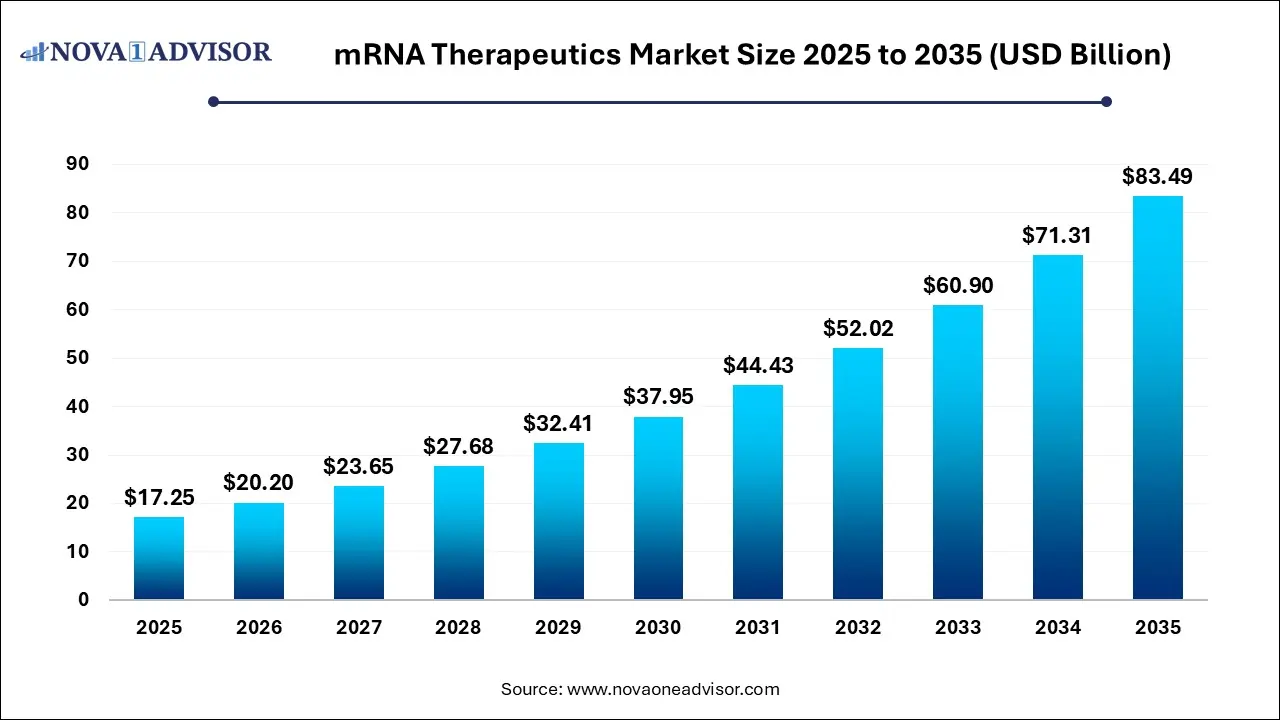

mRNA Therapeutics Market Size and Growth 2026 to 2035

The global mRNA therapeutics market size was valued at USD 17.25 billion in 2025 and is projected to surpass around USD 83.49 billion by 2035, registering a CAGR of 17.08% over the forecast period of 2026 to 2035.

Key Takeaways:

- The North America mRNA therapeutics market accounted for the largest revenue share of 40.75% share in 2025.

- The Asia Pacific mRNA therapeutics market is anticipated to witness the fastest growth from 2026 to 2035.

- The infectious disease segment held the largest market share of 100% in 2025.

- The oncology segment is expected to register the highest CAGR over the forecast period.

- The prophylactic segment completely dominated the market with a share of 100% in 2025.

- The therapeutics segment is expected to register the highest CAGR from 2026 to 2035.

- The hospitals & clinics segment dominated the market with a share of 47% in 2025 and is expected to register the fastest growth rate from 2026 to 2035.

- The other segment is expected to register a significant CAGR from 2026 to 2035.

