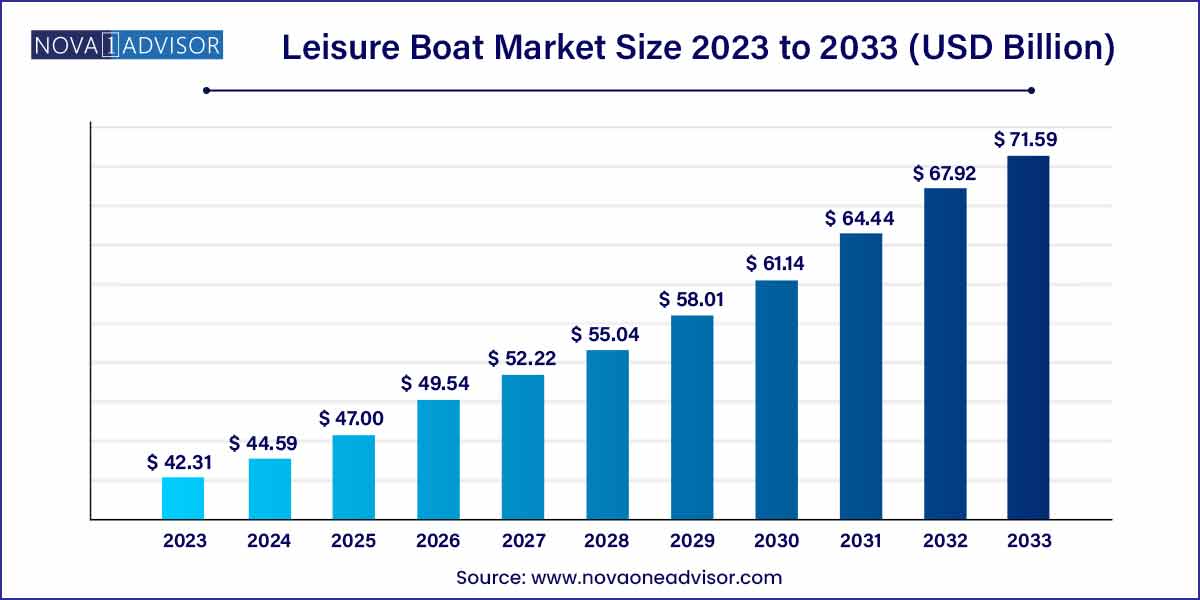

The global leisure boat market size was exhibited at USD 42.31 billion in 2023 and is projected to hit around USD 71.59 billion by 2033, growing at a CAGR of 5.4% during the forecast period of 2024 to 2033.

Key Takeaways:

