Multi Cancer Early Detection Market Size and Research

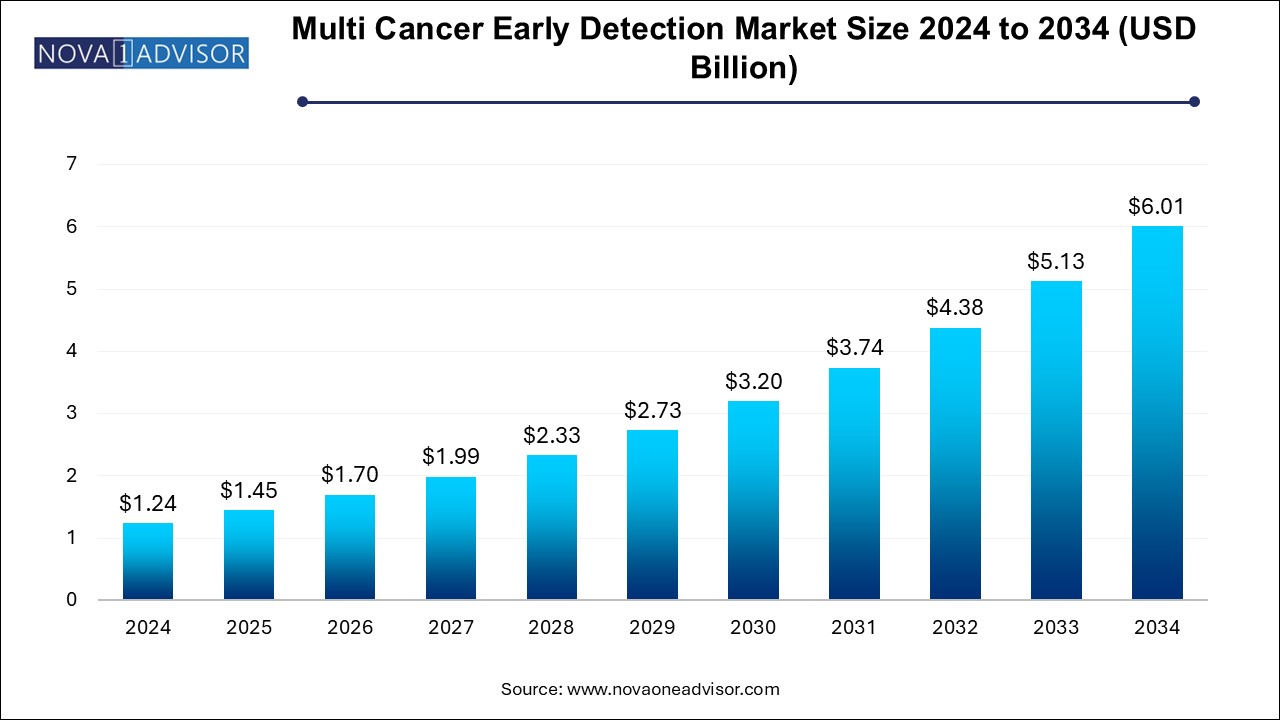

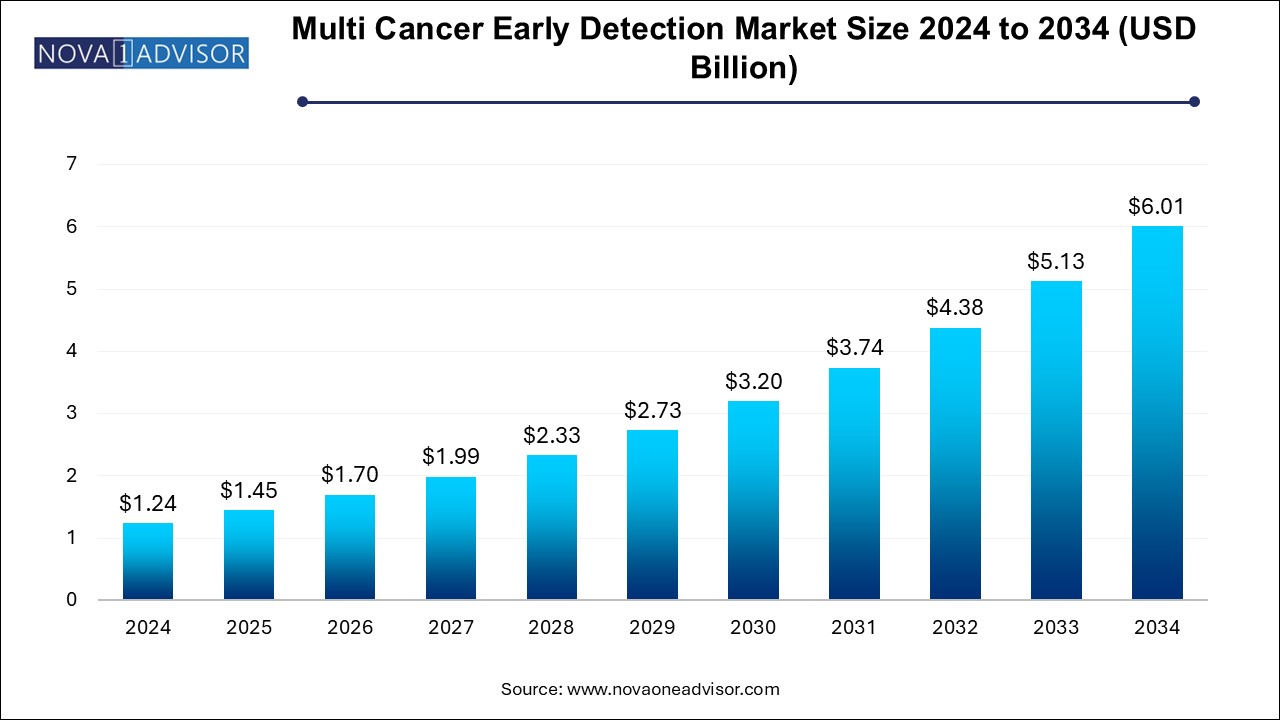

The multi cancer early detection market size was exhibited at USD 1.24 billion in 2024 and is projected to hit around USD 6.01 billion by 2034, growing at a CAGR of 17.1% during the forecast period 2024 to 2034. The growth of the multi cancer early detection market can be linked to the rising prevalence of multitude of cancers across the globe, need for effective and rapid diagnostic procedures, and increased research activities for the development of innovative products and platforms for early cancer detection.

Multi Cancer Early Detection Market Key Takeaways:

- Gene Panel, LDT, & others led the MCED market, accounting for 91.28% of the global revenue in 2024.

- Liquid biopsy is anticipated to grow fastest over the forecast period.

