Instrumentation Sterilization Containers Market Size and Growth

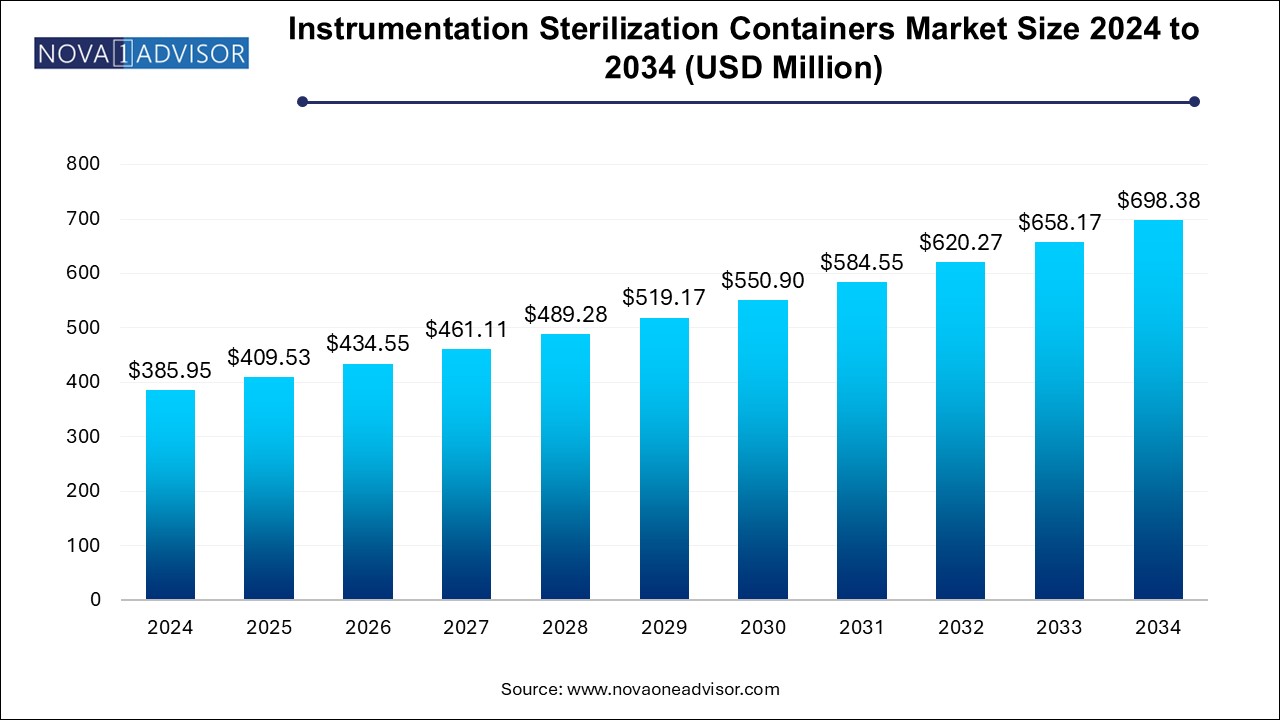

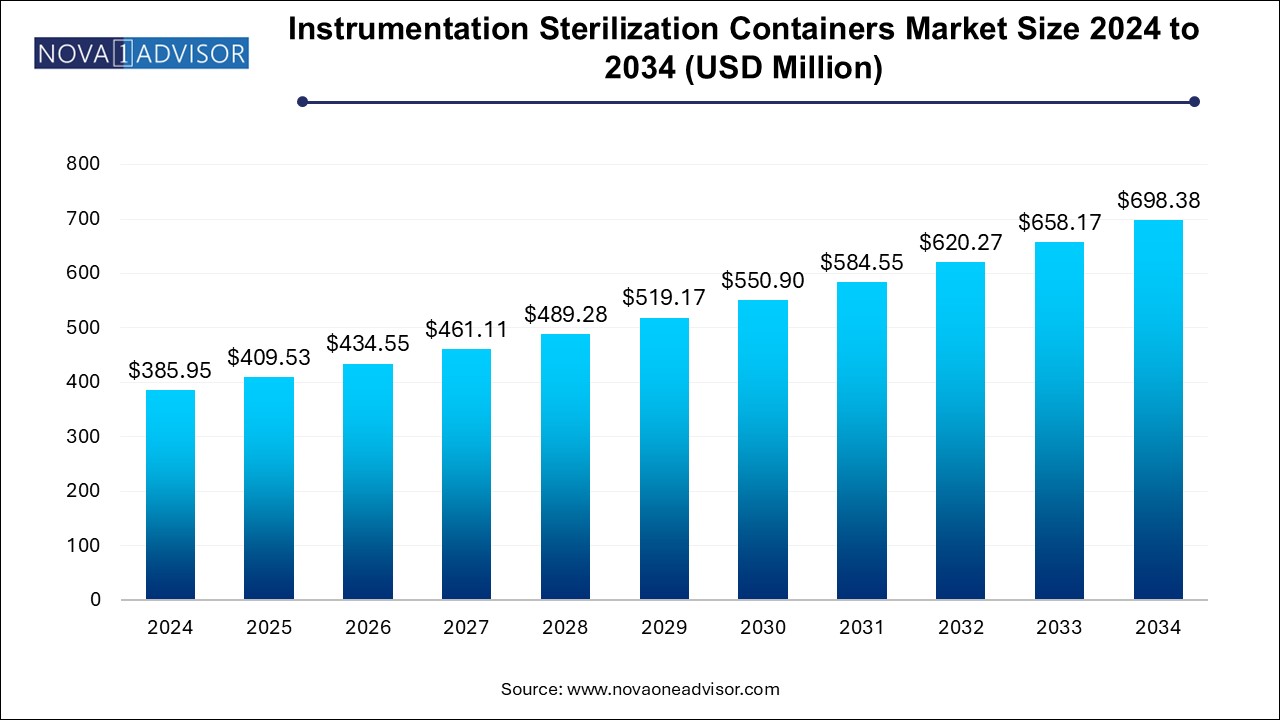

The instrumentation sterilization containers market size was exhibited at USD 409.53 million in 2024 and is projected to hit around USD 698.38 million by 2034, growing at a CAGR of 6.11% during the forecast period 2024 to 2034. The expansion of the instrumentation sterilization containers market can be linked to the rising number of surgical procedures, increasing incidences of hospital-acquired infections (HAIs), advancements in sterilization technologies, and growing focus on control and prevention of infection in healthcare settings.

Instrumentation Sterilization Containers Market Key Takeaways:

