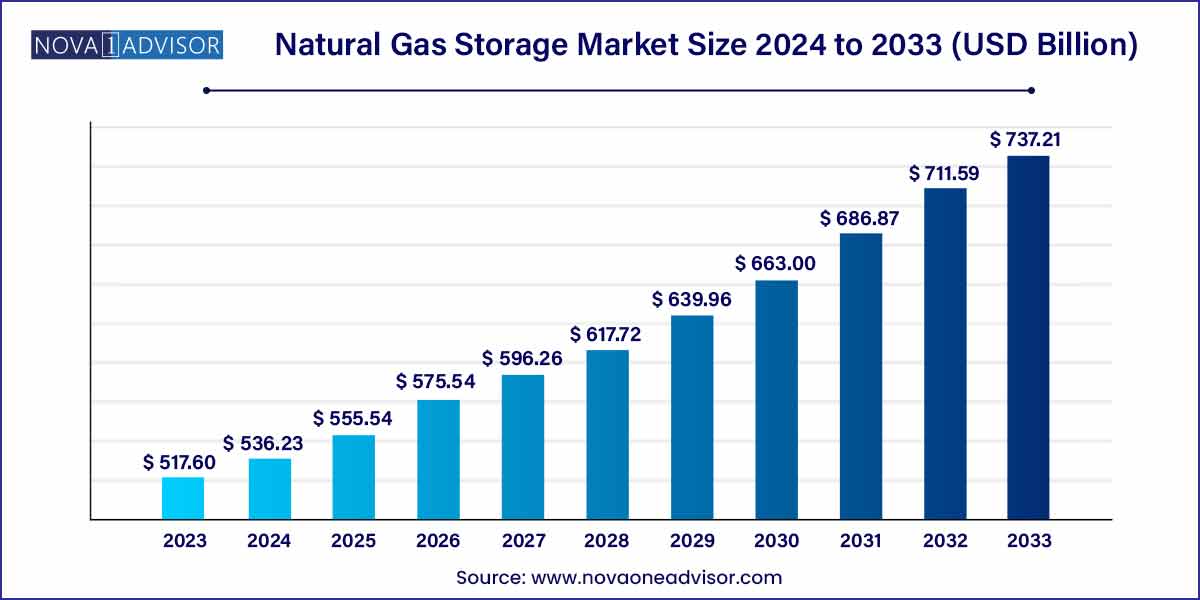

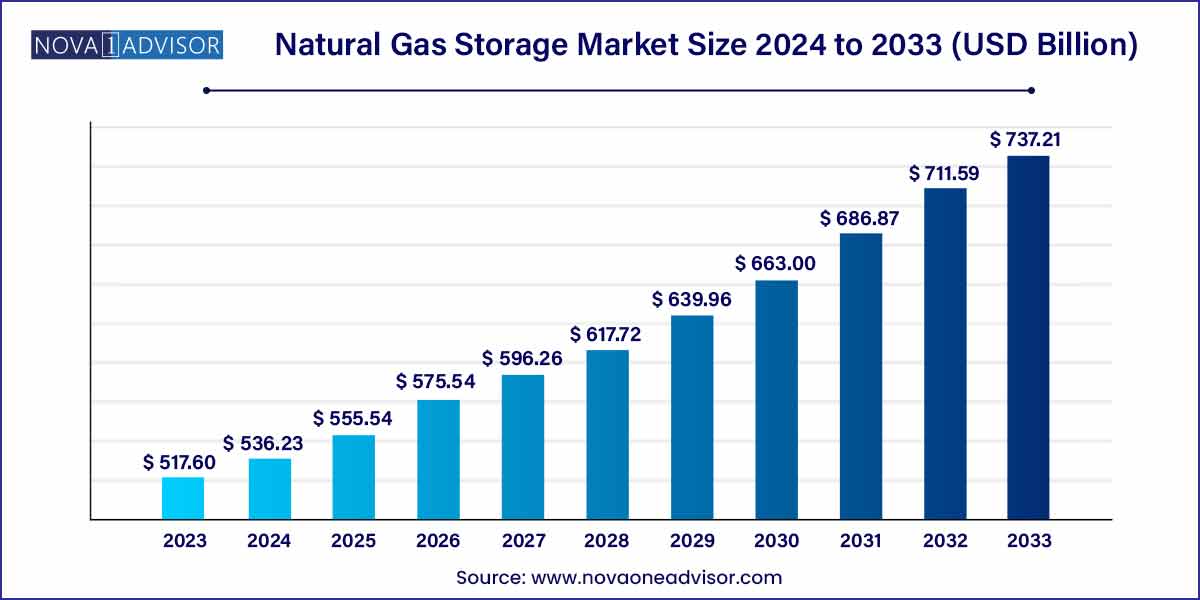

The global natural gas storage market size was exhibited at USD 517.60 bcm in 2023 and is projected to hit around USD 737.21 bcm by 2033, growing at a CAGR of 3.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- The North American market accounted for 45.0% of the revenue share in 2023.

- By underground storage type, the depleted reservoir segment held 78.5% of the total revenue share in 2023.

- By type, the underground storage type segment accounted for 93% of the total revenue share in 2023.

Natural Gas Storage Market: Overview

In the realm of energy markets, natural gas storage plays a pivotal role in ensuring supply reliability, balancing demand fluctuations, and mitigating price volatility. This overview delves into the key components, trends, and dynamics shaping the natural gas storage market landscape.

Natural Gas Storage Market Growth

The growth of the natural gas storage market is propelled by several key factors. Firstly, increasing demand for natural gas as a cleaner alternative to coal and oil fuels the need for robust storage infrastructure to ensure supply reliability. Additionally, the energy transition towards renewable sources underscores the importance of flexible storage solutions to balance intermittent energy generation. Furthermore, geopolitical uncertainties and extreme weather events highlight the necessity of ample storage capacity to mitigate supply disruptions and price volatility. Moreover, advancements in drilling technologies and reservoir characterization enhance storage efficiency and capacity, driving market growth. Lastly, supportive regulatory frameworks and government incentives encourage investment in modernizing and expanding storage facilities, fostering market expansion and innovation. Overall, these growth factors converge to create a dynamic landscape ripe with opportunities for stakeholders in the natural gas storage market.

Natural Gas Storage Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 517.60 BCM |

| Market Size by 2033 |

USD 737.21 BCM |

| Growth Rate From 2024 to 2033 |

