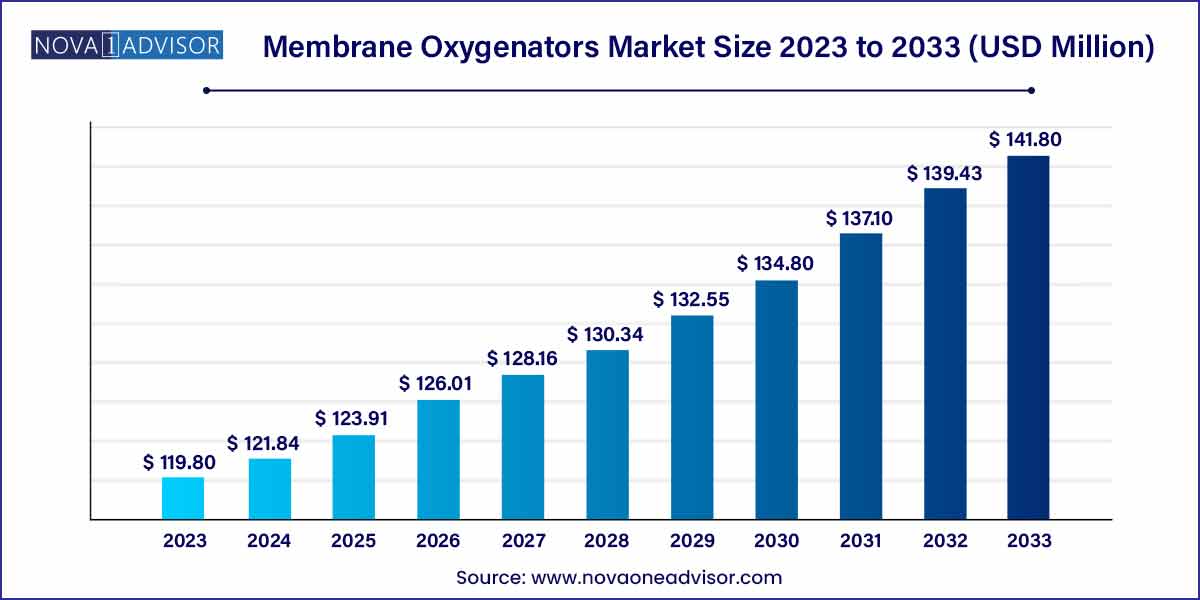

The global membrane oxygenators size was estimated at USD 119.80 million in 2023, is expected to surpass around USD 141.80 million by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 1.7% during the forecast period of 2024 to 2033.

Key Takeaways:

- The hollow fiber membrane oxygenators segment dominated the market and accounted for the largest revenue share of 63.4% in 2023.

- The adult segment dominated the market and accounted for the largest revenue share of 56.2% in 2023.

- The respiratory segment dominated the membrane oxygenator market and accounted for the largest revenue share of 53.0% in 2023.

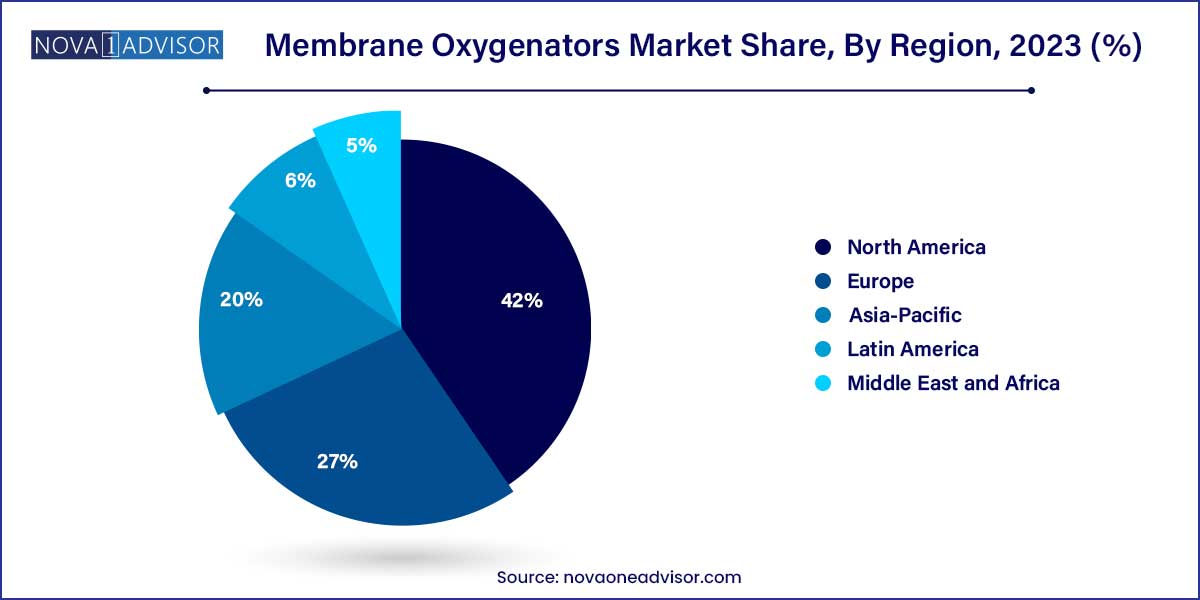

- North America dominated the market and accounted for the largest revenue share of 42.0% in 2023.

