North America Acute Care Telemedicine Market Size and Research

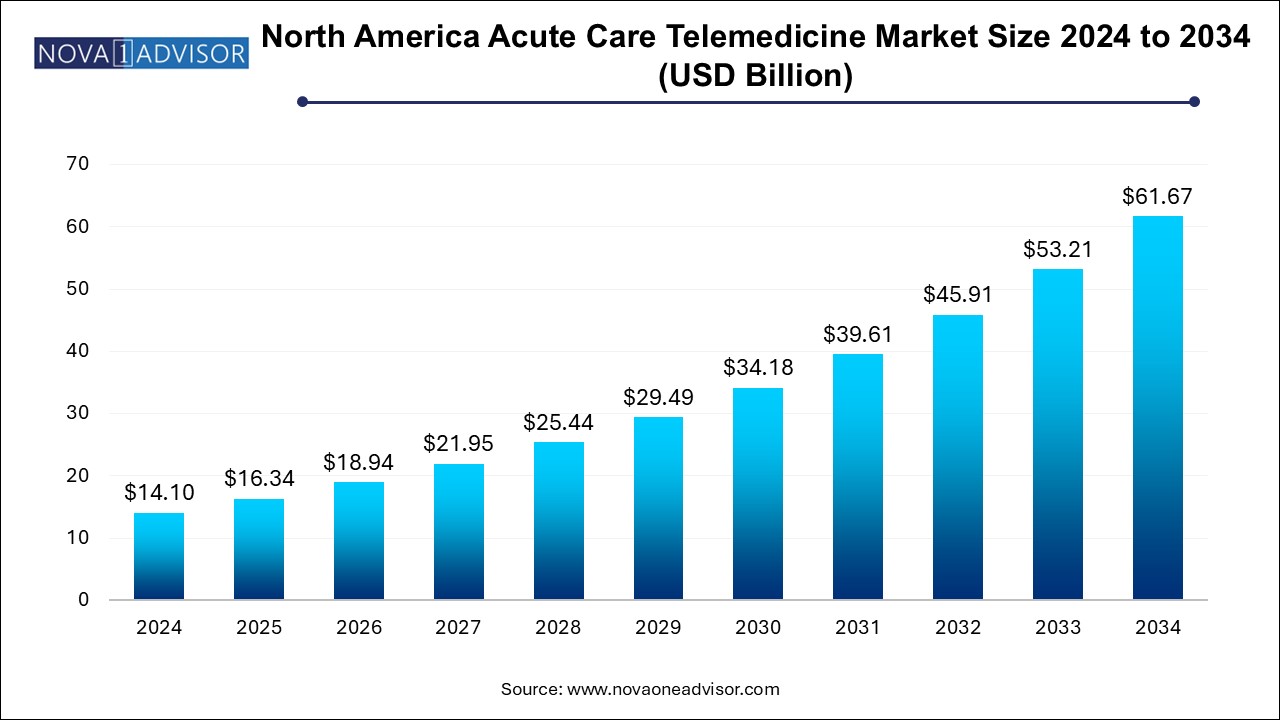

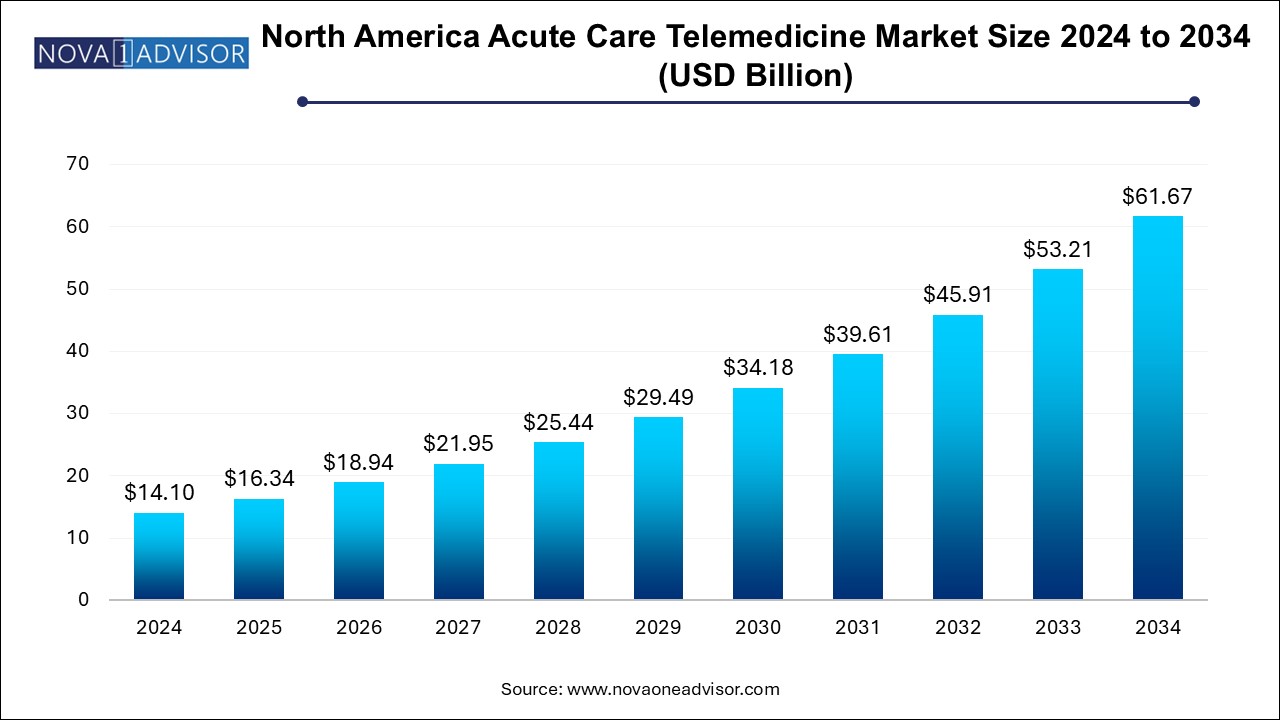

The North America acute care telemedicine market size was exhibited at USD 14.1 billion in 2024 and is projected to hit around USD 61.67 billion by 2034, growing at a CAGR of 15.9% during the forecast period 2025 to 2034.

Market Overview

The North America acute care telemedicine market is undergoing a transformative phase as the region continues to respond to escalating demands for high-speed, efficient, and accessible emergency and critical care services. Acute care, which encompasses time-sensitive medical conditions requiring immediate intervention such as stroke, trauma, sepsis, and acute psychiatric crises, is increasingly being supported by telemedicine platforms. With the proliferation of real-time communication technologies, integrated electronic health records (EHRs), and AI-powered diagnostic tools, acute care delivery is no longer confined to the four walls of hospitals.

Telemedicine in acute care allows for rapid triage, specialist consultation, and continuous monitoring—especially vital in stroke management (telestroke), intensive care (tele-ICU), and trauma care. It bridges geographical gaps, improves time-to-treatment metrics, and reduces unnecessary hospital transfers. The North American market—dominated by the United States—is supported by a mature healthcare IT infrastructure, favorable reimbursement models, and growing clinician adoption. Canada and Mexico are also witnessing increased uptake, driven by rural health initiatives and cross-border partnerships.

