North America Aerosol Market Size and Trends

The North America aerosol market size was exhibited at USD 19.15 billion in 2023 and is projected to hit around USD 29.74 billion by 2033, growing at a CAGR of 4.5% during the forecast period 2024 to 2033.

North America Aerosol Market Key Takeaways:

- Personal care segment accounted for the largest revenue share of 31.0% in 2023.

- The household segment is expected to expand at the fastest CAGR of 5.1% from 2024 to 2033.

- Aluminum led the market, accounting for a revenue share of 58.9% in 2023.

- The standard valve segment dominated the market, with a revenue share of 87.0% in 2023

- Bag-in valve is expected to expand at the fastest CAGR from 2024 to 2033.

Market Overview

The North America aerosol market is a vital component of the region's consumer goods, industrial, and healthcare sectors. Characterized by its adaptability, convenience, and precision, aerosol packaging has evolved from a basic delivery mechanism into a high-performance, sustainable solution used across personal care, household, automotive, medical, food, and paint applications. Aerosols are typically pressurized containers that expel liquids or solids as a fine mist, foam, or spray, using a propellant gas.

With rising consumer demand for ease-of-use, hygienic dispensing, and aesthetic packaging, aerosol-based products have become a mainstay in households, hospitals, and manufacturing environments. In North America, the U.S. leads both production and consumption, with Canada and Mexico also making notable contributions through expanding personal care and industrial product lines.

Key materials like aluminum and steel dominate aerosol can production due to their recyclability and durability. Manufacturers have shifted to using eco-friendly propellants (such as compressed air or hydrofluoroolefins) and adopting bag-in-valve technology for enhanced product stability, shelf life, and reduced environmental impact.

Growth in aerosol usage is supported by factors such as increasing personal care awareness, evolving lifestyles, rising demand for disinfectants and air fresheners post-COVID-19, and strong innovation in industrial sprays and pharmaceutical aerosols. Simultaneously, regulatory shifts surrounding VOC emissions and recycling mandates have spurred a new era of product innovation focused on safety, sustainability, and material circularity.

Major Trends in the Market

-

Shift Toward Sustainable Packaging: Brands are increasingly adopting recyclable aluminum cans, bag-in-valve systems, and low-GWP (Global Warming Potential) propellants to comply with ESG goals.

-

Post-Pandemic Surge in Household and Medical Aerosols: Demand for disinfectants, sanitizing sprays, and medical inhalers has seen a sustained rise since 2020.

-

Premiumization of Personal Care Products: Consumers are showing preference for aesthetically appealing and multifunctional aerosol products in deodorants, sun care, and hair styling.

-

Growth in Automotive Detailing Sprays and Lubricants: With DIY auto care on the rise, demand for spray greases, degreasers, and rust removers is climbing in the U.S. and Canada.

-

Adoption of Bag-In-Valve Technology: More brands are using this format for pharmaceuticals and food products due to its ability to maintain product purity and offer 360° dispensing.

-

Digital Labeling and Smart Packaging: Brands are exploring QR code-enabled cans to provide ingredient transparency and usage instructions to end-users.

-

Localized Manufacturing and Supply Chain Resilience: North American manufacturers are ramping up domestic production capacity to reduce import dependency and manage raw material volatility.

Report Scope of North America Aerosol Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 20.01 Billion |

| Market Size by 2033 |

USD 29.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Type, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S.; Canada; Mexico |

| Key Companies Profiled |

S. C. Johnson & Son, Inc.; Procter & Gamble; Honeywell International Inc.; Crabtree & Evelyn; Estée Lauder Inc.; Sluyter Company Ltd.; PLZ Corp; CCL Container; Sprayway Inc.; Trivium Packaging |

Key Market Driver: Expanding Personal Care Industry and Demand for Hygiene-Centric Products

A major driver for the North America aerosol market is the rising demand from the personal care sector, which continues to expand due to evolving grooming habits, social media influence, and hygiene consciousness. Aerosols have become integral in products like deodorants, hairsprays, shaving foams, sunscreens, and dry shampoos, offering consumers convenience, extended shelf life, and even application.

