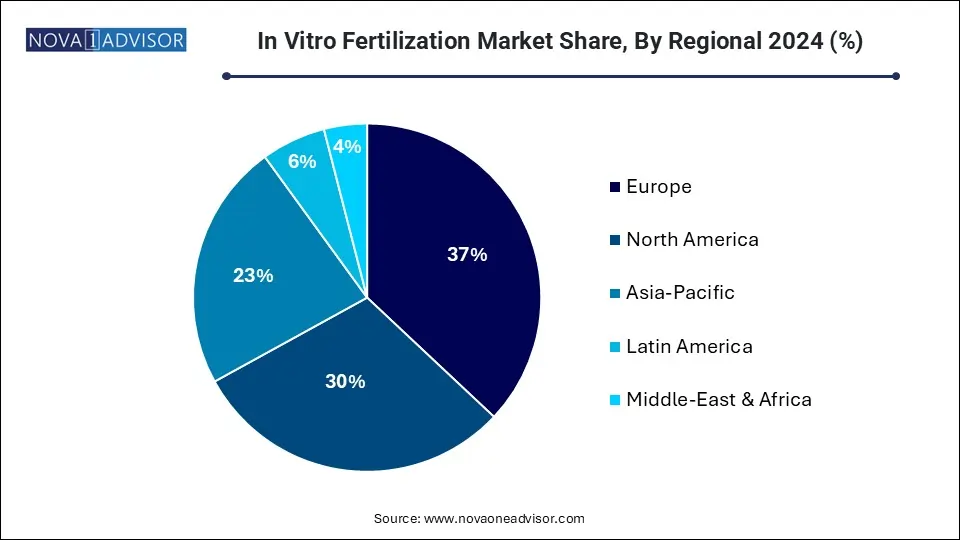

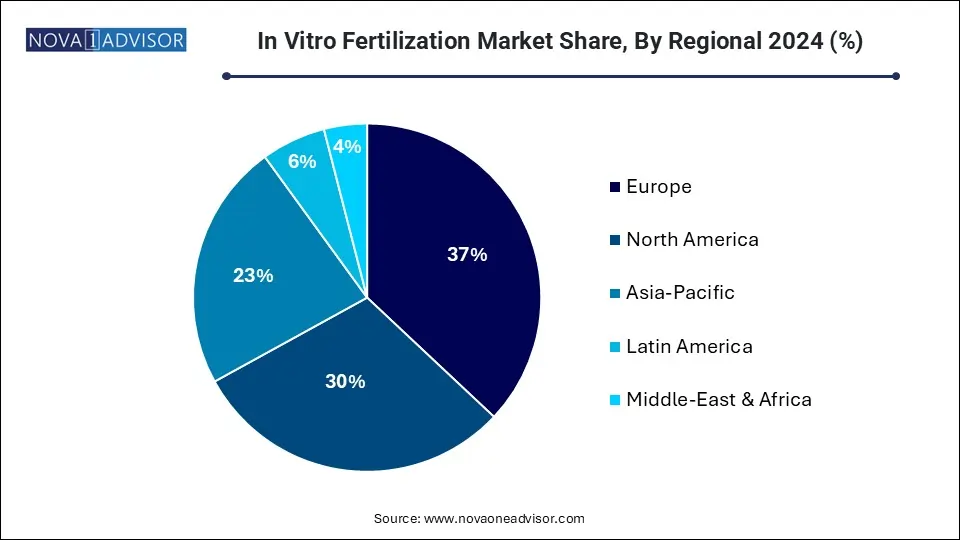

- Europe dominated the market with largest revenue share of 34.0% in 2024.

Market Overview

The In Vitro Fertilization (IVF) market has emerged as one of the most significant segments in assisted reproductive technology (ART), revolutionizing infertility treatment across the globe. IVF refers to a process of fertilization where an egg is combined with sperm outside the body, in vitro ("in glass"). This technique, since its inception in the late 20th century, has undergone tremendous advancements in terms of technology, clinical efficacy, and accessibility.

The increasing prevalence of infertility, driven by lifestyle factors such as late pregnancies, smoking, obesity, environmental toxins, and chronic diseases, is propelling the global demand for IVF procedures. According to the World Health Organization, infertility affects approximately 17.5% of the global adult population at some point in their lives. IVF provides a viable solution for couples facing these challenges.

Additionally, the rising acceptance of same-sex couples and single parents seeking fertility treatment, alongside growing awareness and social acceptance of assisted reproduction, have significantly boosted market growth. Technological improvements such as time-lapse embryo imaging, preimplantation genetic testing (PGT), cryopreservation techniques, and artificial intelligence (AI) in embryo selection are also contributing to increased success rates, making IVF a more reliable and preferred solution.

The global IVF market is characterized by its multidisciplinary structure, incorporating pharmaceutical innovation, high-end laboratory equipment, diagnostic tools, and clinical expertise. With the integration of digital technologies and genetic engineering, IVF is gradually transitioning from a specialized service to a more standardized and scalable model of reproductive care.

