North America Agricultural Packaging Market Size and Research

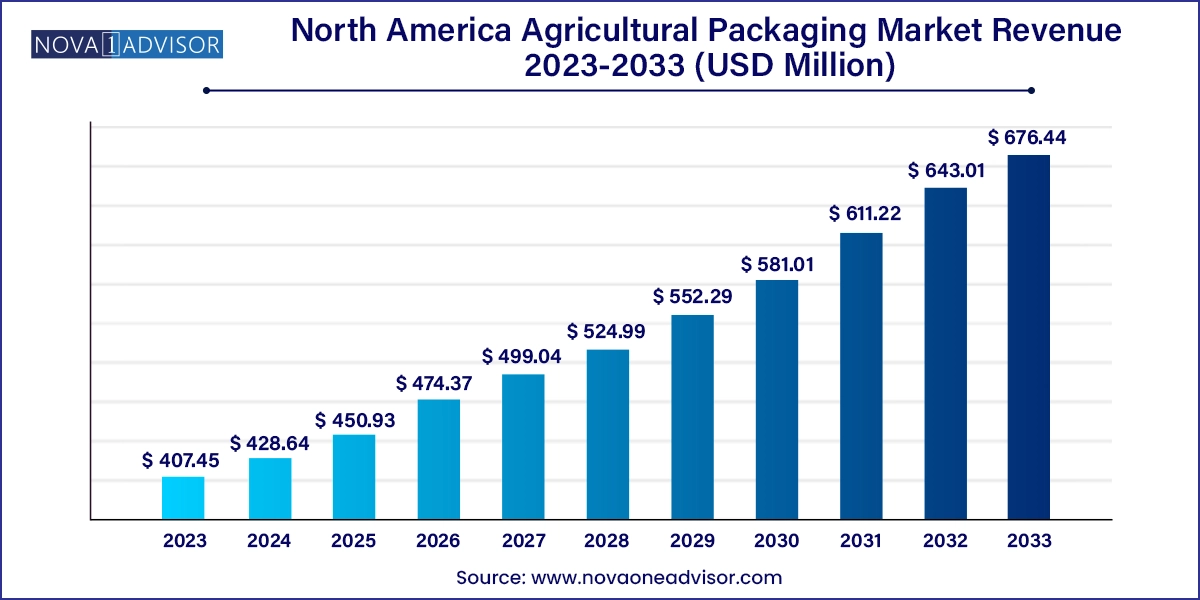

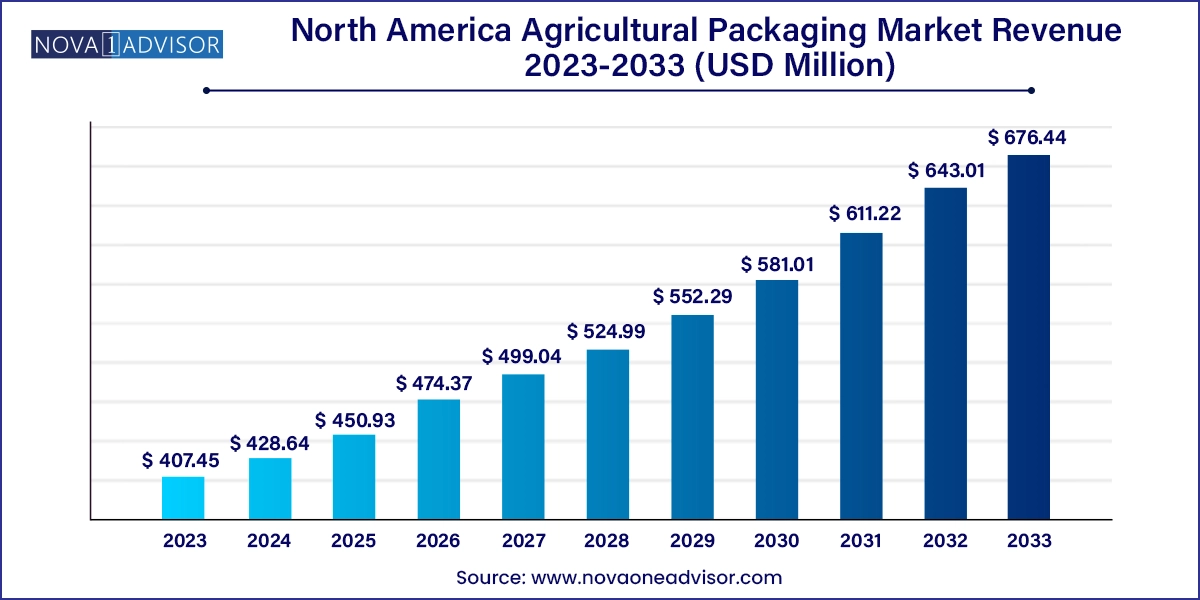

The North America agricultural packaging market size was exhibited at USD 407.45 million in 2023 and is projected to hit around USD 676.44 million by 2033, growing at a CAGR of 5.2% during the forecast period 2024 to 2033.

North America Agricultural Packaging Market Key Takeaways:

- Plastics is anticipated to dominate the overall market with a market share of over 64.0% in 2023.

- Furthermore, paper & paperboard material segment is expected to grow at a fastest CAGR of 5.8% over the forecast period.

