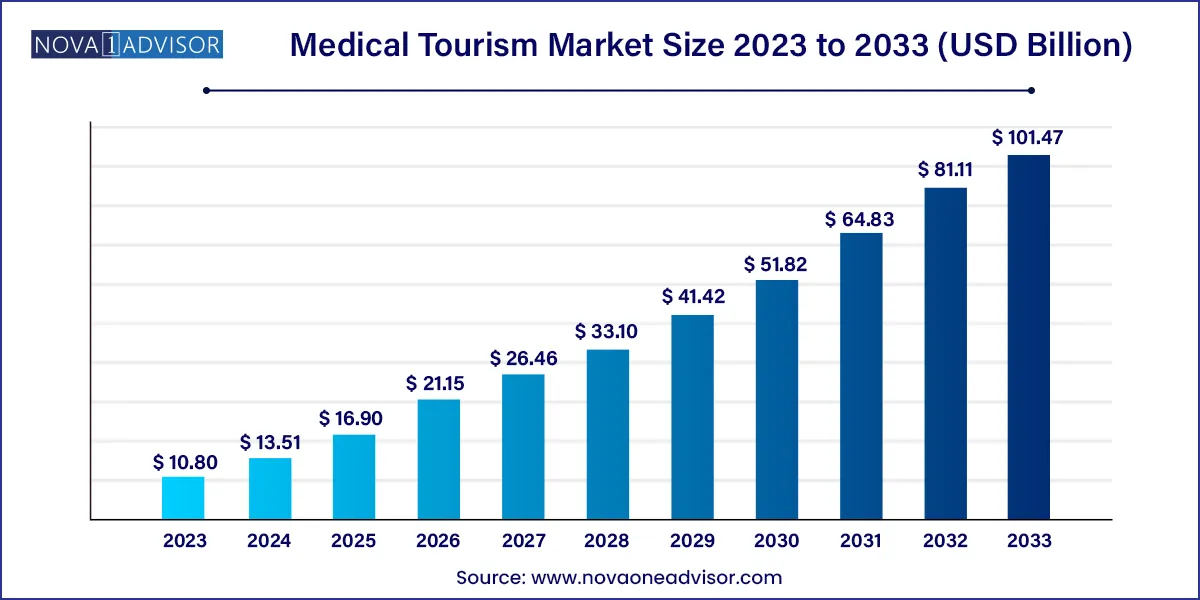

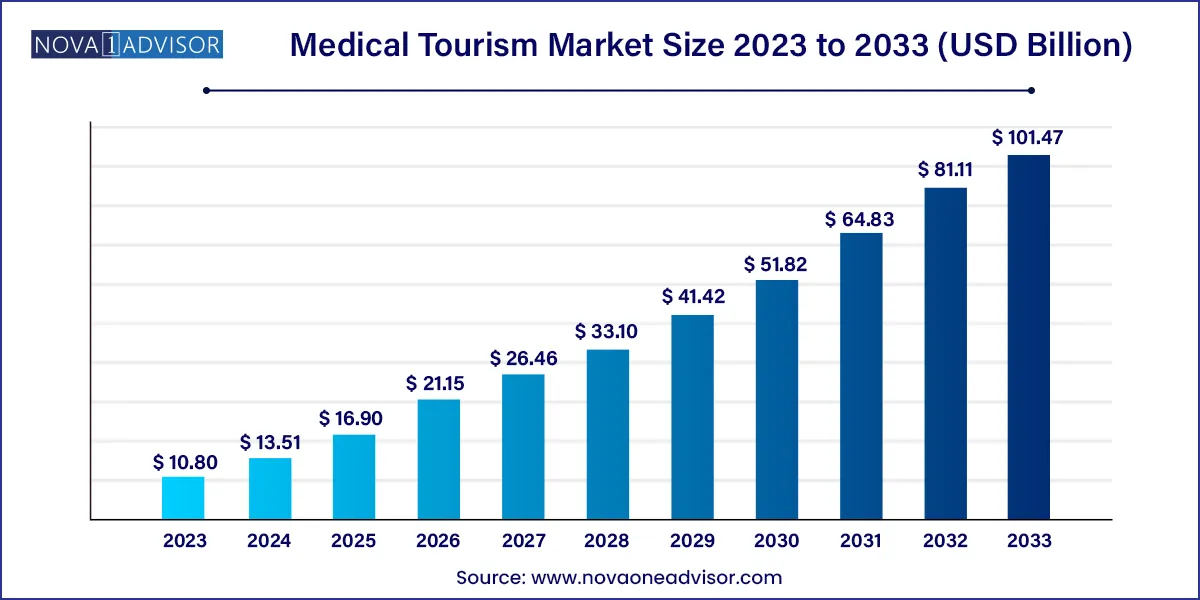

The global medical tourism market size was exhibited at USD 10.80 billion in 2023 and is projected to hit around USD 101.47 billion by 2033, growing at a CAGR of 25.11% during the forecast period of 2024 to 2033.

