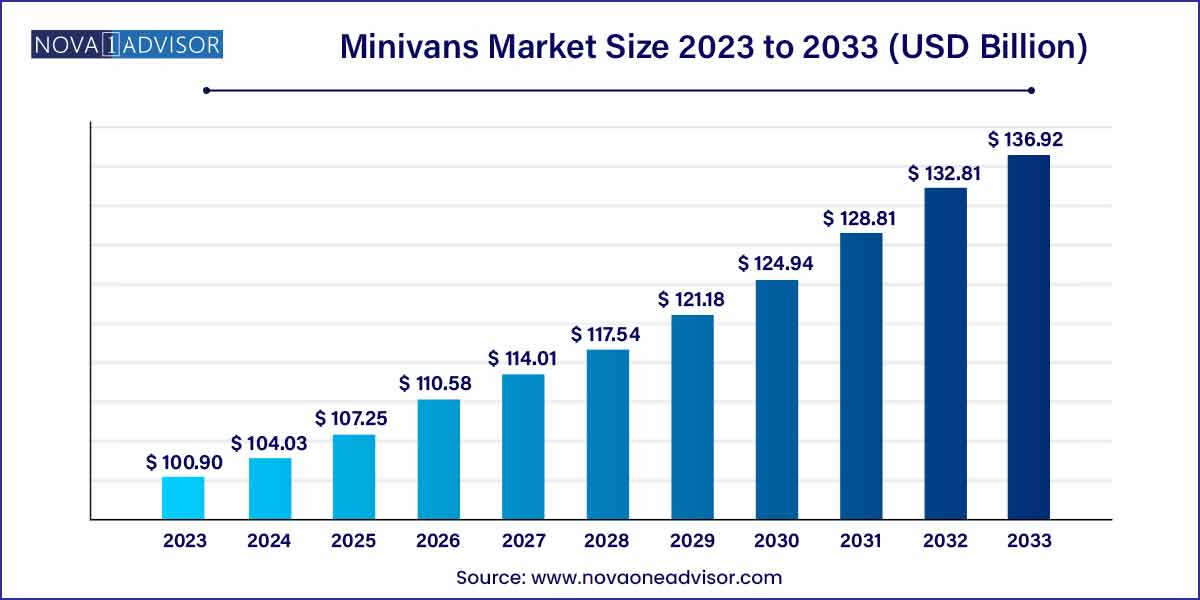

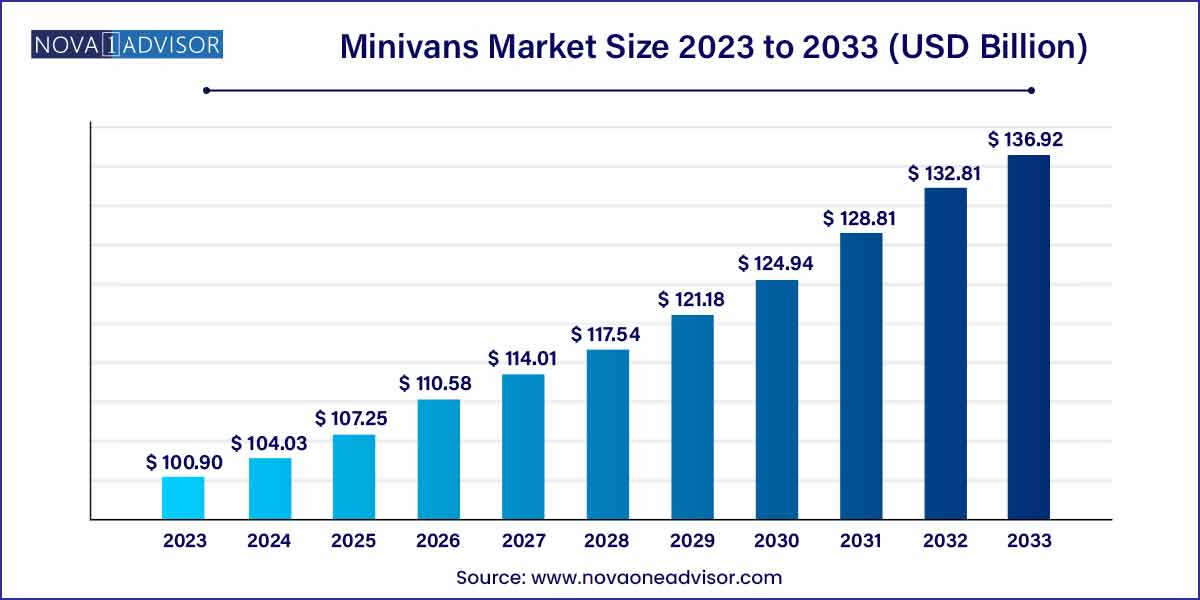

The global minivans market size was exhibited at USD 100.90 billion in 2023 and is projected to hit around USD 136.92 billion by 2033, growing at a CAGR of 3.1% during the forecast period of 2024 to 2033.

Key Takeaways:

