Lancets Market Size and Trends

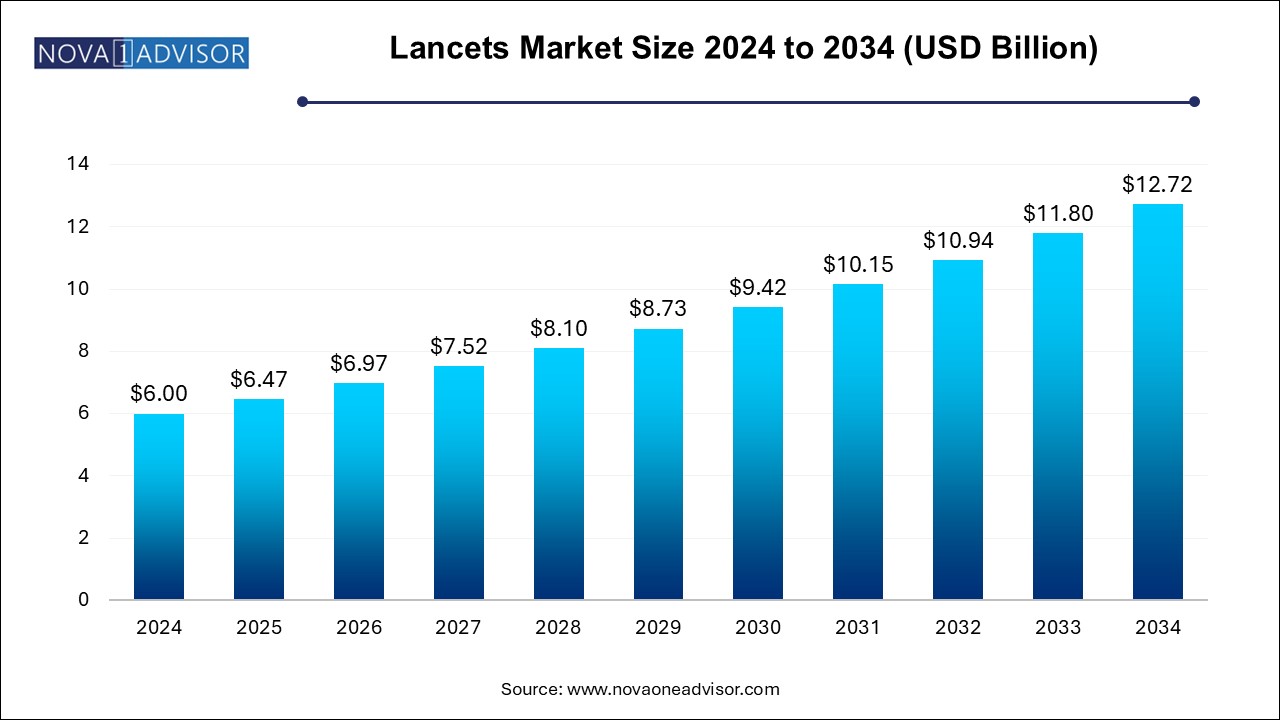

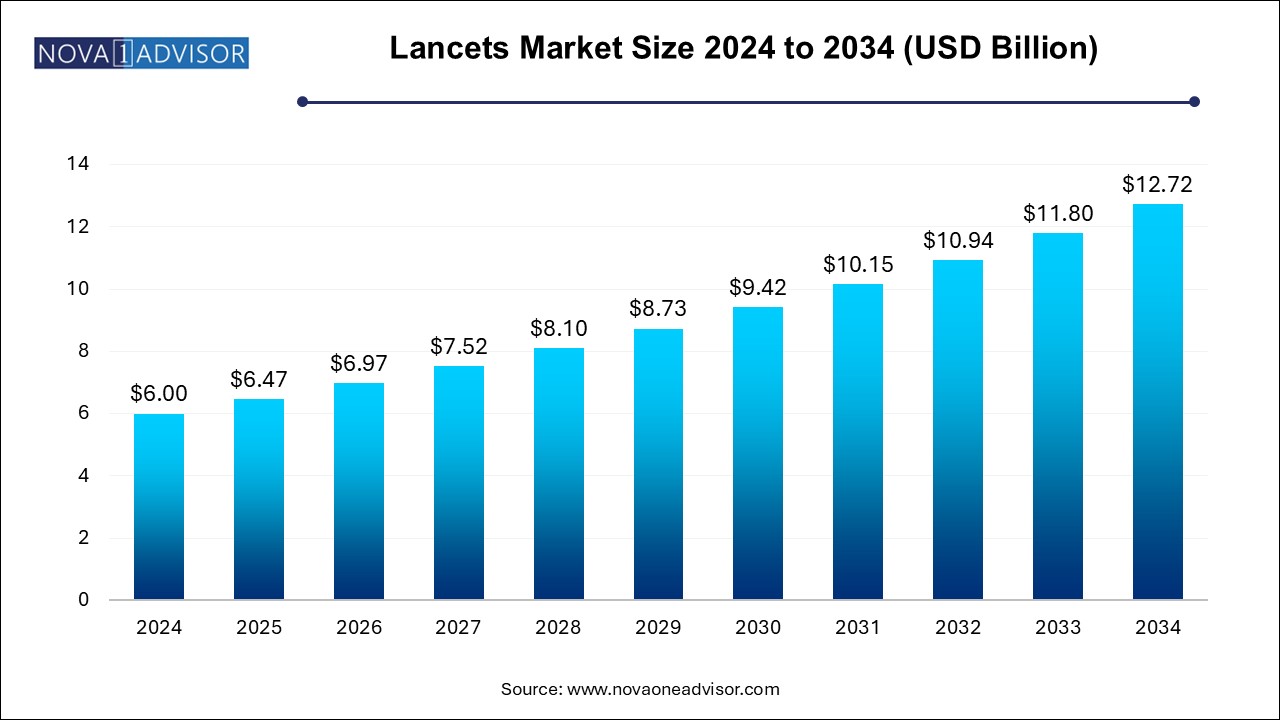

The lancets market size was exhibited at USD 6.00 billion in 2024 and is projected to hit around USD 12.72 billion by 2034, growing at a CAGR of 7.8% during the forecast period 2024 to 2034.

Lancets Market Key Takeaways:

