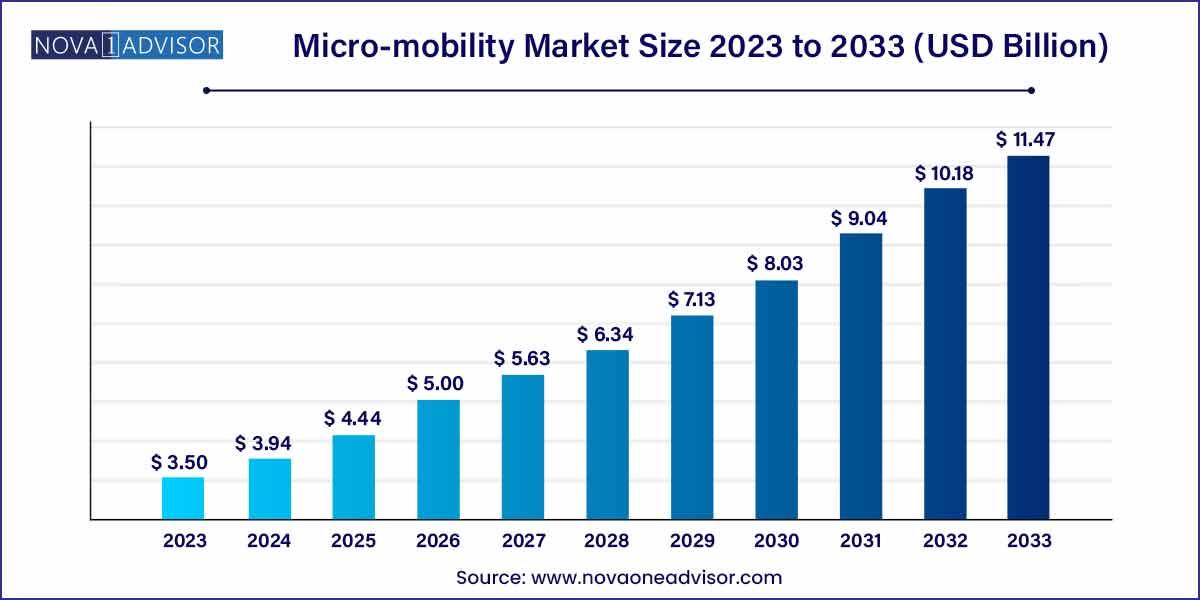

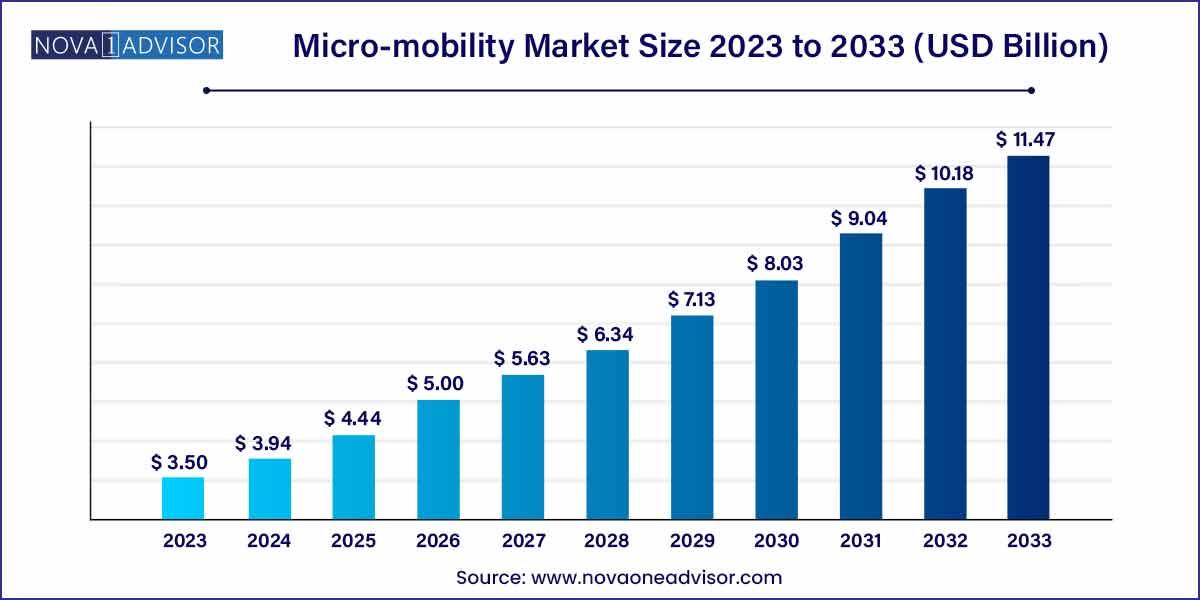

The global micro-mobility market size was exhibited at USD 3.50 billion in 2023 and is projected to hit around USD 11.47 billion by 2033, growing at a CAGR of 12.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- The Asia-Pacific region dominated the market in 2023 and accounted for over 46.0% of global revenue.

