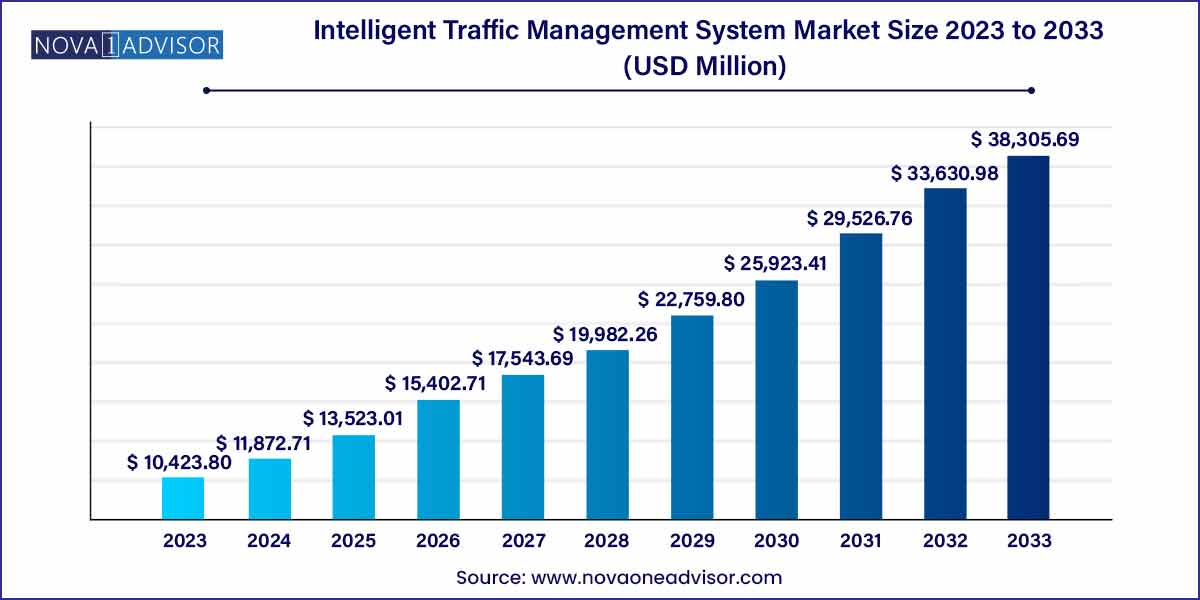

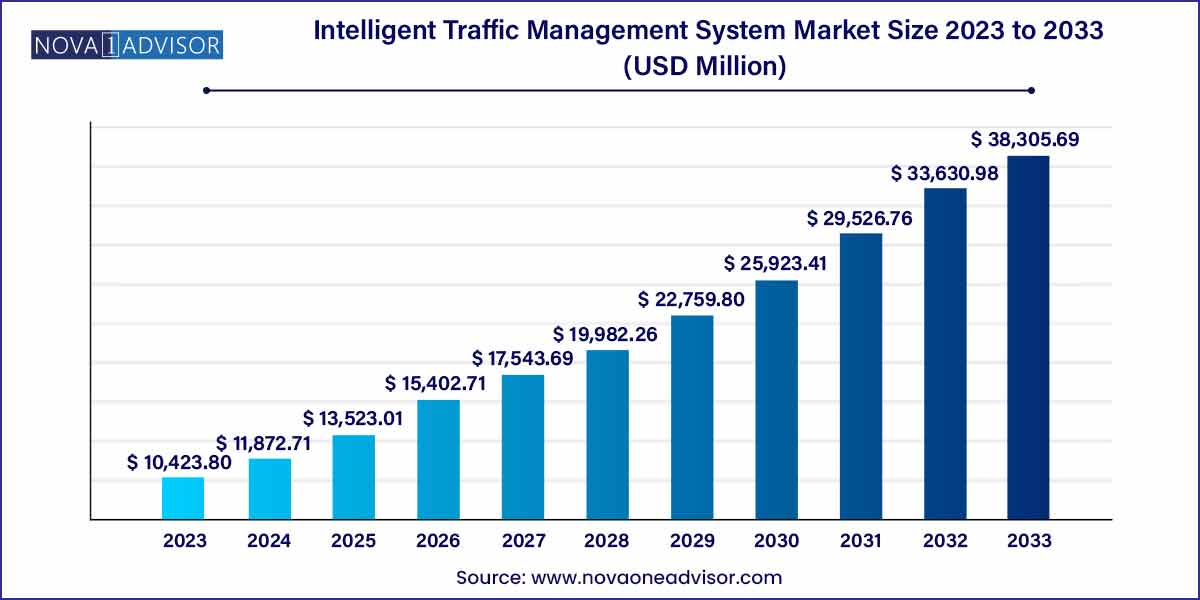

The global intelligent traffic management system market size was exhibited at USD 10,423.8 million in 2023 and is projected to hit around USD 38,305.69 million by 2033, growing at a CAGR of 13.9% during the forecast period of 2024 to 2033.

Key Takeaways:

