North America aerosol propellants market Size and Trends

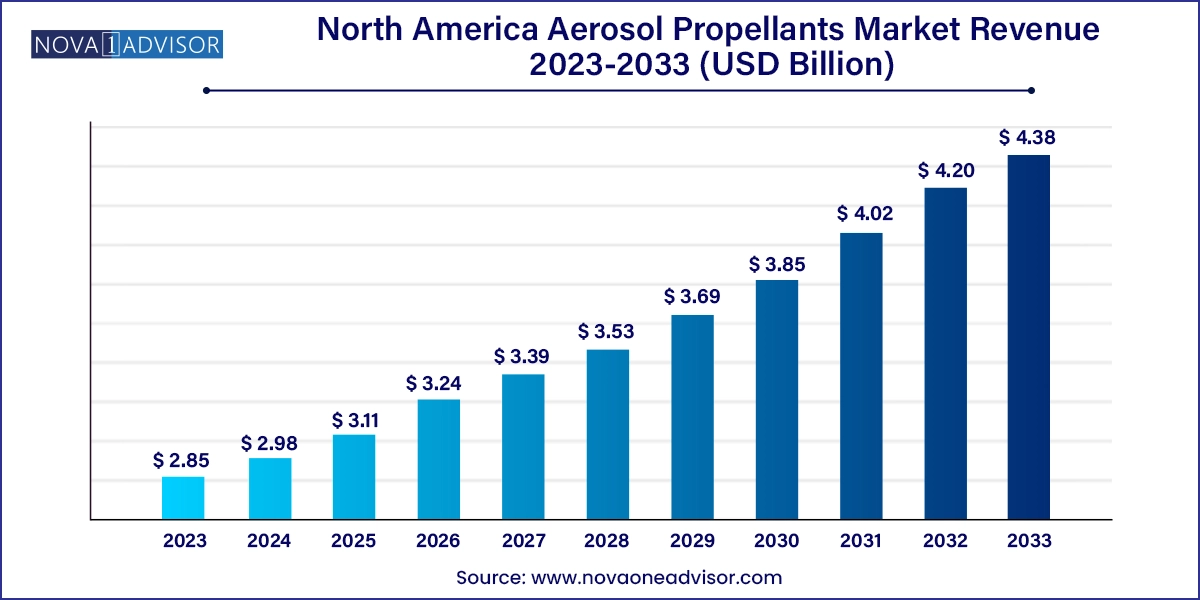

The North America aerosol propellants market size was exhibited at USD 2.85 billion in 2023 and is projected to hit around USD 4.38 billion by 2033, growing at a CAGR of 4.4% during the forecast period 2024 to 2033.

North America Aerosol Propellants Market Key Takeaways:

- Hydrocarbons dominated the market with a revenue share of 81.5% in 2023.

- On the other hand, dimethyl ether (DME) and methyl ethyl ether are projected to witness the fastest growth in terms of revenue, with a CAGR of 5.8% from 2024 to 2033.