The COVID-19 pandemic served as a pivotal moment, accelerating the adoption of telemedicine across the acute care spectrum. Even as the emergency phase wanes, the demand for remote consultations, 24/7 virtual ICUs, and mobile stroke units connected via telehealth continues to surge. Regulatory frameworks have adjusted to accommodate this paradigm, with permanent changes in Medicare reimbursements in the U.S. and health system modernization in Canada further solidifying the market.

As of 2025, the North American acute care telemedicine market reflects a convergence of clinical urgency and digital innovation. Players in the market range from established telehealth vendors and hospital networks to cloud computing firms and AI startups. This evolving ecosystem underscores the region’s commitment to making critical care more accessible, scalable, and outcomes-driven.

Major Trends in the Market

-

Rapid Integration of AI in Diagnostic Telemedicine: AI algorithms are being deployed for stroke detection in CT scans, sepsis prediction, and real-time ICU monitoring.

-

Expansion of Telestroke and Telepsychiatry Programs: Hospitals and stroke centers are increasingly adopting remote neurologist consultations for time-sensitive care.

-

Hybrid Telemedicine Models in Emergency Departments: Emergency rooms are integrating tele-triage and remote diagnostics to streamline patient throughput and reduce overcrowding.

-

Surge in Mobile and Virtual ICU Models: Remote monitoring centers staffed by intensivists are managing critical patients in community hospitals using live telemetry.

-

Blockchain for Secure Medical Data Exchange: Ensuring secure, real-time patient data access across hospitals and telemedicine platforms is becoming a top priority.

-

Focus on Interoperability Across Systems: Vendor-neutral telehealth platforms that integrate with multiple EHRs and imaging systems are gaining traction.

-

Tele-nephrology and Tele-oncology in Emergency Settings: New acute specialties are joining the telehealth domain for conditions like tumor lysis syndrome and acute kidney injury.