Major Trends in the Market

-

Rising Demand for Fertility Preservation: Cryopreservation of eggs and sperm is increasingly popular among individuals seeking to delay parenthood due to career, medical conditions, or lifestyle preferences.

-

Growth of Fertility Tourism: Countries like India, Thailand, and Ukraine are witnessing a rise in international patients owing to affordable IVF services and high success rates.

-

Integration of Artificial Intelligence (AI): AI is being used in embryo selection and diagnostics to improve success rates and reduce human errors in IVF laboratories.

-

Surging Use of Genetic Screening: Preimplantation genetic diagnosis (PGD) and screening (PGS) are becoming integral for selecting embryos without chromosomal abnormalities, thereby improving implantation and live birth rates.

-

Shift Toward Frozen Embryo Transfers (FET): With better outcomes and reduced complications, FET is increasingly preferred over fresh embryo transfers.

-

Adoption of Mini-IVF and Natural IVF: These low-stimulation protocols are gaining traction among patients looking for less invasive and more affordable options.

-

Rise in Corporate IVF Benefits: Companies like Google and Facebook offer IVF and egg-freezing coverage as part of employee health benefits, influencing the demand among the working population.

Report Scope of In Vitro Fertilization Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 28.97 Billion |

| Market Size by 2034 |

USD 47.11 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 5.55% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Instrument, Procedure Type, Providers, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bayer AG; Cook Medical LLC; EMD Serono, Inc.; Ferring B.V.; FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation); Genea Biomedx; EMD Serono, Inc. (Merck KGaA); Merck & Co., Inc.; The Cooper Companies, Inc.; Thermo Fisher Scientific, Inc.; Vitrolife; Boston IVF; Nova IVF; RMA Network (Reproductive Medicine Associates); TFP Thames Valley Fertility; Fortis Healthcare; U.S. Fertility |

Key Market Driver: Increasing Infertility Rates Globally

One of the primary drivers of the IVF market is the rising incidence of infertility across both developed and developing nations. Factors such as advanced maternal age, sedentary lifestyles, stress, unhealthy diets, and exposure to environmental pollutants are significantly impacting reproductive health. In many countries, the average age of first-time mothers is increasing, directly correlating with diminished fertility. For instance, in countries like Japan, Italy, and South Korea, the average maternal age is over 30 years, leading to higher demand for assisted reproductive technologies.

Moreover, male infertility is emerging as a substantial concern, with declining sperm counts attributed to lifestyle and occupational hazards. IVF procedures involving Intracytoplasmic Sperm Injection (ICSI) have been particularly successful in treating male-factor infertility. The convergence of medical advancements and increasing infertility prevalence continues to be a critical growth engine for the IVF market.

Key Market Restraint: High Cost and Uneven Insurance Coverage

Despite the promise of IVF technology, affordability remains a significant barrier to widespread adoption. The high cost of IVF treatment, which may include multiple cycles, hormone therapies, and diagnostic procedures, often makes it inaccessible for middle- and lower-income populations. In the U.S., for example, a single IVF cycle can cost between $12,000 and $15,000, excluding medication and additional procedures.

Additionally, insurance coverage for IVF varies widely between countries and even within regions. In many jurisdictions, IVF is considered elective and thus not covered under standard health plans. This lack of comprehensive coverage forces many individuals to pay out of pocket, further limiting access and creating disparities in reproductive healthcare. Cost remains a critical restraint that could slow market growth, particularly in low-resource settings.

Market Opportunity: Expansion in Emerging Economies

Emerging economies such as India, Brazil, China, and Mexico present a significant growth opportunity for the IVF market. These regions have witnessed a marked increase in infertility rates, coupled with a growing middle-class population and improving healthcare infrastructure. With regulatory frameworks becoming more supportive and awareness campaigns gaining traction, the demand for fertility treatments is set to rise substantially.

In India, for example, the Assisted Reproductive Technology (Regulation) Act of 2021 is aimed at standardizing IVF practices and ensuring patient safety. Clinics in Tier-II and Tier-III cities are also beginning to offer IVF services, broadening market access. Moreover, the cost of IVF procedures in emerging economies is significantly lower compared to developed countries, making them attractive destinations for medical tourism. These factors collectively position emerging markets as fertile ground for IVF market expansion.

In Vitro Fertilization Market By Instrument Insights

Culture Media dominated the IVF instrument market due to its essential role in ensuring embryo viability and development. Culture media includes specialized solutions used at various IVF stages, such as sperm processing, egg fertilization, embryo culture, and cryopreservation. Among subtypes, Embryo Culture Media holds the largest share owing to its critical function in maintaining optimal conditions for embryo development before implantation. Companies continue to invest in research to develop media that closely mimic the human reproductive environment, increasing the chances of successful fertilization and pregnancy.

