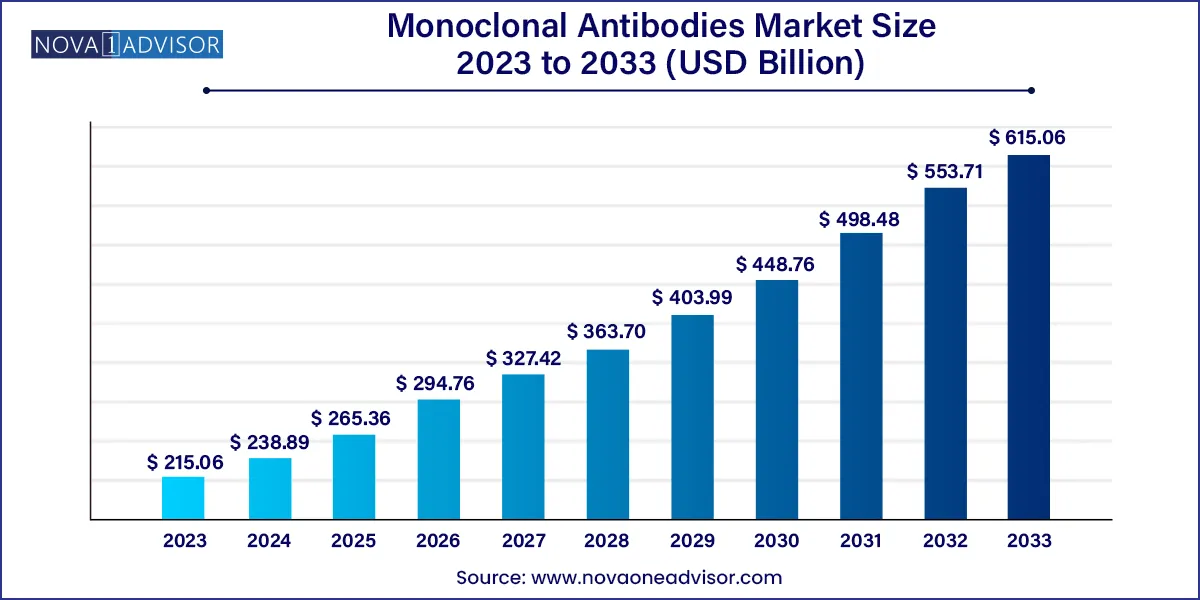

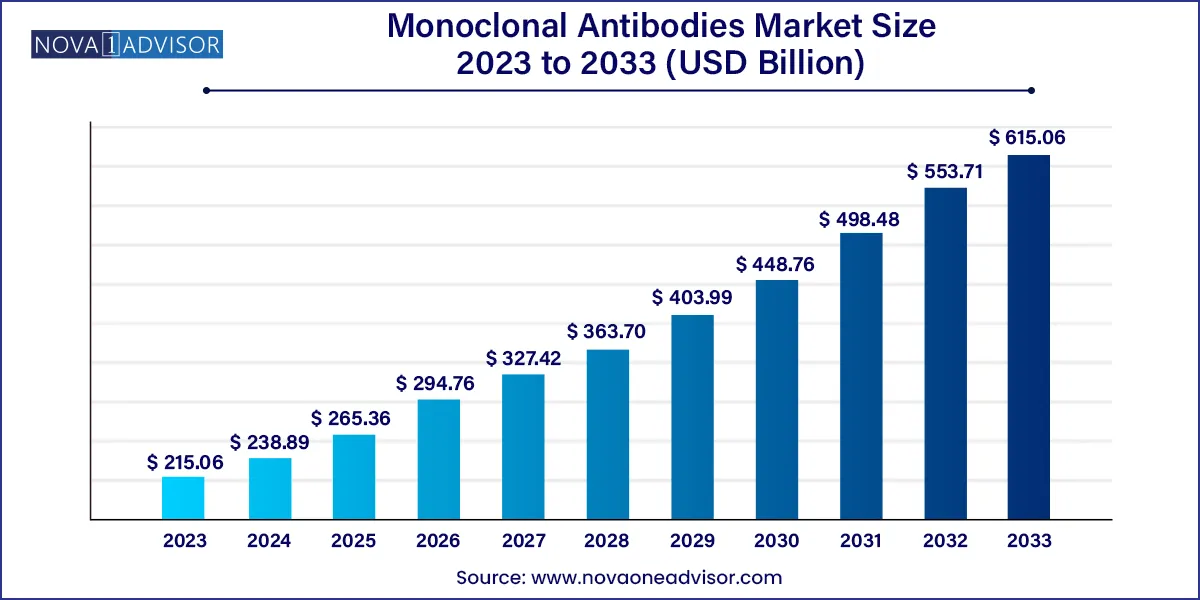

The global monoclonal antibodies market size was exhibited at USD 215.06 billion in 2023 and is projected to hit around USD 615.06 billion by 2033, growing at a CAGR of 11.08% during the forecast period 2024 to 2033.

Key Takeaways:

