Liquid Biopsy Market Size and Growth 2026 to 2035

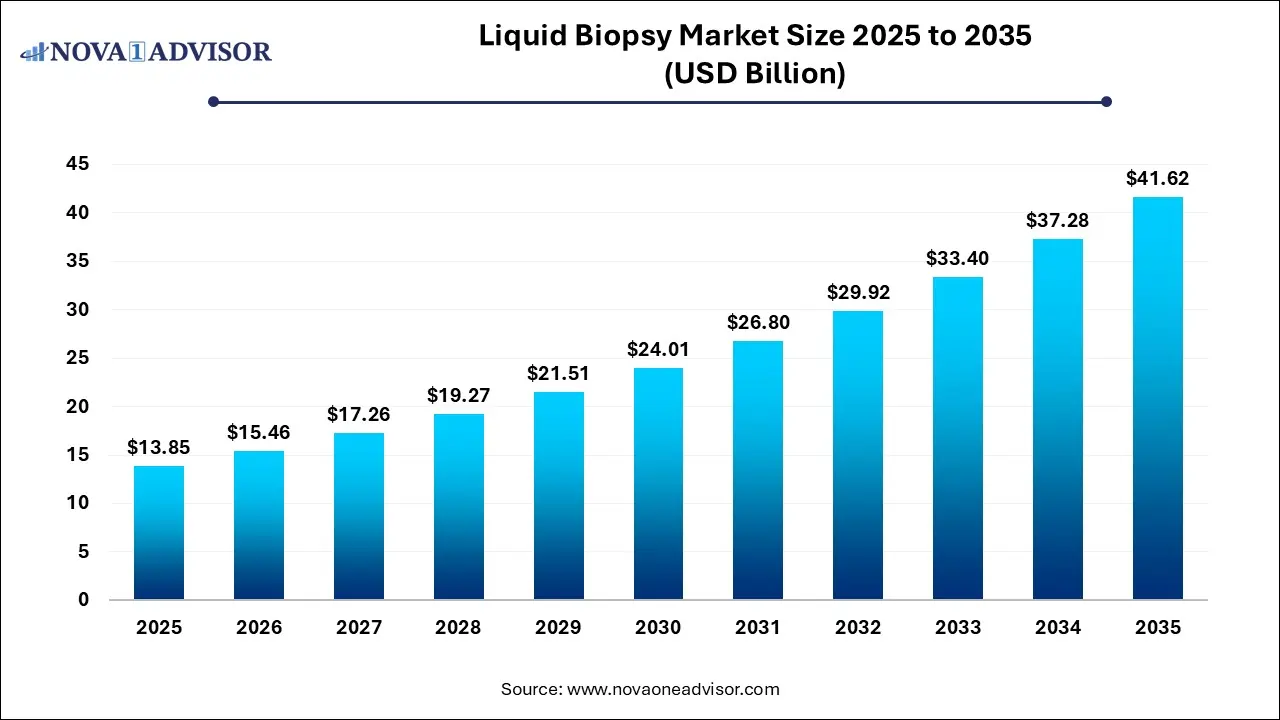

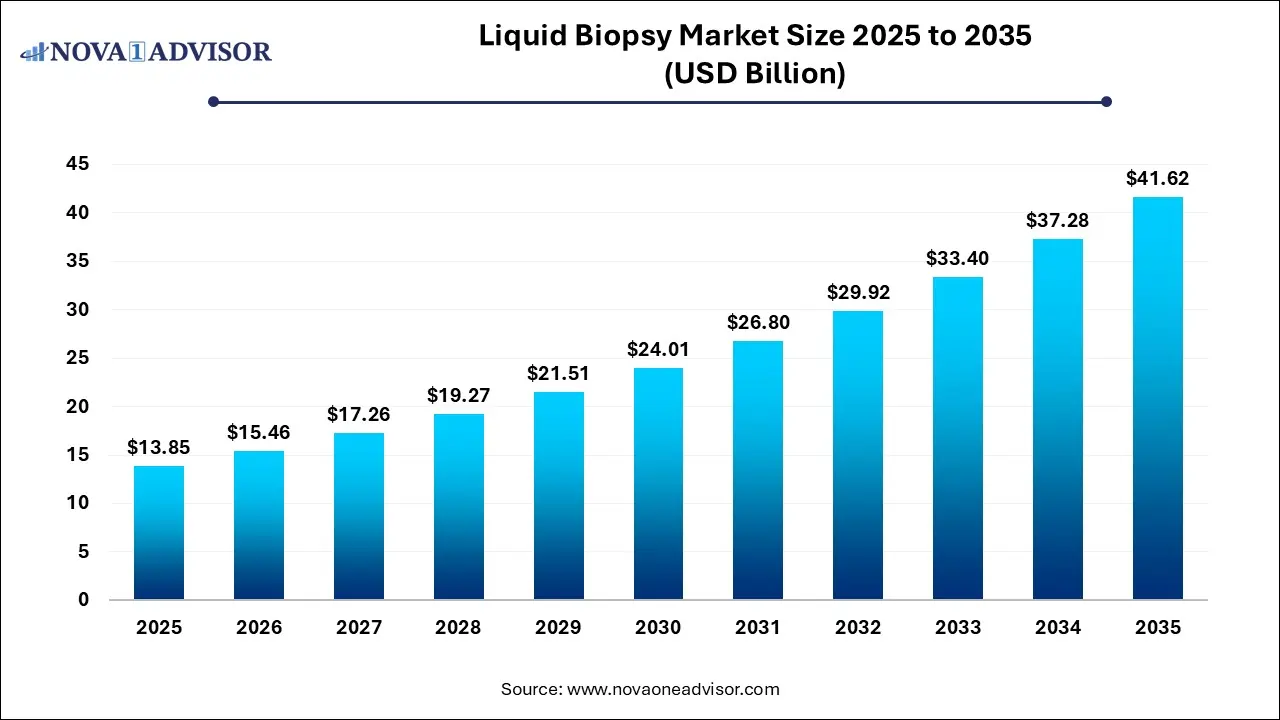

The liquid biopsy market size reached USD 13.85 billion in 2025 and is projected to hit around USD 41.62 billion by 2035, expanding at a CAGR of 11.63% during the forecast period from 2026 to 2035.

Key Takeaways:

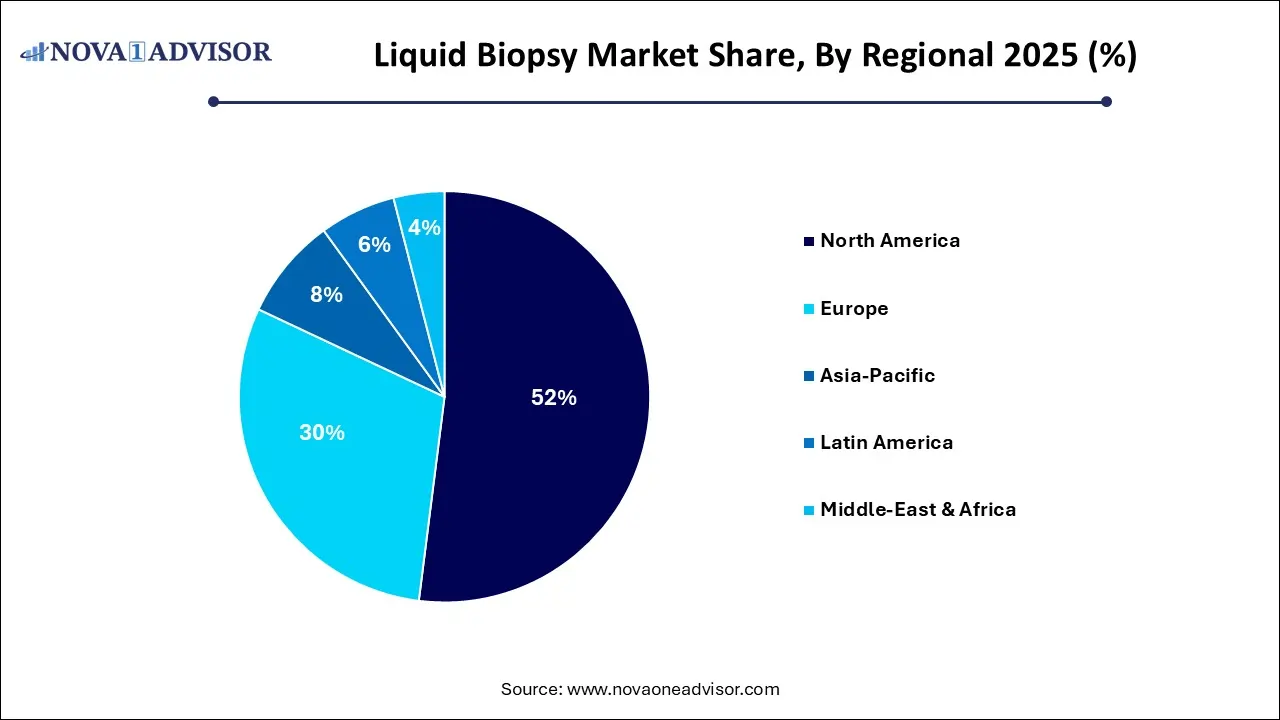

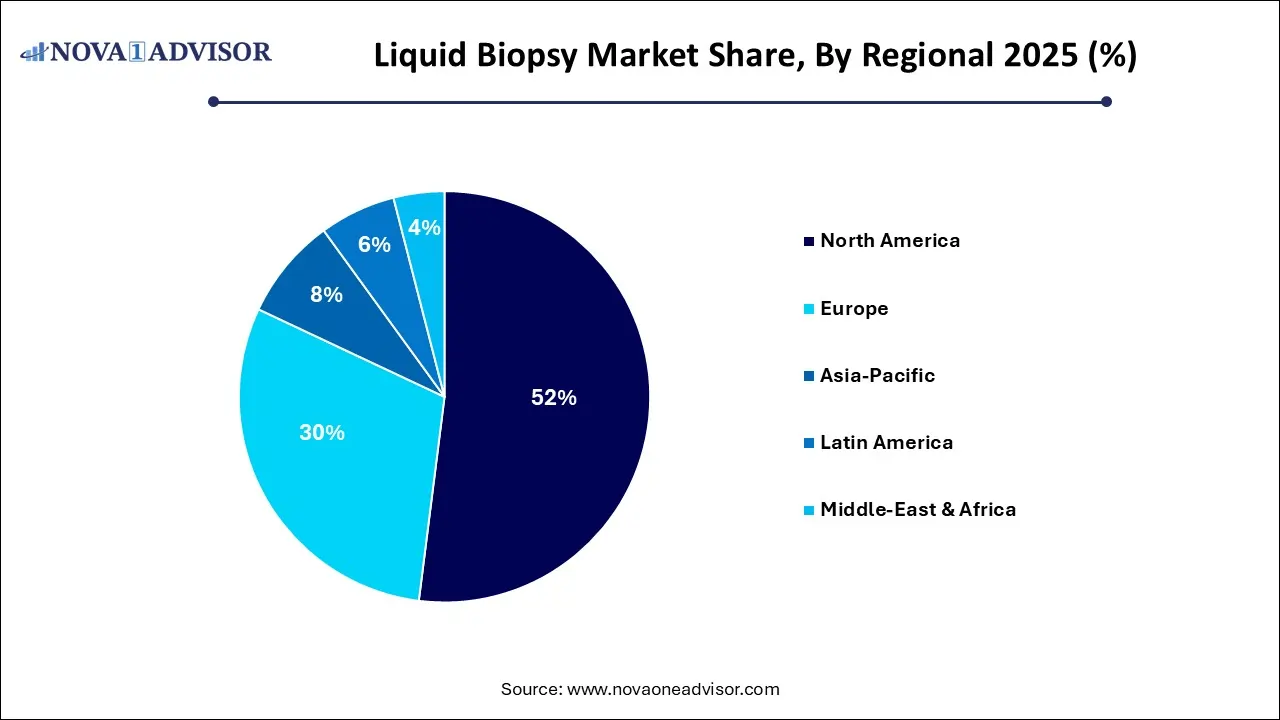

- North America dominated the market with a revenue share of 52% in 2025

- The market in Asia Pacific is expected to grow at the fastest CAGR of 13.09% over the forecast period

- The multi-gene-parallel analysis (NGS) segment held the largest market revenue share of 76.08% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period.

- Single Gene Analysis (PCR Microarrays) segment is anticipated to show significant growth during the forecast period.

- Circulating Nucleic Acids biomarker segment held the largest market share of 36.16% in 2025

- Exosomes/Microvesicles segment is anticipated to grow at the fastest CAGR over the forecast period.

- Cancer application segment dominated the overall market with a revenue share of 86.46% in 2025

- Reproductive health segment is anticipated to witness the fastest CAGR of 12.82% over the forecast period

- The hospitals and laboratories end-use segment dominated the market in 2025 with a revenue share of 42.38% in 2025.

- Specialty clinics segment is anticipated to grow at the fastest CAGR of 12.22% over the forecast period.

- Therapy selection segment dominated the overall market in 2025 with a revenue share of 33.86%.

- Early screening segment is expected to show the fastest CAGR of 12.44% over the forecast period.

- The instruments product segment dominated the market in 2025 with a revenue share of 46.49%

- Kits and reagents segment is expected to be the fastest-growing segment during the forecast period

