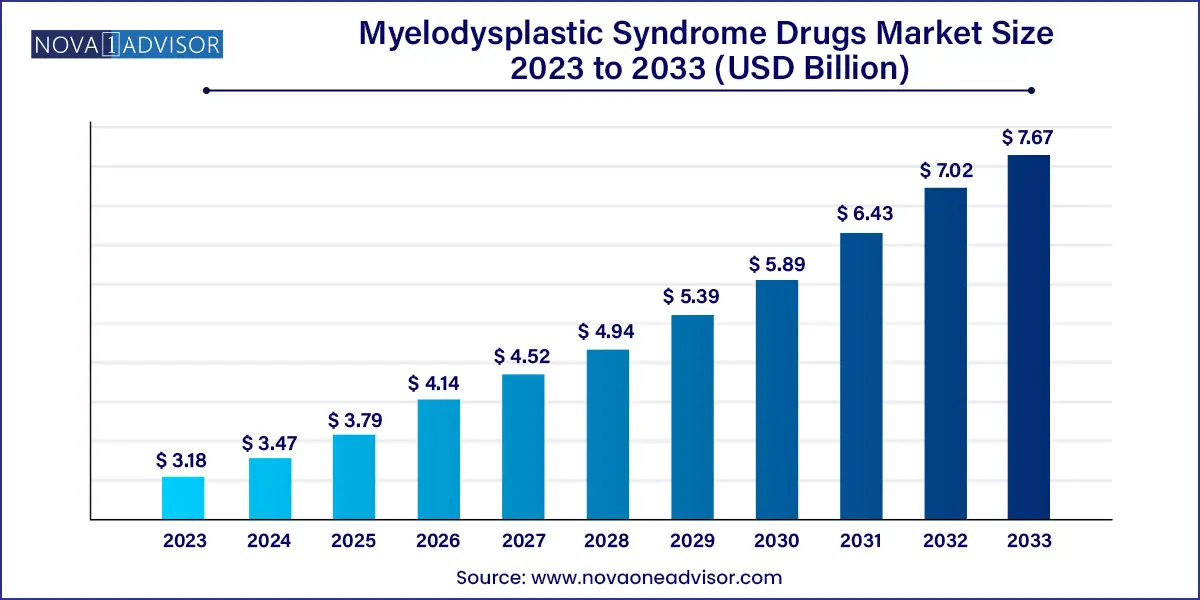

The global myelodysplastic syndrome drugs market size was valued at USD 3.18 billion in 2023 and is anticipated to reach around USD 7.67 billion by 2033, growing at a CAGR of 9.2% from 2024 to 2033.

Myelodysplastic syndromes (MDS) represent a complex group of hematologic malignancies marked by ineffective hematopoiesis, dysplasia in the bone marrow, and varying risks of transformation into acute myeloid leukemia (AML). These disorders primarily affect older adults, with a median age of diagnosis around 70 years. MDS arises due to genetic abnormalities or acquired mutations affecting hematopoietic stem cells, often leading to life-threatening complications such as anemia, infection, and bleeding.

The global market for MDS drugs is being shaped by a growing patient population, increased awareness among clinicians, and a surge in research and development activities aimed at understanding disease pathogenesis and discovering novel therapies. Although MDS was historically managed with supportive care, the emergence of disease-modifying treatments such as hypomethylating agents (HMAs), lenalidomide, and allogeneic stem cell transplants has transformed the therapeutic landscape. Moreover, the U.S. FDA's approval of newer drugs like luspatercept and oral decitabine/cedazuridine has provided clinicians with more tailored, less toxic treatment options.

In terms of market dynamics, pharmaceutical companies are actively investing in targeted therapies and personalized medicine approaches that align with genetic and molecular risk stratification. Additionally, the adoption of next-generation sequencing (NGS) technologies in diagnostic laboratories has made it possible to subtype MDS more precisely, enabling better therapeutic decisions and improved patient outcomes. As healthcare systems in emerging markets enhance their hematology care infrastructure, the global market for MDS drugs is poised for significant expansion in the coming years.

Shift Toward Oral Hypomethylating Agents: Oral drugs like oral azacitidine and oral decitabine/cedazuridine are replacing traditional intravenous forms due to better patient convenience and similar efficacy.

Rise in Targeted Therapies: New therapies are being designed based on mutations like TP53, SF3B1, and IDH1/2, offering customized options with improved effectiveness.