Key Takeaways:

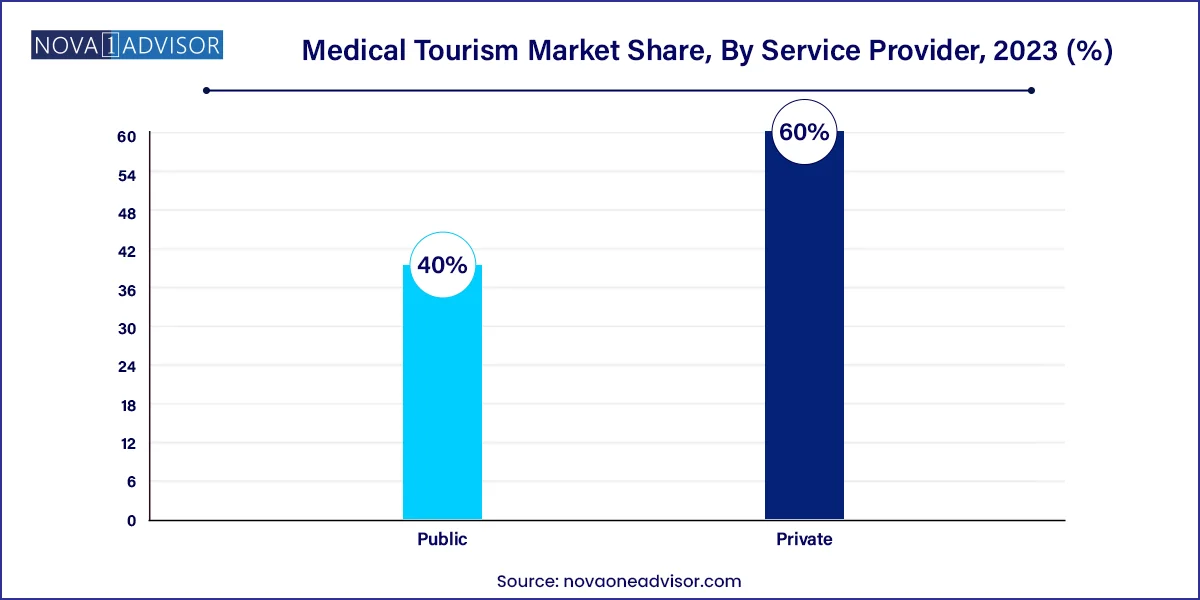

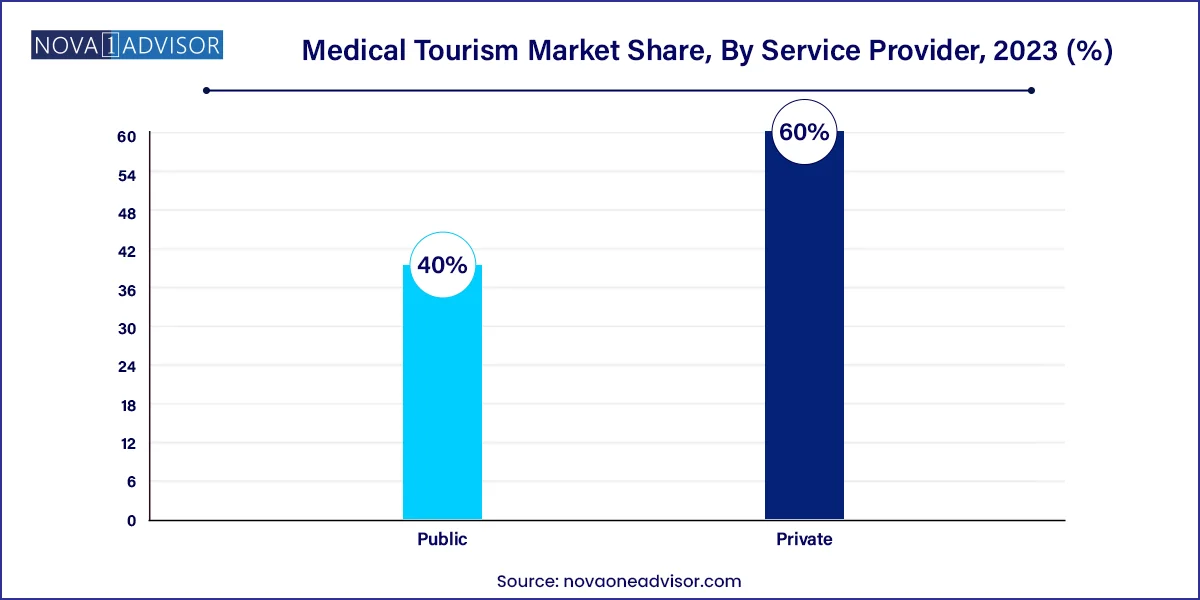

- The private segment dominated the market in 2023 and is projected to have the fastest CAGR of 25.86% from 2023 to 2033.

- The cosmetic segment held the largest revenue share of 23.9% in 2023.

- Turkey dominated the market in 2023 with a revenue share of 19.5%.

Market Overview

The global medical tourism market represents a dynamic and rapidly evolving segment of the healthcare and travel industries. Defined as the practice of traveling across international borders to obtain medical treatment, medical tourism has transformed into a multibillion-dollar industry. It offers patients access to affordable, timely, and often high-quality healthcare services that may not be available or affordable in their home countries.

The market encompasses a wide range of treatments from elective surgeries and cosmetic procedures to complex cardiac and orthopedic surgeries, cancer therapies, and fertility treatments. Patients are drawn to destinations that offer specialized services, world-class infrastructure, accredited healthcare institutions, and cost-effective packages. Increasingly, countries like India, Thailand, Mexico, and Turkey are investing in healthcare infrastructure, marketing, and cross-border alliances to attract international patients.

Key driving forces include rising healthcare costs in developed countries, long waiting times, lack of advanced medical technology in home countries, and increasing patient awareness through digital platforms. Government initiatives and public-private partnerships in medical hubs further reinforce the appeal of medical tourism. Despite the sector being temporarily disrupted by the COVID-19 pandemic, it is rebounding strongly as global travel resumes and healthcare systems normalize.

Medical Tourism Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 13.51 Billion |

| Market Size by 2033 |

