Multiple Sclerosis Therapeutic Market Size and Growth Report 2026 to 2035

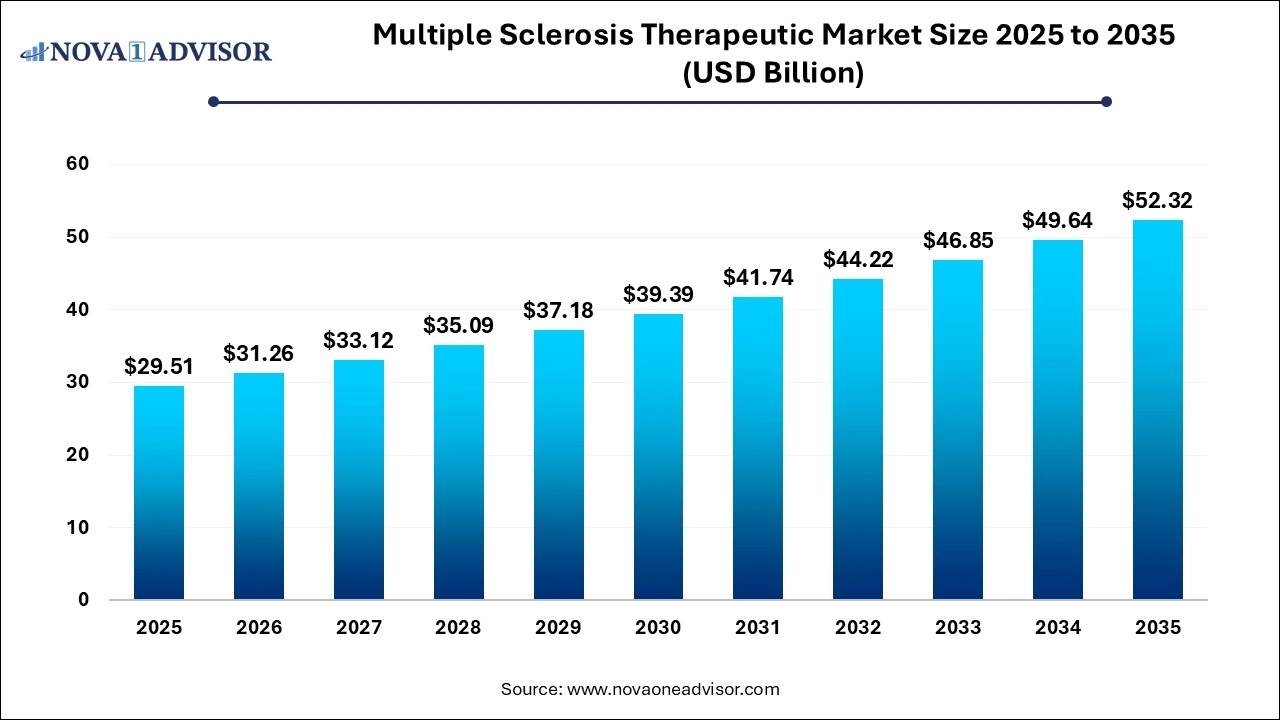

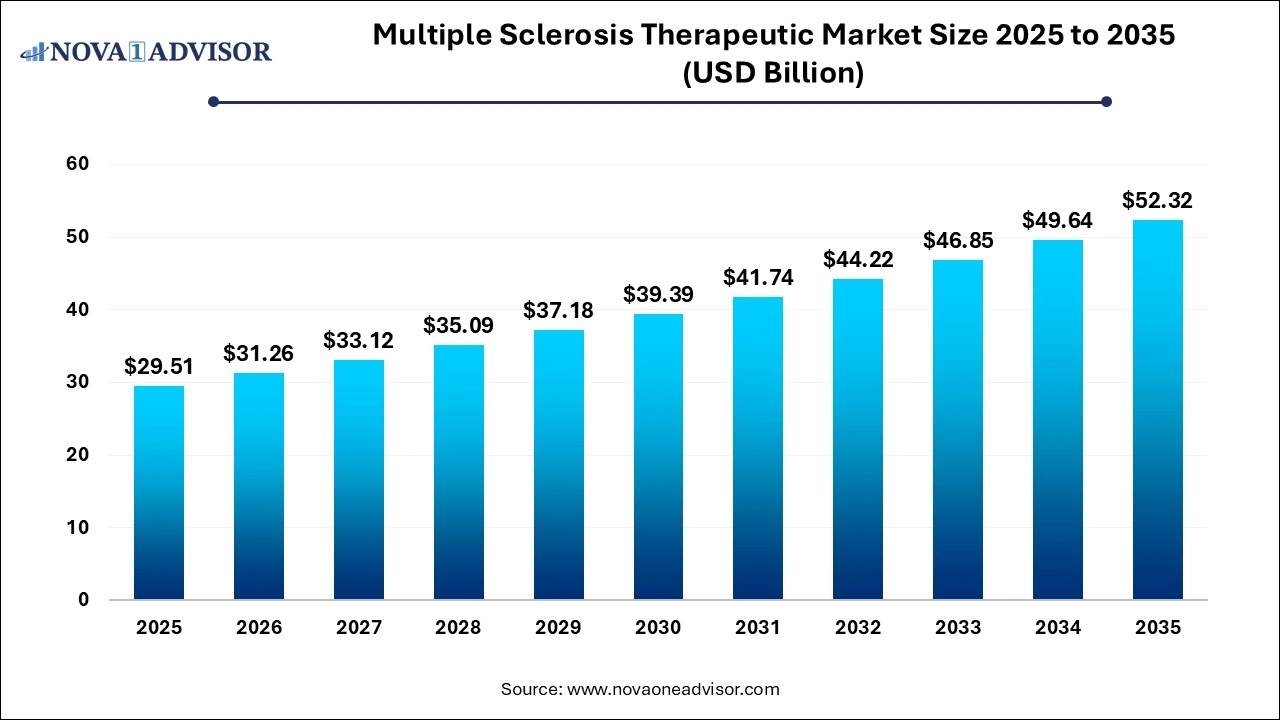

The global multiple sclerosis therapeutic market size was valued at USD 29.51 billion in 2025 and is anticipated to reach around USD 52.32 billion by 2035, growing at a CAGR of 5.89% from 2026 to 2035. The market is expanding due to the rising global prevalence of multiple sclerosis, increasing demand for effective treatments, and advancements in disease-modifying therapies that offer improved patient outcomes and convenience.

