Infection Control Market Size and Research

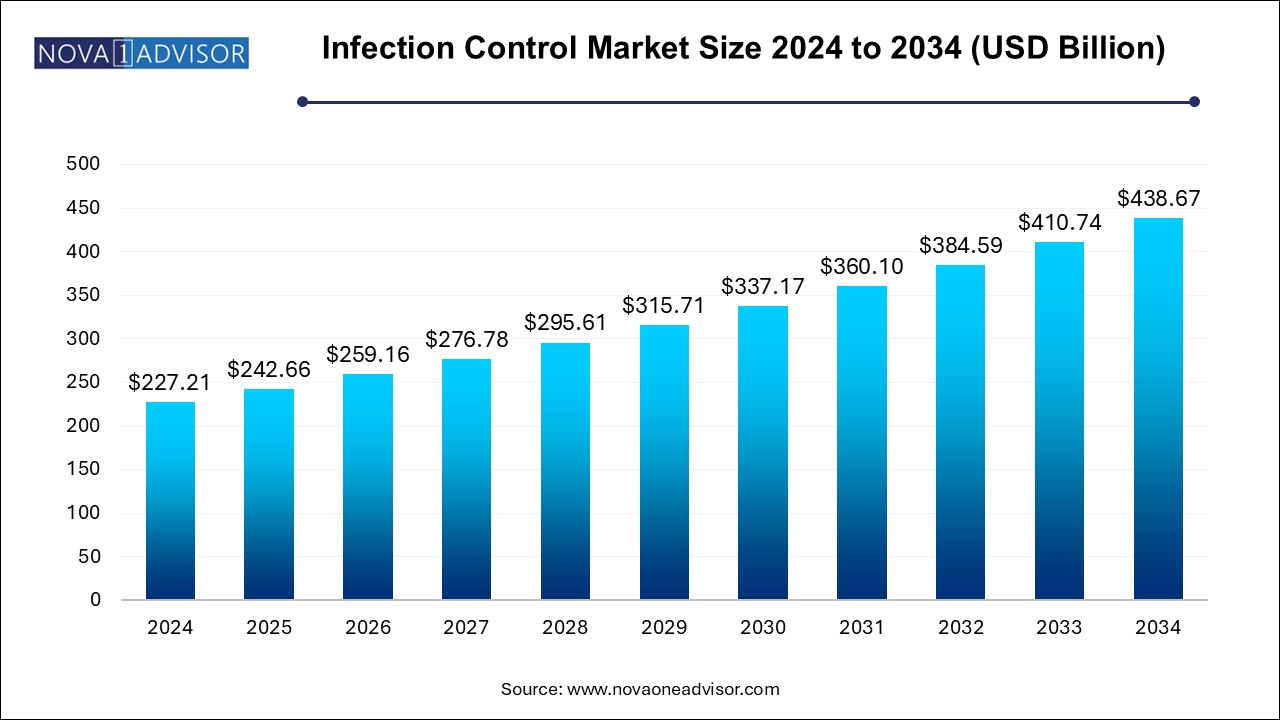

The infection control market size was exhibited at USD 227.21 billion in 2024 and is projected to hit around USD 438.67 billion by 2034, growing at a CAGR of 6.8% during the forecast period 2024 to 2034.

Infection Control Market Key Takeaways:

- The consumables segment dominated the market for infection control and accounted for the largest revenue share in 2024.

- Based on type, the services segment is expected to grow at the fastest CAGR during the forecast period.

- The hospital segment dominated the market for infection control and accounted for the largest revenue share of around 41.0% in 2024 and is also expected to grow at the fastest CAGR of 7.4% over the forecast period from 2024 to 2034.

- North America dominated the infection control market and accounted for the largest revenue share of over 31.0% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 8.3% over the forecast period from 2024 to 2034.

