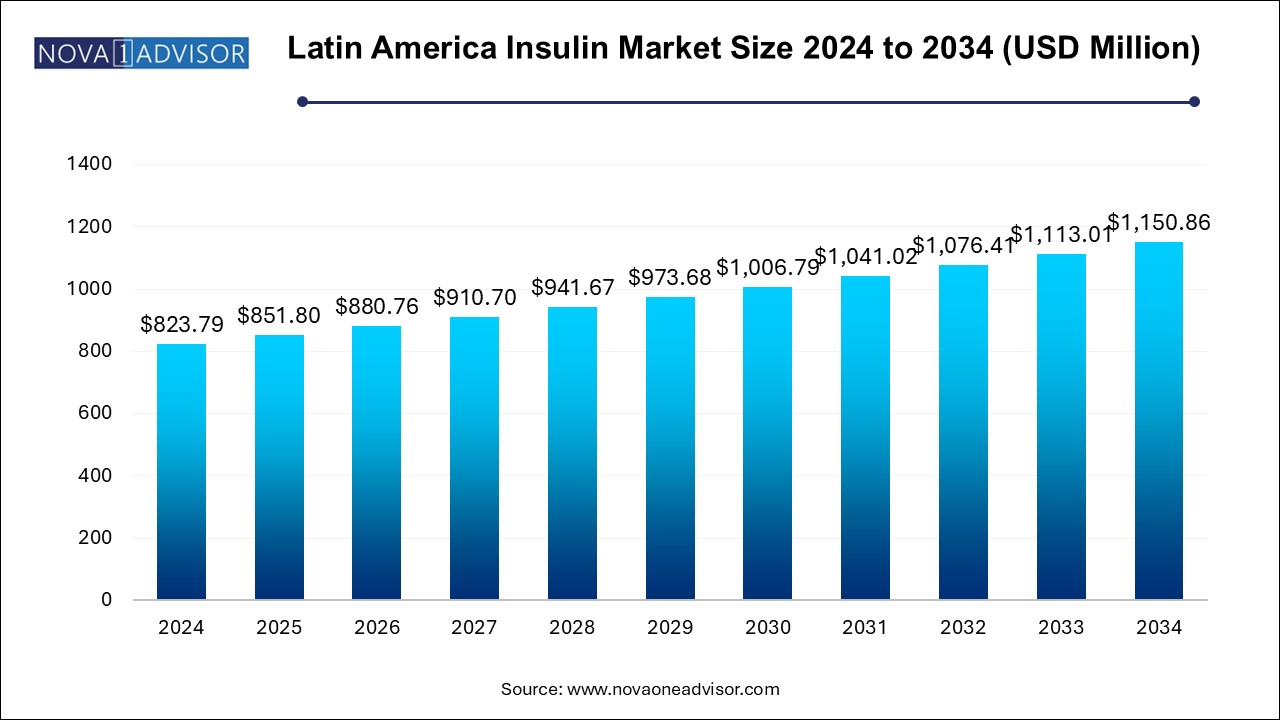

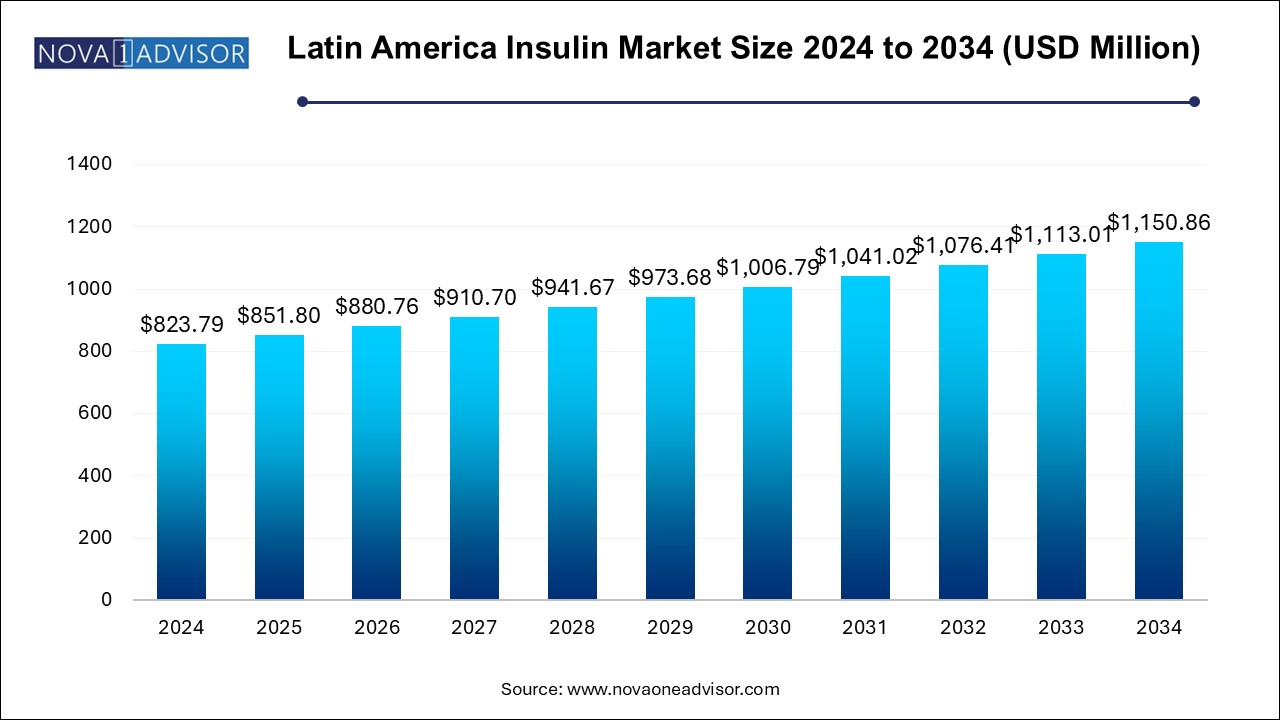

Latin America Insulin Market Size and Growth

The Latin America insulin market size was exhibited at USD 823.79 million in 2024 and is projected to hit around USD 1150.86 million by 2034, growing at a CAGR of 3.5% during the forecast period 2025 to 2034.

Market Overview

The Latin America insulin market is evolving rapidly, propelled by the escalating prevalence of diabetes, growing public health initiatives, and expanding access to modern insulin therapies. Insulin remains the cornerstone of diabetes management, particularly for patients with type 1 diabetes and for many with advanced type 2 diabetes. In Latin America, where urbanization and changing lifestyles have contributed to a surge in diabetes cases, the demand for safe, effective, and affordable insulin therapies is more critical than ever.

According to the International Diabetes Federation (IDF), Latin America hosts approximately 32 million adults living with diabetes as of 2024, with the majority residing in countries such as Brazil, Mexico, and Argentina. Among these, Brazil holds the highest share, both in terms of diabetic population and insulin consumption. Public healthcare systems in many countries are stepping up efforts to improve the availability of insulin, particularly long-acting and analog formulations, through subsidy programs, partnerships with private pharmaceutical players, and improvements in cold chain logistics.

In addition to public-sector initiatives, the private market is experiencing growth through retail pharmacies and specialty clinics, which offer patients greater access to innovative insulin therapies such as biosimilars and insulin pens. Meanwhile, biosimilar insulin products are becoming increasingly popular due to their cost-effectiveness and favorable outcomes in clinical practice. The region is also witnessing investments from international pharmaceutical companies aiming to localize production or establish regional distribution hubs to minimize supply chain disruptions and enhance affordability.