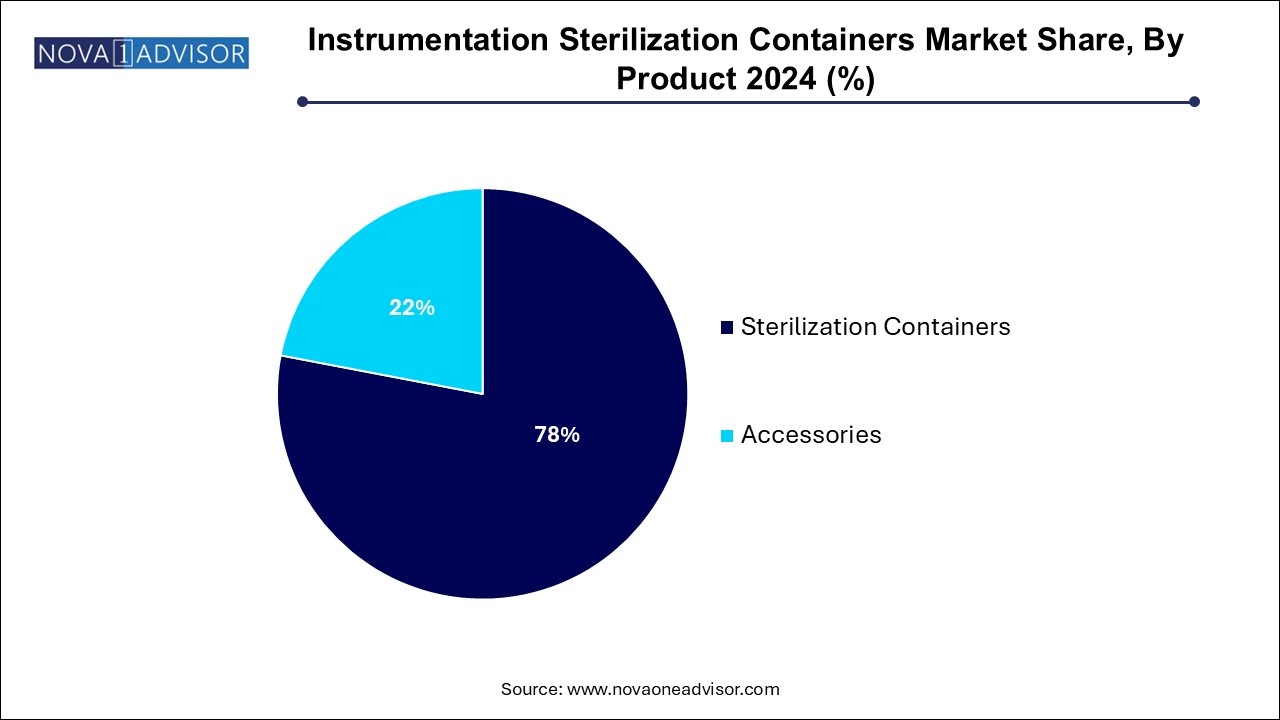

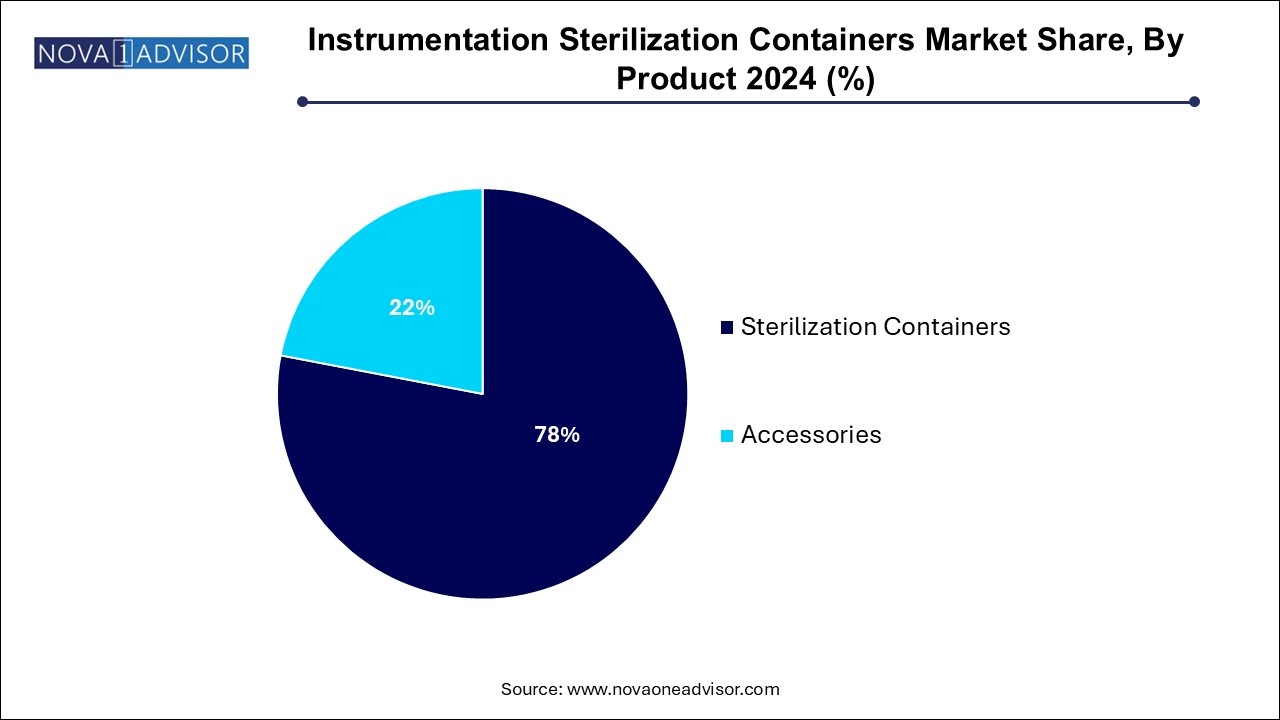

- Sterilization containers led the market and accounted for 78.0% of the global revenue in 2024.

- Accessories are expected to register the fastest CAGR from 2024 to 2034.

- Perforated accounted for the largest revenue share in 2024.

- Non-perforated is expected to register a moderate CAGR from 2024 to 2034.

- Aluminum accounted for the largest revenue share in 2024.

- The stainless steel segment is projected to witness the highest growth rate from 2024 to 2034.

- North America instrumentation sterilization containers market dominated the global market with a share of 33.34% in 2024.