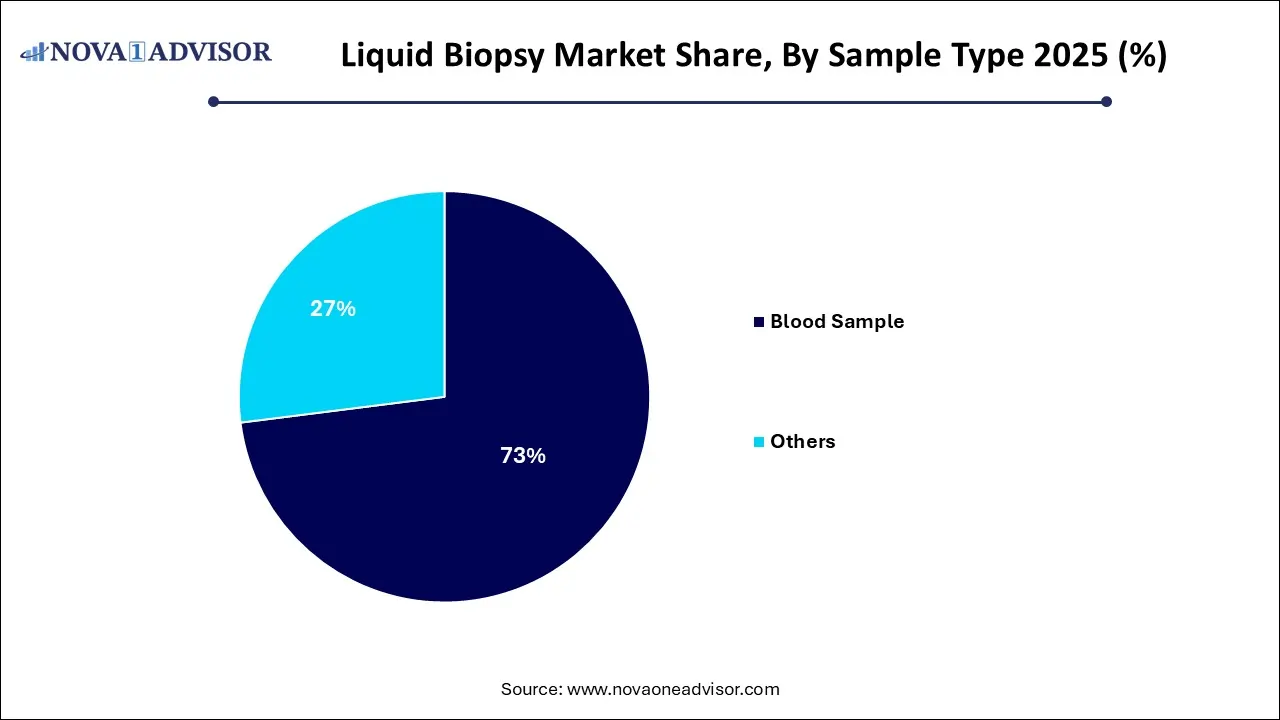

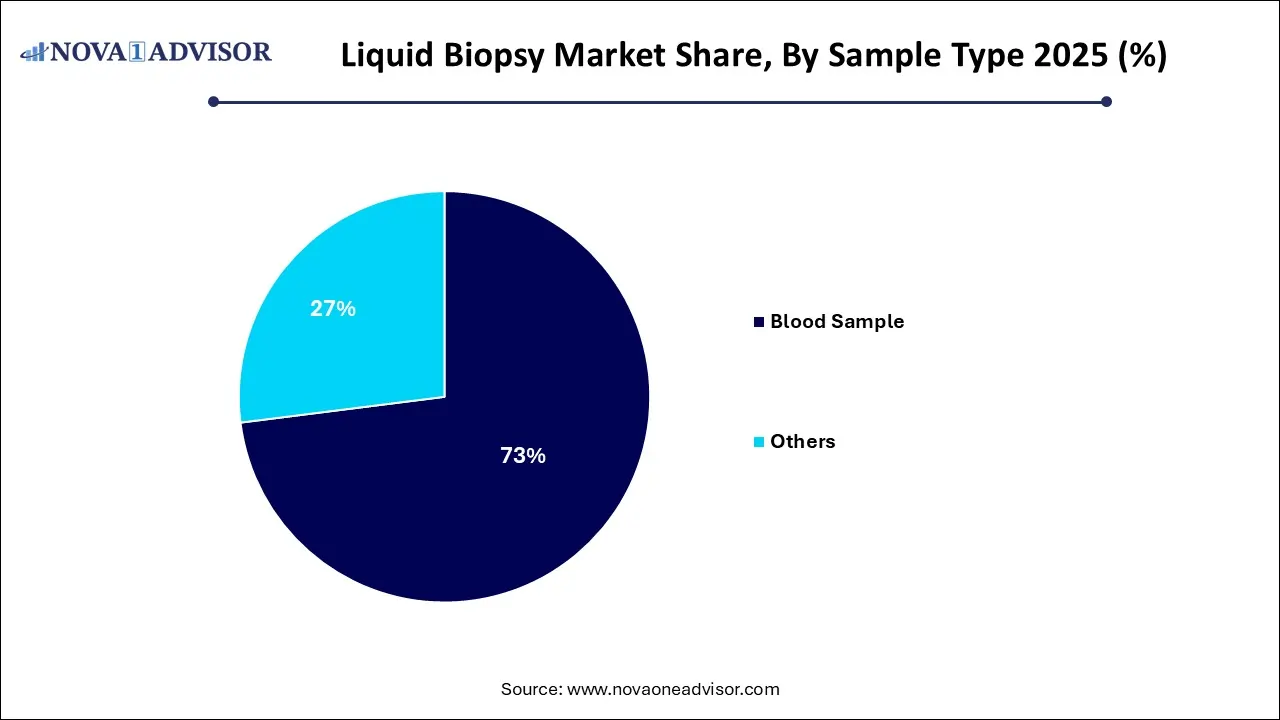

- Blood sample segment held the largest market share of 73.0% in 2025

- Others segment is anticipated to grow at the fastest CAGR of 12.75% over the forecast period.

