Lymphoma Therapeutics Market Size and Research

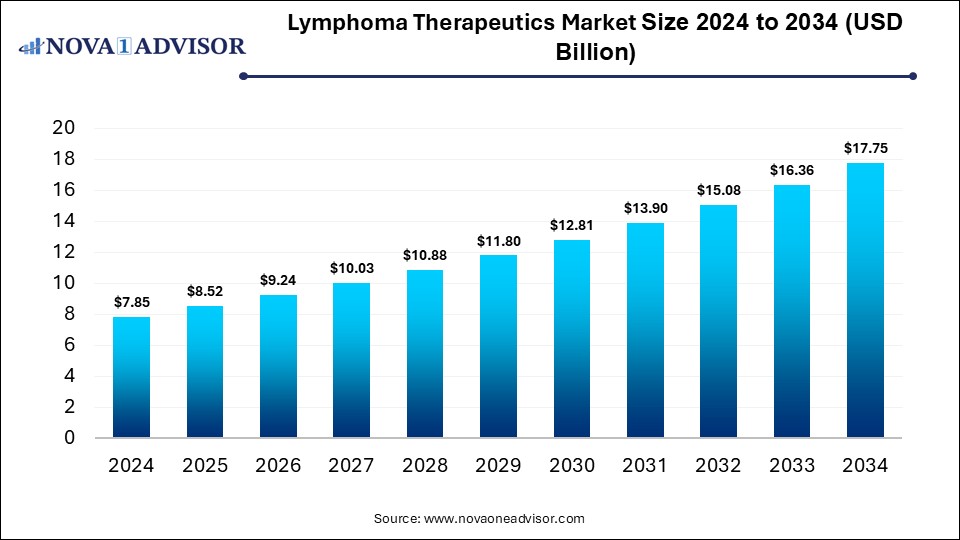

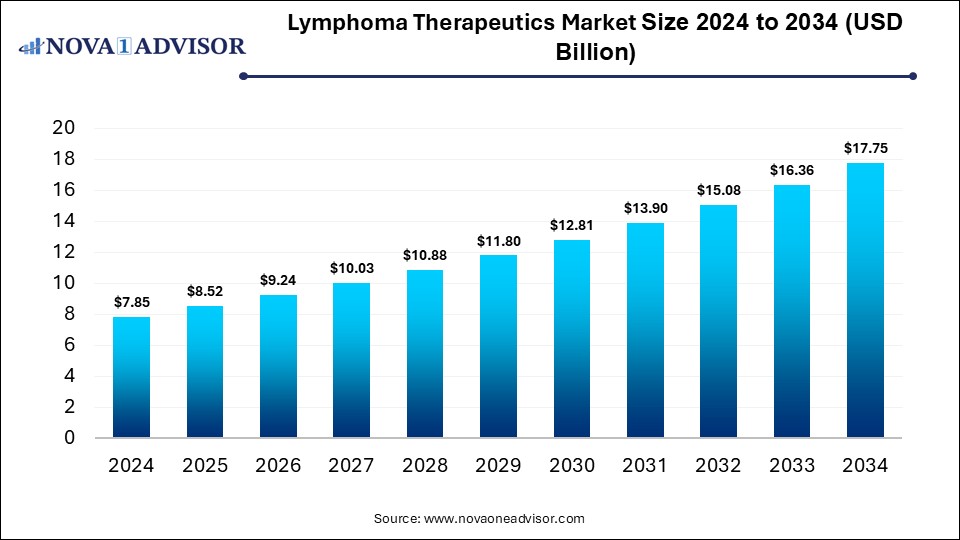

The global lymphoma therapeutics market size is calculated at USD 7.85 billion in 2024, grow to USD 8.52 billion in 2025, and is projected to reach around USD 17.75 billion by 2034, grow at a CAGR of 8.5% from 2025 to 2034. The market is growing due to the rising incidence of lymphoma and increasing adoption of targeted therapies. Advancements in immunotherapy and personalized medicine are further market expansion.

Key Takeaways

- North America dominated the lymphoma therapeutics market revenue shares in 2024.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By type, the non-Hodgkin lymphoma segment dominated the market with a revenue share.

- By type, the Hodgkin lymphoma segment is expected to grow at the fastest CAGR in the market during the studied years.

- By drug, the Rituxan (Mab Thera) segment held the largest market share.

- By drug, the Keytruda segment is expected to grow at the fastest CAGR in the market during the studied years.

- By distribution, the hospital pharmacies segment led the market in 2024.

- By distribution, the specialty segment is expected to grow at the fastest CAGR in the market during the studied years.

How is Innovation Impacting the Lymphoma Therapeutics Market?

