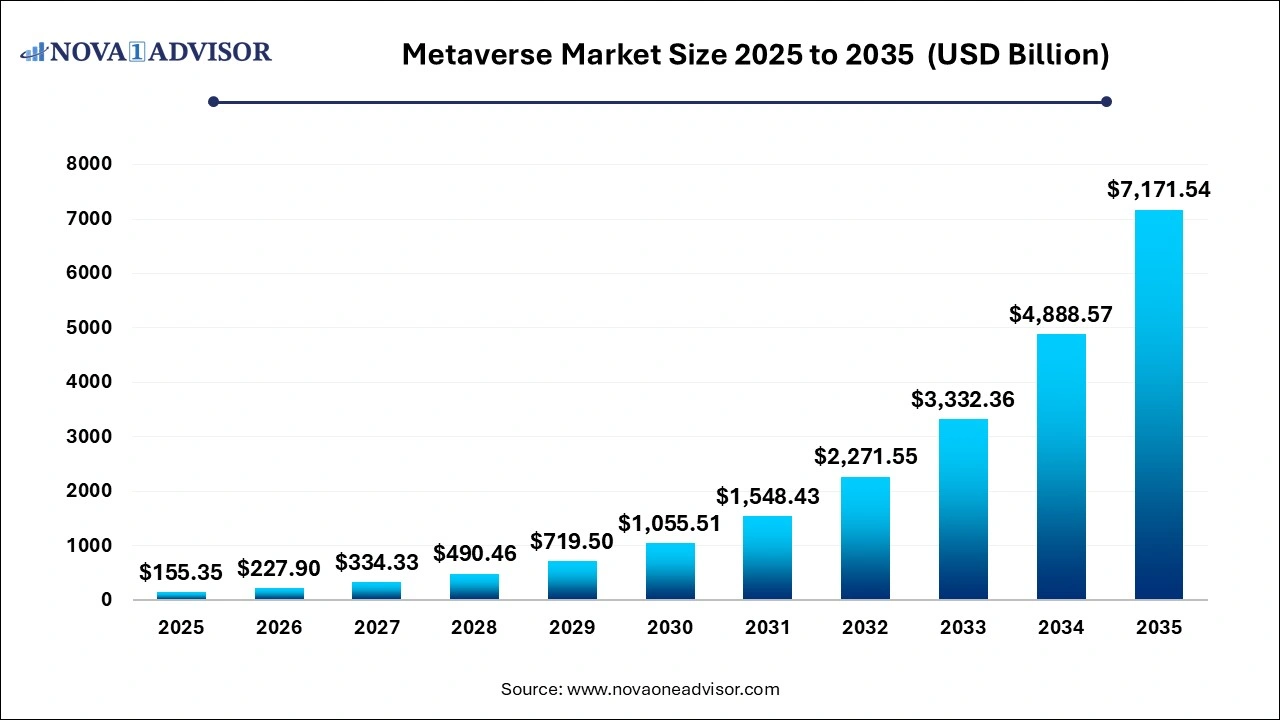

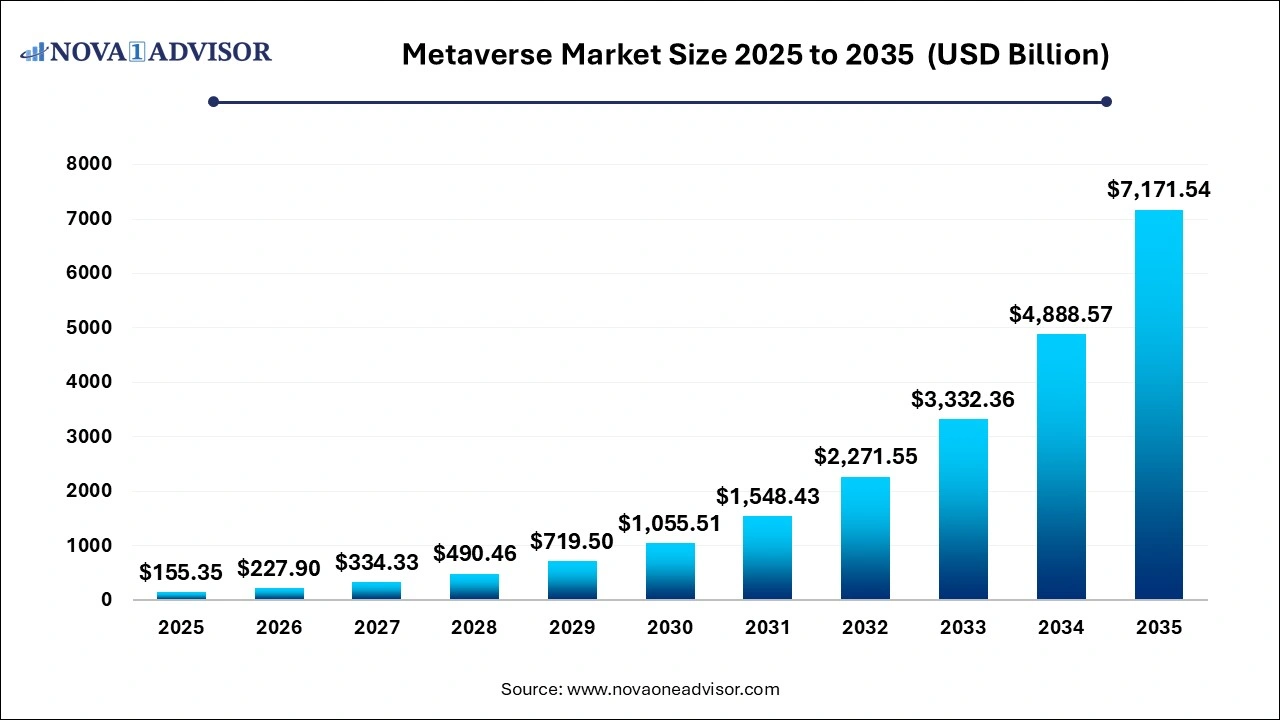

The metaverse market size was exhibited at USD 155.35 billion in 2025 and is projected to hit around USD 7,171.54 billion by 2035, growing at a CAGR of 46.7% during the forecast period 2026 to 2035.

Market Overview

The Metaverse market refers to the burgeoning digital economy and ecosystem where virtual environments and interconnected digital experiences are created, interacted with, and monetized by users. This immersive virtual space, facilitated by advancements in technologies such as Virtual Reality (VR), Augmented Reality (AR), artificial intelligence (AI), blockchain, and 3D computing, has evolved rapidly over the past few years. Initially perceived as a futuristic concept, the Metaverse has now become a significant part of global digital transformation, gaining traction across diverse industries, including entertainment, gaming, real estate, retail, education, and even healthcare.

The Metaverse market is driven by the increasing adoption of virtual and augmented reality technologies, the demand for immersive gaming experiences, and the growing interest in creating digital social spaces that mimic real-world interaction. Furthermore, key players in technology and gaming sectors are investing heavily in creating digital ecosystems that will shape how individuals interact, work, and engage with one another in this virtual space.

Growth Factors

- Technological Advancements: Rapid innovations in VR, AR, AI, and blockchain are propelling the development of the Metaverse. These technologies enable more immersive, realistic, and interactive virtual experiences, boosting the market growth.

- Increasing Demand for Immersive Gaming Experiences: The gaming industry is one of the largest contributors to the Metaverse market. With gamers seeking more immersive and engaging experiences, the demand for Metaverse platforms that offer digital worlds and interactive environments is escalating.

- Rising Popularity of Virtual Events: The growing popularity of virtual events, conferences, and social meetups within the Metaverse has also been a significant growth factor. These virtual events enable participants to engage in real-time, fostering a sense of community and interaction, regardless of geographical location.

