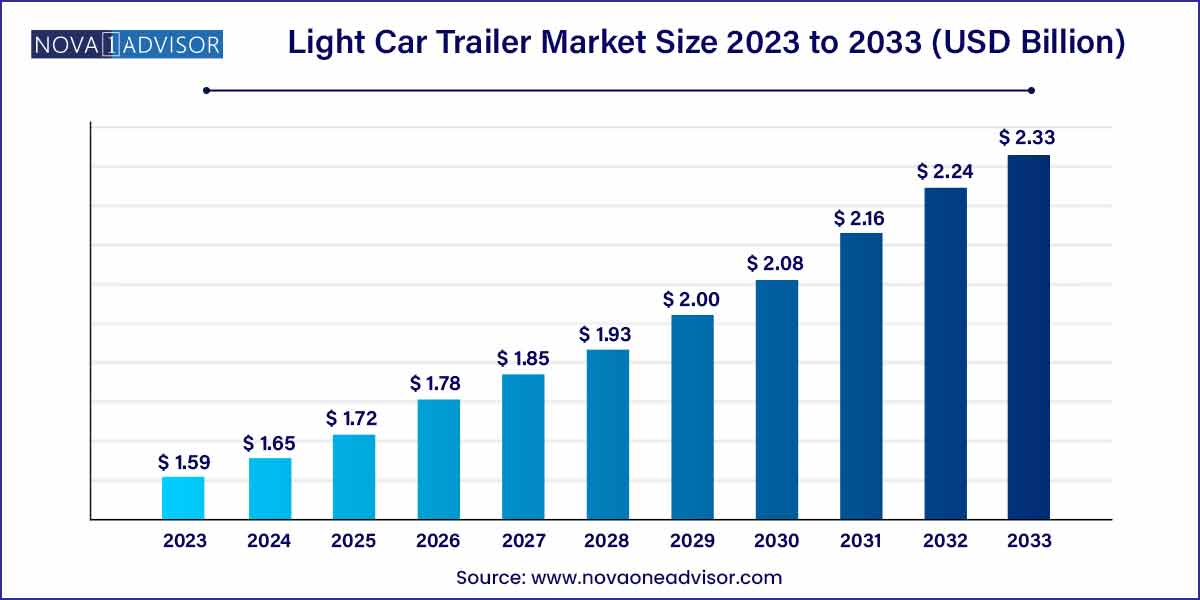

The global light car trailer market was estimated at USD 1.59 billion in 2023 and is expected to surpass around USD 2.33 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 3.9% during the forecast period of 2024 to 2033.

Key Takeaways:

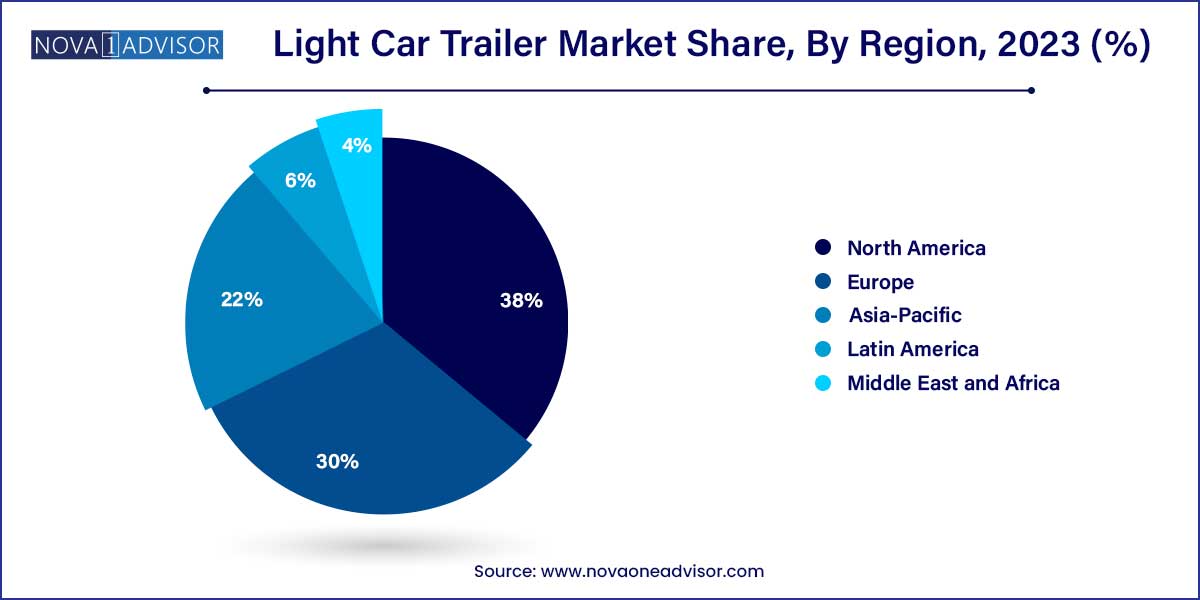

- North America held the largest revenue share of over 38.0% in 2023

- The utility light car trailer segment held the largest revenue share of over 60.0% in 2023

- Single axle light car trailers held the largest share of over 50.0% in 2023

- The open trailer held the largest share of over 54.0% in 2023.

- Motorcycle light car trailers held the largest share of over 20.0% in 2023

Light Car Trailer Market: Overview

The light car trailer market is witnessing steady growth due to several factors such as increasing recreational activities, burgeoning demand for transportation of lightweight vehicles, and advancements in trailer design and technology. A light car trailer, typically weighing less than 3,000 pounds, serves as a practical solution for individuals and businesses alike, offering convenience and efficiency in transporting vehicles over short to medium distances.

Light Car Trailer Market Growth

The growth of the light car trailer market is propelled by several key factors. Firstly, the increasing popularity of recreational activities such as camping, off-roading, and motorsports drives the demand for trailers capable of transporting vehicles like ATVs and motorcycles. Secondly, advancements in trailer design and technology, including aerodynamic constructions and lightweight materials, enhance fuel efficiency and safety, appealing to consumers seeking reliable towing solutions. Additionally, the expansion of the automotive industry, with the introduction of lightweight vehicles, contributes to the rising demand for light car trailers as efficient means of transportation. Urbanization trends and evolving mobility needs also play a role, as compact trailers offer flexibility for urban dwellers to transport their vehicles conveniently. Lastly, growing environmental concerns and regulatory compliance requirements drive the preference for fuel-efficient vehicles, further boosting the demand for light car trailers.

Light Car Trailer Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1.59 Billion |

| Market Size by 2033 |

USD 2.33 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Axle, Product, Design, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Aluma Ltd.; ATC Trailers Holdings, Inc.; Felling Trailers, Inc.; Haulmark Industries, Inc.; Kaufman Trailers, Inc.; Pace American, Inc.; Woodford Trailers Ltd.; Sylvansports; Sundowner Trailers, Inc.; Diamond C Trailer (RoadClipper Enterprise, Inc.) |

Light Car Trailer Market Dynamics

- Rising Recreational Activities:

The surge in recreational activities such as camping, off-roading, and motorsports is a significant driving force behind the growth of the light car trailer market. As more individuals and families engage in outdoor pursuits, there is an increasing need for trailers capable of efficiently transporting recreational vehicles like ATVs, motorcycles, and small boats. This trend is fueled by a desire for adventure and exploration, leading consumers to invest in versatile trailers that enable them to transport their recreational equipment safely and conveniently.

- Technological Advancements:

Continuous advancements in trailer design and technology have a profound impact on the light car trailer market. Manufacturers are increasingly incorporating innovative features such as aerodynamic designs, lightweight materials, and advanced braking systems to enhance the performance and safety of trailers. These technological enhancements not only improve fuel efficiency but also ensure a smoother towing experience, thereby attracting consumers who prioritize efficiency and convenience. Additionally, the introduction of smart trailer technologies, such as integrated monitoring systems and wireless connectivity, further enhances the appeal of light car trailers by providing users with real-time data and enhanced control over their towing experience.

