Medical Specimen Tracking System Market Size and Trends

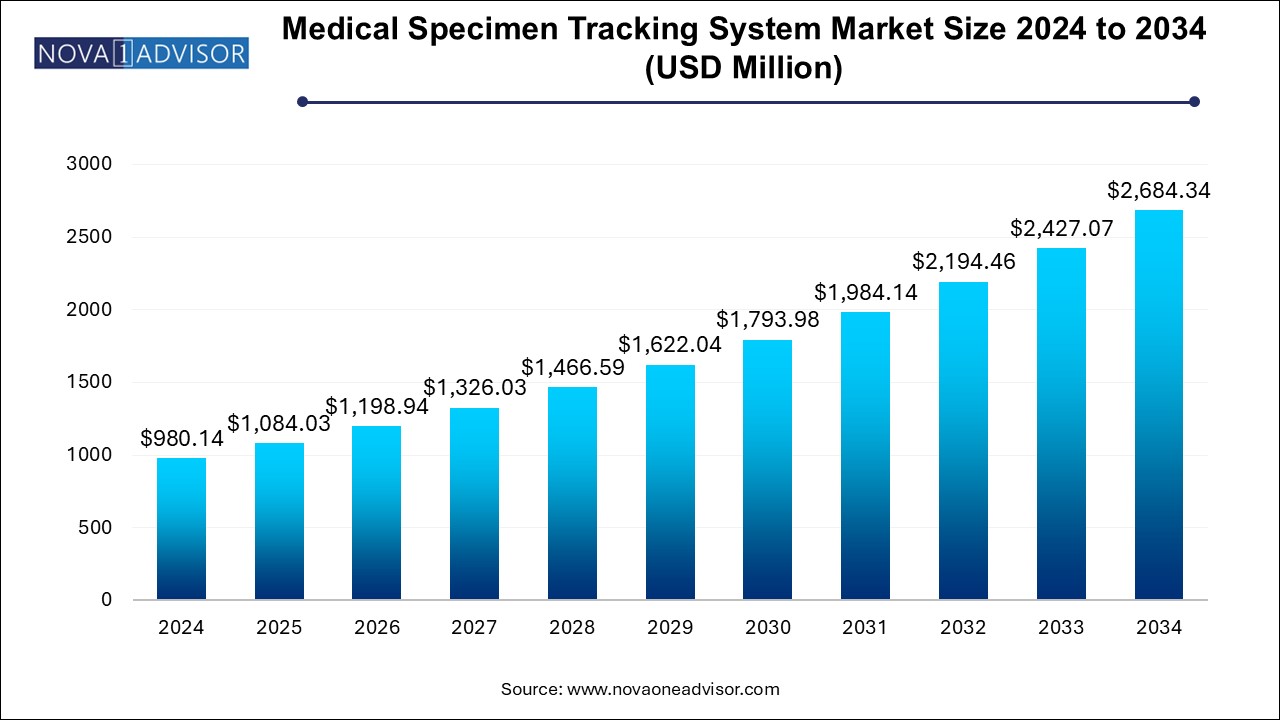

The medical specimen tracking system market size was exhibited at USD 980.14 million in 2024 and is projected to hit around USD 2684.34 million by 2034, growing at a CAGR of 10.6% during the forecast period 2025 to 2034.

