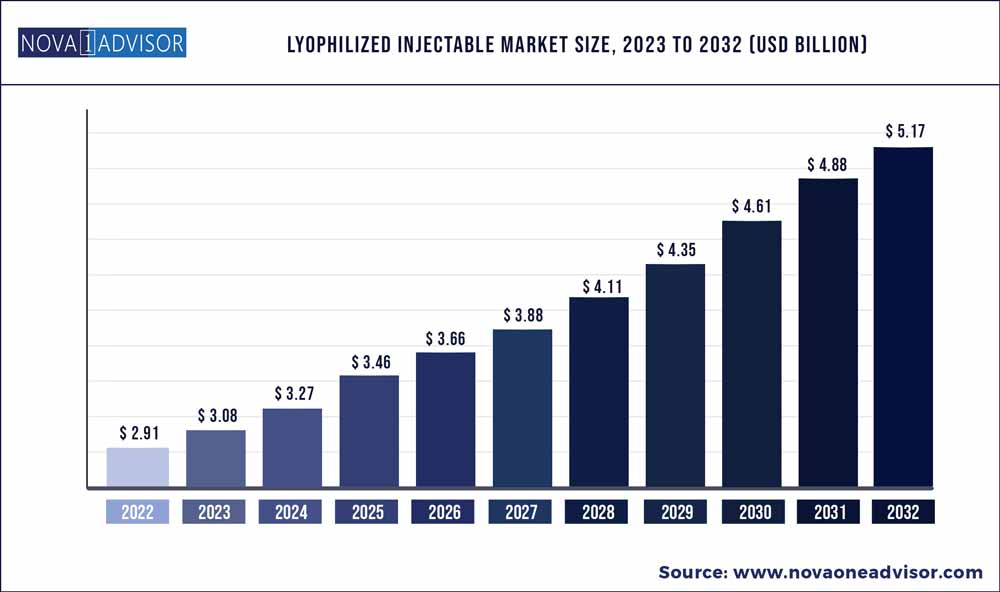

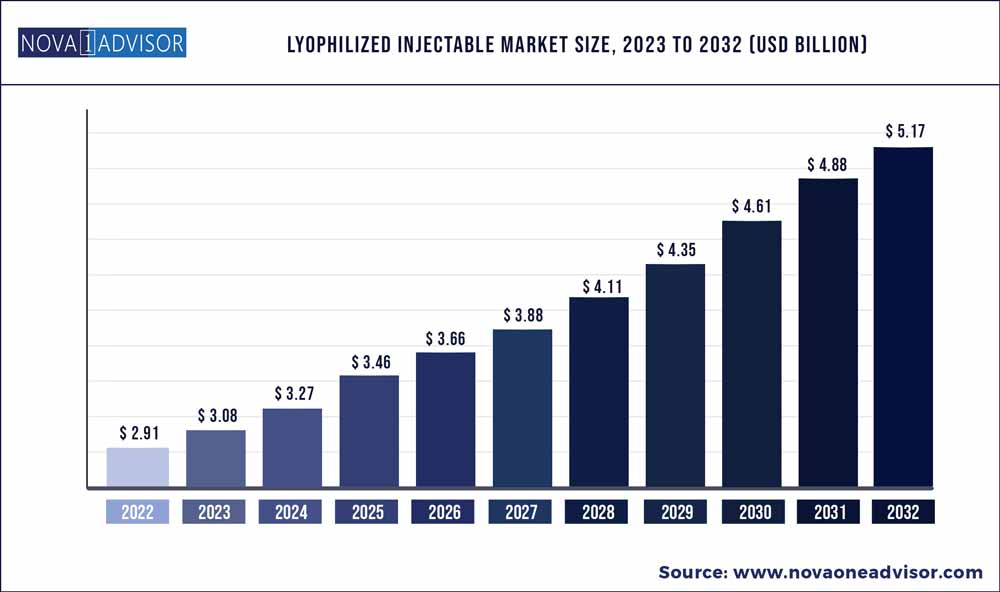

The global lyophilized injectable market size was exhibited at USD 2.91 billion in 2022 and is projected to hit around USD 5.17 billion by 2032, growing at a CAGR of 5.9% during the forecast period 2023 to 2032.