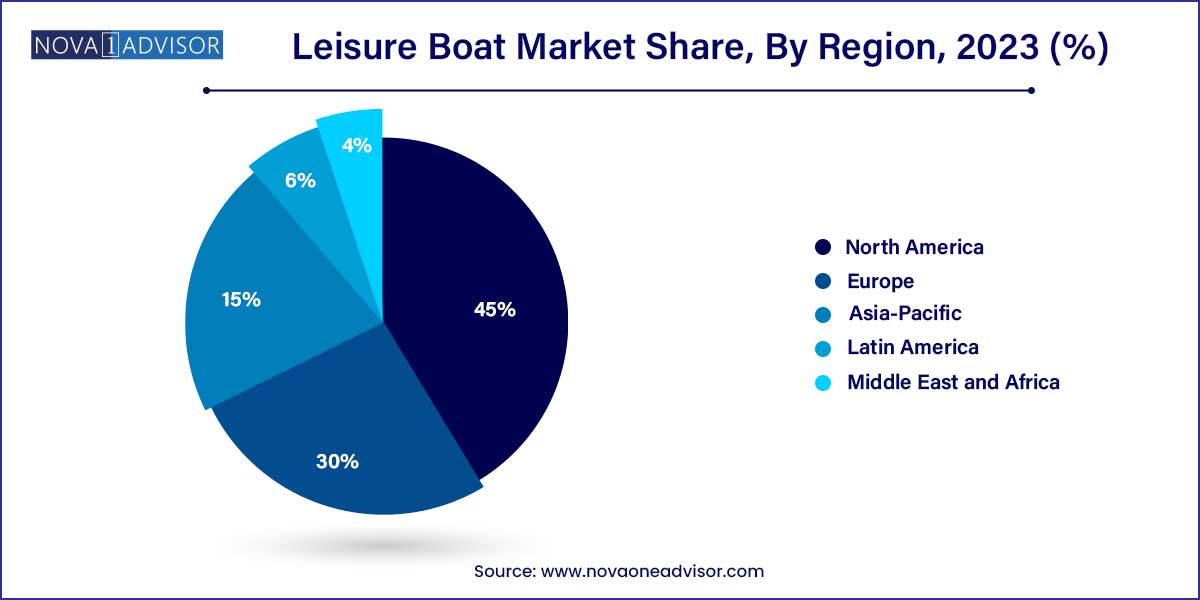

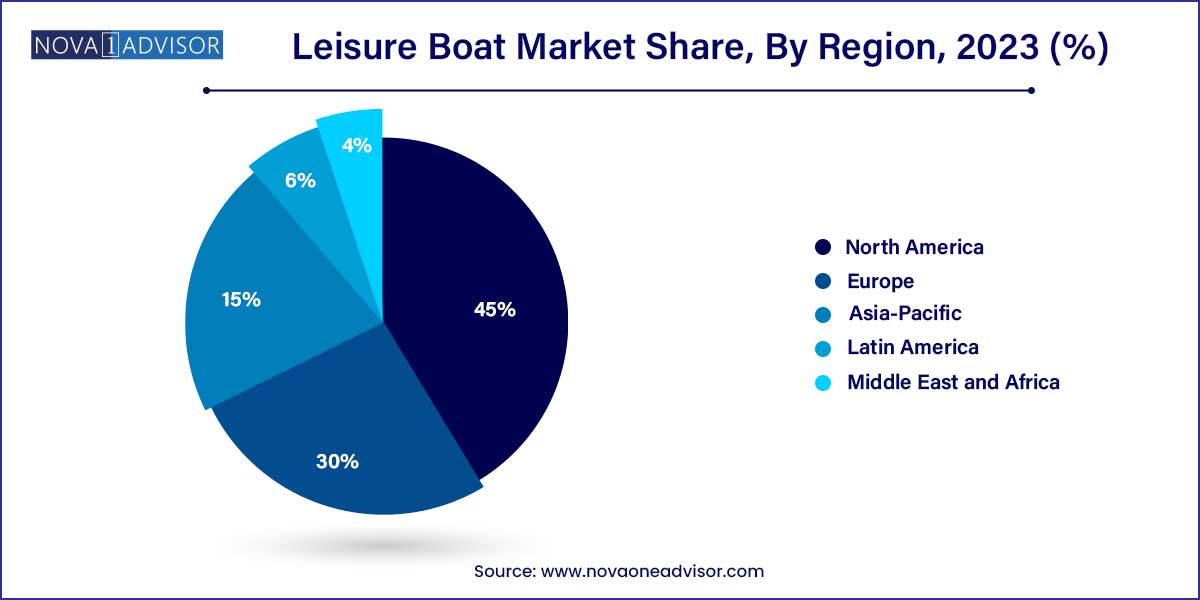

- North America dominated the market and accounted for more than 45% of global revenue in 2023.

- The used leisure boat segment accounted for over 80% of the market share in 2023.

