IV Tubing Sets And Accessories Market Size and Growth

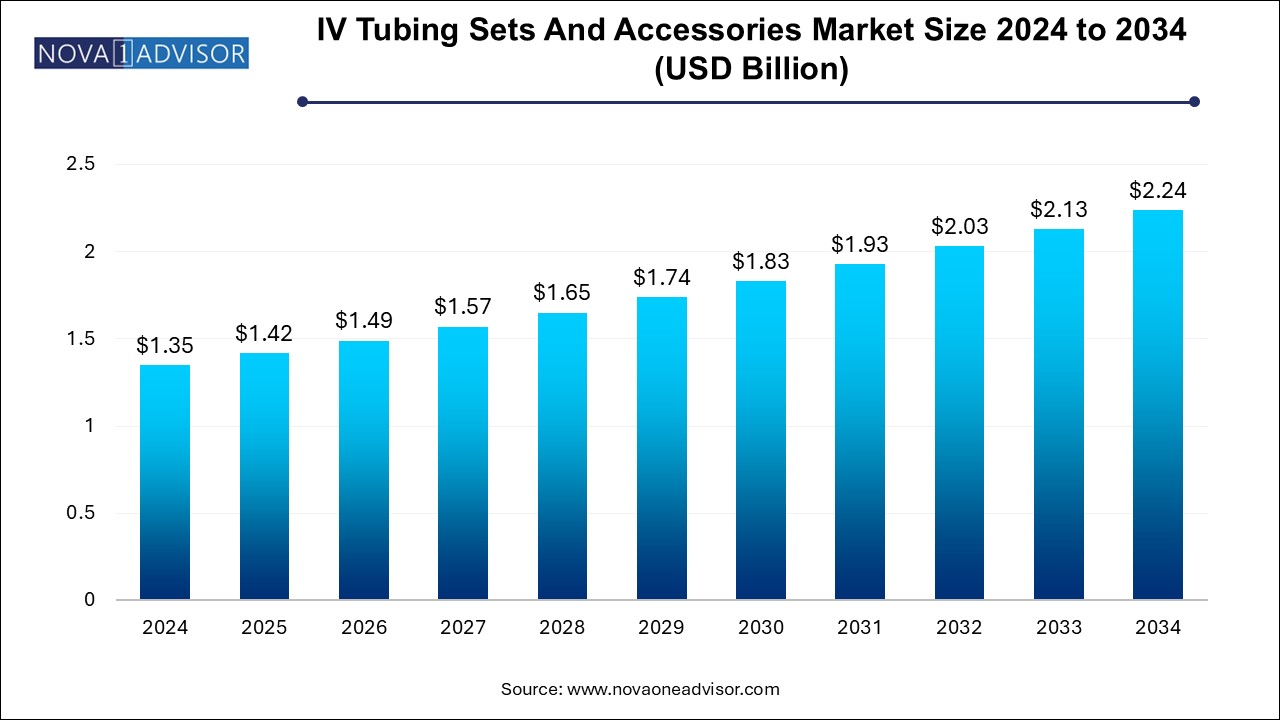

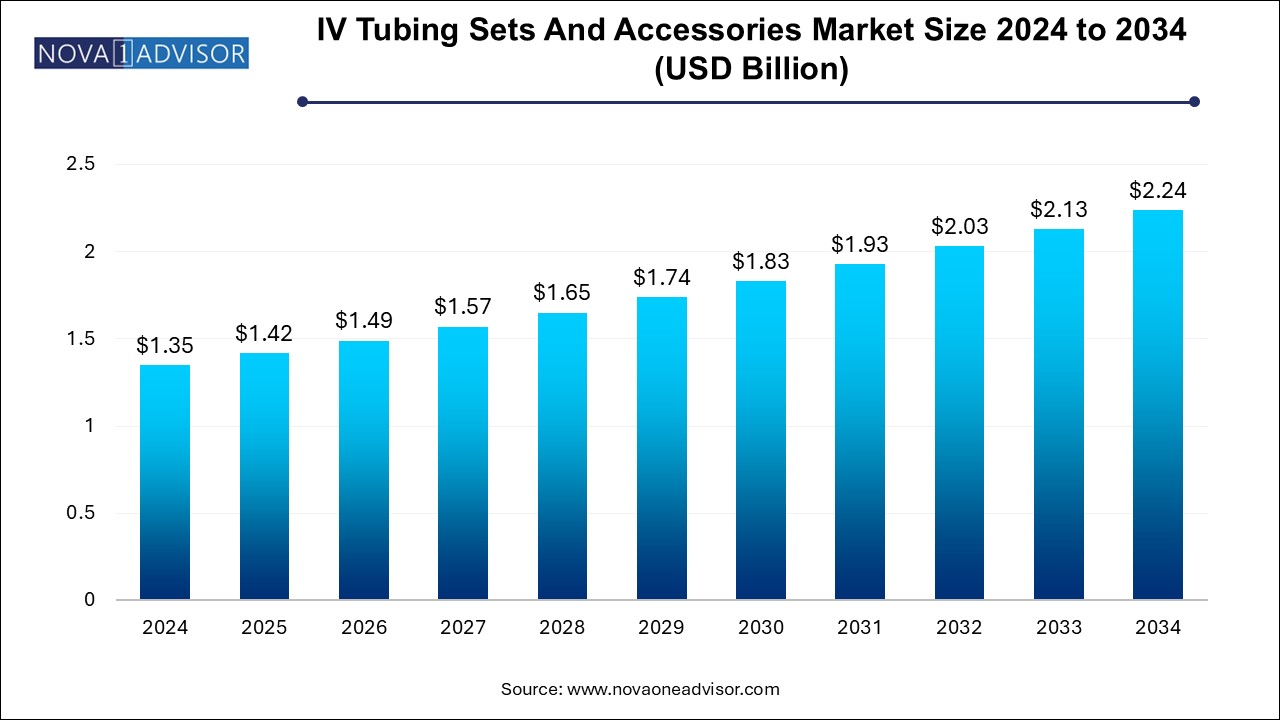

The IV tubing sets and accessories market size was exhibited at USD 1.35 billion in 2024 and is projected to hit around USD 2.24 billion by 2034, growing at a CAGR of 5.2% during the forecast period 2024 to 2034.

IV Tubing Sets And Accessories Market Key Takeaways:

- Primary IV tubing sets led the market with a revenue share of 32.2% in 2024.

- Extension IV tubing sets are expected to grow at the fastest CAGR of 5.8% over the forecast period.

- Peripheral intravenous catheter insertion dominated the market with a revenue share of 48.5% in 2024.

- Central venous catheter (CVC) placement is expected to register the fastest CAGR of 5.4% over the forecast period.