Market Overview

The Instrumentation Sterilization Containers Market plays a critical role in ensuring safe, efficient, and repeatable sterilization practices within the global healthcare ecosystem. As hospitals, surgical centers, and clinics increasingly emphasize infection prevention and regulatory compliance, the demand for robust and reusable sterilization solutions has surged. These containers serve as pivotal tools in the sterilization process, ensuring that surgical instruments remain sterile until they are needed, thus minimizing the risk of contamination and post-surgical infections.

Unlike traditional sterilization wraps, which are disposable and prone to tearing or puncture, sterilization containers offer a durable, environmentally friendly, and cost-effective alternative. They are especially popular in high-volume surgical facilities where reprocessing of surgical tools is a routine activity. Constructed primarily from materials such as stainless steel and aluminum, these containers come in various configurations—perforated, non-perforated, and with customized accessories—to suit diverse procedural requirements and sterilization methods.

In recent years, the market has been positively influenced by the rising surgical volumes, especially due to the growing elderly population and an increase in chronic diseases requiring surgical intervention. Coupled with stringent healthcare regulations focused on infection control, hospitals are investing in sterilization containers as a long-term, sustainable solution. Technological advancements in container design, including intelligent tracking systems, filters, and advanced locking mechanisms, are further driving adoption.

The market is segmented by product (sterilization containers, accessories), type (perforated, non-perforated), material (stainless steel, aluminum, and others), and geography (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa). With a dynamic competitive landscape and strong demand fundamentals, the Instrumentation Sterilization Containers Market is set for robust expansion over the coming decade.

Major Trends in the Market

-

Sustainable Reprocessing Initiatives: The shift from disposable wraps to reusable sterilization containers is gaining traction due to growing awareness of healthcare waste reduction and cost-efficiency.

-

Integration of RFID and Smart Labels: Smart tracking technologies such as RFID tags and barcode scanning are being integrated into sterilization containers to monitor sterilization cycles, inventory, and maintenance schedules.

-

Customized Container Systems: Vendors are offering containers tailored for specific instruments, procedures, and specialty departments, which increases efficiency and protects sensitive equipment.

-

Expansion in Outpatient Surgical Centers: The proliferation of ambulatory surgery centers (ASCs) has increased the demand for portable, space-saving sterilization solutions.

-

Enhanced Filter Systems: Innovations in filter technologies improve airflow and filtration during autoclaving, optimizing the sterilization process and extending filter life.

-

Sterile Barrier System Improvements: Sterilization containers now feature enhanced gasket designs and locking mechanisms to maintain the integrity of the sterile barrier during storage and transport.

-

Hybrid Sterilization Compatibility: Modern containers are designed to be compatible with multiple sterilization methods including steam, ethylene oxide, and hydrogen peroxide plasma.

How are Regulatory Shifts Impacting the Instrumentation Sterilization Containers Market?

Rising focus on addressing HAIs and antibiotic-resistant pathogens is driving the need for imposing stringent regulations for sterilization processes which further facilitates significant investments in healthcare facilities to procure advanced and reliable sterilization container systems. Regulations focused on ensuring material compatibility and safety of containers by implementing harmless sterilization methods, using improved sealing mechanisms and reliable sterilization verification through integrated indicators. Compliance with ISO standards can significantly increase the financial strain for manufacturers.

Furthermore, increased emphasis of regulatory and environmental agencies like the U.S. Environmental Protection Agency (EPA) and the FDA on reducing emissions by lowering Ethylene Oxide (EtO) use and finding alternate sterilization methods like radiation and vaporized hydrogen peroxide are enabling development of safe, effective and environmentally responsible regulations.

Report Scope of Instrumentation Sterilization Containers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 409.53 Million |

| Market Size by 2034 |

USD 698.38 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 6.11% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Type, Material, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Aesculap, Inc. - a B. Braun company; Asel Tibbi Aletler A.Åž.; Medline Industries, LP.; DePuy Synthes (Johnson & Johnson); Bahadir Medical Devices; Integra LifeSciences; MELAG Medizintechnik GmbH & Co. KG; Case Medical; KLS Martin Group.; STERIS; Aspen Surgical Products, Inc. |

Market Driver: Rising Surgical Volume Due to Aging Population

One of the strongest driving forces behind the growth of the Instrumentation Sterilization Containers Market is the escalating global surgical volume, particularly fueled by an aging population. According to global health statistics, people aged 65 and above represent a rapidly expanding demographic, with many requiring surgical interventions such as orthopedic, cardiovascular, or gastrointestinal procedures. These surgeries demand precise infection control practices and repeated sterilization of surgical tools.

