Non-viral Gene Delivery Technologies Market Size and Trends

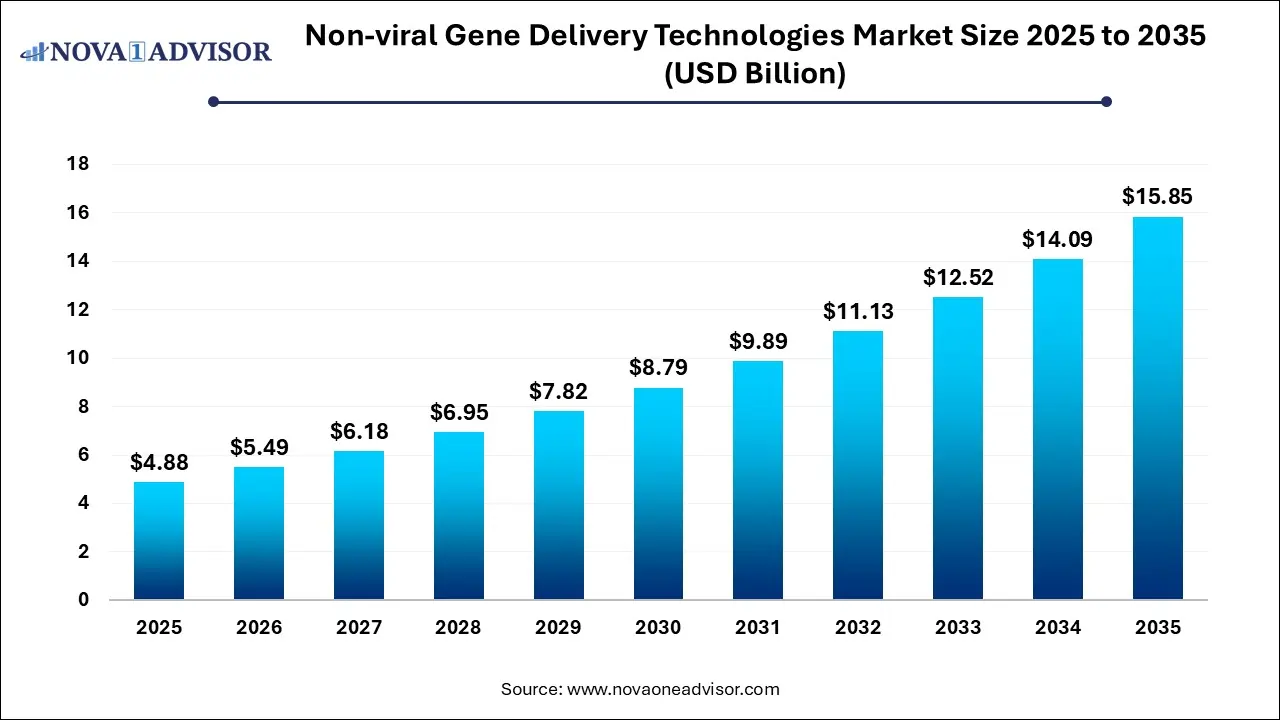

The non-viral gene delivery technologies market size was exhibited at USD 4.88 billion in 2025 and is projected to hit around USD 15.85 billion by 2035, growing at a CAGR of 12.5% during the forecast period 2026 to 2035.

