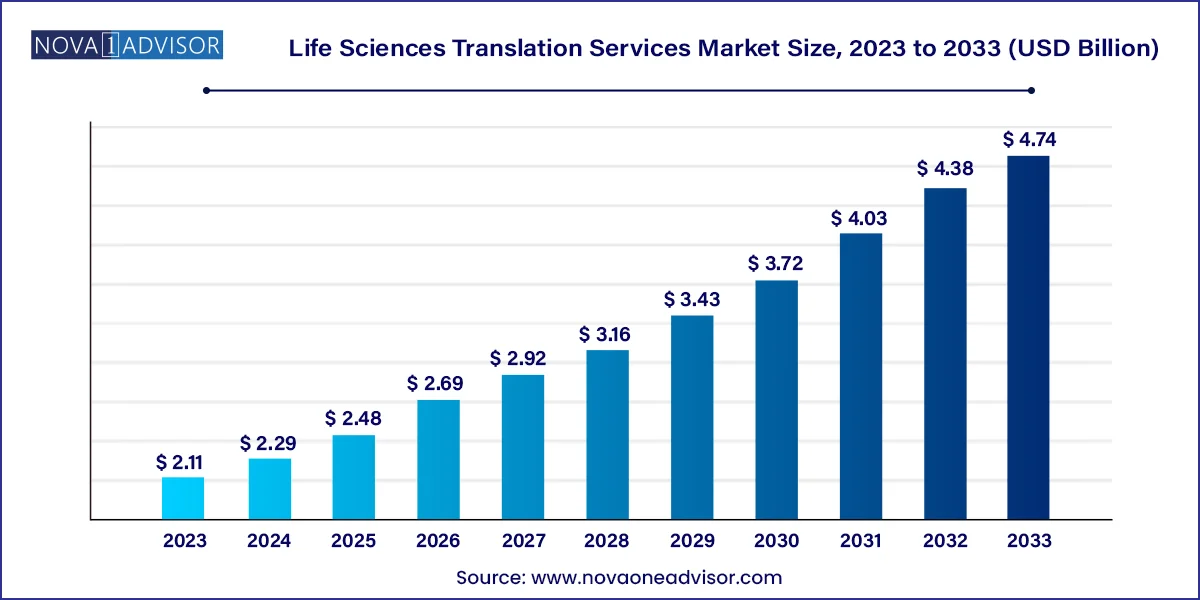

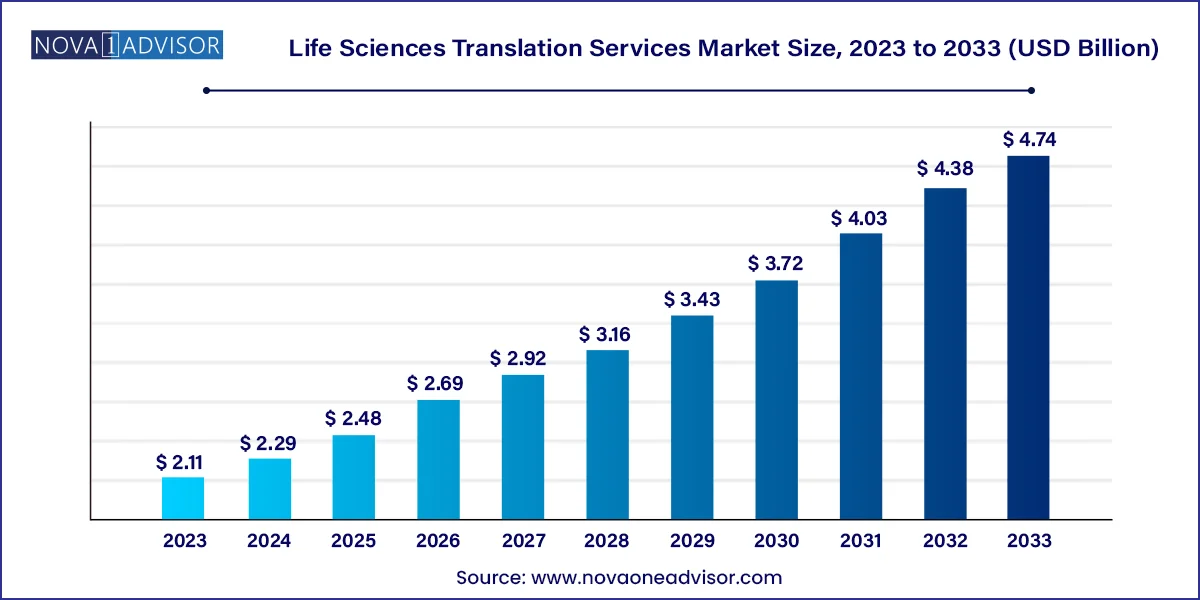

Life Sciences Translation Services Market Size and Forecast 2024 to 2033

The global life sciences translation services market size was valued at USD 2.11 billion in 2023 and is anticipated to reach around USD 4.74 billion by 2033, growing at a CAGR of 8.44% from 2024 to 2033.

Life Sciences Translation Services Market Key Takeaways

- North America life sciences translation services market dominated globally, with the largest revenue share of 46.28% in 2023.

- The Asia Pacific life sciences translation services market is expected to witness the fastest CAGR over the forecast period.

- Based on type, the technical translation segment dominated the market with the largest revenue share of 39.75% in 2023.

- The clinical/document translation segment is expected to experience significant growth in the forecast period.

- Based on category, the technology/AI-based segment dominated the market with the largest revenue share of 67.87% in 2023 and is expected to grow at the fastest CAGR during the forecast period.

- The manual segment is expected to grow at a significant CAGR during the forecast period.

Market Overview

The life sciences translation services market has evolved into a critical pillar within the healthcare, pharmaceutical, and biotechnology ecosystems. It encompasses the linguistic conversion of complex, regulated, and often time-sensitive documentation across clinical trials, regulatory filings, product labeling, scientific research, and marketing communications. In an increasingly globalized life sciences environment, where companies routinely engage with multinational regulatory bodies, patients, healthcare professionals, and supply chains, the need for accurate and culturally sensitive translation has never been more essential.

From regulatory submissions to patient consent forms, and from medical device manuals to scientific manuscripts, the demand for precision translation services is growing across all subsectors. Errors or ambiguities in translated content can result in regulatory delays, product recalls, or even patient harm—making linguistic accuracy a non-negotiable requirement. Life sciences translation is distinct from general translation services in that it demands industry-specific expertise, familiarity with scientific terminologies, and compliance with local and international health authorities such as the FDA, EMA, and PMDA.