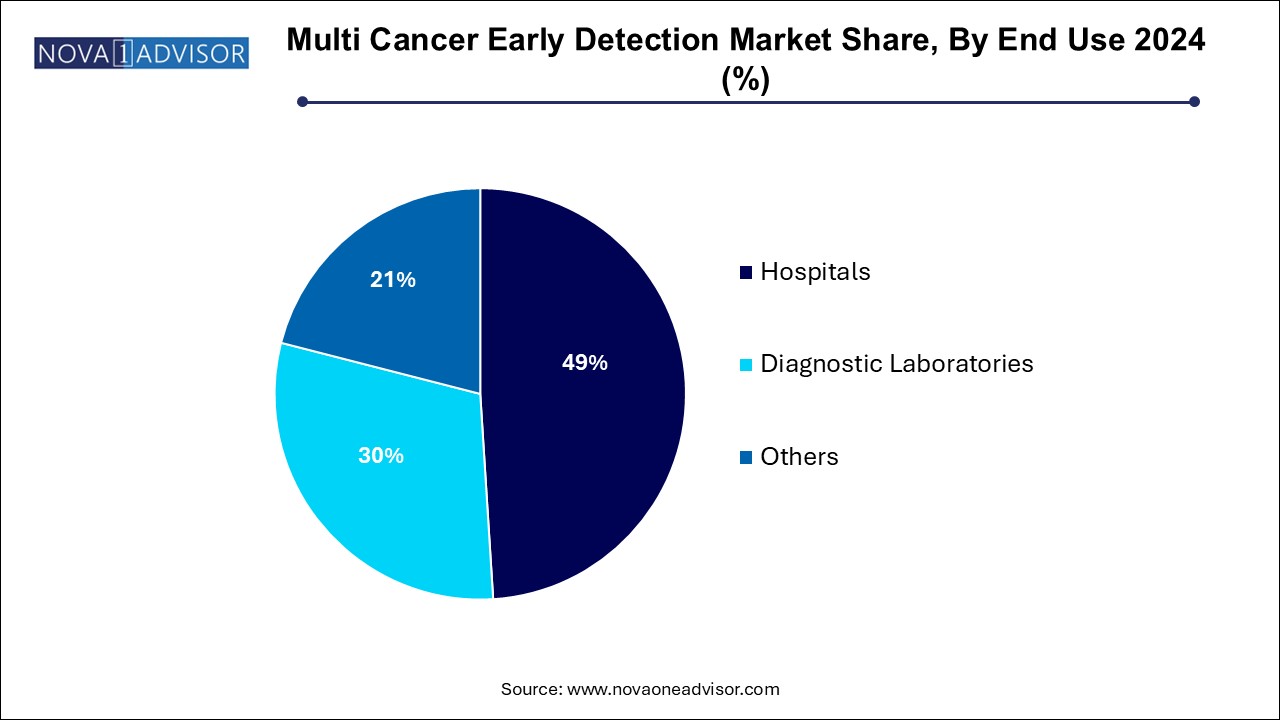

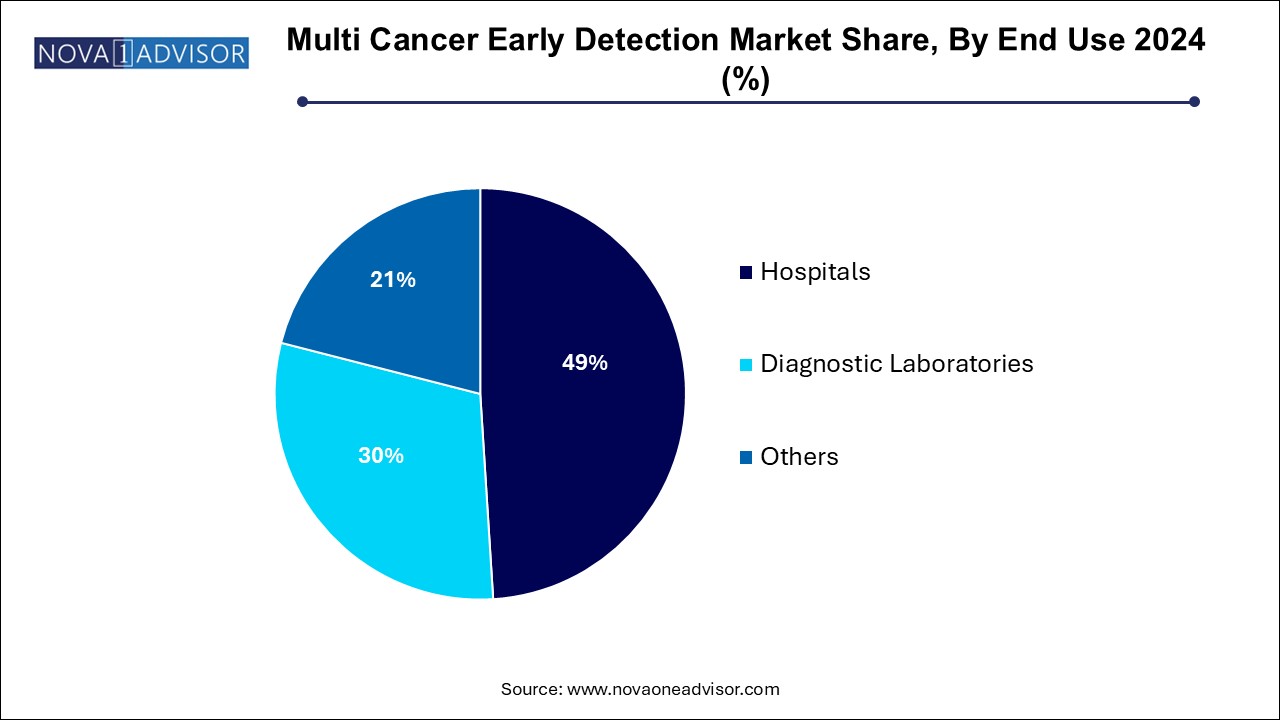

- Hospitals led the MCED market with a share of 49.0% in 2024.

- Europe multi cancer early detection market dominated and accounted for a 36.05% share in 2024.