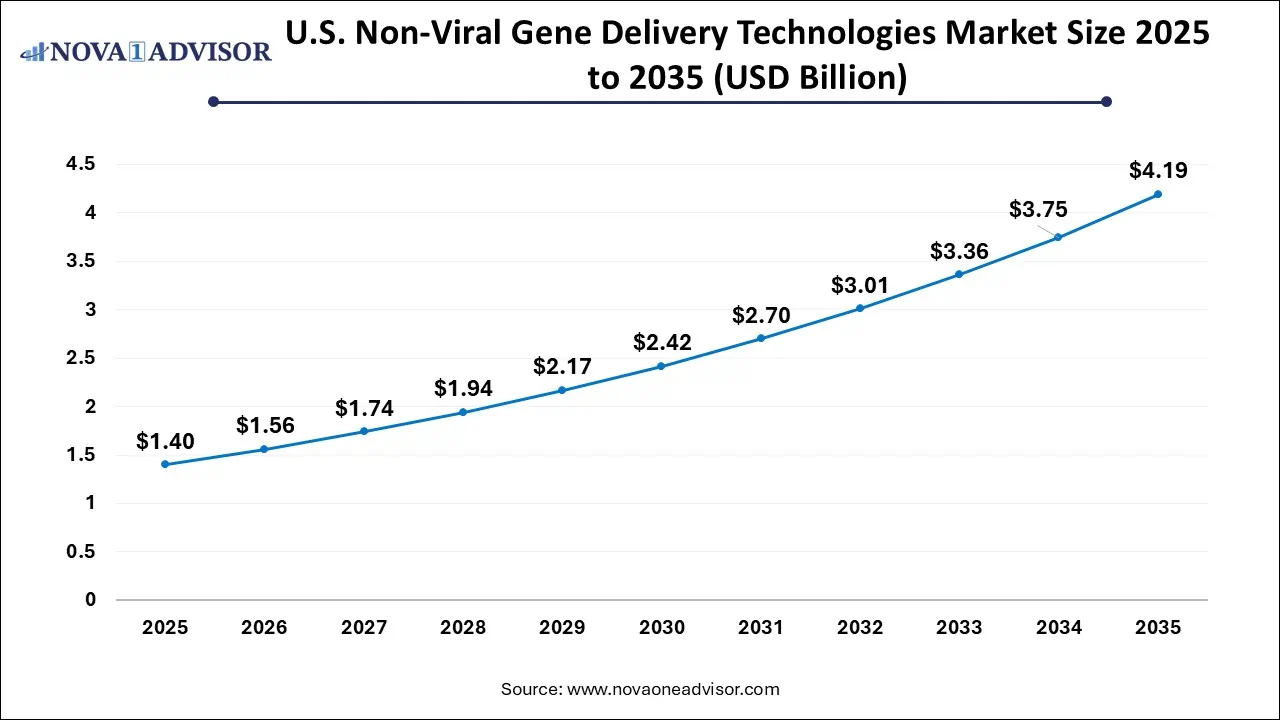

U.S. Non-Viral Gene Delivery Technologies Market Size and Growth 2026 to 2035

The U.S. non-viral gene delivery technologies market size is evaluated at USD 1.40 billion in 2025 and is projected to be worth around USD 4.19 billion by 2035, growing at a CAGR of 11.58% from 2026 to 2035.

North America Dominates the Market with Advanced R&D Ecosystem

North America, particularly the United States, continues to dominate the global non-viral gene delivery technologies market. The region boasts a dense concentration of biotechnology companies, top-tier academic research institutions, and favorable regulatory pathways that support innovation in gene therapy and drug delivery technologies.

Government initiatives such as the NIH's funding programs and the FDA's expedited approval mechanisms for breakthrough therapies further accelerate market growth. Moreover, a strong IP ecosystem and venture capital availability make North America a hotbed for non-viral delivery innovations. Companies like Moderna and Intellia Therapeutics are headquartered here, contributing significantly to advancements in LNP and CRISPR delivery systems.

Asia Pacific Emerges as the Fastest Growing Market

The Asia Pacific region is experiencing the fastest growth in the non-viral gene delivery space, driven by increasing investments in

biotechnology infrastructure and favorable government policies. Countries like China, South Korea, and Japan are rapidly advancing their capabilities in gene therapy and mRNA therapeutics. For example, Chinese biotech companies are developing LNP platforms for local and export markets, while academic institutions in Japan are pioneering polymeric vector research.

Growing demand for affordable and accessible therapies, a large patient population, and rising healthcare awareness are contributing to the region’s momentum. Additionally, Asia Pacific is seeing increased participation in clinical trials for non-viral gene therapies, which is a positive signal for future market expansion.

