Mortuary Bags Market Size and Research

The mortuary bags market size was exhibited at USD 1.59 billion in 2024 and is projected to hit around USD 2.98 billion by 2034, growing at a CAGR of 6.5% during the forecast period 2025 to 2034.

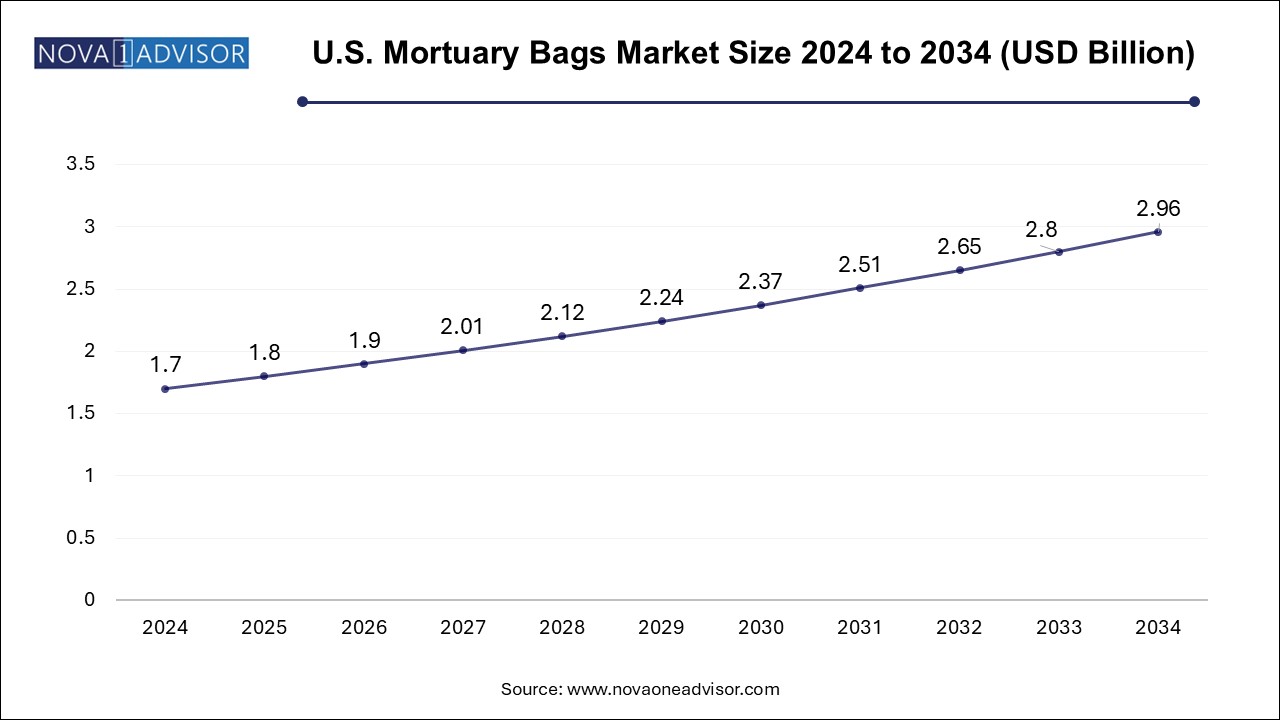

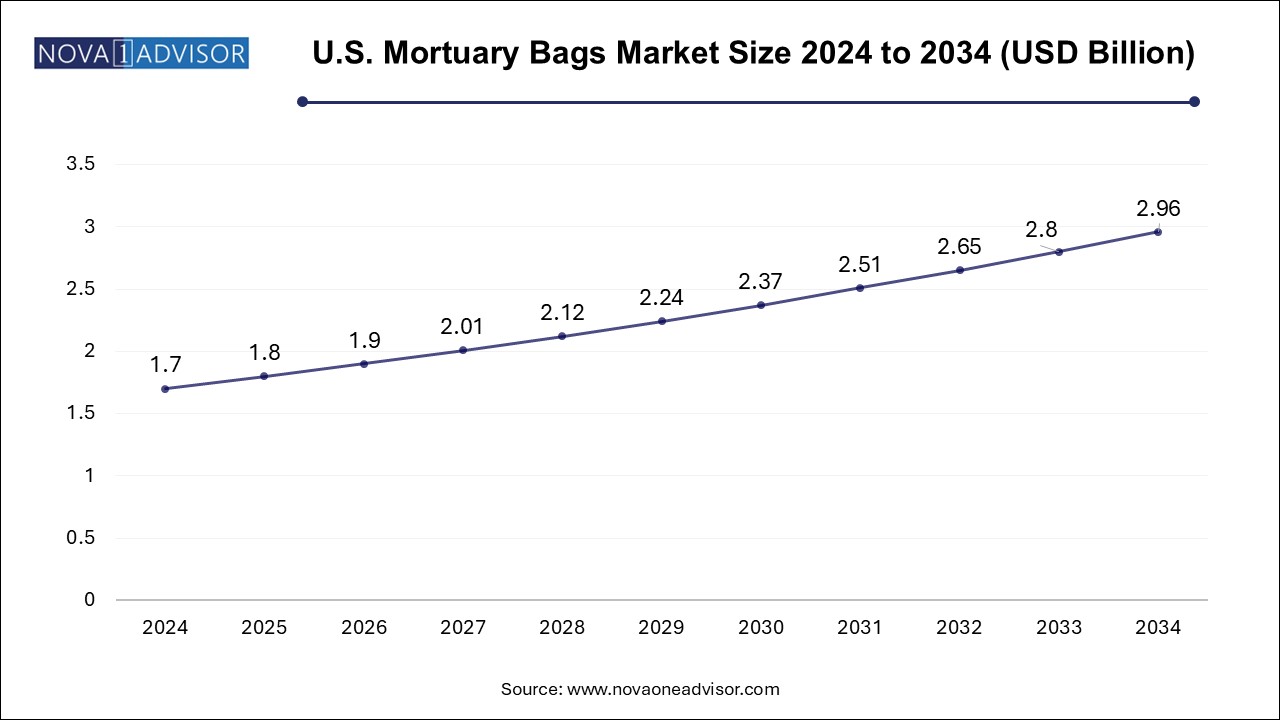

U.S. Mortuary Bags Market Size and Growth 2025 to 2034

The U.S. mortuary bags market size is evaluated at USD 1.7 billion in 2024 and is projected to be worth around USD 2.96 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

The North America accounted for the largest share in the mortuary bags market in 2024, driven by high healthcare standards, government preparedness for mass fatalities, and advanced infrastructure in both hospital and forensic facilities. The U.S. Department of Health and Human Services and FEMA maintain strategic reserves of body bags as part of national emergency response plans. The United States also has a highly decentralized healthcare system with a large number of private and public hospitals, each managing their own inventory, thereby contributing to consistent demand across states.

In addition, Canada has seen increased mortuary bag procurement post-pandemic, particularly in long-term care homes and provincial emergency management units. The prevalence of opioid-related deaths, especially in certain U.S. states like Ohio and West Virginia, has also created a steady stream of demand from forensic and police departments. North American manufacturers benefit from strong logistical capabilities, enabling them to meet surges in demand during crises.

Asia Pacific is projected to be the fastest-growing regional market, fueled by increasing healthcare investment, population growth, and a shift toward organized death care systems. Countries like India, China, and Indonesia are expanding their hospital networks, while also improving rural healthcare logistics. With rising incidences of natural disasters, industrial accidents, and mass casualty events, government agencies are stocking emergency supplies, including mortuary bags, as part of national disaster preparedness programs.

