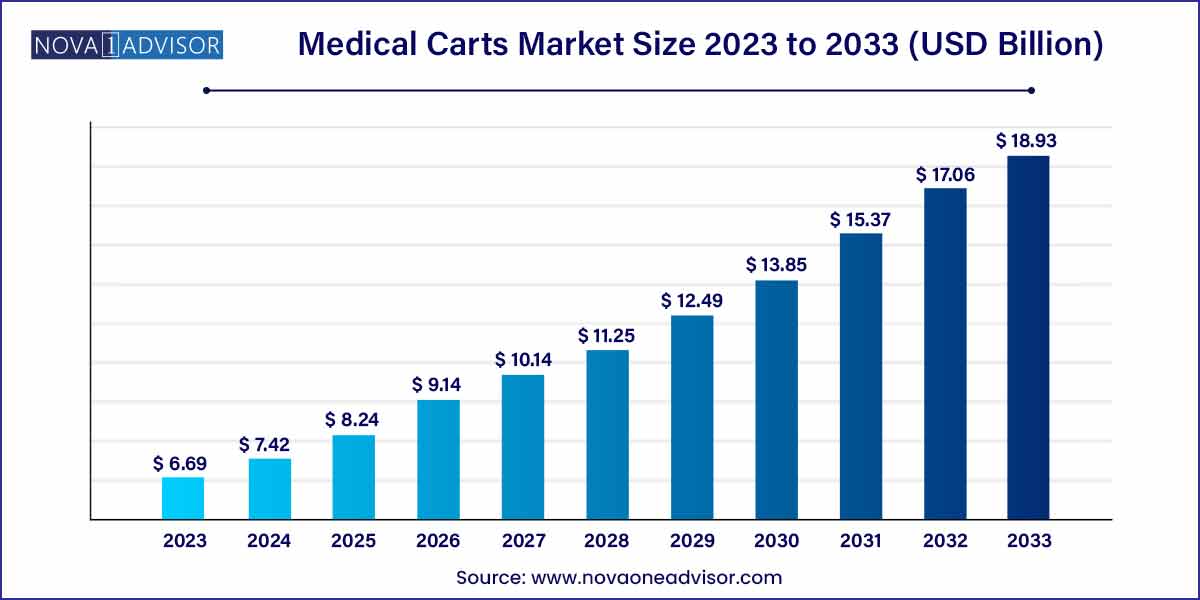

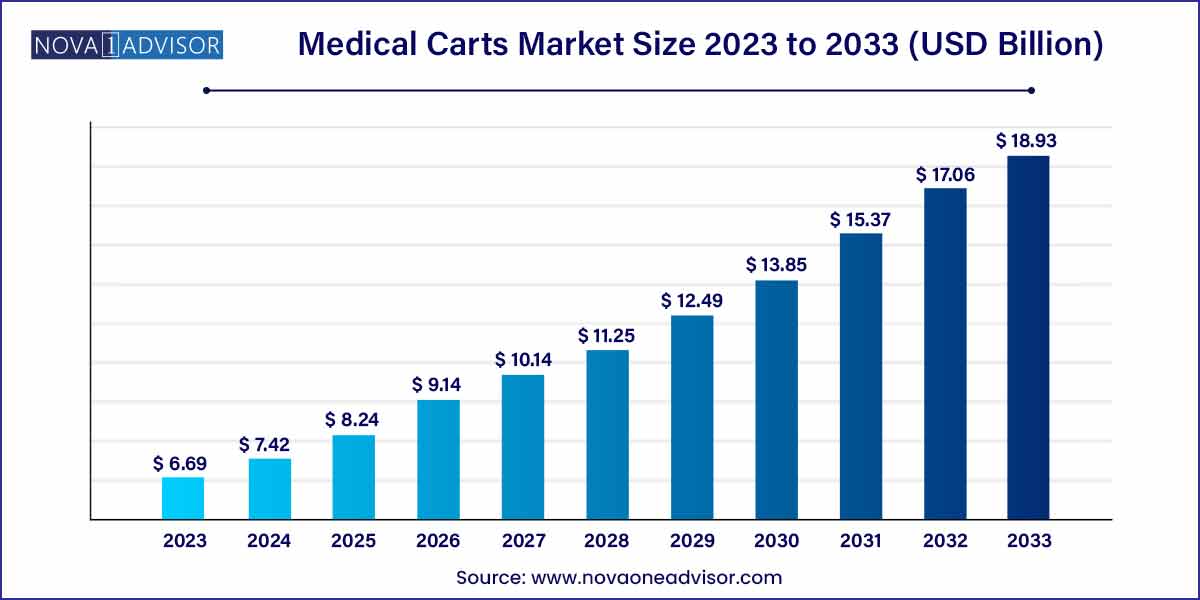

The global medical carts market was estimated at USD 2.63 billion in 2023 and is expected to surpass around USD 12.64 billion by 2033. It is poised to grow at a compound annual growth rate (CAGR) of 17.00% during the forecast period of 2024 to 2033.