Multiple Sclerosis Therapeutic Market Key Takeaways

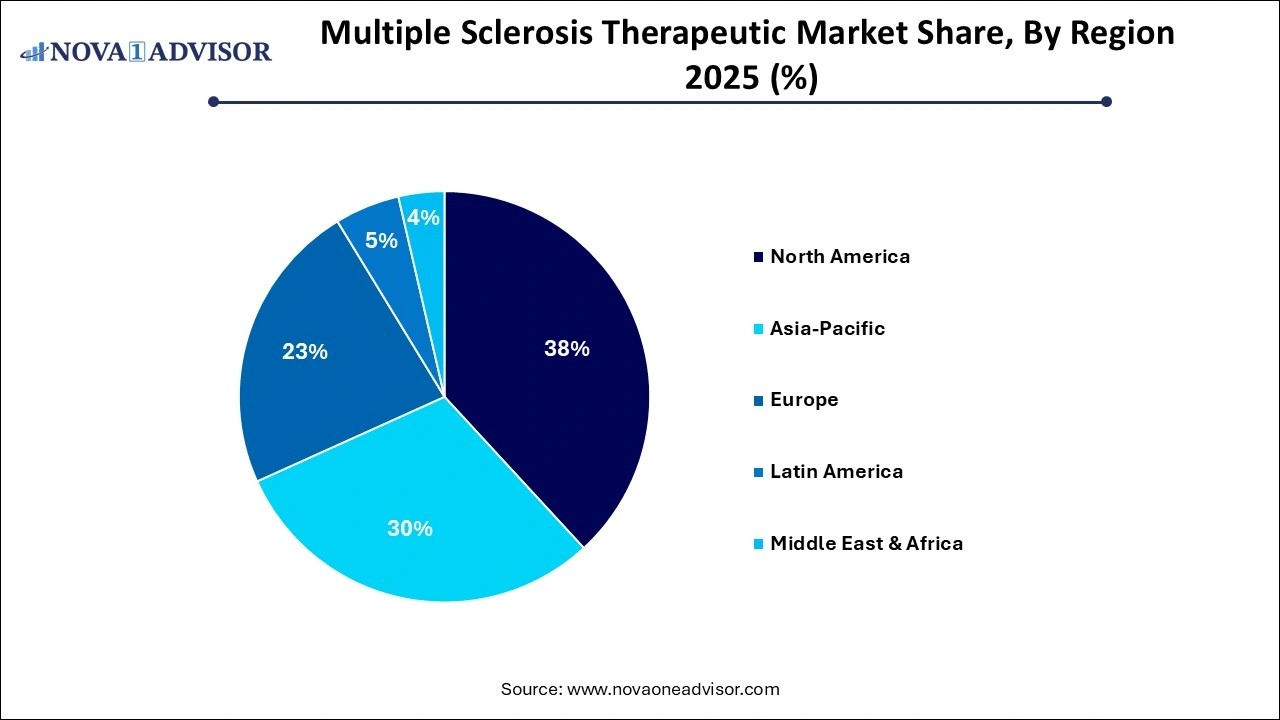

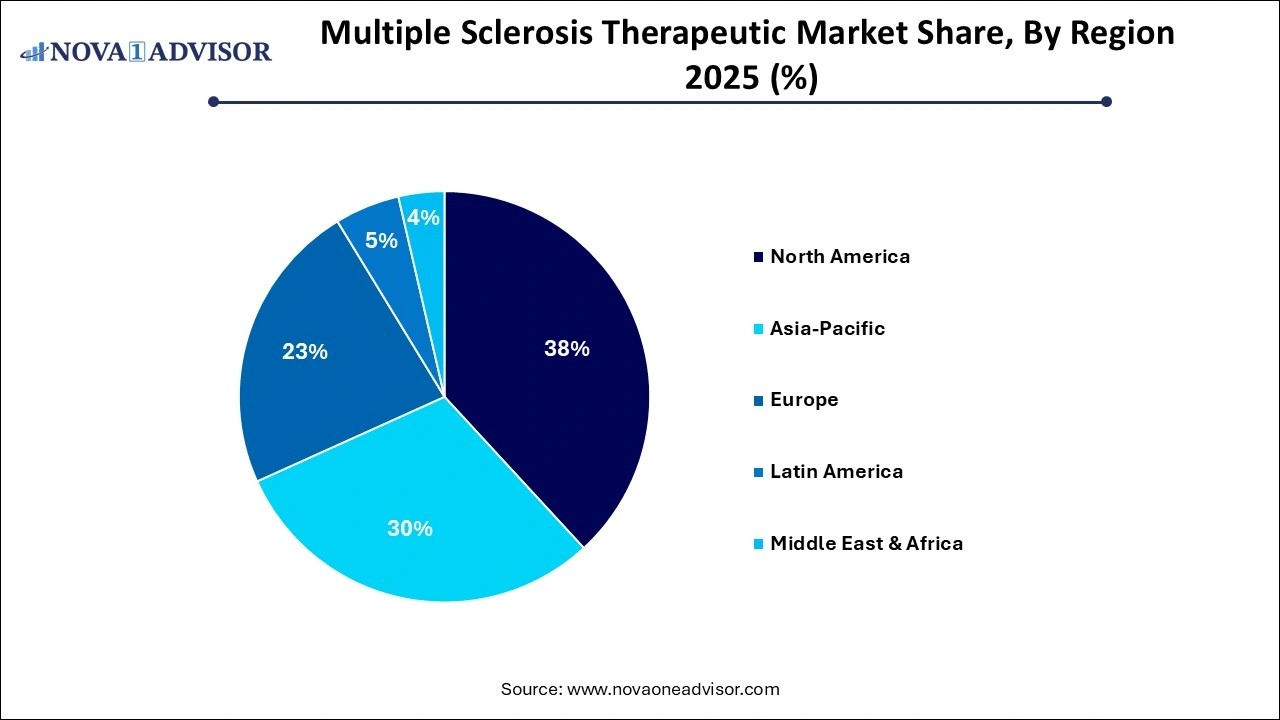

- North America dominated the multiple sclerosis therapies market in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By drug class, the immunosuppressants segment held the major market revenue share in 2025.

- By drug class, the immunostimulants segment is expected to grow at the fastest CAGR in the market during the studied years.

- By route of administration, the injectable segment held the largest market share.

- By route of administration, the oral segment is expected to grow at the fastest CAGR in the market during the studied years.