While infrastructural challenges and disparities in healthcare access persist across some countries, the overall market is shifting towards modernization, digitalization, and integrated diabetes management strategies. This creates a compelling landscape for stakeholders in the insulin ecosystem, including drug manufacturers, policy makers, retail pharmacies, and diagnostic service providers.

Major Trends in the Market

-

Rise in Use of Insulin Analogs: New-generation insulin analogs are being increasingly prescribed due to their enhanced efficacy and reduced risk of hypoglycemia.

-

Expansion of Public Health Insurance Coverage: Governments in countries like Brazil and Argentina are expanding insulin access under public health systems.

-

Growth of Biosimilar Insulin Products: Cost-saving biosimilars are entering the market, reducing reliance on premium-priced originator drugs.

-

Technological Integration with Insulin Delivery: Smart insulin pens and continuous glucose monitoring devices are gaining traction in private healthcare.

-

Increasing Retail and Specialty Pharmacy Penetration: These channels are becoming dominant in urban areas for insulin dispensing and patient counseling.

-

Local Production and Import Substitution: Countries like Brazil are investing in domestic manufacturing to reduce dependency on imports.

-

Patient Education and Awareness Campaigns: Public-private partnerships are promoting diabetes education and insulin therapy adherence.

-

Regulatory Harmonization for Faster Approvals: Latin American countries are streamlining drug approval processes to accelerate market entry of new insulin types.