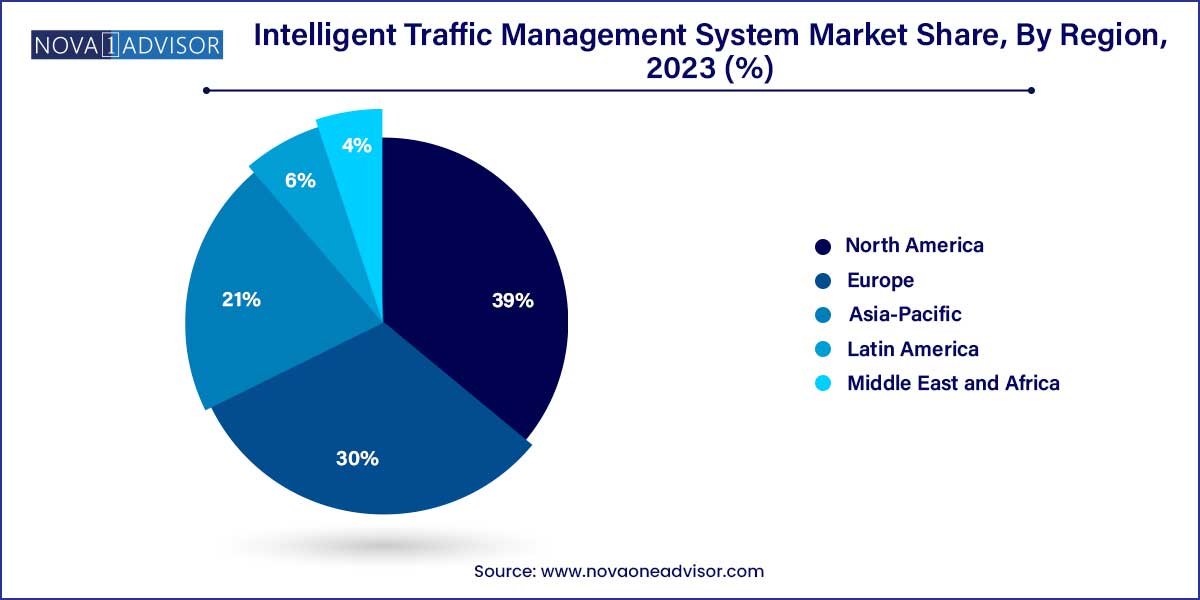

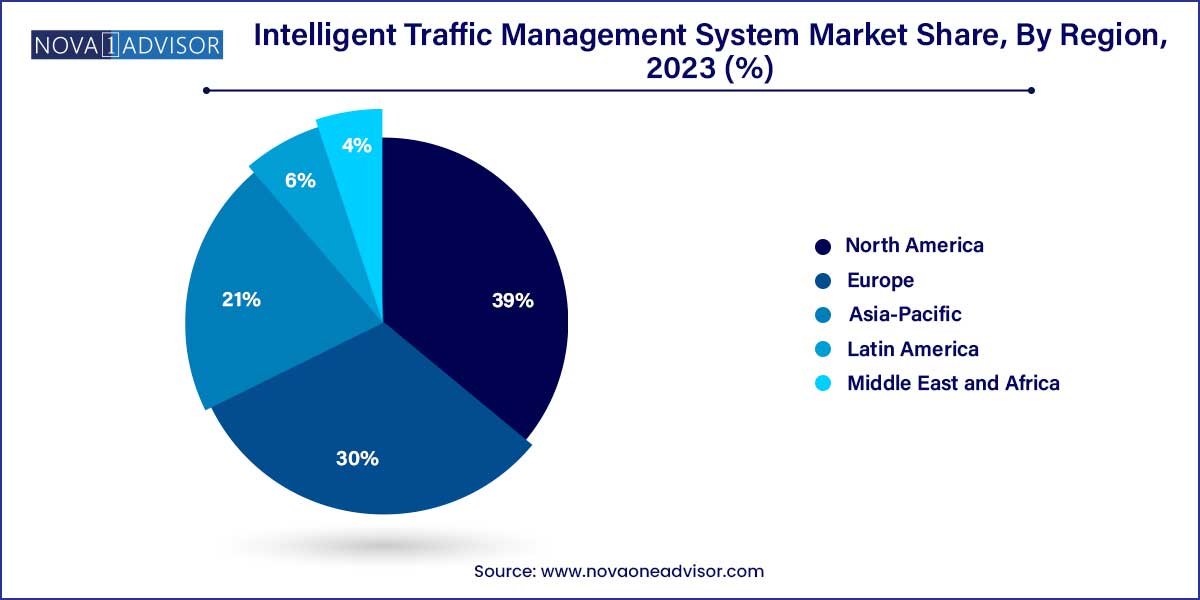

- North America held the major share of 39.0% in 2023 of the global intelligent traffic management system market.

- The traffic monitoring system segment accounted for a market share of 22.0% in 2023.

Intelligent Traffic Management System Market: Overview

The Intelligent Traffic Management System (ITMS) Market is revolutionizing the way urban areas manage congestion, ensure road safety, and enhance transport efficiency. As urban populations swell and vehicle ownership rises globally, traditional traffic management methods are proving inadequate to address increasingly complex mobility challenges. Intelligent traffic management systems leverage technologies such as artificial intelligence (AI), machine learning (ML), the Internet of Things (IoT), big data analytics, and advanced communication networks to optimize traffic flow, reduce congestion, and minimize environmental impacts.

ITMS integrates real-time traffic data collection, adaptive traffic signal control, incident detection, predictive analytics, and traveler information dissemination into cohesive solutions that facilitate smoother urban mobility. These systems not only improve commuter experiences but also contribute significantly to public safety, emergency response efficiency, and urban sustainability goals.