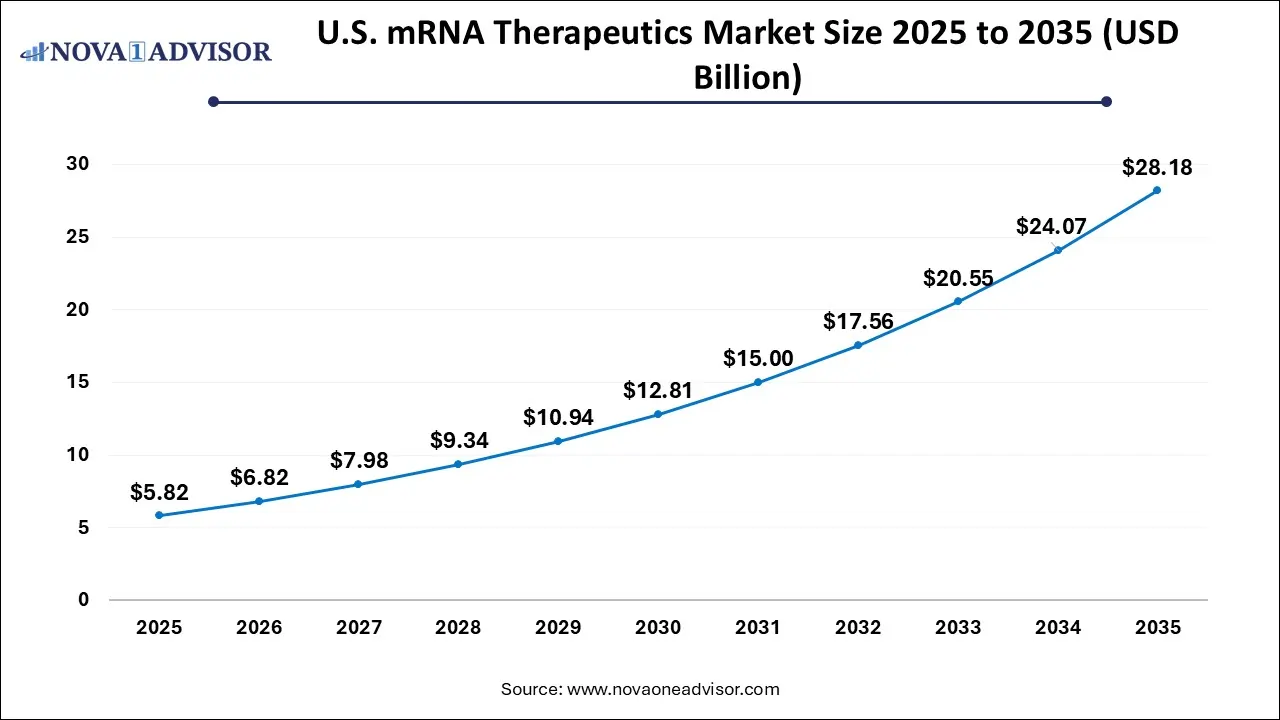

What is the Size of the U.S. mRNA Therapeutics Market?

The U.S. mRNA therapeutics market size is calculated at USD 5.82 billion in 2025 and is expected to reach nearly USD 28.18 billion in 2035, accelerating at a strong CAGR of 15.42% between 2026 and 2035.

North America dominated the global mRNA therapeutics market in 2025, attributed primarily to its advanced healthcare infrastructure, presence of key market players, and significant funding mechanisms. The U.S., home to pioneers like Moderna, Pfizer-BioNTech, and Arcturus Therapeutics, continues to lead in terms of clinical trials, FDA approvals, and innovation ecosystems. Public-private partnerships, like Operation Warp Speed, have demonstrated the ability to bring mRNA products from lab to market in record time. Furthermore, institutions like the NIH and BARDA are actively supporting research with substantial grants, reinforcing North America’s dominance.

Asia-Pacific is expected to be the fastest-growing region in the mRNA therapeutics market. Countries like China, Japan, South Korea, and India are ramping up investments in biotechnology, local manufacturing, and clinical research capabilities. China, in particular, is witnessing a boom in homegrown biotech firms exploring mRNA applications beyond infectious diseases, including oncology and cardiovascular conditions. The rising burden of chronic diseases, coupled with increasing healthcare access and population density, makes the region an attractive market for global players seeking to expand clinical trials and commercialization pipelines.