Report Scope of North America Acute Care Telemedicine Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 16.34 Billion |

| Market Size by 2034 |

USD 61.67 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.9% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Delivery, Application, End Use, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America |

| Key Companies Profiled |

Teladoc Health, Inc.; AMD Global Telemedicine; Eagle Telemedicine; AMN Healthcare Services Inc.; Access TeleCare, LLC; Enghouse Video (Vidyo, Inc.); RelyMD; Doctor On Demand (Included Health, Inc.); GE HealthCare; Advanced Telemed Services |

Key Market Driver: Rising Incidence of Time-Critical Conditions and Provider Shortages

The most influential driver of the acute care telemedicine market in North America is the rising incidence of time-sensitive medical emergencies coupled with a shortage of specialty care providers. Stroke, cardiac arrest, sepsis, and acute mental health crises require immediate evaluation and intervention—often within a window of minutes to hours. Yet, many hospitals, especially those in rural or underserved areas, lack round-the-clock access to neurologists, intensivists, or psychiatrists.

Telemedicine effectively addresses this gap by enabling virtual consultations and decision-making across distances. For example, in telestroke care, neurologists can assess a patient remotely within minutes, determine eligibility for thrombolysis, and guide emergency teams accordingly. Likewise, tele-ICU programs allow intensivists to oversee multiple ICU beds across facilities simultaneously. The ability to optimize limited clinical resources and reduce delays in care has positioned telemedicine as a life-saving and cost-effective model across North America’s complex healthcare systems.

Key Market Restraint: Technology Disparities and Interoperability Challenges

Despite strong momentum, a significant restraint remains: technology disparities and lack of interoperability across telemedicine platforms and hospital systems. Many facilities, particularly in rural parts of Canada and the southern U.S., lack the bandwidth, IT infrastructure, or modern EHR systems necessary to support seamless telemedicine delivery. Even when virtual consultations are available, incompatible software, outdated imaging systems, and fragmented health data repositories hinder efficient workflows.

Moreover, a lack of universal standards across different telemedicine vendors and EHR platforms makes it difficult to integrate data into clinical decision-making in real time. Physicians often must log into multiple systems or manually reconcile patient records, which delays treatment in critical scenarios. Without scalable, interoperable, and vendor-neutral solutions, the full potential of acute telemedicine remains limited, particularly in regions with underfunded healthcare infrastructure.

Key Market Opportunity: Integration of Wearable Devices and Remote Monitoring in Acute Settings

A growing opportunity in the North American acute care telemedicine market is the integration of wearable devices and biosensors for real-time remote monitoring, particularly for high-risk patients post-discharge or in transitional care units. Smart wearables, ranging from continuous glucose monitors to ECG patches and blood pressure cuffs, are being integrated with telemedicine platforms to extend acute care beyond hospitals.

These devices allow for early detection of complications such as sepsis, arrhythmias, or respiratory distress, enabling tele-triage teams to intervene before a full-blown emergency develops. AI-powered alerts and mobile apps can notify caregivers, emergency teams, or on-call specialists instantly. This proactive, data-driven approach enhances care continuity, reduces readmissions, and supports aging populations living independently. The increasing availability of FDA-cleared, clinically validated wearable technologies creates a fertile ground for innovation and scalability across North America’s diverse healthcare landscape.

North America Acute Care Telemedicine Market By Delivery Insights

Clinician-to-clinician delivery dominated the acute care telemedicine market in North America in 2024, primarily due to its pivotal role in emergency decision-making and critical care collaboration. This model supports inter-hospital consultations where generalists at smaller hospitals can connect with specialists in academic medical centers to assess complex cases, interpret imaging, or guide critical procedures. Clinician-to-clinician platforms are particularly vital in telestroke, tele-ICU, and trauma care, where neurologists, intensivists, or surgeons must provide expert input within tight timeframes. This approach improves triage, reduces unnecessary transfers, and enhances the quality of emergency care delivery.

However, the clinician-to-patient model is the fastest-growing segment, fueled by advancements in user-friendly telehealth interfaces, patient engagement tools, and mobile diagnostics. Patients experiencing acute symptoms—such as severe anxiety, transient ischemic attacks (TIAs), or asthma attacks—can now engage directly with emergency physicians or specialists via teleconsultation. This model has proven especially valuable in remote and underserved areas, enabling patients to receive urgent guidance without traveling long distances. It also supports post-acute follow-up care, chronic disease exacerbation management, and virtual observation units, accelerating its adoption across North America.

North America Acute Care Telemedicine Market By Application Insights

Teleradiology remains the dominant application segment in the North America acute care telemedicine market, owing to the centrality of diagnostic imaging in emergency medical decision-making. From evaluating stroke onset through brain CT scans to detecting trauma-related injuries, rapid interpretation of imaging is crucial. Tele-radiology services enable hospitals, especially those in smaller communities, to gain access to 24/7 radiologist support. The scalability and cost-effectiveness of outsourcing radiology interpretation, along with AI tools for flagging critical findings like hemorrhages, have helped maintain this segment’s leadership in acute care workflows.