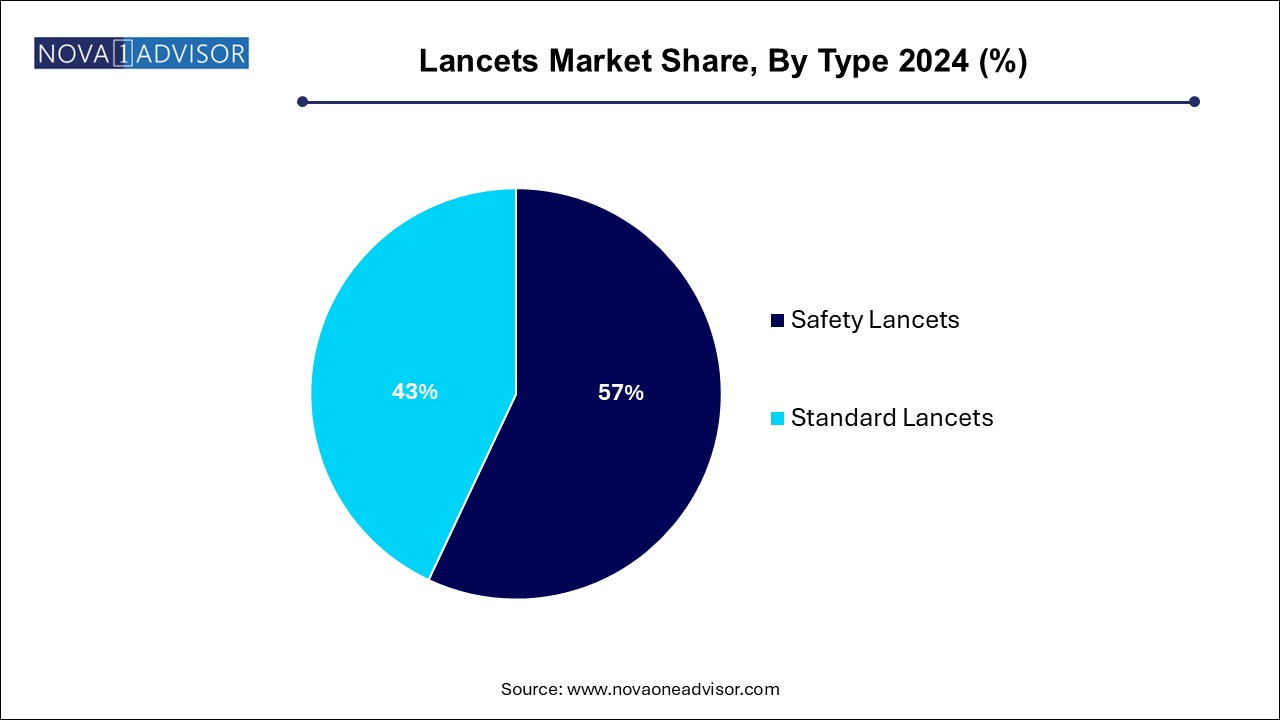

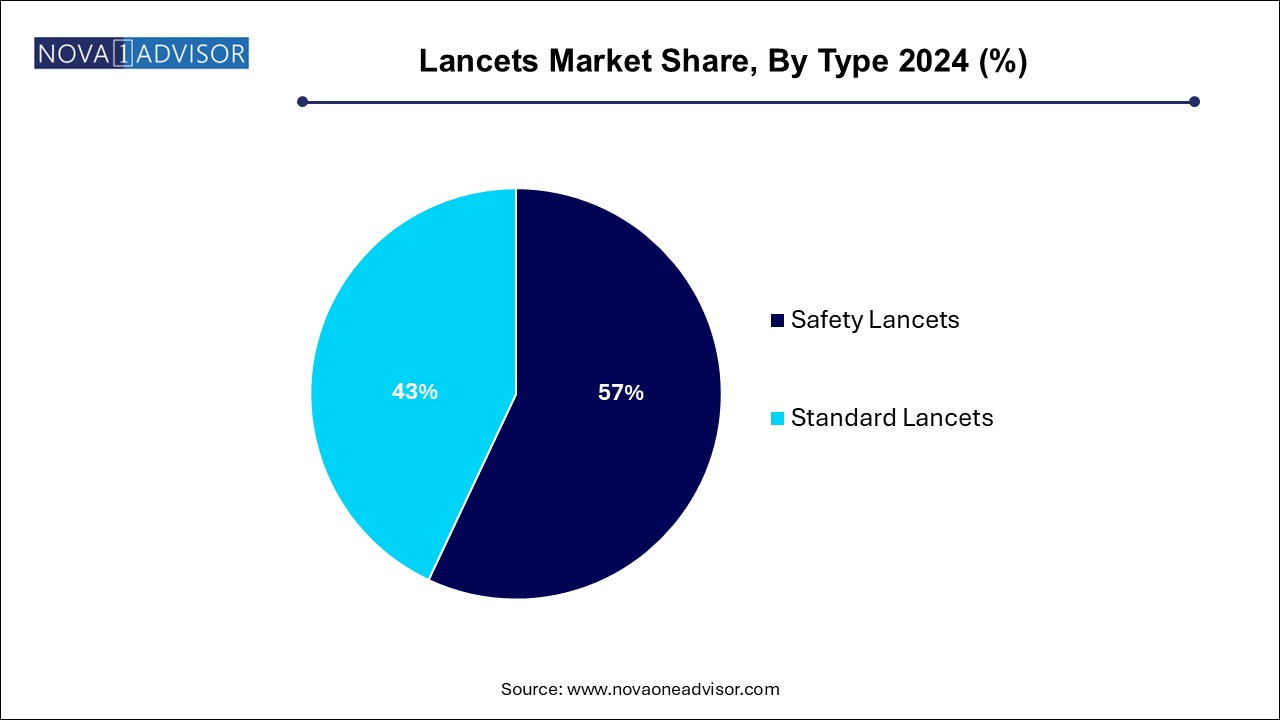

- Safety lancets accounted for the largest share of 57.0% in 2024

- The standard lancets segment is expected to grow at the fastest CAGR of 8.4% over the forecast period.

- The blood glucose testing segment accounted for the largest market share of 41.1% in 2024.

- The hemoglobin testing segment is expected to register the fastest CAGR of 8.1% over the forecast period from 2025 to 2030.

- The hospitals and clinics segment dominated the market in 2024.

- The homecare settings segment is projected to grow at the fastest CAGR over the forecast period.

- North American lancets market accounted for the largest market revenue share of 36.4% in 2024

Market Overview

Lancets are critical components in the global diagnostic and patient-monitoring ecosystem, particularly valued for their role in minimally invasive capillary blood sampling. These tiny, sharp-pointed instruments, often used in conjunction with lancing devices, are instrumental in testing for conditions such as diabetes, anemia, cholesterol levels, and various infectious diseases. The global lancets market has been experiencing steady growth due to the escalating demand for diagnostic and self-monitoring devices driven by a surge in chronic diseases, increasing elderly population, and expanding point-of-care (POC) testing capabilities.

With the exponential increase in diabetes prevalence globally—especially Type 2 diabetes—there has been a parallel rise in the frequency of blood glucose testing. Patients increasingly depend on user-friendly, painless lancet systems that offer convenience and safety, particularly in homecare environments. This has prompted manufacturers to develop advanced safety lancets and adopt ergonomic designs. Simultaneously, governments and health organizations are promoting early diagnostics and routine health checkups, further propelling the lancets market forward.

