Male Infertility Market Size and Research

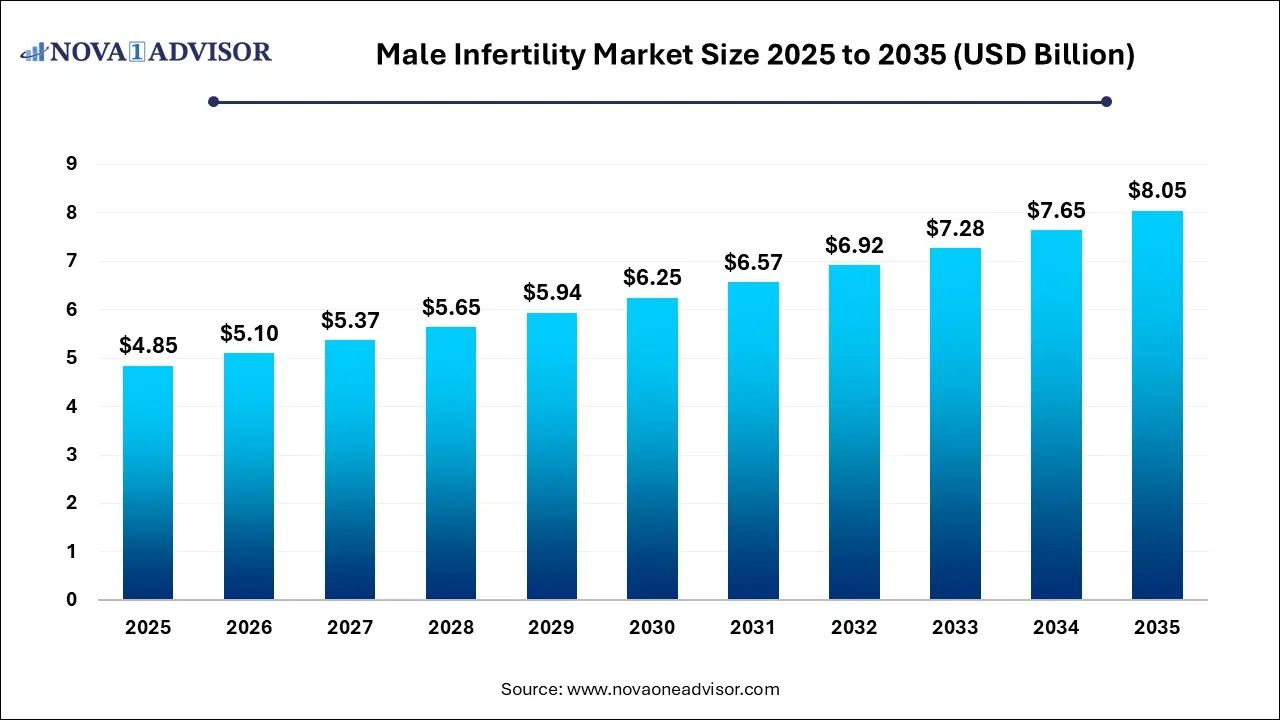

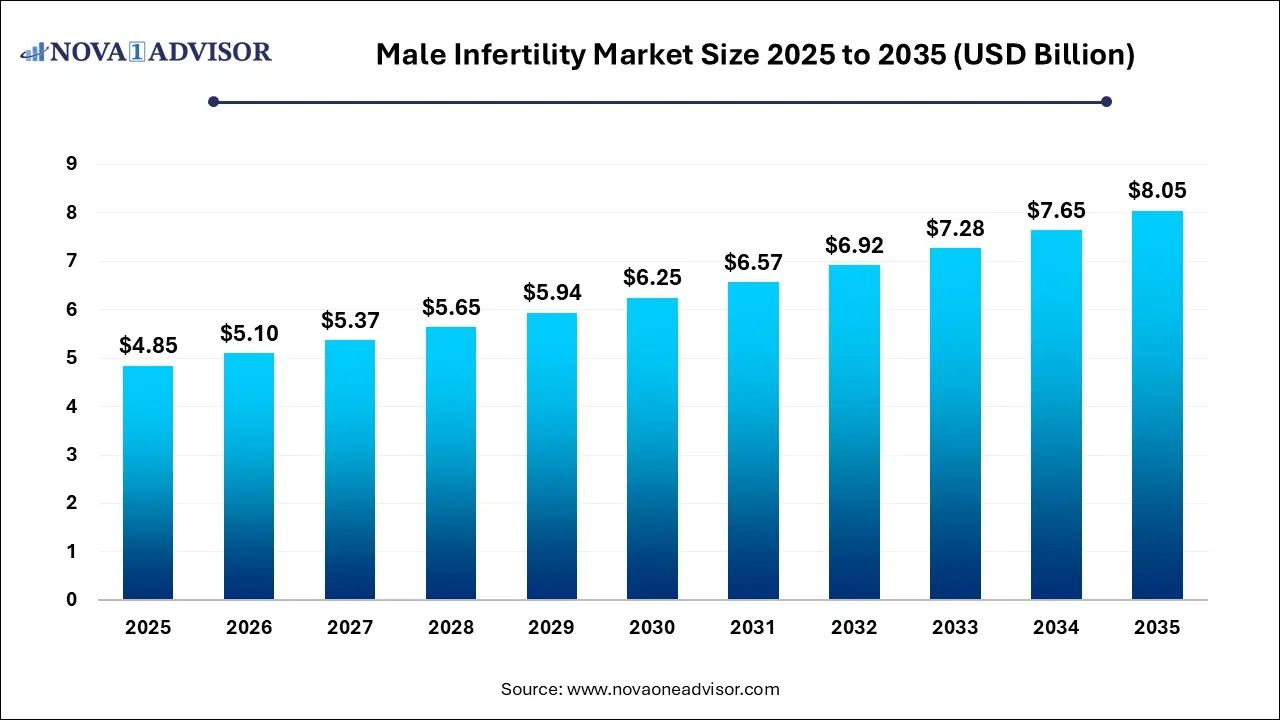

The male infertility market size was exhibited at USD 4.85 billion in 2025 and is projected to hit around USD 8.05 billion by 2035, growing at a CAGR of 5.2% during the forecast period 2026 to 2035.

Market Overview

The male infertility market has emerged as a pivotal segment of the broader reproductive health landscape, driven by growing awareness, increased infertility rates, technological advancements in diagnostics and treatments, and shifting societal perspectives towards reproductive issues. Male infertility, defined as the inability of a male to cause pregnancy in a fertile female partner, affects approximately 7% of all men, according to global health data. The causes are varied, ranging from hormonal imbalances and genetic conditions to lifestyle factors and environmental toxins. With the rising prevalence of lifestyle-related health issues such as obesity, stress, substance abuse, and exposure to environmental pollutants, the incidence of male infertility is steadily increasing.

Global healthcare systems and stakeholders are beginning to prioritize male reproductive health, recognizing it as an integral part of family planning and fertility treatments. This shift has led to a surge in demand for diagnostic procedures and treatment options specifically targeted at male infertility. Moreover, increasing investments by healthcare companies and governments, coupled with the development of advanced diagnostic techniques, are accelerating market growth. As a result, the male infertility market is poised for steady expansion over the coming years.

Major Trends in the Market

-

Increasing awareness campaigns by healthcare organizations and NGOs highlighting male infertility as a common and treatable condition.

-

Advancements in genetic testing and precision medicine are enabling targeted diagnostics and therapies.

-

Growing preference for non-invasive diagnostic tests such as DNA fragmentation and oxidative stress analysis.

-

Rising popularity of Computer-Assisted Semen Analysis (CASA) for accurate and efficient diagnosis.

-

Surge in adoption of Assisted Reproductive Technology (ART) and intra-cytoplasmic sperm injection (ICSI) procedures.

-

Strategic collaborations between fertility clinics and diagnostic labs to provide integrated solutions.