Market Overview

The Multi Cancer Early Detection (MCED) market represents a revolutionary advancement in oncology diagnostics, shifting the paradigm from reactive treatment to proactive prevention. MCED tests are designed to detect multiple cancer types from a single biological sample often a blood draw enabling earlier diagnosis and improving the probability of successful treatment. This approach stands in contrast to traditional cancer screening methods, which are typically organ-specific and less comprehensive.

The growing global burden of cancer with over 20 million new cases and nearly 10 million deaths in 2022 according to the World Health Organization (WHO) underscores the need for innovative diagnostic tools that can intercept malignancies before clinical symptoms emerge. MCED tests are at the forefront of this transformation, leveraging advances in liquid biopsy, genomics, machine learning, and bioinformatics to screen for dozens of cancers simultaneously, often at the early stages when interventions are more effective and survival rates higher.

Major market players, including biotechnology startups and established diagnostics firms, are racing to develop MCED platforms that combine next-generation sequencing (NGS), methylation profiling, and AI algorithms to achieve high sensitivity and specificity. Leading examples such as GRAIL’s Galleri test, Exact Sciences' pipeline products, and Guardant Health’s liquid biopsy platforms are already reshaping oncology workflows and clinical trial designs.

Although MCED is still an emerging segment with regulatory and infrastructural challenges, the commercial potential is immense. It promises to reduce healthcare costs, improve outcomes, and support population-scale cancer screening initiatives. As governments, payers, and health systems increasingly shift toward value-based care, MCED is poised to become an integral component of personalized, preventive medicine.

Where is AI Finding Applications in Multi Cancer Early Detection Market?

Integration of artificial intelligence in multi cancer early detection is enhancing detection of different cancers at early stages for timely interventions. AI algorithms can enhance medical imaging processes by deploying deep learning models such as Convolutional Neural Networks (CNNs) for analyzing CT scans mammograms, PET scans and MRIs for identifying subtle anomalies and patterns indicating early stage of cancers. AI-powered tools can be utilized for analysis of digitized pathology slides enabling the detection of cancerous cells. Furthermore, AI can enhance the efficiency and workflows for liquid biopsy analysis and risk assessment of individuals by examining electronic health records (EHRs) for predicting cancer development. GRAIL’s Galleri test, PathAI, iCAD and Freenome are some of the AI-powered tools and companies in the market facilitating the multi cancer early detection.

Major Trends in the Market

-

Expansion of liquid biopsy technologies as the foundational tool for non-invasive multi-cancer detection.

-

Increasing investments and partnerships between diagnostic firms, pharma companies, and AI startups to accelerate MCED development.

-

Emergence of blood-based DNA methylation profiling as a core biomarker strategy in MCED tests.

-

Regulatory initiatives to support MCED integration into national screening programs (e.g., FDA Breakthrough Device designations).

-

Adoption of AI algorithms and machine learning to enhance signal detection, cancer type prediction, and test interpretation.

-

Shift toward decentralized testing models to enable MCED deployment in primary care and rural settings.

-

Growing focus on health equity and access, with MCED tests seen as a tool to reduce cancer disparities.

-

Development of longitudinal databases and biobanks to improve MCED training datasets and test accuracy.

-

Expansion of LDT-based offerings through CLIA-certified labs as an entry point before full regulatory approval.

Report Scope of Multi Cancer Early Detection Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1.45 Billion |

| Market Size by 2034 |

USD 6.01 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 17.1% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Illumina, Inc.; GRAIL, Inc.; Exact Sciences Corporation; FOUNDATION MEDICINE, INC.; AnchorDx; Guardant Health; Burning Rock Biotech Limited; GENECAST; Beijing Lyman Juntai International Medical Technology Development Co.; Freenome Holdings, Inc; Elypta AB |

Market Driver: Rising Cancer Incidence and Limitations of Traditional Screening

A powerful driver of the MCED market is the rising global cancer incidence coupled with the limitations of traditional, single-cancer screening methods. Despite widespread screening for cancers such as breast, colorectal, and cervical, the majority of cancer-related deaths occur from cancers without approved early detection protocols—such as pancreatic, ovarian, liver, and esophageal cancers.

Early detection is critical; survival rates drop dramatically once cancer spreads beyond its origin. However, current screening paradigms are fragmented, expensive, and often underutilized. For instance, adherence to recommended screenings in the U.S. for colon or lung cancer remains below optimal levels due to accessibility, invasiveness, or lack of awareness.

