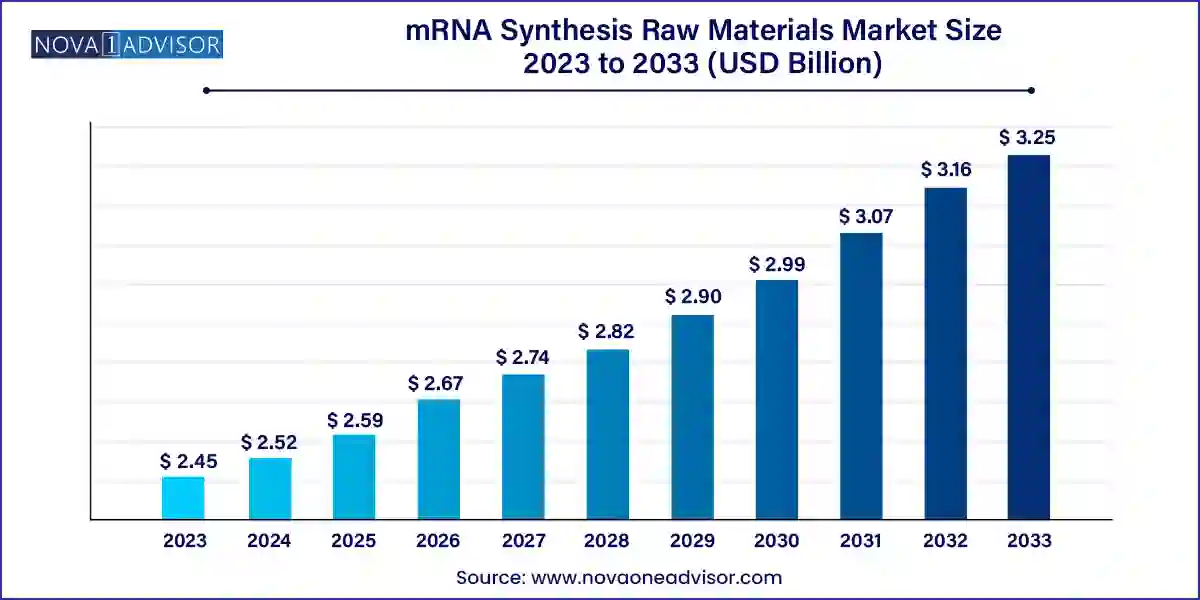

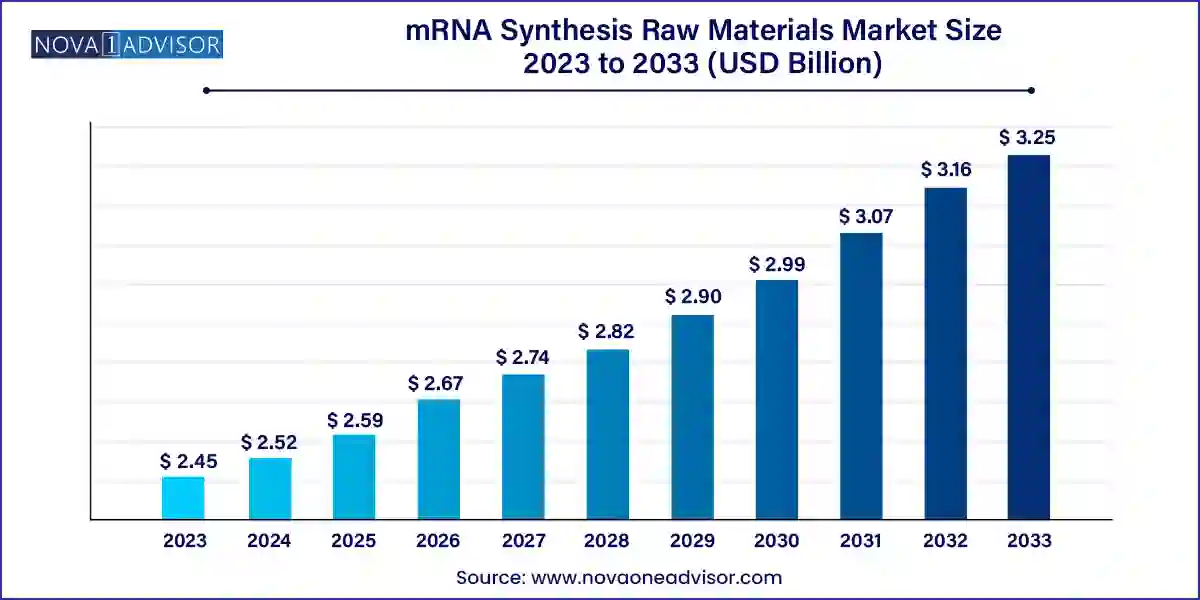

mRNA Synthesis Raw Materials Market Size and Growth

The global mRNA Synthesis Raw Materials market size was valued at USD 2.45 billion in 2023 and is projected to surpass around USD 3.25 billion by 2033, registering a CAGR of 2.87% over the forecast period of 2024 to 2033.

