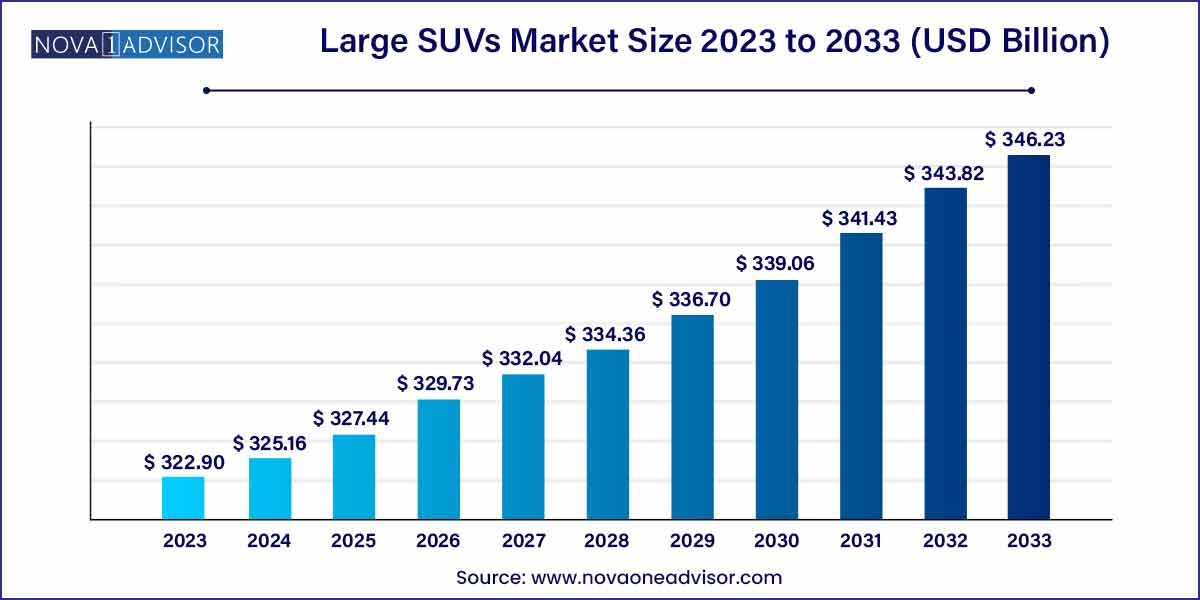

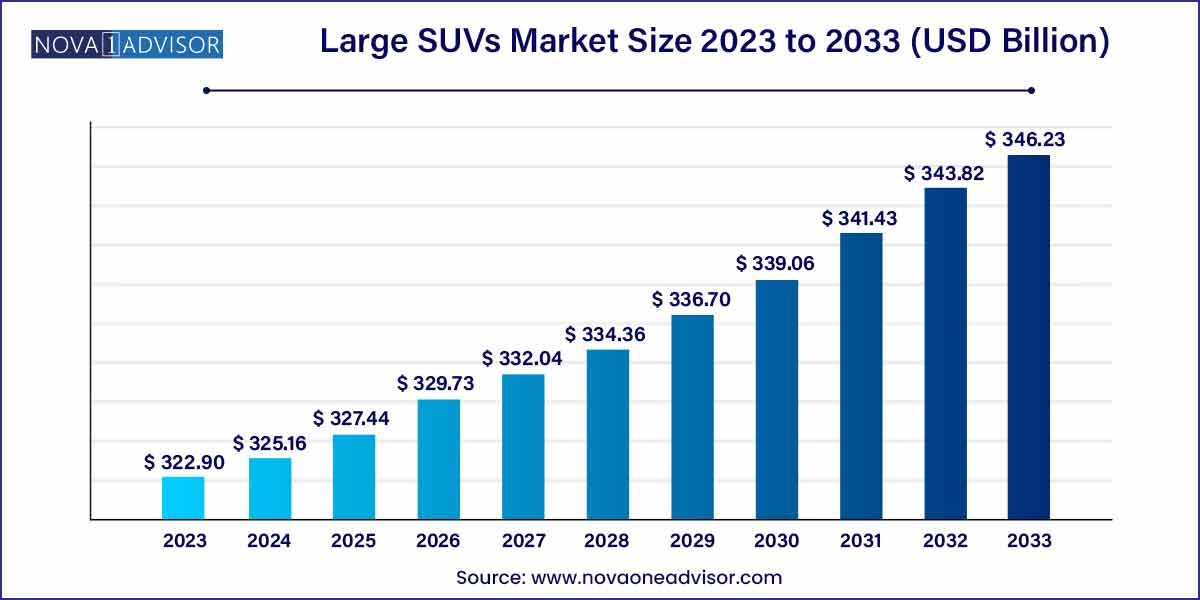

The global large SUVs market size was exhibited at USD 322.90 billion in 2023 and is projected to hit around USD 346.23 billion by 2033, growing at a CAGR of 0.7% during the forecast period of 2024 to 2033.

Key Takeaways:

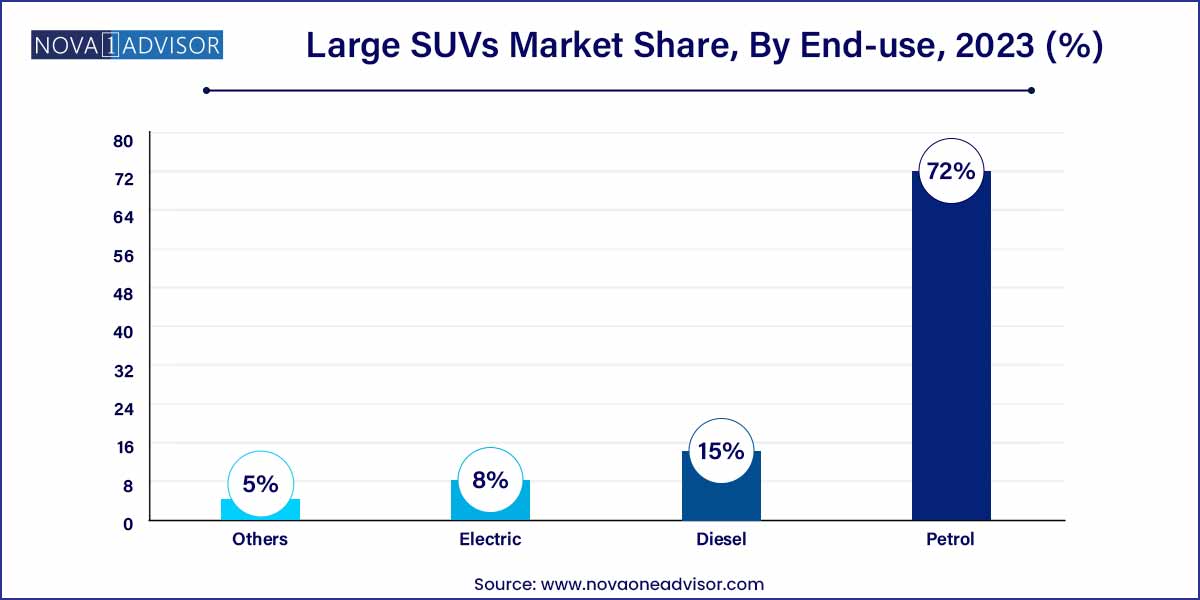

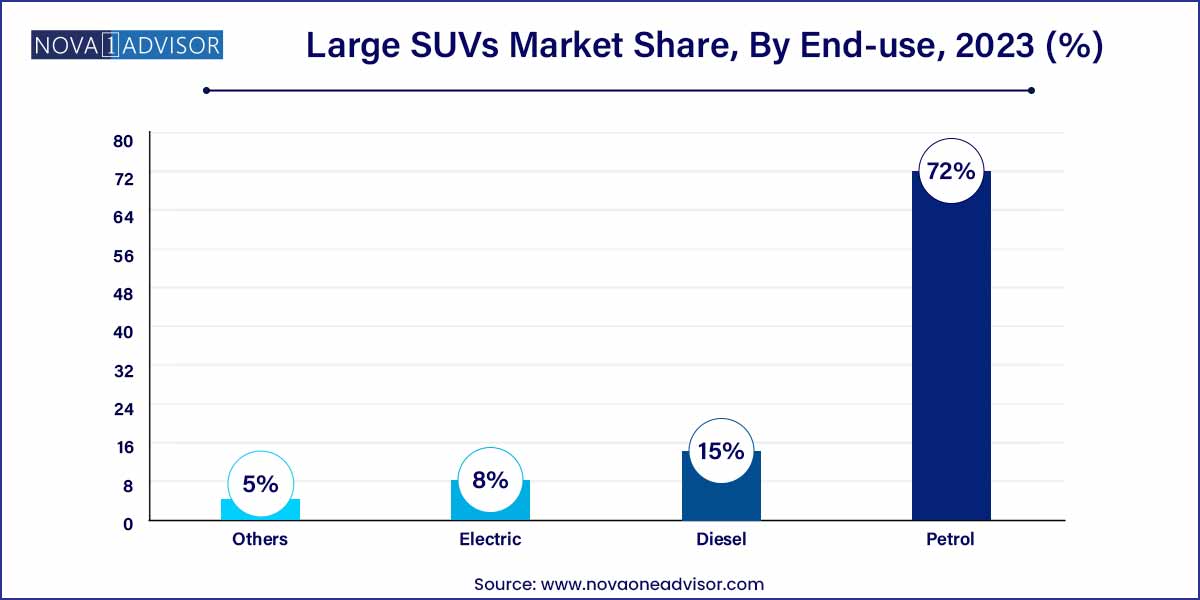

- By fuel type segmentation, the petrol segment dominated the global large SUVs market, registering a market share of around 72% in 2023.