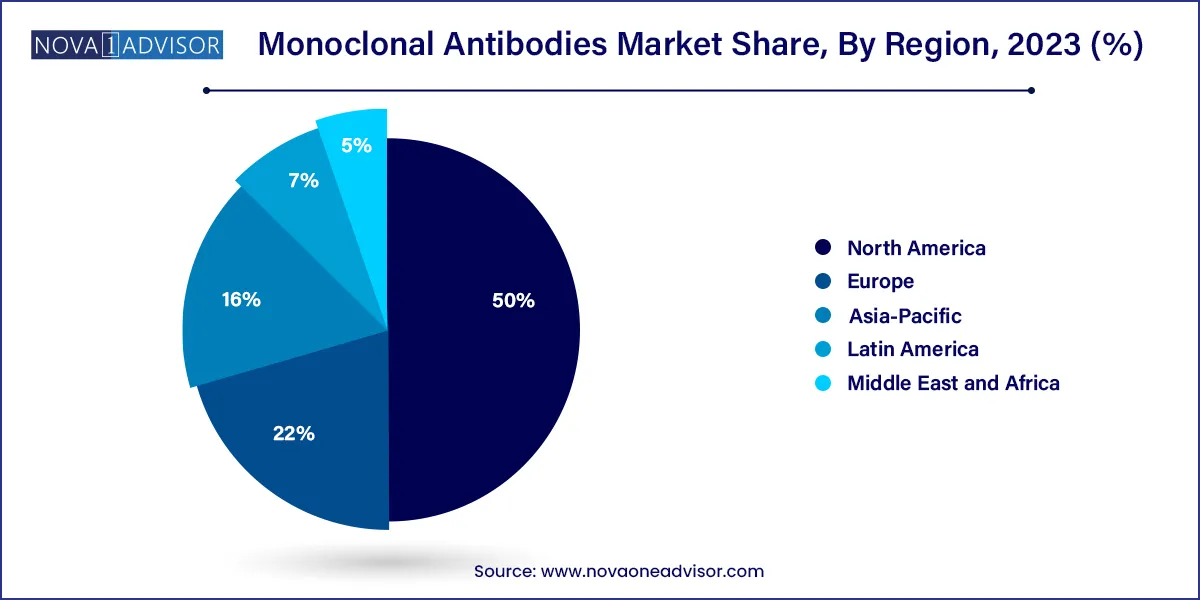

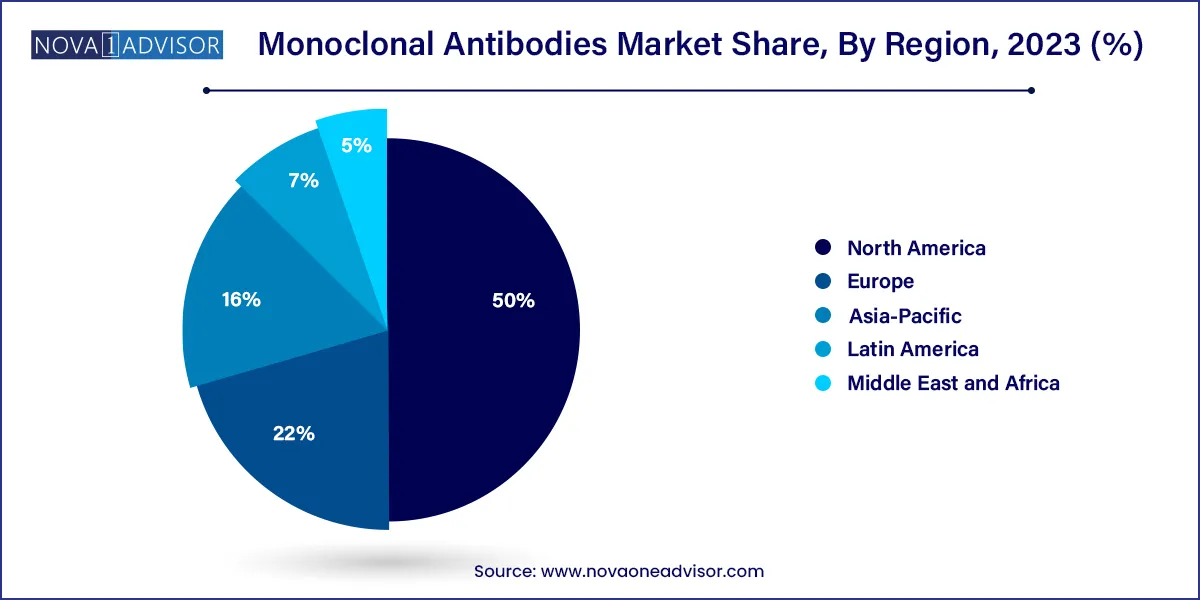

- North America recorded the largest market share of 50.0% in 2023

- The human source type held the largest share and accounted for 54.3% of the market value in 2023.