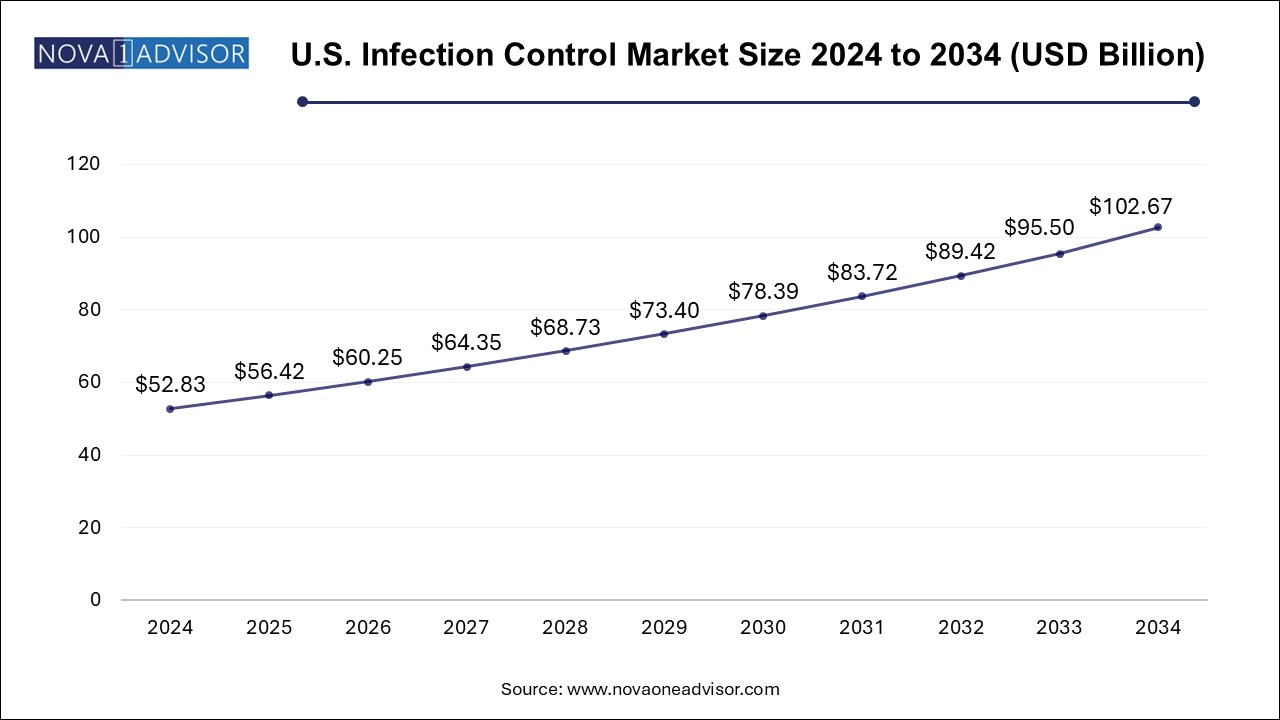

U. S. Infection Control Market Size and Growth 2024 to 2034

The U.S. infection control market size is evaluated at USD 52.83 billion in 2024 and is projected to be worth around USD 102.67 billion by 2034, growing at a CAGR of 6.22% from 2024 to 2034.

North America dominates the infection control market, driven by its advanced healthcare infrastructure, stringent regulatory frameworks, and high infection awareness. The U.S. Centers for Medicare & Medicaid Services (CMS) and Centers for Disease Control and Prevention (CDC) mandate strict infection prevention protocols across hospitals. Major players like 3M, Steris, and Ecolab are headquartered in the region and lead innovation in sterilization equipment, disinfectants, and PPE.

Additionally, healthcare spending in North America is among the highest globally, supporting frequent upgrades and adoption of cutting-edge infection control technologies. Large hospital networks, outpatient surgery centers, and nursing homes drive significant demand for sterilization and waste disposal services.

Asia Pacific is the fastest-growing region, owing to improving healthcare access, rising surgeries, and aggressive public health reforms. Nations like China, India, and Indonesia are witnessing rapid hospital construction, increased medical tourism, and a greater focus on patient safety. Infection control has become a central focus in national health policies post-COVID-19, spurring investments in automated disinfection, local PPE manufacturing, and infectious waste disposal.

Moreover, multinational companies are expanding into the region through partnerships or local subsidiaries. The introduction of portable and cost-effective sterilization equipment tailored for mid-size hospitals in Asia further accelerates market penetration.

Market Overview

The global infection control market has emerged as a central pillar of the modern healthcare ecosystem, fueled by an increasing need to prevent hospital-acquired infections (HAIs), manage sterilization workflows, and ensure patient safety in medical environments. The market encompasses a broad range of products and services, including disinfectants, sterilization equipment, waste disposal solutions, and personal protective equipment (PPE). Together, these solutions help mitigate the spread of infectious diseases across healthcare settings, laboratories, pharmaceutical production units, and even the general public.

The demand for infection control solutions has seen significant acceleration post the COVID-19 pandemic, which acted as a global catalyst for revamping disinfection and sterilization protocols across public and private healthcare institutions. While pandemic conditions triggered temporary surges in demand for PPE and disinfectants, a lasting impact has been the integration of infection control into the core of healthcare design and operations. The market is further shaped by advancements in sterilization technologies, emergence of contract sterilization services, and increasingly strict regulatory frameworks.

