mHealth Market Size and Trends

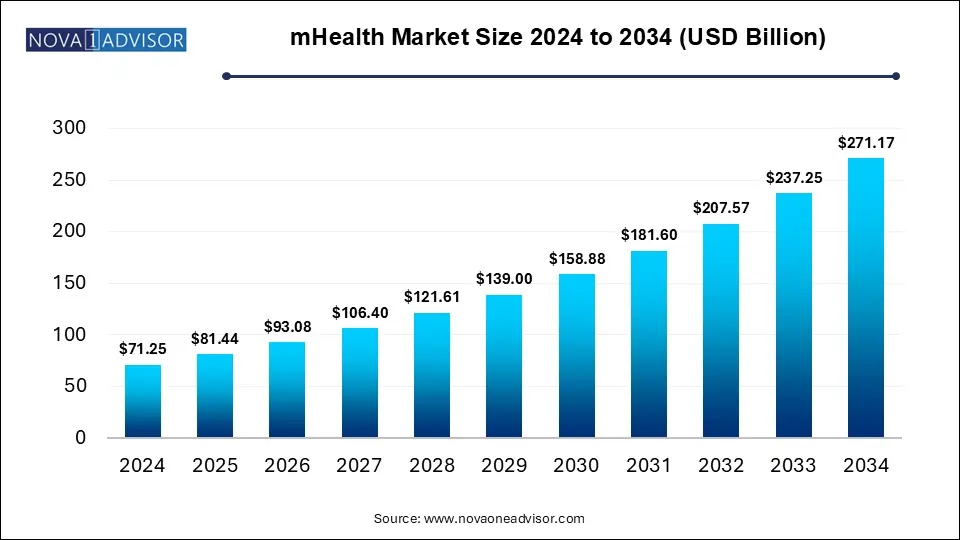

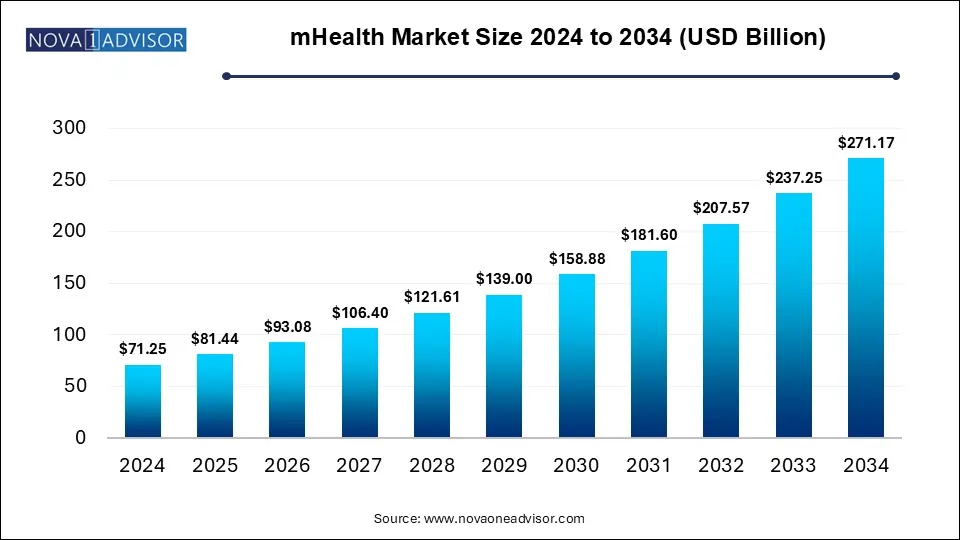

The global mHealth market size is calculated at USD 71.25 billion in 2024, grow to USD 81.44 billion in 2025, and is projected to reach around USD 271.17 billion by 2034, to grow at a CAGR of 14.3% from 2025 to 2034. The market is growing due to increasing smartphone penetration and widespread internet access. Rising demand for remote healthcare and chronic disease management fuels its expansion. Advancements in wearables technology and health apps drive user engagement and investment.

Key Takeaways

- North America dominated the mHealth market in 2024.

- Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period.

- By component, the mHealth apps segment held the major market share.

- By component, the services segment is projected to grow at the fastest rate between 2025 and 2034.

- By end-user, the patient segment contributed the biggest market share in 2024.

- By end-user, the providers segment is predicted to grow at the significant growth in the market during the studied years.

How is Innovation Impacting the mHealth Market?

mHealth that is mobile health is the use of mobile devices and wireless technologies to support medical and public health practices, including health monitoring, diagnosis, treatment, and patient education, enabling remote and real-time healthcare delivery. Innovation transforming the mHealth market by enhancing accessibility, efficiency, and personalized healthcare services. Advancements such as AI-powered health apps, wearables devices, telemedicine platforms, and remote monitoring tools allow real-time data collection and remote monitoring tools allow real-time data collection and analysis, improving diagnosis and treatment. These innovations empower patients to manage their health proactively and enable providers to deliver more accurate, timely care. As, a result mHealth is becoming a vital component of modern, technology-driven healthcare systems.

- For Instance, In April 2024, Koninklijke Philips N.V. formed a partnership with SmartQare, a company focused on developing multi-sensor technologies for continuous health monitoring. The goal of this collaboration is to integrate SmartQare’s advanced viQtor solution into Philips’ existing patient monitoring systems, enhancing their ability to provide round-the-clock, real-time health insights.

How is AI enhancing advancements in the mHealth Market?

AI is significantly enhancing advancements in the mHealth market by enabling smarter, more efficient healthcare solutions. It powers health apps and wearable devices to monitor vital signs, detect anomalies, and provide real-time insights. AI-driven chatbots and virtual assistants support patient engagement and self-care. Additionally, AI helps personalize treatment plans, predict health risks, and streamline diagnostics, making healthcare more accessible, proactive, and data-driven.

What are the leading trends shaping the mHealth Market in 2025?

- In April 2025, FirstHx, a leading innovator in AI-powered healthcare solutions, revealed its entry into the U.S. market. The company aims to revolutionize the patient intake process with its advanced technology, offering solutions that could significantly improve and modernize the American healthcare experience.

- In October 2023, Cedars-Sinai introduced its new mobile health app, Cedars-Sinai Connect, which leverages artificial intelligence to deliver virtual healthcare services across various medical needs. The app allows users to book same-day primary care appointments and provides round-the-clock virtual access to healthcare professionals for urgent medical concerns.

