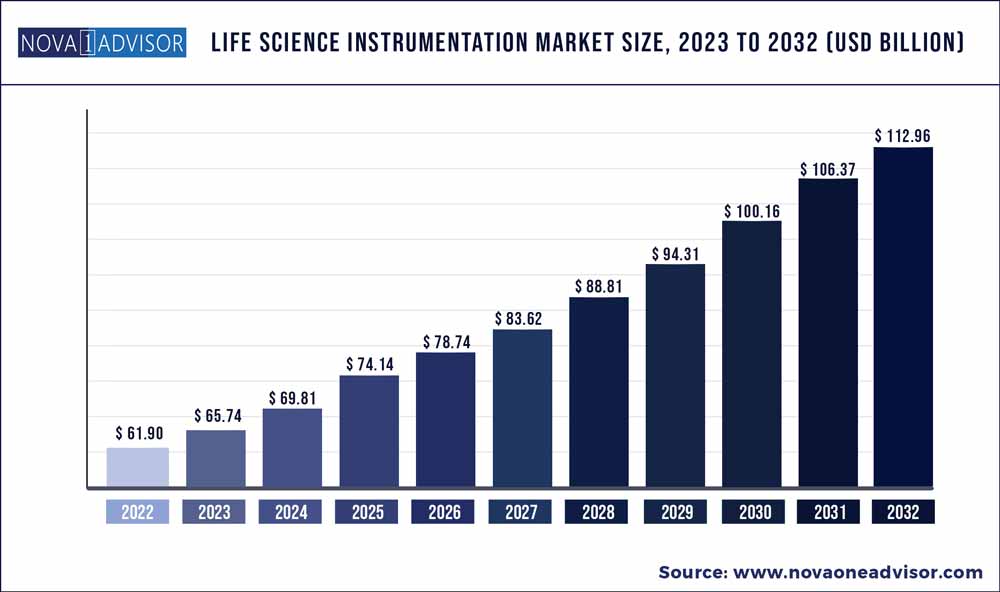

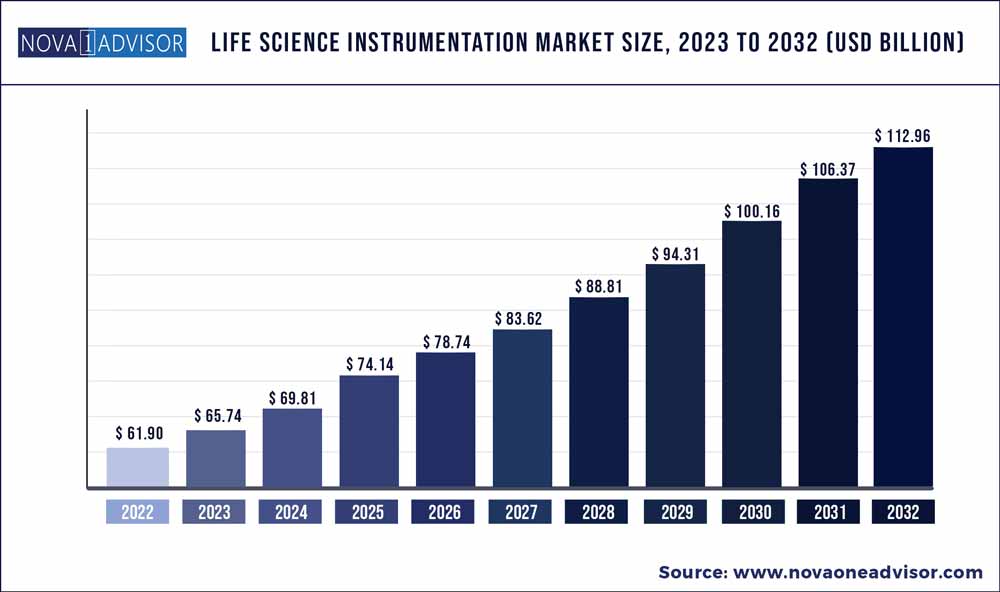

The global life science instrumentation market size was exhibited at USD 61.90 billion in 2022 and is projected to hit around USD 112.96 billion by 2032, growing at a CAGR of 6.2% during the forecast period 2023 to 2032.

Key Takeaways:

- The U.S. life science instrumentation market reached US$ 13.57 billion in 2022 and is priicted to be worth over US$ 22.31 billion by 2032, at a CAGR of 5.11% from 2023 to 2032.