Liquid Biopsy Market Overview

The liquid biopsy market, driven by technological innovations and a growing emphasis on non-invasive diagnostic solutions, has witnessed significant expansion. This market segment focuses on the analysis of circulating biomarkers, such as cell-free DNA (cfDNA), circulating tumor cells (CTCs), and exosomes, extracted from bodily fluids like blood or urine.

Liquid Biopsy Market Growth

The market for liquid biopsy is witnessing growth due to factors such as the growing prevalence of cancer, technological advancements in cancer diagnostics, and rising preference for minimally invasive cancer diagnostics. Moreover, ongoing research for liquid biopsy assays and tests, aided with the rising adoption and development of multi-cancer early detection tests, provides opportunity for growth of overall market.

With the onset of COVID-19 pandemic, cancer diagnoses were delayed due to reduced diagnostic services and screening programs. Cancer patients are facing many challenges amid the pandemic, such as susceptibility to severe infection and interruption of cancer or usual medical care. The negative impact is likely to be stronger in low- and middle-income countries with poor infrastructure, limited resources, scarcity of medical supplies & personal protective equipment, and shortage of healthcare providers & organized care teams, resulting in a lack of ability to provide & deliver critical care.

For various applications, such as breast, colorectal, ovarian cancer, non-small-cell lung cancer, and prostate cancer, liquid biopsy is used for diagnostics & screening, making it a vital tool. After various studies and speculations, it has been derived that liquid biopsy technique could provide an improved diagnostic outcome. Data suggests the use of screening techniques on high-risk patients who have an ancestral history of cancer. Moreover, over the past several years, studies have shown positive outcomes of liquid biopsy platforms. The government and various regulatory bodies have also shown interest in the area by promoting multiple breakthrough devices for rapid development of the technology.

However, amid the pandemic, several companies have adopted various strategic initiatives for providing safe & easy in-home access for liquid biopsy tests. For instance, in November 2020, NeoGenomics, Inc. announced the launch of a mobile phlebotomy service for liquid biopsy tests, including InvisionFirst and NeoLAB. The company offers its service through two phlebotomy companies, Metro Health Staffing LLC and ExamOne, for broad geographic coverage to ensure tests are performed efficiently.

Liquid Biopsy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2025 |

USD 15.46 Billion |

| Market Size by 2036 |

USD 41.62 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 11.63% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Sample type, Biomarker, Technology, End-use, Application, Clinical Application, Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

QIAGEN; Myriad Genetics, Inc.; Biocept, Inc.; Guardant Health; F. Hoffmann-La Roche Ltd; Illumina, Inc.; ANGLE plc; Oncimmune Holdings PLC; Thermo Fisher Scientific, Inc.; Lucence Health, Inc.; Freenome Holdings, Inc.; Epigenomics AG |

Market Driver – Growing Prevalence of Cancer

Cancer remains one of the leading causes of mortality worldwide. According to the World Health Organization (WHO), nearly 10 million deaths were attributed to cancer in 2022. The growing burden of cancer has triggered demand for early, accurate, and less invasive diagnostic alternatives. Traditional tissue biopsies, though considered the gold standard, present challenges such as surgical risk, inaccessibility of tumor sites, and limited ability for longitudinal monitoring. Liquid biopsies, on the other hand, offer a safer, repeatable, and efficient solution, enabling dynamic tracking of tumor progression, mutation status, and response to therapy. As precision oncology advances, liquid biopsy is becoming an indispensable tool, supported by insurance reimbursements and clinical guidelines, thereby fueling widespread adoption.

Market Restraint – Limited Standardization and Regulatory Approval

Despite its promising clinical potential, liquid biopsy faces challenges related to regulatory approval and standardization across platforms. The accuracy and reproducibility of results can vary based on biomarker types, sample preparation techniques, and technology used. Moreover, lack of universally accepted protocols hinders cross-comparability between studies and tests. Regulatory bodies like the U.S. FDA and EMA are still developing comprehensive frameworks specific to liquid biopsy assays, especially for multi-cancer detection. The absence of clear regulatory pathways and clinical validation restricts its integration into routine practice in many countries, slowing down the broader market penetration.