- The electric bicycle segment dominated the market in 2023 and accounted for more than 85% of the global revenue.

- The sealed lead-acid battery segment dominated the market in 2023 and accounted for more than 55.0% of the global revenue.

- The below-24V segment dominated the market in 2023 and accounted for more than 75.0% of the global revenue.

Micro-mobility Market: Overview

The micro-mobility market represents a significant paradigm shift in urban transportation, offering compact, electric, and lightweight mobility options for short-distance travel. Ranging from electric kick scooters to electric bicycles and skateboards, micro-mobility solutions address some of the biggest challenges in modern cities — traffic congestion, last-mile connectivity, environmental sustainability, and cost-effective commuting.

The increasing urbanization, coupled with worsening traffic conditions and growing concerns about carbon emissions, has driven individuals, businesses, and municipalities to adopt alternative mobility solutions. Micro-mobility bridges the gap between public transit and a commuter’s final destination, making it an attractive option for daily transport, recreational activities, and business operations (such as delivery services).

Technological advancements in battery life, lightweight materials, GPS integration, and smartphone connectivity have made these vehicles more efficient, affordable, and user-friendly. Furthermore, the rise of sharing platforms, such as Lime, Bird, and Tier Mobility, has dramatically increased the accessibility of micro-mobility services across major cities worldwide.

COVID-19 accelerated the demand for personal mobility devices, as commuters looked for socially distanced travel options. Post-pandemic, the trend towards flexible, sustainable transport options continues to gather momentum. Meanwhile, supportive government initiatives, dedicated micro-mobility lanes, and increased venture capital funding in mobility startups are fueling market growth.

As cities aim for carbon neutrality and reduced vehicular traffic, micro-mobility is poised to become a cornerstone of urban transportation strategies globally.

Micro-mobility Market Growth

The growth of the micro-mobility market is propelled by several key factors.Firstly, increasing urbanization and congestion in cities worldwide have spurred the demand for flexible and efficient transportation options. Additionally, heightened awareness about environmental sustainability has led to a shift towards eco-friendly modes of transportation, driving the adoption of micro-mobility solutions. Furthermore, technological advancements, such as IoT integration and mobile applications, have enhanced the user experience and operational efficiency of micro-mobility services, contributing to market growth. Moreover, the rise of shared mobility solutions and the implementation of supportive government policies and incentives further stimulate the expansion of the micro-mobility market. These combined factors create a conducive environment for the continued growth and evolution of micro-mobility as a sustainable and convenient urban transportation solution.

Micro-mobility Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.50 Billion |

| Market Size by 2033 |

USD 11.47 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 12.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Vehicle Type, Bttery, Voltage, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Yadea Technology Group Co., Ltd.; JIANGSU XINRI E-VEHICLE CO., LTD.; Xiaomi; SEGWAY INC.; SWAGTRON; Boosted USA; Airwheel Holding Limited; YAMAHA MOTOR CO., LTD.; Accell Group; Derby Cycle. |

Micro-mobility Market Dynamics

The micromobility market is underpinned by several key growth drivers. Firstly, the rise of urbanization and congestion in cities worldwide has amplified the demand for flexible and sustainable transportation options. As cities become more densely populated, the need for efficient last-mile connectivity solutions has become increasingly apparent. Secondly, heightened awareness surrounding environmental sustainability has catalyzed the adoption of micro-mobility services. E-scooters, electric bikes, and shared bicycles offer emission-free alternatives to traditional modes of transportation, aligning with the growing emphasis on reducing carbon footprints. Moreover, technological advancements, including IoT integration and mobile applications, have significantly improved the accessibility and user experience of micro-mobility solutions.

Despite its promising growth prospects, the micro-mobility market faces several challenges that warrant consideration. Regulatory challenges and compliance issues pose significant hurdles for micro-mobility operators, as varying regulations across different jurisdictions can hinder expansion efforts and increase operational costs. Safety concerns also remain a prominent challenge, with reports of accidents involving e-scooters and other micro-mobility vehicles raising questions about rider and pedestrian safety. Additionally, infrastructure limitations, such as inadequate bike lanes and parking facilities, can impede the seamless integration of micro-mobility services into urban environments. Furthermore, market saturation and heightened competition present challenges for new entrants seeking to establish a foothold in the industry.