Rapid technological advancements, government initiatives supporting smart city development, and increasing investments in infrastructure modernization are key drivers of market growth. The COVID-19 pandemic further accelerated the demand for touchless, automated traffic management solutions, boosting investments in intelligent traffic systems across developed and emerging economies alike.

As cities strive to become smarter and greener, ITMS is emerging as a critical pillar of future urban transportation frameworks, offering solutions that balance efficiency, safety, and environmental stewardship.

Intelligent Traffic Management System Market Growth

The growth of the Intelligent Traffic Management System (ITMS) market is propelled by several key factors.Firstly, rapid urbanization and population growth worldwide are driving increased demand for solutions to alleviate traffic congestion and improve mobility. Secondly, advancements in technology, including sensor technology, artificial intelligence, and data analytics, are enhancing the capabilities of ITMS, making it more efficient and effective in managing traffic flow. Additionally, the global focus on sustainability and reducing carbon emissions is prompting governments and organizations to invest in ITMS as part of broader efforts to promote eco-friendly transportation solutions. Furthermore, the emergence of smart cities initiatives, coupled with government funding for infrastructure modernization, is creating favorable conditions for the adoption of ITMS. Overall, these growth factors underscore the promising trajectory of the ITMS market as it continues to evolve and expand to meet the evolving needs of urban transportation systems.