mRNA Synthesis Raw Materials Market Key Takeaways

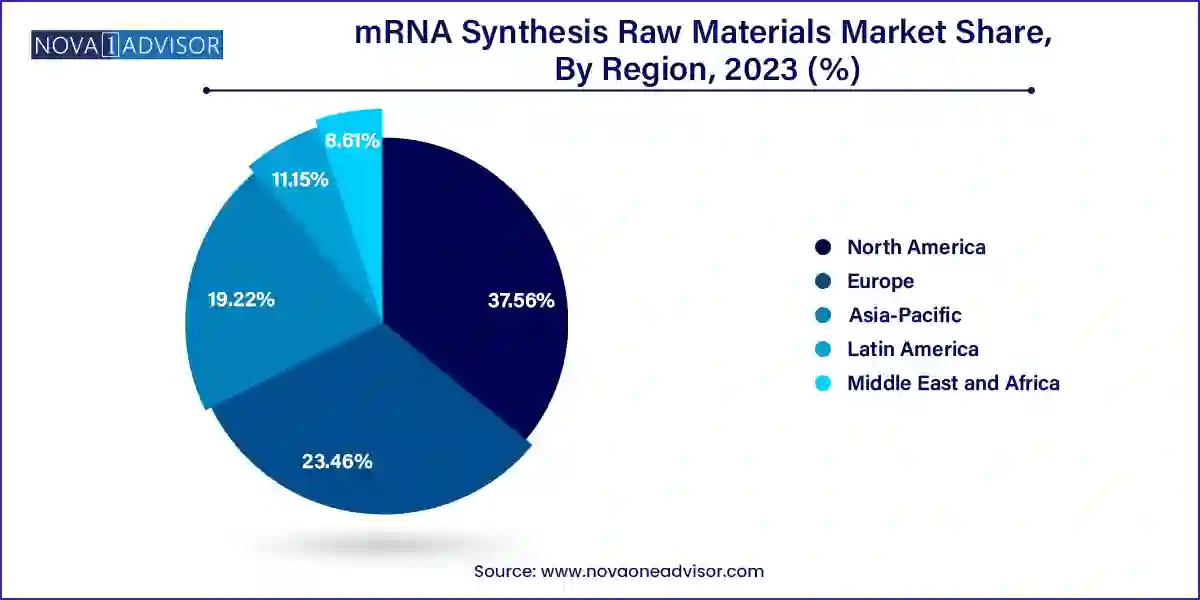

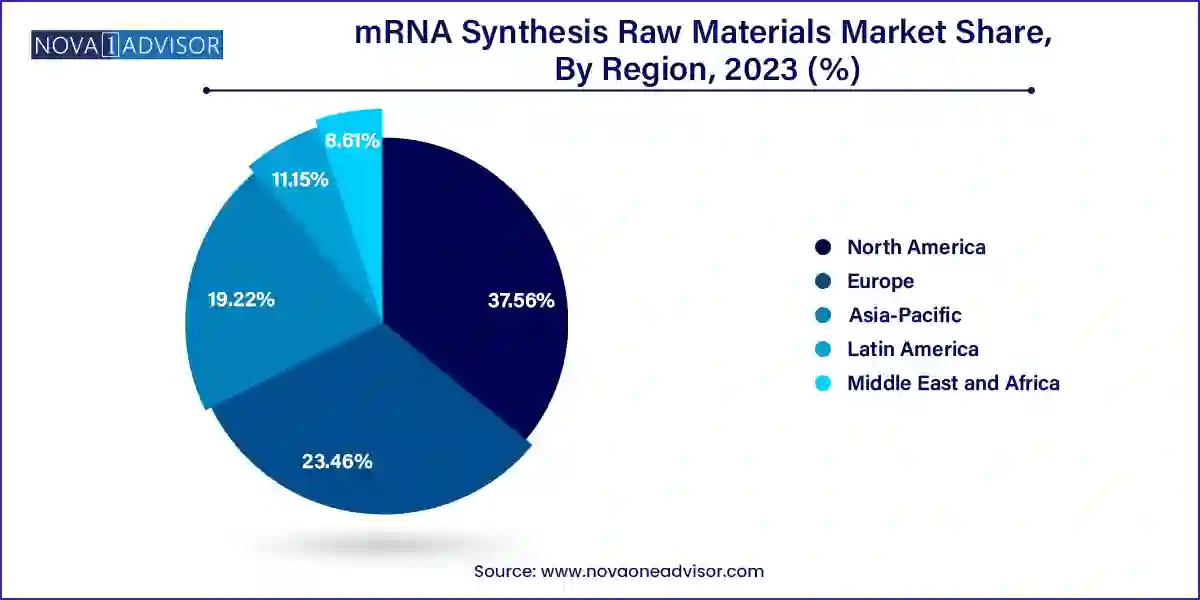

- North America dominated the global industry in 2023 and accounted for the largest share of more than 37.56% of the overall revenue in 2023, and is expected to grow at the highest CAGR over the forecast period.

- The mRNA synthesis raw materials market in Asia Pacific held a significant share in 2023.

- Based on type, the capping agents segment dominated the global industry with the largest revenue share of 39.23% in 2023.

- The segment is also anticipated to expand at the fastest CAGR of 3.26% during the forecast period.

- The vaccine production segment dominated the global industry with the largest revenue share in 2023.

- The therapeutics production segment is expected to expand at a significant CAGR of 2.65% from 2024 to 2033

- The biopharmaceutical and pharmaceutical companies segment dominated the market with the highest revenue share in 2023

- Moreover, the biopharmaceutical and pharmaceutical segment is also expected to expand at a rapid pace during 2024-2033

Market Overview

The mRNA synthesis raw materials market is a vital and rapidly evolving segment within the broader biopharmaceutical supply chain, underpinned by the increasing adoption of messenger RNA (mRNA) technologies in vaccine development, therapeutics, and advanced gene therapies. This market gained significant momentum in the wake of the COVID-19 pandemic, when mRNA-based vaccines developed by Pfizer-BioNTech and Moderna demonstrated unprecedented efficacy and speed of development, reshaping the global perception of RNA technologies.

Raw materials used in mRNA synthesis such as nucleotides, capping agents, enzymes (like polymerases and RNase inhibitors), and plasmid DNA are foundational to the production process. These components are involved in in vitro transcription (IVT), purification, stabilization, and formulation of synthetic mRNA strands used in vaccines and therapeutics. The precision, purity, and scalability of these raw materials directly influence the quality, efficacy, and regulatory acceptance of the final mRNA products.

