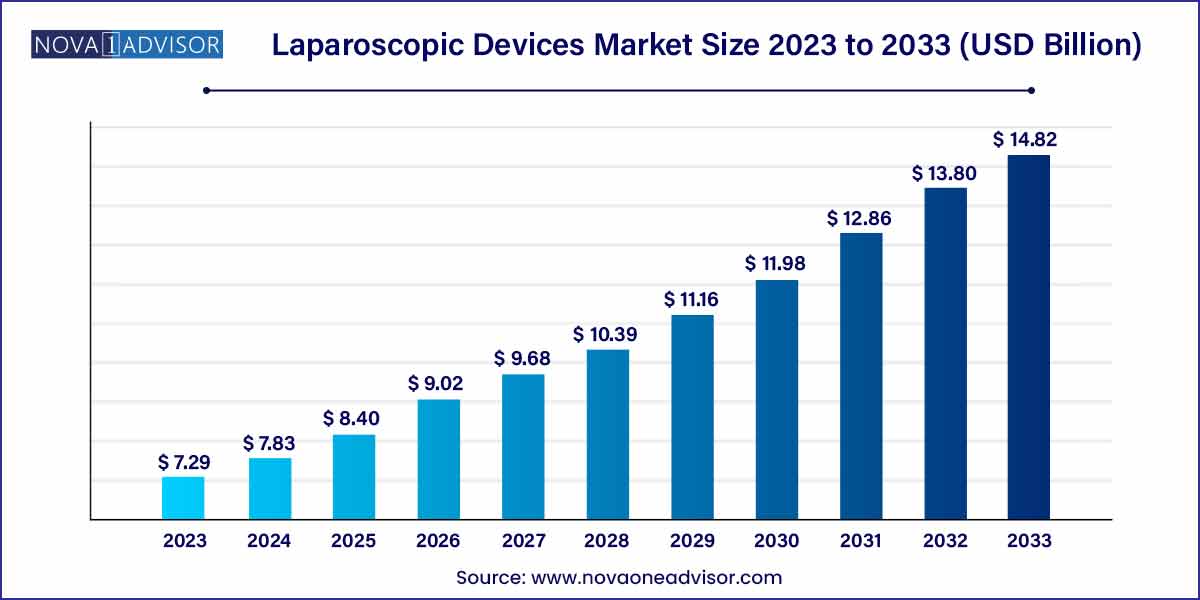

The global laparoscopic devices market size was estimated at USD 7.29 billion in 2023 and is expected to surpass around USD 14.82 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 7.35% during the forecast period 2024 to 2033.

Key Takeaways:

- The energy systems segment dominated the market for laparoscopic devices and captured the largest revenue share of around 21.1% in 2023.