Additionally, increased mortality linked to pollution, chronic diseases, and aging demographics in countries like Japan and South Korea has led to an uptick in hospital and home deaths—necessitating improvements in cadaver handling. China, which was a major manufacturer and consumer of mortuary bags during the COVID-19 outbreak, is now focusing on standardizing quality and enhancing biodegradability in domestic production, which is expected to stimulate regional innovation.

Market Overview

The mortuary bags market, though niche, plays a crucial role in the healthcare, emergency services, and disaster management ecosystems. Mortuary bags, also referred to as body bags or cadaver pouches, are designed for the containment, storage, and transportation of deceased bodies. These bags are commonly used by hospitals, forensic departments, mortuaries, military organizations, and disaster response teams. Their demand is largely driven by mortality rates, mass fatality incidents, healthcare preparedness, and forensic investigation requirements.

The market experienced a notable surge during the COVID-19 pandemic, which spotlighted the critical importance of hygienic and durable cadaver management systems. Post-pandemic, the market is stabilizing but remains elevated due to improved protocols across healthcare and emergency systems, increased hospital capacities, and a heightened focus on disease containment. Additionally, aging global populations, the rise of chronic illnesses, and the expansion of mortuary infrastructure in both urban and rural healthcare centers have collectively sustained the demand for mortuary bags.