Report Scope of Latin America Insulin Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 851.8 Million |

| Market Size by 2034 |

USD 1150.86 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 3.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Product, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Novo Nordisk A/S; Eli Lilly and Company.; Sanofi; Biocon.; Wockhardt; Boehringer Ingelheim International GmbH.; Julphar; United Laboratories International Holdings Limited.; Tonghua Dongbao Pharmaceutical Co. Ltd.; Xinbai Pharmaceutical |

Market Driver: Rising Diabetes Prevalence in Latin America

The most prominent driver for the Latin America insulin market is the alarming increase in diabetes cases, especially type 2 diabetes, across the region. Sedentary lifestyles, urban dietary shifts, increasing obesity rates, and aging populations are key contributors. Countries like Brazil and Mexico report some of the highest diabetes burdens globally, and other nations like Colombia and Argentina are following similar patterns.

This public health crisis has triggered substantial healthcare responses. Governments are adopting national diabetes plans, often involving the free or subsidized distribution of insulin products via public healthcare networks. For example, Brazil’s Unified Health System (SUS) covers the cost of essential insulin therapies for millions of its citizens. These developments have created a robust and steady demand base, driving manufacturers to ensure stable supply, invest in education programs, and develop products that align with evolving treatment guidelines.

Market Restraint: Inequitable Healthcare Access and Supply Chain Challenges

Despite growing insulin demand, the Latin America market is constrained by significant disparities in healthcare access and complex supply chains, especially in rural and low-income regions. Public health infrastructure, while improving, often lacks consistency in drug distribution, cold chain reliability, and staff training. Stock-outs of insulin products, particularly in remote areas, remain a critical issue.

Additionally, affordability remains a concern in countries with weak healthcare financing structures. While biosimilars and public procurement programs offer some relief, patients in middle-income brackets or those relying on out-of-pocket spending may still face barriers. The fragmented regulatory environment across Latin America also poses challenges for pharmaceutical companies, delaying market entry for new insulin formulations and complicating cross-border distribution.

Market Opportunity: Growth in Biosimilar Insulin and Local Manufacturing

A significant opportunity lies in the rapid uptake of biosimilar insulin products and the push for local manufacturing. As cost pressures mount and healthcare systems seek value-based procurement, biosimilars present a compelling alternative. These products are clinically equivalent to branded insulin analogs but are offered at significantly lower prices, making them attractive for both public and private payers.

In Brazil, the government has encouraged local production under technology transfer agreements with international pharma firms. For instance, Biomm, a Brazilian biopharma company, has partnered with global players to manufacture insulin locally, reducing import dependency and improving affordability. Similar initiatives are underway in Argentina and Colombia. Such localization efforts not only enhance market resilience but also foster regulatory agility and strengthen supply chain stability across the region.

Latin America Insulin Market By Type Insights

The Insulin Analog dominated the market in 2024, gaining preference over traditional human insulin due to its improved pharmacokinetic profile, reduced risk of hypoglycemia, and better patient compliance. Long-acting analogs such as insulin glargine and insulin detemir are widely used for basal coverage, while rapid-acting analogs are preferred for mealtime glucose control. These analogs enable flexible dosing and mimic natural insulin secretion more effectively. Their popularity has increased in both private and public healthcare systems in Brazil and Chile, where advanced treatment protocols are being implemented in diabetic care centers.

Human Insulin is projected to be the fastest-growing segment in low-income and remote areas where affordability is a critical factor. Government tenders and public procurement programs often prioritize cost-efficient therapies, allowing traditional insulins such as NPH and regular insulin to retain relevance. Argentina and Peru continue to rely heavily on human insulin for managing diabetes through public initiatives. Furthermore, emerging biosimilar human insulin manufacturers are enhancing availability, stimulating growth even amidst analog-dominated urban centers.

Latin America Insulin Market By Product Insights

Based on Long-Acting Insulin products captured the largest share of the market due to their daily administration schedules, patient adherence advantages, and favorable reimbursement frameworks. These are especially important for type 2 diabetes patients who require consistent basal insulin levels. In Brazil and Colombia, long-acting insulin glargine is widely used in both public and private sectors. Pharmaceutical giants such as Sanofi and Novo Nordisk have expanded their product portfolios to include multiple long-acting formulations to meet rising demand in these countries.

Biosimilars are witnessing the fastest growth, supported by national cost containment strategies and rising acceptance by physicians. Argentina’s National Administration of Drugs, Food and Medical Technology (ANMAT) has accelerated approvals of biosimilar insulin, enabling companies like Richmond and Elea to introduce affordable alternatives. These products are especially gaining momentum in public hospitals and regional clinics where budget constraints are prominent. As quality improves and trust builds among prescribers, biosimilars are expected to revolutionize insulin access in underserved markets.

Latin America Insulin Market By Application Insights

Type II Diabetes held the dominant share in 2024, largely because it accounts for over 90% of total diabetes cases in Latin America. With increasing obesity and lifestyle-related disorders, insulin is becoming a standard part of therapy for many type 2 patients who do not respond adequately to oral hypoglycemic agents. Governments in countries like Colombia and Chile are promoting early insulin initiation in type 2 patients through physician education and formulary changes.