Moreover, COVID-19 underscored the importance of decentralized diagnostic tools, increasing the acceptance of home-based sample collection, where lancets serve as a primary tool for quick blood samples. The growing adoption of wearable health monitoring systems, integration of lancets in compact diagnostic kits, and increasing health literacy among consumers are shaping the market's evolving dynamics.

Major Trends in the Market

-

Rising Adoption of Safety Lancets: To reduce the risk of cross-contamination and accidental needle-stick injuries, there is a notable shift towards safety-engineered lancets in hospitals, clinics, and home-use devices.

-

Proliferation of Home Diagnostics: Growing consumer preference for self-care and home testing is driving demand for lancets that are easy-to-use and offer minimal discomfort.

-

Integration with Digital Health Platforms: Smart lancets that connect to mobile apps for real-time health data tracking are emerging, enhancing patient compliance and remote monitoring.

-

Customized Lancet Designs: Companies are increasingly offering lancets with variable penetration depths and ergonomic grips tailored to user age, skin thickness, or testing frequency.

-

Eco-Friendly and Biodegradable Lancets: There is a growing push towards sustainable materials, especially for single-use lancets to minimize medical waste in high-volume testing environments.

-

Expansion in Emerging Economies: Asia Pacific, Latin America, and Africa are becoming significant focus regions due to expanding healthcare access, government screening programs, and awareness campaigns.

Report Scope of Lancets Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 6.47 Billion |

| Market Size by 2034 |

USD 12.72 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 7.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Application, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

BD; Roche Diagnostics; Medline Industries, LP.; MTD Medical Technology and Devices; B. Braun SE; Terumo Medical Corporation; Owen Mumford; Arkray; AgaMatrix; Nipro Europe Group Companies. |

Market Driver: Rising Incidence of Diabetes

A primary factor accelerating growth in the lancets market is the global rise in diabetes prevalence. According to the International Diabetes Federation, over 537 million adults were living with diabetes as of 2021, and this number is expected to increase significantly by 2045. Diabetes management requires regular blood glucose monitoring, often multiple times daily. Lancets, being an essential tool for capillary blood collection, are therefore indispensable.

Technological advancements have also improved user experience. Modern safety lancets, such as those with spring-loaded mechanisms and ultra-thin needles, minimize pain and eliminate reuse risks. Further, the increased affordability of home testing kits and growing awareness have encouraged even pre-diabetic individuals to opt for regular testing. Collectively, these trends create a sustained and expanding demand for lancets across both developed and developing regions.

Market Restraint: Needle Phobia and Pain Aversion

Despite their importance in diagnostics, lancets face a psychological barrier: needle phobia. Many individuals, especially children and the elderly, exhibit an aversion to pricking themselves with needles, even if the lancets are designed to minimize discomfort. This can deter consistent monitoring, especially for chronic conditions requiring frequent testing like diabetes or coagulation disorders.

Additionally, concerns over improper use, disposal challenges, and risks of infection in unsupervised settings such as rural homecare can limit market penetration. Educational efforts, community outreach, and the development of virtually painless lancet technologies will be critical to overcoming these restraints.

Market Opportunity: Integration into Point-of-Care and Remote Health Systems

An immense opportunity lies in integrating lancets into point-of-care (POC) and remote healthcare systems. As healthcare moves closer to patients through mobile health vans, telemedicine platforms, and decentralized diagnostics, compact and safe sampling devices like lancets become crucial components.

For instance, remote diabetes monitoring systems often pair blood glucose meters with lancet devices that transmit data to health apps or cloud-based records. Governments in developing economies are rolling out community-based screening initiatives for anemia, infectious diseases, and chronic illnesses, where health workers rely heavily on disposable lancets. The synergy between portable diagnostics and lancet usability presents a growth avenue that is not yet fully tapped but rapidly gaining momentum.

Lancets Market By Type Insights

Safety lancets dominated the global lancet market owing to their superior features that minimize accidental pricks and ensure user safety. Healthcare institutions, particularly in developed economies like the U.S., Germany, and Japan, prefer safety lancets to comply with stringent regulations related to infection control and occupational safety. These lancets come with pre-loaded needles that automatically retract after use, eliminating the risk of reuse and cross-contamination. Their integration into pediatric care and use in remote blood testing also boost demand. Additionally, hospitals seeking to reduce liability from needle-stick injuries are significantly switching to safety lancet adoption.

