Mobile Artificial Intelligence Market Size and Growth

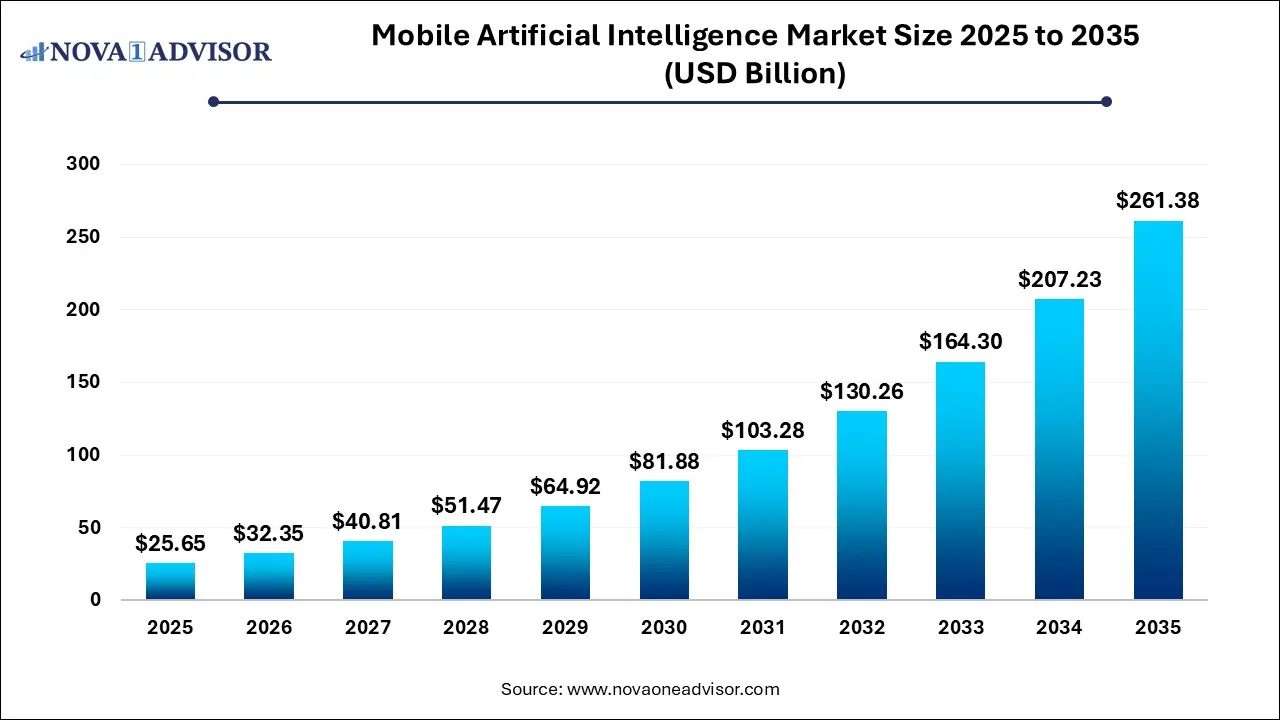

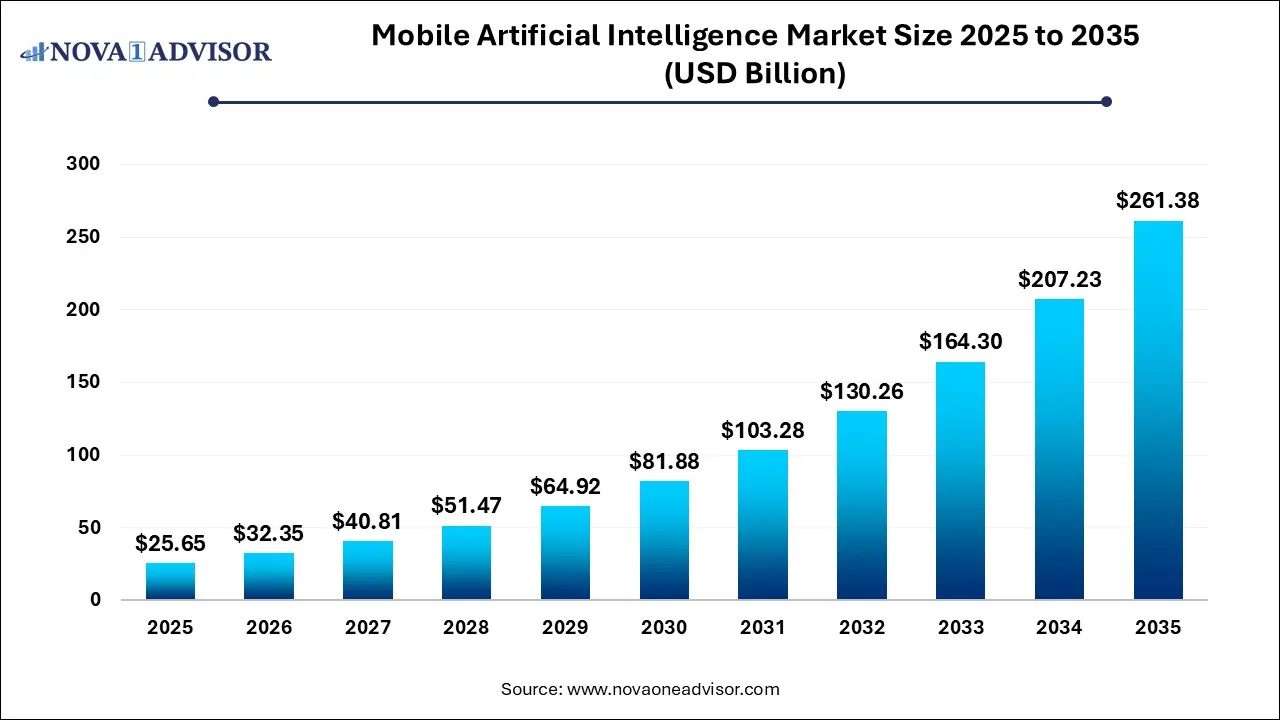

The mobile artificial intelligence market size was exhibited at USD 25.65 billion in 2025 and is projected to hit around USD 261.38 billion by 2035, growing at a CAGR of 26.13% during the forecast period 2026 to 2035.

Mobile Artificial Intelligence (AI) Market Key Takeaways:

- The 10 nm segment led the market in 2025, accounting for over 44.56% revenue share of the global revenue.

- 7 nm technology node is the fastest-growing segment accounting for 32.5% CAGR growth over the forecast period.

- The smartphone segment dominated the market and accounted for more than 38.0% share of the global revenue in 2025.

- North America is estimated to hold the leading share of 31.0% of the global revenue in 2025.

- The market in Asia Pacific is projected to grow at the highest CAGR during the forecast period.

Market Overview

The Mobile Artificial Intelligence (AI) Market is rapidly emerging as a cornerstone of the next-generation digital economy, transforming smartphones, drones, AR/VR systems, and automotive technologies into intelligent, autonomous tools capable of real-time decision-making. Mobile AI, driven by on-device processing, delivers faster, more secure, and power-efficient performance compared to cloud-dependent models.

AI-powered mobile chips embedded in consumer electronics have enhanced functionalities such as face recognition, voice assistants, real-time language translation, smart photography, and AR overlays. The market is benefiting from advances in semiconductor miniaturization, particularly the development of 7nm and 10nm nodes, which allow faster computation with lower power consumption—key to sustaining AI algorithms on mobile devices.

With the rising demand for edge computing, mobile AI is becoming indispensable. AI accelerators, neural processing units (NPUs), and tensor processing chips are now standard in flagship smartphones and are being increasingly adopted across mid-tier devices. Autonomous driving systems and smart surveillance drones are further propelling mobile AI demand. As industries converge toward smarter, portable, and connected ecosystems, mobile AI is unlocking a future where devices not only respond but anticipate, personalize, and act autonomously.

Major Trends in the Market

-

Adoption of AI Accelerators: Integration of NPUs and dedicated AI chips in smartphones and IoT devices is becoming mainstream.

-

Edge AI Supplanting Cloud AI: On-device processing for privacy, latency reduction, and offline functionality is gaining prominence.

-

7nm and 10nm Chip Advancements: Smaller nodes enable more powerful AI on mobile devices with enhanced energy efficiency.