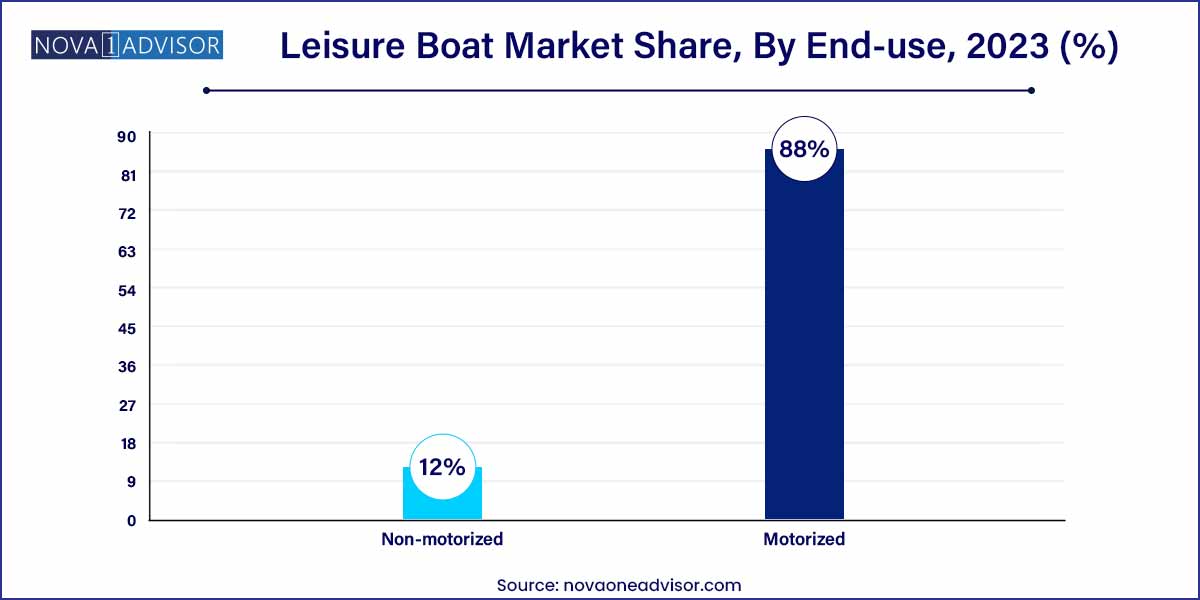

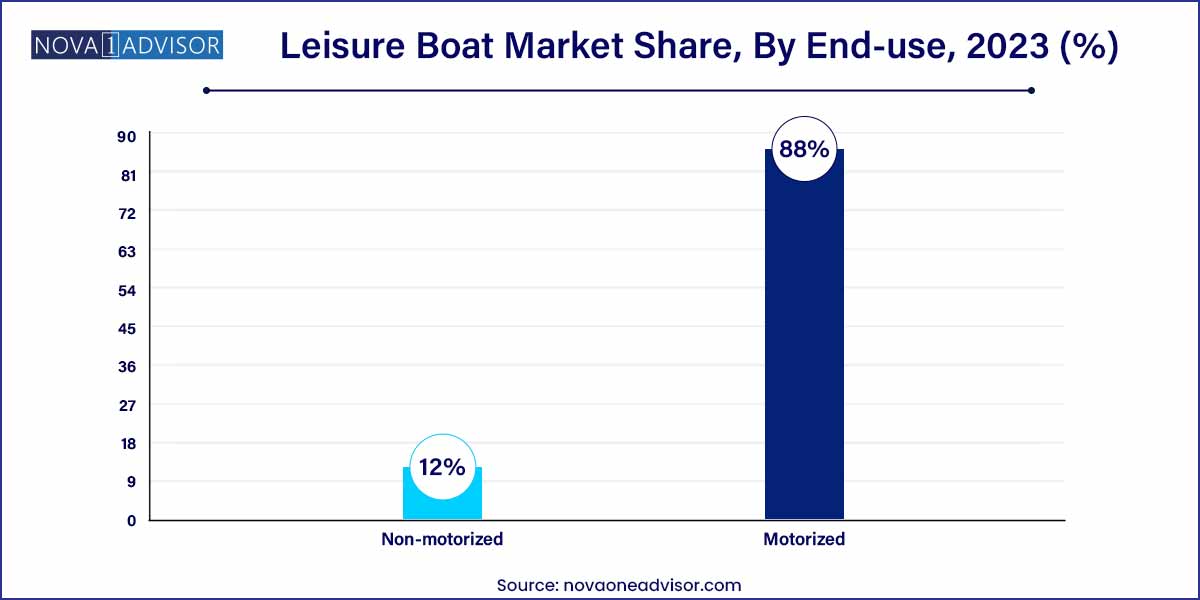

- The motorized leisure boat segment accounted for over 88% of the market share in 2023.

Leisure Boat Market: Overview

The leisure boat market has emerged as a thriving segment within the global recreational and tourism industry. With growing affluence, increasing disposable incomes, a rising culture of outdoor leisure, and the influence of lifestyle-centric social media, the demand for leisure boating has soared globally. Leisure boats are primarily used for personal enjoyment and activities such as cruising, water sports, sailing, and fishing, rather than for commercial or military purposes. These vessels range from small non-motorized boats like kayaks and canoes to luxurious motorized yachts equipped with state-of-the-art amenities.

One of the primary drivers of this market has been the surge in marine-based tourism, particularly in coastal nations and island economies. Countries like the U.S., Italy, France, Australia, and Thailand have witnessed increased marine tourism due to improved marina infrastructure, favorable climatic conditions, and targeted promotional campaigns. The increased desire for private and exclusive vacation experiences post-pandemic has also contributed to the rising sales of leisure boats, especially in regions where chartering and ownership are both growing in popularity.

Furthermore, the expansion of boat rental and sharing platforms has made leisure boating accessible to a broader demographic. These platforms, often digitized, allow short-term rentals and eliminate the high entry barrier of boat ownership, thereby creating a new consumer base comprising young professionals and families.

The leisure boat market is supported by ancillary industries such as marine electronics, outboard motor production, composite material manufacturing, and boat maintenance services, creating a dynamic ecosystem. As technological innovation and sustainability concerns reshape the manufacturing and usage patterns, this market is poised for transformation in the coming years.