USD 101.47 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 25.11% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Treatment Type, Service Provider, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

MOHW Hengchun Tourism Hospital; Apollo Hospitals Enterprise Ltd.; Bumrungrad International Hospital; Mount Elizabeth Hospitals; Raffles Medical Group; Dr. B. L. Kapur Memorial Hospital; Kasemrad Hospital International Rattanathibet; Mission Hospital; Bangkok Hospital; Miot Hospital; Penang Adventist Hospital |

Key Market Driver: Rising Healthcare Costs in Developed Nations

One of the strongest drivers of medical tourism is the escalating healthcare costs in developed nations like the United States, Canada, and the U.K. For example, procedures such as knee replacement, dental implants, or IVF treatments in these countries can cost up to three times more than in medical tourism destinations. Moreover, high out-of-pocket expenses and limited insurance coverage for elective procedures further encourage outbound medical travel.

In contrast, countries such as India, Thailand, and Turkey offer comparable, often superior, treatment quality at a fraction of the cost. These nations have hospitals accredited by global bodies and employ internationally trained medical professionals. As patients become increasingly price-conscious yet demand quality and safety, medical tourism presents an appealing solution, especially for the uninsured or underinsured populations.

Key Market Restraint: Cross-Border Regulatory and Ethical Concerns

While medical tourism offers numerous advantages, it is also fraught with regulatory and ethical challenges. Issues such as inconsistent legal frameworks, lack of transparency in pricing and outcomes, and ethical concerns surrounding organ transplantation or surrogacy practices can hinder market growth. Furthermore, complications arising post-treatment, when patients return home, pose medico-legal dilemmas and impact patient safety.