| Report Coverage |

Details |

| Market Size in 2026 |

USD 227.90 Billion |

| Market Size by 2035 |

USD 7,171.54 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 46.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product, Platform, Technology, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Active Theory, Antiersolutions, ByteDance Ltd., Decentraland, Epic Games, Inc., Lilith Games, Meta, Microsoft, NetEase, Inc., Nextech AR Solutions Inc., NVIDIA Corporation, Roblox Corporation, Tencent Holdings Ltd., The Sandbox, Unity Technologies |

Driver

The primary driver of the Metaverse market’s expansion is the growing demand for immersive experiences. Consumers and businesses alike are seeking more interactive, engaging, and lifelike virtual environments. Gaming, in particular, is one of the largest catalysts for this demand, as players are looking for more engaging, expansive worlds in which they can interact with others and experience games on a new level. The introduction of Metaverse platforms enables gamers to interact in shared virtual spaces that feel alive, dynamic, and ever-changing, enhancing their gaming experiences.

Another significant driver is the widespread adoption of VR and AR technologies. As VR headsets and AR devices become more affordable and accessible, the general population is more inclined to explore virtual worlds. Additionally, advancements in AI and machine learning are facilitating the development of highly personalized experiences within the Metaverse, further driving user engagement and interest.

Restraint

Despite its rapid growth and potential, several factors could hinder the expansion of the Metaverse market. One of the main challenges is technological limitations. While VR, AR, and AI have advanced significantly, the infrastructure required to support truly immersive Metaverse experiences remains under development. High-speed internet connections, cutting-edge hardware (like VR headsets and AR devices), and robust server systems are still essential for creating seamless virtual environments. These requirements can limit the accessibility and affordability of the Metaverse for certain demographics.