MCED technologies aim to address this gap by providing a comprehensive, less invasive, and scalable solution that can be integrated into routine health checkups. By detecting multiple cancers from a single test and pinpointing their tissue of origin, MCED holds the potential to fundamentally reduce cancer mortality through earlier and broader intervention.

Market Restraint: Regulatory Uncertainty and Validation Requirements

Despite the promise of MCED, a significant restraint is the regulatory ambiguity and rigorous validation requirements for these novel tests. As MCED involves detecting multiple diseases from a single assay, often using proprietary algorithms and statistical models, ensuring analytical validity, clinical utility, and safety is complex.

Unlike traditional diagnostics with clear-cut endpoints, MCED tests must demonstrate high specificity to avoid false positives, which could lead to unnecessary anxiety, further invasive procedures, and healthcare expenditures. Simultaneously, they must maintain high sensitivity to detect early-stage cancers.

Regulatory agencies such as the U.S. FDA are still defining frameworks for evaluating such multi-indication tools. Additionally, the lack of long-term outcome data and clinical guidelines poses hurdles for widespread adoption. Without standardized validation pathways and payer reimbursement models, market penetration could be delayed despite technological readiness.

Market Opportunity: Integration into Population Health and Preventive Care Models

One of the most significant opportunities lies in integrating MCED tests into national and population-wide cancer screening programs. As healthcare systems globally shift toward preventive and value-based models, MCED can serve as a high-impact tool for early risk stratification, routine wellness screening, and annual checkups.

Health systems, employers, and insurers are increasingly looking to invest in tools that lower long-term treatment costs and improve patient outcomes. MCED can be positioned as a cost-effective preventive strategy by reducing the need for multiple tests and enabling early interventions that mitigate expensive late-stage cancer treatments.

The rise of telehealth, home testing kits, and digital care coordination platforms also opens avenues for decentralized MCED deployment. By incorporating MCED into health apps, remote diagnostics programs, or wearable-integrated care models, the market could significantly expand its addressable population beyond traditional hospital settings.

Multi Cancer Early Detection Market By Type Insights

Liquid biopsy dominates the MCED market, accounting for the largest revenue share due to its non-invasive nature, scalability, and compatibility with high-throughput genomic technologies. By analyzing circulating tumor DNA (ctDNA), methylation patterns, and other biomarkers in blood plasma, liquid biopsy enables early cancer detection with minimal patient burden. The rapid advancement of NGS platforms and AI-based analysis tools has further strengthened the reliability and resolution of liquid biopsy techniques.

Liquid biopsy-based MCED solutions are especially attractive in primary care and wellness screening programs where invasive tissue biopsies are impractical. Leading tests like Galleri by GRAIL are built entirely on liquid biopsy platforms, offering detection of over 50 cancer types from a single blood draw.

Gene panels, laboratory-developed tests (LDTs), and other molecular diagnostics are the fastest growing segment, particularly in specialized diagnostic centers and academic institutions. Many companies are developing multi-analyte panels that combine DNA, RNA, protein, and epigenomic markers to improve detection specificity. LDTs, often commercialized through CLIA-certified labs, offer a regulatory shortcut for early market entry and real-world evidence generation. This segment is expected to grow significantly as new biomarker discoveries emerge and multiplexing technologies become more affordable.

Multi Cancer Early Detection Market By End Use Insights

Hospitals led the MCED market with a share of 49.0% in 2024. largely due to their role in complex cancer care pathways and their access to broad patient populations. Large academic and specialty hospitals are often early adopters of new diagnostics and have the infrastructure to integrate MCED into comprehensive cancer screening programs. Hospitals are also preferred venues for conducting clinical trials and collecting high-quality data on patient outcomes.

Diagnostic laboratories is projected to grow significantly over the forecast period. These labs are instrumental in scaling up MCED test volumes, especially through remote physician referrals and mail-in kits. With the proliferation of digital health tools, more patients can access advanced cancer screening services from diagnostic labs without visiting a hospital. Companies such as Exact Sciences and Guardant Health are leveraging this model to expand their customer base and data repositories rapidly.