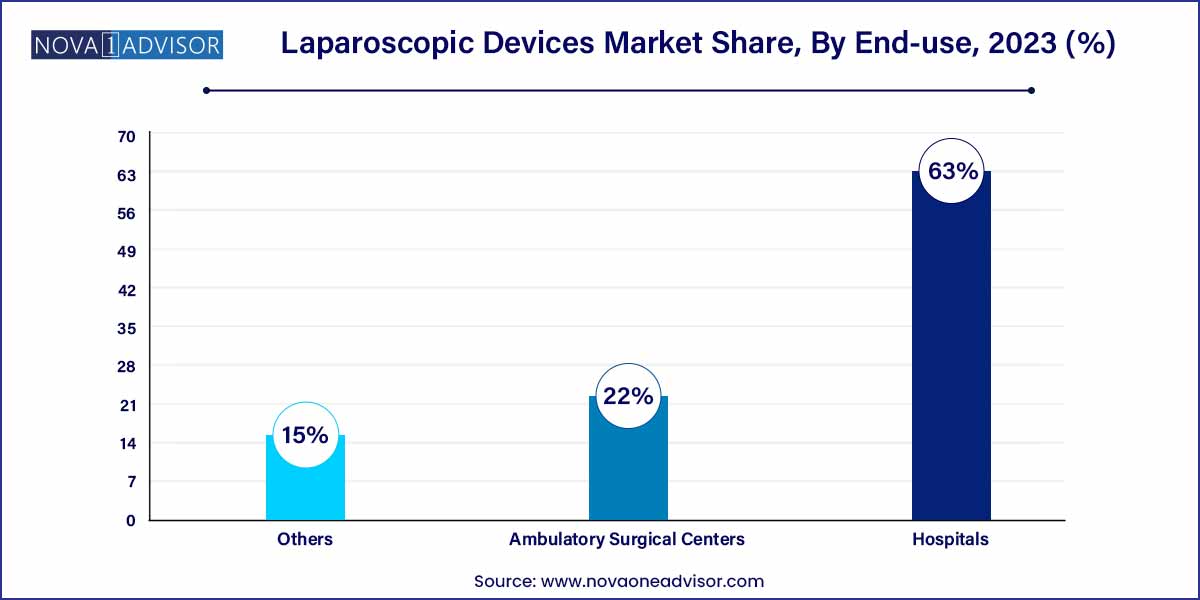

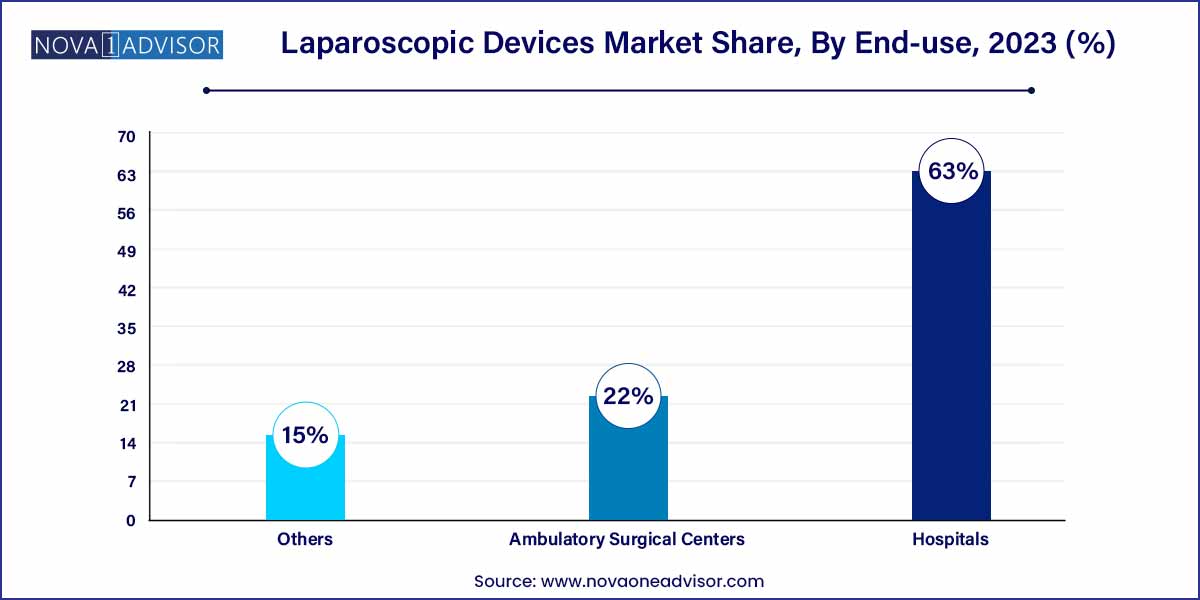

- The hospital segment dominated the market for laparoscopic devices and accounted for the largest revenue share of 63.0% in 2023.

- The other surgeries segment dominated the market for laparoscopic devices and accounted for a revenue share of around 22.5% in 2023.