Market Overview

The non-viral gene delivery technologies market is evolving as a pivotal component of modern biotechnology and gene therapy strategies. Unlike viral vectors, non-viral methods provide a safer, more controllable, and potentially scalable route for gene delivery—particularly essential in applications requiring repeated dosing or large-scale manufacturing. These technologies utilize synthetic or physical means to transport genetic material into host cells, thereby avoiding the immunogenic risks and regulatory challenges often associated with viral vectors.

Driven by a growing pipeline of cell and gene therapies, increasing funding in genetic research, and advances in nanotechnology, the market has shown robust growth in recent years. From lipid nanoparticles (LNPs) used in mRNA vaccine delivery to electroporation techniques in cancer immunotherapy, the scope of non-viral delivery continues to expand across research and therapeutic domains.

The market also reflects a global thrust toward precision medicine, where customized therapies based on genetic profiles are gaining prominence. Companies are investing in the development of next-generation platforms that enhance transfection efficiency, reduce cytotoxicity, and are compatible with CRISPR and other gene-editing tools. This convergence of disciplines is leading to a rise in strategic collaborations between biotech firms, pharmaceutical giants, and academic institutions to develop non-viral alternatives with broad applicability.

Major Trends in the Market

-

Rapid integration of LNP technology in RNA therapeutics and vaccines post-COVID-19, especially for delivering mRNA-based solutions.

-

Increased funding and partnerships between academic research institutions and private companies to develop non-viral platforms.

-

Emergence of polymer-based vectors such as dendrimers and polyplexes for safer and more efficient intracellular delivery.

-

Expansion of CRISPR gene editing applications, requiring robust non-viral delivery methods to ensure high gene-editing precision.

-

Miniaturization and microfluidics advancements in electroporation and microinjection for cell-level gene delivery in clinical settings.

-

Shift toward personalized medicine, requiring safe and repeatable gene delivery solutions without immunogenic responses.

-

Growing use of non-viral methods in CAR-T cell manufacturing and other autologous cell therapies.

Report Scope of Non-viral Gene Delivery Technologies Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 5.49 Billion |

| Market Size by 2035 |

USD 15.85 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.5% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Mode, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc., GenScript, Danaher, Merck KGaA, Bio-Rad Laboratories, Altogen Biosystems, Lonza, Sonidel, SIRION BIOTECH GmbH, Innovative Cell Technologies, Inc.

|

Market Driver: Rising Demand for Safe and Scalable Gene Therapy Delivery Systems

One of the most influential drivers shaping the non-viral gene delivery technologies market is the increasing demand for safe, scalable, and re-dosable delivery systems in gene therapy. Viral vectors, while effective, often pose significant limitations—including limited payload capacity, immune response risks, and manufacturing complexities. In contrast, non-viral methods such as lipid nanoparticles and electroporation allow repeated administration without eliciting adverse immune reactions.

Moreover, the scalability of non-viral systems makes them ideal for commercial-level therapeutic manufacturing. For instance, LNPs have become a cornerstone of mRNA vaccines, showcasing how these technologies can be mass-produced and administered globally, as seen during the COVID-19 pandemic. This shift has encouraged biotech firms and pharmaceutical companies to invest in non-viral alternatives that offer a balance between safety, efficiency, and scalability.

Market Restraint: Lower Transfection Efficiency in Certain Cell Types

Despite their advantages, non-viral gene delivery technologies are still challenged by lower transfection efficiency, especially in hard-to-transfect cell types such as primary T cells, stem cells, and neurons. This limitation restricts their applicability in advanced gene therapies, where high levels of gene expression are required for clinical efficacy.

For example, while physical methods like electroporation have made strides in delivering genes into immune cells, they can also cause substantial cell death due to membrane disruption. Similarly, chemical vectors such as polymers and lipids can struggle with intracellular trafficking and endosomal escape. These barriers necessitate continuous R&D investment, which could slow commercialization timelines, particularly for therapies targeting niche or complex diseases.

