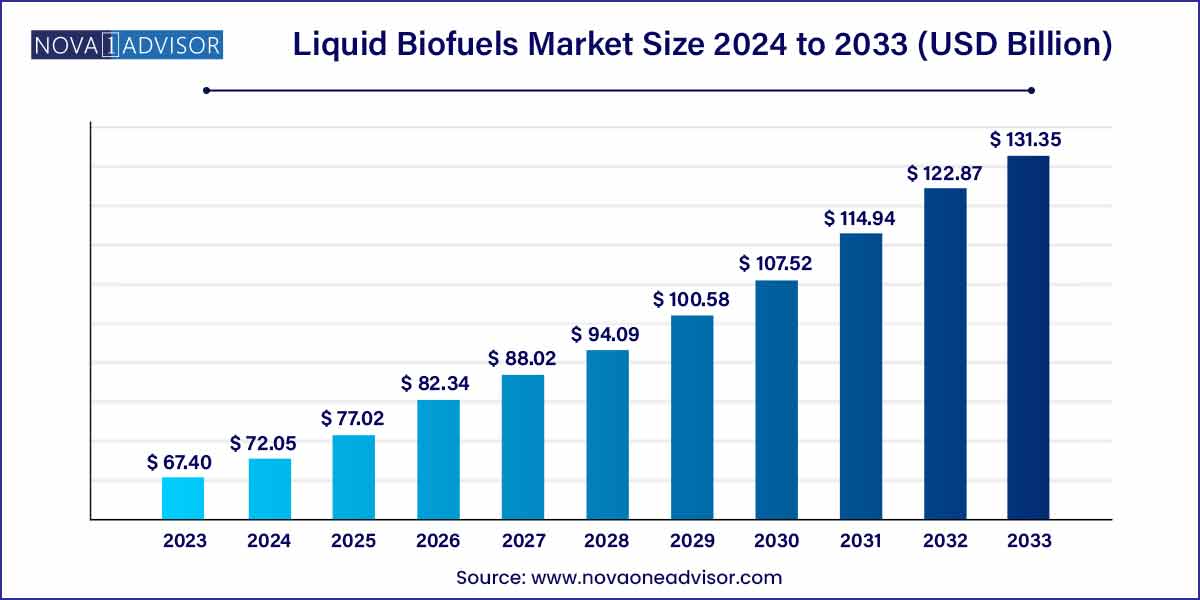

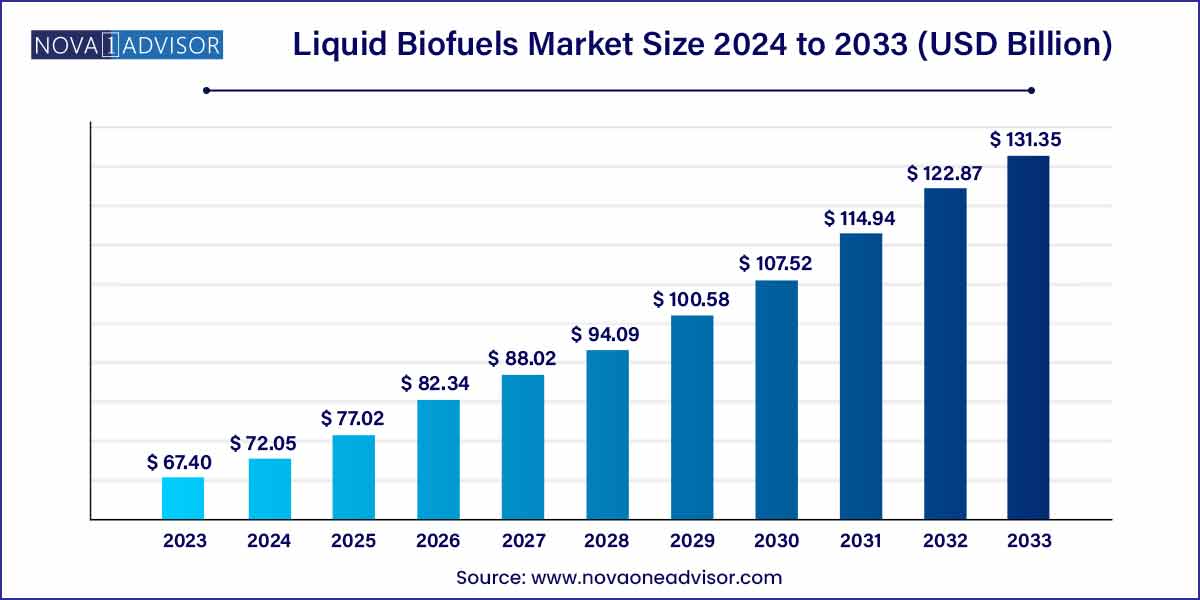

The global liquid biofuels market size was exhibited at USD 67.40 billion in 2023 and is projected to hit around USD 131.35 billion by 2033, growing at a CAGR of 6.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- This compares the 10% of global transportation fuel demand with the current level which is around 3.5%

- North America has dominated the global market over the past few years, owing to the abundance of feedstock and arable area for biofuel production.

- Transportation biofuel consumption is needed to triple by 2033.

Liquid Biofuels Market: Overview

The liquid biofuels market is emerging as a pivotal component of the global energy transition landscape, offering a sustainable alternative to conventional fossil fuels. Liquid biofuels are renewable fuels derived from biomass sources, including agricultural crops, forestry residues, algae, and waste materials. They are primarily used in transportation, power generation, and heating applications, contributing significantly to carbon emission reduction goals.

In 2024, the global focus on mitigating climate change, coupled with supportive governmental policies, is propelling the growth of the liquid biofuels market. The sector is diversified into various products, notably bioethanol and biodiesel, each catering to specific energy demands. Biofuels provide distinct advantages, including biodegradability, carbon neutrality over their lifecycle, and adaptability with existing internal combustion engines. Furthermore, the increasing volatility in crude oil prices and geopolitical tensions surrounding oil supplies have heightened the attractiveness of biofuels as an energy security measure.

Significant investments in research and innovation are also shaping the market. Advanced biofuels, such as second-generation bioethanol and algal biodiesel, are under extensive development to overcome limitations associated with food crop usage and land competition. As industries, transportation sectors, and governments push towards net-zero emissions, liquid biofuels stand out as a critical solution, especially for hard-to-electrify sectors like aviation and heavy freight transportation.

Liquid Biofuels Market Growth

