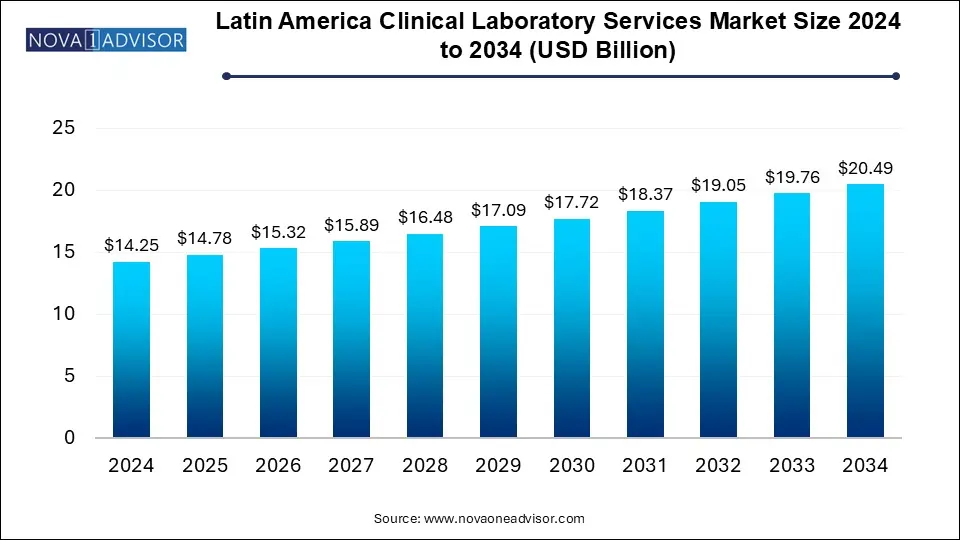

The Latin America clinical laboratory services market size was exhibited at USD 14.25 billion in 2024 and is projected to hit around USD 20.49 billion by 2034, growing at a CAGR of 3.7% during the forecast period 2025 to 2034.

The clinical laboratory services market in Latin America plays a foundational role in the region’s healthcare infrastructure. It serves as the backbone for disease diagnosis, treatment planning, prevention programs, and monitoring of chronic conditions. Clinical laboratories provide a wide range of diagnostic tests spanning genetic, biochemical, microbiological, and molecular domains. In a region grappling with both communicable diseases like dengue and tuberculosis and the growing burden of non-communicable diseases such as diabetes, cancer, and cardiovascular ailments, the demand for reliable, efficient, and accessible clinical laboratory services is intensifying.

Latin America’s healthcare landscape is diverse and fragmented, with varying degrees of public-private partnership in diagnostics across countries. In Brazil and Mexico, national health systems are increasingly incorporating laboratory networks, while in countries like Argentina, Chile, and Colombia, private diagnostics chains are playing a central role in enhancing access and quality of laboratory services. The COVID-19 pandemic dramatically exposed the gaps and accelerated investments in laboratory infrastructure, equipment automation, and digital reporting systems across the region.

The regional market is being transformed by the integration of advanced technologies, a rising number of chronic disease cases, aging populations, and an expanding middle class that is demanding higher standards in healthcare. Telemedicine, mobile labs, and home diagnostics are gradually gaining traction, further enhancing the reach of lab-based services in remote and underserved communities.

Increased Automation and Digitalization: Laboratories are automating workflows and adopting Laboratory Information Management Systems (LIMS) to improve efficiency and reduce human error.

Rise of Genetic and Molecular Testing: Human and tumor genetic testing is gaining popularity due to increasing cancer prevalence and demand for personalized medicine.

Public-Private Collaborations: Governments are increasingly collaborating with private labs to improve diagnostic access and meet the growing testing burden.

Emergence of Point-of-Care and Home-based Testing: The market is witnessing a shift toward decentralized diagnostics, driven by demand for convenience and early detection.

Integration with Telehealth Platforms: Diagnostic services are being integrated with virtual care, enabling lab test ordering and result reporting through digital channels.

Quality Accreditation and International Standards Compliance: Laboratories are pursuing ISO certifications and international quality benchmarks to attract multinational clinical trial and research work.