-

Emergence of telemedicine and digital health platforms for fertility counseling and follow-ups.

-

Integration of artificial intelligence and machine learning in sperm analysis and fertility treatment planning.

Report Scope of Male Infertility Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 5.10 Billion |

| Market Size by 2035 |

USD 8.05 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.0% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Test, Treatment, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bayer Healthcare; Andrology solutions; Aytu BioScience, Inc.; Cadila Healthcare Ltd.; Halotech DNA SL; EMD Sereno, Inc.; SCSA Diagnostics, Inc.; Intas Pharmaceuticals Ltd. |

Key Market Driver: Increasing Male Infertility Rates

One of the primary drivers of the male infertility market is the escalating prevalence of infertility among men, largely fueled by changing lifestyles and environmental factors. Smoking, alcohol consumption, poor diet, sedentary lifestyle, and exposure to radiation or toxic substances are widely acknowledged as contributors to declining sperm count and motility. A global health study published by the World Health Organization (WHO) estimates that approximately 15% of couples globally experience infertility, with male-related factors contributing to nearly half of these cases. This rising burden has led to increased demand for diagnostic tools and therapeutic options tailored to male reproductive health.

In recent years, healthcare providers and institutions have begun integrating routine infertility assessments for men into fertility care programs. Moreover, social stigmas around male infertility are slowly eroding, encouraging more individuals to seek diagnosis and treatment. This cultural shift is creating fertile ground for healthcare innovation and investment in male infertility diagnostics and therapies, further propelling market growth.

Market Restraint: High Cost of Treatment and Diagnostics

Despite the increasing demand for male infertility solutions, the high cost of diagnostic tests and advanced fertility treatments continues to be a significant barrier to market growth. Procedures such as DNA fragmentation, oxidative stress analysis, and assisted reproductive techniques like in-vitro fertilization (IVF) and ICSI involve substantial financial investment, often without insurance coverage in many countries. This financial burden deters a significant portion of the population, especially in low- and middle-income regions, from seeking timely medical attention.

Furthermore, the lack of standardized pricing across diagnostic labs and fertility clinics adds to the variability in accessibility. In developing regions, limited healthcare infrastructure and a shortage of trained professionals further exacerbate the issue. As a result, cost-related constraints hinder early diagnosis and effective management of male infertility, restraining the overall expansion of the market.

Market Opportunity: Technological Advancements in Diagnostics

An emerging opportunity within the male infertility market lies in the rapid development and adoption of advanced diagnostic technologies. Innovations such as DNA fragmentation testing, Computer-Assisted Semen Analysis (CASA), and oxidative stress assessment tools are revolutionizing the way male infertility is diagnosed. These technologies offer higher accuracy, faster results, and less subjectivity compared to traditional microscopic methods.

Additionally, the integration of artificial intelligence and machine learning into diagnostic systems is further enhancing the precision and efficiency of fertility assessments. AI-powered platforms can now analyze sperm motility patterns and morphology more accurately, providing critical data to guide personalized treatment plans. Companies investing in the development of smart, user-friendly, and cost-effective diagnostic solutions stand to gain a competitive edge, making this a lucrative area of opportunity in the market.

Male Infertility Market By Test Insights

The Computer-Assisted Semen Analysis (CASA) segment holds the largest share in the male infertility diagnostics market, primarily due to its ability to provide accurate, automated, and standardized sperm assessments. CASA systems significantly reduce human error, allowing for reproducible results in parameters such as sperm count, motility, and morphology. These systems are particularly useful in fertility clinics and specialized laboratories, where precision is critical to effective diagnosis and treatment planning. An increasing number of healthcare providers are incorporating CASA systems into routine fertility assessments, driven by the need for faster and more reliable diagnostics.