The growth of the liquid biofuels market is underpinned by several key factors. Firstly, stringent environmental regulations aimed at reducing greenhouse gas emissions have spurred demand for renewable energy sources, driving the adoption of biofuels. Additionally, volatile oil prices and geopolitical uncertainties have intensified the focus on alternative fuel sources, positioning liquid biofuels as attractive substitutes to traditional fossil fuels. Moreover, government mandates and incentives, such as Renewable Fuel Standards (RFS) and Low Carbon Fuel Standards (LCFS), provide a regulatory framework that encourages the production and consumption of biofuels. Technological advancements in feedstock diversification, production processes, and distribution infrastructure further contribute to market growth, enhancing the efficiency and scalability of biofuel production. Finally, increasing consumer awareness and demand for sustainable energy solutions reinforce the market's upward trajectory, fostering innovation and investment in the liquid biofuels sector.

Liquid Biofuels Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 67.40 Billion |

| Market Size by 2033 |

USD 131.35 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, And Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Archer Daniels Midland Company; Gevo; Green Plains; Wilmar International; Algenol; Pacific Ethanol Inc.; Valero Energy Corp.; Petrobras; Butamax; Renewable Energy Corp.; and Bunge North America Inc. |

Liquid Biofuels Market Dynamics

The dynamics of the liquid biofuels market are significantly influenced by regulatory frameworks established by governments and international organizations. Mandates such as Renewable Fuel Standards (RFS) and Low Carbon Fuel Standards (LCFS) compel fuel producers to blend a certain percentage of biofuels into their products, driving demand. These regulations create a stable market for liquid biofuels by providing a guaranteed market for producers and incentivizing investment in research and development. Moreover, policy initiatives aimed at reducing carbon emissions and promoting sustainability further bolster the growth of the biofuels industry, fostering innovation and market expansion.

Economic conditions play a pivotal role in shaping the dynamics of the liquid biofuels market. Fluctuations in crude oil prices directly impact the competitiveness of biofuels, as they are often priced relative to fossil fuels. In times of high oil prices, biofuels become more attractive as cost-effective alternatives, driving demand. Conversely, during periods of low oil prices, biofuel producers may face challenges in remaining competitive. Additionally, economic incentives such as tax credits and subsidies influence investment decisions and market growth. As economies strive for energy security and independence, the economic viability of liquid biofuels becomes increasingly important, driving innovation and market penetration.