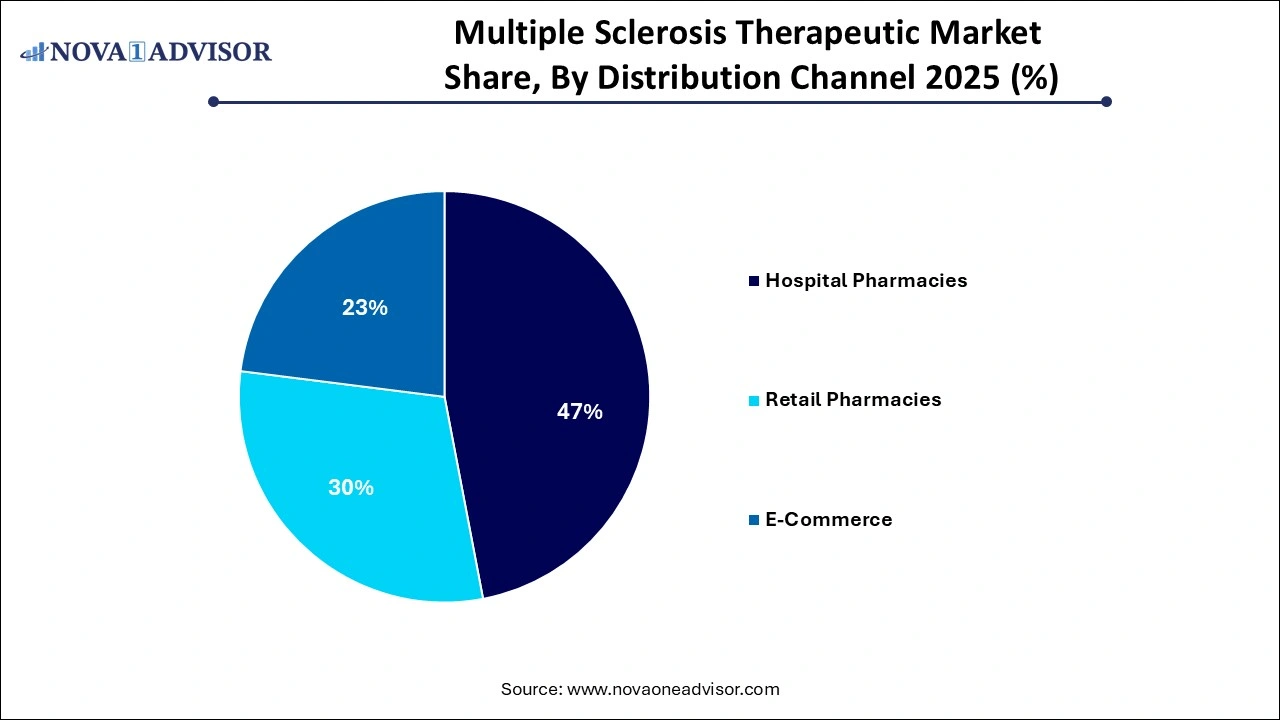

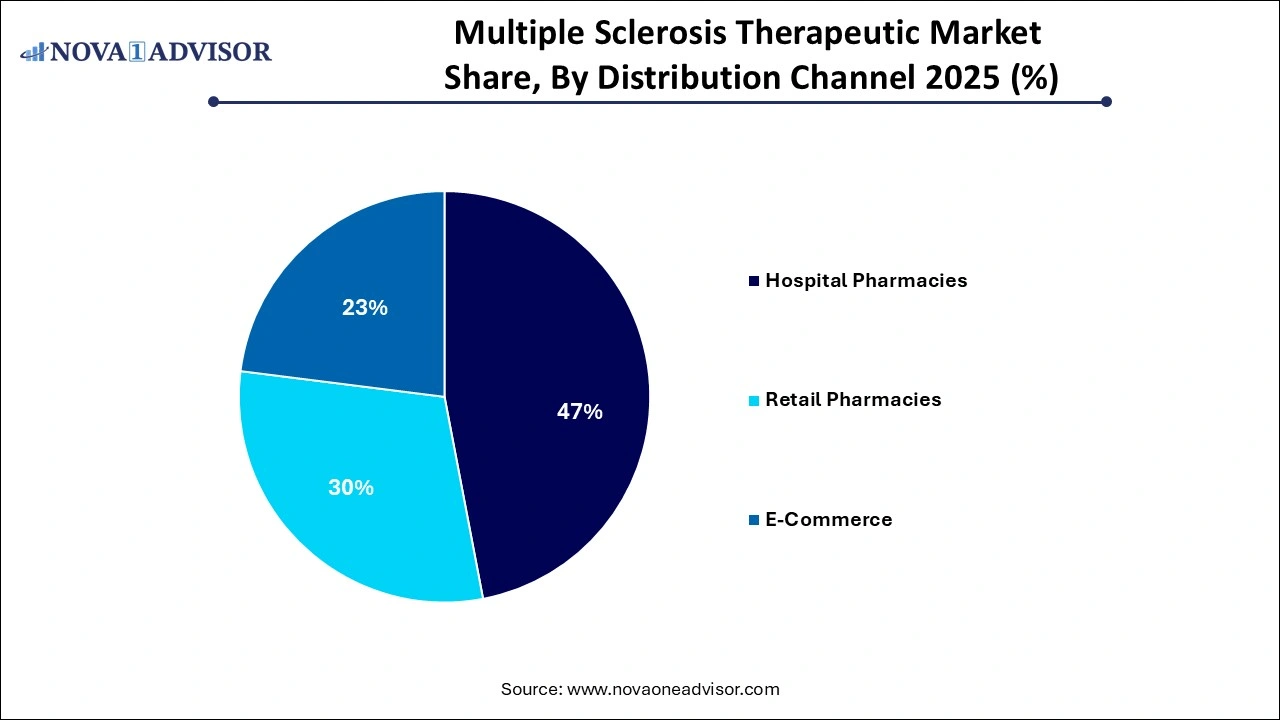

- By distribution, the hospital pharmacies segment led the market in 2025.

- By distribution, the E-commerce segment is expected to grow at the fastest CAGR in the market during the studied years.

How Innovation is Impacting the Multiple Sclerosis Therapies Market?