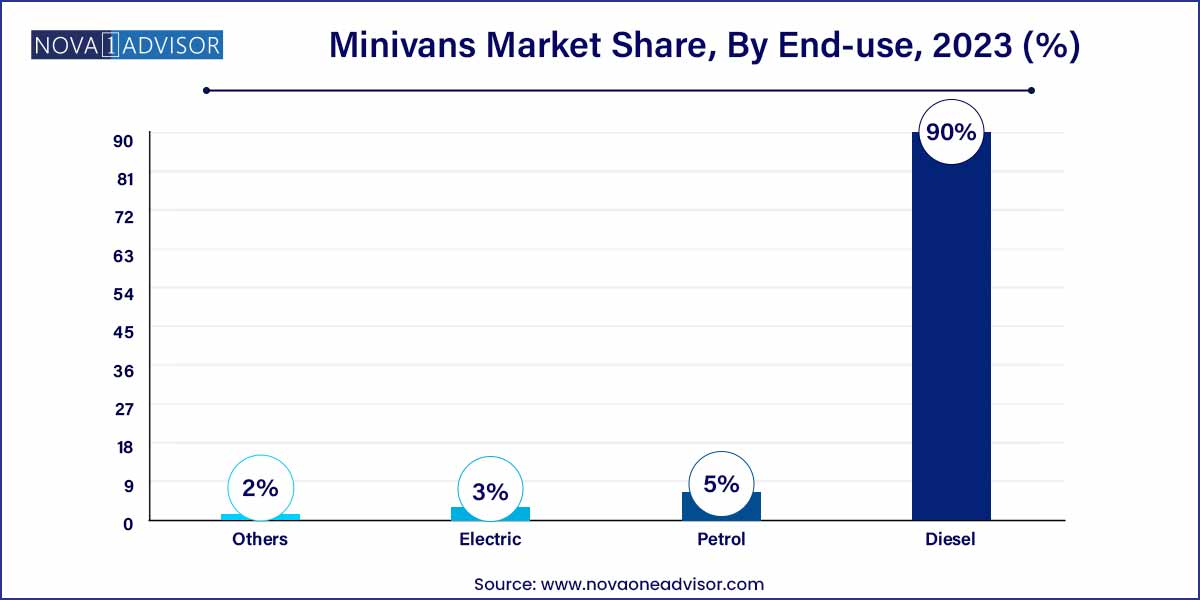

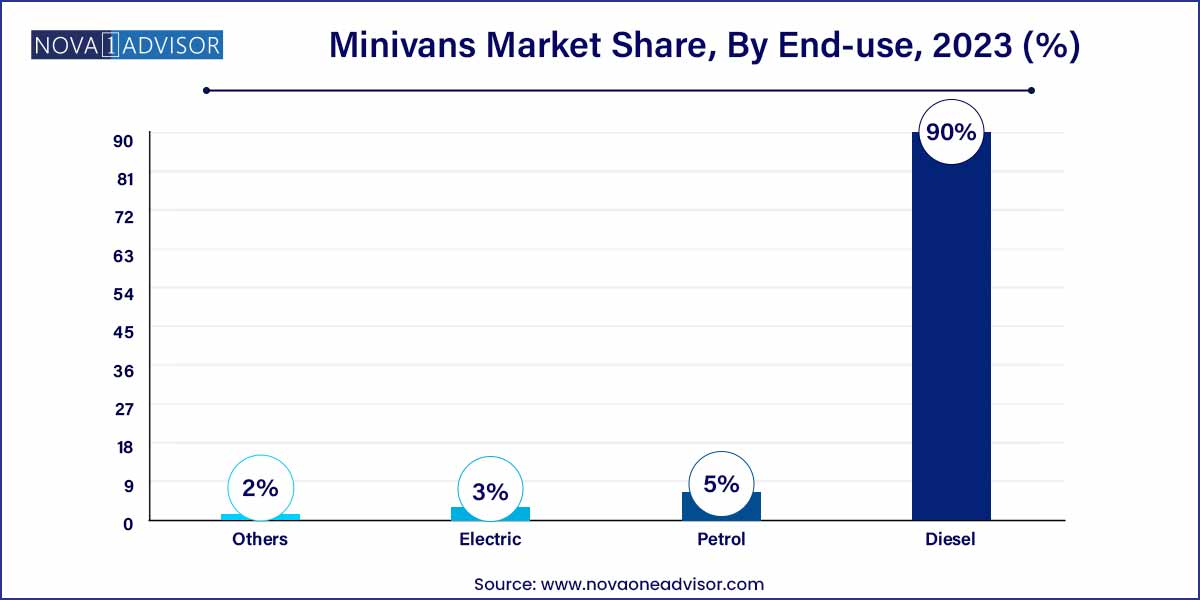

- The diesel segment accounted for a global market revenue share of over 90%.