Major Trends in the Market

-

Electrification of Boats: Electric and hybrid propulsion systems are being rapidly adopted due to environmental regulations and consumer interest in sustainable alternatives.

-

Smart Boat Integration: IoT-based features such as remote diagnostics, navigation aids, and onboard automation are gaining traction.

-

Growth in Boat Clubs and Sharing Models: Subscription-based and sharing economy models are helping to democratize access to leisure boating.

-

Custom-built Boats: High net worth individuals (HNWIs) are demanding customized yachts tailored to personal aesthetics and functionality.

-

Increased Participation in Water Sports: Rising interest in sports like jet skiing, wakeboarding, and paddleboarding is influencing demand for specific boat types.

-

Marina Infrastructure Development: Governments and private players are heavily investing in marina expansions and waterfront developments.

-

Influx of Millennial Consumers: Younger generations are exploring boating as a lifestyle choice, influencing design and marketing trends.

Leisure Boat Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 42.31 Billion |

| Market Size by 2033 |

USD 71.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Avon Marine; Azimut Benetti Group; Baja Marine; Bavaria Yachtbau GmbH; Bombardier Recreational Products (BRP) Inc.; Brunswick Corporation; Chaparral Boats, Inc.; Farr Yacht Design, Ltd.; Ferretti S.P.A.; Fountain Powerboats, Inc. |

Leisure Boat Market Dynamics

- Consumer Lifestyle Trends:

The dynamics of the leisure boat market are intricately tied to evolving consumer lifestyles. As disposable incomes rise and leisure time becomes more precious, individuals and families are seeking recreational activities that offer a unique and memorable experience. Leisure boats have emerged as a symbol of freedom and relaxation, aligning with the desire for outdoor adventure and quality time spent on the water. This shift in consumer preferences towards experiential recreation is a significant driver, shaping the market dynamics and influencing manufacturers to focus on creating boats that cater to diverse lifestyles and preferences.

- Technological Innovation and Sustainability:

The rapid pace of technological innovation is reshaping the leisure boat market dynamics. Integrating advanced technologies, such as GPS navigation, entertainment systems, and smart connectivity, enhances the overall boating experience, attracting tech-savvy consumers. Moreover, there is a growing emphasis on sustainability within the industry, with manufacturers investing in eco-friendly propulsion systems and materials. Electric and hybrid boats are gaining popularity, not only due to environmental concerns but also as consumers seek cost-effective and energy-efficient alternatives.

Leisure Boat Market Restraint

- High Initial Costs and Ongoing Maintenance:

A prominent restraint in the leisure boat market lies in the substantial initial costs associated with purchasing a boat, coupled with ongoing maintenance expenses. The upfront investment required for acquiring a leisure boat can be a significant financial barrier for potential buyers. Additionally, the continuous expenses related to storage, repairs, and upkeep may dissuade individuals from entering the market. Overcoming these cost-related challenges is essential for industry stakeholders to broaden the market's accessibility and appeal to a more diverse consumer base.

Stringent Regulatory Compliance:

Stringent regulatory requirements pose a significant challenge for the leisure boat market. Compliance with safety standards, emissions regulations, and licensing requirements varies across regions, necessitating manufacturers and operators to navigate a complex regulatory landscape. Meeting these diverse and often evolving standards can be resource-intensive and time-consuming, impacting both production processes and market entry.

Leisure Boat Market Opportunity

- Rising Interest in Boating Experiences:

A compelling opportunity for the leisure boat market lies in the growing interest and demand for unique boating experiences. Consumers are increasingly seeking personalized and memorable recreational activities, and the boating industry is well-positioned to capitalize on this trend. Offering themed cruises, adventure packages, and collaborative experiences with other recreational industries can attract a broader audience. Manufacturers and operators can seize this opportunity by diversifying their offerings to cater to different demographics and creating innovative experiences that go beyond traditional boating, thereby expanding the market and enhancing customer engagement.

- Emerging Markets and Global Expansion:

The leisure boat market presents a significant opportunity for expansion into emerging markets and global regions. As economic prosperity rises in developing countries, there is a corresponding increase in disposable income and interest in recreational activities. Targeting these untapped markets can unlock substantial growth potential for manufacturers and service providers. Moreover, promoting boating as a global leisure activity and facilitating international partnerships can contribute to market expansion.