Market Opportunity – Expansion into Reproductive Health and Transplantation

While oncology remains the primary application, liquid biopsy’s extension into other clinical domains presents substantial growth opportunities. In reproductive health, cell-free fetal DNA testing (a form of liquid biopsy) has revolutionized non-invasive prenatal testing (NIPT), providing a safe alternative for genetic screening of chromosomal abnormalities. Furthermore, in the field of organ transplantation, liquid biopsies are being developed to detect donor-derived cell-free DNA, offering early warning signs of graft rejection. This cross-disciplinary versatility underscores the transformative potential of liquid biopsy and opens new avenues for innovation and commercialization beyond traditional cancer diagnostics.

By Biomarker

Circulating tumor cells (CTCs) dominated the biomarker landscape. These intact cancer cells shed from primary or metastatic tumors into the bloodstream serve as key indicators for metastasis and therapy selection. Their ability to be cultured and analyzed phenotypically offers unique insights beyond genetic information alone, making them valuable in prognosis and personalized treatment planning.

However, circulating nucleic acids, especially ctDNA, are the fastest growing segment due to their dynamic representation of tumor heterogeneity. They enable real-time monitoring and detection of emerging mutations. The growing sensitivity of sequencing tools and enhanced computational analysis has boosted their clinical relevance, particularly in therapy monitoring and minimal residual disease (MRD) detection.

By Technology

Single gene analysis using PCR and microarrays currently dominates the market. PCR-based tests, being cost-effective, simple, and widely accessible, have been the standard in many diagnostic workflows, especially in low- and middle-income countries. They are particularly effective in known mutation detection scenarios such as EGFR or KRAS mutations.

Nevertheless, multi-gene-parallel analysis (NGS) is emerging as the fastest-growing segment. NGS allows simultaneous profiling of hundreds of genes, offering a panoramic view of tumor mutations. Its use is expanding in multi-cancer detection, complex case evaluations, and companion diagnostics, driven by decreasing sequencing costs and enhanced bioinformatics support.

By Application

Cancer applications dominate the liquid biopsy landscape, accounting for the majority of commercial and clinical use. Within cancer types, lung cancer remains a key area due to its high incidence, inaccessibility of tumor sites, and the need for continual molecular monitoring. Liquid biopsy is particularly valuable in identifying actionable mutations like EGFR and T790M in non-small cell lung cancer (NSCLC).

Meanwhile, reproductive health is emerging as the fastest-growing application. Non-invasive prenatal testing (NIPT) using cell-free fetal DNA has become a standard screening method in many developed nations. Its clinical adoption continues to rise, especially as guidelines evolve and test accuracy improves. The trend toward early diagnosis of congenital conditions ensures long-term market traction.

By End-use

Hospitals and laboratories are the dominant end-users of liquid biopsy solutions. These institutions have access to advanced infrastructure, trained personnel, and robust reimbursement networks. Most regulatory-approved tests are integrated within hospital systems and clinical labs, making them the core clientele for market players.

In contrast, academic and research centers are the fastest-growing segment. These institutions are pivotal in discovering novel biomarkers, optimizing liquid biopsy protocols, and validating real-world utility. Increased funding for translational research and clinical trials further supports their growth, as these centers serve as hubs for innovation and early adoption.

By Clinical Application

Therapy selection dominates the clinical application segment. Liquid biopsies offer actionable insights into genetic mutations and resistance patterns, guiding clinicians to tailor treatment regimens such as targeted therapies or immunotherapies. Their real-time nature ensures patients receive optimal treatments with minimal delay.

Early cancer screening is the fastest-growing application due to its game-changing potential in reducing cancer mortality. Companies are investing heavily in tests capable of detecting asymptomatic cancers across multiple organ systems. Clinical validation efforts, such as those by GRAIL and others, are reshaping the narrative of cancer screening from organ-specific to systemic.

By Product

Consumables, kits, and reagents represent the largest product category. These include DNA extraction kits, library prep reagents, and sequencing consumables, which are repeatedly used in each test, ensuring continuous demand. This recurring revenue model appeals to both manufacturers and investors.

Software and services is expected to be the fastest-growing product category. With growing complexity of genomic data, sophisticated bioinformatics tools are required to derive actionable insights. Cloud-based platforms, AI integration, and data-sharing capabilities are enhancing diagnostic precision and clinician decision-making, driving this segment forward.

By Sample Type Insights

Blood samples dominated the market and continue to be the preferred choice for liquid biopsy. Blood offers a rich source of cell-free DNA (cfDNA), CTCs, and exosomes, enabling comprehensive analysis of tumor dynamics with minimal patient discomfort. Blood-based biopsies are widely adopted across hospitals and diagnostic labs due to their ease of collection, high patient compliance, and broad compatibility with sequencing platforms. Clinical trials and commercial tests predominantly leverage blood samples, further cementing their dominance.