Multiple sclerosis therapies refer to a range of medical treatments aimed at managing the symptoms, slowing the progression, and modifying the course of multiple sclerosis progression, and modifying the course of multiple sclerosis, a chronic autoimmune disease that affects the central nervous system. These therapies include disease-modifying therapies, symptomatic treatments, rehabilitative interventions, and lifestyle modifications, and they work by reducing inflammation, preventing relapses, delaying disability, and improving patients' quality of life. Innovation is driving growth in the multiple sclerosis therapies market through advanced disease-modifying drugs, personalized treatment approaches, and neuroprotective research. Digital tools enhance monitoring and care, while gene and cell therapies show future promise. These developments are improving patient outcomes, expanding therapeutic options, and reshaping the treatment landscape for more effective and targeted multiple sclerosis management.

- For Instance, In October 2023, Tiziana Life Sciences gained FDA approval for foralumab, an intranasal anti-CD3 monoclonal antibody developed for self-administration by multiple sclerosis patients. This fully human drug represents a convenient treatment option. Such regulatory approvals, along with growing initiatives by pharma companies to create innovative therapies, are contributing to the expansion of the multiple sclerosis pipeline drugs market.

What are the Key Trends in the Multiple Sclerosis Therapies Market in 2025?

-

In June 2025, CivicaScript, LLC, declared the availability of dimethyl fumarate delayed-relapse capsules which is a low-cost medication indicated for treating relapsing forms of multiple sclerosis (MS) in adults.

-

In March 2025, Clario, a leader in providing endpoint data solutions for the clinical trials industry, acquired NeuroRx, a leading imaging analysis company with expertise in multiple sclerosis.

- In February 2024, Neuraxpharm Group introduced BRIUMVI in the European market for the treatment of adults diagnosed with relapsing multiple sclerosis.

- In August 2023, the U.S. FDA approved Tyruko, the first biosimilar to Tysabri injection, for adults with relapsing forms of multiple sclerosis. It is authorized to treat relapsing-remitting MS, active secondary progressive MS, and clinically isolated syndrome, offering a new treatment alternative in the MS therapeutic landscape.

What is the Impact of AI in the Multiple Sclerosis Therapies Market?

Artificial intelligence (AI) is significantly enhancing the multiple sclerosis therapies market by improving early diagnosis, predicting disease progression, and personalizing treatment strategies. AI-driven tools analyze vast datasets, including MRI scans and patient records, to identify patterns and optimize therapeutic decisions. Additionally, AI supports drug discovery and clinical trial design, accelerating the development of new treatments. These advancements lead to better disease management, increased treatment efficiency, and overall improvements in patient outcomes and healthcare delivery.

- For instance, in January 2025, Century Health, a pioneer in integrating AI with real-world data for accelerating research, formed an alliance with Nira Medical. The partnership focuses on curating EHR data from more than 3,000 multiple sclerosis patients to create structured databases with Century Health’s AI platform, further unlocking valuable clinical data to enhance the understanding of the disease and treatment outcomes.

Multiple Sclerosis Therapeutic Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 31.26 Billion |

| Market Size by 2035 |

USD 52.32 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.89% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Drug class, By Route of Administration, By Distribution Channel |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Teva Pharmaceutical Industries Ltd., Pfizer Inc., Biogen, Bayer AG, Sanofi, F. Hoffmann-La Roche Ltd, Johnson & Johnson Services, Inc., Merck & Co., Inc., Takeda Pharmaceutical Company Limited., Horizon Therapeutics plc |

Multiple Sclerosis Therapeutic Market Dynamics

Driver

Rising Prevalence of Multiple Sclerosis Worldwide

The growing number of multiple sclerosis cases globally is propelling the demand for improved and accessible treatment solutions. As the patient pool expands, healthcare systems,s and pharmaceutical firms are under pressure to provide more effective and diverse therapeutic options. This surge in cases not only highlights the need for better disease management but also stimulates innovation, funding, and commercial interest, making it a key factor driving growth in the multiple sclerosis therapies market.

For Instance, As of 2024, the global prevalence of multiple sclerosis (MS) continues to rise, with approximately 2.9 million individuals affected worldwide. This increase underscores the growing demand for effective MS therapies, prompting pharmaceutical companies to invest in innovative treatments to address the expanding patient population.

Restraint

High-Cost Treatment

The elevated cost associated with multiple sclerosis therapies poses a significant challenge, particularly for patients requiring long-term treatment. Many advanced drugs come with high price tags, leading to financial strain on both individuals and healthcare systems. This economic burden often results in delayed treatment initiation or inconsistent therapy adherence, especially in regions with limited reimbursement support. Consequently, these cost-related issues can show the market’s expansion and restrict the widespread use of newer, more effective therapies.

- For Instance, According to data published by WebMD LLC in October 2023, the median annual cost of disease-modifying therapies had reached nearly USD 94,000 by February 2022.