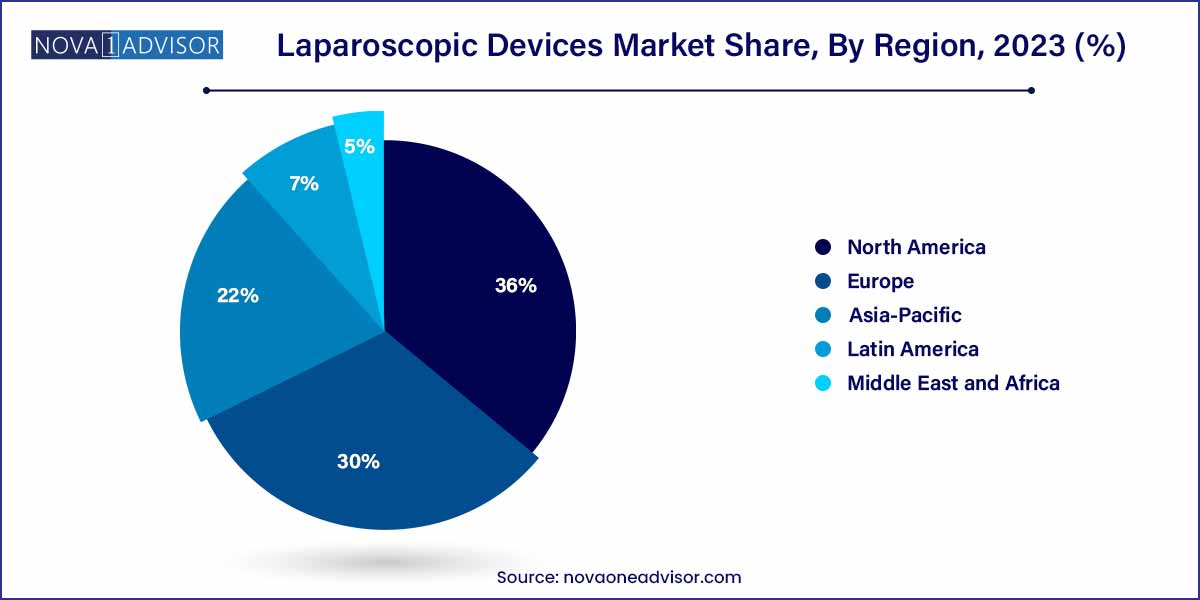

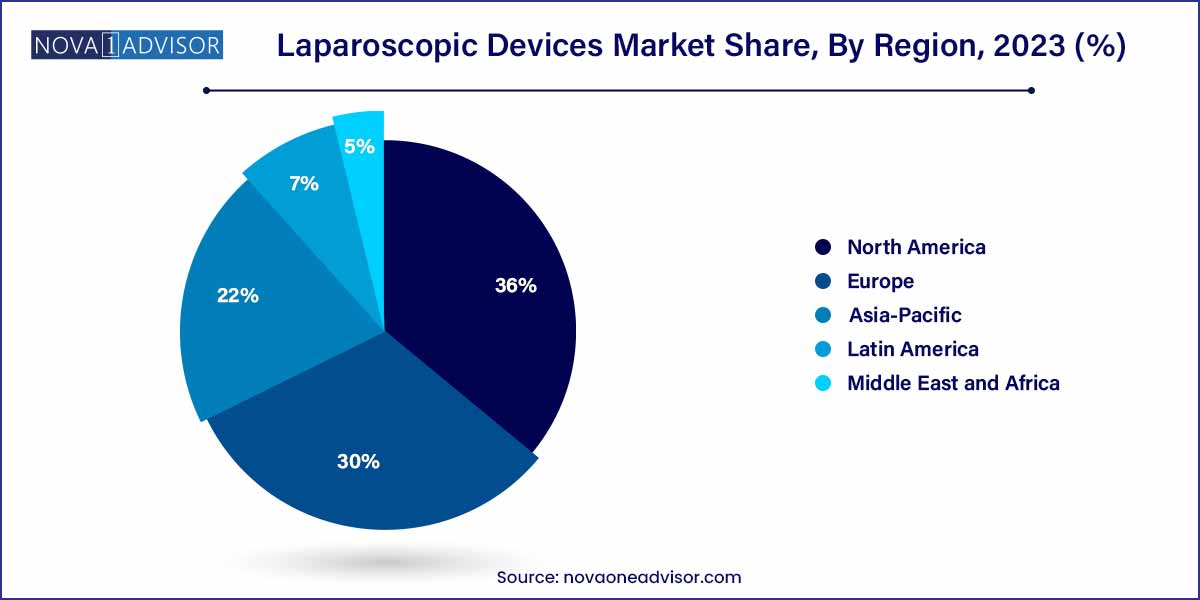

- North America dominated the laparoscopic devices market and accounted for the highest revenue share of 36.0% in 2023.

Market Overview

The global Laparoscopic Devices Market is undergoing dynamic expansion, propelled by the growing preference for minimally invasive surgeries (MIS) across various medical specialties. Laparoscopic devices, which include a broad range of instruments such as laparoscopes, trocars, energy systems, insufflation devices, and robot-assisted systems, have revolutionized modern surgical techniques by offering less pain, shorter hospital stays, and faster recovery compared to open surgeries.