Intelligent Traffic Management System Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 10,423.8 Million |

| Market Size by 2033 |

USD 38,305.69 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 13.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Solution, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Cubic Corporation; SNC-Lavalin Group (Atkins); Thales Group; International Business Machines Corporation; General Electric Company; Siemens AG; Kapsch TrafficCom; TomTom International BV; Q-Free ASA; TransCore. |

Intelligent Traffic Management System Market Dynamics

- Technological Advancements:

The ITMS market is significantly influenced by continuous technological advancements. Innovations in sensor technology, artificial intelligence (AI), and machine learning (ML) are revolutionizing the capabilities of ITMS solutions. Advanced sensors embedded in road infrastructure and vehicles provide real-time data on traffic flow, congestion levels, and incidents. AI and ML algorithms process this data to optimize traffic signal timings, predict traffic patterns, and dynamically adjust traffic management strategies. Furthermore, the integration of cloud computing and Internet of Things (IoT) technologies enables remote monitoring and control of traffic operations, enhancing efficiency and responsiveness.

- Urbanization and Population Growth:

The rapid pace of urbanization and population growth globally is a significant driver of the ITMS market. As more people migrate to urban areas, cities face escalating traffic congestion, safety concerns, and environmental issues. Governments and municipalities are increasingly turning to ITMS solutions to manage traffic more efficiently, improve road safety, and reduce carbon emissions. The deployment of ITMS technologies, such as adaptive signal control systems, dynamic route guidance, and intelligent transportation networks, enables cities to optimize traffic flow, reduce travel times, and enhance overall transportation efficiency.

Intelligent Traffic Management System Market Restraint

- High Initial Investment Costs:

One of the primary restraints hindering the widespread adoption of ITMS solutions is the high initial investment costs associated with implementation and infrastructure deployment. Building and integrating the necessary hardware components, such as sensors, cameras, and communication networks, incur substantial upfront expenses for governments and transportation authorities. Additionally, the installation of ITMS software and data analytics platforms requires significant investment in licensing fees and system customization. Moreover, the maintenance and ongoing operational costs further contribute to the financial burden on stakeholders.

- Interoperability and Compatibility Challenges:

Another key restraint faced by the ITMS market is the complexity of ensuring interoperability and compatibility among diverse systems and technologies. ITMS solutions often comprise a heterogeneous mix of hardware and software components sourced from multiple vendors, each with its own proprietary standards and protocols. Achieving seamless integration and interoperability between these disparate systems poses significant technical challenges, leading to potential inefficiencies, data silos, and compatibility issues. Moreover, as ITMS ecosystems evolve and incorporate new technologies, ensuring backward compatibility with existing infrastructure and legacy systems becomes increasingly challenging.

Intelligent Traffic Management System Market Opportunity

- Integration with Smart City Initiatives:

The integration of ITMS solutions with broader smart city initiatives presents a significant opportunity for market growth. As governments and municipalities worldwide prioritize the development of smart and sustainable urban environments, ITMS plays a crucial role in optimizing transportation systems and improving overall quality of life. By leveraging ITMS technologies such as advanced traffic signal control, real-time data analytics, and smart routing algorithms, cities can enhance traffic flow, reduce congestion, and mitigate environmental impacts. Furthermore, integrating ITMS with other smart city applications, such as intelligent public transit systems, smart parking solutions, and connected infrastructure, creates synergies that further enhance urban mobility and efficiency.

- Emergence of Connected and Autonomous Vehicles (CAVs):

The rapid advancement of connected and autonomous vehicle (CAV) technologies presents a compelling opportunity for the ITMS market. CAVs rely on real-time data exchange with surrounding infrastructure and vehicles to navigate safely and efficiently. ITMS solutions, such as vehicle-to-infrastructure (V2I) communication systems, traffic signal prioritization, and predictive traffic management, play a pivotal role in supporting the deployment and operation of CAVs. By providing CAVs with access to up-to-date traffic information, road conditions, and route optimization algorithms, ITMS enhances the safety, reliability, and efficiency of autonomous driving systems. Furthermore, as CAVs become more prevalent on roads, the demand for ITMS solutions that can accommodate and support these advanced vehicles is expected to escalate.

