Laboratory Filtration Market Size and Trends

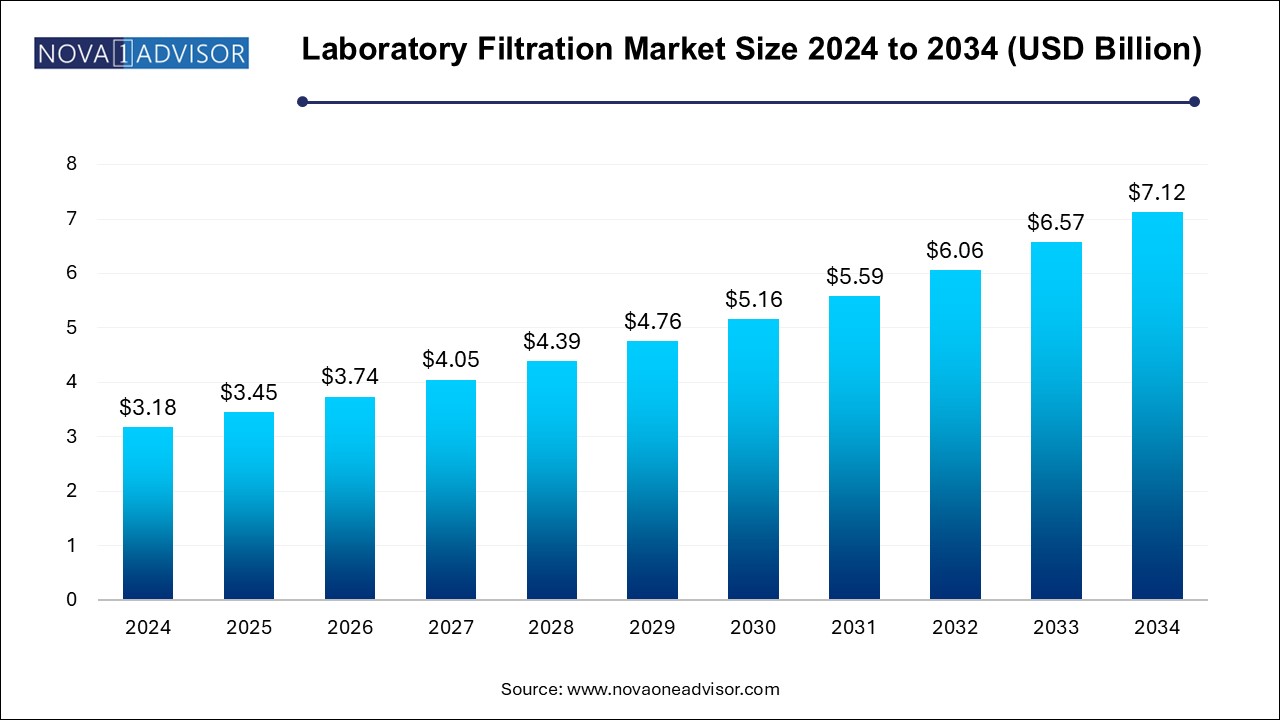

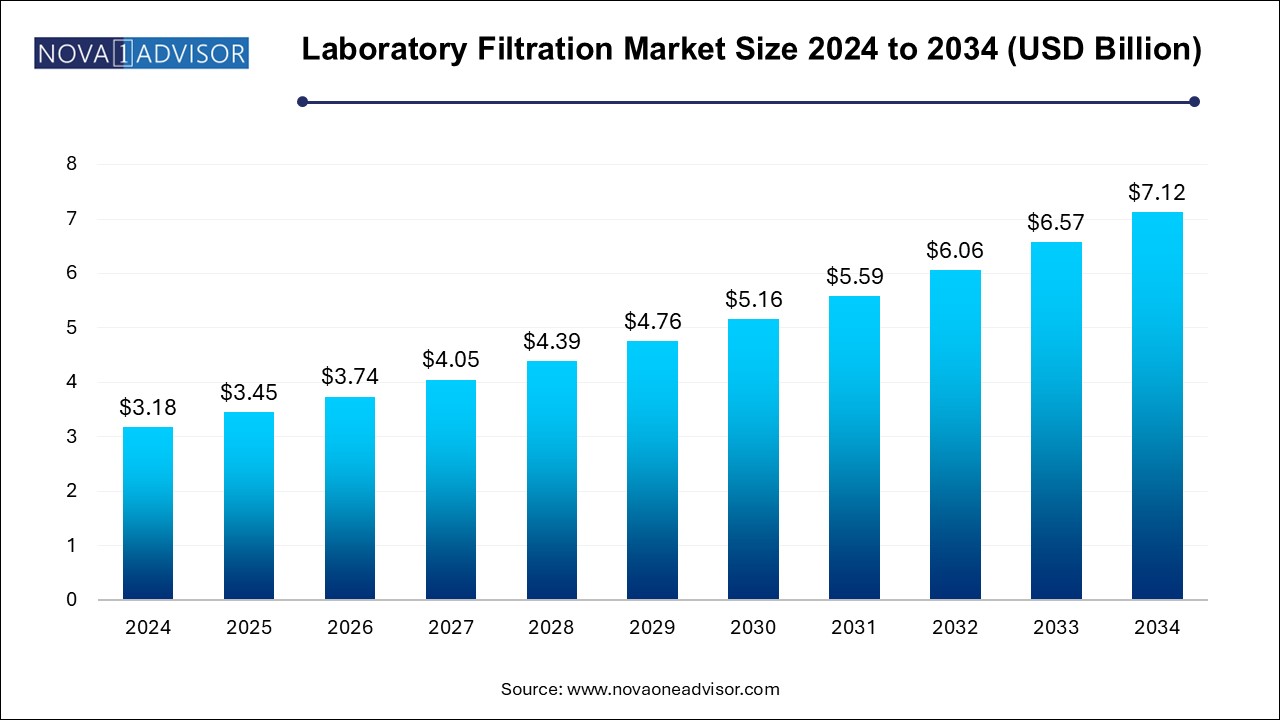

The laboratory filtration market size was exhibited at USD 3.18 billion in 2024 and is projected to hit around USD 7.12 billion by 2034, growing at a CAGR of 8.4% during the forecast period 2024 to 2034.

Market Overview

The laboratory filtration market plays a fundamental role in supporting scientific research, pharmaceutical manufacturing, biotechnology innovation, and clinical diagnostics. Filtration processes are essential in laboratories for the purification, separation, and concentration of biological, chemical, and analytical samples. Applications range from removing particulates from solvents, clarifying cell cultures, to separating biomolecules like proteins, DNA, and RNA.

Driven by the expansion of biopharmaceutical research, stringent quality control standards, and the rise of environmental and food testing labs, laboratory filtration technologies have seen considerable advancements. Modern laboratories increasingly demand high-throughput, high-purity filtration solutions that ensure accuracy, reproducibility, and safety across various protocols.

The field is characterized by a broad range of products, from basic filter papers and membrane filters to sophisticated ultrafiltration and reverse osmosis systems. Technological innovations are focusing on improving membrane porosity, chemical compatibility, and automation compatibility, while sustainability concerns are steering developments towards reusable and biodegradable filtration products.

The COVID-19 pandemic further highlighted the critical role of efficient filtration in diagnostic workflows, vaccine production, and pharmaceutical quality assurance, leading to a surge in investment in lab infrastructure globally. As scientific research and manufacturing processes become increasingly complex, the laboratory filtration market is poised for sustained and dynamic growth.

Major Trends in the Market

-

Miniaturization and Automation of Filtration Systems: Development of micro-scale, high-throughput filtration technologies integrated into automated workflows.

-

Expansion of Single-use and Disposable Filtration Products: Reducing cross-contamination and labor-intensive cleaning processes.

-

Growing Demand for Biocompatible and Chemically Resistant Membranes: Catering to increasingly sensitive biopharma and analytical applications.