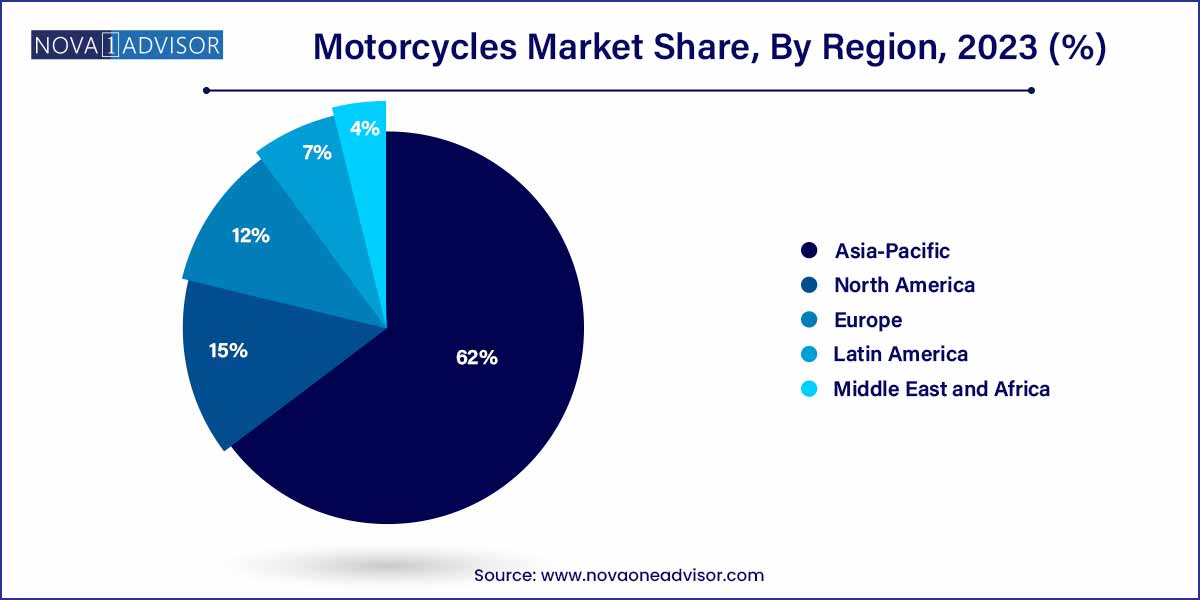

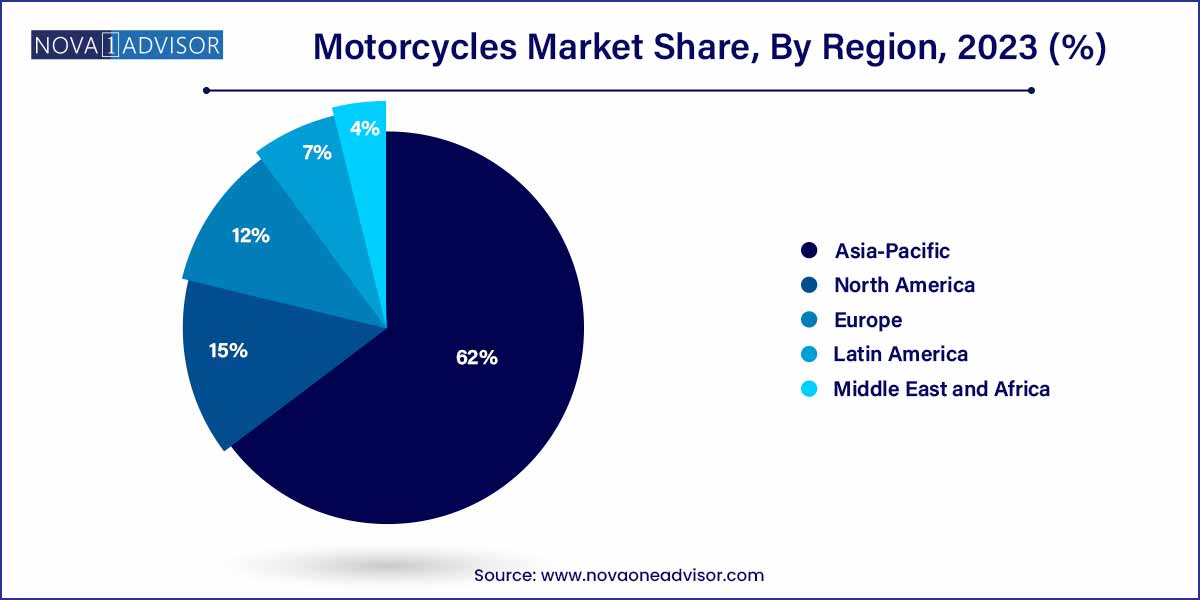

- The Asia Pacific dominated the global market and held the largest market revenue share of around 61% in 2023.

Minivans Market by Overview

The minivans market is a dynamic segment within the automotive industry, characterized by vehicles designed to cater to the versatile needs of families and individuals alike. These compact yet spacious vehicles have evolved over the years, offering a blend of comfort, safety, and functionality.

Minivans Market Growth

The growth of the minivans market is propelled by several key factors. Firstly, the increasing demand for family-friendly vehicles with spacious interiors and versatile seating arrangements has driven a surge in minivan popularity. Manufacturers, in response, continually integrate innovative features, including advanced safety technologies and entertainment systems, enhancing the overall appeal of these vehicles. Furthermore, the market is witnessing a shift towards environmental sustainability, with manufacturers exploring hybrid and electric options to align with eco-conscious consumer preferences. Connectivity features such as infotainment systems and smartphone integration cater to the modern consumer's desire for seamless technology integration. Despite facing competition from SUVs and crossovers, minivans remain a preferred choice for those seeking a harmonious blend of comfort, safety, and practicality, ensuring sustained growth in this dynamic automotive segment.