Intelligent Traffic Management System Market Challenges

- Data Security and Privacy Concerns:

The proliferation of ITMS solutions that rely on collecting, analyzing, and sharing vast amounts of sensitive traffic data raises significant concerns regarding data security and privacy. As ITMS systems become more interconnected and reliant on cloud-based platforms for data storage and processing, they become vulnerable to cyber threats, data breaches, and unauthorized access. Malicious actors could exploit vulnerabilities in ITMS infrastructure to disrupt traffic operations, manipulate traffic signals, or access personally identifiable information (PII) of road users. Moreover, the widespread deployment of surveillance cameras and sensors for traffic monitoring raises privacy concerns regarding the collection and use of personal data without consent. Addressing these data security and privacy challenges requires robust encryption protocols, secure authentication mechanisms, and stringent access controls to safeguard sensitive information and ensure compliance with data protection regulations.

- Infrastructure Compatibility and Legacy Systems:

Another significant challenge facing the ITMS market is the compatibility of ITMS solutions with existing infrastructure and legacy systems. Many cities and municipalities operate aging traffic management systems built on outdated technologies and proprietary standards, making integration with modern ITMS solutions complex and challenging. Retrofitting existing infrastructure to support new ITMS technologies may require substantial investments in hardware upgrades, software updates, and system integration efforts. Moreover, interoperability issues between different generations of traffic management systems can lead to data silos, inefficiencies, and operational limitations. Additionally, the long lifecycle of infrastructure assets and the slow pace of infrastructure renewal in some regions further exacerbate the challenge of modernizing and upgrading traffic management systems.

Segments Insights:

Solution Insights

Traffic Monitoring Systems dominated the solution segment due to the crucial role they play in collecting, analyzing, and disseminating real-time traffic data. These systems typically involve a network of cameras, sensors, radar units, and data processing platforms that monitor traffic density, detect incidents, and track vehicle speeds across road networks.

Effective traffic monitoring forms the backbone of intelligent traffic management, enabling authorities to make informed decisions regarding signal adjustments, emergency responses, and congestion management. Companies like FLIR Systems and Kapsch TrafficCom offer sophisticated monitoring solutions integrating AI-based video analytics for better incident detection and traffic flow optimization.

Conversely, Integrated Corridor Management (ICM) solutions are expected to experience the fastest growth. ICM platforms coordinate multiple transportation systems across entire corridors, including highways, arterial roads, and public transit routes, allowing authorities to manage traffic holistically rather than in isolated segments. Increasing investments in corridor-based traffic management in regions like North America and Europe are fueling demand for integrated, multimodal management solutions.

Regional Insights

North America led the global intelligent traffic management system market, driven by early adoption of smart technologies, strong government support, and the region’s focus on enhancing urban mobility. Major cities such as New York, Los Angeles, Toronto, and Chicago have invested heavily in ITS (Intelligent Transportation Systems) deployment, integrating adaptive traffic signals, connected vehicle infrastructure, and real-time traffic analytics platforms.

The U.S. Department of Transportation's Intelligent Transportation Systems Joint Program Office (ITS JPO) has been instrumental in funding pilot programs and research initiatives supporting smart traffic management. Furthermore, public-private partnerships are flourishing, with tech giants like IBM, Cisco, and Siemens partnering with municipalities to implement integrated traffic solutions.

Asia-Pacific is witnessing the fastest growth, fueled by rapid urbanization, increasing traffic congestion, government-backed smart city initiatives, and rising investments in infrastructure modernization. China, Japan, South Korea, India, and Singapore are leading adopters of intelligent traffic technologies.

China’s smart transportation projects, such as those in Hangzhou and Shenzhen, are globally recognized for integrating big data analytics and AI to streamline traffic flows. India's Smart Cities Mission includes the deployment of intelligent traffic systems across dozens of urban areas to tackle severe congestion problems.

In addition, rising disposable incomes, expanding vehicle ownership, and digital transformation initiatives are further accelerating ITMS adoption across Asia-Pacific.

Some of the prominent players in the intelligent traffic management system market include:

- Cubic Corporation

- SNC-Lavalin Group (Atkins)

- Thales Group

- International Business Machines Corporation

- General Electric Company

- Siemens AG

- Kapsch TrafficCom

- TomTom International BV

- Q-Free ASA

- TransCore

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global intelligent traffic management system market.

Solution

- Traffic Monitoring System

- Traffic Signal Control System

- Traffic Enforcement Camera

- Integrated Corridor Management

- Intelligent Driver Information System

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)