U.S. mRNA therapeutics market trends

The growing focus of medical companies to enhance research and development of advanced therapeutics for treating cancer and cardiovascular diseases has boosted the market expansion. Additionally, numerous government initiatives aimed at developing the cancer treatment sector is playing a vital role in shaping the industrial landscape.

China mRNA therapeutics market analysis

The rising demand for high-quality mRNA therapeutics to treat a wide range of genetic diseases coupled with technological advancements in the genetic engineering sector has driven the market growth. Also, rise in number of biotech startups along with surging focus of healthcare professionals to adopt RNA therapeutics for treating cancers is playing a prominent role in shaping the industry in a positive manner.

Why Europe is a significant contributor of the mRNA therapeutics market?

Europe is a significant contributor of the biobanks industry. The rising cases of lungs cancers in several nations such as Germany, UK, Italy, UK and some others has boosted the market growth. Additionally, numerous government initiatives aimed at developing the biotech sector coupled with technological advancements in the healthcare industry is playing a prominent role in shaping the industrial landscape. Moreover, the presence of several market players such as BioNTech, CureVac, Arcturus Therapeutics and some others is expected to accelerate the growth of the mRNA therapeutics market in this region.

Germany mRNA therapeutics market analysis

The growing emphasis of healthcare providers to adopt mRNA therapeutics for treating a wide range of infectious diseases has boosted the market expansion. Additionally, technological advancements in the healthcare sector coupled with rapid investment by government for developing the biopharma industry is playing a vital role in shaping the industrial landscape.

What is the role of Latin America in the mRNA therapeutics market?

Latin America has played a prominent role in the mRNA therapeutics market. The increasing prevalence of respiratory diseases in several countries including Argentina, Brazil, Peru, Venezuela and some others has boosted the market growth. Also, technological advancements in the genetic engineering sector coupled with rise in number of biotech startups is playing a vital role in shaping the industry in a positive manner. Additionally, the presence of numerous healthcare providers along with rising prevalence of chronic diseases is expected to propel the growth of the mRNA therapeutics market in this region.

Argentina mRNA therapeutics market trends

The growing demand for high-quality medicinal products for treating cancer along with rapid expansion of the mRNA therapeutics sector has boosted the market expansion. Moreover, rising investment by market players for constructing new therapeutics facilities is contributing to the industry in a positive manner.

Why Middle East and Africa held a notable share of the mRNA therapeutics market?

Middle East and Africa held a notable share of the industry. The rise in number of biopharma companies in numerous countries including UAE, Saudi Arabia, Qatar, Kenya, South Africa and some others has driven the market expansion. Also, rapid investment by biotech companies for opening up new research and development centers is playing a prominent role in shaping the industry in a positive direction. Moreover, the presence of various genetic engineering companies is expected to propel the growth of the mRNA therapeutics market in this region.

UAE mRNA therapeutics market analysis

The rising emphasis of biotechnology companies for developing advanced therapeutics to treat a wide range of infectious diseases has boosted the market expansion. Additionally, rapid investment by government for developing the genetic engineering sector is playing a vital role in shaping the industrial landscape.

Market Overview

The mRNA therapeutics market has emerged as one of the most transformative sectors within the broader field of biotechnology and precision medicine. With the ability to instruct cells to produce proteins that can prevent or treat diseases, messenger RNA (mRNA) offers a revolutionary therapeutic platform. Initially thrust into the global spotlight with the rapid development and deployment of COVID-19 vaccines by Moderna and Pfizer-BioNTech, mRNA therapeutics have proven their efficacy, safety, and scalability under unprecedented circumstances.

Beyond infectious diseases, mRNA technologies are making significant inroads in treating oncological, genetic, and autoimmune disorders, with companies racing to develop customized, personalized treatments. The flexibility, relatively fast development timelines, and potential for targeted protein expression make mRNA-based therapies particularly suited for addressing previously untreatable or complex diseases.

