Intracranial Aneurysm Market Size and Trends

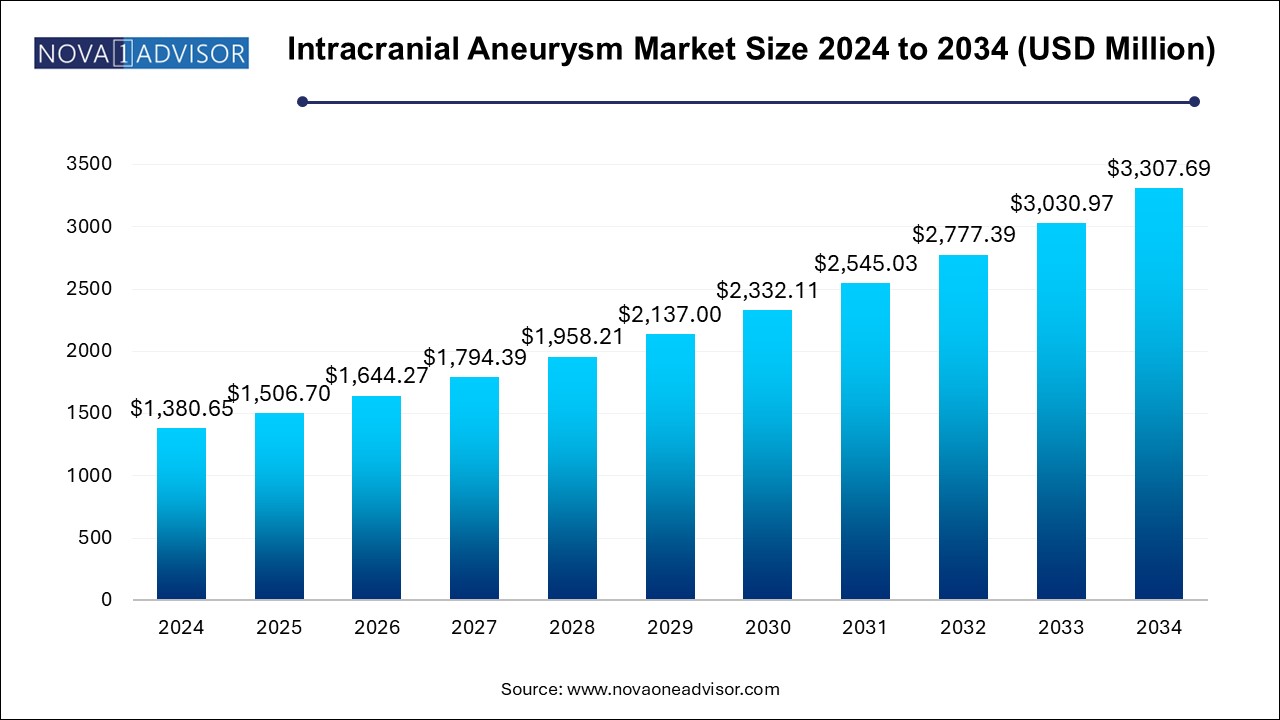

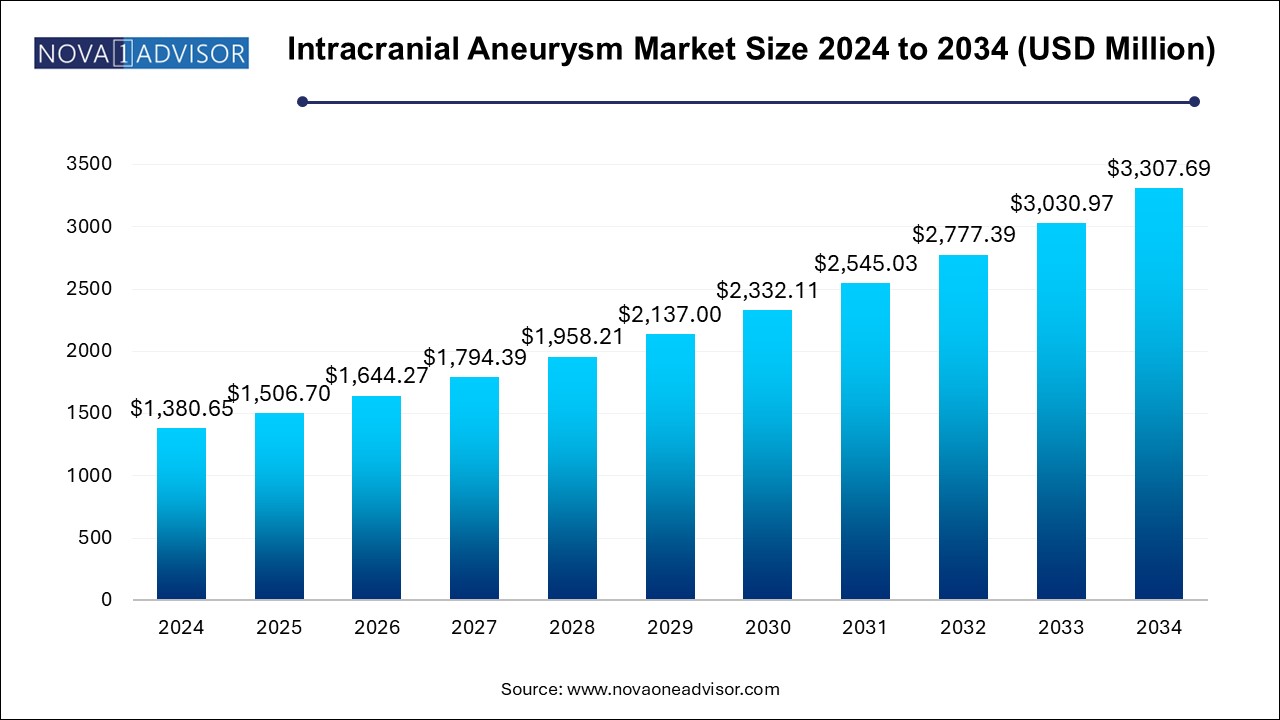

The intracranial aneurysm market size was exhibited at USD 1,380.65 million in 2024 and is projected to hit around USD 3,307.69 million by 2034, growing at a CAGR of 9.13% during the forecast period 2024 to 2034.

Intracranial Aneurysm Market Key Takeaways:

- Based on type, the endovascular coiling segment led the market with the largest revenue share of 84.6% in 2024.

- The flow diverters segment is anticipated to witness fastest CAGR over the forecast period.