Opportunity

Development of Regenerative and Neuroprotective Therapies

Regenerative and neuroprotective therapies offer promising potential in the multiple sclerosis market, as they focus on restoring nerve function and preventing further neurological damage. These innovative treatments could address the root causes of disability in multiple sclerosis rather than just managing symptoms. As research progresses, such therapies are expected to fill critical gaps in current care, offering new hope for improved long-term outcomes and expanding future therapeutic options for patients.

- For Instance, In April 2024, Clene Inc. presented long-term results from its Phase 2 VISIONARY-MS trial at the American Academy of Neurology Annual Meeting. The study demonstrated that daily oral treatment with CNM-Au8 30 mg led to significant improvements in vision and cognitive function over three years. MRI and visual evoked potential assessments indicated evidence of remyelination and neuronal repair, highlighting CNM-Au8's potential as a non-immunomodulatory therapy for multiple sclerosis.

Multiple Sclerosis Therapeutic Market Segmental Insights

By Drug Class Insights

How does the Immunosuppressants Segment Dominate the Multiple Sclerosis Therapies Market in 2025?

The immunosuppressant segment led the market in 2025 because of its ability to effectively slow disease progression and manage inflammatory activity. These drugs help minimize immune system attacks on the nervous system, offering sustained symptom control. Their established safety profiles, expanding indications, and widespread use in both relapsing and progressive forms of multiple sclerosis contributed to their strong adoption, securing a major share of market revenues during the year.

The immunostimulant segment is anticipated to register the fastest growth in the multiple sclerosis therapies market as these treatments focus on modulating immune responses without broadly suppressing immune function. Their favorable safety profile and ability to reduce relapse frequency with fewer complications make them appealing for long-term use. Additionally, growing R&D efforts and increased adoption of drugs like glatiramer acetate are fueling demand, contributing to the rapid expansion of the market during the forecast period.

By Route of Administration Insights

Why Did the Injectable Segment Dominate in the Multiple Sclerosis Therapies Market in 2025?

The intramuscular injectable segment dominated the market in 2025, largely because of its proven track record in managing multiple sclerosis symptoms effectively. Medications delivered through this route, such as certain interferons, offer stable absorption and consistent results. This method is also well-integrated into treatment protocols, making it a routine choice for both patients and clinicians. Its established role in therapy and dependable outcomes contributed to its continued market leadership during the year.

The oral segment is projected to witness the fastest growth in the multiple sclerosis therapies market as patients increasingly prefer easy-to-administer treatments that fit into daily routines. Unlike injectables, oral medication offers greater comfort and independence, leading to better treatment compliance. Moreover, recent approvals of innovative oral drugs with strong efficacy and safety data are boosting their demand, making this route an attractive alternative for both newly diagnosed and long-term multiple sclerosis patients.

By Distribution Channel Insights

How Does the Hospital Pharmacies Segment Dominate the Market?

The hospitals' pharmacies segment dominated the multiple sclerosis therapies market in 2025 as they serve as primary centers for administering advanced treatment and managing serves cases. These settings are equipped to handle complex dosing protocols and monitor patient responses closely. Many multiple sclerosis therapies, especially injectables and infusions, require trained personnel and infrastructure found in hospitals, which boosts dispensing through hospital pharmacies and supports their leading role in the distribution of multiple sclerosis treatments.

The E-commerce segment is projected to grow at the fastest rate in the multiple sclerosis therapies market as more patients turn to online channels for ease, privacy, and time-saving benefits. The growth of digital health services and increased trust in online pharmacies have made it simpler for individuals to refill prescriptions without visiting physical stores. The shift, combined with expanding delivery networks and digital payment options, is driving strong momentum in the online distribution of multiple sclerosis medications.

The E-commerce segment is projected to grow at the fastest rate in the multiple sclerosis therapies market as more patients turn to online channels for ease, privacy, and time-saving benefits. The growth of digital health services and increased trust in online pharmacies have made it simpler for individuals to refill prescriptions without visiting physical stores. The shift, combined with expanding delivery networks and digital payment options, is driving strong momentum in the online distribution of multiple sclerosis medications.