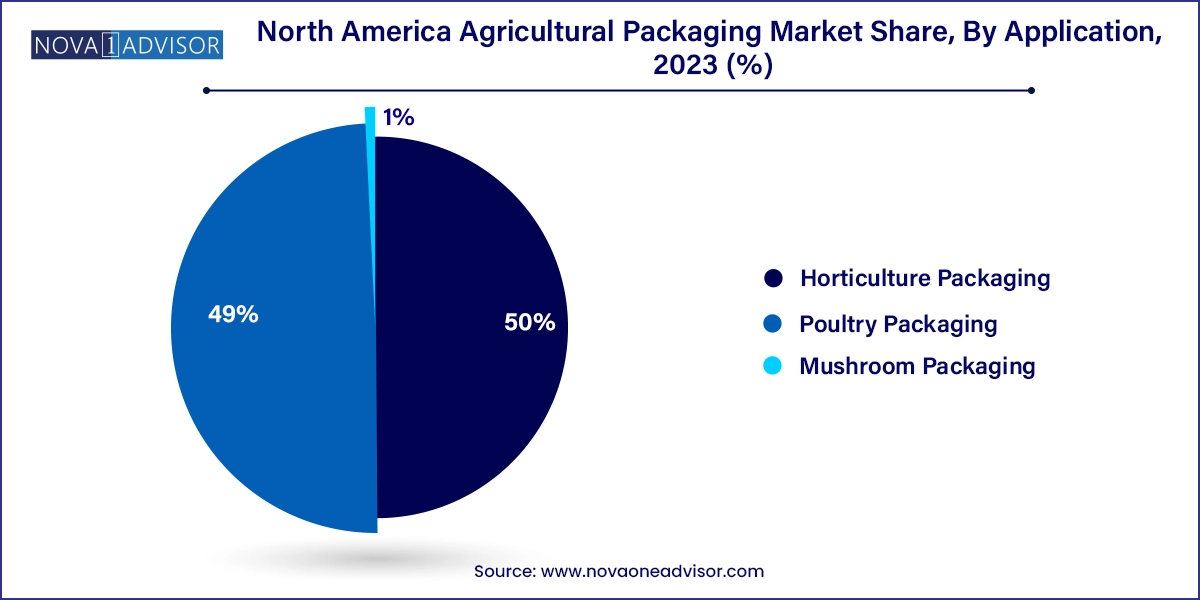

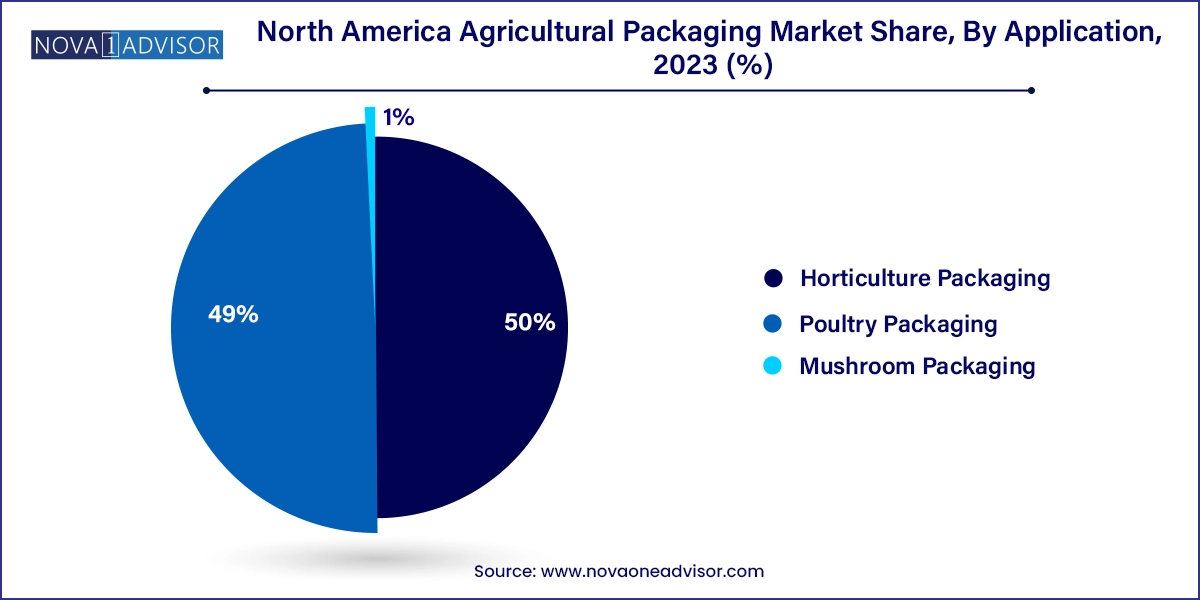

- Poultry packaging application segment dominated market and accounted for largest revenue share of over 50.0% in 2023 and is expected to grow at a fastest CAGR of 5.2% over the forecast period.

Market Overview

The North America Agricultural Packaging Market has witnessed significant evolution over the past decade, influenced by the growth in agribusiness, heightened awareness around food safety, and the expanding reach of organized retail and export channels. Agricultural packaging plays a pivotal role in the supply chain by protecting fresh produce, poultry, mushrooms, and horticulture products during storage, handling, and transportation. Packaging not only preserves the freshness and quality of agricultural products but also ensures regulatory compliance and supports branding, especially in the case of exports.

As North America continues to innovate across the agricultural value chain, from farm to shelf, packaging has become more specialized, customized, and sustainability-oriented. Materials such as plastics, paperboard, and molded pulp are widely used, each offering distinct benefits in terms of durability, biodegradability, or moisture control. The rise of controlled atmosphere packaging, clamshells, heat-seal bags, and compartmentalized trays has enhanced product shelf life and consumer convenience.