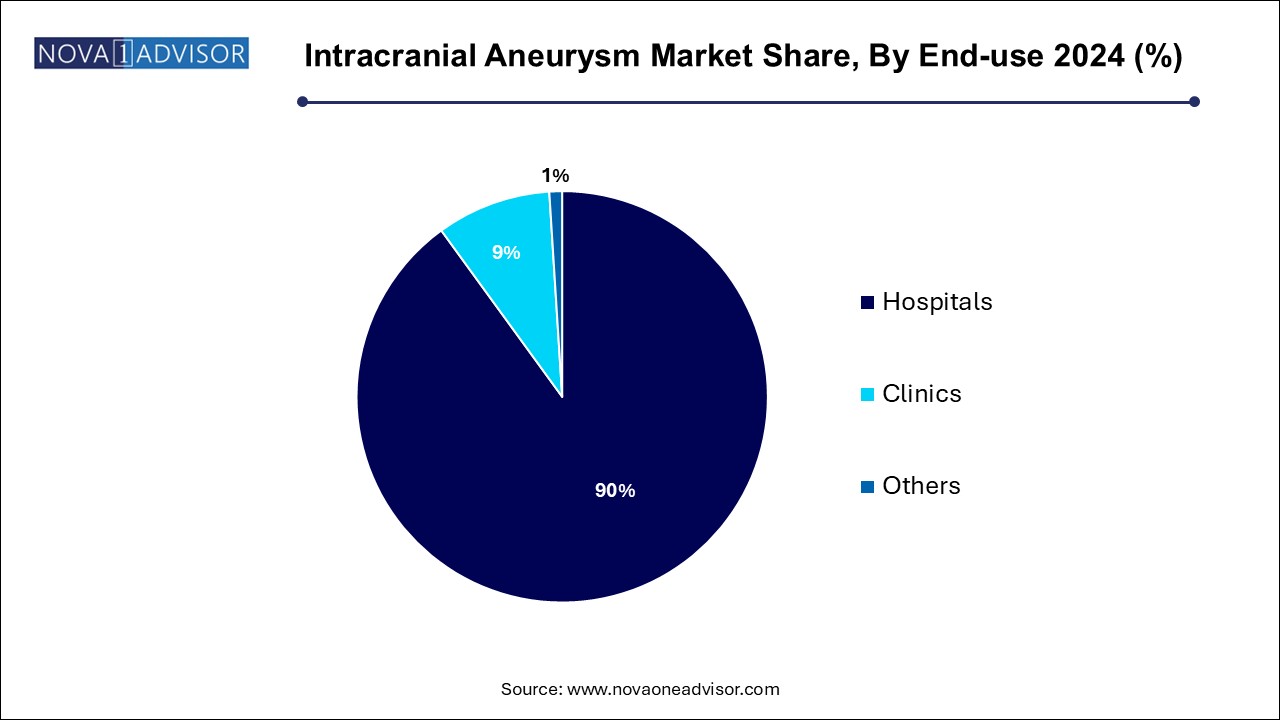

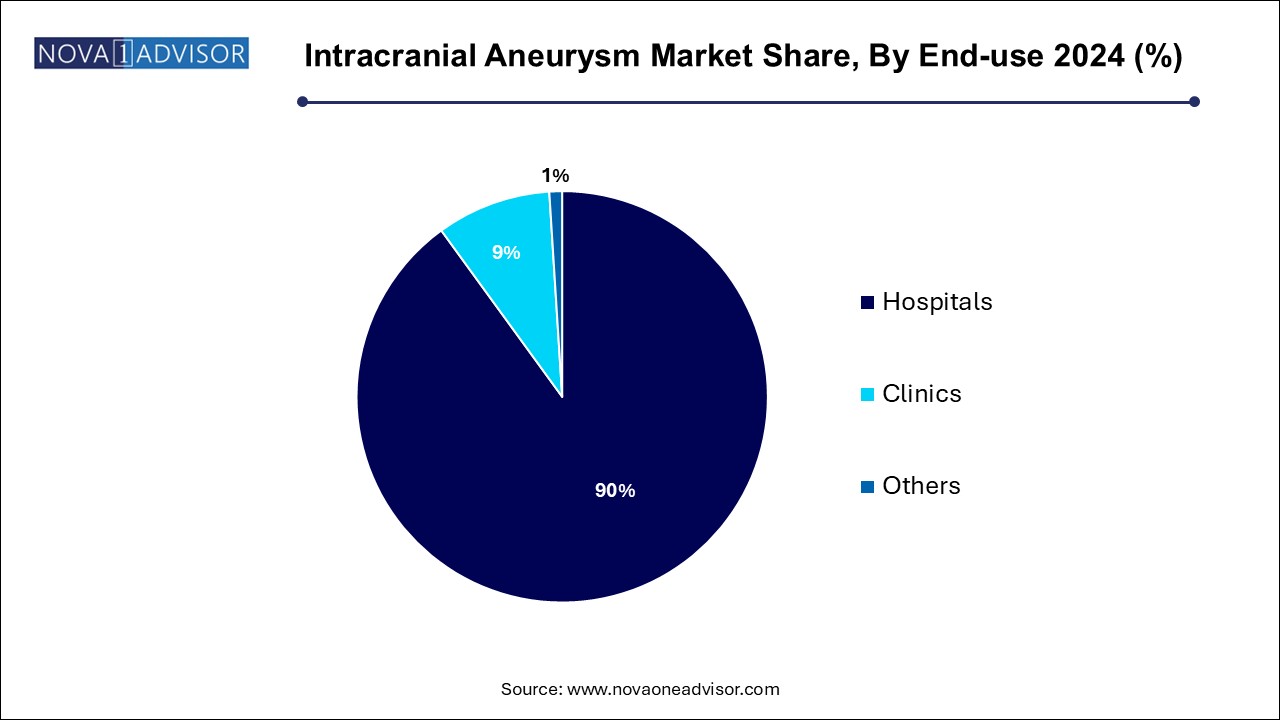

- Based on end-use, the hospital segment led the market in 2024 with the largest revenue share of 90.0%.

- The clinic segment is also anticipated to witness a significant CAGR over the forecast period.

- North America dominated the market with the revenue share of 26.65% in 2024.

- The Asia Pacific market is anticipated to witness the fastest CAGR over the forecast period.

Market Overview

The Intracranial Aneurysm Market represents a vital segment of the neurology and vascular intervention industry, focused on the prevention, diagnosis, and treatment of aneurysmal ruptures within the cerebral vasculature. An intracranial aneurysm, often described as a ballooning or dilation of a blood vessel in the brain, poses significant health risks, including hemorrhagic stroke, permanent neurological damage, or death if ruptured. Early diagnosis, preventive surgical interventions, and technological advancements in neurosurgery have collectively improved patient outcomes, fueling growth in this market.

Intracranial aneurysms are becoming increasingly recognized as a public health concern, driven by higher detection rates due to improvements in imaging modalities like MRI and CT angiography. According to the Brain Aneurysm Foundation, an estimated 6 million people in the United States (about 1 in 50) have an unruptured brain aneurysm. Innovations in minimally invasive treatments such as endovascular coiling, flow diverters, and enhanced surgical clipping techniques are transforming the management of these life-threatening conditions.