In addition, there is often inadequate alignment between healthcare systems of the host and home countries, making post-operative care and follow-up challenging. Language barriers, differing clinical guidelines, and quality assurance gaps also act as deterrents. These concerns highlight the importance of accreditation, international standards, and bilateral agreements to streamline medical tourism practices.

An emerging opportunity lies in the expansion of digital health platforms that assist patients in planning and coordinating international medical treatments. These platforms offer end-to-end services including virtual consultations, hospital selection, cost estimates, visa and travel support, and post-operative care coordination. As internet penetration increases and telehealth becomes mainstream, these digital interfaces are revolutionizing patient journeys.

Companies are leveraging AI and data analytics to match patients with the most appropriate hospitals and doctors globally. Additionally, patient reviews, real-time feedback, and transparency tools are increasing consumer trust. In the coming years, digitalization will play a pivotal role in democratizing access to global healthcare and scaling the medical tourism ecosystem.

Segments Insights:

By Service Provider Insights

Private providers dominate the medical tourism market, as they offer customized treatment packages, faster service, and premium facilities that appeal to international patients. These hospitals and specialty centers often partner with global accreditation agencies and insurance providers to ensure international quality standards. Many have dedicated medical tourism departments to handle logistics and patient experience.

Public providers are the fastest-growing segment, particularly in countries with government-supported healthcare tourism initiatives. For instance, Malaysia and Thailand have launched national health tourism programs that include public sector hospitals. These institutions offer competitive pricing and credible services, especially for treatments like cardiac surgeries, cancer therapies, and organ transplants. Their growth is supported by investment in infrastructure and branding.

By Treatment Type Insights

Cosmetic treatment dominates the medical tourism market, driven by growing global demand for procedures such as rhinoplasty, liposuction, facelifts, and breast augmentation. These procedures are often elective and not covered by insurance, leading patients to seek affordable options abroad. Destinations like South Korea, Brazil, and Turkey have emerged as leaders in cosmetic surgery, offering world-class expertise at reduced costs. Their specialized clinics, streamlined visa processes, and luxury recovery facilities appeal to both domestic and international patients seeking aesthetic enhancements.

Infertility treatment is the fastest-growing segment, reflecting increasing awareness, delayed family planning, and higher infertility rates. IVF, IUI, and advanced reproductive technologies are expensive and heavily regulated in some countries. Countries like India, Ukraine, and Greece are offering advanced fertility care at a fraction of Western prices, often with shorter waiting periods. Clinics in these regions boast high success rates, state-of-the-art labs, and multilingual staff, making them popular for cross-border fertility care

By Regional Analysis

Asia-Pacific dominates the medical tourism market, with countries like India, Thailand, Singapore, and Malaysia leading the charge. These nations combine advanced medical expertise, affordable pricing, and robust hospitality infrastructure. India is renowned for its cardiac, orthopedic, and oncology procedures; Thailand for cosmetic and bariatric treatments; and Singapore for high-end diagnostics and surgical care. Government support, medical visa facilitation, and growing international patient trust have bolstered the region’s position.

Latin America is the fastest-growing region, driven by proximity to North America, cultural affinity, and affordability. Mexico, Costa Rica, and Colombia are top destinations for dental care, cosmetic surgery, and bariatric procedures. These countries offer convenient travel, short waiting periods, and high-quality care, particularly appealing to U.S. patients. Additionally, Latin America is seeing investments in medical infrastructure and cross-border collaborations to enhance its competitiveness.

Some of the prominent players in the medical tourism market include:

- MOHW Hengchun Tourism Hospital

- Apollo Hospitals Enterprise Ltd.

- Bumrungrad International Hospital

- Mount Elizabeth Hospitals

- Raffles Medical Group

- Dr. B. L. Kapur Memorial Hospital

- Kasemrad Hospital International Rattanathibet

- Mission Hospital

- Bangkok Hospital

- Miot Hospital

- Penang Adventist Hospital

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global medical tourism market.

Treatment Type

- Cardiovascular Treatment

- Orthopedic Treatment

- Cosmetic Treatment

- Bariatric Treatme

- Dental Treatment

- Ophthalmology Treatment

- Infertility Treatment

- Alternative Medicine

- Other Services

Service Provider

Country

- Thailand

- India

- Costa Rica

- Mexico

- Malaysia

- Singapore

- Brazil

- Colombia

- Turkey

- Taiwan

- South Korea

- Czech Republic

- Spain

- China

- Australia

- Indonesia

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)