Countries like the U.S. and Canada have seen a surge in consumer demand for pesticide-free, organically packaged products with eco-labeling, while Mexico has emerged as a major exporter of fresh produce and poultry, spurring investment in packaging innovations. From mushroom trays in Pennsylvania to molded pulp egg cartons in Ontario and berry clamshells in Baja California, agricultural packaging is not only protecting products but also enabling international trade and consumer engagement.

Major Trends in the Market

-

Rise in Sustainable Packaging Materials: Increasing environmental awareness has led to a surge in demand for biodegradable, compostable, and recyclable packaging, especially molded pulp and FSC-certified paperboard.

-

Automation and Smart Packaging Integration: Agricultural producers and cooperatives are investing in automated filling and sealing systems, along with track-and-trace barcodes and QR codes for transparency and efficiency.

-

Growth in Export-Oriented Packaging: With Mexico’s growing exports of fruits and vegetables and Canada’s poultry shipments, there is increasing emphasis on durable and standardized packaging that meets international quality norms.

-

Demand for Convenience Packaging Formats: The rise of ready-to-eat produce and pre-packed poultry has led to increased adoption of clamshells, punnets, and resealable containers.

-

Temperature-Controlled Packaging Evolution: As cold chain logistics improve, there's a parallel growth in packaging that supports temperature integrity, especially for mushrooms and fresh poultry.

-

Customization and Branding: Horticulture and organic farms are leveraging packaging as a brand touchpoint through printed cartons, transparent windows, and eco-labeling to communicate quality and sustainability.