The market has also seen a significant surge in investments, with both public and private sectors recognizing its potential. Venture capital inflows, government funding, and strategic collaborations are paving the way for the expansion of clinical pipelines. As of 2025, the mRNA therapeutics market is characterized by a robust research landscape, increasing commercial viability, and diversification of applications across a spectrum of therapeutic areas.

mRNA therapeutics outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to rise significantly due to rising demand for high-quality RNA therapeutics for treating cancer patients coupled with numerous government initiatives aimed at developing the biopharma sector.

- Major Investors: Numerous market players are actively entering this market, drawn by partnerships, R&D and business expansions. Several mRNA therapeutics companies such as Argos Therapeutics Inc., Ethris, Pfizer Inc. and some others have started investing rapidly for developing advanced mRNA therapies for treating numerous diseases.

- Startup Ecosystem: Various startup brands are engaged in developing mRNA therapeutics across the globe. The prominent startup companies dealing in mRNA therapeutics comprises of Capstan Therapeutics, Korro Bio, Orna Therapeutics and some others.

Major Trends in the Market

-

Expansion Beyond Vaccines: mRNA platforms are increasingly being used to develop therapies for cancer, rare genetic diseases, and chronic conditions, moving beyond the initial success in infectious disease vaccines.

-

Advancements in Delivery Systems: Innovations in lipid nanoparticles (LNPs) and polymer-based carriers are enhancing mRNA stability and cellular uptake, improving therapeutic efficacy.

-

Strategic Collaborations and M&A: Companies are engaging in partnerships for technology sharing, co-development, and acquisition of mRNA-based IPs and biotech firms to expand portfolios.

-

Increased Focus on Rare Diseases: With regulatory incentives and lower competition, rare genetic diseases are becoming attractive targets for mRNA therapeutics.

-

Emergence of Personalized mRNA Therapeutics: Patient-specific mRNA therapies, especially in oncology, are being tailored using genomic profiling and machine learning tools.

-

Government and Regulatory Support: Regulatory frameworks are evolving to accelerate approvals and support innovation in mRNA-based drug development.

-

Manufacturing Infrastructure Investment: Post-pandemic lessons have driven investments into regional mRNA manufacturing hubs to ensure scalability and supply chain resilience.

mRNA Therapeutics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 20.2 Billion |

| Market Size by 2035 |

USD 83.49 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 17.06% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Application, Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Moderna Inc.; BioNTech SE; CureVac N.V.; Arcturus Therapeutics; Sanofi; GSK Plc.; Argos Therapeutics Inc.; Ethris; Pfizer Inc.; AstraZeneca |

Key Market Driver: Rising Prevalence of Chronic and Infectious Diseases

The growing global burden of chronic and infectious diseases is a major driver for the mRNA therapeutics market. For instance, according to the World Health Organization, over 10 million people died from cancer in 2022, and infectious diseases like tuberculosis and influenza continue to affect millions annually. mRNA technology offers a unique approach to rapidly develop vaccines and therapies for these diseases due to its plug-and-play nature. Unlike traditional biologics, mRNA therapeutics can be designed, synthesized, and produced within weeks, enabling faster responses to emerging health threats and personalized treatments. This technological edge is crucial for healthcare systems globally, making mRNA an indispensable therapeutic modality.

Key Market Restraint: Stability and Storage Challenges

One of the most significant restraints facing the mRNA therapeutics market is the inherent instability of mRNA molecules, which necessitate ultra-cold storage conditions. For instance, early COVID-19 vaccines required storage at -70°C, limiting their distribution in regions with inadequate cold chain infrastructure. Although advances have been made in developing more stable formulations, the logistical burden and cost implications remain high. Furthermore, degradation due to exposure to RNases or suboptimal handling conditions can reduce the efficacy of the final product. Overcoming these challenges is essential for widespread adoption, especially in low- and middle-income countries where infrastructure remains underdeveloped.