The market is now expanding beyond infectious disease vaccines into therapeutic domains such as oncology, rare genetic diseases, cardiovascular disorders, and personalized medicine. Governments and private sectors are investing heavily in RNA research and manufacturing capabilities to future-proof public health infrastructure and accelerate the shift towards precision medicine. As global demand for mRNA-based modalities increases, manufacturers of these raw materials are scaling up capacity, enhancing quality control, and establishing strategic collaborations to secure their position in the evolving mRNA ecosystem.

Major Trends in the Market

-

Post-pandemic expansion of mRNA-based platforms: The success of COVID-19 mRNA vaccines has catalyzed interest in applying mRNA to a wide array of therapeutic areas, leading to sustained demand for raw materials.

-

Shift towards synthetic biology and modular manufacturing: Biotech firms are integrating synthetic biology tools to design more efficient pathways for raw material synthesis, boosting scalability and reducing cost.

-

Strategic partnerships and vertical integration: Key players are forming alliances or acquiring upstream suppliers to ensure uninterrupted access to high-quality raw materials and secure the supply chain.

-

Increased focus on Good Manufacturing Practices (GMP): As mRNA applications move into regulated therapeutic spaces, demand for GMP-grade nucleotides, enzymes, and plasmid DNA is surging.

-

Emergence of lipid nanoparticle (LNP) technologies: Although not a raw material per se, the growth of LNPs in mRNA delivery is stimulating adjacent demand for compatible mRNA formulations, influencing raw material specifications.