Key Takeaways:

- The mobile computing carts segment dominated the medical carts market with the largest revenue share of 73.2% in 2023.

- The emergency carts segment dominated the market with the largest revenue share of 40.6% in 2023.

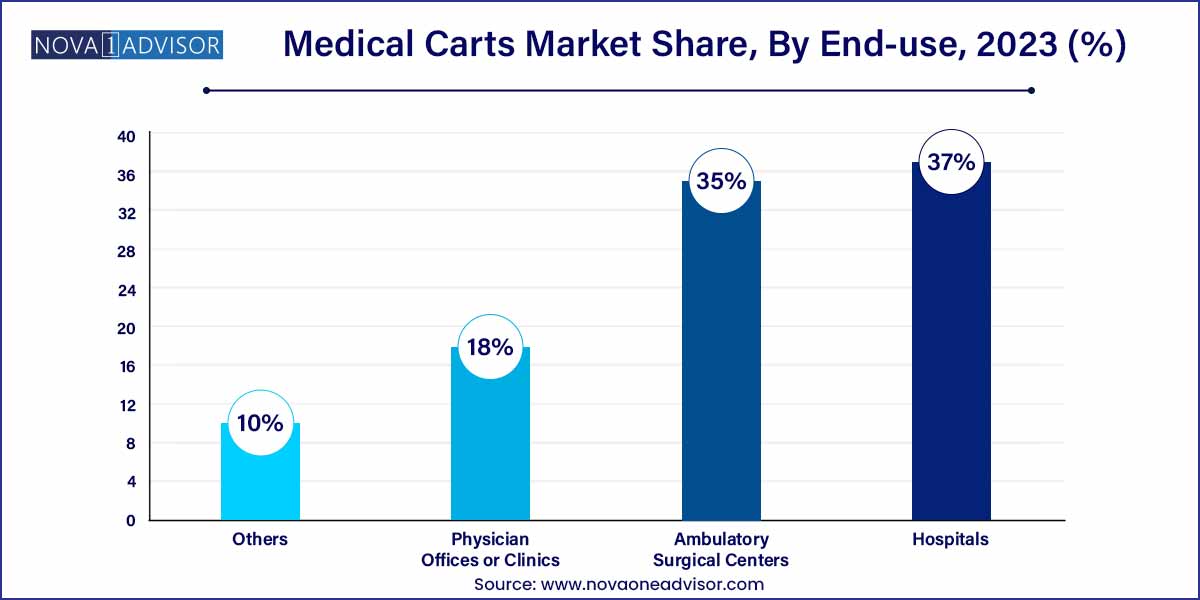

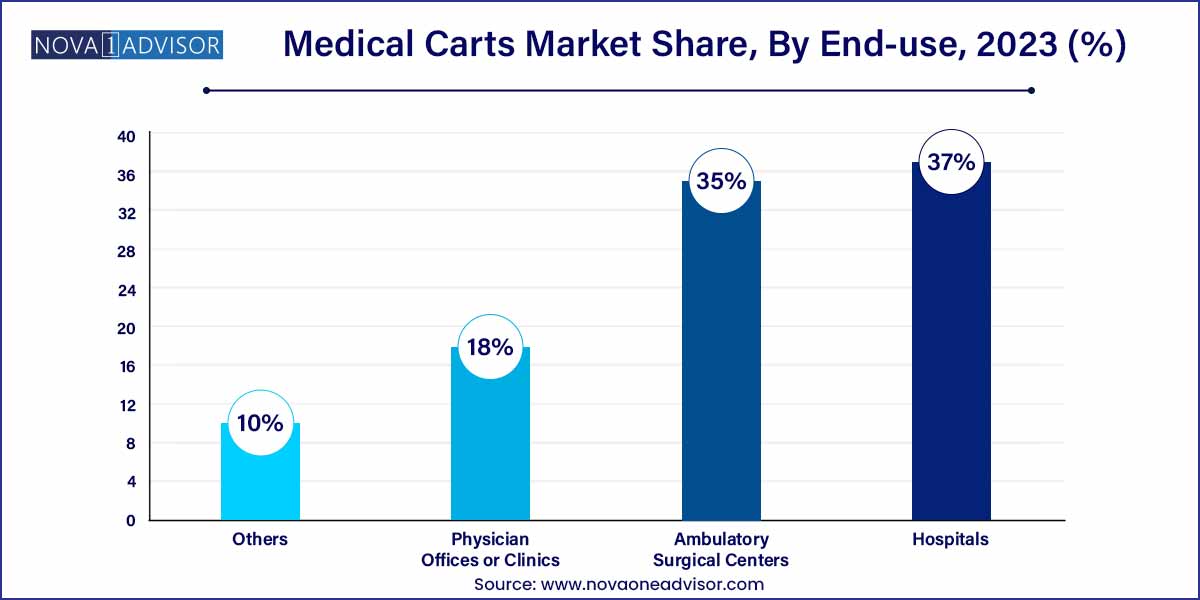

- The hospitals segment dominated the market with the largest revenue share of 37.0% in 2023.