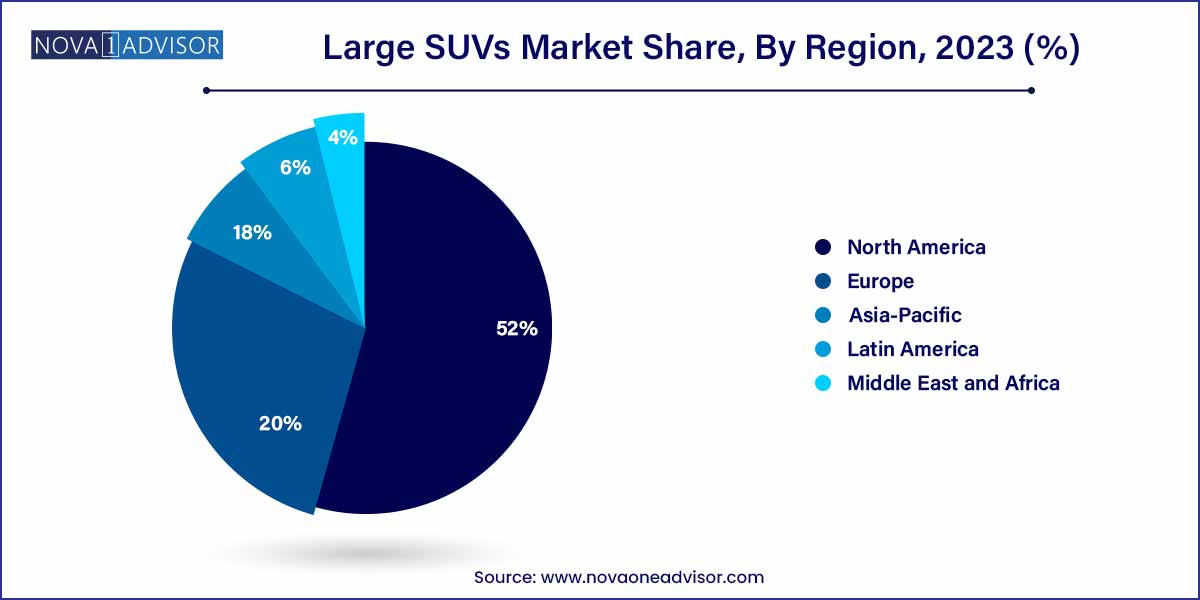

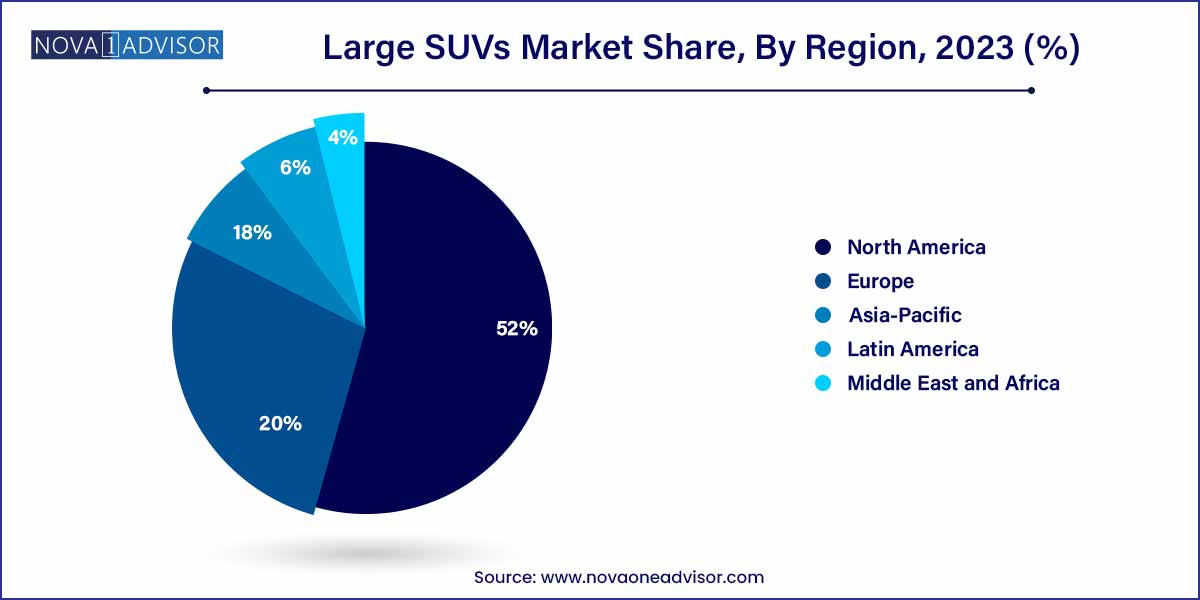

- North America dominated the global market in 2023, recording around 52% market revenue share.

Large SUVs Market Overview

The Large SUVs Market is a significant and steadily expanding segment of the global automotive industry, defined by consumer preference for spacious, powerful, and multi-functional vehicles. Large SUVs typically featuring three-row seating, high ground clearance, robust towing capacity, and off-road capabilities have established a strong foothold among families, adventure seekers, commercial fleet buyers, and luxury vehicle enthusiasts. As mobility demands shift and the global economy evolves, large SUVs are witnessing a resurgence, particularly in regions with favorable terrain and higher average income levels.

The segment has historically been popular in markets like North America and the Middle East, where road infrastructure and fuel affordability have supported the proliferation of these vehicles. Over the years, advancements in fuel efficiency, drivetrain technologies, and hybrid powertrains have broadened their appeal. Today's large SUVs no longer serve only utilitarian purposes; instead, they reflect a mix of luxury, comfort, and performance, blurring the line between traditional SUVs and high-end sedans.