Market Overview

The membrane oxygenators market is an integral segment of the critical care and cardiopulmonary medical device industry. Membrane oxygenators play a vital role in extracorporeal circulation, where they facilitate gas exchange by oxygenating blood outside the body. These devices are extensively used during open-heart surgeries, in respiratory support for acute respiratory failure, and as part of Extracorporeal Membrane Oxygenation (ECMO) systems.

The global burden of cardiovascular diseases (CVDs) and respiratory disorders, along with the increasing incidence of conditions such as Acute Respiratory Distress Syndrome (ARDS) and COVID-19, has greatly amplified the demand for membrane oxygenators. ECMO therapy, once restricted to specialized centers, has now expanded into more mainstream critical care, particularly during the COVID-19 pandemic, which underscored the life-saving potential of ECMO systems.

Technological innovations leading to biocompatible materials, miniaturization, and long-term durability have enhanced the efficacy of membrane oxygenators. Furthermore, growing healthcare investments, the increasing adoption of advanced critical care management protocols, and heightened awareness of ECMO as a therapeutic option are collectively propelling market expansion. However, challenges such as high costs, operational complexity, and skilled personnel requirements continue to influence market dynamics.

Major Trends in the Market

-

Increasing Adoption of ECMO for COVID-19 and ARDS Treatment: Expanded use in intensive care units (ICUs) globally.

-

Technological Advancements in Membrane Materials: Development of long-lasting, biocompatible oxygenators with minimal clotting risk.

-

Miniaturization and Portability of ECMO Systems: Creating opportunities for wider clinical adoption.

-

Preference for Hollow Fiber Membrane Oxygenators: Due to superior efficiency and durability.

-

Rising Application in Pediatrics and Neonatal Care: Specialized oxygenators designed for young populations.

-

Public-private Partnerships for ECMO Infrastructure Development: Governments and private entities enhancing critical care capabilities.

-

Training and Education Initiatives: Expansion of ECMO education programs to address personnel shortages.

Membrane Oxygenators Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 119.80 Million |

| Market Size by 2033 |

USD 141.80 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 1.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, Age Group, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Medtronic; Fresenius SE & Co KGaA; Getinge AB; Terumo Medical Corporation; MicroPort Scientific Corporation; Nipro Medical Corporation. |

Driver: Rising Global Burden of Respiratory and Cardiac Diseases

One of the major drivers of the membrane oxygenators market is the escalating incidence of respiratory and cardiac diseases worldwide. Conditions such as chronic obstructive pulmonary disease (COPD), pulmonary embolism, myocarditis, and cardiogenic shock are increasingly prevalent due to aging populations, sedentary lifestyles, and environmental factors like pollution. For instance, the World Health Organization (WHO) reports that cardiovascular diseases are the leading cause of death globally, accounting for nearly 18 million deaths annually. Membrane oxygenators provide critical support in managing patients experiencing severe cardiac or respiratory failure, enabling effective oxygenation and carbon dioxide removal when conventional ventilation strategies fail. This vital role ensures a steady and rising demand for membrane oxygenator systems.

Restraint: High Cost and Operational Complexity

Despite the life-saving potential of membrane oxygenators, their high cost and operational complexity present significant barriers to broader market adoption. ECMO procedures, supported by membrane oxygenators, are resource-intensive, requiring expensive devices, dedicated staff, rigorous monitoring, and specialized training. Many healthcare systems, particularly in low- and middle-income countries, lack the infrastructure and trained personnel necessary to implement ECMO therapy effectively. Additionally, the cost of maintenance, consumables, and frequent training for safe device operation further add to the financial burden. This limits the accessibility of membrane oxygenator-supported therapies in underfunded regions, hampering overall market growth.

Opportunity: Expanding Role of ECMO in Emerging Markets

Emerging economies present a compelling opportunity for the membrane oxygenators market. As countries like India, China, Brazil, and South Africa continue to upgrade their healthcare infrastructure, the integration of advanced critical care solutions, including ECMO therapy, is gaining traction. Increased healthcare funding, expanding insurance coverage, and growing awareness of advanced life-support technologies are facilitating this transition. Furthermore, international collaborations and government initiatives to enhance ICU capacity in response to pandemics and other health crises are accelerating the adoption of ECMO systems. Companies investing in affordable, easy-to-use membrane oxygenators tailored for emerging markets stand to gain significant competitive advantage.