Technological innovations, an aging population prone to chronic diseases, increasing bariatric procedures due to rising obesity rates, and the continual demand for cosmetic and gynecological surgeries are contributing to the vibrant growth of the laparoscopic devices market. Furthermore, the integration of advanced imaging technologies, robotic assistance, and ergonomic instrument designs are setting new standards for surgical precision and patient outcomes.

Healthcare providers worldwide are increasingly investing in laparoscopic infrastructure, and patient awareness regarding the benefits of minimally invasive surgery is rising. Despite challenges such as high equipment costs and technical complexities, the laparoscopic devices market is poised for sustained growth over the coming decade.

Major Trends in the Market

-

Growing Adoption of Robotic-assisted Laparoscopic Surgery: Robotic systems are enhancing precision, dexterity, and visualization during procedures.

-

Technological Advances in Energy Systems: Development of advanced bipolar, ultrasonic, and hybrid energy devices is improving surgical efficiency.

-

Miniaturization and Portability of Devices: Smaller, lightweight instruments are facilitating greater surgical precision and ease of use.

-

Rise in Bariatric and Metabolic Surgeries: Laparoscopic sleeve gastrectomy and gastric bypass are increasingly performed using laparoscopic techniques.

-

Single-incision and Natural Orifice Transluminal Endoscopic Surgery (NOTES): Emerging trends focusing on reducing surgical trauma and visible scarring.

-

Integration of 4K and 3D Imaging Technologies: Enhanced visualization tools are aiding complex laparoscopic procedures.

-

Expansion in Ambulatory Surgical Centers (ASCs): Shift toward outpatient settings for laparoscopic surgeries is gaining traction.

-

Increased Training and Simulation Programs: Surgeons are receiving advanced laparoscopic skills training through virtual simulators and cadaver labs.

Laparoscopic Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 7.29 Billion |

| Market Size by 2033 |

USD 14.82 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.35% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, End-User, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic; Stryker Corporation; Karl Storz SE & CO. Kg; Johnson and Johnson; Olympus Corporation; CONMED Corporation; B. Braun Melsungen AG; The Cooper Companies Inc.; Richard Wolf GmbH; Microline Surgical; BD; Welfare Medical Ltd.; DEAM, Intuitive Surgical; Shenzen Mindray Bio Medical Electronics Co., Ltd. |

Driver: Rising Demand for Minimally Invasive Procedures

A key driver of the laparoscopic devices market is the rising global demand for minimally invasive surgeries. Patients and healthcare providers alike prefer minimally invasive techniques due to reduced postoperative pain, shorter hospital stays, faster recovery times, lower risk of infection, and minimized scarring.

Conditions such as obesity, uterine fibroids, gallstones, and hernias are increasingly being managed through laparoscopic approaches. As surgical techniques become more sophisticated and outcomes more favorable, the adoption of laparoscopic surgery is expanding across general surgery, gynecology, urology, and bariatrics, reinforcing market growth.

Restraint: High Cost of Laparoscopic Equipment and Training

Despite numerous advantages, the high cost of laparoscopic devices and associated systems remains a significant barrier to widespread adoption, particularly in low- and middle-income countries. Robot-assisted laparoscopic platforms, advanced imaging devices, and specialized energy systems entail substantial capital investment.

Additionally, laparoscopic surgery has a steep learning curve, necessitating extensive surgeon training and simulation-based education, which further adds to costs. Smaller hospitals and clinics often struggle to justify these expenses, limiting their ability to adopt advanced laparoscopic technologies.

Opportunity: Surge in Robotic-assisted and AI-integrated Laparoscopic Systems

An exciting opportunity lies in the surge of robotic-assisted laparoscopic surgery combined with artificial intelligence (AI) integration. Robotic platforms offer enhanced visualization, articulation, and precision, enabling complex surgeries that would otherwise be difficult with traditional laparoscopic instruments.

AI algorithms are also being incorporated for surgical planning, intraoperative guidance, and postoperative analysis, significantly improving patient outcomes. The ongoing miniaturization of robotic systems and their gradual reduction in cost could democratize access, opening vast growth opportunities across both developed and emerging markets.

Product Insights

Laparoscopes dominated the laparoscopic devices market in 2024. As the primary tool enabling minimally invasive visualization of internal organs, laparoscopes are indispensable across all laparoscopic procedures. The demand for high-definition (HD), 3D, and 4K laparoscopes is surging, as they offer surgeons improved depth perception and spatial orientation. Major manufacturers are consistently innovating in terms of imaging quality, flexibility, and ergonomic design, further entrenching laparoscopes' market leadership.