The global market is benefiting from rising patient awareness, a growing elderly population susceptible to vascular anomalies, favorable reimbursement policies, and expanded clinical trials for novel devices. As neurosurgical techniques evolve toward safer, faster, and more effective interventions, the intracranial aneurysm treatment ecosystem is poised for significant expansion over the next decade.

Major Trends in the Market

-

Shift Toward Minimally Invasive Treatments: Endovascular coiling and flow diverters are gaining preference over traditional open surgeries.

-

Advancements in Imaging Technology: High-resolution 3D rotational angiography and AI-enhanced imaging aid earlier and more precise aneurysm diagnosis.

-

Development of Bioactive Coils: Next-generation coils promoting endothelial healing and reducing recurrence rates are entering the market.

-

Rising Adoption of Flow Diverter Devices: Increasing usage of flow diversion techniques for wide-neck and complex aneurysms.

-

Artificial Intelligence and Robotics: AI-guided interventions and robotic-assisted neurosurgery are improving procedural outcomes.

-

Focus on Early Detection Programs: Public health initiatives promoting brain screening for at-risk populations are on the rise.

-

Customized, Patient-Specific Devices: Personalized implants and surgical planning based on 3D printing and simulation technologies.

-

Growing Role of Ambulatory Surgical Centers (ASCs): Outpatient centers are expanding their capabilities in minimally invasive neuro-interventions.

-

Increased Clinical Trials for Combination Therapies: Simultaneous use of coiling with flow diverters is under study to optimize outcomes.

-

Rising Awareness in Emerging Economies: Growing access to healthcare services in Asia Pacific and Latin America is boosting demand.

Report Scope of Intracranial Aneurysm Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,506.70 Million |

| Market Size by 2034 |

USD 3,307.69 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 9.13% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Medtronic; Stryker; MicroPort Scientific Corporation.; Johnson & Johnson Services, Inc.; MicroVention Inc.; B. Braun Melsungen AG; Integra LifeSciences; RAUMEDIC AG; Terumo Corporation; Delta Surgical |

Key Market Driver: Technological Advancements in Aneurysm Treatment Devices

A major driving force behind the expansion of the intracranial aneurysm market is the continuous advancement in treatment device technologies. The introduction of flow diverters, next-generation bioactive coils, detachable microcatheters, and stent-assisted coiling devices has significantly transformed clinical practice. Unlike conventional surgical clipping, these minimally invasive techniques reduce recovery times, lower the risk of procedural complications, and extend treatment eligibility to elderly and high-risk patients.

For instance, the Pipeline Embolization Device (PED), developed by Medtronic, revolutionized the treatment of large and giant wide-necked intracranial aneurysms, offering new hope for patients previously deemed untreatable. Similarly, newer flow-diverter stents with improved biocompatibility and radial strength enhance blood flow remodeling and facilitate faster healing. These innovations have improved procedural success rates and reduced recurrence, driving their widespread adoption across hospitals and neurosurgical centers.

Key Market Restraint: High Cost and Limited Access to Advanced Treatment Options

Despite impressive advancements, the high cost associated with endovascular devices and complex surgical interventions remains a significant restraint on the intracranial aneurysm market. Procedures involving flow diverters or stent-assisted coiling can cost between $20,000 to $50,000, excluding hospital and rehabilitation expenses. In many emerging economies, the affordability of such treatments is a major concern, particularly in regions with limited insurance penetration.

Additionally, the availability of highly trained neurosurgeons and endovascular specialists is restricted to urban centers, creating accessibility gaps for rural and underserved populations. Complex device deployment techniques also necessitate specialized infrastructure and training, which may not be readily available in all hospitals. These barriers to equitable access slow down market penetration, particularly in cost-sensitive regions.

Key Market Opportunity: Expansion of Preventive Screening and Early Intervention Programs

A significant opportunity lies in the expansion of preventive brain screening initiatives and early intervention programs, particularly among high-risk groups. Family history, hypertension, smoking, and genetic predispositions are strong risk factors for aneurysm formation. Early detection through non-invasive imaging like MRI or MRA can identify asymptomatic aneurysms, allowing for proactive management before rupture.

Countries such as Japan have successfully implemented brain health screening initiatives (Brain Dock programs) leading to higher detection of unruptured aneurysms. This proactive approach not only improves patient prognosis but also increases the procedural volume for endovascular and surgical interventions. Encouraging preventive screenings, coupled with insurance coverage, offers a tremendous growth avenue for healthcare providers, imaging centers, and device manufacturers.