Light Car Trailer Market Restraint

- Regulatory Compliance and Safety Standards:

One of the primary restraints facing the light car trailer market is the stringent regulatory compliance and safety standards imposed by government authorities. Compliance with various safety regulations, including towing capacity limits, trailer braking requirements, and lighting specifications, adds complexity and cost to the manufacturing process. Failure to meet these standards can result in legal repercussions and damage to brand reputation. Additionally, ensuring compliance with diverse regulatory frameworks across different regions poses challenges for manufacturers operating in multiple markets.

- High Initial Cost and Maintenance Expenses:

Another significant restraint for the light car trailer market is the high initial cost of purchasing a trailer and ongoing maintenance expenses. Light car trailers, especially those equipped with advanced features and technologies, can be relatively expensive, making them a significant investment for consumers. Moreover, ongoing maintenance costs, including repairs, servicing, and insurance, further add to the total cost of ownership over the trailer's lifespan. This high cost of acquisition and maintenance may deter price-sensitive consumers from investing in a light car trailer or prompt them to opt for alternative transportation solutions, thereby limiting market growth.

Light Car Trailer Market Opportunity

- Growing Demand for Electric Vehicles (EVs):

The increasing adoption of electric vehicles (EVs) presents a significant opportunity for the light car trailer market. As consumers transition towards more environmentally friendly modes of transportation, there is a rising demand for trailers capable of towing EVs over short to medium distances. Light car trailers equipped with features such as regenerative braking systems, aerodynamic designs, and lightweight materials can cater to the specific requirements of EV owners, offering efficient and eco-friendly transportation solutions. Moreover, with governments worldwide incentivizing the adoption of EVs through subsidies and infrastructure development, the demand for light car trailers tailored for electric vehicles is expected to witness substantial growth, presenting manufacturers with a lucrative market opportunity to capitalize on.

- Expansion of E-Commerce and Last-Mile Delivery Services:

The rapid expansion of e-commerce and last-mile delivery services represents another promising opportunity for the light car trailer market. With the proliferation of online shopping platforms and the growing preference for doorstep deliveries, there is an increasing need for efficient logistics solutions to transport goods from distribution centers to end consumers. Light car trailers, equipped with features such as adjustable cargo space, secure tie-down points, and lightweight construction, can serve as versatile tools for transporting small to medium-sized parcels and packages over short distances.

Light Car Trailer Market Challenges

- Competition from Alternative Transportation Solutions:

One of the primary challenges confronting the light car trailer market is the increasing competition from alternative transportation solutions. With the rise of car-sharing services, ride-hailing platforms, and rental options for recreational vehicles, consumers have access to a wide range of alternatives for transporting their vehicles or belongings. These alternative solutions often offer convenience, flexibility, and cost-effectiveness, posing a threat to the traditional light car trailer market. Additionally, advancements in autonomous vehicle technology and the development of self-driving delivery vehicles could further disrupt the market by offering efficient and autonomous transportation solutions that eliminate the need for trailers altogether.

- Infrastructure and Towing Regulations:

Infrastructure limitations and towing regulations present significant challenges for the light car trailer market. Inadequate road infrastructure, including narrow lanes, low bridges, and weight restrictions on certain roads, can restrict the use of light car trailers in certain regions or limit the routes available for towing vehicles. Moreover, varying towing regulations and licensing requirements across different jurisdictions add complexity and compliance burdens for trailer owners and operators. Navigating these regulations can be particularly challenging for consumers who are new to towing or for businesses operating across multiple geographic areas. Additionally, insufficient parking and storage facilities for trailers in urban areas further exacerbate the challenges associated with trailer ownership and usage.