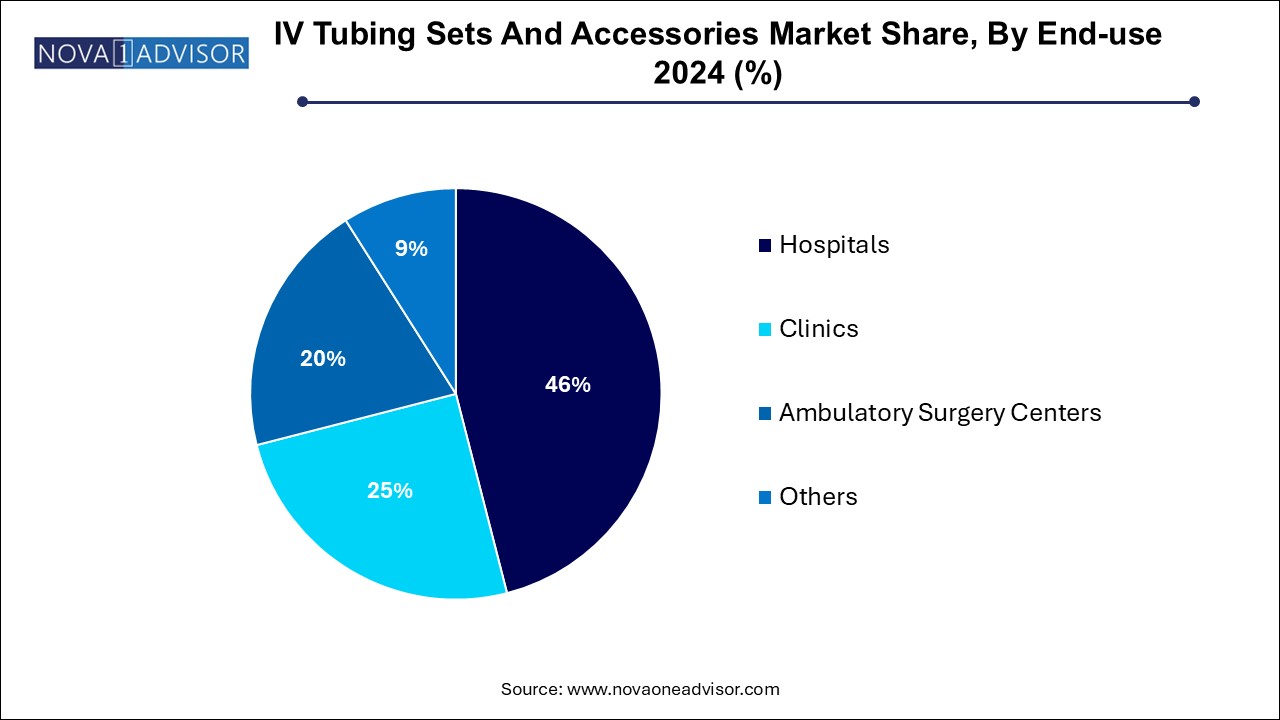

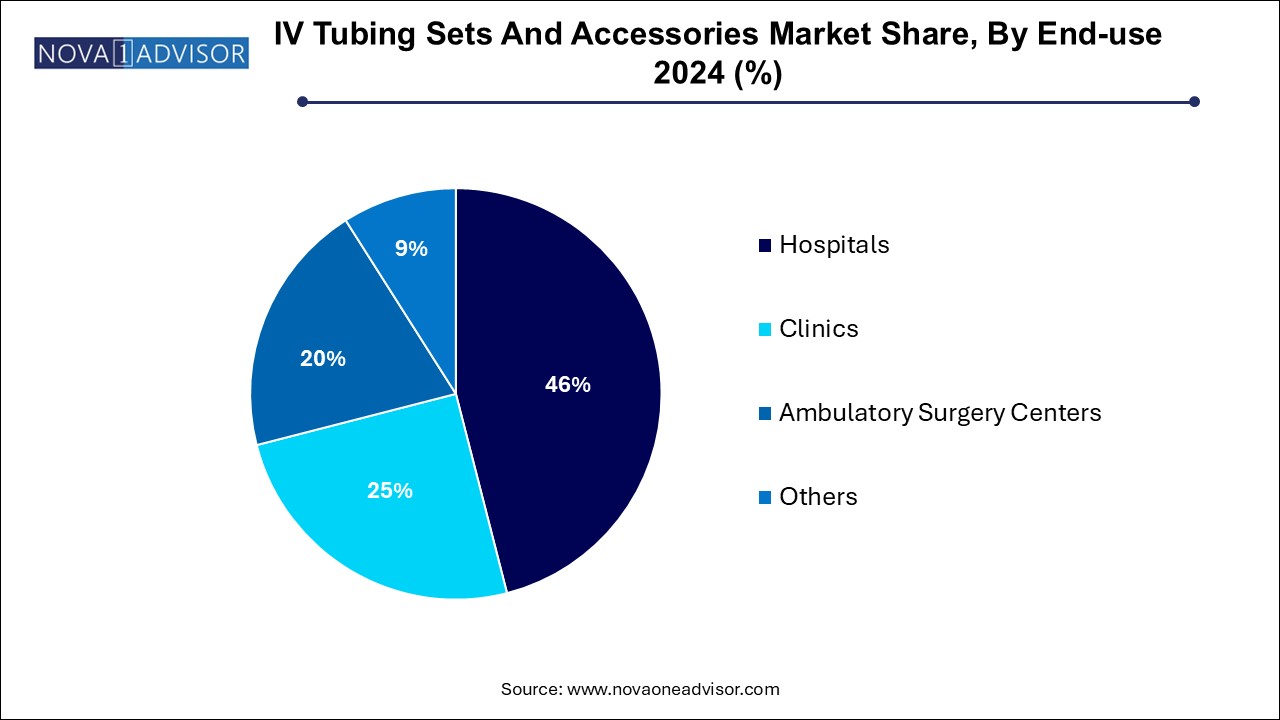

- Hospitals held the largest market share of 46.0% in 2024.

- Ambulatory surgical centers (ASCs) are projected to the fastest growth of 5.8% over the forecast period

- The North America IV tubing sets and accessories market dominated the global market with a revenue share of 46.9% in 2024.

Market Overview

The IV Tubing Sets & Accessories Market plays a fundamental role in modern healthcare, facilitating the efficient and safe administration of fluids, medications, blood products, and nutrients directly into a patient's bloodstream. Intravenous (IV) therapy remains a cornerstone of patient management in hospitals, clinics, and outpatient settings, with IV tubing sets being critical for precise and controlled fluid delivery.

The growing global burden of chronic diseases, increasing hospital admission rates, and rising surgical procedures are key factors driving demand for IV tubing sets and associated accessories. Furthermore, technological innovations aimed at enhancing patient safety—such as anti-kinking tubing, needle-free connectors, and smart infusion systems—are reshaping the market landscape. Hospitals and ambulatory surgery centers increasingly rely on standardized IV sets to optimize care quality and reduce the risk of infection, infiltration, or dosing errors.