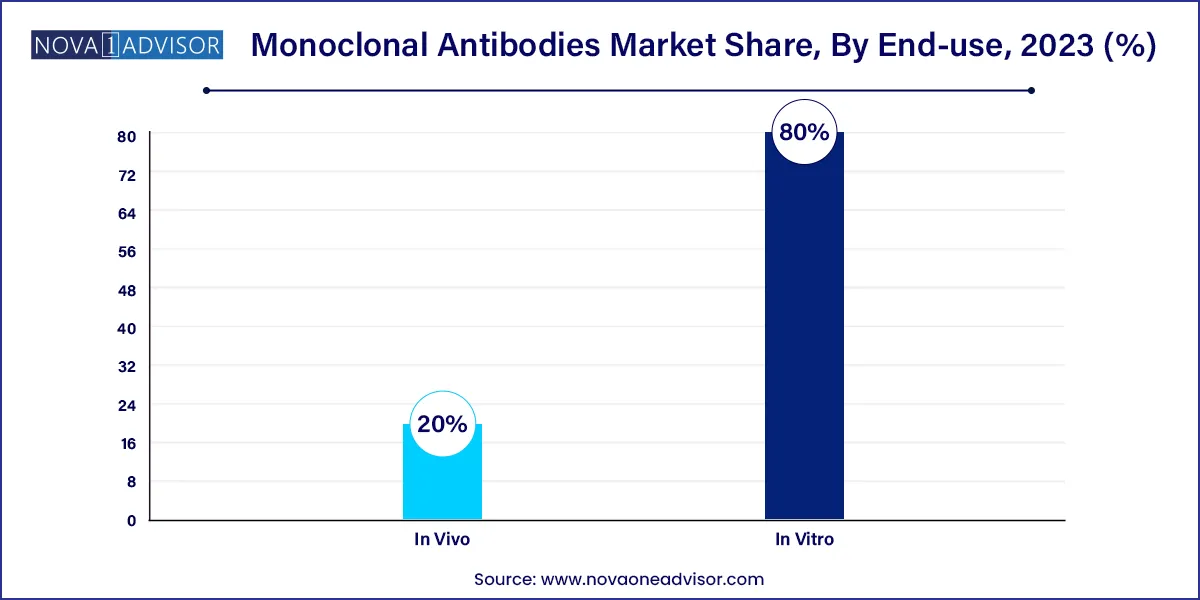

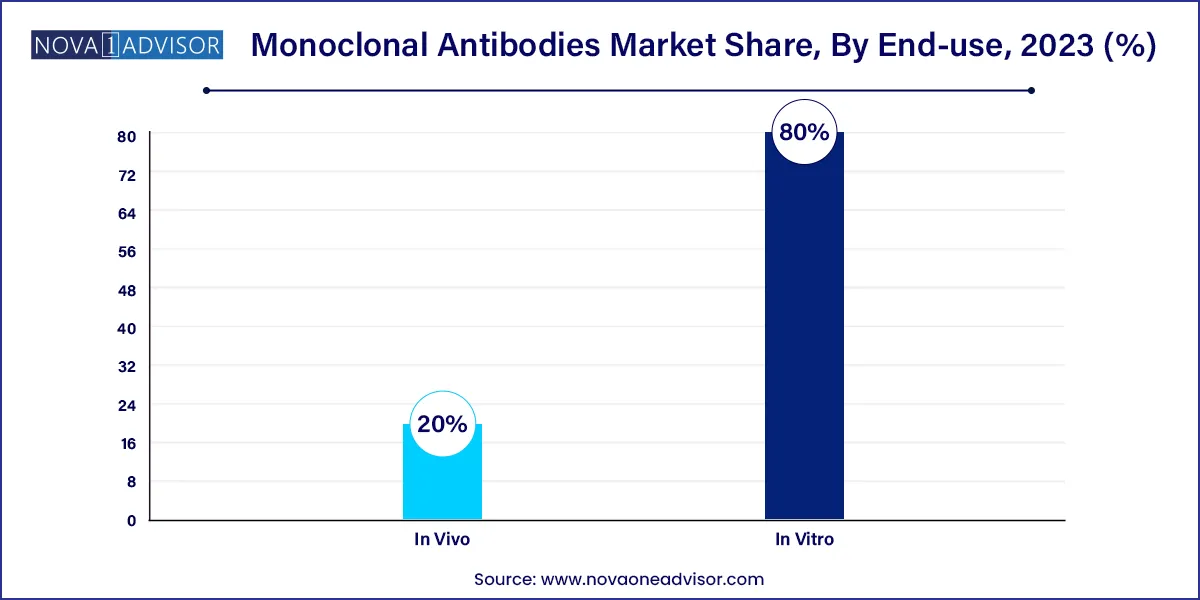

- IIn vitro production type held the larger market share of 80.0% in 2023.

- Oncology segment dominated the applications market for mAbs and accounted for 49.2% of the market value in 2023.

- The hospitals segment held the largest market share of 39.7% in 2023.

Market Overview

The monoclonal antibodies (mAbs) market is one of the most transformative sectors in modern biotechnology and pharmaceutical sciences. Monoclonal antibodies are laboratory-produced molecules engineered to serve as substitute antibodies that can restore, enhance, or mimic the immune system’s attack on harmful cells. Their application spans across several therapeutic areas including oncology, autoimmune diseases, infectious diseases, and more recently, neurology.

With the increasing prevalence of chronic and life-threatening diseases, combined with technological advancements in recombinant DNA and hybridoma technologies, monoclonal antibodies have become vital components in therapeutic interventions. As of 2025, over 100 monoclonal antibodies are approved globally, and several hundred more are in development pipelines.

The market is also witnessing the emergence of biosimilars, which offer cost-effective alternatives to branded biologics, and the expansion of mAbs in non-traditional areas like Alzheimer’s and COVID-19. Monoclonal antibodies such as pembrolizumab (Keytruda), adalimumab (Humira), and trastuzumab (Herceptin) have not only generated billions in sales but also reshaped treatment paradigms.