-

AI for Enhanced Mobile Photography and AR: AI-based image enhancement, object detection, and AR overlays dominate camera upgrades.

-

Growing AI Applications in Autonomous Drones: Real-time navigation, obstacle avoidance, and surveillance tasks are AI-powered.

-

Mobile AI in Automotive Infotainment: Cars now feature voice interfaces, predictive navigation, and driver behavior analysis powered by embedded AI.

-

Surge in AI-enabled Wearables: Health monitoring, activity tracking, and personal coaching functions now operate via AI chips in wearables.

Report Scope of Mobile Artificial Intelligence (AI) Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 32.35 Billion |

| Market Size by 2035 |

USD 261.38 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 26.11% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology Node, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Qualcomm; Nvidia; Intel; IBM; Microsoft; Apple; Huawei (Hisilicon); Alphabet (Google); Mediatek; Samsung; Cerebras Systems; Graphcore; Cambricon Technology; Shanghai Thinkforce Electronic Technology Co.; Ltd (Thinkforce); Deephi Tech; Sambanova Systems; Rockchip (Fuzhou Rockchip Electronics Co., Ltd.); Thinci; Kneron |

Key Market Driver: Rising Demand for On-device Intelligence in Smartphones and IoT Devices

A major driver propelling the mobile AI market is the demand for on-device intelligence to enhance user experience, ensure data privacy, and reduce latency. As smartphones evolve into digital hubs, users expect instantaneous, context-aware responses. AI enables real-time facial recognition for unlocking devices, noise cancellation in voice calls, predictive typing, and personalized content recommendations.

Apple’s A-series Bionic chips, Google’s Tensor SoCs, and Qualcomm’s Snapdragon platforms integrate AI engines to support these features. Importantly, on-device AI bypasses the need to transmit data to external servers, enhancing privacy—a critical factor in the post-GDPR, data-sensitive era. For example, Apple’s Face ID processes biometric data entirely on-device, never sending it to the cloud. As edge computing gains favor, mobile AI is becoming essential to meet the performance and privacy expectations of modern users.

Key Market Restraint: High Cost and Technical Complexity of Integration

Despite its advantages, the mobile AI market faces a significant restraint in the form of integration complexity and high initial development costs. Designing and fabricating AI-specific chipsets at nodes like 7nm and 10nm requires massive R&D investments and highly specialized expertise. This acts as a barrier to entry for smaller players and raises the cost of end-user devices.

Moreover, software integration is not trivial ensuring that AI features function seamlessly within a device’s hardware constraints requires collaborative development between chipmakers, OS providers, and app developers. Power optimization, thermal management, and model compression are persistent technical challenges. These complexities slow down AI adoption in budget and mid-tier devices, limiting mass-market penetration.

Key Market Opportunity: Proliferation of AI in Mobile AR/VR and Gaming

An important growth opportunity lies in the convergence of mobile AI with AR/VR and immersive gaming experiences. AI enhances AR/VR by enabling object detection, environment mapping, natural language interaction, and spatial computing—all of which are critical for delivering realistic, responsive virtual environments.

For example, AI enables a smartphone to understand a user's surroundings and overlay virtual furniture in AR apps accurately. In gaming, AI helps personalize gameplay, adapt difficulty levels, and enhance animation realism. The introduction of AI-enhanced mixed reality glasses, such as Meta’s Ray-Ban smart glasses and Apple’s Vision Pro (scheduled for global rollouts), signals a major leap in this space. As 5G, wearable displays, and AI-capable chips mature, the mobile AI-AR/VR nexus will unlock immersive consumer and enterprise experiences.

Mobile Artificial Intelligence (AI) Market By Technology Node Insights

The 7nm segment dominates the mobile AI chip market, driven by its optimal balance of performance and energy efficiency. Chips at 7nm allow higher transistor density, which translates to faster AI computation, better battery life, and less heat. Flagship processors from Apple (A14/A15 Bionic), Qualcomm (Snapdragon 8 series), and MediaTek use 7nm or smaller nodes to power AI tasks such as facial recognition and voice commands. These chips can handle trillions of operations per second, enabling real-time inferencing for AI applications.