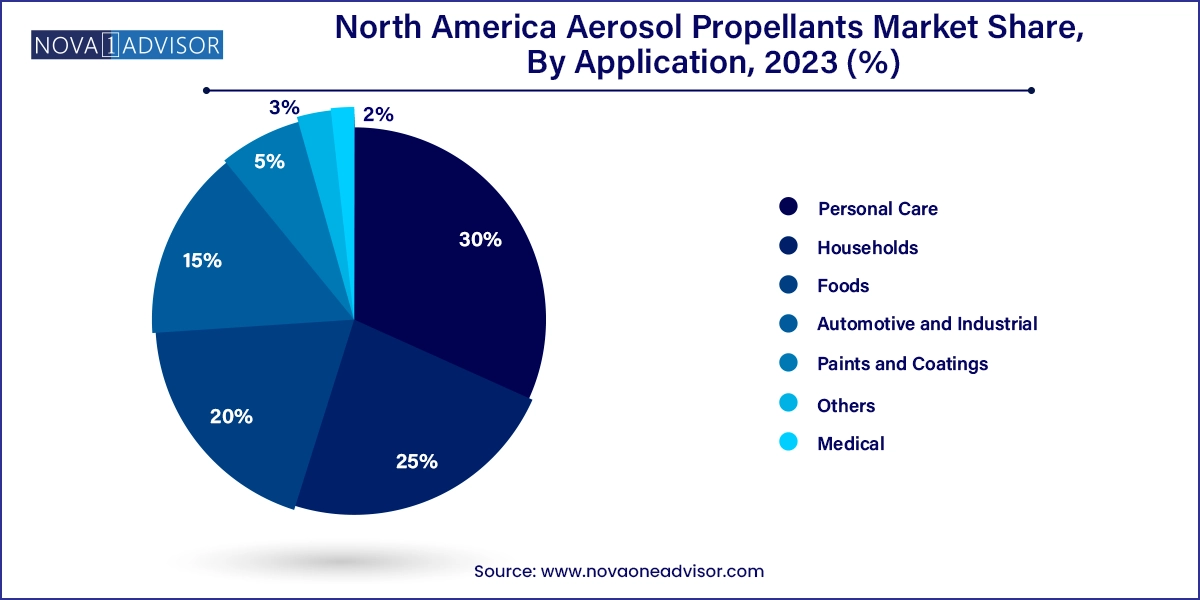

- The personal care application dominated the market with a revenue share of 30.0% in 2023.

- The medical segment is projected to experience the fastest growth, with a CAGR of 6.9% from 2024 to 2033.

Market Overview

The North America aerosol propellants market is a critical segment of the chemical and packaging industry, driving a wide array of consumer and industrial products ranging from deodorants and hair sprays to automotive lubricants, food sprays, and pharmaceutical inhalers. Aerosol propellants are gaseous substances used to expel the contents of an aerosol canister. These can be compressed or liquefied gases, and they serve as a vital delivery mechanism in pressurized packaging systems. They not only ensure uniform product dispersion but also contribute to product stability and extended shelf life.

The North American market is anchored by an advanced manufacturing ecosystem, strong consumer product demand, and well-established regulatory frameworks that ensure safety and environmental compliance. With increasing urbanization and evolving lifestyles, particularly in the U.S. and Canada, the demand for convenient, hygienic, and easy-to-use packaging formats has surged—driving the consumption of aerosol-based products across personal care, medical, and household applications.

Moreover, the market is witnessing rapid transformations driven by environmental sustainability concerns. Traditionally dominant hydrocarbon-based propellants are facing scrutiny due to their volatile organic compound (VOC) emissions, prompting innovations in low-impact and green alternatives such as dimethyl ether (DME), nitrous oxide, and compressed gases. Regulatory agencies such as the Environmental Protection Agency (EPA) and Environment and Climate Change Canada are playing a pivotal role in steering the industry towards more eco-conscious solutions.

Strategically, the market remains competitive, with multinational conglomerates and niche players vying to differentiate through formulation innovations, product customization, and sustainability positioning. Investments in R&D and production capacity expansion are defining current industry strategies.

Major Trends in the Market

-

Transition Toward Low-GWP Propellants: A major trend is the gradual shift from high Global Warming Potential (GWP) hydrofluorocarbons (HFCs) toward low-GWP alternatives such as DME and carbon dioxide, especially in personal care and medical applications.

-

Rising Popularity of Natural and Organic Aerosol Products: The consumer shift toward eco-friendly and non-toxic products has fueled demand for aerosol sprays formulated with natural ingredients and propellants like compressed air or nitrogen.

-

Innovation in Inhalation Drug Delivery: Pharmaceutical companies are investing in metered-dose inhalers (MDIs) using safe and efficient propellants for respiratory conditions such as asthma and COPD, reflecting growth in the medical segment.

-

Private Label Expansion: Retailers across North America are launching private label aerosol-based home and beauty products, pushing demand for customized, cost-effective propellant formulations.

-

Adoption of Sustainable Packaging: Recyclable aerosol containers and refillable spray systems are gaining traction as brands seek to reduce carbon footprints and align with corporate sustainability goals.

-

Technological Integration in Aerosol Dispensing: Smart aerosols equipped with sensors and enhanced actuator mechanisms are being developed for precise dosage control, particularly in medical and industrial sectors.