-

Automation and digitalization in mRNA synthesis: The integration of automated IVT platforms and AI-driven quality analytics is transforming how raw materials are tested, stored, and utilized.

-

Sustainability and green chemistry in raw material production: Environmental concerns are encouraging companies to optimize enzymatic processes and reduce hazardous byproducts in synthesis pathways.

mRNA Synthesis Raw Materials Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 2.52 Billion |

| Market Size by 2033 |

USD 3.25 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 2.87% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Type, application, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Jena Bioscience GmbH; Merck KGaA; Yeasen Biotechnology (Shanghai) Co., Ltd.; BOC Sciences; Thermo Fisher Scientific, Inc.; Maravai LifeSciences; New England Biolabs; Creative Biogene; HONGENE |

Market Driver: Expanding Pipeline of mRNA-based Therapeutics

A primary driver of the mRNA synthesis raw materials market is the expanding pipeline of mRNA-based therapeutics targeting not just infectious diseases, but also cancers, rare genetic disorders, and autoimmune conditions. According to GlobalData, over 500 mRNA-related drug candidates are in various stages of preclinical and clinical development. Unlike traditional biologics, mRNA drugs do not require culturing cells or proteins, making them faster to design and easier to scale. This shift is increasing the demand for high-quality raw materials like nucleotide triphosphates (NTPs), IVT enzymes, and capping analogs essential for therapeutic-grade synthesis. Companies such as BioNTech, Moderna, and CureVac are at the forefront of this expansion, driving raw material innovation and volume requirements.

Market Restraint: Supply Chain Bottlenecks and Quality Control Challenges

A notable restraint is the persistent challenge of supply chain instability and quality control, especially for niche or highly specialized raw materials. The ultra-high purity and GMP-grade requirements for clinical and commercial production significantly narrow the pool of qualified suppliers. Additionally, enzymes such as RNase inhibitors and capping agents are sensitive to contamination and require complex storage logistics, which can be cost-intensive and risky during transport. The pandemic highlighted vulnerabilities in raw material access, as manufacturers struggled to meet sudden spikes in demand. While redundancy planning and vertical integration are improving resilience, delays and disruptions still pose challenges for smaller developers and CMOs reliant on third-party sourcing.

Market Opportunity: Rising Outsourcing to CROs and CMOs

An emerging opportunity lies in the increased outsourcing of mRNA production to Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). Smaller biotech firms, unable to maintain full in-house production capabilities, are turning to specialized CMOs that offer end-to-end solutions including raw material procurement, synthesis, and final product formulation. This trend is boosting demand for raw materials in bulk quantities and standardized formats. Companies like Aldevron (a Danaher company), which specializes in plasmid DNA and enzyme production, are expanding to serve this growing outsourcing segment. As more drug sponsors embrace the lean operational model, demand for raw material kits tailored for contract manufacturing settings is expected to soar.

By Type Insights

Nucleotides dominate the type segment, primarily due to their indispensable role in the in vitro transcription of mRNA. Each mRNA strand is composed of nucleotides adenine (A), guanine (G), cytosine (C), and uracil (U) which are polymerized using enzymatic processes. High-purity nucleotides, often GMP-grade, are crucial for minimizing immunogenicity and maximizing yield. Companies such as TriLink BioTechnologies and Thermo Fisher Scientific supply modified nucleotides (e.g., pseudouridine) that improve stability and translational efficiency in therapeutic applications, making them a preferred choice in mRNA-based drug development.

Enzymes are the fastest-growing segment, reflecting their expanding use across specialized applications including transcription, capping, degradation protection, and purification. Polymerases are used for synthesizing mRNA from DNA templates, while DNase and RNase inhibitors are necessary to protect nucleic acids during and after synthesis. The evolution of engineered enzymes with improved thermostability and reduced error rates is further fueling this segment’s expansion. As mRNA therapy expands into clinical and commercial settings, enzyme formulation and optimization will become increasingly critical to ensuring scalable production with high reproducibility.

By Application Insights

Vaccine production dominates the application segment, with mRNA-based vaccines for infectious diseases driving bulk demand. The COVID-19 pandemic triggered an unprecedented surge in production of nucleotides, enzymes, and plasmid DNA for vaccines. Even post-pandemic, mRNA vaccines are being developed for seasonal influenza, RSV, Zika, and even malaria. The ability to rapidly design and update mRNA vaccine sequences in response to emerging variants has made this technology a cornerstone of future public health strategies, thereby anchoring raw material demand within this application area.