Increased Stem Cell Transplant Access: With better donor registries and transplantation protocols, more patients—especially in middle-income countries—can now access curative options.

Combination Therapy Trials: Clinical trials combining hypomethylating agents with immunotherapies or BCL-2 inhibitors are gaining traction.

Aging Global Population: The rising elderly population globally is directly increasing the number of MDS diagnoses, expanding the addressable market.

Use of Artificial Intelligence in Diagnostics: AI-driven platforms are being integrated into hematology labs to aid early MDS detection through bone marrow and blood smear analyses.

Patient-Centric Drug Development: Companies are focusing on reducing treatment toxicity and improving quality of life, particularly for lower-risk MDS patients.

Orphan Drug Designation: Many MDS therapies are receiving orphan status, speeding up development and providing financial incentives for companies.

| Report Attribute | Details |

| Market Size in 2024 | USD 3.47 Billion |

| Market Size by 2033 | USD 7.67 Billion |

| Growth Rate From 2024 to 2033 | CAGR of 9.2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Treatment, route of administration, end-use, region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled | Celgene Corporation, Otsuka Pharmaceutical Co. Ltd, Amgen Inc., Teva Pharmaceutical Industries Ltd., Sun Pharmaceutical Industries Limited, Takeda Pharmaceutical Company Ltd, Mylan N.V., Cipla Pharmaceutical Limited, Onconova Therapeutics, Hikma Pharmaceuticals PLC |

One of the most powerful drivers in the MDS drugs market is the rise of genomic-based targeted therapies. As our understanding of the molecular biology of MDS evolves, drug development has shifted toward targeting specific mutations. For instance, therapies targeting SF3B1-mutated MDS, such as luspatercept, have shown promising results in reducing transfusion dependence. Similarly, patients with TP53 mutations—a high-risk subgroup with historically poor prognosis—are now the focus of new drug candidates like eprenetapopt (APR-246). These tailored therapies not only offer better disease control but also minimize exposure to toxic treatments that may not be effective for genetically distinct subgroups. This paradigm shift is enhancing clinical outcomes and patient survival, thus driving demand for advanced therapeutics.

Despite advancements, the market faces a significant restraint in the form of limited curative options and high relapse rates. Allogeneic stem cell transplantation remains the only potential cure for MDS, but it is accessible to a minority of patients—often limited by age, comorbidities, or lack of suitable donors. Even when patients undergo transplants, relapse rates remain high, particularly in high-risk MDS. Moreover, many of the existing drugs provide symptomatic relief or delay progression rather than offering a definitive cure. Resistance to hypomethylating agents, which are the cornerstone of therapy for higher-risk MDS, also remains a significant clinical challenge, leading to relapse and limited options post-failure. These factors hinder the long-term efficacy of treatment regimens and impact the overall success of therapeutic interventions.

Emerging markets, particularly in Asia-Pacific and Latin America, present a notable opportunity for the growth of the MDS drugs market. Historically, access to MDS treatments in these regions has been constrained by cost, lack of specialized care, and limited awareness. However, with the rise of generic oral hypomethylating agents and patient access programs, this situation is rapidly changing. Countries like India and Brazil have witnessed significant improvements in hematology infrastructure, allowing for more diagnoses and timely interventions. Additionally, government-sponsored healthcare schemes and increased penetration of e-pharmacies are bridging the accessibility gap. Companies that can develop affordable, effective, and easy-to-administer oral therapies are likely to tap into a vast, underserved patient population in these fast-developing markets.

Chemotherapy continues to dominate the MDS treatment segment, especially in higher-risk cases where disease progression is rapid. Agents such as azacitidine and decitabine remain the standard of care and are widely used due to their proven efficacy in prolonging survival and delaying leukemia transformation. These drugs have set a benchmark in therapeutic outcomes and have become integral to global treatment guidelines. In many healthcare settings, especially those with limited access to advanced therapies, traditional chemotherapy remains the go-to treatment due to its relatively established safety profile and physician familiarity. Moreover, even in transplant-eligible patients, chemotherapy is often used as a bridging strategy to reduce disease burden prior to hematopoietic stem cell transplantation.