-

Strategic Capacity Expansion: Companies are expanding propellant manufacturing facilities to meet growing demand, especially in Canada and Mexico, where cost efficiencies and trade benefits are attractive.

Report Scope of North America Aerosol Propellants Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 2.98 Billion |

| Market Size by 2033 |

USD 4.38 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.4% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico |

| Key Companies Profiled |

Royal Dutch Shell PLC; Honeywell International Inc.; Arkema Group; The Chemours Company; Nouryon; Aeropres Corporation; BOC Ltd.; AkzoNobel NV; DuPont de Nemours, Inc.; Lapolla Industries Inc |

Market Driver: Expansion of Personal Care and Hygiene Products

A key driver of the North America aerosol propellants market is the robust demand from the personal care and hygiene industry, which relies heavily on aerosolized products for cosmetics, deodorants, hair sprays, and skincare. The pandemic catalyzed a broader focus on cleanliness, hygiene, and convenience, accelerating demand for sanitizers, disinfectant sprays, and dry shampoos. With urban consumers increasingly valuing portable, quick-application products, the aerosol format has emerged as the preferred delivery mechanism.

U.S.-based multinational corporations such as Procter & Gamble and Unilever have expanded their aerosol offerings, with innovations focusing on gentler, skin-safe propellants and formulations. For example, the surge in popularity of dry shampoos, especially among Gen Z and millennial consumers, has significantly increased the use of hydrocarbon and DME-based propellants. Additionally, new grooming products tailored to male consumers are pushing the boundaries of propellant innovation.

Market Restraint: Environmental and Regulatory Constraints

The market, however, is restrained by environmental regulations and increasing scrutiny of VOC emissions. Many traditional aerosol propellants, especially hydrocarbons and HFCs, contribute to smog formation and global warming. Regulatory agencies such as the EPA in the U.S. and Health Canada have established guidelines limiting the use of specific propellants in consumer products. For example, the U.S. phased down certain high-GWP propellants under the American Innovation and Manufacturing (AIM) Act.

Moreover, new labeling requirements and compliance costs for emissions reporting have raised the barrier for entry, particularly for small and medium-scale manufacturers. Some propellants also face transportation and storage restrictions, further complicating logistics. These factors compel companies to invest heavily in R&D for greener alternatives, which, while promising, often come with higher production costs and require reformulation of entire product lines.

Market Opportunity: Emergence of Bio-Based and Hybrid Propellants

A significant market opportunity lies in the development and commercialization of bio-based and hybrid aerosol propellants. As the demand for sustainable consumer goods rises, particularly in the U.S. and Canada, bio-derived propellants like bio-DME and naturally sourced gases (e.g., COâ‚‚ captured from fermentation processes) are gaining appeal. These alternatives offer a lower carbon footprint and are often non-toxic and biodegradable.

In 2024, several companies began pilot testing aerosol sprays using a blend of bio-based DME and compressed nitrogen, targeting eco-conscious consumers. This is especially relevant in personal care and food-grade applications where chemical sensitivity is a concern. Retailers and brands are actively promoting green credentials, and regulatory support in the form of tax credits and R&D funding is accelerating commercialization. This trend provides a lucrative avenue for innovation and brand differentiation.

North America Aerosol Propellants Market By Product Insights

Hydrocarbons dominated the product segment in the North America aerosol propellants market, attributed to their low cost, high performance, and compatibility with a wide variety of formulations. Propane, butane, and isobutane remain the propellants of choice in personal care and household products such as deodorants, air fresheners, and cleaning sprays. These hydrocarbons provide strong atomization, efficient pressure, and excellent product discharge rates. Despite environmental concerns, hydrocarbons are still prevalent due to their affordability and established infrastructure. The extensive usage by household names such as Reckitt and SC Johnson in their air care products reinforces hydrocarbon dominance.

On the other hand, DME and Methyl Ethyl Ether (MEE) emerged as the fastest-growing product segment, especially in environmentally regulated applications. DME, a biodegradable ether, offers a non-toxic and low-VOC alternative to hydrocarbons, making it attractive for hair sprays, antiperspirants, and paint sprays. With a push from eco-labeling and clean beauty trends, companies are reformulating products using DME to meet VOC compliance. Its water miscibility also improves stability and spray characteristics, encouraging adoption across industrial coatings and adhesives. Increased investment in DME production, especially in Canada, further supports its rapid growth.