Intracranial Aneurysm Market By Type Insights

Endovascular Coiling dominated the intracranial aneurysm market in 2024. Endovascular coiling has emerged as the preferred treatment for many intracranial aneurysms due to its minimally invasive nature, reduced hospitalization time, and lower surgical risks compared to open surgical clipping. The procedure involves inserting a catheter into the aneurysm site and filling it with platinum coils to block blood flow, thereby preventing rupture. The advent of softer, bioactive coils that encourage endothelialization has further enhanced outcomes. Studies like the ISAT trial (International Subarachnoid Aneurysm Trial) demonstrated the superiority of endovascular coiling over surgical clipping in reducing morbidity and mortality, solidifying its dominant position.

Flow Diverters are anticipated to experience the fastest growth in the coming years. Flow diverters, such as Medtronic’s Pipeline Flex and Stryker’s Surpass Streamline, have opened new horizons for treating wide-necked and fusiform aneurysms that are difficult to coil. These devices redirect blood flow away from the aneurysm, facilitating gradual occlusion and healing of the vessel wall. Continuous improvements in device design, including enhanced trackability, flexibility, and reduced thrombogenicity, are expanding the eligible patient population. As clinical guidelines increasingly endorse flow diverters for complex aneurysms, their adoption is set to surge significantly.

Intracranial Aneurysm Market By End-use Insights

Hospitals captured the largest market share among end-use categories in 2024. Hospitals, particularly tertiary care centers and academic medical institutions, remain the primary settings for intracranial aneurysm treatments. They offer the comprehensive infrastructure, multidisciplinary expertise, and advanced imaging capabilities needed to manage complex neurovascular procedures. The availability of hybrid operating rooms that combine surgical and imaging facilities further consolidates hospitals’ dominant position in the market.

Clinics are expected to grow at the fastest pace over the forecast period. Specialized neurology and interventional radiology clinics are expanding their capabilities to perform minimally invasive procedures like coiling and flow diversion on an outpatient basis. Improvements in device delivery systems, shorter recovery times, and increased procedural safety are making clinics a viable alternative to hospital-based interventions. Moreover, standalone neurovascular clinics are emerging in urban centers to cater to elective aneurysm screening and treatment, contributing to segment growth.

Intracranial Aneurysm Market By Regional Insights

North America, particularly the United States, dominated the intracranial aneurysm market in 2024, driven by advanced healthcare infrastructure, widespread access to cutting-edge neurosurgical techniques, and a high level of public awareness about brain health. The presence of major industry players like Medtronic, Stryker, and Johnson & Johnson ensures early availability of new technologies. Additionally, government-backed health initiatives promoting stroke and aneurysm awareness, coupled with favorable reimbursement policies, have fostered rapid adoption of endovascular therapies. Robust clinical research environments and a concentration of highly skilled neurosurgeons further reinforce North America’s leadership position.

Asia Pacific is projected to be the fastest-growing region in the intracranial aneurysm market. Countries such as Japan, China, India, and South Korea are witnessing an uptick in cerebrovascular disease prevalence due to aging populations and lifestyle factors such as smoking and hypertension. Government initiatives to strengthen neurocritical care infrastructure, increased healthcare spending, and rising medical tourism for affordable neuro-interventions are propelling regional growth. Japan, in particular, leads in early aneurysm detection through brain screening programs, while China and India are rapidly expanding access to advanced neurovascular care, supported by investments in modern hospital facilities and training programs.

Some of the prominent players in the intracranial aneurysm market include:

- Medtronic plc

- Stryker Corporation

- MicroPort Scientific Corporation.

- Johnson & Johnson Services, Inc.

- MicroVention Inc.

- B. Braun Melsungen AG

- Integra LifeSciences

- RAUMEDIC AG

- Terumo Corporation

- Delta Surgical

Intracranial Aneurysm Market Recent Developments

-

March 2025 – Stryker Corporation received FDA approval for its next-generation Neuroform Atlas stent system, designed for stent-assisted coiling of wide-neck intracranial aneurysms.

-

January 2025 – Medtronic plc announced the launch of its latest Pipeline Vantage flow diverter system in Europe, offering enhanced visibility and flexibility during deployment.

-

November 2024 – MicroVention, Inc. (a Terumo company) unveiled the SOFIA Plus 6F catheter for enhanced neurovascular access during coiling and flow diverter procedures.

-

September 2024 – Balt USA expanded its Silk Vista Baby flow diverter range with FDA clearance for use in smaller, distal vessels.

-

July 2024 – Phenox GmbH introduced a new generation of low-profile embolization devices, optimizing treatment for small and medium-sized aneurysms.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the intracranial aneurysm market

Type

- Surgical Clipping

- Endovascular Coiling

- Flow Diverters

- Others

End-use

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)