On the other hand, Equipment is the fastest-growing segment driven by rapid advancements in lab automation and imaging systems. Devices such as micromanipulator systems, laser systems, and imaging incubators are revolutionizing embryo handling and selection. For instance, time-lapse incubators integrated with AI-based embryo scoring improve precision and success rates. The growing trend of laboratory automation in fertility centers, aimed at minimizing human error and optimizing clinical outcomes, significantly contributes to the demand for sophisticated IVF equipment.

In Vitro Fertilization Market By Procedure Type Insights

Fresh Non-donor procedures dominate the market owing to their widespread preference and use in standard IVF protocols. In this method, the couple's own eggs and sperm are used without cryopreservation. It is often chosen by patients undergoing their first cycle and is associated with higher success rates in specific demographics, particularly younger women. These procedures are more common in regions where fertility awareness is high and the need for donor gametes is minimal.

Conversely, Frozen Donor procedures represent the fastest-growing segment. The use of frozen donor eggs or embryos is becoming increasingly popular due to improved cryopreservation techniques, which preserve cell viability. Additionally, frozen donor cycles offer scheduling flexibility and reduce the risk of ovarian hyperstimulation syndrome (OHSS). This segment is especially beneficial for women with poor ovarian reserve or same-sex couples seeking conception, contributing to its growing acceptance.

In Vitro Fertilization Market By Providers Insights

Fertility Clinics dominate the provider segment as they specialize exclusively in reproductive health and offer a comprehensive range of IVF services, including diagnostics, counseling, and treatment. These clinics often house state-of-the-art laboratories and employ specialized personnel, giving them an edge over general hospitals. Patients also prefer these dedicated centers for their higher success rates, tailored treatment protocols, and convenience.

However, Hospitals & Other Settings are emerging as the fastest-growing segment. Multispecialty hospitals are increasingly establishing ART departments to meet rising demand and expand service offerings. In addition, government and private hospitals in developing regions are partnering with fertility specialists to broaden access. As regulatory oversight strengthens and ART becomes more mainstream, these settings are expected to play a more significant role in expanding IVF availability.

In Vitro Fertilization Market By Regional Insights

Europe is the dominating region in the global IVF market, holding the largest share due to its favorable regulatory environment, widespread public acceptance of IVF, and government support for fertility treatments. Countries like France, the UK, and Belgium provide partial or full reimbursement for IVF procedures, significantly reducing financial barriers. Europe also benefits from a strong presence of IVF clinics, advanced laboratory infrastructure, and research institutions that continuously drive innovation in reproductive technologies.

Asia Pacific is the fastest-growing region, witnessing a sharp rise in demand driven by increasing infertility rates, rising healthcare awareness, and medical tourism. India, China, and Japan are leading contributors to this growth. In India, for example, the IVF market is expected to witness double-digit CAGR due to improved regulatory clarity and expanding infrastructure in semi-urban regions. Furthermore, the cost-effectiveness of treatment in Asia Pacific compared to Western nations makes it an attractive destination for international patients.

Some of the prominent players in the In vitro fertilization market include:

- Bayer AG

- Cook Medical LLC

- EMD Serono, Inc.

- Ferring B.V.

- FUJIFILM Irvine Scientific (FUJIFILM Holdings Corporation)

- Genea Biomedx

- EMD Serono, Inc. (Merck KGaA)

- Merck & Co., Inc.

- The Cooper Companies, Inc.

- Thermo Fisher Scientific, Inc.

- Vitrolife

- Key Service Providers in In Vitro Fertilization Companies:

- Boston IVF

- Nova IVF

- RMA Network (Reproductive Medicine Associates)

- TFP Thames Valley Fertility

- Fortis Healthcare

- U.S. Fertility

In Vitro Fertilization Market Recent Developments

-

In March 2025, CooperSurgical launched a next-generation embryo imaging system equipped with AI-powered predictive analytics to enhance embryo selection efficiency.

-

In February 2025, Vitrolife AB announced a strategic partnership with a biotechnology firm to develop advanced embryo culture media tailored for personalized IVF cycles.

-

In January 2025, Ferring Pharmaceuticals received regulatory approval in Europe for its new r-hFSH (recombinant human follicle-stimulating hormone) formulation, aimed at improving ovarian stimulation outcomes.

-

In December 2024, Genea Biomedx introduced a fully automated micromanipulation system designed to improve precision in ICSI procedures.

-

In November 2024, Bloom Fertility in India opened five new clinics in Tier-II cities, aiming to make IVF accessible to a broader population.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the In vitro fertilization market

By Instrument

- Disposable Devices

- Culture Media

-

- Cryopreservation Media

- Embryo Culture Media

- Ovum Processing Media

- Sperm Processing Media

-

- Sperm Analyzer Systems

- Imaging Systems

- Ovum Aspiration Pumps

- Micromanipulator Systems

- Incubators

- Gas Analyzers

- Laser Systems

- Cryosystems

- Sperm Separation Devices

- IVF Cabinets

- Anti-vibration Tables

- Witness Systems

- Other

By Procedure Type

- Fresh Donor

- Frozen Donor

- Fresh Non-donor

- Frozen Non-donor

By Providers

- Fertility Clinics

- Hospitals & Others Setting

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)