North America Aerosol Propellants Market By Application Insights

Personal care products led the application segment, driven by the widespread use of aerosolized items like body sprays, shaving foams, and hair styling products. North America's fashion and grooming-conscious population, particularly in urban centers like Los Angeles, Toronto, and New York, sustains high demand for cosmetic aerosols. Influencer-led trends and beauty product subscription services have further expanded the aerosol product pipeline. The segment's dominance is also supported by advanced packaging technologies that improve usability and enhance brand appeal through tactile and visual innovation.

Meanwhile, the medical segment is anticipated to witness the fastest growth, owing to increased utilization of metered-dose inhalers (MDIs) for respiratory therapies. The rising prevalence of asthma and COPD, especially in the aging population of the U.S., is driving the adoption of pressurized aerosol delivery systems for prescription medications. Pharmaceutical players are actively collaborating with aerosol solution providers to develop HFA-free inhalers and improve dose accuracy. Government reimbursements and advancements in drug-device combination products are expected to further fuel this segment’s expansion.

Country Insights

United States

The U.S. is the largest market for aerosol propellants in North America, driven by its massive personal care, automotive, and healthcare sectors. With a mature consumer base and the highest per capita consumption of aerosol products globally, the U.S. sets the tone for product innovation and regulation. Local giants like Honeywell and Diversified CPC are leading R&D in sustainable propellants. Federal incentives under the Inflation Reduction Act are also encouraging the development of green chemical manufacturing, offering a favorable environment for low-emission propellant technologies.

Canada

Canada’s market is rapidly expanding, fueled by environmental awareness, rising cosmetic product penetration, and demand for sustainable solutions. Canadian companies are actively transitioning to low-VOC formulations in alignment with the national Clean Air Regulatory Agenda. Government grants for clean technology and collaborative efforts between universities and aerosol manufacturers are advancing the development of novel propellants. Furthermore, increasing disposable income and lifestyle changes in urban centers like Vancouver and Montreal are boosting demand for high-end personal and household aerosol products.

Mexico

Mexico is emerging as a key production hub, especially for cost-effective aerosol manufacturing. The presence of free trade agreements like USMCA, lower labor costs, and strategic proximity to the U.S. market are attracting investments in aerosol packaging and filling facilities. Local demand is growing, particularly in household and automotive maintenance sprays. In 2024, several international brands announced plans to expand aerosol operations in Monterrey and Guadalajara to serve both domestic and export markets. Regulatory harmonization with U.S. standards is facilitating smoother cross-border operations.

North America Aerosol Propellants Market Recent Developments

- In November 2023, The Chemours Company commenced a strategic enhancement of its manufacturing capabilities, targeting a 20% increase in the production of the eco-friendlier aerosol propellant, HFC-152a, at its Texas plant. This initiative is in direct response to evolving regulatory standards aimed at minimizing the usage of propellants with a high global warming potential (GWP)

- In August 2023, Honeywell announced a commercial partnership with Recipharm to speed the development of pressurized metered dose inhalers (pMDIs) that use Honeywell’s near-zero global warming potential (GWP) propellant. This highlightsa broader industry shift towards environmentally responsible products

- In June 2023, AkzoNobel NV disclosed a series of new investments within the North American territory, encompassing the establishment of a pilot manufacturing facility and a dedicated regional research and development hub. These strategic investments are anticipated to significantly contribute to the growth trajectory in the region, enhancing its innovation capacity and market reach.

Some of the prominent players in the North America aerosol propellants market include:

- Royal Dutch Shell PLC

- Honeywell International Inc.

- Arkema Group

- The Chemours Company

- Nouryon

- Aeropres Corporation

- BOC Ltd.

- AkzoNobel NV

- DuPont de Nemours, Inc.

- Lapolla Industries Inc

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America aerosol propellants market

Product

- Hydrocarbons

- DME and Methyl Ethyl Ether

- Nitrous Oxide and Carbon Dioxide

- Others

Application

- Personal Care

- Households

- Automotive and Industrial

- Foods

- Paints and Coatings

- Medical

- Others

Country