The fastest-growing segment is 10nm, particularly in mid-range devices that aim to balance cost and capability. Smartphone makers are adopting 10nm chips to bring AI features like smart photography, scene detection, and voice recognition to broader demographics. As AI proliferates beyond premium phones to wearables, tablets, and entry-level smartphones, 10nm technology offers a viable path for mass-market AI deployment.

Mobile Artificial Intelligence (AI) Market By Application Insights

Smartphones remain the dominant application, accounting for the largest share of the mobile AI market. Every major smartphone manufacturer now incorporates AI to improve device intelligence. Google Pixel’s use of Tensor chips for speech processing, Samsung’s camera enhancements via AI, and Apple’s Siri and image optimization exemplify the depth of integration. AI handles tasks like power management, adaptive brightness, app suggestions, and call filtering, making it indispensable in the smartphone ecosystem.

The fastest-growing segment is AR/VR, fueled by rising demand for immersive experiences in gaming, training, virtual meetings, and metaverse applications. Mobile AI enables real-time mapping, gesture recognition, and contextual overlays in AR headsets and apps. Companies like Meta, Niantic, and Snap are investing in AI to power advanced AR platforms. As hardware becomes more compact and energy-efficient, mobile AI’s role in AR/VR will continue to expand.

Mobile Artificial Intelligence (AI) Market By Regional Insights

North America leads the global mobile AI market, due to its advanced technological infrastructure, early adoption of AI-enabled devices, and presence of key innovators. U.S.-based tech giants like Apple, Google, and Qualcomm are driving development in AI chips and software. The region also benefits from high smartphone penetration and disposable incomes that support premium AI-enabled mobile devices.

Additionally, the U.S. government’s funding for AI research and strategic semiconductor investments under the CHIPS Act further strengthens regional dominance. North American consumers are also highly receptive to AI-driven features in personal devices, driving sustained demand for cutting-edge mobile technologies.

Asia Pacific is the fastest-growing region, propelled by massive smartphone adoption, expanding middle-class populations, and growing investments in AI R&D. China leads in AI hardware and applications, with companies like Huawei, Xiaomi, and Oppo integrating AI into their chipsets and camera systems. South Korea’s Samsung is a global AI chip leader, while India’s rapidly growing mobile market provides an ideal testing ground for AI innovations in mid-tier devices.

Governments in the region—particularly in China, Japan, and South Korea—are actively supporting AI ecosystems, while local startups innovate in facial recognition, translation, and smart assistant technologies. With the world’s largest mobile user base, Asia Pacific offers unmatched scale and growth potential for mobile AI solutions.

Some of the prominent players in the mobile artificial intelligence market include:

- Qualcomm Inc

- Nvidia

- Intel Corporation

- IBM Corporation

- Microsoft Corporation

- Apple Inc

- Huawei (Hisilicon)

- GoogleLLC

- Mediatek

- Samsung

- Cerebras Systems

- Graphcore

- Cambricon Technology

- Shanghai Thinkforce Electronic Technology Co., Ltd (Thinkforce)

- Deephi Tech

- Sambanova Systems

- Rockchip (Fuzhou Rockchip Electronics Co., Ltd.)

- Thinci

- Kneron

Mobile Artificial Intelligence (AI) Market Recent Developments

-

April 2025: Qualcomm unveiled its Snapdragon 8 Gen 4 chip, boasting a 7nm AI engine capable of handling 25 trillion operations per second, optimized for generative AI tasks on smartphones.

-

March 2025: Apple announced an upgrade to its Neural Engine in the A18 Bionic chip, enhancing real-time language translation and image processing in the iPhone 16 series.

-

February 2025: Samsung launched the Exynos 2500 with an advanced NPU for edge AI computing in its flagship Galaxy S25, focusing on camera enhancements and AR performance.

-

January 2025: MediaTek revealed the Dimensity 9400 chipset, with a 10nm architecture and integrated AI accelerator targeting mid-tier mobile devices in Asia.

-

December 2024: Google expanded its Tensor chip line with a new low-power variant optimized for smartwatches and AR glasses, supporting continuous on-device learning.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the mobile artificial intelligence market

By Technology Node

- 7 nm

- 10 nm

- 20-28 nm

- Others (12 nm and 14 nm)

By Application

- Smartphones

- cameras

- Drones

- Automobile

- Robotics

- AR/VR

- Others (smart boards, Laptops, PCs)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)