Key Pointers:

- In terms of type of packaging, the global lyophilized injectable market has been classified into single-use vials, point-of-care reconstitution, and specialty packaging

- Based on type of delivery, the global lyophilized injectable market has been categorized into prefilled diluent syringes, proprietary reconstitution devices, single-step devices, and multi-step devices

- In terms of indication, the global lyophilized injectable market has been segregated into autoimmune diseases, metabolic conditions, infectious diseases, and others

- Based on end user, the global lyophilized injectable market has been divided into hospitals, specialty clinics, ambulatory surgical centers, and others

- Each of the segments has been analyzed in detail for trends, recent trends & developments, drivers, restraints, opportunities, and useful insights. The lyophilized injectable market report provides current and future revenue for each of these segments for the period from 2018 to 2032, considering 2022 as the base year.

Lyophilization is the most commonly used method for the manufacturing of parenteral pharmaceutical products, when the product is unstable in aqueous solution. It is central to the protection of materials, which require low moisture content (less than 1%) in order to ensure stability and require a sterile and gentle preservation process.

Improved quality and shelf life of lyophilized drugs has attracted industry experts to implement lyophilization in their manufacturing processes. Contract research and manufacturing organizations have increased the use of lyophilized injectable drugs to provide quality products to customers. Therefore, rapidly growing contract research manufacturing services (CRAMS) is projected to drive the global lyophilized injectable market.

Lyophilized injectable drugs are stable at ambient temperatures and only require simple rehydration to be ready to use. This removes many sources of pipetting errors, while streamlining and simplifying workflows.

Elimination of the cold chain minimizes costs and carbon footprint, and provides a positive environmental impact by minimizing the need of expanded polystyrene (EPS or ‘Styrofoam’) containers often utilized to ship temperature-controlled products

Lyophilized products are considered safe for use, while delivering the desired functionality compared to non-lyophilized products. Moreover, lyophilization helps retain the biological and chemical activity of the chemical compound in the final product. This drives the demand for lyophilized injectable drugs in the pharmaceutical and biotechnology industries.

The ever-evolving nature of coronavirus has become a major threat to the public health, owing to its severe respiratory symptoms. Ongoing studies are surfacing about the safety and efficacy of novel lyophilized therapeutic agents in hospitalized adult patients diagnosed with COVID-19. Amid all this, healthcare giant Cipla - a global pharmaceutical company is gaining recognition for introducing its CIPREMI, a remdesivir lyophilized powder for injection (100mg). Manufacturers in the lyophilized injectable market are taking cues from such innovations to increase the availability of the U.S. FDA-approved emergency use authorization (EUA) treatment for patients with severe COVID-19 symptoms.

Since India is suffering from a third wave of the pandemic, companies in the India lyophilized injectable market are increasing efforts to gain regulatory approval by the Drug Controller General of India (DCGI) for restricted emergency use in the country.

Lyophilized injectable Market Segmentation

| By Type of Packaging |

By Type of Delivery |

By Indication |

By End User |

|

Single-use Vials

Point-of-care Reconstitution

Specialty Packaging

|

Prefilled Diluent Syringes

Proprietary Reconstitution Devices

Single-step Devices

Multi-step Devices

|

Autoimmune Diseases

Infectious Diseases

Metabolic Conditions

Others

|

Hospitals

Ambulatory Surgical Centers

Specialty Clinics

Others

|

Lyophilized injectable Market Key Players And Regions

| Companies Profiled |

Regions Covered |

|

B. Braun Melsungen AG

Baxter International, Inc.

BD

Schott AG

Aristopharma Ltd.

Vetter Pharma

Jubilant HollisterStier LLC

among others

|

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

|