CAGR of 3.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Type, By Underground Storage Type, By Application |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Cardinal Gas Storage Partners LLC., Centrica plc, Chart Industries, Chiyoda Corporation, DTE Energy, E. ON SE, Enbridge Gas Distribution Inc., Engie S. A., Foster Wheeler, Gazprom, GDF Suez,Martin Midstream Partners L.P., McDermott International, Inc., NAFTA A.S., Niska Gas Storage Partners, LLC., Royal Vopak N.V., Samsung Heavy Industries Co., Ltd., Spectra Energy Corporation, Technip S.A.,. |

Natural Gas Storage Market Dynamics

The natural gas storage market is profoundly influenced by the interplay between supply and demand dynamics. Fluctuations in natural gas production, consumption patterns, and seasonal variations create a need for robust storage infrastructure to balance the market. During periods of low demand, surplus gas is stored in facilities such as underground reservoirs or depleted fields. Conversely, during peak demand seasons or unforeseen supply disruptions, stored gas is withdrawn to meet consumer needs and stabilize prices. This dynamic equilibrium requires strategic planning, efficient operations, and sufficient storage capacity to ensure uninterrupted supply and mitigate price volatility.Moreover, emerging trends such as the integration of renewable energy sources further complicate supply-demand dynamics, necessitating flexible storage solutions to accommodate intermittent energy generation and maintain grid stability.

- Technological Innovations:

Technological advancements play a pivotal role in shaping the landscape of the natural gas storage market. Innovations in drilling techniques, reservoir characterization, and storage technologies have the potential to revolutionize storage operations, enhance efficiency, and reduce costs. For instance, advancements in horizontal drilling and hydraulic fracturing techniques have unlocked access to previously inaccessible gas reserves, expanding storage opportunities. Additionally, enhanced reservoir characterization techniques enable more accurate assessment of storage capacities and performance, optimizing resource utilization. Moreover, novel storage solutions such as salt caverns, aquifer storage, and LNG terminals offer increased flexibility and scalability to meet evolving market demands.