Conversely, standard lancets are projected to register the fastest growth, particularly in cost-sensitive markets. In countries across Asia Pacific and Africa, standard lancets are used extensively due to their affordability and availability. Community health programs, which require bulk testing tools with minimal overhead, frequently opt for standard lancets, especially in large-scale campaigns for anemia and infectious diseases. Although these lancets pose higher reuse risks, their low price point and easy compatibility with various lancing devices ensure their continued demand.

Lancets Market By Application Insights

Blood glucose testing remains the dominant application segment, reflecting the burden of diabetes globally. Patients with Type 1 and Type 2 diabetes routinely use lancets to monitor their sugar levels at home and during clinical visits. Innovations like automatic depth adjustment and painless designs in glucose monitoring kits have reinforced this segment's supremacy. Blood glucose testing kits incorporating lancets are now widely available over-the-counter and through government health programs, making them the primary revenue driver.

On the other hand, infectious disease testing is anticipated to grow rapidly due to the expansion of decentralized diagnostics in low-resource settings. During COVID-19, blood-based antibody and antigen testing increased awareness about capillary sampling. Post-pandemic, similar methodologies are being applied to screen for diseases such as HIV, malaria, and hepatitis. Mobile testing labs and rapid diagnostics in rural settings are pushing demand for lancets suited for single-use blood sampling—especially in portable kits used by NGOs and government health missions.

Lancets Market By End-use Insights

Hospitals and clinics dominate the end-use segment due to their high daily patient volumes, especially in tertiary care centers and outpatient diagnostics. These institutions often handle a variety of testing requirements ranging from cholesterol and hemoglobin testing to coagulation and infectious disease screenings where lancets are used intensively. Safety concerns, staff training, and adherence to health protocols have made hospitals prefer premium, retractable lancets. Moreover, bulk procurement in hospitals creates consistent demand and strong vendor relationships, ensuring the institutional sector remains the top consumer.

Homecare settings, however, represent the fastest growing end-use segment. Increasing health awareness, rising chronic disease burden, and the aging global population have led to a surge in self-monitoring devices. Consumers now seek easy-to-use, low-pain lancets for routine testing at home. The growth of e-commerce has made these products more accessible, while healthcare providers and pharmacists often recommend specific lancet brands for homecare kits. Furthermore, regulatory approvals for home-based diagnostic tools are expanding, opening up substantial new revenue streams in this segment.

Lancets Market By Regional Insights

North America leads the global lancets market in terms of revenue share. This dominance is attributed to advanced healthcare infrastructure, high awareness of chronic diseases, and widespread adoption of self-monitoring practices. The U.S., in particular, has a high diabetic population who rely on home-use lancets for daily glucose monitoring. Moreover, strict occupational safety regulations enforce the use of safety lancets in healthcare facilities. Technological innovation, reimbursement support, and robust distribution networks further cement North America’s position as the market leader.

Asia Pacific is the fastest growing regional market, driven by rapid urbanization, rising healthcare expenditure, and increasing prevalence of lifestyle diseases like diabetes and cardiovascular conditions. Countries like India and China are witnessing massive healthcare infrastructure development and an influx of affordable diagnostic tools. Public health initiatives aimed at anemia detection, maternal health, and infectious disease control use lancets in large volumes. Additionally, domestic manufacturers are emerging in the region, offering competitively priced products, which is spurring local adoption.

Some of the prominent players in the lancets market include:

- BD

- Roche Diagnostics

- Medline Industries, LP.

- EQT AB

- MTD Medical Technology and Devices

- B. Braun SE

- Terumo Medical Corporation

- Owen Mumford

- Arkray

- AgaMatrix

- Nipro Europe Group Companies.

Recent Developments

-

March 2025: Roche Diagnostics launched a new generation of safety lancets designed for high-throughput blood collection in clinical labs. These devices are compatible with Roche’s latest point-of-care testing kits, targeting hospital procurement channels.

-

January 2025: Abbott Laboratories expanded its FreeStyle range with enhanced ergonomic lancets integrated with smartphone-based health tracking. This marks an effort to provide a more unified digital experience for diabetic users.

-

November 2024: BD (Becton, Dickinson and Company) announced the development of eco-friendly lancets using biodegradable materials. The initiative supports the company’s broader sustainability goals and aims to reduce medical plastic waste.

-

September 2024: Terumo Corporation received regulatory approval in Japan for a new line of ultra-thin lancets tailored for geriatric and pediatric care, combining minimal invasiveness with safety.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the lancets market

Type

- Safety Lancets

- Standard Lancets

Application

- Blood Glucose Testing

- Hemoglobin Testing

- Cholesterol Testing

- Coagulation Testing

- Infectious Disease Testing

- Others

End-use

- Hospitals and Clinics

- Homecare Settings

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)