In particular, the U.S. and Canadian consumers are prioritizing skincare and hygiene routines, with younger demographics adopting gender-neutral personal care products that often come in spray form. Aerosol deodorants and shaving foams have shown significant volume growth due to their portability and reduced contamination risk.

Moreover, the post-COVID emphasis on hygiene has led to a surge in use of antibacterial sprays, sanitizers, and air disinfectants, further reinforcing aerosol packaging as the ideal format due to its contactless and uniform dispensing capabilities.

Key Market Restraint: Environmental Concerns and Regulatory Scrutiny

Despite their widespread use, aerosols have come under scrutiny due to environmental and health-related concerns. Issues such as VOC (Volatile Organic Compound) emissions, non-recyclable components, and the legacy perception of ozone-depleting propellants (such as CFCs) have triggered tighter regulatory oversight from agencies like the EPA in the U.S. and Environment and Climate Change Canada (ECCC).

Although most modern aerosols no longer use harmful propellants, consumer perception still lags behind technological progress. Furthermore, disposal and recycling of aerosol containers pose logistical challenges, especially for steel cans with mixed materials (plastic valves, rubber seals). Improper disposal increases the risk of pressurization incidents and fire hazards.

These factors compel manufacturers to invest heavily in compliance, material innovation, and consumer education, which can increase production costs and slow new product development cycles.

Key Market Opportunity: Growth in Aerosol-Based Pharmaceutical and Medical Products

One of the most promising opportunities lies in the expansion of aerosol-based delivery systems for pharmaceuticals and medical applications. Inhalers used to treat asthma, COPD, and other respiratory conditions rely heavily on aerosolization for effective drug delivery. As the incidence of these diseases rises, particularly among aging populations in the U.S. and Canada, the demand for MDIs (Metered Dose Inhalers) is expected to grow significantly.

Additionally, topical drug delivery sprays, antiseptics, analgesics, and wound cleansers are being developed in aerosol formats for faster absorption and ease of application. Bag-in-valve systems are gaining popularity in this domain due to their sterility, chemical inertness, and ability to deliver drugs in a pressurized, preservative-free format.

As North American healthcare systems adopt more home-care and self-administration models, the use of aerosols in medical devices is set to become more mainstream, supported by regulatory approval pathways and innovations in drug formulation.

North America Aerosol Market By Application Insights

Personal care is the leading application segment, encompassing a wide range of products such as deodorants, shaving foams, hair sprays, and sun protection sprays. The convenience and portability of aerosol packaging make it ideal for on-the-go personal hygiene and grooming. U.S.-based brands like Procter & Gamble and Unilever continue to expand their aerosol offerings to meet the preferences of younger, active consumers seeking gender-neutral and eco-friendly options.

Medical aerosols are the fastest-growing application, with metered dose inhalers (MDIs) and topical drug sprays seeing increased demand due to chronic respiratory conditions and post-pandemic health consciousness. The U.S. healthcare sector is promoting aerosol-based therapies as they offer rapid drug absorption, ease of use, and reduced systemic side effects. Innovations in propellant types and BOV delivery systems are further enhancing this growth.

North America Aerosol Market By Material Insights

Aluminum dominated the aerosol material segment, owing to its superior corrosion resistance, lightweight properties, and excellent recyclability. Many leading brands prefer aluminum cans for personal care and medical applications due to their compatibility with pressurized contents, aesthetic appeal, and safety features. For instance, deodorants, hair sprays, and pharmaceutical sprays often use sleek aluminum containers to convey premium branding and reduce shipping weight.

Steel is the fastest-growing segment, particularly for household and industrial aerosols. Products like air fresheners, insecticides, lubricants, and paint sprays often use tin-coated steel cans due to their robustness and affordability. Steel's compatibility with a wide range of propellants and its ability to withstand higher pressures make it ideal for larger volume aerosols. Additionally, rising adoption of eco-friendly initiatives and curbside recycling programs in North America is improving steel’s perception among consumers.