Lymphoma therapeutics refer to the treatment used to manage and cure lymphoma, including chemotherapy, immunotherapy, targeted therapy, and radiation, aimed at destroying cancerous lymphocytes and controlling disease progression. Innovation is significantly transforming the lymphoma therapeutic market by introducing advanced treatments such as CAR-T cell therapy, bispecific offers higher efficacy, reduced side effects, and improved survival rates compared to traditional treatments. Additionally, advancements in genomics and personalized medicine are enabling more precise and patient-specific approaches. As a result, innovation is not only expanding treatment options but also enhancing patient outcomes and driving strong market growth.

- For Instance, In March 2024, the FDA approved the combination of Zanubrutinib (Brukinsa) by BeiGene and Obinutuzumab (Gazyva) for the treatment of follicular lymphoma in patients whose disease has relapsed or is resistant to prior therapy. This approval highlights a new option for difficult-to-treat cases.

What are the Key Trends in the Lymphoma Therapeutics Market in 2025?

- In March 2023, AstraZeneca’s Calquence (acalabrutinib) received conditional approval in China for treating adult patients with mantle cell lymphoma (MCL) who have received at least one previous treatment, marking its first approved use in the country.

- In May 2024, the FDA approved Bristol Myers Squibb’s Breyanzi, a CD19-targeted CAR T-cell therapy, for adults with relapsed or refractory follicular lymphoma who have previously received at least two systemic therapies.

How Can AI Affect the Lymphoma Therapeutics Market?

AI can significantly impact the lymphoma therapeutic market by enhancing early diagnosis, predicting treatment responses, and supporting personalized therapy plans. It can analyze complex patient data, such as genetic and clinical information, to identify optimal treatment strategies. AI also accelerates drug discovery and clinical trial design, reducing development time and costs. By improving efficiency and precision across the care pathway, AI is poised to boost treatment outcomes and drive innovation in lymphoma therapeutics.

Report Scope of Lymphoma Therapeutics Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 8.52 Billion |

| Market Size by 2034 |

USD 17.75 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 8.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Drug, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

AstraZeneca, Bristol Myers, Novartis, Merck, Teva Pharmaceuticals, Eli Lilly, AbbVie, Janssen Pharmaceuticals, Takeda Pharmaceutical , Sanofi, Roche |

Market Dynamics

Driver

Rising Prevalence of Lymphoma

The increasing incidence of lymphoma is fueling demand for improved and more targeted treatment options, making it a key driver of market growth. As more patients are diagnosed, healthcare providers and pharmaceutical companies are prioritizing the development of innovative therapies to meet this rising need. This trend also leads to greater investments in research and clinical trials, helping bring advanced treatments to market faster and expanding the overall scope of the lymphoma therapeutics industry.

- For Instance, In 2024, non-Hodgkin lymphoma (NHL) is projected to rank as the 11th most prevalent cancer globally, with around 80,620 new cases anticipated in the U.S. Its incidence tends to be higher in developed nations. According to the Lymphoma Coalition’s 2024 Global Patient Survey, responses were gathered from 79 countries, with 87% of participants diagnosed with either lymphoma or chronic lymphocytic leukemia (CLL).

Restraint

The high cost of advanced treatments is a restraint in the lymphoma therapeutics market because it limits patient access, particularly in low-income regions and among uninsured populations. Expensive therapies like CAR T-cell and targeted drugs place a financial burden on healthcare systems and patients, leading to disparities in treatment availability. This cost barrier can delay or prevent the adoption of innovative therapies, slowing overall market growth despite medical advancements.

Opportunity

Development of personalized and precision Medicine

The development of personalized and precision medicine presents a major future opportunity in the lymphoma therapeutics market because it allows treatments to be tailored to a patient's specific genetic and molecular profile. This approach increases the effectiveness of therapies while reducing adverse effects, leading to better patient outcomes. As research advances, more biomarkers and targeted drugs are being identified, opening the door for highly individualized treatment plans and expanding the potential for innovation and growth in the market.

Segmental Insights

How will the non-Hodgkin lymphoma Segment Dominate the Lymphoma Therapeutics Market in 2024?

The non-Hodgkin lymphoma segment led the market due to higher global prevalence compared to Hodgkin lymphoma. NHL encompasses a wide range of subtypes, many of which are aggressive and require continuous medical intervention. The growing number of NHL cases, along with the availability of advanced treatment options like targeted therapies and immunotherapies, has driven significant demand. Additionally, increased awareness and early diagnosis have further contributed to the market's position.

The Hodgkin lymphoma segment is expected to grow at the fastest rate in the lymphoma therapeutics market due to rising incidence rates, early diagnosis, and the availability of innovative treatments such as checkpoint inhibitors and antibody-drug conjugates. Advancements in immunotherapy have significantly improved patient outcomes, encouraging broader adoption. Additionally, a strong pipeline of new drugs and supportive healthcare initiatives are enhancing access to care, further driving the rapid growth of the market.

Why Did the Rituxan (Mab Thera) Segment Dominate the Market in 2024?