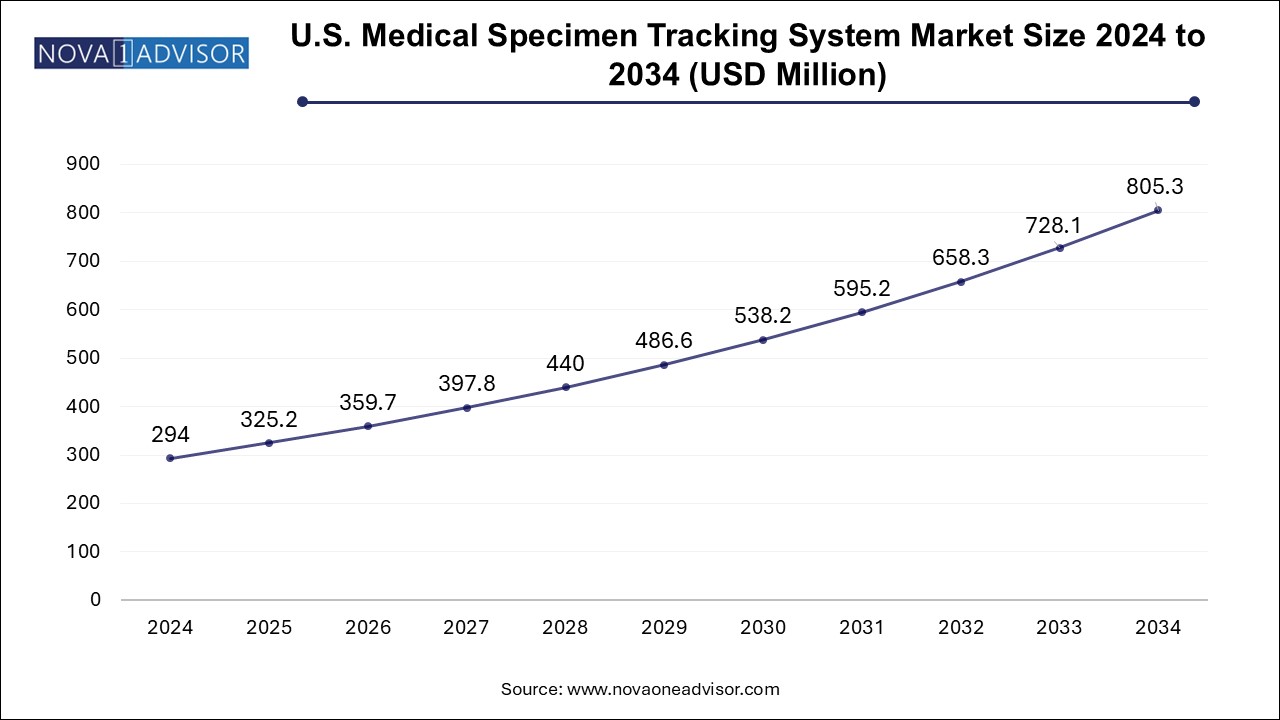

U.S. Medical Specimen Tracking System Market Size and Growth 2025 to 2034

The U.S. medical specimen tracking system market size is evaluated at USD 294.0 million in 2024 and is projected to be worth around USD 805.3 million by 2034, growing at a CAGR of 9.59% from 2025 to 2034.

North America emerged as the dominant market for specimen tracking systems in 2024, driven by strong regulatory enforcement, advanced healthcare infrastructure, and high digital maturity. The United States, in particular, benefits from widespread adoption of EMRs and LIS, allowing seamless integration of tracking software. Federal programs such as the Clinical Laboratory Improvement Amendments (CLIA) and HIPAA compliance guidelines further support investment in traceable, secure specimen handling.

Asia Pacific is expected to grow at the highest CAGR, driven by rapid healthcare digitization, rising diagnostics demand, and supportive government initiatives. Countries like China, India, South Korea, and Japan are investing heavily in laboratory modernization, especially post-pandemic, where lab capacity expansion became a national priority. Public-private partnerships and funding for AI-driven diagnostics and laboratory automation are creating fertile ground for specimen tracking systems.

India’s Ayushman Bharat initiative and China's National Health Informatization Project are paving the way for interconnected lab systems that require end-to-end traceability. Moreover, the booming clinical trial industry in South Korea and Australia is supporting adoption in research settings. As global pharma companies increasingly outsource R&D and trials to Asia, the need for compliant and sophisticated specimen tracking infrastructure continues to rise.

Market Overview

The medical specimen tracking system market plays a vital role in modern healthcare by ensuring the integrity, accuracy, and traceability of biological samples throughout the diagnostic and research lifecycle. These systems are designed to manage the collection, labeling, transportation, processing, storage, and analysis of specimens—such as blood, tissues, urine, and other biological samples—across clinical, laboratory, and research environments. With rising demands for diagnostic accuracy, regulatory compliance, and patient safety, specimen tracking has evolved into a mission-critical function for hospitals, pathology laboratories, and research organizations.

Traditional manual systems are being replaced by automated and digital platforms that integrate hardware (like barcode scanners and RFID readers), software (such as LIS or EMR-integrated systems), and consumables (like labeled containers, RFID chips, and barcoded tags). These systems improve workflow transparency, minimize human error, and enhance real-time visibility of sample movement and status. In an era where one mislabeled specimen can lead to diagnostic errors, lawsuits, and loss of credibility, the implementation of robust tracking technologies is no longer optional.

The growing emphasis on precision medicine, biobanking, and clinical trials has further magnified the need for meticulous specimen handling. Moreover, with the rise of decentralized healthcare models, including telehealth and home diagnostics, maintaining specimen traceability across dispersed networks is becoming increasingly complex—further fueling market growth. Government mandates and healthcare accreditation bodies are also playing an active role in shaping the market by enforcing strict compliance standards.

As technological advancements continue to unfold, the specimen tracking systems market is expected to grow rapidly, supported by innovations such as blockchain-based traceability, AI-powered error detection, and cloud-based workflow platforms. From preventing pre-analytical errors to enhancing the chain of custody in forensic and clinical trial environments, this market is poised for transformative growth over the next decade.