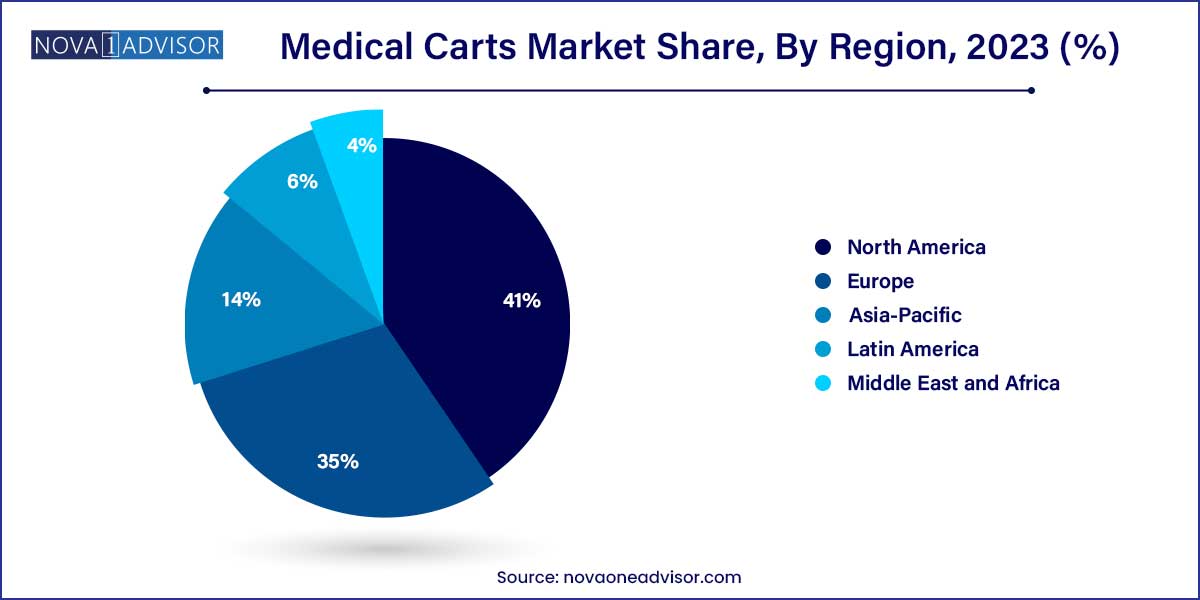

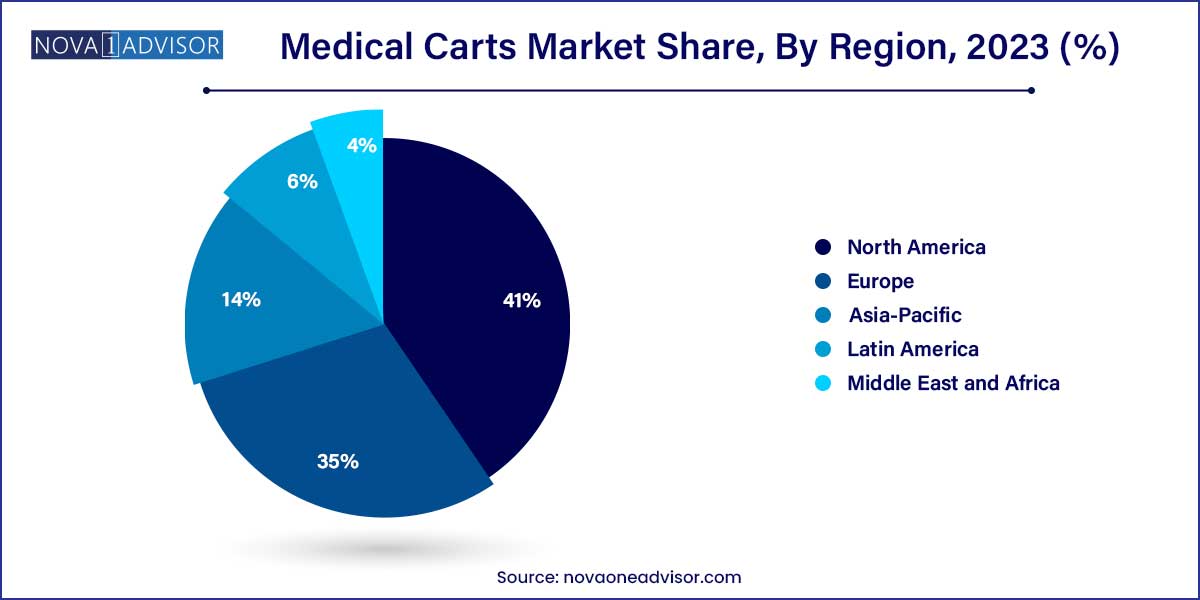

- North America dominated the market, with the largest revenue share of 41.0% in 2023.

Market Overview

The Medical Carts Market plays an increasingly critical role in modern healthcare delivery, offering versatile, mobile solutions that enhance efficiency, patient care, and clinical workflow in hospitals, clinics, ambulatory surgical centers (ASCs), and other healthcare settings. Medical carts include mobile computing carts, medication carts, emergency carts, and various specialized procedure carts that are pivotal in patient monitoring, drug administration, record keeping, and medical device transport.

The surge in hospital admissions, rising patient awareness, and the widespread adoption of Electronic Health Records (EHR) are key factors driving the medical carts market's expansion. Furthermore, increasing demands for point-of-care access, improved hygiene practices, and staff workflow optimization are propelling investments in ergonomic and technologically advanced carts.

Leading companies such as Ergotron, Capsa Healthcare, and Midmark Corporation are at the forefront, innovating with lightweight materials, modular designs, integrated power supplies, and IoT-enabled carts. The future of medical carts is highly dynamic, shaped by the evolution of healthcare IT, the focus on infection control, and the rising prominence of mobile health solutions.

Major Trends in the Market

-

Integration of Wireless and IoT Technologies: Smart carts with real-time data tracking and connectivity to EHR systems.

-

Surging Demand for Ergonomic and Lightweight Carts: Focus on reducing caregiver fatigue and improving mobility.

-

Expansion of Mobile Computing Carts: Increasing need for point-of-care documentation and telehealth applications.

-