Key Market Opportunity: Expansion into Oncology Therapeutics

While mRNA-based vaccines have shown great promise in infectious disease prevention, a compelling opportunity lies in their application for cancer treatment. Personalized cancer vaccines using mRNA can instruct the immune system to recognize tumor-specific antigens, triggering targeted immune responses. Companies like BioNTech and Moderna are conducting clinical trials for mRNA-based cancer vaccines targeting melanoma and pancreatic cancer. The potential to individualize cancer treatment and the relative speed with which mRNA therapies can be developed positions this as a highly lucrative opportunity. As biomarker research advances, so will the potential to create tailored mRNA therapies across diverse oncology subtypes.

mRNA Therapeutics Market By Application Insights

Oncology dominated the mRNA therapeutics market by application in 2024, owing to rapid innovation in personalized cancer vaccine development. The flexibility of mRNA platforms allows for patient-specific tumor antigen targeting, leading to higher efficacy in immune activation. Several mRNA cancer vaccines are currently in Phase II and III trials, demonstrating promise in treating melanoma, lung, and prostate cancers. Companies like BioNTech and Moderna are pioneering neoantigen-specific vaccines, leveraging next-generation sequencing (NGS) and AI to identify immunogenic targets. The rise in cancer prevalence and unmet need for effective treatments further amplifies demand for mRNA-based oncology solutions.

Rare genetic diseases are anticipated to be the fastest-growing application segment during the forecast period. This is attributed to the potential of mRNA therapeutics to replace defective genes and restore normal protein expression. For example, mRNA therapies aimed at treating cystic fibrosis, phenylketonuria, and methylmalonic acidemia are in various stages of development. These conditions, often caused by single-gene mutations, are well-suited for mRNA-based interventions. Additionally, regulatory incentives such as orphan drug status and fast-track designations enhance the commercial viability and speed-to-market for such therapies, making rare diseases a hotbed for innovation.

mRNA Therapeutics Market By End-use Insights

Hospitals and clinics remain the dominant end-use segment due to their role in vaccine administration and treatment delivery. The mass rollout of mRNA-based COVID-19 vaccines globally was largely executed through hospital networks and immunization centers. Hospitals also serve as central hubs for clinical trials, diagnostics, and treatment of patients receiving novel therapies, thereby capturing a significant portion of market share.

Research organizations are projected to be the fastest-growing segment. This growth is driven by increased funding from government agencies and private investors focused on early-stage R&D. Academic institutions, biotech startups, and contract research organizations (CROs) are spearheading the next wave of mRNA applications, from exploring mRNA in regenerative medicine to preclinical oncology models. The expanding role of synthetic biology and computational biology in research settings is accelerating the pace of innovation and pushing this segment forward.

mRNA Therapeutics Market By Type Insights

Prophylactic mRNA therapeutics accounted for the largest revenue share, thanks to the monumental success of COVID-19 vaccines. These vaccines demonstrated not only high efficacy rates but also the rapid scalability and adaptability of mRNA platforms. Continued efforts in developing prophylactic vaccines for respiratory syncytial virus (RSV), Zika virus, and influenza are reinforcing this segment's dominance. Governments and NGOs are also investing heavily in pandemic preparedness initiatives using mRNA-based vaccine platforms, which ensures steady demand in this category.

Therapeutic mRNA therapies are expected to grow at the highest CAGR during the forecast period. Therapeutic applications extend mRNA’s utility beyond prevention to actual disease treatment, such as protein replacement, cancer immunotherapy, and enzyme restoration. Recent clinical-stage candidates are focusing on cardiovascular disorders, immunological diseases, and metabolic syndromes. The therapeutic type's growth is further supported by improved delivery systems and promising preclinical data, drawing increasing investor interest and R&D funding.

mRNA Therapeutics Market Recent Developments

- In September 2025, Quotient Sciences partnered with CPI. This partnership is done for accelerating RNA-based drug development.

- In August 2025, Raina Biosciences launched an AI-based platform. This AI-enabled platform is designed for enhancing the production of mRNA therapeutics.

- In May 2025, GenScript launched GMP-like mRNA manufacturing service. This service is designed for supporting preclinical studies and IND-enabling research.

Key mRNA Therapeutics Company Insights

The market players operating in the mRNA therapeutics market are adopting product approval strategies to increase the reach of their products and improve their availability in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

mRNA Therapeutics Market Top Key Companies:

The following are the leading companies in the mRNA therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

mRNA Therapeutics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the mRNA Therapeutics market.

By Application

- Infectious Diseases

- Oncology

- Rare Genetic Diseases

- Respiratory Diseases

- Others

By Type

By End-use

- Hospitals & Clinics

- Research Organizations

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)