Sterilization containers offer a reliable and repeatable means of ensuring surgical instruments are sterile, especially critical in complex procedures involving elderly patients with compromised immune systems. Unlike disposable wraps, which can fail under stress, containers are built to withstand repeated autoclaving and handling, making them the preferred choice in high-volume surgical centers. Moreover, health systems aiming to improve cost-efficiency over time recognize the economic value of investing in reusable containers versus the recurring costs of single-use wraps.

Market Restraint: High Initial Capital Investment

Despite their long-term cost advantages, the high upfront cost associated with sterilization containers remains a key restraint for widespread adoption, particularly among small healthcare facilities and in emerging economies. A single sterilization container system, depending on its complexity and material, can be significantly more expensive than disposable alternatives.

Hospitals and clinics operating on tight budgets may find it difficult to justify the initial investment, especially if they lack advanced sterilization infrastructure. In some cases, compatibility issues with existing sterilizers can require additional investment in equipment upgrades, further increasing the cost burden. Additionally, proper staff training and process adaptation are required to optimize the usage of these systems, adding another layer of complexity to adoption. These factors can delay purchasing decisions, especially in regions with constrained healthcare budgets.

Market Opportunity: Technological Integration with Smart Healthcare Systems

The growing adoption of digital health infrastructure and smart hospitals offers a substantial opportunity for the Instrumentation Sterilization Containers Market. Integrating sterilization containers with digital tracking systems—like RFID tags, QR codes, or IoT-enabled sensors—enables real-time tracking of instruments, maintenance scheduling, and compliance with sterilization protocols.

Smart containers can alert users to filter change requirements, sterilization cycle completions, or mishandling during storage and transport. Hospitals integrating automated inventory management and surgical instrument tracking are likely to see improved workflow efficiency, reduced human error, and better compliance with regulatory audits. This fusion of sterilization technology with healthcare informatics is expected to transform how hospitals manage surgical inventory, especially in developed markets and high-tech facilities.

Instrumentation Sterilization Containers Market By Product Insights

Sterilization containers led the market and accounted for 78.0% of the global revenue in 2024. Owing to their core role in ensuring the sterility of surgical instruments across a wide range of healthcare facilities. These containers are widely used due to their reusability, robust construction, and compatibility with different sterilization techniques. Hospitals prefer them over wraps as they provide secure handling, minimize human error, and withstand multiple sterilization cycles without compromising performance. Stainless steel variants remain particularly popular due to their durability and excellent resistance to corrosion, which is critical in environments involving frequent steam sterilization.

However, the accessories segment—comprising filters, indicators, identification labels, handles, trays, and locks—is projected to witness the fastest growth. The rising demand for customization, along with stringent sterilization validation requirements, is prompting healthcare providers to invest in compatible accessories to optimize the performance and safety of the containers. For example, the increasing demand for single-procedure filter kits, tamper-proof seals, and modular trays enhances the value proposition of accessories. Additionally, evolving standards around sterility assurance levels (SAL) and packaging integrity are further fueling growth in this sub-segment.

Instrumentation Sterilization Containers Market By Type Insights

Perforated sterilization containers hold the leading market share, primarily due to their superior airflow dynamics during the sterilization cycle. These containers, designed with precision-drilled holes and secure filters, allow effective penetration of steam or gas while maintaining a sterile barrier post-process. Hospitals and surgical centers that rely heavily on steam sterilization prefer perforated models for their ability to ensure complete contact between sterilant and instruments. Their widespread use in orthopedic, cardiovascular, and neurosurgical procedures solidifies their dominance in this category.

In contrast, non-perforated containers are expected to grow at a faster pace, particularly due to their increasing use in alternative sterilization techniques such as low-temperature hydrogen peroxide or ethylene oxide methods. These containers offer enhanced containment and security for sensitive or high-value instruments, including scopes and micro-surgical tools. As hospitals adopt more varied sterilization techniques to accommodate advanced medical devices, the demand for non-perforated models—capable of preserving instrument integrity without exposure to high temperatures—continues to expand.

Instrumentation Sterilization Containers Market By Material Insights

Stainless steel sterilization containers command the largest share of the material segment, owing to their unmatched strength, corrosion resistance, and ability to withstand repetitive sterilization cycles. These containers are particularly favored in surgical environments where durability, longevity, and contamination control are paramount. Healthcare providers often choose stainless steel for its consistent performance, aesthetic appeal, and ability to retain shape even after repeated autoclaving. Moreover, it offers a smooth, cleanable surface that meets strict infection control standards.