Micro-mobility Market Restraint

- Regulatory Challenges and Compliance Issues:

Regulatory hurdles and compliance issues pose significant restraints on the expansion of the micro-mobility market. With the rapid proliferation of e-scooters, electric bikes, and other micro-mobility solutions in urban areas, authorities are faced with the challenge of establishing clear guidelines and regulations to ensure safe and responsible operation. However, regulatory frameworks vary widely across different regions, leading to inconsistencies and uncertainties for micro-mobility operators. Navigating complex regulatory landscapes increases operational costs and administrative burdens, thereby hindering market growth. Additionally, concerns regarding rider safety, liability, and insurance further complicate regulatory compliance efforts.

- Safety Concerns and Accidents:

Safety concerns and the occurrence of accidents represent significant restraints for the micro-mobility market. Despite offering convenient and eco-friendly transportation options, e-scooters, electric bikes, and other micro-mobility vehicles have been associated with a rising number of accidents and injuries. Factors contributing to safety risks include inadequate infrastructure, such as poorly maintained roads and limited designated lanes for micro-mobility vehicles, as well as user behavior, such as reckless riding and non-compliance with traffic rules. Moreover, the absence of standardized safety measures and training programs for riders exacerbates safety concerns. Public perception of safety risks associated with micro-mobility services can undermine consumer confidence and deter adoption, thereby impeding market growth.

Micro-mobility Market Opportunity

- Urbanization and Last-Mile Connectivity:

The rapid pace of urbanization presents a significant opportunity for micro-mobility solutions to address the growing demand for last-mile connectivity in urban areas. As cities become more densely populated, traditional modes of transportation often struggle to provide efficient and convenient mobility solutions for short-distance trips. Micro-mobility options such as e-scooters, electric bikes, and shared bicycles offer a flexible and cost-effective alternative for covering short distances within urban environments. By providing convenient access to transportation hubs, commercial centers, and residential areas, micro-mobility services can complement existing public transit systems and alleviate congestion on roads.

- Environmental Sustainability and Green Mobility:

The increasing emphasis on environmental sustainability presents a significant opportunity for the micro-mobility market to position itself as a viable and eco-friendly transportation solution. With growing concerns about climate change and air pollution, there is a growing demand for alternative modes of transportation that minimize carbon emissions and reduce environmental impact. Micro-mobility options powered by electric propulsion systems offer emission-free alternatives to traditional gasoline-powered vehicles, making them an attractive option for environmentally conscious consumers. Additionally, the shared mobility model employed by many micro-mobility operators promotes resource efficiency and reduces the overall number of vehicles on the road, further contributing to environmental sustainability.

Micro-mobility Market Challenges

- Infrastructure Limitations:

One of the foremost challenges hindering the growth of the micro-mobility market is the lack of adequate infrastructure to support these innovative transportation solutions. Micro-mobility vehicles such as e-scooters, electric bikes, and shared bicycles require designated lanes, parking facilities, and charging stations to operate efficiently and safely within urban environments. However, many cities lack sufficient infrastructure tailored to the needs of micro-mobility users, resulting in issues such as sidewalk clutter, parking congestion, and inadequate bike lanes. Additionally, the absence of standardized infrastructure specifications and regulations further complicates the integration of micro-mobility services into existing urban landscapes.

- Safety Concerns and Regulatory Challenges:

Safety concerns and regulatory challenges represent significant hurdles for micro-mobility operators and users alike. Despite offering convenient and eco-friendly transportation options, micro-mobility vehicles have been associated with a rising number of accidents and injuries. Factors contributing to safety risks include inadequate rider education, non-compliance with traffic rules, and conflicts with pedestrians and other road users. Moreover, navigating complex regulatory frameworks and compliance requirements across different jurisdictions poses challenges for micro-mobility operators, leading to uncertainties and operational inefficiencies. Achieving a balance between promoting innovation and ensuring safety standards is essential for fostering consumer trust and regulatory compliance within the micro-mobility market.

Segments Insights:

Vehicle Type Insights

Electric Bicycles (E-Bikes) dominated the vehicle type segment, capturing the largest market share owing to their versatility, longer range, and rising popularity among urban commuters and delivery personnel. E-bikes are suitable for diverse use cases—commuting, recreation, and logistics—and offer the advantage of assisted pedaling, making longer trips and uphill rides effortless.