Expansion of Clinical Trial Testing Services: Latin America is emerging as a hotspot for cost-effective clinical research, increasing demand for trial-related lab services.

| Report Coverage | Details |

| Market Size in 2025 | USD 14.78 Billion |

| Market Size by 2034 | USD 20.49 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 3.7% |

| Base Year | 2024 |

| Forecast Period | 2025-2034 |

| Segments Covered | Test Type, Service Provider, Application, Country |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled | Abbott; OPKO Health, Inc.; Fresenius Medical Care AG & Co. KgaA; QIAGEN; Quest Diagnostics Incorporated; Siemens Healthcare GmbH; Charles River Laboratories; Laboratory Corporation of America Holdings (LabCorp); DaVita Inc.; Myriad Genetics, Inc.; Genomic Health (Exact Sciences Corporation); DASA; Sysmex Corporation |

One of the most significant drivers of the Latin America clinical laboratory services market is the growing prevalence of chronic and lifestyle-related diseases. According to the World Health Organization (WHO), over 75% of deaths in Latin America are attributed to non-communicable diseases (NCDs) such as diabetes, cancer, and cardiovascular diseases. These conditions require routine diagnostic monitoring and early detection, significantly boosting demand for laboratory tests.

In countries like Brazil and Mexico, rising obesity rates and aging populations are pushing healthcare providers to enhance diagnostic capabilities. For example, the increased incidence of diabetes has led to a surge in glycated hemoglobin (HbA1c) and glucose tolerance tests. Similarly, rising cancer prevalence is fueling demand for tumor marker testing, biopsy analysis, and genetic screening. Public health initiatives are also promoting preventive screening, which contributes to consistent demand across both public and private laboratories.

Despite the market’s growth, Latin America’s clinical laboratory services face significant constraints due to uneven infrastructure and healthcare disparities. While urban centers in countries like Brazil, Chile, and Colombia offer modern diagnostic facilities, rural and remote regions often lack even basic laboratory access. This urban-rural divide affects diagnostic accuracy, timely treatment, and overall healthcare outcomes.

Moreover, public healthcare systems in several countries suffer from budget constraints, outdated technology, and inefficient supply chains, which hamper the scalability and reliability of lab services. In addition, private sector services, although more advanced, are often unaffordable for large segments of the population. Regulatory hurdles, fragmented reimbursement policies, and limited skilled workforce further complicate the expansion of standardized diagnostic services across the region.

A major opportunity in the Latin American market is the rapid growth of clinical research and contract-based laboratory testing. With lower operational costs, a diverse patient population, and growing regulatory alignment with international standards, Latin America has become an attractive destination for pharmaceutical companies conducting clinical trials. Countries like Argentina, Colombia, and Brazil have seen a surge in trial activity in oncology, infectious diseases, and chronic conditions.

As a result, there is a rising demand for lab services to support preclinical and clinical trial phases, including bioanalytical testing, toxicology studies, and pharmacokinetic analysis. Laboratories that are Good Laboratory Practice (GLP) certified and offer quick turnaround times are being chosen as preferred partners. Additionally, lab services for personalized medicine—such as companion diagnostics—are gaining importance as clinical research becomes more targeted and data-driven.

Clinical chemistry tests dominate the Latin America clinical laboratory services market due to their broad application in routine diagnostics, chronic disease monitoring, and emergency care. These tests include lipid profiles, liver function tests, kidney markers, and electrolyte analysis, forming the core of most health check-ups. With hospitals and clinics heavily dependent on these tests for decision-making, the volume of clinical chemistry tests conducted in the region remains substantial. Moreover, automation of chemistry analyzers and integration with electronic health records has made these tests faster and more accurate, contributing to their continued dominance.

However, human and tumor genetics is the fastest growing segment, fueled by the increasing adoption of precision medicine and cancer diagnostics. Genetic testing is no longer limited to rare diseases; it is now applied in oncology, reproductive health, and preventive screening. The introduction of next-generation sequencing (NGS) technologies has made these tests more accessible and cost-effective. Private laboratories in Brazil and Mexico are expanding their genomic offerings, and partnerships with international biotech firms are enabling the transfer of expertise and equipment, further accelerating growth in this segment.