Conversely, Robot-assisted systems are expected to experience the fastest growth during the forecast period. With the increasing acceptance of robotic surgery platforms such as da Vinci Surgical Systems and emerging compact robotic solutions, the precision, scalability, and versatility offered by robotic assistance are expanding rapidly. Robotic platforms are becoming integral, especially in complex urological, gynecological, and colorectal surgeries.

End-user Insights

Hospitals dominated the market by end-use in 2023. Large hospitals have the necessary infrastructure, skilled personnel, and financial resources to invest in state-of-the-art laparoscopic devices, robotic systems, and integrated operating rooms.

However, Ambulatory Surgical Centers (ASCs) are projected to grow at the fastest pace. ASCs offer cost-effective, efficient outpatient surgical options, and laparoscopic procedures fit perfectly into their minimally invasive, fast-recovery model. The growing trend toward same-day discharge and healthcare cost containment is encouraging the migration of laparoscopic surgeries to ASCs.

Application Insights

General surgery accounted for the largest share of the laparoscopic devices market in 2023. Laparoscopic appendectomies, cholecystectomies, hernia repairs, and gastrointestinal surgeries have become the standard of care in many health systems due to their proven clinical benefits.

Meanwhile, bariatric surgery is anticipated to register the fastest growth. Rising obesity rates globally, coupled with the effectiveness of laparoscopic gastric bypass and sleeve gastrectomy procedures, are fueling this segment. Governments and insurers increasingly support bariatric surgeries as a solution to combat obesity-related comorbidities, further stimulating demand.

Regional Insights

North America held the largest share of the laparoscopic devices market in 2023. High adoption of advanced technologies, favorable reimbursement structures, growing preference for minimally invasive surgeries, and strong presence of leading medical device companies like Medtronic, Johnson & Johnson (Ethicon), and Stryker are key factors contributing to regional dominance.

The United States, in particular, is at the forefront of robotic surgery adoption and laparoscopic innovations, with continuous investments in healthcare infrastructure and research.

Asia-Pacific is forecasted to be the fastest-growing region over the next decade. Rapidly improving healthcare infrastructure, increasing healthcare expenditure, growing medical tourism, and rising patient awareness are major growth drivers.

Countries such as China, India, Japan, and South Korea are witnessing a surge in laparoscopic procedures, driven by both government initiatives and private sector investments. Furthermore, the affordability of laparoscopic surgeries compared to traditional methods is making them more attractive across emerging economies.

Some of the prominent players in the Laparoscopic devices market include:

- Karl Storz SE & CO. Kg

- Medtronic

- Johnson and Johnson

- Olympus Corporation

- CONMED Corporation

- B. Braun Melsungen AG

- The Cooper Companies Inc.

- Richard Wolf GmbH

- Microline Surgical

- BD

- Welfare Medical Ltd

- DEAM

- Intuitive Surgical

- Shenzen Mindray Bio Medical Electronics Co., Ltd

Recent Developments

-

March 2025: Medtronic launched the Hugo™ Robotic-Assisted Surgery (RAS) system in select Asia-Pacific markets, aiming to make robotic laparoscopic surgery more accessible.

-

January 2025: Intuitive Surgical unveiled its latest da Vinci Single-Port (SP) system advancements, enhancing access to urologic and transoral surgeries.

-

December 2024: Olympus Corporation introduced the Visera Elite III surgical visualization platform, combining 4K/3D imaging for improved laparoscopic surgery performance.

-

November 2024: Stryker acquired OrthoSensor, a leader in sensor technology for smart laparoscopic instruments, aiming to integrate real-time data analytics into surgical workflows.

-

September 2024: Johnson & Johnson's Ethicon unit announced FDA clearance for its new ENSEAL X1 Curved Jaw Tissue Sealer, offering advanced energy solutions for laparoscopic surgeries.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global laparoscopic devices market.

Product

- Laparoscopes

- Energy Systems

- Trocars

- Closure Devices

- Suction/ Irrigation Device

- Insufflation Device

- Robot Assisted Systems

- Hand Access Instruments

Application

- Bariatric Surgery

- Urological Surgery

- Gynecological Surgery

- General Surgery

- Colorectal Surgery

- Other Surgeries

End-user

- Hospital

- Clinic

- Ambulatory

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)