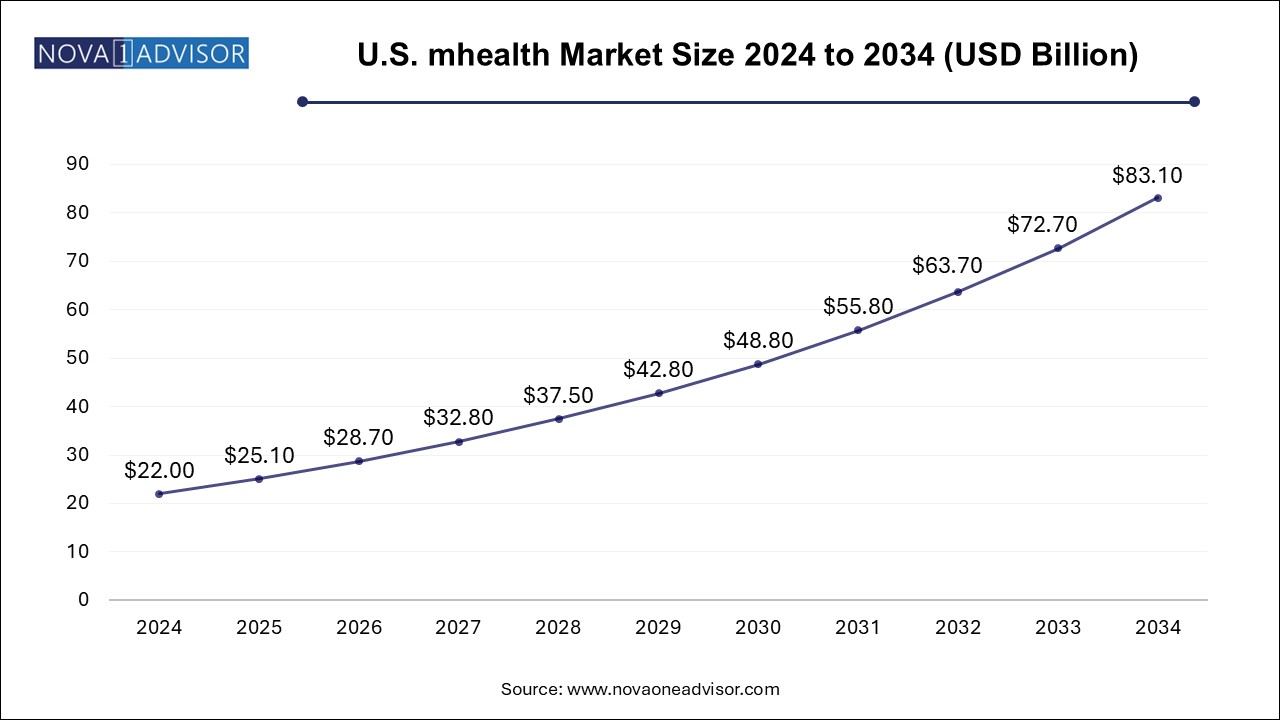

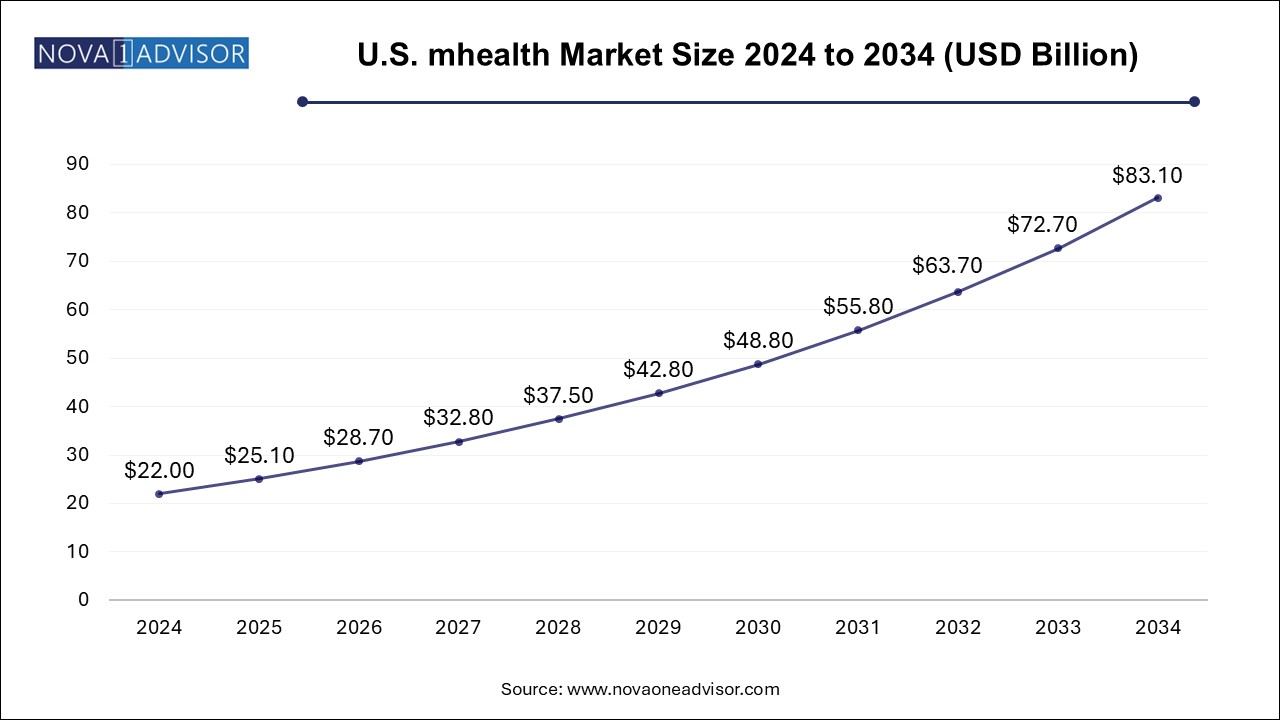

U.S. mHealth Market Size and Growth 2025 to 2034

The U.S. mHealth market size is evaluated at USD 22.0 billion in 2024 and is projected to be worth around USD 83.1 billion by 2034, growing at a CAGR of 12.84% from 2025 to 2034.