Liquid Biofuels Market Restraint

- Feedstock Availability and Competition:

One of the primary restraints facing the liquid biofuels market is the availability and competition for feedstock resources. The production of biofuels requires significant quantities of biomass, including crops like corn, sugarcane, and soybeans, as well as waste materials such as used cooking oil and agricultural residues. However, competition for these feedstocks exists not only within the biofuels industry but also with other sectors such as food and animal feed production. This competition can lead to price volatility and supply chain disruptions, impacting the profitability and scalability of biofuel production. Additionally, concerns about land use change and deforestation further complicate the sourcing of sustainable feedstocks, posing challenges to the long-term viability of the liquid biofuels market.

- Technological Limitations and Costs:

Despite advancements in biofuel production technologies, significant challenges remain in terms of scalability, efficiency, and cost-effectiveness. Many production processes, such as cellulosic ethanol and algae-based biofuels, are still in the early stages of development and face technical hurdles that limit their commercial viability. Moreover, the capital investment required to establish biofuel production facilities can be substantial, particularly for emerging technologies. High production costs may render biofuels less competitive compared to conventional fossil fuels, especially in the absence of sufficient government incentives or regulatory support. Additionally, ongoing research and development efforts are needed to improve the efficiency of biofuel production processes and reduce overall costs, ensuring the continued growth and sustainability of the liquid biofuels market.

Liquid Biofuels Market Opportunity

- Global Energy Transition:

The transition towards a low-carbon economy presents a significant opportunity for the liquid biofuels market. As countries worldwide commit to reducing their carbon footprint and mitigating the impacts of climate change, there is growing recognition of the role that biofuels can play in decarbonizing the transportation sector. Liquid biofuels offer a renewable and sustainable alternative to conventional fossil fuels, providing an avenue for reducing greenhouse gas emissions and improving air quality. With increasing focus on renewable energy sources and sustainable practices, the demand for biofuels is poised to escalate, presenting a lucrative opportunity for market growth and investment in the liquid biofuels sector.

- Technological Innovation and Advancements:

The rapid pace of technological innovation in the biofuels industry presents significant opportunities for market expansion. Advances in biotechnology, process engineering, and feedstock diversification have led to the development of novel biofuel production pathways and improved efficiency in conversion processes. Technologies such as cellulosic ethanol, algae-based biofuels, and advanced biorefining techniques hold promise for enhancing the sustainability, scalability, and cost-effectiveness of biofuel production. Additionally, innovations in feedstock cultivation and processing enable the utilization of non-food biomass sources, reducing competition with food production and enhancing the overall sustainability of biofuel production. As research and development efforts continue to drive technological advancements, the liquid biofuels market stands poised to capitalize on these opportunities and emerge as a key player in the global energy landscape.

Liquid Biofuels Market Challenges

- Feedstock Availability and Sustainability:

One of the foremost challenges confronting the liquid biofuels market is the availability and sustainability of feedstock resources. The production of biofuels relies heavily on biomass derived from crops, agricultural residues, and waste materials. However, increasing demand for these feedstocks, coupled with competition with food and animal feed production, can lead to concerns regarding land use change, deforestation, and ecosystem degradation. Additionally, the sustainability of biofuel feedstock production practices, such as land management, water usage, and chemical inputs, requires careful consideration to mitigate environmental impacts and ensure long-term viability.

- Policy and Regulatory Uncertainty:

Policy and regulatory uncertainty pose significant challenges to the growth and development of the liquid biofuels market. Government policies, such as biofuel blending mandates, tax incentives, and trade tariffs, play a critical role in shaping market dynamics and driving investment decisions. However, frequent changes in regulations, inconsistent policy frameworks across regions, and geopolitical factors can create uncertainty and volatility in the market. For instance, shifts in political priorities, trade disputes, and fluctuations in energy prices can impact the competitiveness of biofuels relative to fossil fuels and influence market dynamics. Moreover, conflicting policy objectives, such as balancing energy security, environmental sustainability, and economic development, further complicate the regulatory landscape and hinder market growth.