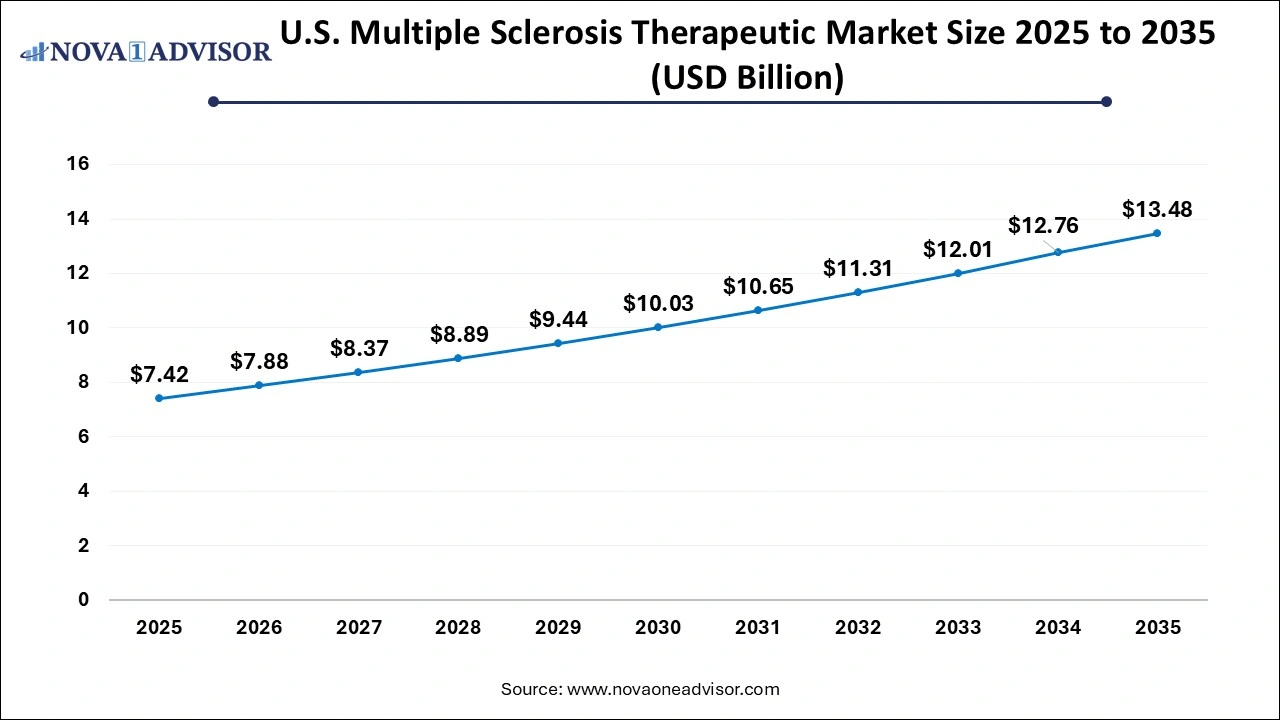

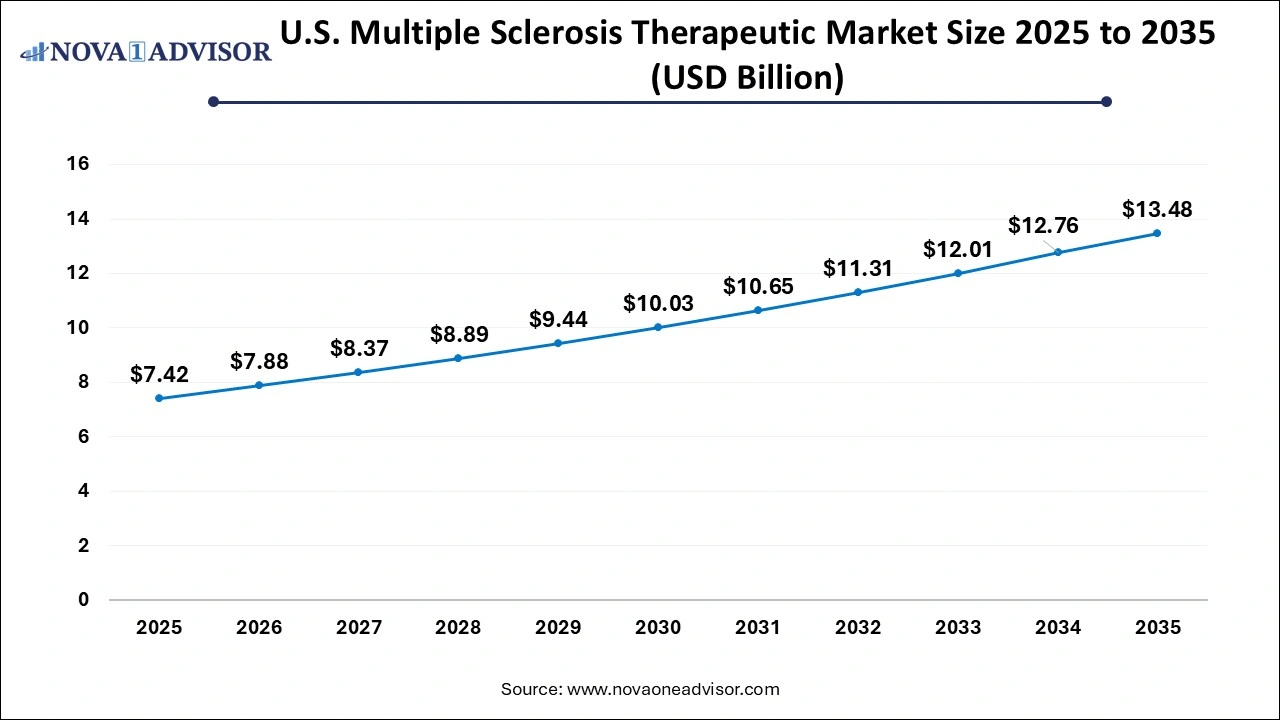

U.S. Multiple Sclerosis Therapeutic Market Size, Industry Report 2026 to 2035

The U.S. multiple sclerosis therapeutic Market size is expected to be worth around USD 13.48 Billion by 2035 from USD 7.42 Billion in 2025, growing at a Compound Annual Growth Rate (CAGR) of 6.15% during the forecast period from 2026 to 2035.