Meanwhile, telepsychiatry is the fastest-growing application, driven by the surge in acute mental health cases, particularly during and after the COVID-19 pandemic. Emergency departments across North America report increasing presentations of suicidal ideation, panic attacks, and acute psychosis. However, a national shortage of psychiatric professionals means many patients face long wait times. Telepsychiatry bridges this gap by allowing remote psychiatrists to conduct assessments, recommend interventions, and initiate stabilization protocols swiftly. This has been instrumental in reducing unnecessary inpatient admissions and connecting patients with timely care—especially among adolescents and veterans.

North America Acute Care Telemedicine Market By End Use Insights

Hospitals and clinics dominate the end-use segment of the North America acute care telemedicine market, primarily because they are the frontline providers of emergency and critical care services. Hospitals utilize telemedicine for virtual triage, inter-hospital transfers, radiology interpretation, and ICU monitoring. Tertiary care centers increasingly offer tele-specialist services to community hospitals through centralized hubs, creating an interconnected acute care network. This hospital-centric model ensures that critically ill patients receive the right level of care promptly and without geographic limitations.

However, the “Others” segment—which includes ambulatory care centers, urgent care chains, and emergency medical services (EMS)—is expanding rapidly. These non-traditional acute care settings are integrating telehealth to augment decision-making in mobile units, nursing homes, and even correctional facilities. EMS teams can now consult with ER physicians en route, improving triage and bypass decisions. Urgent care centers equipped with tele-neurology or tele-radiology capabilities are also able to handle higher-acuity cases, avoiding unnecessary emergency room referrals. As the push toward decentralization and value-based care intensifies, these alternative end-users will play a bigger role in the market.

Country Insights

United States: Dominating the North American Market

The United States remains the dominant force in the North America acute care telemedicine market, fueled by a large, fragmented healthcare system, robust private investments, and progressive regulatory reforms. U.S. hospitals have been early adopters of tele-ICU models, telestroke networks, and AI-enhanced teleradiology platforms. Organizations such as Teladoc Health, SOC Telemed, and American Well lead in integrating specialist care with emergency departments and rural hospitals. The Centers for Medicare & Medicaid Services (CMS) has expanded reimbursement for telehealth services, including emergency care, under its permanent rule changes initiated during the pandemic. Additionally, large health systems like Mayo Clinic and Cleveland Clinic have invested in tele-critical care command centers, influencing adoption across smaller facilities.

Canada: Fastest-Growing Acute Care Telemedicine Market

Canada is the fastest-growing country in this space, propelled by federal funding, universal healthcare coverage, and a commitment to healthcare equity across its vast geography. Rural and Indigenous communities, often hours away from tertiary care, are primary beneficiaries of virtual emergency services. Provinces such as Ontario and British Columbia have expanded telestroke, telepsychiatry, and tele-ICU capabilities across regional health networks. Organizations like Ontario Health and the Canadian Virtual Care Initiative are driving investments in interoperability, virtual triage systems, and integrated care pathways. As Canada emphasizes health system digitization, the demand for scalable, acute telemedicine solutions will continue its strong upward trajectory

Some of the prominent players in the North America acute care telemedicine market include:

- Teladoc Health, Inc.

- AMD Global Telemedicine

- Eagle Telemedicine

- AMN Healthcare Services Inc.

- Access TeleCare, LLC

- Enghouse Video (Vidyo, Inc.)

- RelyMD

- Doctor On Demand (Included Health, Inc.)

- GE HealthCare

- Advanced Telemed Services

North America Acute Care Telemedicine Market Recent Developments

-

In February 2025, Teladoc Health launched AcuteConnect, an AI-powered tele-ICU monitoring system that leverages predictive analytics to alert clinicians of patient deterioration in real-time across multiple facilities.

-

SOC Telemed, in January 2025, expanded its emergency tele-neurology services through a strategic partnership with a U.S. Midwest health system covering over 100 hospitals.

-

In November 2024, Think Research Corporation, based in Canada, received federal funding to scale its Virtual Critical Care platform, designed to support ICUs across remote provinces and territories.

-

Amwell (American Well), in December 2024, integrated its telepsychiatry services with multiple urgent care chains in the U.S., improving access to emergency mental health consultations.

-

GE Healthcare, in October 2024, launched a collaborative initiative with health systems in Texas to integrate its real-time patient telemetry with tele-critical care command centers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the North America acute care telemedicine market

By Delivery

- Clinician-to-Clinician

- Clinician-to-Patient

By Application

- Teleradiology

- Telepsychiatry

- Tele-ICU

- Teleneurology

- Telenephrology

- Others

By End Use

- Hospitals and Clinics

- Others

By Regional