Cities like Amsterdam, Berlin, and New York are witnessing a significant shift toward e-bike commuting, aided by government incentives and expanding bike lane networks. E-bike manufacturers like VanMoof, Rad Power Bikes, and Giant Bicycles continue to launch advanced models featuring integrated GPS, anti-theft systems, and improved battery technology.

Meanwhile, Electric Kick Scooters are the fastest-growing segment. The compact size, ease of use, and affordability of e-scooters make them ideal for short urban commutes. Shared e-scooter fleets are expanding rapidly across Europe, North America, and parts of Asia-Pacific. In dense urban centers, scooters provide a nimble solution for navigating traffic and reaching areas inaccessible to cars.

Battery Insights

Lithium-ion batteries dominated the market, and continue to do so, owing to their superior energy density, lightweight properties, faster charging capabilities, and longer life compared to sealed lead-acid or NiMH alternatives. Li-ion technology enables extended vehicle range, making e-bikes and scooters more viable for daily commuting.

The rapid decline in lithium-ion battery costs over the past decade, combined with technological advancements in battery management systems (BMS), has made Li-ion-powered micro-mobility vehicles affordable and reliable for both consumers and fleet operators.

Conversely, Sealed Lead Acid (SLA) batteries still find application in low-cost models in emerging markets, but their share is declining due to bulkiness, shorter life cycles, and environmental concerns.

Voltage Insights

36V battery systems captured the largest market share within micro-mobility vehicles. Offering a balanced combination of power, range, and affordability, 36V batteries are ideally suited for e-bikes and e-scooters designed for urban commuting. They offer sufficient torque for moderate inclines and are compatible with a wide range of electric drive systems.

Meanwhile, 48V systems are experiencing the fastest growth. Vehicles using 48V batteries offer higher speeds, better climbing ability, and extended range making them attractive for high-performance e-bikes and shared scooter fleets in cities with challenging terrains or longer average commute distances.

Manufacturers are increasingly adopting 48V systems for their ability to support additional features such as regenerative braking, smart displays, and integrated GPS without compromising battery performance.

Regional Insights

Europe currently dominates the micro-mobility market, driven by supportive government policies, strong environmental consciousness, excellent cycling infrastructure, and high urbanization rates. Countries like Germany, France, the Netherlands, and Spain have implemented policies promoting sustainable transportation alternatives, including subsidies for e-bike purchases and the development of extensive bike lanes.

Cities such as Paris have aggressively promoted micro-mobility to reduce vehicle emissions and improve urban livability. Initiatives like banning cars from city centers and integrating micro-mobility solutions into public transportation networks have fueled market expansion. Moreover, European micro-mobility startups like Tier Mobility, Dott, and Voi Technology have secured substantial funding, spurring innovation and fleet expansion.

Asia-Pacific is witnessing the fastest growth, led by rising urban populations, increasing disposable incomes, rapid infrastructure development, and growing awareness of environmental sustainability. China is a powerhouse in the region, with massive production and usage of electric two-wheelers.

India is emerging as a significant player, with startups like Yulu and Bounce expanding rapidly in metropolitan areas. Government initiatives encouraging electric mobility adoption, like India's FAME II scheme, are providing significant impetus.

Southeast Asian countries such as Indonesia, Vietnam, and Thailand are also showing rising interest in micro-mobility solutions for short-distance commuting in congested cities, further accelerating regional market growth.

Recent Developments

- In March 2023, Segway-Ninebot launched the new Segway GT-series, P-series, and E110A. The product helped to satisfy the changing needs of modern transportation., with reliability and sustainability by allowing riders to travel in comfort and style.

- In June 2023, Porsche expanded its electric bike business by purchasing new models from the manufacturer of electric bicycles in Germany. The joint venture focuses on the development, production, and distribution of a new generation of high-quality Porsche e-bikes

- In May 2023, Nashville's transit gaps are be filled via public transportation and micro-mobility integration. As a mobility coordinator, the company sees collaborations with micro-mobility providers like Bird as possibilities to broaden its function from just a transit provider to a mobility coordinator

Some of the prominent players in the Micro-mobility market include:

- Yadea Technology Group Co., Ltd.

- JIANGSU XINRI E-VEHICLE CO., LTD.

- Xiaomi

- SEGWAY INC.

- SWAGTRON

- Boosted USA

- Airwheel Holding Limited

- YAMAHA MOTOR CO., LTD.

- Accell Group

- Derby Cycle

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global micro-mobility market.

Vehicle Type

- Electric Kick Scooters

- Electric Skateboards

- Electric Bicycles

Battery

- Sealed Lead Acid

- NiMH

- Li-ion

Voltage

- Below 24V

- 36V

- 48V

- Greater than 48V

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)