With increasing clinical trials conducted across non-English-speaking countries, the rise of patient-centric healthcare models, and the growth of emerging life science hubs in Asia-Pacific and Latin America, the demand for multilingual communication is surging. Additionally, digital health platforms, wearable technologies, and telemedicine solutions further necessitate multilingual user interfaces, privacy policies, and medical literature.

The market has become highly competitive, comprising specialized translation agencies, large language service providers (LSPs), AI-powered platforms, and in-house translation departments. Technological innovation—particularly AI, neural machine translation (NMT), and computer-assisted translation (CAT) tools—is disrupting the traditional translation workflow. However, given the stakes involved, human review and domain expertise remain irreplaceable components in this high-stakes landscape.

Major Trends in the Market

-

Rise of Hybrid Translation Models (AI + Human Review): Life sciences companies are adopting a blended model combining AI-powered translation tools with expert human linguists for faster and cost-effective translation without compromising quality.

-

Increased Demand from Clinical Trials Expansion: The growing number of multinational clinical trials is driving demand for patient-facing translation services across consent forms, trial protocols, and case report forms.

-

Growing Importance of Localization over Literal Translation: The shift toward patient-centricity is prompting firms to prioritize cultural adaptation and linguistic localization to improve engagement and comprehension.

-

Regulatory Harmonization Driving Translation Complexity: As countries align regulatory standards (e.g., through ICH and WHO guidelines), companies require uniform, high-accuracy translations of complex dossiers.

-

Surge in Multilingual Medical Device Documentation: With medical devices becoming increasingly software-integrated and globally distributed, the demand for localized IFUs (instructions for use) and labeling has grown significantly.