The rituximab segment dominated the lymphoma therapeutics market due to its high effectiveness in treating various B-cell lymphomas, such as diffuse large B-cell nd follicular lymphoma. As a widely used CD20-targeting monoclonal antibody, Rituximab is a key component of standard treatment protocols. Its strong clinical success, broad approval across multiple indications, and increased access through biosimilars have contributed to its widespread adoption and dominant position in the global market

The Keytruda segment is anticipated to register the fastest growth in the lymphoma therapeutics market due to its expanding indications and strong clinical efficacy. As a PD-1 inhibitor, Keytruda has demonstrated significant success in treating classical Hodgkin lymphoma, particularly in relapsed or refractory cases. Ongoing clinical trials exploring its use in combination therapies and other lymphoma subtypes are further broadening its application. Additionally, advancements like the development of a subcutaneous formulation aim to enhance patient convenience and accessibility, contributing to its rapid market growth.

How Does the Hospital Pharmacies Segment Dominate the Lymphoma Therapeutics Market?

In 2024, the hospital pharmacies segment held the highest market share due to many lymphoma treatments, such as chemotherapy and immunotherapy, require intravenous administration and close monitoring, which are best managed within hospital settings. Hospitals possess the necessary infrastructure to store and handle the complex biologic drugs, ensuring proper storage conditions and adherence to safety protocols. Additionally, hospital pharmacies facilities coordinated care among multidisciplinary teams, enhancing treatment efficacy and patient outcomes. These capabilities make hospital pharmacies the primary distribution channel for lymphoma therapeutics.

The specialty pharmacy segment is projected to grow rapidly in the lymphoma therapeutics market due to the rising use of complex and high-cost therapies like biologics and immunotherapies. These pharmacies specialized in handling, storing, and distributing such advanced support and personalized care services. As demand for targeted and individualized therapies increases, specialty pharmacies play a crucial role in improving treatment access and outcomes, driving the market expansion.

Regional Insights

How is North America Contributing to the Expansion of the Lymphoma Therapeutics Market?

North America dominated the lymphoma therapeutics market in 2024, primarily due to its advanced healthcare infrastructure, substantial in oncology research, and early adoption of innovative treatments like CAR-T cell therapy and immunotherapies. The region benefits from a strong presence of pharmaceutical companies, favorable reimbursement policies, and high public awareness, facilitating early diagnosis and access to cutting-edge therapies. Additionally, a robust regulatory environment accelerates drug approvals, further solidifying North America’s leading position in the global lymphoma therapeutics market.

- For Instance, According to the American Cancer Society, an estimated 80,620 individuals in the U.S. are expected to be diagnosed with non-Hodgkin lymphoma (NHL) in 2024, reflecting an increase from 77,240 cases reported in 2020. Similarly, the Canadian Cancer Society projects that around 11,700 people in Canada will be diagnosed with NHL in the same year.

How is Asia-Pacific approaching the Lymphoma Therapeutics Market in 2024?

Asia-Pacific is expected to witness the fastest CAGR in the lymphoma therapeutics market due to rising cancer prevalence, improving healthcare infrastructure, and growing awareness about early diagnosis and treatment. Increased government healthcare spending and expanding access to advanced therapies are also contributing to market growth. Additionally, the presence of a large patient population, along with ongoing clinical trials and pharmaceutical investments in emerging economies like China and India, is accelerating the region's market expansion during the forecast period.

Top Companies in the Lymphoma Therapeutics Market

- AstraZeneca

- Bristol Myers

- Novartis

- Merck

- Teva Pharmaceuticals

- Eli Lilly

- AbbVie

- Janssen Pharmaceuticals

- Takeda Pharmaceutical

- Sanofi

- Roche

Recent Developments in the Lymphoma Therapeutics Market

- In May 2023, AbbVie received FDA approval for EPKINLY (epcoritamab-bysp), the first bispecific antibody authorized for treating adults with relapsed or refractory diffuse large B-cell lymphoma (DLBCL) after two or more prior treatments. This milestone highlights a major advancement in managing difficult-to-treat lymphoma cases. Epcoritamab offers a new therapeutic option for patients with limited choices, reinforcing AbbVie's dedication to advancing care and improving outcomes in blood-related cancers.

- In October 2024, Gilead’s subsidiary Kite expanded its CAR T-cell therapy capabilities by launching a new manufacturing site in Amsterdam. The facility aims to accelerate the production process for personalized cancer treatments, helping to reduce turnaround times and increase the availability of CAR T therapies for patients throughout Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the Lymphoma Therapeutics Market.

By Type

- Hodgkin Lymphoma

- Non-Hodgkin Lymphoma

By Drug

- Rituxan/MabThera

- Revlimid

- Imbruvica

- Adcetris

- Keytruda

- Opdivo

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Specialty Pharmacy

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)