Growth of Specialized Carts for Emergency and Anesthesia Use: Customization based on department-specific needs.

-

Emphasis on Infection Control and Antimicrobial Coatings: In response to rising healthcare-associated infection (HAI) concerns.

-

Battery-powered and Hot-swappable Solutions: Enabling longer cart usage without interruptions.

-

Customization and Modular Designs: Enabling healthcare providers to tailor carts to specific operational requirements.

Medical Carts Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.63 Billion |

| Market Size by 2033 |

USD 12.64 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.0% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ergotron Inc.; ITD GmbH; Capsa Healthcare; Enovate Medical; TouchPoint Medical; JACO Inc.; Advantech Co., Ltd.; Harloff Manufacturing Co.; Medline Industries Inc.; Armstrong Medical Inc.; McKesson Medical-Surgical Inc.; Omnicell Inc.; Altus Health Systems; CompuCaddy; GCX Corporation; Parity Medical; Hergo Ergonomic Support Systems, Inc.; Performance Health (formerly Patterson Medical); Market Lab, Inc. |

Key Market Driver

Increasing Adoption of Electronic Health Records (EHR) and Point-of-Care Access

The rapid digitization of healthcare is a key driver for the medical carts market. Hospitals and clinics are increasingly adopting EHR systems to streamline patient information management, comply with government regulations, and improve clinical decision-making. Mobile computing carts equipped with secure, wireless access to EHRs enable real-time charting, medication administration, and clinical documentation at the patient's bedside, enhancing both accuracy and patient engagement. In March 2024, the U.S. Office of the National Coordinator for Health Information Technology reported a 12% year-over-year increase in EHR adoption across small- to mid-sized hospitals, directly impacting medical cart demand.