Report Scope of North America Agricultural Packaging Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 428.64 Million |

| Market Size by 2033 |

USD 676.44 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 5.2% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Material, Application, Country |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

U.S., Canada, Mexico |

| Key Companies Profiled |

Amcor plc; FormTight, Inc.; DS Smith; Mondi; Atlantic Packaging; FLAIR Flexible Packaging Corporation; PPC Flexible Packaging LLC; Flexpack; Transcontinental Inc.; Tekni-Plex, Inc.; Sealed Air; Sonoco Products Company; Huhtamaki Oyj; CLONDALKIN GROUP; ProAmpac; Genpak; Sambrailo Packaging; WINPAK LTD. |

Key Market Driver: Growth of Fresh Produce and Poultry Exports

A major driver fueling the North American agricultural packaging market is the accelerated growth in fresh produce and poultry exports, particularly from Mexico and the United States. Over the last decade, the U.S. has strengthened its position as a global supplier of processed and packaged poultry, while Mexico’s exports of tomatoes, avocados, berries, and peppers to the U.S. and Canada have risen steadily. This cross-border trade necessitates efficient and compliant packaging that ensures product quality, minimizes spoilage, and adheres to international food safety standards.

For instance, clamshell packaging for strawberries exported from Baja California has become standard due to its ability to protect the fruit during transit while allowing consumers to visually inspect the product. Similarly, egg trays made from molded pulp in Canada are used extensively to reduce breakage during long-haul transportation. These examples underline how packaging is not merely a protective measure but a critical logistics and trade enabler in the modern agri-supply chain.

Key Market Restraint: Environmental Impact of Plastic Packaging

While plastics continue to dominate due to their strength, cost-effectiveness, and adaptability, they pose a major environmental challenge in the form of non-biodegradability and landfill accumulation. A large volume of plastic trays, clamshells, and liners used in agricultural packaging ends up in the environment, causing growing concern among consumers, regulators, and advocacy groups. This concern is more pronounced in the U.S. and Canada, where municipal waste audits frequently cite agricultural packaging as a significant contributor to plastic waste.

Legislative measures such as bans on certain single-use plastics and extended producer responsibility (EPR) frameworks have begun to put pressure on packaging manufacturers to innovate or transition to greener alternatives, often at higher costs. As a result, smaller farms and agribusinesses with tighter budgets may struggle to comply, creating a bottleneck in market adoption and product availability. This friction between environmental responsibility and economic feasibility remains a pressing challenge for the industry.

Key Market Opportunity: Expansion of Molded Pulp Packaging Solutions

The most promising opportunity within the North American agricultural packaging market lies in the rapid expansion of molded pulp-based packaging, which aligns with the growing push for sustainability without compromising product safety. Molded pulp, derived from recycled paper or natural fibers, is biodegradable, compostable, and versatile. It is increasingly being used for egg trays, fruit containers, and mushroom tiles, offering an environmentally friendly alternative to traditional plastic packaging.

Molded pulp has particularly gained traction in Canada and parts of the U.S., where retailers are pressuring suppliers to adopt low-impact packaging. For instance, several Ontario-based poultry farms have adopted molded pulp clamshells for organic eggs to satisfy consumer demand and retailer mandates. Moreover, molded pulp's ability to cushion fragile items like mushrooms or eggs during transportation makes it an ideal solution for delicate agricultural goods. With improvements in water resistance, design customization, and structural integrity, molded pulp is poised to revolutionize sustainable packaging in North America.

North America Agricultural Packaging Market By Material Insights

Plastics continue to dominate the material segment due to their cost efficiency, structural strength, and moisture resistance, making them indispensable for packaging poultry, mushrooms, and certain horticulture products. Particularly in the U.S. and Mexico, plastic-based clamshells and trays are used extensively for fruits like blueberries, tomatoes, and mushrooms. These materials offer high transparency and shelf appeal, which is crucial in retail environments. However, concerns about plastic waste are gradually tempering their adoption, especially in premium organic produce packaging.

On the other hand, molded pulp is emerging as the fastest-growing material segment, driven by both policy and preference shifts toward sustainability. Products like egg trays, seedling trays, and fruit containers made of molded pulp are becoming popular across Canada and northern U.S. states. This growth is also supported by technology innovations that have enhanced molded pulp’s water resistance and printability. As regulations tighten on plastic usage, molded pulp’s adoption is expected to accelerate even among large-scale commercial farms and distributors.