Segmental Analysis

By Product

Bioethanol dominated the product segment, accounting for the largest share of the liquid biofuels market in 2024. Bioethanol, primarily produced through the fermentation of sugars derived from corn, sugarcane, and other biomass, is extensively used as a gasoline substitute or additive. Its widespread use in major automotive markets like the U.S., Brazil, and Europe underscores its dominance. Countries like the U.S. mandate 10% ethanol blending (E10) in gasoline, while Brazil's ethanol-blended gasoline (E27) showcases even higher usage rates. Bioethanol's compatibility with existing engine designs and its relatively lower greenhouse gas emissions have solidified its position at the forefront of the market.

Biodiesel is the fastest-growing product segment, fueled by increasing diesel engine use in commercial transportation and supportive policies favoring renewable diesel. Biodiesel is produced through the transesterification of vegetable oils, animal fats, or recycled greases. It can be used directly or blended with petroleum diesel (e.g., B20 blend). The push for low-carbon fuels, particularly in Europe and North America, and the rising demand for cleaner marine and heavy-duty transportation fuels are accelerating biodiesel adoption. Technological advances improving cold weather performance and feedstock flexibility are further boosting its growth trajectory.

By Application

Transportation fuel dominated the application segment, representing the bulk of liquid biofuels consumption. Bioethanol and biodiesel have been seamlessly integrated into vehicle fueling infrastructures, meeting regulatory mandates for renewable content. The automotive sector's push towards cleaner fuels, combined with the aviation industry's early adoption of sustainable aviation fuels (SAFs), ensures transportation remains the dominant application. Initiatives like the "Fit for 55" package in the European Union, targeting transportation sector emissions, further emphasize biofuels' crucial role.

Power generation is the fastest-growing application segment, propelled by the global transition toward renewable electricity and decentralized energy solutions. Liquid biofuels are increasingly being used in backup generators, microgrids, and utility-scale power plants, offering dispatchable renewable energy. In regions like Southeast Asia and parts of Africa, where grid stability remains a concern, liquid biofuels provide a reliable, low-carbon alternative for power generation. Investments in biofuel-powered Combined Heat and Power (CHP) systems are also driving growth in industrial and commercial sectors.

Regional Analysis

North America dominated the liquid biofuels market, with the United States and Brazil leading global production and consumption. The U.S. Renewable Fuel Standard mandates blending of biofuels, while Brazil's longstanding ethanol program, supported by abundant sugarcane cultivation, has created one of the most mature biofuel markets. Companies like POET, Valero, and ADM in the U.S., and Raízen and Petrobras in Brazil, are continuously expanding capacities and innovating production methods. Additionally, emerging opportunities in Sustainable Aviation Fuel (SAF) production further solidify North America's leadership position.

Asia-Pacific is the fastest-growing region, fueled by rising energy demand, government policies promoting energy diversification, and concerns about urban air pollution. Countries like India, China, and Indonesia are implementing ambitious biofuel blending mandates for instance, India aims for 20% ethanol blending in petrol by 2025. Southeast Asia's abundant agricultural residues offer feedstock advantages, while research initiatives into algae-based fuels are gaining momentum in China and Japan. Growing investments, combined with supportive policy frameworks, ensure that Asia-Pacific remains a dynamic growth frontier for the liquid biofuels market.

Some of the prominent players in the Liquid biofuels market include:

- Archer Daniels Midland Company

- Gevo

- Green Plains

- Wilmar International

- Algenol

- Pacific Ethanol Inc.

- Valero Energy Corp.

- Petrobras; Butamax

- Renewable Energy Corp.

- Bunge North America Inc.

Recent Developments

-

April 2025: POET LLC announced the opening of its new cellulosic ethanol production facility in South Dakota, aimed at scaling up second-generation biofuel output.

-

March 2025: Raízen commenced commercial production at its first dedicated biogas-to-liquid fuel plant in Brazil, a major milestone in waste-to-energy conversion.

-

February 2025: Neste Oyj expanded its renewable diesel production facility in Singapore, making it the largest facility of its kind in the Asia-Pacific region.

-

January 2025: Gevo Inc. secured a major offtake agreement with Delta Air Lines for Sustainable Aviation Fuel (SAF), underscoring aviation's growing commitment to biofuels.

-

December 2024: Valero Energy Corporation announced a strategic partnership with BlackRock to invest in expanding renewable diesel capacities across North America.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global liquid biofuels market.

Product

- Biodiesel

- Bioethanol

- Others

Application

- Transportation Fuel

- Power Generation

- Thermal Heating

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)