Moreover, the COVID-19 pandemic has accelerated the need for reliable IV administration solutions, particularly in critical care settings such as intensive care units (ICUs). With healthcare providers prioritizing efficiency and infection control, the importance of robust, high-quality IV tubing systems has grown considerably. As healthcare systems worldwide modernize, the IV tubing sets and accessories market is poised for sustainable expansion.

Major Trends in the Market

-

Rise of Needle-free IV Connectors: To minimize needlestick injuries and catheter-associated bloodstream infections (CABSI).

-

Growth in Home Infusion Therapy: Demand for user-friendly IV tubing for outpatient and home healthcare environments is increasing.

-

Introduction of Antimicrobial-coated Tubing: Innovations aimed at preventing infection during IV therapy are gaining traction.

-

Integration of Smart IV Systems: Automated monitoring and flow regulation systems linked with IV tubing are emerging.

-

Adoption of Eco-friendly and DEHP-free Tubing: Regulatory push toward safer, non-toxic materials is influencing product designs.

-

Customization and Modular Tubing Systems: Demand for customized sets based on specific therapeutic requirements is rising.

-

Expansion of Single-use IV Tubing Sets: Single-use systems to prevent cross-contamination and maintain sterility are dominating procurement.

-

Growing Popularity of Pressure-resistant Tubing: For applications such as rapid infusion in critical care.

-

Tightening of Regulatory Standards: Stricter product approval guidelines by bodies like the FDA and EMA.

-

Globalization of Manufacturing and Distribution: Leading companies are expanding production capabilities to emerging markets.