Stem cell transplant, though less common, is the fastest-growing treatment segment due to increasing adoption and improved outcomes. Curative in nature, stem cell transplants are gaining traction among younger patients and those with favorable donor matches. The success of unrelated donor registries and haploidentical transplant protocols has broadened the eligible patient base. High-resolution HLA typing and reduced-intensity conditioning regimens are minimizing complications, allowing older patients to undergo the procedure safely. Furthermore, long-term data now support the survival benefit of early transplantation in intermediate and high-risk MDS. As transplant infrastructure becomes more robust and access improves globally, the uptake of this modality is expected to surge.

Parenteral administration remains dominant, as the majority of disease-modifying agents such as azacitidine and decitabine have historically been delivered via subcutaneous or intravenous routes. These methods ensure bioavailability and controlled dosing, especially critical for fragile MDS patients. In clinical settings, parenteral administration also allows healthcare providers to monitor patient response and manage side effects effectively. Additionally, patients undergoing combination therapies or preparative regimens for transplantation typically require parenteral drugs as part of inpatient care.

However, oral administration is gaining rapid momentum and is projected to be the fastest-growing segment. Recent approvals of oral decitabine/cedazuridine (Inqovi) and oral azacitidine (Onureg) represent a significant advancement in drug delivery for MDS. These options offer patients the flexibility of home-based treatment, reducing travel burden and improving compliance. This route is particularly appealing for elderly patients who may struggle with frequent hospital visits. The convenience and efficacy of oral agents are likely to revolutionize treatment paradigms and broaden access, particularly in rural and under-resourced areas.

Hospitals currently lead the end-use segment, driven by the complexity of MDS management. Diagnosis requires specialized laboratory tests, bone marrow biopsies, and cytogenetic analysis—all typically performed in hospital settings. Furthermore, parenteral drug administration, patient monitoring for cytopenias, and stem cell transplants necessitate inpatient or specialized day-care facilities. Hospitals are also the primary centers for conducting clinical trials, thereby having early access to investigational therapies that attract patients from across the region.

Clinics, however, are emerging as the fastest-growing end-use segment due to a rise in outpatient management of low-risk MDS. With the introduction of oral agents, many patients can now be managed effectively in ambulatory care centers and hematology clinics. These settings offer more personalized attention and shorter waiting times compared to larger hospitals. In developed nations, clinics equipped with laboratory and pharmacy support are becoming central hubs for chronic MDS management. Additionally, patient monitoring tools, including mobile apps and wearable technology, allow clinics to offer remote care, further enhancing their appeal in the evolving healthcare ecosystem.

North America remains the dominant region in the global MDS drugs market, primarily led by the United States. Several factors contribute to this leadership position, including a well-established healthcare system, high disease awareness, and strong reimbursement policies. The U.S. FDA has shown proactive engagement with pharmaceutical companies through accelerated approvals and orphan drug designations, fueling innovation in this space. The presence of industry giants such as Bristol Myers Squibb and Takeda Pharmaceuticals further consolidates the region’s dominance. Academic institutions like the Moffitt Cancer Center and Dana-Farber Cancer Institute are also actively involved in MDS research, driving early access to clinical trials and cutting-edge therapies.

Asia-Pacific is the fastest-growing regional market, spurred by rising incidence rates, expanding diagnostic capabilities, and improved access to cancer care. Countries like China, Japan, and India are investing heavily in healthcare infrastructure, particularly in hematologic malignancies. For example, Japan has established national cancer registries and early diagnosis programs that help in MDS case detection. India, on the other hand, is benefiting from an expanding network of private oncology hospitals offering advanced treatment options at competitive prices. The market is further supported by a growing pharmaceutical manufacturing base and the availability of generic hypomethylating agents, which make treatment more affordable and accessible.

March 2025: Bristol Myers Squibb announced successful Phase III trial results of its oral azacitidine formulation for lower-risk MDS, showing significant reduction in transfusion dependence.

January 2025: Takeda Pharmaceuticals received FDA breakthrough therapy designation for pevonedistat, an investigational therapy for high-risk MDS patients.

November 2024: Geron Corporation submitted an NDA for imetelstat, a telomerase inhibitor showing strong efficacy in MDS patients who have failed standard therapies.

September 2024: Onconova Therapeutics began enrollment for a Phase II study evaluating rigosertib in combination with decitabine for treatment-naïve high-risk MDS.

July 2024: The European Medicines Agency approved luspatercept for the treatment of anemia in MDS patients with ring sideroblasts, further expanding its indications.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Myelodysplastic Syndrome Drugs market.

By Treatment

By Route Of Administration

By End-use

By Region