-

Integration of Filtration with Analytical Systems: Smart filtration platforms directly linked to downstream analytics.

-

Focus on Sustainability: Introduction of eco-friendly, biodegradable filtration media and recyclable assemblies.

-

Rise of Customized Filtration Solutions: Tailored membranes and assemblies optimized for specific laboratory needs.

-

Increased Investment in Life Sciences and Biopharma R&D: Driving the need for precision filtration in sample preparation and purification.

-

Emergence of Advanced Nanofiltration Technologies: Offering enhanced selectivity for complex separations.

Report Scope of Laboratory Filtration Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 3.45 Billion |

| Market Size by 2034 |

USD 7.12 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 8.4% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Technology, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Merck Millipore; Sigma-Aldrich; GE Healthcare; Thermo Fisher Scientific; Sartorius Group; 3M Company; Cantel Medical Corporation; Macherey-Nagel Gmbh& Co. Kg. |

Key Market Driver: Growth in Biopharmaceutical and Biotechnology Industries

The most significant driver accelerating the laboratory filtration market is the rapid expansion of biopharmaceutical and biotechnology industries globally. Biologic drugs such as monoclonal antibodies, vaccines, and gene therapies require extremely high-purity environments during production and research phases.

Filtration is crucial for sterile filtration, protein concentration, virus clearance, and buffer preparation processes. As more companies invest in cell and gene therapies, personalized medicine, and large-scale vaccine manufacturing, the need for advanced, scalable, and reliable filtration systems grows proportionately.

For instance, the production of mRNA-based COVID-19 vaccines involved multiple filtration steps to purify lipid nanoparticles and nucleic acids. This demonstrated the indispensable nature of laboratory filtration technologies and has led to continued market growth even beyond the pandemic period.

Key Market Restraint: High Cost of Advanced Filtration Systems

Despite growing demand, the high cost of advanced laboratory filtration systems remains a key barrier, particularly for academic institutions, small research labs, and emerging markets.

Ultrafiltration and nanofiltration assemblies, especially those integrated with digital monitoring and automation systems, can be capital-intensive. Moreover, recurring costs associated with consumables like membrane replacements, cartridge filters, and system maintenance can burden budgets over time.

In regions with limited research funding or healthcare infrastructure, the adoption of high-end filtration technologies remains restricted, often confining them to premier research institutions and multinational pharma companies. Balancing technological innovation with cost-effectiveness remains a critical challenge for market players.

Key Market Opportunity: Rising Adoption of Laboratory Automation and Smart Filtration Systems

A major emerging opportunity in the market is the integration of laboratory filtration with smart, automated platforms. As laboratories strive to enhance reproducibility, minimize human error, and increase throughput, the demand for filtration systems that can seamlessly integrate with automated liquid handling and analytical devices is soaring.

Technologies enabling real-time monitoring of filtration parameters such as pressure, flow rate, membrane integrity, and contaminant levels are highly sought after. Smart filtration assemblies equipped with sensors, IoT connectivity, and data logging capabilities are becoming instrumental in regulatory compliance and process validation, particularly in cGMP environments.

Companies focusing on developing plug-and-play filtration modules compatible with next-generation lab automation systems will likely capture a significant share of this high-growth niche.

Laboratory Filtration Market By Product Insights

Filtration media dominate the product segment, comprising membranes, filter papers, syringe filters, and microplates used daily in sample preparation, solvent filtration, microbial removal, and particulate clearance. Membrane filters, including PVDF, PES, and cellulose-based membranes, remain core consumables across pharmaceutical, clinical, and environmental laboratories due to their critical role in achieving high-quality separations.

Filtration assemblies are growing fastest, propelled by rising adoption of integrated systems like vacuum filtration units, microfiltration and ultrafiltration assemblies. Laboratories increasingly favor modular, easy-to-operate assemblies that offer higher throughput, consistent performance, and compatibility with automation. Recent developments such as compact vacuum filtration stations for high-volume biologics processing have accelerated the growth of this segment.