Report Scope of IV Tubing Sets And Accessories Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.42 Billion |

| Market Size by 2034 |

USD 2.24 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 5.2% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

B. Braun Medical Inc.; ICU Medical, Inc.; Baxter; BD; Fresenius Kabi AG; Zyno Medical (Intuvie Holdings LLC); Nipro Medical Corporation; Polymedicure |

Key Market Driver: Increasing Prevalence of Chronic Diseases and Surgical Procedures

The rising global burden of chronic diseases and surgical interventions is a primary driver of the IV tubing sets and accessories market. Conditions such as cancer, cardiovascular diseases, diabetes, and kidney failure frequently require long-term IV therapies, whether for chemotherapy, dialysis, hydration, or parenteral nutrition.

According to the World Health Organization, chronic diseases account for approximately 71% of all deaths globally, highlighting the vast patient population dependent on regular hospital-based or home-based intravenous care. Moreover, an aging global population and advancements in surgical techniques have led to a surge in elective and emergency surgical procedures, increasing demand for IV tubing sets in perioperative and postoperative settings. These clinical dynamics make IV tubing products indispensable components of modern healthcare delivery.

Key Market Restraint: Risk of IV-associated Infections and Complications

Despite their critical role, the risk of IV-associated infections and mechanical complications acts as a notable restraint on market expansion. Intravenous lines can serve as pathways for microbial invasion if not handled or maintained correctly, leading to serious infections such as bloodstream infections (BSIs), phlebitis, and sepsis.

Healthcare facilities bear substantial costs for treating IV-related complications and face penalties under value-based purchasing programs emphasizing patient safety. While advancements in tubing design have reduced risk factors, improper insertion, handling, or maintenance by healthcare staff still leads to preventable complications. Concerns over infection risks necessitate rigorous staff training, adherence to protocols, and high manufacturing standards, raising operational costs and complicating market entry for new players.

Key Market Opportunity: Expansion of Home Healthcare and Outpatient Services

A significant opportunity lies in the rapid growth of home healthcare services and outpatient infusion therapy. Increasing healthcare costs, the aging population, and patient preference for home-based care have led to a surge in home infusion therapy programs for antibiotics, nutrition, hydration, and pain management.

Home infusion requires easy-to-use, safe, and reliable IV tubing sets that non-clinical caregivers or patients themselves can handle. Manufacturers focusing on simplified designs, pre-assembled sets, portable IV pumps, and self-sealing connectors are poised to tap into this growing segment. Furthermore, the expansion of ambulatory surgery centers (ASCs) is creating additional demand for IV tubing products optimized for outpatient procedures and shorter hospital stays.

IV Tubing Sets And Accessories Market By Product Insights

Primary IV Tubing Sets dominated the market in 2024. Primary IV sets are the backbone of intravenous therapy, used for delivering continuous fluids, blood, or medications directly into a patient's bloodstream. These sets usually connect the fluid container to the IV catheter and often include clamps, drip chambers, and Y-sites for secondary lines. Their widespread use in surgical wards, ICUs, emergency departments, and general inpatient care underlines their dominant position. Hospitals and clinics standardize primary sets for consistent usage, procurement efficiency, and clinical familiarity.

Secondary IV Tubing Sets are expected to grow at the fastest rate. Also known as "piggyback sets," secondary IV tubing enables the administration of intermittent medications without disconnecting the primary line, reducing infection risk and enhancing efficiency. The increasing prevalence of antibiotic therapies, chemotherapy regimens, and specialty infusions requiring secondary access is driving this segment. Improvements in back-check valve designs and easier compatibility with multiple primary sets further support their growing adoption in busy clinical environments.

IV Tubing Sets And Accessories Market By Application Insights

Peripheral Intravenous Catheter Insertion dominated the application segment in 2024. Peripheral IV catheterization remains the most common vascular access procedure globally, particularly for short-term fluid and medication administration. The simplicity, cost-effectiveness, and versatility of peripheral IV access contribute to the widespread use of related tubing sets in both inpatient and outpatient care. Innovations such as pressure-rated tubing and pre-slit injection ports enhance their utility across a wide range of clinical scenarios.