Therapeutics production is the fastest-growing application, reflecting the broader shift toward personalized and gene-based therapies. Oncology is a major focus, where mRNA is used to encode tumor-associated antigens that stimulate immune responses. Beyond cancer, developers are exploring mRNA treatments for cystic fibrosis, muscular dystrophy, and heart failure. This diversification is compelling raw material suppliers to broaden their product portfolios with materials tailored for therapeutic rather than prophylactic applications, requiring more stringent purity and regulatory standards.

By End-use Insights

Biopharmaceutical & pharmaceutical companies dominate the end-use segment, as they spearhead most commercial and clinical development initiatives involving mRNA. These firms have substantial budgets for sourcing high-quality raw materials and invest in proprietary synthesis workflows to protect intellectual property. Companies like Moderna and BioNTech have even begun backward integration by securing exclusive contracts or acquiring suppliers of critical raw materials, ensuring consistency and regulatory compliance.

CROs & CMOs are the fastest-growing end-user segment, as demand from small and mid-sized biotech firms for outsourced synthesis grows. These organizations often purchase bulk enzymes, capping agents, and plasmids under OEM (original equipment manufacturer) agreements. This has led to the rise of scalable, modular raw material solutions designed specifically for plug-and-play use in contract settings. In parallel, academic and research institutions continue to play a foundational role in early-stage mRNA innovation, often acting as the incubators for future commercial applications.

By Regional Insights

North America is the dominant region in the mRNA synthesis raw materials market, largely due to the concentration of mRNA innovators, robust biotech infrastructure, and proactive government support. The United States houses major players like Moderna, Thermo Fisher, and Danaher, all of which maintain or partner with extensive raw material supply networks. Additionally, the U.S. Department of Health and Human Services and BARDA have allocated substantial funding to bolster domestic mRNA manufacturing capacity, including upstream raw material readiness. This has strengthened North America’s leadership in both innovation and production scale.

Asia-Pacific is the fastest-growing region, driven by rising investments in biopharma manufacturing, national genomics programs, and local mRNA production initiatives. China, South Korea, and India are actively expanding their capabilities in RNA-based vaccine and drug development. For instance, China-based CanSino and Walvax are developing mRNA vaccines domestically, stimulating demand for localized supply of raw materials. India’s vaccine giants like Bharat Biotech and Serum Institute are also exploring mRNA technologies, creating demand for enzymes and nucleotides. Regional governments are providing regulatory and financial incentives to establish biomanufacturing hubs, positioning Asia-Pacific as a growth engine for the market.

Recent Developments

-

Danaher Corporation (via Aldevron) – March 2025: Announced the launch of a new GMP-grade plasmid DNA product line designed for high-volume mRNA vaccine production, aimed at both U.S. and Asia-Pacific customers.

-

TriLink BioTechnologies – February 2025: Introduced a new class of modified nucleotides optimized for long-read mRNA sequences used in oncology therapeutics.

-

BioNTech – January 2025: Entered a multi-year agreement with a European enzyme manufacturer to secure supply of polymerases and RNase inhibitors for its expanding mRNA therapeutic pipeline.

-

Moderna – December 2024: Completed the acquisition of a U.S.-based enzyme supplier, integrating raw material production to de-risk its manufacturing strategy for pipeline therapies.

-

Thermo Fisher Scientific – November 2024: Opened a new facility in Singapore to produce and distribute enzymes and nucleotides for Asia-Pacific biomanufacturers.

mRNA Synthesis Raw Materials MarketTop Key Companies:

- F. Hoffmann-La Roche Ltd.

- Jena Bioscience GmbH

- Merck KGaA

- Yeasen Biotechnology (Shanghai) Co., Ltd.

- BOC Sciences

- Thermo Fisher Scientific, Inc.

- Maravai LifeSciences

- New England Biolabs

- Creative Biogene

- HONGENE.

mRNA Synthesis Raw Materials Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the MRNA Synthesis Raw Materials market.

By Type

- Capping Agents

- Nucleotides

- Plasmid DNA

- Enzymes

- Others

- DNase

- RNase Inhibitor

- Polymerase

- Others

By Application

- Vaccine Production

- Therapeutics Production

- Others

By End-use

- Biopharmaceutical & Pharmaceutical Companies

- CROs & CMOs

- Academic & Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)