Major Trends in the Market

-

Rising Use of Monoclonal Antibodies in Cancer Immunotherapy: Especially PD-1/PD-L1 and CTLA-4 checkpoint inhibitors.

-

Surge in Biosimilar Approvals and Launches: Expanding access to mAbs in emerging markets and reducing overall healthcare costs.

-

Innovations in Antibody Engineering: Growth in bi-specific, tri-specific, and antibody-drug conjugates (ADCs).

-

Integration of AI in Antibody Discovery: Accelerating the development of target-specific antibodies with high affinity.

-

Increased Investments in mAbs for Rare and Neurological Diseases: Companies exploring applications in Alzheimer’s and ALS.

-

Expansion of In Vitro Production Platforms: Enhancing yield, scalability, and cost efficiency in manufacturing.

-

Collaborative Development Models: Co-developments between pharma giants and biotech startups.

-

Geographical Diversification of Trials and Manufacturing: Especially in Asia-Pacific and Latin America to meet demand and regulatory preferences.

Monoclonal Antibodies Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 238.89 Billion |

| Market Size by 2033 |

USD 615.06 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.08% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Source Type, Production Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Novartis AG; Pfizer Inc; GlaxoSmithKline plc; Amgen Inc.; Merck & Co., Inc.; Daiichi Sankyo Company, Limited; Abbott Laboratories; AstraZeneca plc; Eli Lilly And Company; Johnson & Johnson Services, Inc.; Bayer AG; Bristol Myers Squibb; F. Hoffman-La Roche Ltd.; Viatris Inc.; Biogen Inc.; Thermo Fisher Scientific, Inc.; Novo Nordisk A/S; Sanofi S.A.; Merck KGaA |

Market Driver: High Efficacy and Target Specificity of mAbs

The most significant driver for the mAbs market is their exceptional specificity and therapeutic efficacy. Unlike traditional small-molecule drugs, mAbs are designed to bind with high precision to specific antigens, such as proteins on the surface of cancer cells or immune checkpoints in autoimmune diseases. This specificity translates to fewer off-target effects, higher treatment tolerability, and better patient outcomes.

For instance, in oncology, the use of trastuzumab for HER2-positive breast cancer and nivolumab for NSCLC have led to measurable improvements in progression-free survival and overall survival. This clinical superiority has driven strong physician adoption and insurance support, cementing mAbs as essential therapies in modern medicine.

Market Restraint: High Cost of Development and Accessibility Challenges

Despite their clinical success, the high cost of monoclonal antibody therapies remains a significant barrier, especially in low- and middle-income countries. Development of a single mAb can cost upwards of $1 billion, considering the complexities of R&D, clinical trials, and biomanufacturing infrastructure.

Moreover, the cold chain logistics and need for intravenous or subcutaneous administration limit the reach of these drugs in remote or under-resourced healthcare settings. Although biosimilars offer a solution, uptake has been slower than expected due to regulatory complexities, patent disputes, and physician hesitation.

Market Opportunity: Growth of Personalized Medicine and Companion Diagnostics

An emerging opportunity for the mAbs market lies in the intersection of monoclonal antibodies with personalized medicine and companion diagnostics. As genomics and molecular diagnostics become integrated into routine clinical care, identifying the right patients for specific antibody therapies becomes more precise.

For example, PD-L1 testing is used to determine eligibility for checkpoint inhibitors, while EGFR mutation screening informs use of specific mAbs in NSCLC. This precision approach not only enhances efficacy but also reduces unnecessary exposure and costs, thereby aligning with the value-based healthcare models gaining traction globally.

Segments Insights:

By Source type Insights

Human monoclonal antibodies dominate the market, primarily due to their superior safety profiles and lower immunogenicity. Drugs like adalimumab and dupilumab are fully human, reducing the likelihood of anti-drug antibody (ADA) formation and allergic reactions. Advances in phage display and transgenic mouse models have accelerated the development of fully human mAbs, increasing their clinical acceptance.