Minivans Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 100.90 Billion |

| Market Size by 2033 |

USD 136.92 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 3.1% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Fuel Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Stellantis N.V.; Nissan Motor Co. Ltd.; Toyota Motor Corporation; Honda Motor Company; Kia Corporation; General Motors Company; Hyundai Motor Company; Daimler AG; Tata Motors Limited; Mahindra & Mahindra; Suzuki Motor Corporation . |

Minivans Market Dynamics

The minivans market is experiencing a surge in popularity, primarily driven by the versatile nature of these vehicles. Families, in particular, are drawn to the spacious interiors, sliding doors, and customizable seating arrangements that minivans offer. These features address the practical needs of transporting both passengers and cargo comfortably, making minivans a preferred choice for family-oriented consumers. The market's growth is further fueled by ongoing innovations from manufacturers, who continuously introduce advanced safety technologies and entertainment systems, ensuring that minivans remain relevant and appealing in the competitive automotive landscape.

The minivans market is characterized by a dynamic landscape of continuous innovation. Automotive manufacturers in this segment are dedicated to enhancing the driving experience by introducing cutting-edge features. These include advanced safety technologies, entertainment systems, and a focus on improved fuel efficiency. With an emphasis on meeting the evolving expectations of consumers, minivan manufacturers are at the forefront of incorporating technological advancements into their vehicles. This commitment to innovation not only sustains the market's growth but also ensures that minivans remain attractive to a broad spectrum of consumers seeking modern and efficient transportation solutions for their families.

Minivans Market Restraint

- Competition from SUVs and Crossovers:

Despite the continued popularity of minivans, the market faces a significant restraint in the form of stiff competition from SUVs (Sports Utility Vehicles) and crossovers. Changing consumer preferences, driven by a desire for a more rugged and versatile image, have led to a shift away from traditional minivans. The perceived appeal of SUVs and crossovers as stylish and adventure-ready alternatives poses a challenge for minivan manufacturers to retain market share. Adapting to these shifting preferences while maintaining the unique selling points of minivans becomes crucial for sustained growth in the face of intense competition

A persistent challenge for the minivans market lies in overcoming preconceived notions and perceptions associated with these vehicles. Some consumers view minivans as less stylish or less socially desirable compared to other segments like SUVs. Addressing and reshaping these perceptions becomes a crucial hurdle for market growth. While minivans excel in providing practical solutions for families, the challenge is to reposition them as not just utilitarian vehicles but as sophisticated and modern choices that align with contemporary lifestyles.

Minivans Market Opportunity

- Rising Demand for Electric and Hybrid Options:

An exciting opportunity in the minivans market lies in responding to the growing demand for environmentally sustainable transportation. As global awareness of climate change increases, consumers are increasingly seeking electric and hybrid options. By introducing eco-friendly minivan models, manufacturers can tap into a burgeoning market segment focused on reducing carbon footprints. This shift towards greener alternatives presents a strategic opportunity for the minivans market to not only meet consumer demands but also contribute to the broader automotive industry's commitment to sustainability.

- Expanding Market in Emerging Economies:

The minivans market holds significant untapped potential in emerging economies where rising incomes and changing lifestyles are influencing automotive preferences. As more families in these regions seek reliable and spacious transportation solutions, minivans can emerge as a preferred choice. Manufacturers have the opportunity to strategically enter and expand their presence in these markets by tailoring minivan models to meet the specific needs and preferences of consumers in emerging economies. This expansion not only broadens the market reach but also positions minivans as practical and attractive options for diverse global audiences.