Multi Cancer Early Detection Market By Regional Insights

North America currently leads the MCED market, owing to a robust ecosystem of biotechnology innovation, strong venture capital investment, early regulatory engagement, and a high prevalence of cancer screening programs. The U.S., in particular, is home to major players like GRAIL, Exact Sciences, Guardant Health, and Freenome, all of whom are advancing MCED technologies at various stages of clinical validation and commercialization.

Additionally, the region benefits from the presence of academic medical centers, clinical research networks, and payers willing to explore coverage for preventive diagnostics. The U.S. FDA’s Breakthrough Device designations for several MCED platforms also facilitate accelerated review and broader clinical trial integration. Moreover, public awareness and willingness to adopt precision medicine tools are relatively higher in North America, fueling market leadership.

Asia Pacific is emerging as the fastest growing region, driven by rising cancer prevalence, healthcare digitization, and expanding genomic medicine initiatives. Countries such as China, India, Japan, and South Korea are witnessing increasing demand for early cancer detection technologies due to rapidly aging populations and growing healthcare infrastructure.

Governments and private companies in the region are investing heavily in genomic sequencing facilities, AI-driven diagnostics, and cross-border collaborations with Western biotech firms. In China, for example, companies like Genetron Health and Burning Rock Dx are developing MCED solutions tailored to local populations and cancer profiles. Favorable regulatory reforms, growing insurance coverage, and the rise of national cancer registries further support regional market growth.

Key Trends in Japan’s Multi Cancer Early Detection Market

Japan is anticipated to show the fastest growth in the Asia Pacific market. The market growth can be linked to the rising incidences of cancer, rapidly aging population, increased public awareness and growing demand for personalized treatment strategies. Additionally, growing number of diagnostic centers with sophisticated technologies, emergence of new market players, rising disposable incomes are significantly contributing to the expansion of the market. Development of direct-to-consumer (DTC) MCED tests is an option expected to create market growth opportunities in the upcoming years.

The Japanese government is actively participating in the multi cancer early detection market through various initiatives and approaches such as national guidelines provided by the The Ministry of Health, Labor and Welfare (MHLW) for population-based cancer screenings, comprehensive health checkups (Ningen Dock), increased emphasis on early detection and development of advanced medical institutions.

Some of the prominent players in the multi cancer early detection market include:

- Illumina, Inc.

- GRAIL, Inc.

- Exact Sciences Corporation

- FOUNDATION MEDICINE, INC.

- AnchorDx

- Guardant Health

- Burning Rock Biotech Limited

- GENECAST

- Beijing Lyman Juntai International Medical Technology Development Co.

- Freenome Holdings, Inc

- Elypta AB

Multi Cancer Early Detection Market Recent Developments

- In May 2025, GRAIL, Inc., a healthcare company focused on early cancer detection, formed a new collaboration with athenahealth, a premium provider of network-enabled software and services for healthcare providers and systems countrywide. The partnership aims at integrating GRAIL’s Galleri multi-cancer early detection (MCED) test with Athena Coordinator Core which is a service created for streamlining laboratory order transmission and care coordination of healthcare facilities. The integration will be backed by athenahealth's leading cloud-based electronic health record (EHR) solution, Athena One.

- In January 2025, Clear Note Health, a company fixated on enhancing early detection of some of the deadliest cancers, declared that its Advantest Multi-Cancer Detection Test was chosen by the National Cancer Institute, a part of the National Institutes of Health (NIH) for the Vanguard Study. The critical study aims at evaluating clinical feasibility of utilizing targeted multi-cancer detection tests in randomized controlled trials (RCTs).

- In December 2024, Function Health, a transformative health management platform, entered into a partnership with GRAIL, Inc., which is a healthcare company fixated on detecting cancer early when it can be cured. The collaboration will provide access to GRAIL's Galleri multi-cancer early detection (MCED) test for Function Health’s 100,000+ eligible members nationwide. The test is a first-of-a-kind, clinically validated MCED test screening multiple cancers through a simple blood draw.

- In December 2024, the bioinformatics and genomics subsidiary of Reliance Industries Limited, Strand Life Sciences, launched a pioneering blood-based test, CancerSpot which is designed for early detection of multiple cancers. The test offers a simple and non-invasive way for cancer screening by leveraging advanced methylation profiling technology for identification of tumor DNA fragments present in the blood.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the multi cancer early detection market

Type

- Liquid Biopsy

- Gene Panel, LDT & Others

End Use

- Hospitals

- Diagnostic Laboratories

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)