Modern mortuary bags are manufactured using a variety of raw materials including PVC, polyethylene, nylon, and polyester, each offering different levels of durability, fluid resistance, and cost-effectiveness. Advances in materials have led to the production of bags with antimicrobial coatings, odor control features, and tamper-proof sealing mechanisms. Furthermore, heavy-duty and bariatric bags are gaining attention due to increasing obesity rates and the need for specialized handling equipment. While the product itself may be functionally straightforward, the demand is dictated by a complex interplay of social, medical, and geopolitical factors.

As government bodies and humanitarian organizations worldwide adopt standardized guidelines for disaster preparedness and mass casualty management, the mortuary bags market is expected to evolve further—both in terms of quantity and quality of demand. The introduction of biodegradable materials, AI-assisted inventory management systems, and customized solutions tailored to geographic needs are shaping the market's future.

Major Trends in the Market

-

Shift Toward Biodegradable Mortuary Bags: Sustainability initiatives are pushing manufacturers to develop eco-friendly, compostable alternatives to PVC-based bags.

-

Increased Use of Heavy-Duty and Bariatric Bags: The global rise in obesity is prompting demand for larger, reinforced cadaver bags in hospitals and disaster services.

-

Strategic Stockpiling by Government Agencies: Health ministries and disaster response teams are increasing mortuary bag inventories as part of mass fatality preparedness plans.

-

Technological Integration with Inventory Systems: Hospitals and morgues are adopting digital inventory tracking for efficient mortuary supplies management.

-

Customizable Bags for Forensic Use: Specialized mortuary bags are now being manufactured with transparent viewing panels, evidence compartments, and RFID tagging.

-

Globalization of Supply Chains: Multinational manufacturers are expanding distribution partnerships to address shortages during crises or natural disasters.

-

Enhanced Focus on Infection Control: Post-pandemic hygiene standards have led to increased use of antimicrobial-coated and leak-proof mortuary bags.

-

Military and Defense Sector Demand: Armed forces continue to be a significant user group, requiring battlefield-grade, tear-resistant mortuary solutions.

Report Scope of Mortuary Bags Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.69 Billion |

| Market Size by 2034 |

USD 2.98 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 6.5% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Raw Material, Size, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Flexmort; Isofroid; CEABIS (Vezzani Group); Mopec; Peerless Plastics; Classic Plastics Corporation; Auden Funeral Supplies Limited; SmartChoice Funeral Supplies; Eastman Chemical Company; Evonik Industries AG |

Market Driver: Growing Demand for Preparedness in Mass Fatality Management

The strongest driver for the mortuary bags market is the increased global emphasis on mass fatality preparedness following pandemics, natural disasters, and geopolitical conflicts. Events such as the COVID-19 outbreak, the Syrian civil war, and recent earthquakes in Turkey and Morocco have revealed vulnerabilities in death care infrastructure across both developing and developed nations. These situations often lead to overwhelming morgues, delays in identification processes, and public health hazards.

In response, governments, humanitarian NGOs, and medical institutions have bolstered emergency response protocols to include the pre-procurement and systematic deployment of mortuary bags. For instance, the U.S. Federal Emergency Management Agency (FEMA) maintains a reserve stock of body bags for rapid deployment. Similarly, the World Health Organization (WHO) provides standardized body bag specifications for use in epidemic zones. This increased institutionalization of post-mortem care standards is a crucial force behind the growing, sustained demand for mortuary bags globally.

Market Restraint: Environmental Impact and Waste Management Issues

One of the most pressing restraints in the mortuary bags market is the environmental concern associated with the disposal of non-biodegradable bags, especially PVC-based products. Most mortuary bags are single-use, designed for sanitary reasons, and end up in landfills or are incinerated along with biomedical waste. The large-scale use of such synthetic, non-recyclable materials poses long-term environmental hazards.

Additionally, low-income and disaster-struck regions often lack proper biomedical waste disposal infrastructure, leading to improper burning or dumping of used bags. The environmental implications of such practices are now gaining more attention from regulatory authorities and NGOs. This has created a push-pull dynamic for manufacturers, who must balance between durability, cost-efficiency, and sustainability—a complex trade-off that often limits innovation and slows down market expansion in highly regulated environments.

Market Opportunity: Rise of Sustainable and Biodegradable Alternatives

A major opportunity lies in the development and commercialization of biodegradable and eco-friendly mortuary bags. With sustainability becoming a key concern for governments, healthcare providers, and NGOs, there is growing interest in compostable materials such as PLA (polylactic acid), biodegradable polyesters, and water-soluble films for short-term cadaver storage and transport.