Minivans Market Challenges

- Shifting Consumer Preferences towards SUVs and Crossovers:

One of the significant challenges faced by the minivans market is the ongoing shift in consumer preferences towards SUVs and crossovers. These alternative vehicle types are often perceived as more stylish and versatile, attracting consumers who seek a more rugged image. Minivan manufacturers must address this challenge by innovating and adapting their designs to incorporate elements that appeal to the changing tastes of consumers. Balancing the traditional strengths of minivans with the evolving preferences for SUVs becomes crucial in maintaining market competitivene

- Image and Styling Perceptions:

The minivans market grapples with a persistent challenge related to the image and styling perceptions associated with these vehicles. Some consumers view minivans as less fashionable or socially desirable compared to other segments. Overcoming these stereotypes and reshaping the perception of minivans requires strategic marketing and design efforts. Manufacturers need to emphasize the modern features, sleek designs, and technological advancements in their minivan models to position them as stylish and sophisticated choices, thereby challenging the negative perceptions that may hinder market growth.

Segments Insights:

Fuel Type Insights

The diesel segment accounted for a global market revenue share of over 90%. This largest market revenue share of the diesel fuel type segment is attributed to the higher consumer preference for the diesel models of minivans over the other fuel type. Diesel-powered vans are efficient as well as powerful, suitable for multipurpose vehicles such as minivans for light-duty hauling and towing capacity. Diesel-powered minivans effectively deal with the payloads running at a low cost compared to the other fuel-type vehicles. Furthermore, the majority of the minivan models available in the market are diesel engine models.

The electric segment of the fuel type is anticipated to witness the fastest growth rate, registering a CAGR of 7.3% over the forecast period. The electric vehicle market is rapidly increasing as well as evolving due to technological developments in electric batteries and other areas. It has become a prime concern of global leaders and automotive manufacturers to reduce the consumption of fossil fuels and prevent global warming. Government initiatives and manufacturers' increasing product launches are expected to drive the segment growth in the global minivans industry. For instance, according to media report more than 10 electric models are expected to make their launch in the coming years including, Chrysler Pacifica EV, Voyah Dreamer, Mercedes EQT, Hyundai Staria FCEV, etc.

Regional Insights

The Asia Pacific dominated the global market and held the largest market revenue share of around 61% in 2023. This is credited to the higher consumer adoption and usage of minivans in China, and Japan. The body built and cargo space of the minivan models are more appealing to the consumers in the region compared to the others. Moreover, the market key player’s strong presence, higher brand awareness, and market penetration in the region are also attributable to higher market share. The market in the region is well- established with frequent product launches credited for the higher market revenue. For instance, as reported on 13th January 2022, Toyota launched new Noah and Voxy minivans in Japan, redesigned with TNGA (GA-C) platform, comfortable seats, and roomy cabin space. Also, for instance, Hyundai started to sell Staria minivans in Thailand in July 2023.

North America is anticipated to witness the highest growth rate in the global market, registering a CAGR of 3.5% from 2024 to 2033. The highest growth rate in the region is mainly attributed to the changing consumer perception about the appearance of the minivans and emerging as luxurious and stylish vehicles. Key players increasing product launches and penetration in the region are helping market growth in the region. New minivan models have extra added perks that give them a luxurious look along with comfortable space, perfect for an outing with family and friends. For instance, the new Kia Corporation is planning to introduce the Carnival Hi Limousine minivan in the U.S. in 2022, which has special features including curtains, an air purifier, a high roof, and recliner-style seats.

Some of the prominent players in the Minivans market include:

- Stellantis N.V.

- Nissan Motor Co. Ltd.

- Toyota Motor Corporation

- Honda Motor Company

- Kia Corporation

- General Motors Company

- Hyundai Motor Company

- Daimler AG

- Tata Motors Limited

- Mahindra & Mahindra

- Suzuki Motor Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global minivans market.

Fuel Type

- Diesel

- Petrol

- Electric

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)