Type I Diabetes is expected to grow steadily, especially among children and young adults, who require lifelong insulin therapy. In countries like Venezuela and Peru, awareness and early diagnosis initiatives are boosting insulin demand for type 1 patients. Non-governmental organizations are also playing a vital role in delivering insulin supplies to low-resource settings. Moreover, digital health tools, such as glucose monitoring apps and patient education platforms, are being adopted to enhance long-term disease management.

Latin America Insulin Market By Distribution Channel Insights

The Hospitals Pharmacies dominated the insulin distribution channel, as they are integrated with public health systems and handle bulk procurement for diabetes management programs. In Brazil, for example, most insulin dispensation occurs via hospital-attached pharmacies that serve patients registered under national health schemes. These settings ensure greater compliance with treatment protocols and allow for consistent insulin availability for enrolled patients.

Retail and Specialty Pharmacies are growing rapidly, particularly in urban centers and private care ecosystems. These outlets cater to patients seeking premium insulin products, combination therapies, or personalized counseling. Pharmacies such as Drogasil and Farmacias del Ahorro in Latin America have introduced chronic care programs that include regular follow-ups and refill management, making them a preferred choice for many middle-income diabetic patients. Their accessibility and personalized approach are expected to continue fueling this growth trajectory.

Country Insights

Brazil

Brazil dominates the Latin America insulin market, accounting for the highest share due to its extensive diabetic population, comprehensive national diabetes program, and pharmaceutical manufacturing capabilities. The Unified Health System (SUS) offers free insulin and diabetes supplies to eligible patients, covering both human insulin and selected analogs. In 2023, Brazil’s Ministry of Health expanded its essential medicines list to include newer analog formulations, improving access for millions.

Furthermore, the country has made significant strides in local insulin production. Biomm SA and the Oswaldo Cruz Foundation (Fiocruz) are collaborating to develop domestic biosimilar insulin manufacturing. This strategy is helping reduce import dependence, stabilize pricing, and support the national economy. The strength of Brazil’s regulatory body, ANVISA, ensures rigorous quality and timely approvals, making it a benchmark market in the region.

Argentina

Argentina is emerging as one of the fastest-growing insulin markets, driven by aggressive expansion of public health coverage and strategic entry of local biosimilar players. Through Plan Remediar and public-private partnerships, insulin therapies have become more accessible across provinces. Additionally, Argentina has strengthened its biosimilar ecosystem, with companies like Laboratorios Richmond, Elea, and mAbxience entering the market with insulin products tailored for local affordability.

Recent currency fluctuations and economic challenges have made biosimilars even more appealing to public payers and patients. The country is also emphasizing decentralized access, with telehealth initiatives and rural outreach programs ensuring that insulin reaches remote and indigenous communities. Continued support for innovation and flexible regulatory pathways are expected to sustain Argentina’s growth trajectory in the coming years.

Some of the prominent players in the Latin America insulin market include:

- Novo Nordisk A/S

- Eli Lilly and Company

- Sanofi

- Biocon.

- Wockhardt

- Boehringer Ingelheim International GmbH.

- Julphar

- United Laboratories International Holdings Limited.

- Tonghua Dongbao Pharmaceutical Co., Ltd.

- Xinbai Pharmaceutical

Latin America Insulin Market Recent Developments

-

In January 2025, Biomm SA announced the start of local production of biosimilar insulin glargine in Minas Gerais, Brazil, in partnership with a South Korean biopharmaceutical firm.

-

In November 2024, Laboratorios Elea launched a new biosimilar version of long-acting insulin in Argentina, with pricing models aligned to public reimbursement programs.

-

In October 2024, Novo Nordisk Brazil expanded its insulin pen range with the FlexTouch® pen designed for elderly and visually impaired diabetic patients.

-

In August 2024, the Colombian Ministry of Health signed a public-private agreement with international insulin suppliers to streamline access in remote rural areas.

-

In May 2024, Sanofi introduced an educational campaign in Chile to promote better adherence to basal-bolus insulin regimens, involving over 1,000 healthcare professionals.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Latin America insulin market

By Type

- Insulin Analog

- Human Insulin

By Product

- Rapid-Acting Insulin

- Long-Acting Insulin

- Combination Insulin

- Biosimilar

- Others

By Application

- Type I Diabetes

- Type II Diabetes

By Distribution Channel

- Hospitals Pharmacies

- Retail & Specialty Pharmacies

- Others

By Country

- Brazil

- Argentina

- Chile

- Colombia

- Peru

- Venezuela

- Rest of Latin America