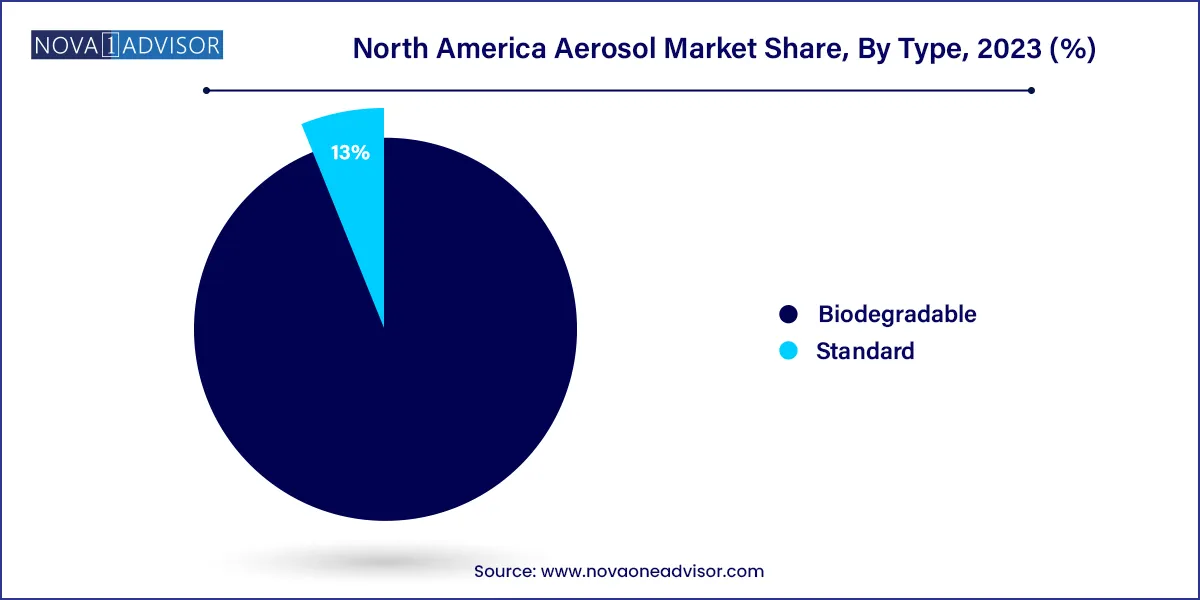

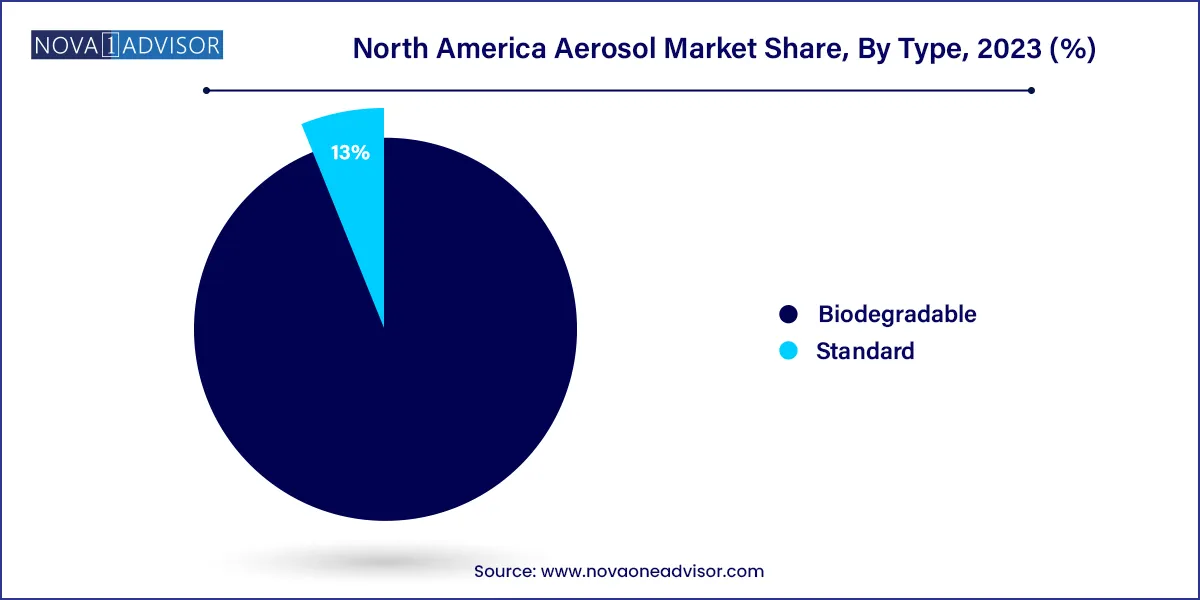

North America Aerosol Market By Type Insights

Standard aerosol cans continue to dominate the market, comprising the majority of product formats across personal care, automotive, and household categories. Their simplicity, cost-effectiveness, and well-established supply chains make them the go-to choice for mass-market products. Standard systems work well for applications where precision dispensing and extended shelf life are less critical.

Bag-in-valve (BOV) aerosols are the fastest-growing segment, especially in pharmaceutical, food, and cosmetic applications. BOV systems separate the product from the propellant using an internal bag, allowing for 360° dispensing, less waste, and preservative-free formulations. Companies in North America are increasingly using BOV to launch sunscreens, nasal sprays, whipped creams, and topical analgesics that require aseptic packaging. The technology also supports product evacuation of over 95%, boosting consumer satisfaction and sustainability metrics.

Country Insights

United States

The U.S. dominates the North America aerosol market, accounting for the largest share across all major application areas. The country has a highly developed personal care industry, strong manufacturing capabilities, and a robust regulatory framework that supports innovation while maintaining safety standards. Key sectors such as automotive detailing, construction, and household cleaning are heavy users of industrial and consumer aerosols.

U.S.-based companies are also at the forefront of developing non-VOC formulations, reusable propellant systems, and smart aerosol dispensers. Furthermore, rising demand for DIY products, especially during and after the pandemic, has spurred sales of cleaning sprays, lubricants, and air fresheners packaged in aerosol form.