Following CASA, DNA fragmentation testing is gaining traction as a critical tool in assessing sperm quality. Fragmented DNA in sperm cells is linked to reduced fertility potential, recurrent pregnancy loss, and poor ART outcomes. As awareness of the importance of DNA integrity in fertility grows, demand for this diagnostic method is expected to surge. Meanwhile, oxidative stress analysis is emerging as the fastest-growing segment due to its ability to detect sperm damage caused by reactive oxygen species (ROS), an increasingly recognized cause of infertility.

Male Infertility Market By Treatment Insights

Among treatment options, Assisted Reproductive Technology (ART) and Varicocele Surgery dominate the market. ART procedures, including IVF and ICSI, are widely used when conventional methods fail to achieve pregnancy. These procedures are particularly beneficial for patients with low sperm motility or severe oligospermia. The growing availability of ART clinics, coupled with improvements in treatment success rates, is driving the segment's dominance. Furthermore, surgical correction of varicocele, a common cause of male infertility, remains a standard and effective treatment, reinforcing this segment's leading position.

Medication is the fastest-growing segment in the treatment category. Hormonal therapies, antioxidants, and supplements such as clomiphene citrate, human chorionic gonadotropin (hCG), and CoQ10 are increasingly prescribed to improve sperm quality. The rise in non-invasive treatment preferences and increased R&D investments in fertility drugs are contributing to the growth of this segment. Pharmaceutical companies are also focusing on the development of targeted therapies that address specific hormonal imbalances and genetic anomalies, further boosting market potential.

Male Infertility Market By Regional Insights

North America stands out as the leading region in the male infertility market, driven by advanced healthcare infrastructure, high awareness levels, and the presence of major market players. The United States, in particular, has witnessed significant advancements in male reproductive health diagnostics and treatments, with widespread availability of ART and state-of-the-art fertility clinics. Moreover, favorable reimbursement policies for infertility treatments in certain U.S. states and Canada have encouraged more men to seek medical care.

Public health initiatives and educational campaigns addressing infertility have also played a pivotal role in destigmatizing the condition. Additionally, robust research and clinical trials in the region have led to the development of innovative diagnostic tools and therapeutic solutions, consolidating North America's dominance in the market.

Asia Pacific is witnessing the fastest growth in the male infertility market due to rapid urbanization, increasing healthcare expenditure, and a growing middle-class population seeking fertility solutions. Countries like India, China, and Japan are experiencing a surge in infertility cases, partly attributed to lifestyle changes, pollution, and rising stress levels. As awareness about male infertility increases, demand for diagnostic and treatment services is expanding rapidly.

In addition, the region is home to a large base of untapped consumers, presenting immense market potential for domestic and international players. Government initiatives to improve access to reproductive health services, coupled with increasing private investments in fertility clinics and diagnostic labs, are expected to further accelerate growth in the Asia Pacific region.

Some of the prominent players in the male infertility market include:

- Bayer Healthcare

- Andrology Solutions

- Aytu BioScience, Inc.

- Cadila Healthcare Ltd.

- Halotech DNA SL

- EMD Sereno, Inc.

- SCSA Diagnostics, Inc.

- Intas Pharmaceuticals Ltd.

Recent Developments

-

In January 2025, CooperSurgical announced the launch of a new CASA system integrated with AI algorithms for enhanced sperm analysis, aimed at improving diagnostic accuracy and reducing turnaround time in fertility clinics.

-

In October 2024, Virtus Health (Australia) expanded its fertility clinic network into Southeast Asia, signaling strategic regional expansion and increased focus on male infertility diagnostics.

-

In June 2024, Merck KGaA collaborated with a biotechnology firm to develop a new line of fertility medications targeting male hormonal imbalances, with clinical trials set to begin in 2025.

-

In August 2024, Andrology Solutions, a UK-based male fertility clinic, launched a teleconsultation platform to provide remote infertility counseling and diagnostic services.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the male infertility market

By Test

- DNA Fragmentation Technique

- Oxidative Stress Analysis

- Microscopic Examination

- Sperm Agglutination

- Computer Assisted Semen Analysis

- Sperm Penetration Assay

- Others

By Treatment

- Assisted Reproductive Technology and Varicocele Surgery

- Medication

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)