Type Insights

Hollow fiber membrane oxygenators dominated the type segment. Hollow fiber membrane oxygenators have become the gold standard in clinical practice due to their superior surface area for gas exchange, biocompatibility, and long-term stability. These oxygenators offer improved blood flow dynamics, reduced hemolysis, and minimal plasma leakage, leading to better patient outcomes. Their durability under continuous flow conditions makes them ideal for prolonged ECMO therapy, which can extend from days to weeks. Leading manufacturers have heavily invested in refining hollow fiber technology, further strengthening this segment's dominance.

Flat sheet membrane oxygenators are the fastest-growing segment. Although traditionally less common, flat sheet membrane oxygenators are gaining attention for specific applications requiring high oxygen transfer rates with low priming volumes. Innovations in membrane coating technologies and material science have enhanced their performance characteristics. Flat sheet designs are also being explored for portable and neonatal ECMO systems, where size, efficiency, and minimal priming volume are critical. This emerging niche application base is propelling the segment's rapid growth.

Age Group Insights

Adults dominated the age group segment. The majority of membrane oxygenator applications cater to adult patients suffering from conditions such as myocardial infarction, ARDS, and septic shock. The high prevalence of cardiovascular and respiratory diseases among adults, coupled with broader ECMO protocol adoption in adult ICUs, cements this group's dominance.

Neonates are the fastest-growing age group segment. Neonatal applications of membrane oxygenators are expanding rapidly due to rising incidences of congenital heart defects, persistent pulmonary hypertension of the newborn (PPHN), and complications arising from preterm births. Specialized neonatal ECMO centers and advancements in miniaturized oxygenator designs are enhancing survival rates and broadening the therapeutic scope for neonates.

Application Insights

Respiratory applications dominated the application segment. Respiratory failures, such as ARDS, COVID-19, pneumonia, and pulmonary embolism, account for a large proportion of ECMO cases utilizing membrane oxygenators. The COVID-19 pandemic alone drastically increased the deployment of respiratory ECMO, particularly for severe cases unresponsive to conventional ventilation. Ongoing respiratory epidemics, rising pollution levels, and the burden of chronic respiratory diseases ensure that respiratory applications remain the primary driver of demand for membrane oxygenators.

ECPR (Extracorporeal Cardiopulmonary Resuscitation) is the fastest-growing application segment. ECPR involves the use of ECMO to support patients experiencing cardiac arrest, particularly in cases where traditional cardiopulmonary resuscitation (CPR) fails. Recent clinical studies and survival outcomes are fueling interest in expanding ECPR use beyond tertiary hospitals to emergency departments and prehospital settings. As protocols and training for ECPR become more widespread, the demand for membrane oxygenators capable of rapid deployment is experiencing swift growth.

Regional Insights

North America dominated the membrane oxygenators market. North America's leadership is underpinned by advanced healthcare infrastructure, widespread adoption of ECMO protocols, and high awareness among critical care professionals. The United States boasts the largest number of ECMO centers globally, supported by organizations such as the Extracorporeal Life Support Organization (ELSO), which standardizes and promotes ECMO use. Favorable reimbursement policies, ongoing clinical research, and robust investments in critical care technologies further solidify North America's dominant position.

Asia-Pacific is the fastest-growing region. Asia-Pacific is witnessing explosive growth driven by healthcare modernization, rising disposable incomes, and increasing critical care capacity. China, India, Japan, and South Korea are leading regional players investing heavily in expanding ICU and ECMO capabilities. The COVID-19 pandemic accelerated this trend, highlighting the urgent need for advanced respiratory and cardiac support systems. Local manufacturing initiatives and partnerships with international ECMO device suppliers are enhancing access to membrane oxygenators across the region.

Some of the prominent players in membrane oxygenators include:

- Medtronic

- Fresenius SE & Co KGaA

- Getinge AB

- Terumo Medical Corporation

- MicroPort Scientific Corporation

- Nipro Medical Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global membrane oxygenators.

Type

- Hollow Fiber Membrane Oxygenators

- Flat Sheet Membrane Oxygenators

Application

-

- Respiratory failure

- Pulmonary embolism

- Acute respiratory distress syndrome

- Pneumonia

- COVID-19

-

- Acute myocardial infarction

- Myocarditis

- Post-transplant complications

- Decompensated cardiomyopathy

- Cardiogenic shock

Age group

- Neonates

- Pediatrics

- Adults

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)