How is North America Contributing to the Expansion of the mHealth Market?

North America dominated the mHealth market in 2024, due to its advanced healthcare infrastructure, high smartphone penetration, and strong adoption of digital health technologies. The region's widespread use of mobile devices facilitates the integration of mHealth solutions into daily healthcare practices. Additionally, a significant aging population and the prevalence of chronic diseases have increased the demand for remote monitoring and telehealth services. Supportive government initiatives and substantial investments in digital health further bolster North America's leading position in the mHealth market.

How is Asia-Pacific approaching the mHealth market in 2025?

Asia-Pacific is anticipated to grow at the fastest rate in the market during the forecast period, driven by rising smartphone usage, expanding internet access, and increasing health awareness among the population. Government initiatives supporting digital health and growing investments in healthcare infrastructure are further accelerating adoption. Additionally, the region’s large population base and rising burden of chronic diseases are boosting the demand for accessible, tech-driven healthcare solutions, making Asia-Pacific a key growth hub for the mHealth industry.

For Instance, In the Mobile Economy 2023 by GSMA, the Asia-Pacific region recorded 1.73 billion unique mobile subscribers by the end of 2022. This number is projected to grow further, reaching approximately 2.11 billion by the end of 2023, highlighting the region's rapid mobile adoption and expanding digital connectivity.

Report Scope of mHealth Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 81.44 Billion |

| Market Size by 2034 |

USD 271.17 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 14.3% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Component, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Apple, Inc.; AT&T Intellectual Property; AirStrip Technologies, Inc.; Veradigm LLC (formerly, Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; Vodafone Group PLC; Google, LLC; Telefonica S.A.; SoftServe, Inc.; Samsung Electronics Co., Ltd.; Orange; SeekMed |

Market Dynamics

Driver

Growing Penetration of Smartphones and Other Wireless Technology

The growing penetration of smartphones and wireless technology is a major driver of the mHealth market because it makes healthcare more accessible and convenient. With widespread smartphone use, people can easily access health apps, telemedicine services, and remote monitoring tools anytime and anywhere. Wireless technologies enable real-time data sharing between patients and providers, improving diagnosis, treatment, and follow-up care. This connectivity bridges gaps in healthcare delivery, especially in remote and underserved areas.

For Instance, According to recent reports, there are currently around 4.88 billion smartphone users worldwide, with projections estimating this number will grow to 7.12 billion by the end of 2024. This article will take a closer look at current smartphone ownership and the expected growth trends from 2024 to 2029.

Restraint

Data Privacy Concerns Associated with These Apps

Data privacy concerns pose a major challenge to the growth of the mHealth market. Many users are aware of sharing personal health information due to the risks of data breaches and misuse. The lack of robust security and regulatory compliance can hinder user trust, making privacy protection essential for the market's sustained development and wider adoption.

Opportunity

The Growing Adoption of mHealth Solution in Other Mobile Platforms

The growing adoption of mHealth solutions across diverse mobile platforms offers a significant opportunity for future market expansion. As these technologies extend beyond smartphones to include tablets, smartwatches, and other wearable devices, they enable more comprehensive and continuous health monitoring. This broader accessibility not only enhances user engagement and convenience but also supports the development of more personalized and data-driven healthcare solutions, paving the way for innovation and growth in the global mHealth landscape.