- By technology, the spectroscopy segment accounted for the largest share of the life science instrumentation market in 2022.

- By application, the research applications segment of the life science instrumentation market to register significant growth in the near future.

- By end user, the pharmaceutical & biotechnology companies segment accounted for the largest share of the life science instrumentation market in 2022.

- By region, North America is expected to be the largest region in the life science instrumentation market during the forecast period.

Growth Factors

The life science instruments are commonly utilized for analytical techniques and method validation during drug development. Nowadays, several innovative technologies are used in the medication development process. The life science instrumentation market will benefit from rising demand for analytical instruments, strong growth in the biotechnology and pharmaceutical industries, and expanding application area of analytical instruments. As sequencing technologies aids in determining the origin of an illness, increased attention on next generation sequencing (NGS) is expected to promote market growth.

The life science instrumentation market is expected to benefit from an increase in research and development activities in various sectors such as biotechnology, pharmaceuticals, food and beverage, and agriculture. Moreover, the increased number of novel product launches by numerous prominent players is expected to boost the growth of the life science instrumentation market during the forecast period.

The growing incidence of chronic diseases in both developing and developed countries is projected to increase the demand for effective technology for early disease diagnosis, which will drive up the demand for instruments in life science. Furthermore, the market for life science instrumentation is being driven by increased public-private investments in life science research and technical developments in analytical equipment. However, the high cost of life science instrumentation is inhibiting the market’s expansion.

During the forecast period, the life science instrumentation market is expected to rise due to rising demand for effective diagnostic technologies and increasing government funding in the development of new instruments utilized in the life sciences and medical devices sectors. The growing applications of life science instruments in other industries, such as the food and beverage industry is expected to boost the life science instrumentation market growth during the forecast period.

The majority of life science and analytical technologies are utilized to study DNA in order to develop new pharmaceutical medications and determine food quality. The companies are heavily investing in this area in order to increase the market growth. The development of new products will improve the ability to accurately diagnose samples. It will assist in the targeting of treatment for a specific patient.

The growth of life science instrumentation market is projected to be hampered by high maintenance and operation costs. In addition, without an alternative, diagnosing the samples will be difficult because the lack of such intricate equipment would make the process much more complicated and cause the outcome to be delayed.

Life Science Instrumentation Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 65.74 Billion |

| Market Size by 2032 |

USD 112.96 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 6.2% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Technology, Application, End User, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Bruker Corporation, Eppendorf AG, Hitachi High Technologies Corporation, Becton Dickinson and Company, Bio-Rad Laboratories Inc., Waters Corporation, Thermo Fisher Scientific, Agilent Technologies, Shimadzu Corporation, Qiagen N.V. |

Life Science Instrumentation Market Dynamics

Driver: Increasing investments in pharmaceutical R&D

The pharmaceutical industry focuses and invests in research to manufacture protein-related products. Drug development and manufacturing involve different types of analytical instruments. Analytical instruments evaluate drug molecules, protein analysis and purification, and quality control. Protein identification and separation is an important step in drug manufacturing. Technologically advanced equipment helps understand the characterization of a molecule and ensure its safety and purity. In recent years, emerging markets have also witnessed a significant increase in foreign direct investment and government investments in pharmaceutical R&D. Thus, increasing R&D spending in the life sciences, pharmaceutical, and biotechnology sectors will likely increase the application usage of life science instruments.

Restraint: High equipment costs

Recent technological advancements and newly added features have increased the cost of life science instruments. There is a consistent rise in the cost of these systems with the introduction of automation with the help of AI. The new state-of-the-art equipment consumes less time and provides users with accurate results but is often costly. In addition, there are recurrent expenses in the form of maintenance costs, which ultimately drive up the overall cost of ownership. Small-scale users such as academic and research institutes, diagnostic laboratories, and small and medium-sized pharma-biopharma companies find it difficult to afford such equipment due to restricted budgets. This high cost has left users reliant on government and private research funding, which restricts market growth to a certain extent.

Opportunity: Widening application scope of analytical instruments

Analytical instruments find a wide range of applications in food and beverage, environmental testing, and forensic industries, among others. Analytical techniques play an important role in analyzing food materials before, during, and after manufacturing. Pesticides, additives, and other contaminants can be detected with the help of analytical equipment. The instruments also help conduct quality control of packaging materials. Analytical technologies play a crucial role in the environmental testing industry. Different analytical techniques can analyze air and water samples and detect solids, liquid aerosols, trace gases, and volatile organic compounds. A rising focus on environment conservation and preservation has increased the demand for life science instruments and technologies in this application segment.