Major Trends in the Market

-

Shift Toward RFID-Based Solutions: The adoption of RFID is rising due to its superior tracking accuracy and non-line-of-sight scanning capabilities.

-

Cloud-Based Tracking Software: Integration with cloud platforms enables real-time specimen visibility across multiple locations and remote labs.

-

Blockchain for Data Integrity: Emerging platforms are exploring blockchain to maintain immutable records of specimen data and reduce tampering.

-

Artificial Intelligence in Error Detection: AI-powered software is being used to detect mismatches, anomalies, or specimen processing delays in real time.

-

Growth in Biobanking and Precision Medicine: Personalized therapies and genomics research are demanding higher sample traceability and long-term integrity.

-

Regulatory Push for Standardization: Compliance with CAP, HIPAA, CLIA, and FDA regulations is mandating the use of advanced specimen management systems.

-

Integration with Laboratory and Hospital Information Systems: Seamless LIS/EMR integration ensures accurate linking of specimens to patient data.

-

Use of Mobile and Handheld Devices: Mobile scanning and tagging devices are increasing specimen traceability in transit and point-of-care collection.

Report Scope of Medical Specimen Tracking System Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1084.03 Million |

| Market Size by 2034 |

USD 2684.34 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 10.6% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Product, Technology, Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

RMS Omega; Peak Technologies (Vision ID); GAO Group; TrakCel; Kuehne + Nagel (Quick International Courier); Cryoport Systems, LLC; LabConnect; Taylor Data Systems; BioIT Solutions; BROOKS AUTOMATION |

Market Driver: Emphasis on Diagnostic Accuracy and Patient Safety

The most powerful driver for the medical specimen tracking system market is the increasing demand for diagnostic accuracy and patient safety, especially in high-throughput and multi-department healthcare environments. A single specimen mislabeling or mix-up can result in incorrect diagnosis, inappropriate treatment, delayed intervention, and significant legal consequences. In pathology and oncology, where a tissue biopsy determines the course of aggressive treatments like chemotherapy or surgery, ensuring that the right sample is linked to the right patient is paramount.

Healthcare providers are under growing pressure to improve accountability, traceability, and compliance throughout the pre-analytical and analytical phases of testing. Systems that enable end-to-end specimen tracking, complete with time-stamped logs, user authentication, and chain-of-custody verification, are becoming essential. Furthermore, specimen tracking helps laboratories reduce lost samples, eliminate retesting costs, and streamline quality assurance audits—directly contributing to operational efficiency and reputational trust.

Market Restraint: High Initial Investment and Integration Complexity

A notable restraint in the market is the significant upfront cost of implementing advanced specimen tracking systems, especially for smaller clinics, stand-alone laboratories, and healthcare facilities in emerging economies. Hardware such as RFID scanners, label printers, and IoT-enabled devices can be capital-intensive. The software layer often requires extensive customization, integration with legacy systems, user training, and ongoing maintenance—factors that add to the total cost of ownership.

Integration with electronic health records (EHRs), laboratory information systems (LIS), and external lab networks is often complex, especially when using disparate systems or outdated infrastructure. For organizations without a robust IT backbone, deploying a full-fledged tracking system can be time-consuming and disruptive. These challenges, combined with cybersecurity concerns and data interoperability issues, may deter rapid adoption in cost-sensitive environments.

Market Opportunity: Rising Clinical Trials and Biobanking Activity

A major opportunity for the market lies in the surging demand for clinical trials and biobanking, which require strict specimen traceability and regulatory compliance. Pharmaceutical and biotech companies are conducting increasing numbers of trials globally, with samples collected and analyzed across diverse geographies. This decentralized model necessitates robust tracking systems to ensure sample integrity, avoid chain-of-custody violations, and comply with Good Clinical Practice (GCP) guidelines.

Simultaneously, biobanks are becoming a cornerstone of precision medicine, housing millions of biological specimens intended for future research. Tracking the location, condition, and associated metadata of these samples over long periods demands sophisticated systems. Vendors offering end-to-end solutions tailored to clinical trial logistics or biobank governance will find significant growth potential, especially as AI and analytics are increasingly applied to specimen metadata for research insights.

Medical Specimen Tracking System Market By Product Insights

The Software solutions dominated the market in 2024, driven by their central role in enabling real-time tracking, reporting, and analytics. These platforms manage the digital backbone of specimen logistics, providing user interfaces for labeling, chain-of-custody documentation, inventory management, and compliance reporting. Cloud-based deployment is gaining popularity for its scalability, lower upfront cost, and remote accessibility. Companies such as LabWare, Sunquest, and Thermo Fisher Scientific are continuously enhancing software platforms to include predictive analytics, AI integrations, and intuitive dashboards.