North America Agricultural Packaging Market By Application Insights

Horticulture packaging is the largest application segment in North America, supported by year-round demand for packaged berries, leafy greens, tomatoes, and flowering plants. Within this, trays and clamshell trays (punnets) are the dominant formats due to their ease of handling, ability to retain freshness, and visual appeal. In states like California and Florida, strawberry and tomato producers rely heavily on transparent clamshells for retail distribution. Moreover, greenhouse operations in Canada use heat seal bags and seedling trays to transport and distribute saplings efficiently.

Conversely, mushroom packaging is one of the fastest-growing segments, owing to increasing mushroom consumption across North America, driven by plant-based food trends. Mushrooms are delicate and require specific packaging to prevent bruising and preserve moisture. Clamshell trays and mushroom tiles made from biodegradable materials are gaining traction, especially for premium and organic varieties. As interest in exotic mushrooms like shiitake and lion’s mane grows, packaging designs are evolving to provide better aesthetics, ventilation, and brand identity.

Country Insights

United States

The United States remains the largest agricultural packaging market in North America due to its vast agribusiness infrastructure, high export volumes, and consumer-driven retail culture. From large-scale berry farms in California using PET clamshells to organic egg producers in Pennsylvania adopting molded pulp trays, packaging innovation is widespread. Regulatory standards from the USDA and FDA also play a critical role in shaping packaging compliance and food safety, prompting investments in automation and sustainability.

Furthermore, U.S. retailers are increasingly requiring suppliers to use recyclable or compostable packaging, triggering a material shift. High-value crops like berries, lettuce, and microgreens now demand advanced packaging formats such as heat-seal bags and compartmentalized trays with modified atmosphere features. Poultry and mushroom sectors are also innovating with tamper-evident clamshells and water-resistant pulp containers.

Canada

Canada's agricultural packaging market is driven by a strong regulatory focus on sustainability and government support for eco-friendly farming practices. Molded pulp has seen widespread adoption for egg trays and mushroom containers, particularly in provinces like Ontario and Quebec. Canadian consumers are among the most eco-conscious in the world, pushing supermarkets and agricultural suppliers to adopt paper-based or biodegradable solutions.

Additionally, Canada’s cold climate encourages greenhouse horticulture, which relies heavily on seedling trays and heat-sealed bags. With its strong export orientation, especially toward the U.S., Canada’s packaging industry is aligning with both local and international sustainability expectations. Major packaging producers are also investing in pulp molding machines to cater to increasing demand from poultry and produce sectors.

Mexico

Mexico is a fast-expanding agricultural packaging market, driven by its position as a key exporter of fruits, vegetables, and poultry to North America. The demand for standardized, export-compliant packaging has led to widespread adoption of plastic trays and clamshells, particularly in produce hubs like Sinaloa and Baja California. Packaging not only ensures product safety during long-distance transport but also adds value through branding and presentation.

While plastic is still prevalent, the Mexican government’s push for sustainable practices has created early momentum for molded pulp and paperboard alternatives. In recent years, exporters of organic avocados, tomatoes, and berries have begun switching to biodegradable containers to meet U.S. and Canadian import standards. With infrastructure improving in rural regions, local packaging providers are beginning to tap into this emerging opportunity.

Some of the prominent players in the North America agricultural packaging market include:

- Amcor plc

- FormTight, Inc.

- DS Smith

- Mondi

- Atlantic Packaging

- FLAIR Flexible Packaging Corporation

- PPC Flexible Packaging LLC

- Flexpack

- Transcontinental Inc.

- Tekni-Plex, Inc.

- Sealed Air

- Sonoco Products Company

- Huhtamaki Oyj

- CLONDALKIN GROUP

- ProAmpac

- Genpak

- Sambrailo Packaging

- WINPAK LTD.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the North America agricultural packaging market

Material

- Plastics

- Paper & Paperboard

- Molded Pulp

Application

-

- Trays, Clamshell Tray (Punnets)

- Heat Seal Bags

- Seedling Flat Trays

-

- Egg Trays

- Clamshells

- Trays

- Others

-

- Clamshell Tray (Punnets)

- Mushroom Tiles

- Containers

Country