Canada

Canada’s aerosol market is steadily growing, led by demand in personal care, paints, and healthcare products. Canadian consumers are increasingly leaning toward organic and natural personal care products, with local companies introducing aerosol versions of sun care and dry shampoo products. Moreover, regulatory emphasis on low-emission and recyclable packaging is pushing companies toward using bag-in-valve and eco-propellant technologies.

Mexico

Mexico is an emerging player, with growth concentrated in the household and automotive aerosol segments. The country’s large manufacturing base, especially in automotive and electronics, is supporting the demand for industrial greases, rust protectors, and contact cleaners. Additionally, the rapid urbanization and growing middle-class population are increasing consumption of air fresheners, disinfectants, and aerosol insecticides, making Mexico a key growth engine in the region.

Some of the prominent players in the North America aerosol market include:

- S. C. Johnson & Son, Inc.

- Procter & Gamble

- Honeywell International Inc.

- Crabtree & Evelyn

- Estée Lauder Inc.

- Sluyter Company Ltd.

- PLZ Corp

- CCL Container

- Sprayway Inc.

- Trivium Packaging

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America aerosol market

Material

Type

Application

-

- Deodorants

- Hair Mousse

- Hair Spray

- Shaving Mousse/Foam

- Suncare

- Others

-

- Insecticides

- Plant Protection

- Air Fresheners

- Furniture & Wax Polishes

- Disinfectants

- Surface care

- Others

-

- Greases

- Lubricants

- Spray Oils

- Cleaners

-

- Oils

- Whipped Cream

- Edible Mousse

- Sprayable Flavours

-

- Inhaler

- Topical Application

Aerosol Country