PICC Line Insertion is projected to experience the fastest growth over the forecast period. Peripherally Inserted Central Catheters (PICCs) are increasingly used for patients requiring medium- to long-term IV access for chemotherapy, antibiotics, or parenteral nutrition. PICC-specific tubing sets, often featuring anti-reflux valves, antimicrobial coatings, and securement systems, are gaining popularity. The growing trend toward outpatient PICC insertion services and home-based infusion therapies is fueling demand for this specialized application segment.

IV Tubing Sets And Accessories Market By End-use Insights

Hospitals continued to be the leading end-user segment in 2024. Hospitals remain the largest consumers of IV tubing sets due to high patient volumes, complex case mixes, and the need for constant intravenous therapy across emergency rooms, operating rooms, and ICUs. Procurement policies emphasize bulk purchasing of standardized sets, ensuring consistent clinical practices and cost optimization. Furthermore, tertiary hospitals frequently adopt the latest innovations in tubing systems to improve patient safety and meet accreditation requirements.

Ambulatory Surgery Centers (ASCs) are emerging as the fastest-growing end-use sector. ASCs are gaining prominence as cost-effective alternatives to hospital-based surgeries for procedures requiring same-day discharge. IV therapy is critical for preoperative hydration, intraoperative anesthesia, and postoperative recovery in ASCs. The focus on fast turnover rates and infection prevention aligns well with the use of advanced, easy-to-set-up IV tubing systems, making this a burgeoning market segment.

IV Tubing Sets And Accessories Market By Regional Insights

North America accounted for the largest share of the IV tubing sets & accessories market in 2024. Factors such as the highly developed healthcare infrastructure, strong regulatory frameworks (FDA and CDC guidelines), and high healthcare spending contribute to this dominance. Moreover, the region experiences a high burden of chronic diseases, a high surgical volume, and widespread adoption of infection prevention protocols, all of which drive steady demand for IV tubing products. Leading manufacturers such as ICU Medical, Becton Dickinson, and Baxter International have a strong footprint in this region, offering technologically advanced, safe, and compliant products.

Asia Pacific is poised to experience the fastest market growth over the forecast period. The region's rising healthcare expenditure, expanding hospital networks, and growing middle-class population are major contributors. Countries like China, India, Japan, and Australia are investing heavily in healthcare infrastructure modernization. Additionally, the rising prevalence of chronic diseases, increasing surgical procedures, and government initiatives to promote infection control are driving demand for high-quality IV tubing products. International players are also establishing local manufacturing bases and partnerships to meet the growing regional demand efficiently.

Some of the prominent players in the IV tubing sets and accessories market include:

- B. Braun Medical Inc.

- ICU Medical, Inc.

- Baxter

- BD

- Fresenius Kabi AG

- Zyno Medical (Intuvie Holdings LLC)

- Nipro Medical Corporation

- Polymedicure

IV Tubing Sets And Accessories Market Recent Developments

-

March 2025 – Becton, Dickinson and Company (BD) launched its new DEHP-free IV tubing sets in North America, focusing on safer infusion therapy solutions for neonatal and pediatric patients.

-

January 2025 – ICU Medical, Inc. introduced a closed system IV tubing set series, enhancing safety for critical care environments and chemotherapy infusions.

-

November 2024 – Baxter International Inc. expanded its portfolio by acquiring a startup specializing in antimicrobial-coated IV tubing technology.

-

September 2024 – Smiths Medical released a modular IV tubing accessory line in Europe, featuring customizable Y-site and needleless connector systems.

-

July 2024 – Fresenius Kabi announced investment in expanding its IV tubing manufacturing plant in India to meet the rising demand across Asia Pacific.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the IV tubing sets and accessories market

Product

- Primary IV Tubing Sets

- Secondary IV Tubing Sets

- Extension IV Tubing Sets

- IV Tubing Accessories

- Others

Application

- Peripheral Intravenous Catheter Insertion

- Central Venous Catheter Placement

- PICC Line Insertion

End Use

- Hospitals

- Clinics

- Ambulatory Surgery Centers

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)