How is North America Contributing to the Expansion of Multiple Sclerosis Therapies Market?

In 2025, North America led the multiple sclerosis therapies market owing to its well-established medical systems, strong investment in R&D, and rapid uptake of new therapeutic options. The region benefits from a high concentration of MS specialists, advanced diagnostic tools, and supportive regulatory frameworks. Additionally, rising healthcare spending and the availability of cutting-edge treatments through both public and private channels played a key role in securing its dominant market share.

For Instance, In March 2025, Janssen Pharmaceuticals introduced the "That’s My Word" campaign aimed at raising awareness and improving health outcomes among individuals at risk of developing multiple sclerosis.

How is Asia-Pacific approaching the Multiple Sclerosis Therapies Market in 2025?

The Asia Pacific region is projected to experience the fastest growth in the multiple sclerosis market due to rising healthcare modernization, greater adoption of innovative treatments, and increasing public and private sector focus on neurological care. As access to specialists and diagnostic tools improves, more patients are being accurately diagnosed and treated. Additionally, economic development and a growing pharmaceutical presence in countries like China, India, and Japan are fueling the region’s rapid market expansion.

- For Instance, In March 2024, China’s National Medical Products Administration (NMPA) approved CARsgen Therapeutics for its CAR-T therapy, following positive outcomes from the LUMSICAR STUDY 1, a Phase II clinical trial conducted in China.

China and India Multiple Sclerosis Therapeutic Market Trends

China and India are leading the market in the Asia Pacific and are expected to witness significant growth over the forecast period. The rising incidences of multiple sclerosis in the large population is creating the demand for safe and long-term effective treatments. Increased healthcare spending by both nations to advance healthcare infrastructure is enabling access to specialized medical services. Furthermore, factors such as shift towards personalized medicine, supportive government initiatives, advancements in diagnostic modalities, increased awareness, and emergence of innovative and advanced therapies are fuelling the market expansion.

Multiple Sclerosis Therapeutic Market Top Key Companies:

The following are the leading companies in the multiple sclerosis therapeutic market. These companies collectively hold the largest market share and dictate industry trends.

- Teva Pharmaceutical Industries Ltd.

- Pfizer Inc.

- Biogen

- Bayer AG

- Sanofi

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson Services, Inc.

- Merck & Co., Inc.

- Takeda Pharmaceutical Company Limited.

- Horizon Therapeutics plc

Multiple Sclerosis Therapeutic Market Recent Developments

-

In January 2025, the National Multiple Sclerosis Society (NMSS) launched national guidelines developed by a dedicated scientific task force based on best available global evidence for the treatment of Multiple Sclerosis (MS) patients in the UAE.

-

In May 2024, The iConquerMS People-Powered Research Network (PPRN), a research initiative of the Accelerated Cure Project (ACP) launched a four-year, large-scale clinical trial of online programs, or digital therapeutics, to treat fatigue in multiple sclerosis. The trial received about $4.5 million grant from the Department of Defense (DoD), Multiple Sclerosis Research Program (MSRP), Congressionally Directed Medical Research Programs (CDMRP).

- In March 2024, France-based Juvisé Pharmaceuticals acquired the global commercial rights, excluding the U.S. and Canada, for Ponvory (ponesimod), a treatment for adults with active relapsing multiple sclerosis, from Actelion Pharmaceuticals Ltd, a subsidiary of Johnson & Johnson.

- In February 2024, Roche Pharma India introduced Ocrevus for the treatment of multiple sclerosis, aiming to support patients across India. Already available in over 100 countries, Ocrevus is one of the company’s key therapies and has received approval in India for both relapsing and primary progressive forms of MS.

Multiple Sclerosis Therapeutic Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the Multiple Sclerosis Therapeutic market.

By Drug Class

- Immunosuppressants

- Immunostimulants

By Route of Administration

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- E-Commerce

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

The

The

For Instance, In March 2025, Janssen Pharmaceuticals introduced the "That’s My Word" campaign aimed at raising awareness and improving health outcomes among individuals at risk of developing multiple sclerosis.

For Instance, In March 2025, Janssen Pharmaceuticals introduced the "That’s My Word" campaign aimed at raising awareness and improving health outcomes among individuals at risk of developing multiple sclerosis.