Segmental Insights

The mHealth Apps Segment: Major Share

By component, the mHealth apps segment held the major market share, due to its versatility, ease of use, and widespread availability on smartphones. These apps offer a range of services such as fitness tracking, appointment scheduling, medication reminders, and remote consultations, making healthcare more accessible and personalized. Their convenience and ability to support real-time health monitoring have driven high adoption rates among both consumers and healthcare providers, solidifying their leading position in the mHealth market.

The services segment: Fastest Growing

By component, the services segment is projected to grow at the fastest rate between 2025 and 2034, due to increasing demand for remote healthcare, teleconsultations, and continuous patient monitoring. As healthcare systems shift towards digital solutions, services-based offerings like virtual care, remote diagnostics, and data analytics are becoming essential. This growth is further supported by rising chronic disease cases, aging populations, and the need for cost-effective, real-time health services accessible through mobile platforms.

- For Instance, In April 2023, fitness brand Anytime Fitness introduced its AF SmartCoaching technology app to enhance its range of offerings. This reflects a broader trend where more mHealth app developers are launching innovative applications. Such efforts are expected to increase adoption among fitness and health-focused organizations, ultimately contributing to the growth of this segment within the mHealth market.

The Patient Segment: Biggest shares

By end-user, the patient segment contributed the biggest market share in 2024 due to the growing use of smartphones, wearable devices, and health apps for personal health management. Patients increasingly rely on mHealth solutions for tracking fitness, managing chronic conditions, accessing virtual consultations, and receiving medication reminders. The demand for convenient, real-time, and user-friendly healthcare tools has driven widespread adoption, making patients the primary end-users and major contributors to the mHealth market.

The Providers Segment: Fastest Growing

By end-user, the providers segment is predicted to grow at the significant growth in the market during the studied years, due to rising adoption of advanced technologies like AI, telemedicine, and wearable devices. These tools enable real-time monitoring, remote consultations, and improved patient engagement. As healthcare providers aim to enhance efficiency and deliver personalized care, mHealth solutions integrated with electronic health records offer streamlined data management and decision-making, driving significant growth in this segment.

Some of the prominent players in the mHealth market include:

mHealth Market Recent Developments

-

In April 2025, HealthEdge, a key player in modern administrative processing, payment accuracy, and care management solutions, introduced its Provider Data Management platform. This new solution is designed to assist healthpayers in automating the often time-consuming but essential process of keeping healthcare provider information accurate and up to date, aiming to improve operational efficiency and data reliability.

-

In February 2023, Vodafone (UK) joined forces with Charité Berlin, Leipzig University Hospital, and 16 other top research and medical institutions in Germany. This collaboration with some of Europe’s leading healthcare and research centers allowed Vodafone to investigate potential future uses of 6G technology in the medical field, aiming to advance next-generation healthcare applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the mHealth market

By Component

- Wearables & Connected Medical Devices

-

- Vital Sign Monitoring Devices

-

-

- Heart Rate Monitors

- Activity Monitors

- Electrocardiographs

- Pulse Oximeters

- Spirometers

- Blood Pressure Monitors

- Others

-

-

- Sleep trackers.

- Wrist Actigraphs

- Polysomnographs

- Others

-

- Electrocardiographs Fetal and Obstetric Devices

- Neuromonitoring Devices

-

-

- Electroencephalographs

- Electromyographs

- Others

-

-

-

- Fitness & Nutrition

- Menstrual Health

- Pregnancy Tracking & Postpartum Care

- Menopause

- Disease Management

- Others

-

-

- Chronic Disease Management Apps

-

-

-

- Diabetes Management Apps

- Blood Pressure and ECG Monitoring Apps

- Mental Health Management Apps

- Cancer Management Apps

- Obesity Management Apps

- Other Chronic Disease Management Apps

-

-

- Personal Health Record Apps

- Medication Management Apps

- Diagnostic Apps

- Remote Monitoring Apps

- Others (Medical Reference, Professional Networking, Healthcare Education)

-

-

- Independent Aging Solutions

- Chronic Disease Management & Post-Acute Care Services

-

- Diagnosis Services

- Healthcare Systems Strengthening Services

- Others

By End-use

- Patients

- Providers

- Payers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)