An illustrative example is the revision of infection control standards by organizations like the Centers for Disease Control and Prevention (CDC) and World Health Organization (WHO), which prompted hospitals to overhaul sterilization workflows and significantly invest in automated and low-temperature sterilization systems. Additionally, increased global travel, antimicrobial resistance (AMR), and the growing number of surgical procedures have highlighted the indispensable role of infection control in preventing cross-contamination and maintaining care quality.

Major Trends in the Market

-

Rising Preference for Low-Temperature Sterilization: To preserve heat-sensitive instruments, low-temperature systems are replacing traditional autoclaves in many hospitals.

-

Surge in Contract Sterilization Services: Medical device and pharma companies are outsourcing sterilization to dedicated providers for scalability and compliance.

-

Integration of IoT and AI in Infection Control Equipment: Automated systems now feature intelligent monitoring and reporting for compliance and traceability.

-

Expansion of Infectious Waste Disposal Services: Increasing awareness and regulation around biomedical waste are propelling demand for advanced disposal technologies.

-

PPE Beyond Healthcare: With public hygiene awareness at all-time highs, PPE is seeing use in education, transportation, and consumer segments.

-

Growth in Single-use Devices: To avoid contamination, hospitals are increasing reliance on disposable devices and related sterilization consumables.

-

Customization of Disinfectants: Surface-specific, non-corrosive, and biodegradable disinfectants are gaining market share.

-

Shift Toward On-site Sterilization Units: Smaller clinics are investing in compact, automated equipment rather than relying on centralized sterilization departments.

Report Scope of Infection Control Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 242.66 Billion |

| Market Size by 2034 |

USD 438.67 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 6.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled |

3M; Belimed AG; O&M Halyard or its affiliates.; Getinge Group; ASP; MATACHANA; Sterigenics U.S., LLC – A Sotera Health company; MMM Group; Cantel Medical Corp.; STERIS Corporation; Midmark Corporation.; Medivators Inc.; W&H |

Infection Control Market By Type Insights

Consumables dominate the infection control market, primarily due to their high usage frequency and disposability. Products like disinfectants, PPE, and sterilization wraps are used daily across hospitals, labs, and public spaces. For instance, disinfectants saw an unprecedented surge in demand during the pandemic, and PPE like gloves, gowns, and face shields became ubiquitous beyond clinical settings. Moreover, infectious waste disposal consumables such as biohazard bags and sharps containers are essential for compliance and safety.

Equipment, however, is the fastest-growing segment, driven by automation trends and rising surgical volumes. Within equipment, sterilization units like autoclaves and low-temperature systems are critical in ensuring reusable devices are contamination-free. High-performance washers, flushes, and endoscope reprocessors are also gaining momentum, particularly in tertiary hospitals. The shift toward integrated, energy-efficient, and AI-supported systems is further fueling equipment sales, with hospitals increasingly replacing legacy systems with advanced sterilization suites.

Infection Control Market By End-use Insights

Hospitals represent the largest end-use segment, as they house surgical departments, ICUs, and maternity wards all hotspots for infection risk. Infection control protocols here span across departments and include surface cleaning, surgical instrument sterilization, hand hygiene, and patient isolation. Hospitals are also early adopters of technologies like antimicrobial surfaces, UV disinfection robots, and high-capacity waste incinerators.

Clinical laboratories are growing fastest, driven by diagnostic expansion and increased biosafety requirements. Labs dealing with high-risk pathogens, such as tuberculosis, MRSA, and SARS-CoV-2, require stringent decontamination and PPE protocols. The rise in public and private diagnostic labs globally, including chains like Quest Diagnostics and SRL, contributes to this trend. These labs invest heavily in air filtration systems, waste autoclaves, and disposable consumables to maintain safety.

Some of the prominent players in the infection control market include:

- 3M

- Belimed AG

- O&M Halyard or its affiliates.

- Getinge Group

- ASP

- MATACHANA

- Sterigenics U.S., LLC – A Sotera Health company

- MMM Group

- Cantel Medical Corp.

- STERIS plc.

- Midmark Corporation.

- Medivators Inc

- W&H

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the infection control market

By Type

-

-

- Washers

- Flushes

- Endoscope Reprocessors

-

-

- Heat Sterilization Equipment

- Low Temperature Sterilization Equipment

- Radiation Sterilization Equipment

- Filtration Sterilization Equipment

- Liquid Sterilization Equipment

-

-

- Ethylene Oxide Sterilization

- E-beam Sterilization

- Gamma Sterilization

- Others

-

- Infectious Waste Disposal

-

- Infectious Waste Disposal

- Disinfectants

- Sterilization Consumables

- Personal Protective Equipment

- Others

By End-use

- Hospitals

- Medical Device Companies

- Clinical Laboratories

- Pharmaceutical Laboratories

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)