Key Market Restraint

High Cost of Advanced Medical Carts

Despite their advantages, advanced medical carts, particularly those integrated with power systems, computing modules, and secure locking features, are expensive. The high initial cost, coupled with ongoing maintenance, can strain healthcare facility budgets, particularly in smaller clinics and emerging markets. Furthermore, additional expenditures on software licensing, cybersecurity, and staff training further compound the financial burden. Consequently, cost-sensitive facilities may opt for basic or refurbished carts, potentially restraining market growth.

Key Market Opportunity

Emergence of Telehealth and Remote Patient Monitoring

The acceleration of telehealth services presents a significant growth opportunity for the medical carts market. Mobile computing carts integrated with video conferencing capabilities, diagnostic devices, and secure communication platforms are essential tools in telemedicine. These carts facilitate remote consultations, virtual rounds, and patient monitoring, especially in rural or underserved areas. In February 2024, a leading U.S. health system announced a 40% expansion in its telehealth fleet using mobile cart units, demonstrating the increasing convergence of mobile healthcare and medical cart solutions.

Product Insights

Mobile Computing Carts dominated the product segment in 2024. The growing emphasis on point-of-care documentation, the need for immediate access to patient records, and seamless integration with hospital IT systems have made mobile computing carts indispensable. These carts often come equipped with adjustable monitor arms, battery systems, medication drawers, and RFID readers, enabling efficient bedside care.

Wall-mounted Workstations are witnessing fast growth, particularly in settings with limited space. Compact, foldable wall-mounted solutions allow providers to access patient data without occupying valuable floor space, a crucial advantage in crowded emergency departments or clinics.

Type Insights

Emergency Carts dominated the type segment. Emergency or crash carts are critical in providing immediate access to life-saving medications, defibrillators, and airway equipment during code situations. Their design focuses on accessibility, durability, and secure locking to prevent tampering.

Anesthesia Carts are growing rapidly, fueled by the increase in surgical volumes globally. Anesthesia carts are customized to store anesthetics, airway management tools, and monitoring devices securely, facilitating smooth perioperative workflows. In March 2024, several hospitals across Europe invested in smart anesthesia carts integrated with RFID-based medication tracking systems.

End-use Insights

Hospitals dominated the end-use segment. Hospitals account for the majority of medical cart deployments, spanning various departments such as critical care, emergency medicine, surgical units, and oncology. The need for mobility, efficient documentation, medication management, and infection control is particularly acute in hospital settings, driving continuous investments in advanced cart solutions.

Ambulatory Surgical Centers (ASCs) are the fastest-growing end-use segment. ASCs require compact, mobile, and cost-effective solutions to optimize their outpatient surgery workflows. Increasing ASC volumes, fueled by a shift toward minimally invasive surgeries and same-day discharge procedures, are boosting medical cart demand in these settings. In February 2024, a major ASC operator in the U.S. expanded its mobile computing cart fleet to support digital patient check-ins and intraoperative data recording.

Regional Insights

North America dominated the global medical carts market in 2024. Factors such as high healthcare IT adoption, substantial investments in hospital infrastructure, a large number of surgeries, and stringent regulatory standards regarding patient safety and documentation contribute to the region's leadership. The U.S. market, in particular, is driven by the HITECH Act, which incentivizes EHR adoption, and by growing telemedicine programs.

Asia-Pacific is the fastest-growing region. Rapid healthcare infrastructure development, increasing healthcare expenditure, rising awareness of infection control practices, and the digital transformation of healthcare systems are propelling market growth. In March 2024, India launched a national healthcare digitization initiative, including incentives for hospitals and clinics to adopt mobile point-of-care technologies, opening significant opportunities for medical cart vendors.

Some of the prominent players in the medical cart market include:

- Ergotron, Inc.

- ITD GmbH

- Capsa Healthcare

- Enovate Medical

- TOUCHPOINT MEDICAL INC.

- JACO Inc.

- Advantech Co., Ltd.

- Harloff Manufacturing Co.

- Medline Industries Inc.

- Armstrong Medical Inc.

- McKesson Medical-Surgical Inc.

- Omnicell Inc.

- Altus Health System

- CompuCaddy

- GCX Corporation

- Parity Medical

- Hergo Ergonomic Support Systems, Inc.

- Performance Health (formerly Patterson Medical)

- Market Lab, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2033. For this study, Nova One Advisor, Inc. has segmented the global medical carts market.

Product

- Mobile Computing Carts

- Wall-mounted Workstations

- Medication

- Medical Storage Columns, Cabinets, & Accessories

- Others

Type

- Anesthesia

- Emergency

- Procedure

- Others

End-use

- Hospitals

- Ambulatory Surgical Centers

- Physician Offices or Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)