From classic behemoths like the Chevrolet Suburban to technologically advanced models like the BMW X7 or Audi Q7, the landscape is filled with diverse offerings. While concerns regarding emissions and fuel consumption exist, industry players are addressing these issues with plug-in hybrid electric vehicles (PHEVs) and fully electric large SUVs. Luxury carmakers are also investing in this segment to cater to a niche clientele that values exclusivity and performance. As such, the global large SUVs market is not only growing it’s also diversifying rapidly in form, function, and technology.

Major Trends in the Market

-

Electrification of Large SUVs: Carmakers are launching electric large SUVs like the Rivian R1S and GMC Hummer EV SUV to reduce carbon footprints while maintaining power and utility.

-

Rise of Luxury and Tech Integration: Features such as panoramic sunroofs, multi-screen infotainment systems, AI voice assistants, and massage seats are now standard in premium large SUVs.

-

Off-Road Capability as a USP: Rugged terrain modes, differential locking systems, and air suspension are being heavily marketed to adventure-oriented buyers.

-

Growing Popularity of Hybrid Models: Toyota Sequoia’s hybrid-only 2023 model is a testament to this trend, offering both power and improved fuel economy.

-

High Focus on Safety Features: Inclusion of Level 2+ autonomous features like lane-centering assist, adaptive cruise control, and 360-degree cameras are standard in most new models.