Leisure Boat Market Challenges

- Economic Volatility and Affordability Concerns:

One of the significant challenges faced by the leisure boat market is its susceptibility to economic volatility. The industry's growth is closely tied to consumers' discretionary income, making it vulnerable during economic downturns. Affordability concerns also play a crucial role, as potential buyers may perceive leisure boats as high-cost investments. Addressing these challenges requires industry stakeholders to implement strategies that enhance affordability, such as offering financing options or developing cost-effective boat models, to ensure sustained demand even in economically uncertain times.

- Navigating Regulatory Compliance:

The leisure boat market encounters challenges in navigating and complying with diverse and evolving regulatory standards. Stringent regulations related to safety, emissions, and licensing vary across regions, imposing complexities on manufacturers and operators. Adapting products to meet different regulatory requirements and ensuring compliance with international standards are essential for global market participation.

Segments Insights:

Type Insights

New leisure boats dominated the market due to increasing first-time buyers and technological advancements in boat design. These buyers are seeking modern features such as connectivity, enhanced fuel efficiency, and luxurious comfort. The appeal of customization, warranties, and the assurance of a defect-free product contributes to this dominance. Manufacturers like Brunswick Corporation and Groupe Beneteau consistently launch updated models, targeting affluent consumers looking for modern recreational solutions. Moreover, the growing number of boat shows and expos, such as the Fort Lauderdale International Boat Show, provide a platform for customers to explore and purchase new boats, further bolstering sales.

Conversely, the fastest-growing segment is the used leisure boat market. Affordability, growing interest in pre-owned luxury, and the proliferation of certified refurbishment services have made used boats more appealing. Many consumers prefer buying pre-owned vessels with certified quality checks, often from trusted dealer networks or peer-to-peer platforms like Boat Trader or Boats.com. These platforms also allow potential buyers to access boats across geographies, expanding their choices. Economic downturns or inflationary pressures also drive interest in the second-hand market, especially among price-sensitive buyers or occasional users.

Product Insights

Motorized boats dominate the product segment, with their wide applicability across activities such as sportfishing, cruising, and luxury travel. These boats are known for their speed, convenience, and functionality. Outboard boats, in particular, have become popular due to advancements in engine efficiency and ease of maneuverability. Yachts represent the pinnacle of this category, favored by the ultra-rich for private travel and entertainment. The global appeal of motorized boats lies in their adaptability to both inland and coastal waters, their broad size range, and their ability to integrate high-end features like GPS navigation, sonar, and even AI-assisted piloting.

However, personal watercrafts (PWCs) are the fastest-growing motorized segment. Often called jet skis or water scooters, PWCs are favored for their compactness, agility, and affordability. They are especially popular in tourist hotspots where short-duration rentals attract large numbers of users. Companies like Sea-Doo and Yamaha have seen rising demand for models that combine performance with fuel efficiency. Additionally, PWCs cater to thrill-seekers and younger demographics, a trend amplified by their widespread presence on social media platforms. Their popularity has led to the creation of dedicated racing events and sports categories, further boosting this niche within the broader leisure boat market.

Regional Insights

North America leads the global leisure boat market, underpinned by robust infrastructure, high disposable incomes, and a deeply embedded boating culture. The U.S. alone boasts over 11 million registered recreational boats. Organizations like the National Marine Manufacturers Association (NMMA) actively support the industry through lobbying, exhibitions, and data dissemination. The presence of extensive coastlines, lakes, and rivers enhances accessibility. Moreover, innovations from American manufacturers in motorized boat segments and electric propulsion systems keep the region at the forefront. Canada, too, is a strong contributor, with its numerous lakes and scenic routes supporting both personal boating and marine tourism industries.

Asia-Pacific is emerging as the fastest-growing region, driven by rising affluence, expanding marina infrastructure, and government-led tourism programs. Countries like China, Australia, South Korea, and Thailand are experiencing a surge in boat sales, rentals, and coastal tourism. China’s focus on recreational marine development under the "Marine Economy" banner, and Australia’s recreational fishing boom, are strong contributing factors. Meanwhile, Southeast Asia's exotic coastlines are being positioned as boating and yachting hubs, attracting investments from both public and private sectors. International boat shows in cities like Shanghai and Singapore are also increasing awareness and interest in leisure boating across the region.

Some of the prominent players in the leisure boat market include:

- Avon Marine

- Azimut Benetti Group

- Baja Marine

- Bavaria Yachtbau GmbH

- Bombardier Recreational Products (BRP) Inc.

- Brunswick Corporation

- Chaparral Boats, Inc.

- Farr Yacht Design, Ltd.

- Ferretti S.P.A.

- Fountain Powerboats, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global leisure boat market.

Type

- New Leisure Boat

- Used Leisure Boat

Product

-

- Personal Watercraft

- Outboard Boats

- Yacht

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)