Conversely, the “Others” segment, encompassing saliva, urine, and cerebrospinal fluid (CSF), is projected to witness faster growth. These matrices offer targeted detection for specific cancer types such as bladder, brain, or head and neck cancers. As technology matures, these sample types may gain clinical utility, particularly where blood lacks sensitivity or specificity. Emerging startups are developing niche assays using these fluids, highlighting the potential of non-blood-based liquid biopsies.

U.S. Liquid Biopsy Market Size and Growth 2026 to 2035

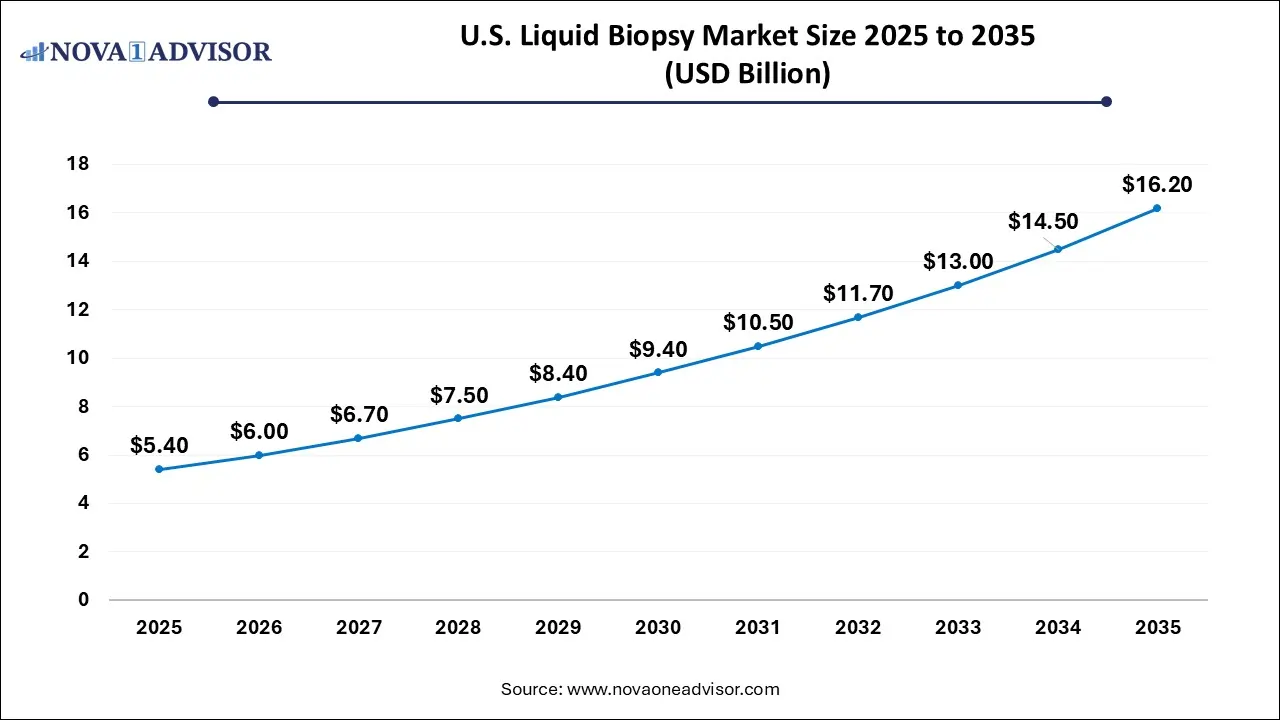

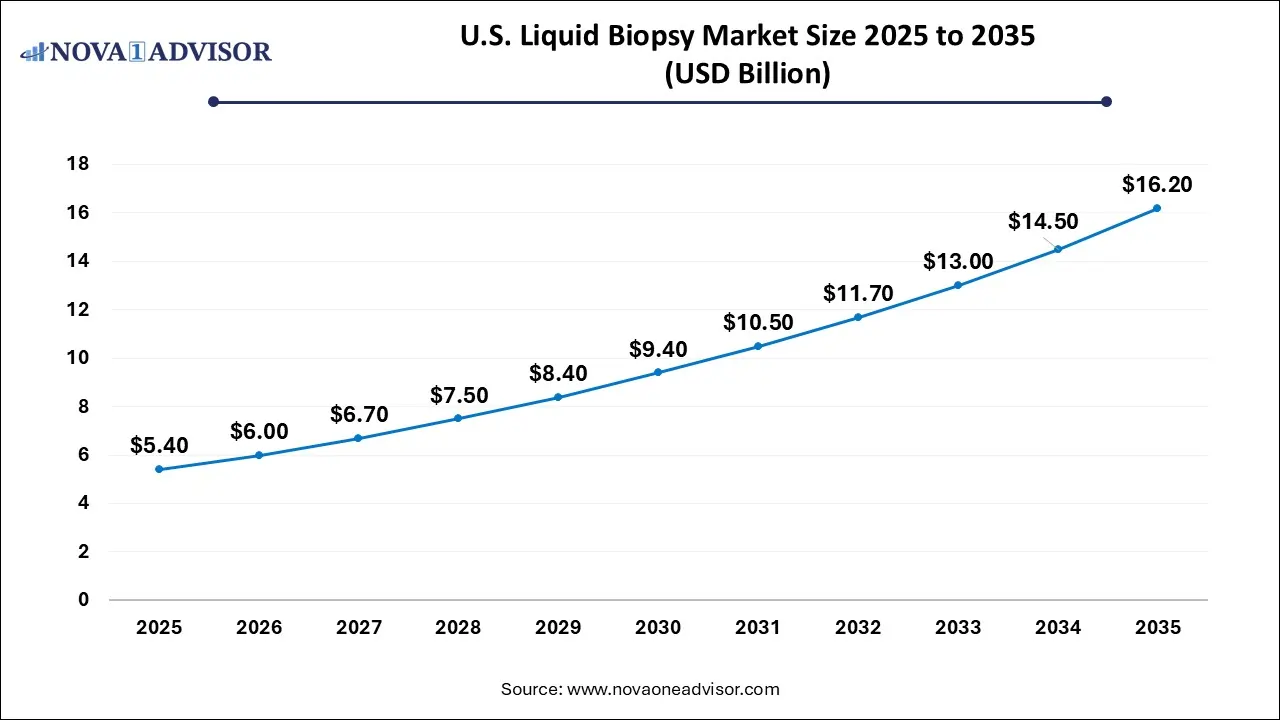

The U.S. liquid biopsy market size is calculated at USD 5.4 billion in 2025 and is expected to reach nearly USD 16.2 billion in 2035, accelerating at a strong CAGR of 10.5% between 2026 and 2035.

By Regional Insights

North America holds the largest share of the global liquid biopsy market. The dominance is attributed to a strong healthcare infrastructure, early adoption of advanced technologies, supportive regulatory framework, and substantial investment in genomic research. The U.S., in particular, is home to many key market players like Guardant Health, Bio-Rad Laboratories, Thermo Fisher Scientific, and Illumina. The region benefits from a high incidence of cancer and favorable reimbursement policies that support the adoption of innovative diagnostics.

Asia-Pacific is the fastest-growing region in the liquid biopsy market, driven by rapid urbanization, rising healthcare spending, and growing awareness about cancer diagnostics. Countries like China, Japan, South Korea, and India are witnessing a surge in cancer prevalence, pushing the demand for advanced diagnostic tools. Moreover, initiatives by regional governments to boost genomics research and digital healthcare ecosystems are creating lucrative opportunities for market entrants. Collaborations between local biotech firms and global diagnostic giants are further enhancing the accessibility and affordability of liquid biopsy solutions.