-

Customization and Trim Diversification: Manufacturers offer a wide range of trims, from basic utility-focused versions to ultra-luxurious variants under the same model.

-

Subscription-Based Ownership Models: OEMs like Volvo and Lincoln are exploring subscription services to attract users interested in high-end SUVs without full ownership.

-

Fleet Utilization in Defense and Law Enforcement: Large SUVs continue to be preferred in institutional fleets for their robustness and storage capacity.

Large SUVs Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 322.90 Billion |

| Market Size by 2033 |

USD 346.23 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 0.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Stellantis NV; Toyota Motor; Renault; Volkswagen; Hyundai Motor Company; Volvo Car Corporation; Suzuki Motor Corporation; General Motors; Ford Motor Company; BMW Group; Peugeot S.A.; Geely. |

Large SUVs Market Dynamics

The dynamics of the large SUVs market are significantly influenced by a robust consumer demand for spacious and versatile vehicles. Consumers, ranging from families to outdoor enthusiasts, are increasingly drawn to the generous interior space and advanced safety features that large SUVs offer. The appeal lies not only in the practicality of these vehicles for daily use but also in their ability to provide a sense of security and comfort on various terrains. This sustained demand continues to drive manufacturers to innovate and enhance the features and performance of large SUVs to meet the evolving expectations of their diverse consumer base.

- Performance and Innovation:

A key driving force behind the large SUVs market dynamics is the relentless pursuit of performance and innovation by leading automotive manufacturers. Technological advancements, such as improvements in fuel efficiency, towing capacity, and the integration of cutting-edge driver-assistance systems, contribute to the overall appeal of large SUVs. This commitment to innovation not only caters to consumer preferences for high-performing vehicles but also positions large SUVs as versatile and adaptable for a wide range of uses.

Large SUVs Market Restraint

- Fuel Efficiency Concerns:

A prominent restraint facing the large SUVs market revolves around persistent concerns related to fuel efficiency. Despite advancements in technology, the inherent size and weight of large SUVs often result in lower fuel efficiency compared to smaller vehicle counterparts. This concern is particularly significant in a landscape where environmental consciousness and fuel economy are key considerations for consumers. Manufacturers are grappling with the challenge of balancing the robust performance and spaciousness that defines large SUVs with the increasing demand for more fuel-efficient alternatives. The industry is actively addressing this restraint by exploring hybrid and electric technologies, aiming to offer eco-friendly options that meet both consumer expectations and environmental sustainability goals.

Another notable restraint influencing the large SUVs market dynamics is the increasing regulatory pressure related to emissions and environmental standards. Governments around the world are implementing stringent regulations to curb emissions and promote cleaner technologies. Large SUVs, being traditionally associated with higher fuel consumption and emissions, face challenges in compliance with these evolving standards. Manufacturers are compelled to invest in research and development to adapt their offerings to meet these regulations, adding a layer of complexity and cost to the production of large SUVs. As regulatory frameworks continue to tighten, the industry must navigate these challenges to ensure long-term sustainability and market viability for large SUVs.

Large SUVs Market Opportunity

- Market Expansion in Emerging Regions:

A significant opportunity within the large SUVs market lies in the expansion into emerging regions. As economic prosperity rises in various parts of the world, there is a growing demand for versatile and spacious vehicles that cater to diverse consumer needs. Large SUVs, with their adaptability to different terrains and lifestyles, are well-positioned to capitalize on this opportunity. Manufacturers can strategically enter untapped markets, offering a range of large SUV models to meet the preferences of consumers in these emerging regions. By understanding and catering to the unique demands of these markets, companies can secure a foothold and contribute to the overall growth of the large SUVs sector on a global scale.

- Advancements in Electric and Hybrid Technologies:

The ongoing advancements in electric and hybrid technologies present a compelling opportunity for the large SUVs market. As the automotive industry undergoes a significant shift towards sustainability, there is a growing demand for eco-friendly alternatives in the SUV segment. Manufacturers can seize this opportunity by investing in the development of electric and hybrid large SUV models, offering consumers the option of high-performance, spacious vehicles with reduced environmental impact. This not only aligns with the evolving preferences of environmentally-conscious consumers but also positions large SUVs as contributors to a greener automotive future. By embracing these technologies, companies can stay at the forefront of innovation and cater to a burgeoning market segment.