Challenges: Inadequate infrastructure for research in emerging countries

Adequate infrastructure is very important to conduct research and development. Appropriate financial support, good research laboratories, and trained professionals are required to use life science instruments for research. Emerging countries in Asia (such as India, Indonesia, and the Philippines), the Middle East (such as Oman, Iraq, and UAE), and Africa lack the necessary infrastructure. This ultimately creates a challenge for the growth of the market in emerging countries.

By technology, the spectroscopy segment accounted for the largest share of the life science instrumentation market in 2022.

Based on technology, the global market is segmented into spectroscopy, chromatography, PCR, immunoassays, lyophilization, liquid handling, clinical chemistry analyzers, microscopy, flow cytometry, NGS, centrifuges, electrophoresis, cell counting, and other technologies. In 2022, the spectroscopy segment accounted for the largest market share. The rising use of advanced instruments in oncology research and the need for better sensitivity and enhanced speed is driving the segment growth.

By end user, the pharmaceutical & biotechnology companies segment accounted for the largest share of the life science instrumentation market in 2022.

Based on end user, the global market is segmented into hospitals and diagnostic laboratories, pharmaceutical & biotechnology companies, academic & research institutes, agriculture & food industries, environmental testing laboratories, clinical research organizations, and other end users. In 2022, pharmaceutical & biotechnology companies accounted for the largest market share. The highest share of this segment is attributed to significant use of life science equipment for the development of medication and rise in R&D.

By application, the research applications segment of the life science instrumentation market to register significant growth in the near future.

Based on application, the global market is segmented into research applications, clinical & diagnostic applications, and other applications. Research applications to register the highest growth rate during the forecast period. The major factors responsible for the highest growth rate of this segment are the availability of funding for R&D in academic institutes.

Regional Insights

Based on the region, the North America segment dominated the global life science instrumentation market in 2022, in terms of revenue and is estimated to sustain its dominance during the forecast period. The life science instrumentation is employed in a variety of applications in North America. The life science instrumentation has shown to be a useful tool for a variety of applications including pharmaceutical applications, final product testing, and food safety testing.

On the other hand, in the life science instrumentation market, the Asia-Pacific region is one of the most profitable regions. The region’s growth is being fueled by strategic expansions by important market players in rising Asian countries, the growing pharmaceutical industry in China and India.

Some of the prominent players in the Life Science Instrumentation Market include:

- Bruker Corporation

- Eppendorf AG

- Hitachi High Technologies Corporation

- Becton Dickinson and Company

- Bio-Rad Laboratories Inc.

- Waters Corporation

- Thermo Fisher Scientific

- Agilent Technologies

- Shimadzu Corporation

- Qiagen N.V.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Life Science Instrumentation market.

By Technology

- Spectroscopy

- Mass Spectroscopy

- Molecular Spectroscopy

- Atomic Spectroscopy

- Chromatography

- Liquid Chromatography (LC)

- Gas Chromatography (GC)

- Super Critical Fluid Chromatography (SCF)

- Thin-layer Chromatography (TLC)

- Flow Cytometry

- Cell Analyzers

- Cell Sorters

- Next Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Microscopy

- Optical Microscopes

- Electron Microscopes

- Scanning Probe Microscopes

- Others

- Liquid Handling

- Electronic Liquid Handling Systems

- Automated Liquid Handling Systems

- Manual Liquid Handling Systems

- Clinical Chemistry Analyzers

- Electrophoresis

- Gel Electrophoresis Systems

- Capillary Electrophoresis Systems

- Cell Counting

- Automated Cell Counters

- Hemocytometers and Manual Cell Counters

- Other Technologies

- Laboratory Freezers

- Heat Sterilization

- Microplate Systems

- Robotic systems

- Laboratory Balances & scales

- Colorimeters

- Incubators

- Fume Hoods

- PH Meters

- Conductivity and Resistivity Meters

- Dissolved CO2 and O2 Meters

- Titrators

- Gas Analyzers

- TOC Analyzers

- Thermal Analyzers

- Shakers/Rotators and Stirrers

By Application

By End User

- Pharma-Biotech

- Agri and Food Industry

- Hospitals & Diagnostic Labs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)