Hospital-based laboratories hold the largest share of the market as most diagnostic services in Latin America are integrated within hospitals and public health systems. These laboratories benefit from a steady patient base, government support, and access to emergency and inpatient departments. Public sector hospitals often rely on their in-house labs to manage high testing volumes, especially for essential health screenings and inpatient diagnostics. Additionally, tertiary hospitals in urban areas are increasingly upgrading their laboratories with high-throughput analyzers and adopting quality certification standards.

In contrast, stand-alone laboratories are the fastest-growing providers in the region. Driven by patient demand for convenience, shorter wait times, and competitive pricing, independent diagnostic chains like Grupo Fleury (Brazil), LAPI (Mexico), and Clínica Bupa (Chile) are expanding rapidly. These labs often offer direct-to-consumer testing, health packages, and digital result delivery, making them popular among middle-income populations. Many of them also participate in health insurance networks, further boosting accessibility. Their agility and focus on customer experience give them an edge in competitive urban markets.

Bioanalytical and laboratory chemistry services dominate the application segment due to their foundational role in supporting diagnostic, therapeutic, and research functions. These services include drug metabolite testing, blood and urine analysis, and biomarker quantification. Used extensively in hospitals, research centers, and pharmaceutical companies, these tests are critical to both routine patient care and clinical research. Their high volume and broad utility across applications ensure their continued dominance in the clinical laboratory landscape.

Cell and gene therapy-related services are among the fastest growing applications as Latin America begins to adopt advanced regenerative medicine and biotechnology solutions. Brazil, in particular, is investing in cell therapy research centers and biobanks. Clinical trials involving CAR-T cell therapies, stem cells, and gene editing tools like CRISPR are gaining momentum in Argentina and Colombia. As these therapies progress from research to commercial stages, demand for sophisticated laboratory services that ensure safety, efficacy, and regulatory compliance will grow exponentially.

Brazil is the largest market for clinical laboratory services in Latin America. Its extensive public health system (SUS) covers a vast population, supported by a network of hospital-based and stand-alone labs. Private diagnostic chains such as Dasa and Fleury dominate urban markets, offering cutting-edge molecular and pathology services. Brazil is also leading in research and development of genomic diagnostics and personalized medicine, backed by institutions like Fiocruz.

Mexico’s clinical lab market is growing rapidly due to increased public-private partnerships and rising chronic disease prevalence. Laboratories like Chopo and LAPI are expanding nationwide. The Mexican government’s push for digital health and preventive screening is enhancing diagnostic accessibility.

Argentina is emerging as a regional hub for clinical trials and personalized diagnostics. Laboratories are investing in automation, and major hospitals are developing partnerships with biotech firms for genomic testing and biobank management. The country is positioning itself for exports in clinical trial services.

Colombia is investing heavily in laboratory modernization, supported by its expanding middle class and universal healthcare initiatives. Institutions like Fundación Santa Fe are setting new standards in lab quality and specialization.

Chile has one of the most organized private healthcare sectors in the region, with strong emphasis on quality lab services. Clinics and diagnostic labs are leveraging digital platforms for patient engagement and remote result access.

These countries represent smaller but fast-growing markets, focusing on upgrading laboratory infrastructure, enhancing quality control, and expanding outreach to rural and underserved areas. International collaborations are playing a key role in knowledge transfer and equipment access

March 2025: Dasa Group announced a $100 million investment to expand its laboratory automation and genetic testing capabilities across Brazil and neighboring countries.

February 2025: Laboratorio Chopo launched a new digital patient portal in Mexico, integrating appointment scheduling, home sample collection, and result access.

January 2025: Fundación Santa Fe in Colombia signed a partnership with a European biotech firm to launch a new molecular diagnostics lab in Bogotá.

December 2024: Grupo LAPI in Mexico partnered with a telemedicine startup to offer integrated diagnostic and virtual consultation packages.

November 2024: The Argentine Ministry of Health rolled out a nationwide genetic screening program for newborns, supported by public and private labs.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Latin America clinical laboratory services market

By Test Type

By Service Provider

By Application

By Country