Privacy and security concerns also pose significant challenges. As users interact more within virtual environments, the potential for personal data breaches, identity theft, and other cyber risks increases. Additionally, the integration of blockchain technology raises questions about the security of virtual currencies and transactions in the Metaverse.

Opportunity

The Metaverse market offers several untapped opportunities across various sectors. One major opportunity lies in virtual commerce. As consumers shift more of their purchasing behavior online, brands are beginning to explore the possibility of selling virtual goods, such as clothing, accessories, and digital real estate, within the Metaverse. This opens up a new dimension for e-commerce, allowing companies to reach customers in immersive, interactive ways.

Moreover, the enterprise Metaverse is another significant opportunity. Businesses are increasingly turning to the Metaverse to host virtual meetings, conferences, and team-building activities, particularly as remote work becomes more common. Platforms that allow for virtual collaboration and networking can provide businesses with innovative ways to connect and work together.

The education sector also represents a large opportunity. Virtual classrooms, simulated learning environments, and collaborative platforms offer students and educators new ways to interact and learn. The Metaverse provides immersive, interactive learning experiences that are not possible with traditional online courses.

In terms of products, the software segment dominated the U.S. Metaverse market in 2025. This segment includes the platforms, tools, and applications used to create, manage, and interact with virtual worlds. Software solutions for gaming, entertainment, enterprise collaboration, and social engagement are key drivers in this segment. The demand for user-friendly software that enhances the user experience and provides seamless interaction within virtual environments is expected to continue growing.

The desktop segment held the largest revenue share in the Metaverse market in 2025. While virtual reality headsets and mobile devices are growing in popularity, desktop platforms continue to be a primary access point for users engaging with Metaverse applications, particularly in gaming and enterprise environments. The ability to offer high-quality visuals and better processing power on desktops ensures that this segment remains dominant.

The VR and AR segment led the market in 2024, holding the largest revenue share. Virtual Reality (VR) and Augmented Reality (AR) are integral to the immersive experience that defines the Metaverse. The combination of VR’s fully immersive environments and AR’s ability to blend the digital and physical worlds creates dynamic, engaging experiences for users. As the technology behind VR and AR continues to improve, the demand for these technologies in Metaverse applications will rise.

The gaming segment held the largest market revenue share in 2025. Gaming remains one of the most influential sectors in the Metaverse, with players increasingly seeking out highly immersive, social, and multiplayer experiences. The development of Metaverse platforms dedicated to gaming, where players can interact with others in expansive virtual worlds, has proven to be a strong driver of market growth. As the gaming community grows, so will the demand for more sophisticated and interactive virtual environments.

In 2025, North America dominated the Metaverse market, holding the largest share of the global market. The U.S. is home to some of the largest tech companies, such as Meta (formerly Facebook), Microsoft, and Google, which are heavily investing in Metaverse technologies. Moreover, the adoption of VR and AR technologies in gaming, entertainment, and enterprise applications is significant in the region. North America’s highly developed technological infrastructure and consumer market make it a dominant force in the Metaverse industry.

The Asia Pacific region, however, is expected to experience the fastest growth during the forecast period. Countries like China, Japan, and South Korea have a strong gaming culture, which is fueling demand for Metaverse platforms, particularly in the gaming sector. The increasing adoption of AR and VR in sectors like education, retail, and healthcare is also contributing to the region’s rapid expansion. Additionally, the rise of emerging markets in Southeast Asia is creating a new, lucrative customer base for Metaverse platforms and services.

- Active Theory

- Antiersolutions.

- ByteDance Ltd.

- Decentraland

- Epic Games, Inc.

- Lilith Games

- Meta

- Microsoft

- NetEase, Inc.

- Nextech AR Solutions Inc.

- NVIDIA Corporation

- Roblox Corporation

- Tencent Holdings Ltd.

- The Sandbox

- Unity Technologies

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the metaverse market

By Product

-

- Chips & Processors

- Network Capabilities

- Cloud & Edge Infrastructure

- Cybersecurity

-

- Holographic Displays

- eXtended Reality (XR) Hardware

-

-

- Haptic Sensors & Devices

- Smart Glasses

- Omni Treadmills

-

- Asset Creation Tools

- Programming Engines

- Virtual Platforms

- Avatar Development

-

- User Experiences

- Asset Marketplaces

- Financial Services

By Platform

By Technology

- Blockchain

- Virtual Reality (VR) & Augmented Reality (AR)

- Mixed Reality (MR)

- Others

By Application

- Gaming

- Online Shopping

- Content Creation & Social Media

- Events & Conference

- Digital Marketing (Advertising)

- Testing and Inspection

- Others

By End Use

- Aerospace & Defense

- Education

- Tourism and Hospitality

- BFSI

- Retail

- Media & Entertainment

- Automotive

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)