Segments Insights:

Type Insights

Utility light car trailers dominated the market in 2024, primarily due to their versatile applications across a wide range of industries and personal uses. Utility trailers are often used for moving household goods, landscaping equipment, construction materials, and agricultural products. Their open design and adaptability make them the preferred choice for consumers seeking flexible, multipurpose hauling solutions.

However, recreational light car trailers are the fastest-growing segment, fueled by rising participation in leisure activities like camping, boating, and motorsports. Recreational trailers are often designed for specific uses, such as carrying boats, motorcycles, or snowmobiles, and they offer specialized features like tie-down points, ramps, and protective enclosures. As consumer spending on outdoor experiences continues to climb, the recreational trailer segment is poised for robust growth.

Axle Insights

Single axle light car trailers dominated the axle segment, reflecting their cost-effectiveness, lighter weight, and ease of maneuverability. Single axle trailers are ideal for small- to medium-load transportation and are favored by individuals and small businesses for their affordability and lower maintenance costs.

Meanwhile, multi-axle trailers are the fastest-growing axle segment. As users demand the ability to haul heavier loads safely and with greater stability, multi-axle designs—which distribute weight more evenly and offer better road handling—are gaining popularity. They are particularly in demand for hauling boats, large motorcycles, and multiple recreational vehicles simultaneously.

Design Insights

Open trailers dominated the light car trailers market, as they are more affordable, lightweight, and versatile across multiple applications. Open designs allow for easy loading and unloading of irregular-sized cargo, appealing to both personal and professional users.

Conversely, enclosed trailers are the fastest-growing design segment. Enclosed trailers offer superior protection against weather conditions, theft, and damage during transportation, making them highly desirable for carrying expensive equipment, motorcycles, and sensitive goods. Businesses transporting valuable merchandise and individuals seeking added security for recreational equipment increasingly prefer enclosed trailer solutions.

Product Insights

OEM (Original Equipment Manufacturer) trailers dominated the product segment, as consumers often prefer purchasing brand-new trailers directly from manufacturers, ensuring warranty coverage, access to latest models, and customization options. Leading OEMs also invest in marketing, dealership networks, and after-sales service, reinforcing customer trust.

However, motorcycle light car trailers are the fastest-growing product subsegment. The rising interest in motorcycle tourism, biking events, and weekend road trips has led to increasing demand for lightweight trailers specifically designed for easy and secure motorcycle transport. Models that allow single or dual motorcycle carriage with built-in ramps and tie-down systems are particularly popular.

Regional Insights

North America dominated the light car trailers market in 2024, led by the United States and Canada, where trailer ownership is widespread among both individuals and small businesses. The region's strong culture of road trips, outdoor sports, DIY projects, and recreational vehicle usage has created consistent demand for light car trailers. The extensive network of parks, lakes, and off-road trails further supports the need for convenient cargo transport solutions.

Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and the expanding middle class in countries like China, India, and Australia. Adventure tourism, water sports, and motorcycle touring are gaining popularity in this region, boosting the sales of recreational and utility trailers. Additionally, the growth of e-commerce and small-scale businesses requiring last-mile transport solutions fuels demand for light trailers in urban and semi-urban areas.

Some of the prominent players in the light car trailer market include:

- Aluma Ltd.

- ATC Trailers Holdings, Inc.

- Felling Trailers, Inc.

- Haulmark Industries, Inc.

- Kaufman Trailers, Inc.

- Pace American, Inc.

- Woodford Trailers Ltd.

- Sylvansports

- Sundowner Trailers, Inc.

- Diamond C Trailer (RoadClipper Enterprise, Inc.)

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global light car trailer market.

Type

- Utility Light Car Trailer

- Recreational Light Car Trailer

Axle

- Single Axle Light Car Trailer

- Multi Axle Light Car Trailer

Product

- OEM

- Motorcycle Light Car Trailer

- Snowmobile Light Car Trailer

- Watercraft Light Car Trailer

- Passenger Light Car Trailer

Design

- Enclosed Trailer

- Open Trailer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)