Start-ups and innovators entering the space are exploring dual-layered biodegradable composites that can match the strength and leak-resistance of traditional PVC bags. If successful, these products could become the new standard, especially in regions with strict environmental regulations like the European Union. This innovation pathway opens up prospects for public sector procurement, especially under "green government" initiatives. Additionally, companies focusing on circular economy models or CSR-linked mortuary solutions may find niche, yet lucrative, opportunities in high-end funeral and healthcare markets.

Mortuary Bags Market By Raw Material Insights

PVC dominated the mortuary bags market in 2024, largely due to its widespread availability, low cost, and superior durability under varying environmental conditions. PVC-based mortuary bags are the industry standard in hospital and military settings where leak-proof containment is paramount. They offer high tensile strength, are moisture and bacteria resistant, and are relatively easy to manufacture in bulk. Despite concerns over environmental sustainability, PVC remains the preferred choice for many emergency response agencies because of its proven performance during crises such as pandemics and natural disasters.

Polyester and polyethylene bags are projected to be the fastest-growing materials as sustainability takes center stage. These materials offer a good compromise between cost, strength, and environmental impact. Polyethylene is lightweight and offers chemical resistance, making it ideal for transport over long distances in hot climates. Polyester, on the other hand, is gaining popularity in advanced markets where customization and aesthetics (such as reusable ceremonial bags) are important. As innovations in biodegradable versions of these materials emerge, their adoption is expected to rise, especially in green-conscious regions like Europe and Canada.

Mortuary Bags Market By Size Insights

The Adult mortuary bags continue to dominate the market, as adult deaths account for the majority of total global mortality. These bags are standard in hospitals, morgues, and disaster response kits. The versatility of adult-sized bags—which are often used for a wide age range including adolescents and older children—adds to their market dominance. In high-capacity institutions like urban hospitals or forensic departments, bulk purchases of adult bags are standard procurement practice. These bags are also available in various grades, from standard to heavy-duty, catering to different use environments from routine hospital deaths to crime scene retrievals.

Heavy-duty and bariatric bags are the fastest-growing segment, propelled by rising obesity rates and the increasing need for reinforced containment during transportation. These bags are engineered to support significantly more weight, with features like six or eight handles, reinforced zippers, and triple-layered linings. Hospitals and mortuaries in North America and Europe are particularly focused on upgrading their equipment to include bariatric options as standard inventory. These bags also find use in military settings, where field retrieval of casualties may involve additional gear or injuries requiring stronger containment solutions.

Mortuary Bags Market By End-use Insights

The Hospitals remain the leading end users, accounting for the largest share of mortuary bag usage globally. From large urban centers to rural healthcare clinics, hospitals require a consistent supply of body bags for daily operations, disease containment, and mass casualty readiness. Many hospitals maintain internal morgue facilities or refrigeration units, necessitating inventory tracking and regular procurement. Infection control protocols, especially in infectious disease wards and ICUs, further emphasize the use of disposable and high-grade mortuary bags.

Morgues and forensic departments are witnessing the fastest growth in demand, especially with the rising importance of forensic investigations, legal autopsies, and crime scene handling. These facilities often require customized mortuary bags with additional features such as transparent viewing windows, internal labeling compartments, and evidence pouches. With increasing deaths linked to drug overdoses, violence, and unexplained causes, coroners and medical examiners are facing rising caseloads—directly translating to more frequent and specialized body bag usage.

Some of the prominent players in the mortuary bags market include:

- Flexmort

- Isofroid

- CEABIS (Vezzani Group)

- Mopec

- Peerless Plastics

- Classic Plastics Corporation

- Auden Funeral Supplies Limited

- SmartChoice Funeral Supplies

- Eastman Chemical Company

- Evonik Industries AG

Mortuary Bags Market Recent Developments

-

In March 2025, Flexmort Ltd. (UK) launched a new biodegradable mortuary bag made from plant-based polymer composites, designed for single-use disaster deployments.

-

In January 2025, EMSRUN Medical (China) expanded its production capacity for PVC and heavy-duty bariatric mortuary bags in response to new procurement contracts in Southeast Asia.

-

In December 2024, BodyBagStore.com (U.S.) introduced RFID-tracked body bags for integration with hospital and morgue inventory systems.

-

In October 2024, the Indian Ministry of Health issued tenders for the supply of 200,000 mortuary bags to be distributed across district hospitals and emergency services.

-

In August 2024, Mortuary Supplies USA signed a distribution agreement with a Canadian government body to provide heavy-duty mortuary bags to remote indigenous communities.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the mortuary bags market

By Raw Material

- PVC

- Polyethylene

- Nylon

- Polyester

- Others

By Size

- Adult Bags

- Child/Infant Bags

- Heavy Duty and Bariatric Bags

By End Use

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)