-

Language Expansion in Pharmacovigilance (PV) Reporting: Regulatory bodies are requiring adverse event reports and safety summaries to be submitted in multiple languages, expanding translation requirements.

-

Automation and Cloud Integration in Translation Workflows: Modern LSPs are integrating cloud-based translation management systems (TMS) to streamline real-time collaboration, version control, and compliance tracking.

Life Sciences Translation Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.29 Billion |

| Market Size by 2033 |

USD 4.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.44% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, category, end use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Vistatec, Language Scientific, marstranslation, BayanTech., Lionbridge Technologies, LLC., Conversis, Morningside, Inc, Crimson Interactive Inc., Welocalize Life Sciences, ALM Translations Ltd, Stepes, Questel., and BURG Translations

|

Market Driver: Increasing Globalization of Clinical Trials and Regulatory Submissions

A key driver fueling the life sciences translation services market is the rapid global expansion of clinical trials and regulatory operations. Pharmaceutical, biotechnology, and medical device companies are increasingly conducting trials across Asia-Pacific, Latin America, Eastern Europe, and Africa to access diverse patient populations, reduce costs, and accelerate enrollment. These multinational studies require translation of clinical trial protocols, informed consent documents, investigator brochures, and safety reports into the local languages of the study regions.

Moreover, regulatory bodies across geographies now demand localized submissions. For instance, the European Medicines Agency (EMA) mandates labeling in the official language of each member state. The U.S. FDA encourages multilingual labeling and patient education materials, particularly for populations with limited English proficiency. As a result, organizations must navigate a complex linguistic landscape while ensuring regulatory accuracy and patient comprehension. This global expansion is creating consistent and recurring demand for expert translation services that understand both the scientific and regulatory nuances of life sciences.

Market Restraint: High Cost and Time Intensity of Human-Centric Translation

Despite the importance of accurate translation, a major restraint in the market is the high cost and time intensity associated with expert-driven translation. Life sciences documents are typically dense, technical, and require stringent quality control measures such as back-translation, validation, and linguistic quality assurance. This results in longer turnaround times and increased costs, especially when compared to general translation services.

For large pharmaceutical firms managing hundreds of regulatory filings and clinical sites, these delays can create workflow bottlenecks. Moreover, sourcing skilled linguists with both scientific expertise and language fluency remains a challenge in some niche markets. While machine translation can help reduce costs, its lack of contextual awareness makes it unsuitable for standalone use in highly sensitive content. As such, companies must strike a balance between speed, quality, and cost—an ongoing challenge that continues to restrain market scalability.

A significant opportunity lies in the integration of AI, NLP, and cloud-based translation management platforms within life sciences translation workflows. As translation volumes surge with expanding global operations, organizations are turning to automation to improve turnaround times and reduce costs. Tools like computer-assisted translation (CAT), translation memory (TM), and neural machine translation (NMT) engines can increase productivity without compromising accuracy—especially when paired with expert post-editing.

Leading platforms are now offering translation memory systems that learn from previous documents, ensuring consistency across large regulatory submissions or multi-site trials. AI-driven quality assurance tools are also being adopted to flag terminology mismatches and formatting inconsistencies. Moreover, cloud-based TMS platforms enable real-time collaboration among project managers, translators, reviewers, and regulatory affairs teams across the globe. This technological evolution is expected to streamline workflows, improve transparency, and enable scalable, agile translation models suited to the fast-paced life sciences sector.

Life Sciences Translation Services Market Segmentation Insights

Life Sciences Translation Services Market By Type Insights

Clinical/document translation remains the dominant segment due to its indispensable role in multinational clinical trials and regulatory submissions. This includes translation of protocols, case report forms (CRFs), informed consent forms, investigator brochures, clinical study reports, and ethics committee documentation. These documents must comply with international regulatory requirements and local ethics boards, necessitating both linguistic precision and scientific integrity. As clinical trials increasingly involve decentralized and cross-border study models, the need for multilingual documentation has become constant and complex, maintaining this segment’s leadership.