Consumables are expected to grow at the fastest rate, particularly due to the increased volume of specimen testing and the shift toward individualized medicine. These include RFID labels, barcode stickers, sample tubes with pre-printed identifiers, and tamper-evident packaging. Hospitals and labs require large, recurring quantities of consumables, making this segment attractive for vendors offering automation-compatible or smart tracking consumables. As home sample collection gains popularity, demand for pre-assembled, trackable specimen kits is rising sharply.

Medical Specimen Tracking System Market By Type Insights

Based on Patient testing accounted for the dominant share of the market, encompassing routine diagnostics performed in hospitals, clinics, and reference labs. This includes blood tests, biopsies, swabs, and other biological samples linked directly to patient care. Ensuring traceability from the point of collection to result delivery is essential for patient safety and clinical decision-making. As diagnostic volumes surge due to rising chronic illnesses, aging populations, and preventive care initiatives, specimen tracking in this segment remains critical.

Clinical trial tissue specimen tracking is the fastest-growing type, supported by the globalization of drug trials and the growing complexity of biospecimen logistics. Clinical trials require meticulous sample tracking to comply with regulatory standards such as FDA 21 CFR Part 11, EMA GCP guidelines, and ICH standards. Errors in specimen labeling or custody can lead to trial delays, data exclusion, or regulatory penalties. As a result, CROs, pharma sponsors, and academic research organizations are investing heavily in dedicated tracking systems tailored for multicenter trials.

Medical Specimen Tracking System Market By Technology Insights

The Barcode technology continues to lead the market, mainly due to its affordability, ease of implementation, and compatibility with legacy systems. Barcode-based systems are widely used in hospitals, labs, and research settings, offering a reliable method of labeling and tracking samples through pre-defined workflows. Linear and 2D barcodes are embedded into specimen labels, requisition forms, and test tubes, making them easy to scan and validate at each touchpoint.

RFID is projected to be the fastest-growing technology, thanks to its non-line-of-sight scanning ability, batch processing, and higher data storage capacity. RFID-enabled specimen tracking systems can simultaneously scan multiple samples within containers or during transit—enhancing efficiency in high-throughput labs or logistics hubs. RFID also facilitates error reduction during handovers and enables temperature tracking when embedded in cold chain systems. As costs fall and integration improves, RFID adoption is expected to expand beyond premium healthcare providers to mid-sized facilities and mobile diagnostic units.

Medical Specimen Tracking System Market By End-use Insights

Based on Hospitals and clinics dominated the end-use segment, as they perform a high volume of patient-related specimen collection and diagnostics. These facilities face increasing regulatory scrutiny and public pressure to minimize diagnostic errors. Integration of tracking systems with LIS, EHR, and automated lab equipment is improving sample handling efficiency. Hospital-based labs are also implementing smart transport containers and automated labeling systems to reduce turnaround time and improve quality control.

Pathology laboratories are the fastest-growing users, especially as outsourced testing becomes more prevalent. Specialized pathology labs process large volumes of histopathological, cytological, and genetic samples that require precise tracking. These labs are investing in scalable platforms that support multi-location networks, specimen scanning robots, and AI-assisted matching tools. Furthermore, digital pathology is converging with tracking systems to provide complete visibility of specimen data, slide creation, and digital imaging in a centralized interface.

Some of the prominent players in the medical specimen tracking system market include:

- RMS Omega

- Peak Technologies (Vision ID)

- GAO Group

- TrakCel

- Kuehne + Nagel (Quick International Courier)

- Cryoport Systems, LLC

- LabConnect

- Taylor Data Systems

- BioIT Solutions

- BROOKS AUTOMATION

Medical Specimen Tracking System Market Recent Developments

-

In March 2025, Thermo Fisher Scientific introduced a new cloud-based upgrade to its SampleManager LIMS, integrating real-time specimen tracking and AI-powered workflow automation.

-

In January 2025, LabWare launched a blockchain-enabled biobank specimen tracking module, aimed at pharmaceutical companies and academic research centers.

-

In December 2024, Zebra Technologies partnered with a leading U.S. health system to deploy RFID-based mobile specimen tracking across 200 hospitals.

-

In October 2024, Sunquest Information Systems unveiled a new mobile app for phlebotomy and specimen tracking, featuring barcode scanning and route optimization for couriers.

-

In August 2024, McKesson expanded its supply chain services to include a cold chain specimen monitoring platform with integrated temperature logging and custody certification.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the medical specimen tracking system market

By Product

- Software

- Hardware

- Consumables

By Technology

By Type

- Patient Testing

- Clinical Trial Tissue Specimen

By End Use

- Hospitals & Clinics

- Pathology Laboratories

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)