Laboratory Filtration Market By Technology Insights

Microfiltration dominates the technology segment, reflecting its wide use in removing bacteria, particulate matter, and large biomolecules from solutions without significantly altering the sample composition. Microfiltration membranes are indispensable in general laboratory processes, sterile filtration of culture media, and clarification of cell lysates.

Nanofiltration is expanding rapidly, offering finer separations of small molecules, organic contaminants, and solvents. With increased focus on protein fractionation, viral clearance, and bioburden reduction in biopharma manufacturing, nanofiltration membranes featuring molecular weight cut-offs between ultrafiltration and reverse osmosis are gaining significant traction.

Laboratory Filtration Market By Regional Insights

North America is the leading market for laboratory filtration, driven by its concentration of pharmaceutical companies, advanced academic research institutions, and a highly developed healthcare infrastructure.

The United States, in particular, has been at the forefront of adopting cutting-edge laboratory filtration solutions, supported by substantial investments in drug discovery, biotechnology innovation, and life sciences research. Regulatory standards from agencies like the FDA enforce stringent filtration protocols, further boosting market demand.

The presence of major filtration technology companies such as Pall Corporation, Merck Millipore, and Thermo Fisher Scientific, combined with a robust culture of innovation, ensures North America’s continued dominance.

Asia-Pacific is the fastest-growing region, propelled by rapid economic development, expanding biopharma manufacturing hubs, rising healthcare expenditures, and government support for research initiatives.

Countries like China, India, South Korea, and Japan are aggressively investing in building research and manufacturing capabilities in biologics, vaccines, and environmental testing, fueling the need for advanced laboratory filtration products. The establishment of global R&D centers by multinational pharma companies in Asia-Pacific further accelerates regional demand.

Moreover, initiatives like “Made in China 2025” and “Atmanirbhar Bharat” in India, aimed at strengthening domestic biotech and pharma industries, provide strong momentum for laboratory equipment markets, including filtration technologies.

Some of the prominent players in the laboratory filtration market include:

For instance, GE Healthcare has developed quartz filters such as Whatman QM_B quartz, microfiber filters, Whatman QM-A quartz MF, and Whatman QM-H, which are used for filtering air samples.

Laboratory Filtration Market Recent Developments

-

March 2025: Pall Corporation launched a new line of automated vacuum filtration systems integrated with IoT-based monitoring, targeting high-throughput biopharmaceutical research labs.

-

February 2025: Merck KGaA introduced its EcoQube™ sustainable filtration microplates, promoting reduced plastic usage and environmentally friendly lab practices.

-

January 2025: Sartorius expanded its range of single-use ultrafiltration devices with the introduction of FlexFiltration™ technology, enhancing scalability for both clinical and research applications.

-

December 2024: Thermo Fisher Scientific announced the acquisition of a startup specializing in nanofiltration membranes for cell and gene therapy applications.

-

November 2024: Danaher Corporation's Pall Biotech division unveiled an advanced disposable capsule filtration system tailored for continuous bioprocessing applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the laboratory filtration market

By Product

-

- Membrane Filters

- Filter Paper

-

-

- Quartz Filter

- Cellulose Filter Papers

- Glass Microfiber Filter Papers

-

- Syringe Filters

- Syringeless Filters

- Capsule Filters

- Filtration Microplates

- Other Filtration Media

- Filtration Assemblies

- Ultrafiltration Assemblies

-

- Microfiltration Assemblies

- Vacuum Filtration Assemblies

- Reverse Osmosis Assemblies

- Other Filtration Assemblies

-

- Filter Holders

- Filter Dispensers

- Filter Flasks

- Cartridge Filters

- Filter Funnels

- Filter Housings

- Seals

- Vacuum Pumps

- Other Laboratory Filtration Accessories

By Technology

- Microfiltration

- Nanofiltration

- Vacuum Filtration

- Ultrafiltration

- Reverse Osmosis

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)