Large SUVs Market Challenges

- Fuel Efficiency Challenges:

One of the primary challenges confronting the large SUVs market is the ongoing struggle to address fuel efficiency concerns. Due to their larger size and weight, traditional large SUVs often exhibit lower fuel efficiency compared to smaller vehicle categories. This challenge is particularly pertinent in an automotive landscape increasingly focused on sustainability and fuel economy. Manufacturers face the dilemma of balancing the spacious, high-performance attributes that define large SUVs with the imperative to enhance fuel efficiency. The industry is actively exploring technological innovations, including hybrid and electric solutions, to mitigate these challenges and align with the rising demand for more eco-friendly alternatives.

- Regulatory Compliance Pressures:

Regulatory pressures pose a significant challenge to the large SUVs market, particularly in the context of stringent emissions and environmental standards. Governments worldwide are implementing increasingly strict regulations to combat climate change, emphasizing reduced emissions and enhanced fuel efficiency. Large SUVs, known for their higher fuel consumption and emissions, find themselves under intensified scrutiny. This necessitates substantial investments by manufacturers in research and development to ensure compliance with evolving standards. Navigating the complex landscape of regulatory requirements becomes crucial for the large SUV segment, with companies needing to adapt their offerings to meet environmental standards while maintaining the performance and appeal that consumers expect from this category.

Segments Insights:

Fuel Type Insights

Petrol-powered large SUVs dominated the market owing to their widespread consumer acceptance, smoother engine performance, and better compatibility with turbocharging technologies. Vehicles such as the Ford Expedition and GMC Yukon continue to be in high demand in regions like North America and the Middle East where fuel prices are relatively manageable, and performance is prioritized. Petrol variants are also known for quieter engines and faster acceleration compared to diesel, offering a premium driving experience. Furthermore, advancements in engine downsizing and cylinder deactivation are helping petrol SUVs offer better mileage than before, thus extending their market relevance even in a sustainability-conscious landscape.

Meanwhile, electric large SUVs are anticipated to be the fastest-growing segment over the forecast period. Spurred by technological advancements and environmental regulations, electric models are gaining momentum. Automakers are aggressively investing in EV platforms with high torque, long-range batteries, and fast-charging capabilities to ensure that electric SUVs do not compromise on performance. For instance, the GMC Hummer EV SUV launched in 2024 features a 300+ mile range and fast charging that adds 100 miles in 12 minutes. As battery costs continue to decline and public charging infrastructure expands, consumer adoption is expected to accelerate, especially in urban and high-income segments.

Regional Insights

North America continues to dominate the large SUVs market, supported by consumer preferences for bigger, more powerful vehicles. The U.S. market, in particular, is deeply rooted in SUV culture. With a vast network of highways, a penchant for long-distance road trips, and a climate that spans rugged terrains, large SUVs are an optimal choice for many households. Major automakers such as Ford, Chevrolet, and Jeep generate a significant portion of their SUV sales from large models like the Suburban, Grand Cherokee, and Navigator. Additionally, relatively lower fuel costs and expansive suburban living promote the use of spacious vehicles. Regulatory standards in the U.S. also remain relatively flexible compared to European emission norms, further supporting sales.

On the other hand, Asia-Pacific is expected to be the fastest-growing regional market, particularly led by rising affluence in China, India, and Southeast Asia. Chinese consumers are increasingly opting for large luxury SUVs such as the Mercedes-Benz GLS and Hongqi E-HS9, viewing them as status symbols. Local players like BYD and NIO are also launching larger EV SUVs to compete with Western brands. In India, while compact SUVs dominate overall volumes, the aspirational segment for large SUVs is expanding rapidly, driven by launches such as the Toyota Fortuner Legender and Mahindra XUV700. The expanding road network, growing urban middle class, and improving economic conditions are driving interest in this segment.

Some of the prominent players in the Large SUVs market include:

- Stellantis NV

- Toyota Motor

- Renault

- Volkswagen

- Hyundai Motor Company

- Volvo Car Corporation

- Suzuki Motor Corporation

- General Motors

- Ford Motor Company

- BMW Group

- Peugeot S.A.

- Geely

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global large SUVs market.

Fuel Type

- Petrol

- Diesel

- Electric

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)