Natural Gas Storage Market Restraint

Environmental considerations pose significant restraints on the natural gas storage market. While natural gas is often touted as a cleaner alternative to coal and oil, concerns persist regarding methane emissions, groundwater contamination risks, and land-use impacts associated with storage operations. Methane, a potent greenhouse gas, can leak from storage facilities during extraction, transportation, and storage processes, contributing to climate change and air pollution. Moreover, storage operations may pose risks to local ecosystems and water resources through potential leaks or spills, raising environmental concerns and public scrutiny. As a result, regulatory agencies increasingly impose stringent environmental standards and monitoring requirements on storage facilities, driving up compliance costs and operational challenges.

- Infrastructure Investments:

Infrastructure investments present significant restraints to the natural gas storage market. Developing, maintaining, and expanding storage facilities entail substantial capital investments, regulatory approvals, and project lead times. Aging infrastructure may require modernization or replacement to meet evolving market demands, regulatory mandates, and safety standards, further increasing investment requirements. Moreover, economic uncertainties, fluctuating energy prices, and evolving energy policies can impact the financial viability and attractiveness of storage projects, deterring potential investors and project developers. Additionally, securing land-use permits, navigating regulatory processes, and addressing community opposition can prolong project timelines and increase development costs. As a result, the pace of infrastructure investments in the natural gas storage sector may lag behind demand growth, leading to capacity constraints, supply disruptions, and price volatility.

Natural Gas Storage Market Opportunity

- Energy Transition and Renewable Integration:

The ongoing global transition towards cleaner energy sources presents a significant opportunity for the natural gas storage market. Natural gas, often regarded as a transitional fuel due to its lower carbon footprint compared to coal and oil, plays a crucial role in supporting the integration of renewable energy sources such as wind and solar. Renewable energy generation is inherently intermittent, with fluctuations in output based on weather conditions. Natural gas storage facilities offer a viable solution to address the intermittency of renewable energy by providing backup power during periods of low or variable renewable generation.This complementary relationship between natural gas storage and renewable energy creates opportunities for the development of hybrid energy systems and innovative storage solutions, such as power-to-gas technology, which converts excess renewable energy into hydrogen or synthetic natural gas for storage.

- Infrastructure Modernization and Expansion:

The need for infrastructure modernization and expansion presents a significant opportunity for the natural gas storage market. Aging storage facilities, coupled with growing demand for natural gas, necessitate investments in upgrading existing infrastructure and developing new storage projects to meet evolving market demands. Modernization efforts focus on enhancing operational efficiency, safety standards, and environmental performance through the adoption of advanced technologies, automation, and digitalization. Furthermore, expanding storage capacities and optimizing storage locations enable market participants to capitalize on arbitrage opportunities, capture market share, and improve supply chain resilience.

Natural Gas Storage Market Challenges

Environmental challenges pose significant hurdles for the natural gas storage market. While natural gas is often considered a cleaner alternative to coal and oil, concerns persist regarding methane emissions, groundwater contamination risks, and land-use impacts associated with storage operations. Methane, a potent greenhouse gas, can leak from storage facilities during extraction, transportation, and storage processes, contributing to climate change and air pollution. Moreover, storage operations may pose risks to local ecosystems and water resources through potential leaks or spills, raising environmental concerns and public scrutiny. Regulatory agencies increasingly impose stringent environmental standards and monitoring requirements on storage facilities, driving up compliance costs and operational challenges.

- Infrastructure Investments:

Infrastructure investments represent a significant challenge for the natural gas storage market. Developing, maintaining, and expanding storage facilities entail substantial capital investments, regulatory approvals, and project lead times. Aging infrastructure may require modernization or replacement to meet evolving market demands, regulatory mandates, and safety standards, further increasing investment requirements. Economic uncertainties, fluctuating energy prices, and evolving energy policies can impact the financial viability and attractiveness of storage projects, deterring potential investors and project developers. Additionally, securing land-use permits, navigating regulatory processes, and addressing community opposition can prolong project timelines and increase development costs. The pace of infrastructure investments in the natural gas storage sector may lag behind demand growth, leading to capacity constraints, supply disruptions, and price volatility.

Segments Insights:

By Type Insights

In 2023, the large underground type held the biggest market share (93%). Like the majority of other products, fossil fuel may be kept in storage for a very long time. Natural gas exploration and development typically take time. Additionally, natural gas sometimes isn't used right away after arriving at its location, so it's kept in facilities, probably underground. With seasonal changes, subterranean coal and gas storage has become a crucial component of the energy supply, especially for countries in Europe and North America. Production that is constant and consistent contrasts with demand and usage that are erratic and follows a seasonal pattern depending on the patterns. Due to the significant increase in demand for subterranean natural gas on the international market, the percentage of usage has been observed to increase steadily.