In contrast, labeling and device translation is the fastest-growing segment, propelled by globalization in medical device manufacturing and distribution. IFUs, user manuals, packaging labels, and safety instructions must be localized into the target market's official language to ensure patient safety and regulatory compliance. The growth of software-based and wearable medical devices, which involve UI/UX localization and real-time digital content updates, is also expanding the scope of this segment. Regulatory shifts—such as the European Union's MDR (Medical Device Regulation)—further necessitate consistent, accurate translation of device documentation into multiple languages.

Life Sciences Translation Services Market By Category Insights

Manual translation leads the market due to its unmatched accuracy, contextual understanding, and compliance assurance. Highly regulated industries like pharmaceuticals and medical devices demand linguists with deep domain knowledge who can interpret scientific nuance and comply with evolving international guidelines. Manual translation, often supplemented by linguistic validation, back-translation, and expert review, remains the gold standard for critical documents. This includes submissions to regulatory bodies, safety summaries, and consent forms that directly impact patient outcomes and legal approval.

However, technology/AI-based translation is growing rapidly, driven by the rise of scalable document workflows, increasing translation volumes, and cost pressures. While AI alone is not sufficient for final submission in most cases, it significantly speeds up first drafts and localization efforts. Advanced neural machine translation (NMT) engines trained on life sciences content—like those used by SDL Trados or DeepL—are becoming integral to translation agencies and in-house teams. When paired with post-editing by qualified reviewers, this hybrid model offers a practical compromise between quality and efficiency.

Life Sciences Translation Services Market By End Use Insights

Pharmaceutical manufacturers dominate the market, accounting for the largest share of translation services. These companies require multilingual communication for nearly every stage of the drug lifecycle—from clinical development and regulatory submission to post-marketing surveillance and pharmacovigilance. As regulatory scrutiny intensifies and global trials expand, pharmaceutical firms must manage thousands of translated documents annually across dozens of languages. Moreover, the rise in biologics and biosimilars necessitates detailed documentation, further increasing demand for precise and timely translations.

Clinical Research Organizations (CROs) are the fastest-growing end-use segment, owing to their expanding role as outsourced partners in drug development. CROs manage end-to-end clinical operations, often across global sites, and serve as central hubs for communication between sponsors, investigators, regulators, and patients. This involves large-scale document translation for trial startup, site management, data capture, and adverse event reporting. As sponsors seek cost-effective and agile partnerships, CROs are expanding their linguistic capabilities—either in-house or via LSPs—creating a high-growth opportunity in this segment.

Life Sciences Translation Services Market Top Key Companies:

The following are the leading companies in the life sciences translation services market. These companies collectively hold the largest market share and dictate industry trends.

- Vistatec

- Language Scientific

- marstranslation

- BayanTech.

- Lionbridge Technologies, LLC.

- Conversis

- Morningside, Inc

- Crimson Interactive Inc.

- Welocalize Life Sciences

- ALM Translations Ltd

- Stepes

- Questel.

- BURG Translations

Life Sciences Translation Services Market Recent Developments

-

TransPerfect (February 2024): Announced the launch of a new AI-assisted translation platform specifically designed for medical device IFU translation, integrated with EU MDR compliance modules.

-

RWS Group (January 2024): Partnered with a leading CRO to develop multilingual translation workflows for a Phase III oncology trial across Asia and Latin America, using its Trados cloud platform.

-

Lionbridge Life Sciences (December 2023): Expanded its linguist network to cover rare and indigenous languages required in remote trial locations, enhancing its global trial translation capacity.

-

Welocalize (November 2023): Launched a new life sciences content localization engine powered by domain-specific neural machine translation, targeting biotech startups and mid-market pharma.

-

SDL (October 2023): Released an upgraded version of SDL Trados tailored for life sciences, with enhanced integration to ICH guidelines and automated quality assurance features.

Life Sciences Translation Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Life Sciences Translation Services market.

By Type

- Clinical/Document Translation

- Technical Translation

- Labeling and Device Translation

- Corporate/Marketing Translation

By Category

- Manual

- Technology/AI-Based

By End Use

- Pharmaceutical Manufacturers

- Biotechnology Companies

- Medical Device Manufacturers

- Clinical Research Organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)