Market Opportunity: Expansion of mRNA-Based Therapeutics Beyond Vaccines

A transformative opportunity within the non-viral gene delivery landscape lies in the expansion of mRNA-based therapeutics beyond infectious disease vaccines into areas such as oncology, rare genetic disorders, and cardiovascular diseases. The success of COVID-19 mRNA vaccines—delivered via lipid nanoparticles—demonstrated the potential of non-viral carriers to safely and effectively transport nucleic acids.

Companies are now actively exploring LNPs and novel biodegradable polymers for delivering mRNA therapeutics in personalized cancer vaccines, protein replacement therapies, and in vivo genome editing. The flexibility and safety of non-viral systems make them particularly well-suited for mRNA-based approaches, offering a scalable solution for rapidly evolving therapeutic landscapes.

Non-viral Gene Delivery Technologies Market By Mode Insights

The chemical mode of gene delivery currently dominates the market, with lipid nanoparticles (LNPs) being the most prominent sub-segment. LNPs gained immense recognition during the global rollout of COVID-19 mRNA vaccines, particularly through Pfizer-BioNTech and Moderna platforms. Their ability to encapsulate, protect, and facilitate the cellular uptake of nucleic acids without triggering immune responses has positioned them at the forefront of both research and commercial applications.

Meanwhile, polymer-based vectors such as polyethylenimine (PEI), chitosan, and dendrimers are gaining traction due to their tunable properties and biodegradability. These offer promising alternatives, particularly for DNA-based therapies and CRISPR applications. The “others” category—encompassing novel nanostructures and hybrid formulations—is also expanding as new startups enter the field with proprietary solutions aimed at overcoming traditional limitations of delivery efficiency and toxicity.

Non-viral Gene Delivery Technologies Market By Application Insights

The therapeutics application segment dominates the market, particularly through its sub-segment of gene therapy. Gene therapies rely heavily on effective gene delivery platforms, and the push toward treating genetic disorders such as hemophilia, spinal muscular atrophy, and inherited retinal diseases has intensified interest in non-viral approaches. Lipid nanoparticles and biodegradable polymers are being investigated for delivering both DNA and mRNA therapies, with several clinical-stage programs exploring these vectors as core components.

Cell therapy, particularly CAR-T and TCR-T therapies, also contributes significantly to market dominance. These therapies often require ex vivo manipulation of immune cells, making electroporation and polymer-based delivery crucial for successful gene insertion. Vaccine development—especially personalized cancer vaccines—is another high-growth area, reflecting the broader role of non-viral vectors beyond traditional genetic disease treatment.

Non-viral Gene Delivery Technologies Market By End-use Insights

Biotechnology and biopharmaceutical companies form the leading end-user segment, owing to their extensive investment in developing and commercializing gene and cell therapies. Companies such as Moderna, BioNTech, and Intellia Therapeutics are actively utilizing non-viral vectors for delivering RNA therapeutics and CRISPR tools.

This segment also benefits from access to manufacturing infrastructure and partnerships with CDMOs (Contract Development and Manufacturing Organizations) to scale delivery platforms for clinical and commercial use. Their pursuit of regulatory approvals and novel therapeutic formulations continues to push the non-viral gene delivery field forward.

Some of the prominent players in the non-viral gene delivery technologies market include:

Non-viral Gene Delivery Technologies Market Recent Developments

-

January 2025 – Moderna announced a strategic expansion of its mRNA platform into rare disease therapeutics, focusing on non-viral delivery using next-gen LNPs.

-

November 2024 – BioNTech partnered with a European polymer technology startup to develop polymer-based non-viral carriers for cancer immunotherapy applications.

-

September 2024 – Intellia Therapeutics reported successful in vivo CRISPR editing using proprietary lipid nanoparticle technology during preclinical trials for liver diseases.

-

August 2024 – Precision NanoSystems, a leader in LNP development, was acquired by a global pharma firm to scale manufacturing of non-viral RNA delivery systems.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the non-viral gene delivery technologies market

By Mode

-

- Electroporation

- Microinjection

- Others

By Application

-

- Gene Therapy

- Cell Therapy

- Vaccines

By End-use

- Biotechnology and Biopharmaceutical Companies

- Research and Academic Institutes

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)