In addition, natural gas is kept in gaseous or liquid form in the above storage tanks. The locations in which the above-ground storage facilities are located lack subsurface caves. The above-ground storage tanks are generally inexpensive to install and provide simple access to storage facilities. Natural gas is additionally stored locally in portable tanks which are placed onto railroads or barges for lengthy transit in addition to stationary terrestrial storage tanks. The terrestrial segment, which had the second-largest share of the market in 2023, is expected to grow at a respectable CAGR over the course of the projected year.

By Underground Storage Type Insights

The shallow groundwater type's drained reservoirs segment held the biggest market share in 2023. One of the earliest and most common types of gas storage is in fractured reservoirs. Formations known as depleted reservoirs have already had all of their exploitable fossil fuels extracted from them. Approximately 50% of the fossil fuels inside the deposit need to be preserved as a cushion gas to sustain pressure in fractured reservoirs. Due to the infrastructure already in place for gas storage, these reservoirs have mostly been utilized for this purpose. They offer a long combustion cycle of 50 to 200 days and a moderate gas delivery.

The CAGR that is anticipated to be the greatest during the forecast timeframe belongs to the salt cavern. Current salt resources give rise to salt caverns. Due to their steel-like structural strength, which makes the caverns resistant to reservoir deterioration over the course of the storage unit, they are appropriate for storing gas. Aquifers are underground formations of porous, permeable rock that serve as spontaneous water reservoirs. Due to the necessity for geological classification before storage, these structures are the least appealing and the costliest type of natural energy storage site. Aquifers are typically found in pressure distribution near water pressure upon exploration.

By Regional Insights

In 2023, the North America region dominated the natural gas storage market due to its large reserves, well-developed infrastructure, and numerous storage options, such as salt caverns and depleted fields. The strategic geographical location of the region, technical improvements, and a market-friendly environment with government assistance all contribute to its growth. North America is a significant region in addressing dynamic energy requirements due to its liberalized energy market, reliance on a diverse energy mix, and flexibility to seasonal demand variations. Additionally, the U.S. is the major producer of natural gas which means that there is a large supply of natural gas available for storage. There are over 4,000 natural gas storage facilities in the United States, which can store a total of approximately 4 trillion cubic feet of natural gas. The demand for natural gas in the U.S. is also increasing due to the increased use of natural gas for power generation and the rising trend of natural gas-powered vehicles.

Recent Developments:

- Sempra Energy declared in April 2023 that it has successfully sold its non-utility storage for natural gas facilities and US renewables business, producing about $2.15 billion of cash.

- To discuss issues about gas imports and storage, the executive members from Gazprom & VNG will meet during the 8th St. Petersburg Worldwide Gas Forum in October 2021. The focus of the discussion was on collaborative efforts in the area of gas storage, namely a collaborative effort for the German Wilhelm UGC facility.

- Trafigura and Singapore LNG Corp. inked a new agreement in January 2021 for the storing and reloading of liquefied natural gas. (LNG). the new agreement. For the next 24 months, Trafigura will also have access to 160000 m3 of LNG storage capacity.

Some of the prominent players in the natural gas storage market include:

- Cardinal Gas Storage Partners LLC.

- Centrica plc

- Chart Industries

- Chiyoda Corporation

- DTE Energy

- E. ON SE

- Enbridge Gas Distribution Inc.

- Engie S. A.

- Foster Wheeler

- Gazprom

- GDF Suez

- Martin Midstream Partners L.P.

- McDermott International, Inc.

- NAFTA A.S.

- Niska Gas Storage Partners, LLC.

- Royal Vopak N.V.

- Samsung Heavy Industries Co., Ltd.

- Spectra Energy Corporation

- Technip S.A.

- Trafigura

- TransCanada Corporation

- Uniper

- WorleyParsons Limited

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global natural gas storage market.

By Type

- Underground

- Aboveground

- Floating

By Underground Storage Type

- Depleted Gas Reservoir

- Aquifer Reservoir

- Salt Caverns

By Application

- Residential

- Commercial

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)