Humanized monoclonal antibodies are the fastest-growing segment, especially in oncology and autoimmune diseases. These antibodies are initially derived from non-human sources but modified to resemble human antibodies. Examples include trastuzumab and bevacizumab, which have proven to be highly effective while balancing immunogenic concerns and production efficiency.

By Production Type Insights

In Vitro production methods lead the market, thanks to their scalability and reproducibility. Mammalian cell cultures, particularly CHO (Chinese Hamster Ovary) cells, are widely used for producing high-purity mAbs. This method supports GMP compliance and enables consistent batch production, making it ideal for high-demand drugs.

In Vivo production, although less prevalent, is still used, particularly in research settings or early-stage development. However, the trend is clearly moving toward more controlled and ethical in vitro systems that support sustainable large-scale manufacturing.

By Application Insights

Oncology is the largest and most mature application area, accounting for more than half of the market share. The role of mAbs in targeting tumor antigens, blocking immune checkpoints, and delivering cytotoxic payloads has made them frontline agents in cancers like breast, lung, colorectal, and hematological malignancies. Combination therapies with chemotherapy, radiotherapy, or other mAbs further enhance their appeal.

Neurological diseases represent the fastest-growing segment, driven by breakthrough approvals such as lecanemab for Alzheimer’s disease. As our understanding of neuroinflammation and proteinopathies improves, mAbs targeting tau proteins, beta-amyloid, and alpha-synuclein are being rapidly developed. Additionally, mAbs are being trialed in multiple sclerosis and migraine management, expanding their neurological footprint.

By End-use Insights

Hospitals remain the primary end-use sector, owing to the intravenous nature of many mAbs and the need for monitored administration. Oncology infusion centers and inpatient rheumatology units are major hubs for mAb delivery. The hospital infrastructure also supports the cold chain and sterile environments necessary for biologic therapies.

Specialty centers are growing in importance, especially as subcutaneous formulations (e.g., adalimumab pens) allow outpatient administration. Dermatology, allergology, and neurology clinics are increasingly using mAbs, supported by training programs and reimbursement models. Specialty pharmacies and home infusion services are also expanding in this space.

By Regional Insights

North America dominates the monoclonal antibodies market, driven by a strong biopharmaceutical R&D ecosystem, high healthcare expenditure, and favorable reimbursement for biologics. The U.S. FDA leads the world in mAb approvals, and companies like Amgen, AbbVie, and Regeneron are headquartered here. The presence of advanced manufacturing facilities and academic research institutions also supports pipeline expansion.

Asia-Pacific is the fastest-growing region, led by rapid biopharma growth in China, India, Japan, and South Korea. China’s "Made in China 2025" biotech initiative and India’s biosimilar focus are creating a fertile landscape for domestic mAb development. Additionally, APAC’s large population base, rising cancer incidence, and expanding insurance coverage are increasing mAb adoption.

Some of the prominent players in the Monoclonal antibodies market include:

- Novartis AG

- Pfizer Inc

- GlaxoSmithKline plc

- Amgen Inc.

- Merck & Co., Inc.

- Daiichi Sankyo Company, Limited

- Abbott Laboratories

- AstraZeneca plc

- Eli Lilly And Company

- Johnson & Johnson Services, Inc.

- Bayer AG

- Bristol Myers Squibb

- F. Hoffman-La Roche Ltd.

- Viatris Inc.

- Biogen Inc.

- Thermo Fisher Scientific, Inc.

- Novo Nordisk A/S

- Sanofi S.A.

- Merck KGaA

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global monoclonal antibodies market.

Source type

- Murine

- Chimeric

- Humanized

- Human

Production Type

Application

- Oncology

- Autoimmune Diseases

- Infectious Diseases

- Neurological Diseases

- Others

End-use

- Hospitals

- Specialty Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)