Aluminum, however, is emerging as a high-growth material segment, particularly in portable and modular container systems. Aluminum containers offer advantages such as lightweight construction, thermal conductivity, and design flexibility, making them well-suited for outpatient centers or mobile surgical units. Their ease of handling also reduces the physical strain on staff during transport and storage. As healthcare systems shift toward ergonomic and cost-efficient solutions, especially in mid-sized and rural hospitals, aluminum-based containers are poised for increased adoption.

Instrumentation Sterilization Containers Market By Regional Insights

North America dominates the global market for instrumentation sterilization containers, accounting for the highest revenue share. This leadership stems from a well-developed healthcare infrastructure, rigorous regulatory frameworks, and widespread adoption of advanced sterilization practices. The U.S. in particular has a high volume of surgical procedures and stringent standards from bodies like the FDA and AAMI, which encourage the use of high-performance sterilization containers. The presence of leading manufacturers such as Aesculap and Medline Industries in the region further fuels innovation and accessibility.

U.S. is a major contributor to the market in North America. The market growth can be linked to the presence of advanced healthcare infrastructure, increased demand for effective sterilization methods for preventing HAIs, growing adoption minimally invasive surgeries, expansion of ambulatory surgical centers (ASCs) and strict regulations imposed by the FDA for ensuring patient safety. Advancements in sterilization container technologies like the use of improved materials offering compatibility with several sterilization methods and better durability, integration of smart technologies such as barcode tracking and RFID tags for enhancing traceability of sterilization containers as well as innovative technologies like vacuum seal technology are bolstering the market growth.

The Asia Pacific region is witnessing the fastest growth in the Instrumentation Sterilization Containers Market. Countries like China, India, Japan, and South Korea are investing heavily in modernizing their healthcare systems, building new hospitals, and expanding surgical capabilities. With rising patient volumes and increasing awareness of hospital-acquired infections (HAIs), sterilization processes are under significant scrutiny.

Additionally, regional governments are implementing national healthcare reforms and infection control mandates that push healthcare institutions toward adopting standardized sterilization protocols. The rapid expansion of medical tourism in countries like Thailand and Malaysia also demands world-class sterilization infrastructure, making the market ripe for growth. International manufacturers are establishing local production or distribution networks, while domestic players are emerging with cost-competitive offerings tailored to regional needs.

China is anticipated to witness lucrative growth in the market over the forecast period. The country’s large and rapidly aging population, rise in surgical procedures, stringent regulatory frameworks, advancements in sterilization technologies and growing focus on reusable solutions to meet environment sustainability goals are the factors driving the market growth. Moreover, government initiatives like the 1000 County Project focused on upgrading medical service capacity across 1000 county-level hospitals in China by 2025 to be on par with tier one hospitals facilitates significant investments for installation of modern medical equipment like sterilization containers.

Some of the prominent players in the instrumentation sterilization containers market include:

- Aesculap, Inc. - a B. Braun company

- Asel Tibbi Aletler A.Åž.

- Medline Industries, LP.

- DePuy Synthes (Johnson & Johnson)

- Bahadir Medical Devices

- Integra LifeSciences

- MELAG Medizintechnik GmbH & Co. KG

- Case Medical

- KLS Martin Group.

- STERIS

- Aspen Surgical Products, Inc.

Instrumentation Sterilization Containers Market Recent Developments

-

In May 2025, Solventum (formerly known as 3M Health Care), launched its Attest eBowie-Dick Test System (eBowie-Dick System) which is an electronic test card and auto-reader developed for sterilization testing further eliminating the requirement of visual interpretation of results and manual documentation. The revolutionary sterilization assurance system swiftly provides definitive test results and also offers an automated record which can be integrated into a hospital’s instrument tracking system.

-

In April 2024, Aesculap, Inc., a leading company in the sterile container systems market, introduced AESCULAP Aicon RTLS, which enables pairing of real-time location service (RTLS) technology with the AESCULAP Aicon Sterile Container System, further enhancing the efficiency of Sterile Processing Departments (SPD).

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the instrumentation sterilization containers market

By Product

- Sterilization Containers

- Accessories

By Type

- Perforated

- Non Perforated

By Material

- Stainless Steel

- Aluminium

- Other Material

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)