Key Liquid Biopsy Companies:

- ANGLE plc

- Oncimmune Holdings PLC

- Guardant Health

- Myriad Genetics, Inc.

- Biocept, Inc.

- Lucence Health Inc.

- Freenome Holdings, Inc.

- F. Hoffmann-La Roche Ltd.

- QIAGEN

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Epigenomics AG

Recent Developments

-

January 2025: Guardant Health launched a new version of its Guardant360 CDx liquid biopsy test, which received FDA approval for expanded indications, including colorectal cancer.

-

November 2024: Illumina announced a collaboration with the NHS Genomic Medicine Service in the UK to evaluate liquid biopsy-based early cancer detection using multi-cancer screening.

-

September 2024: Roche launched AVENIO Edge System, an automated platform for next-generation sequencing-based liquid biopsy applications, aimed at improving lab efficiency.

-

July 2024: Bio-Techne Corporation announced that its ExoDx Prostate IntelliScore test for prostate cancer gained CMS reimbursement approval, expanding its reach across U.S. clinics.

-

May 2024: NeoGenomics Laboratories expanded its portfolio by launching a new liquid biopsy test designed specifically for breast and lung cancer recurrence monitoring.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Liquid Biopsy market.

By Sample Type

By Biomarker

- Circulating Tumor Cells (CTCs)

- Circulating Nucleic Acids

- Exosomes/ Microvesicles

- Circulating Proteins

By Technology

- Multi-gene-parallel Analysis (NGS)

- Single Gene Analysis (PCR Microarrays)

By Application

- Cancer

- Reproductive Health

- Lung Cancer

- Prostate Cancer

- Breast Cancer

- Colorectal Cancer

- Leukemia

- Gastrointestinal Cancer

- Others

By End-use

- Hospitals and Laboratories

- Specialty Clinics

- Academic and Research Centers

- Others

By Clinical Application

- Therapy Selection

- Treatment Monitoring

- Early Cancer Screening

- Recurrence Monitoring

- Others

By Product

- Instruments

- Consumables Kits and Reagents

- Software and Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)